[Branch closed!] EURUSD - Trends, Forecasts and Consequences (Episode 4) - page 342

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

What is the name of the blue-red channel indicator? If not exclusive then where can it be downloaded from?

I'm too lazy to do it with my hands.

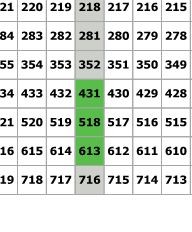

all by hand ! I'm already crazy about these numbers - here are the AUD USD levels

Here are the basic levels -

Make 180 degrees and on the opposite side will be 2 groups of lines - according to price

Poor Greeks... Nobody wants to help them until they reform... They're used to living large and now they're being squeezed from all sides...

I read a German publication about a month ago and it said that if Greece were to leave the Eurozone and become a bankrupt country, the Eurozone's economy would not suffer and only the EU's reputation would be damaged...

So it is. Yesterday I read an interview with a German expert on the DAX. She said that the index will certainly fall for a while, but not critically. Then it will recover quite quickly.

Here comes the 2nd time on the gannu not fortunalo )) as the first time rollback to the level of 180 degrees at the next boundary level - multiply the bid by 3 and wait for a rollback and now waiting -

By the way, a breakthrough level may be a signal to buy - but the trend is boring - we need adrenaline and moose

Well, I got to the monitor and did not find any signs of "up", although the last high was not yet the last, i.e. we will repeat it, and maybe even finish the whole movement at 1.44 or even further. The reversal - we are looking for a divergence on all the frames, but the "down" invitation is still there, it has not been cancelled.

Poor Greeks... Nobody wants to help them until they reform... They're used to living large, and now they're being squeezed from all sides...

I read a German publication about a month ago and it said that if Greece were to leave the Eurozone and become a bankrupt country, the Eurozone's economy would not suffer and only the EU's reputation would be damaged...

* German Chancellor Angela Merkel: Greek debt must be reduced and the country's competitiveness improved

" I am confident that agreements on Greece will be reached ....

" The main conditions for resolving the crisis are solidarity within the EU, Greek spending cuts and private sector participation...

* German Chancellor Angela Merkel: Greek debt must be reduced and the country's competitiveness improved

" I am confident that agreements on Greece will be reached ....

" The main conditions for resolving the crisis are solidarity within the EU, Greek spending cuts and private sector participation...

21-Jun 15:41 German Chancellor Angela Merkel: Greek debt must be reduced and the country's competitiveness improved

Analysts at DBS Group, one of Asia's largest financial holding companies, note that investors are waiting for Fed Chairman Ben Bernanke's press conference, hoping for reassurances that the US economic growth rate will pick up in the second half of the year.

Experts stress that Asian currencies, except the Japanese yen, have come under negative pressure since May, as the pace of global economic recovery slowed in the second quarter. The slowdown is mainly due to a deterioration in the US real estate and labour markets, as well as weakness in Japan's economy following March's earthquakes. Overall investor sentiment deteriorated even though there was some hope for a resolution of the Greek crisis.

According to the DBS, when Greece repays some of its obligations in July, the market's attention will lightning-fast shift to the controversy over raising the debt ceiling in the United States. The deadline for resolving this issue is August 2. As US debt is growing faster than the national economy, the US could lose its top credit rating and face an extremely slow economic recovery.

Romanov, as usual, is in his repertoire:

There are still no prerequisites for positions in the Eurodollar. There are no divergences, neither buy nor sell. There is a breakdown of the downward formation from 1.4946 upwards, despite Greece. But this is a foms waiting factor, because foms is a factor of dollar weakness. Simply because the fom is weak. A pathetic, insignificant individual. And the dollar suffers for that kid. So the closer the foms are, the lower the dollar is. Because the market has been expecting nothing from this open markets committee for a long time. Nothing good. The meeting starts today and will continue tomorrow. Rates are not expected to be raised, although QE2 is expected to be finished and people hope that QE3 will not be announced. There are no technical prerequisites, nor are there any. I think the Yevra made a foul above the RES from the 1.46 peak (blue), but I think it is even harder to believe that it will not go below the greenback (based on Greenwich closing prices ). And a return there is likely. Except that it will draw the head (H&S) and it will fall. And then there's the factor, the result of the Greek vote of confidence in the government is pending. And when it will be, and when the result will be, I don't know. They just say hourly that the eu is waiting for it. They are also waiting for the foms. There is no desire to bet money in such an environment. It's a waste. Yes also ifo today. By the way, the Belgian cofidence yesterday came out -3 vs +1 (that's the business climate index of the Belgian Central Bank), normally it was always an accurate indicator on the ifo. So a collapse in the Ifo today is most likely. But I will pass before the release