Trading Strategy Using Order Blocks

1. Confirm the TrendHigher Timeframe (HTF) Analysis: Start by identifying the trend direction using a higher timeframe. This could be daily or 4-hourly charts, depending on your preference and trading style. Determine whether the trend is bullish or bearish.

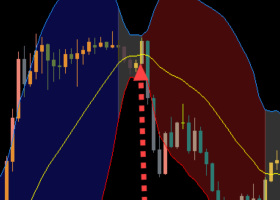

2. Identify Order Blocks (OB)

- Higher Timeframe Order Block (HTF OB): Look for significant price areas where price action has shown a strong reversal or consolidation. These are your Order Blocks on the higher timeframe. These blocks are crucial because they represent areas where institutional traders placed significant orders, causing a strong reaction in price.

3. Wait for a Pullback

- Wait for Price to Pull Back: After identifying the HTF OB, wait for price to retrace or pull back towards this level. This pullback signifies a potential opportunity to enter in the direction of the overall trend identified in Step 1.

4. Entry on Smaller Timeframes

- Lower Timeframe Analysis: Once the price reaches the HTF OB and starts to show signs of stalling or reversing on the smaller timeframes (such as 1-hour or 15-minute charts), switch your focus to these lower timeframes.

5. Break of Structure Confirmation

- Identify Break of Structure: Look for a break of structure on the lower timeframe that aligns with the direction of the higher timeframe trend. A break of structure could be a higher high (for a bullish trend) or a lower low (for a bearish trend).

6. Entry Points

- Enter the Trade: There are two possible scenarios for entering the trade on the lower timeframe:

- First Entry: Enter as soon as the break of structure occurs on the lower timeframe, confirming continuation in the direction of the HTF OB.

- Second Entry (Optional): Alternatively, if you miss the first entry, wait for a new pullback on the lower timeframe to another OB. This gives you a second chance to enter the trade at a potentially better price.

7. Stop Loss and Take Profit

- Set Stop Loss: Place your stop loss below the recent swing low (for long trades) or above the recent swing high (for short trades) on the lower timeframe.

- Take Profit: Aim for a target that is at least equal to your risk, preferably aiming for the next significant support or resistance level identified on the higher timeframe.

Example Scenario:

- Trend Identification: Daily chart shows a bullish trend.

- Higher Timeframe OB: Identified a strong reversal zone on the daily chart.

- Pullback: Price pulls back to the daily OB level.

- Lower Timeframe Entry: Switch to the 1-hour chart.

- Break of Structure: Look for a higher high on the 1-hour chart.

- Entry: Enter the trade on the break of structure or wait for a pullback to a smaller timeframe OB.

Notes:

- Patience: Wait for all conditions to be met before entering a trade.

- Risk Management: Always use stop losses to protect your capital.

- Confirmation: Use additional indicators or price action patterns to confirm entries if needed.

- Recommended broker for my products: https://shorturl.at/0bZT1 🔗

🔗 Trusted Brokers

🔹 Broker with low spreads: https://shorturl.at/VFRZ7

🔹 Broker with 1:500 leverage: https://shorturl.at/0bZT1

📈 Top Prop Firms

🔹 Recommended Prop Firm (FTMO): https://ftmo.com/en/?affiliates=VWYxkgRcQcnjtGMqsooQ

🔹 US-Friendly Prop Firm (10% OFF with code DOITTRADING): https://shorturl.at/7rPXM

💻 VPS for Reliable EA Hosting

🔹 Forex VPS: https://www.forexvps.net/?aff=78368