You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

imho, a question of the alphabet of concepts

So, nothing, but there is a slight (or big) difference. A property is a broader notion. For example. There is such a property.

Any terrnd is correctable. this property is indisputable. But by no means a pattern, as lawmaking presupposes accurate data.

Randomness as you understand it (judging from the text) is an unknowable pattern. This is fine, quite consistent with the philosophical definition, but makes absolutely meaningless the application of probability theory and statistics to further analysis of the question. Accordingly, the very division of patterns into learned and unlearned also makes no sense.

imho, running in place.

I'm afraid you don't understand my understanding of the question:-)) I don't use probability theory or statistics. Randomness or unknowable regularity, as quite rightly noted, can be learned by increasing the sampling rate. Only whether or not to do so is up to me to decide.

AlexeyFX, your extraction of the regular component from the price movement is certainly good, but unfortunately it only shows the regularity that was in the past, and only on the interval you selected. In the same way, we can calculate a linear regression for a certain interval and get the direction of price movement as a result. But this does not mean that the further movement will be in the same direction. The market is not that simple. Therefore, your claim that the further movement supposedly "infallibly extrapolates in this case by about 32 bars" is naive, to say the least. Especially the word "infallible". Nothing in the market is infallible. In fact, even the probability result is not an issue, because this extrapolation will be wrong 50% of the time.

It could be infallible only if all market movements were always smooth. But this is far from being the case.

Oops. Here's another branch. I suggest we rename the branch to MARKETING PROPERTIES. You can't find a more appropriate name for it anyway. WANT TO DISCUSS?

I advise you to stop the mass flubbing in several threads at once.

This is a warning. Otherwise I will have to stop you by force - for at least a week.

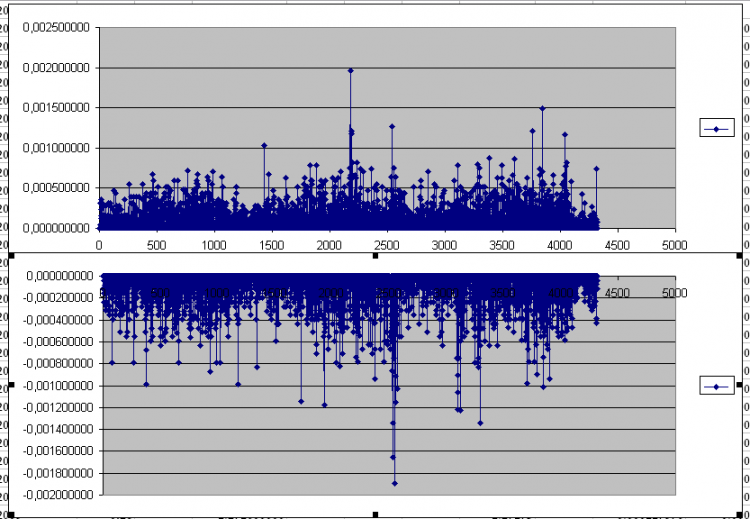

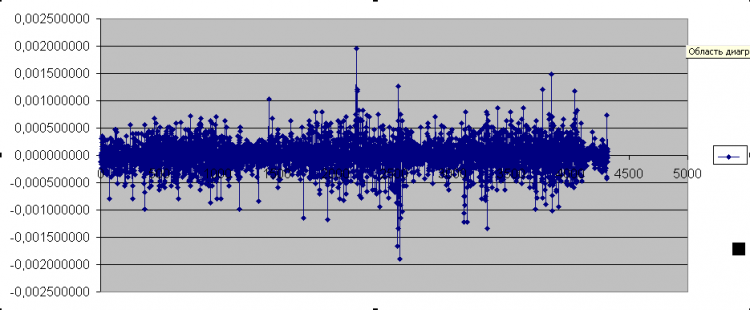

I propose to divide the logical and random components of price at the stage of calculation of indicator lines. The random price fluctuations should not affect the regular indicator line, while the regular price movements should not affect the random line. A full view of the price should be maintained, so random fluctuations should not be discarded, as is common practice.

It looks like you can't do without a picture.

The green line is the close price chart. Blue - regular component, unmistakably extrapolated in this case by approximately 32 bars. Red - random price oscillations, hangs around zero, theoretically with unlimited amplitude, but practice shows that it is possible to draw lines that intersect very seldom. Blue line + red line = green at any point. At the same time the blue one can be seen 32 bars ahead. Don't you think you would have to try very hard to lose on this? It is the simplest way of identifying and using patterns, so primitive that it is not a shame to show it to everyone.

I don't see anything useful in separating downward movement and upward movement. It's just another graphic representation of the same thing, while making it more complicated and less understandable, at least to me. You can change the coordinate system and display the price as a spiral or as a completely black spherical thing in a vacuum, what will it change? It is still unclear what to do with it. I also do not see anything good in excluding time from the chart. When I open a trade, I somehow do not really care if I close it in an hour or a year. So the timing has to be at least that's why. There are other reasons too.

I decided to tell the participants a market pattern that I have discovered (cautiously so far), which is that it turns out that not only individual patterns or pieces of the market can be similar, which many participants have noted many times, but whole sections of the market, sometimes of enormous length, not in terms of the coincidence of absolute price values, but its rhythm, if I may say so.

did you make any money from the market? or as usual...

I decided to tell the participants about a market regularity I have discovered (cautiously so far), which is that it turns out that not only separate patterns or pieces of the market can be similar, which was noted by many participants, but the whole market sections, sometimes of huge length, not in the sense of coincidence of absolute price values, but its rhythm, if I may put it that way. For example it is found out that now on H1 the rhythm that was in the market 96 bars ago is realized; similar results are obtained if we suppose that now the rhythm is similar to the situation 514 bars ago. These segments are found clearly when optimizing the Expert Advisor, which works on the base of the indicator. If you look at the chart 96 bars ago, for example, it looks like the same rhythm was repeated during the last week and now it is repeating itself, i.e. it is getting closer to the U-shape pattern, after we go back down one more time. This information should not be taken literally, but I suggest that you first seriously study it before you believe in this phenomenon. I may not be trying to make myself very clear, but the meaning should be clear, I think, and in the process of questions and answers will become definitively clear.

Did you make any money from the market or the usual...

the usual.

Maybe that's why it doesn't work, because it's analyzing this stream

and not these individually to begin with