MarketKing

-

Introduction

When trading multiple currencies, one of the key advantages is the potential for diversification. If one currency pair is experiencing a loss, there is a strong possibility that another currency pair may be performing well, thus balancing your overall portfolio. This is largely due to the correlation between different currency pairs.

Trading with Multiple Currencies Using an EA

Using this Expert Advisor (EA) to trade multiple currency pairs simultaneously, such as GBP/USD, AUD/USD, and GBP/AUD, can be an effective strategy for managing risk and optimizing returns. Here’s how this approach works:

Benefits of Trading Multiple Currency Pairs

-

Diversification: By trading different currency pairs, you can spread your risk. If one pair is underperforming, the gains from another pair can help offset those losses.

-

Micro Lot Size: Trading with micro lot sizes (1,000 units of the base currency) allows for lower drawdown and more efficient risk management. This is particularly beneficial for traders who want to minimize their exposure while still participating in the forex market.

-

Automated Trading: This EA can automate the trading process, executing trades based on predefined strategies and parameters. This can help in maintaining discipline and consistency in trading decisions.

EA operates when the price is 'overbought' condition, it is likely to decline, signaling a good opportunity to sell. Conversely, when the price is 'oversold,' it indicates a potential rise, suggesting it is a good time to buy. This strategy aligns with the basic trading rule of buying at low prices and selling at high prices.

-

Trading Strategy

Bollinger Bands and Stochastic Oscillator Trading Strategy

The Bollinger Bands (BB) and Stochastic Oscillator strategy is a popular trading approach that combines these two powerful indicators to identify potential entry in the market. Here’s how this strategy works:

Understanding the Indicators

-

Bollinger Bands: This indicator consists of a middle band (the simple moving average) and two outer bands that represent volatility. The distance between the bands varies based on market conditions. When the price approaches the upper band, it may indicate that the asset is overbought, while approaching the lower band suggests it may be oversold .

-

Stochastic Oscillator: This momentum indicator compares a particular closing price of an asset to a range of its prices over a certain period. It generates values between 0 and 100, with readings below 20 indicating oversold conditions and above 80 indicating overbought conditions.

-

Average True Range (ATR)

The Average True Range (ATR) is a widely used technical indicator that measures market volatility. It provides traders with insights into how much a currency pair or asset typically moves over a specified period, which can be crucial for making informed trading decisions.

Uses of ATR

Trailing Stops: One of the primary applications of ATR is in setting trailing stops. A trailing stop is a dynamic stop-loss order that moves with the market price, allowing traders to lock in profits while giving the trade room to grow. By using ATR, traders can determine an appropriate distance for the trailing stop based on current market volatility. For example, a common strategy is to set the trailing stop at a multiple of the ATR below the current price in an uptrend.

Measuring Volatility: ATR quantifies volatility by calculating the average range of price movements over a specific time frame. This helps traders understand whether the market is experiencing high or low volatility, which can influence their trading strategies. In volatile markets, traders might choose to implement wider stops to accommodate larger price swings .

Understanding EA Parameters

Expert Advisors (EAs) are automated trading systems used in Forex trading to execute strategies without human intervention. The effectiveness of an EA largely depends on its parameters, which can significantly influence trading performance.

Key Parameters for EAs

-

Take Profit (TP) and Stop Loss (SL): These are crucial parameters that define the exit points for trades. Setting appropriate TP and SL levels can help manage risk and secure profits .

TakeProfitForfirstTrade: EA create TP for first buy or sell trade

ProfitPercent : Percent of Profit of total buy or sell trade individually and close on total balance percent.

LossPercent : Percent of Profit of total buy or sell trade individually and close on total balance percent.

Stoploss : Stop-losses for every open trade after first trade.

AtrTrailingStart : Pip points from current bid price for buy and ask price for sell

-

Max-spread : Maximum spread price for open new trade.

-

Lot Size: This parameter determines the size of each trade. Adjusting the lot size can affect the overall risk and potential return of the trading strategy.

X_Balance : Balance select for trade.

Lot_Size : Lot size select for trade.

-

Risk Management Settings: Parameters related to risk management, such as maximum drawdown and risk-to-reward ratio, are essential for maintaining a sustainable trading approach.

-

Timeframes: The timeframe settings for the EA can also be a parameter that influences how trades are executed. Different strategies may perform better on different timeframes.

-

Optimization Algorithms: Utilizing optimization algorithms can help in dynamically adjusting EA parameters to find the most effective settings for different market conditions .

DistanceFromLastTrade : pip difference form last buy open trade for buy trade and same for sell trade.

IndicatorTimeFrame : Time-frame for indicators.

VolatilityIndic : Atr value.

VolatilityLevel : levels for volatility measure with Atr.

FilterIndicator : Bollanger Bands value, use for signals filter.

TrendReversalIndic : Modified Stochastic indicator values.

Indicatorlevels : Levels of indicators for overbuy and oversell.

EA_Detail : comments about ea.

EA_No : Magic number.

TesterLossEnable : Calculate Trades losses during back-testing.

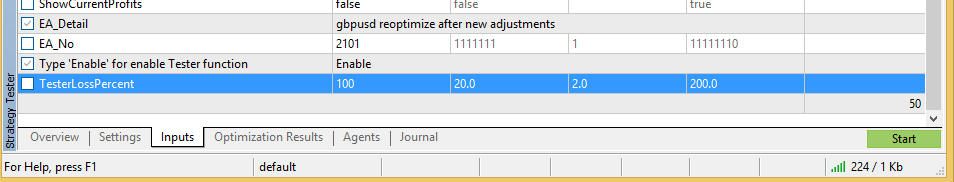

TesterLossPercent : Percent from total balance, if loss reach below adjust level during backtasting test process stop and switch to test next ea parameters. How to optimize for best settingsFollow steps below in picture.

-

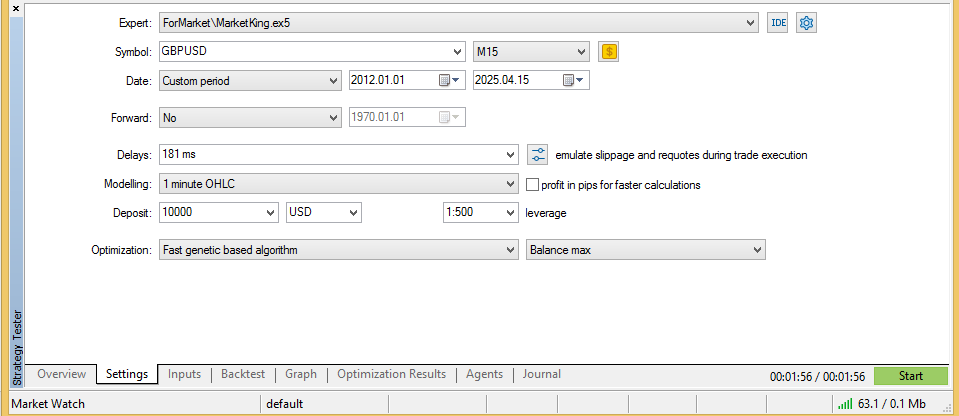

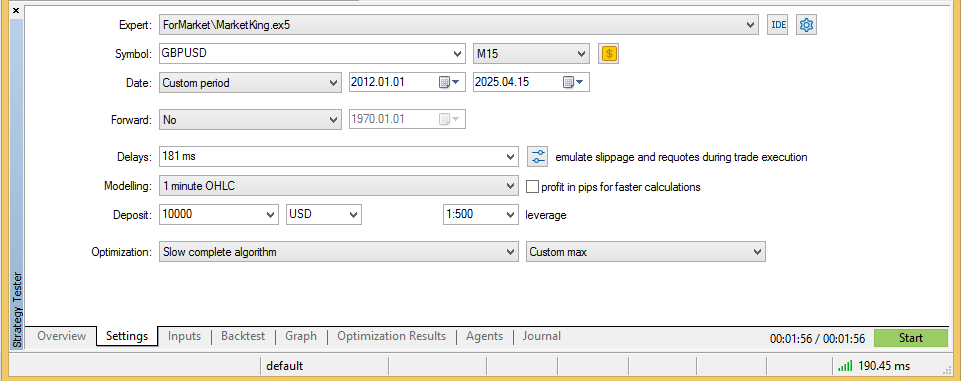

First step

Choose date, forward,delays,modeling,deposit,leverage and optimization.

-

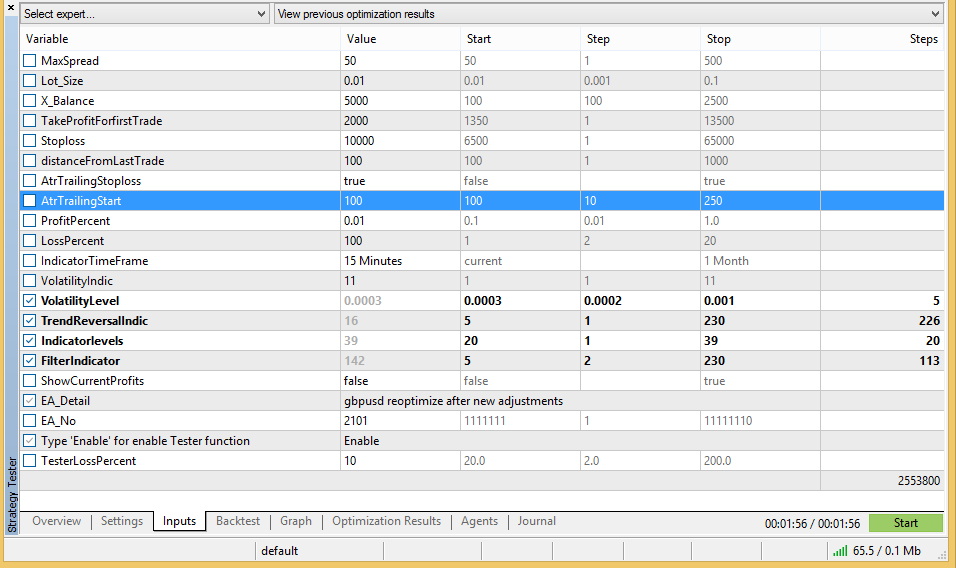

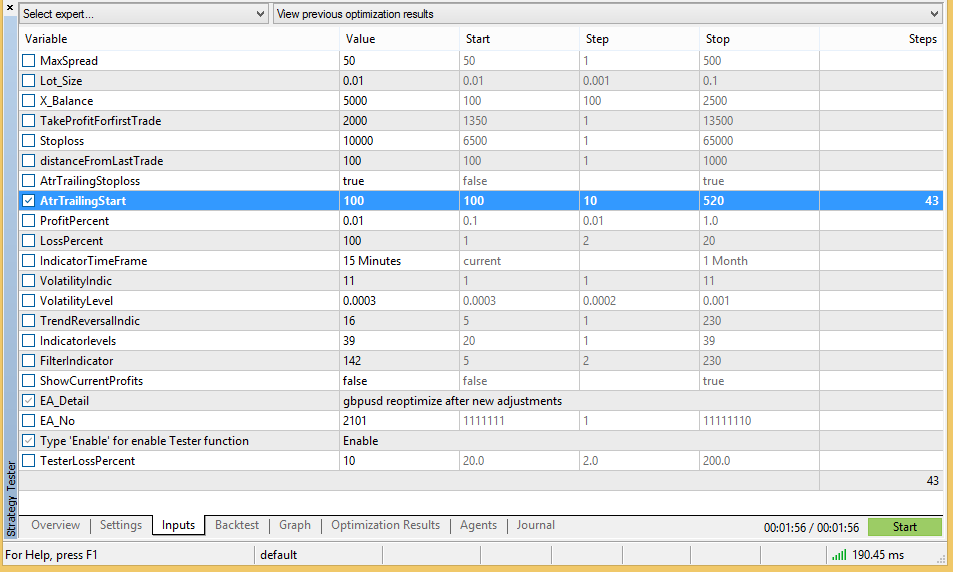

Second step

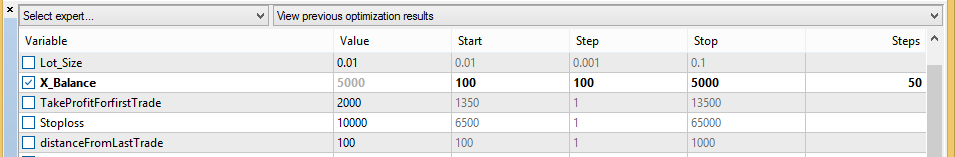

Choose settings you want to optimize.

-

Third step

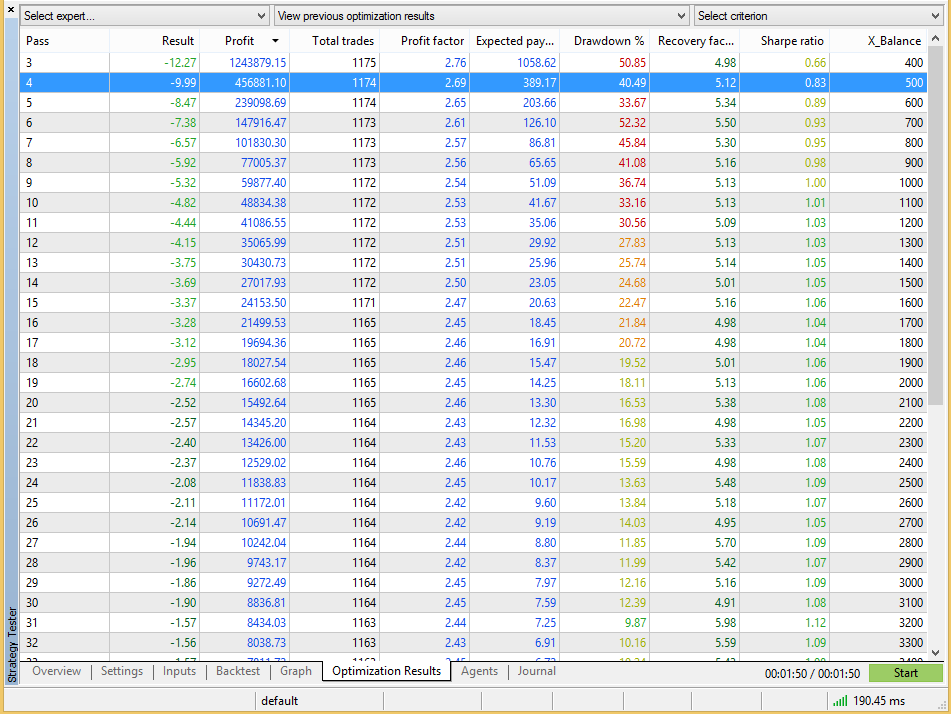

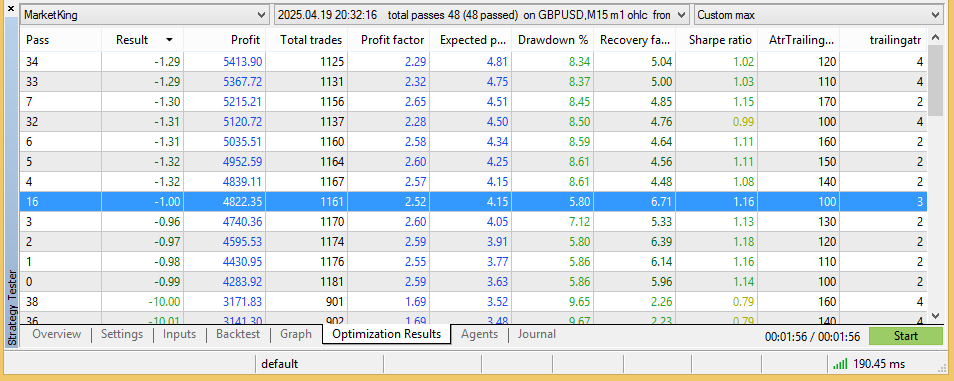

Choose best settings

-

More steps

If you want to more optimize choose one by one setting

Select “Slow complete algorithm”

Choose your setting

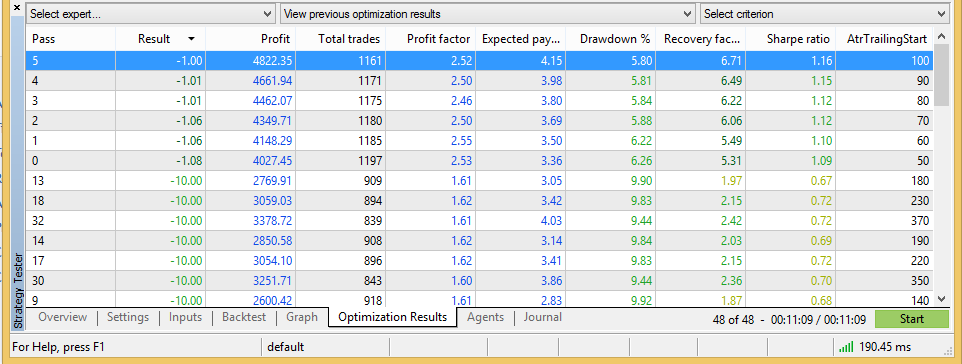

And select final best result

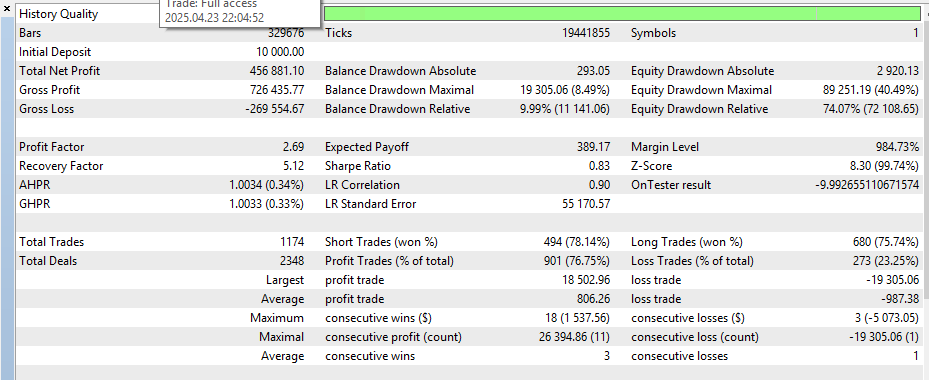

Examine the result

Then test X_balance from your choice, i choose from 100 to 5000 with 100 value step

And type 100 percent in testerlosspercent

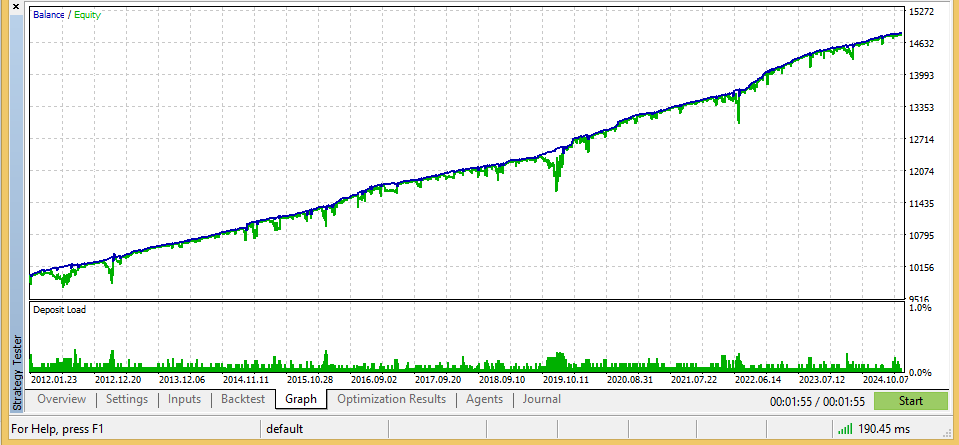

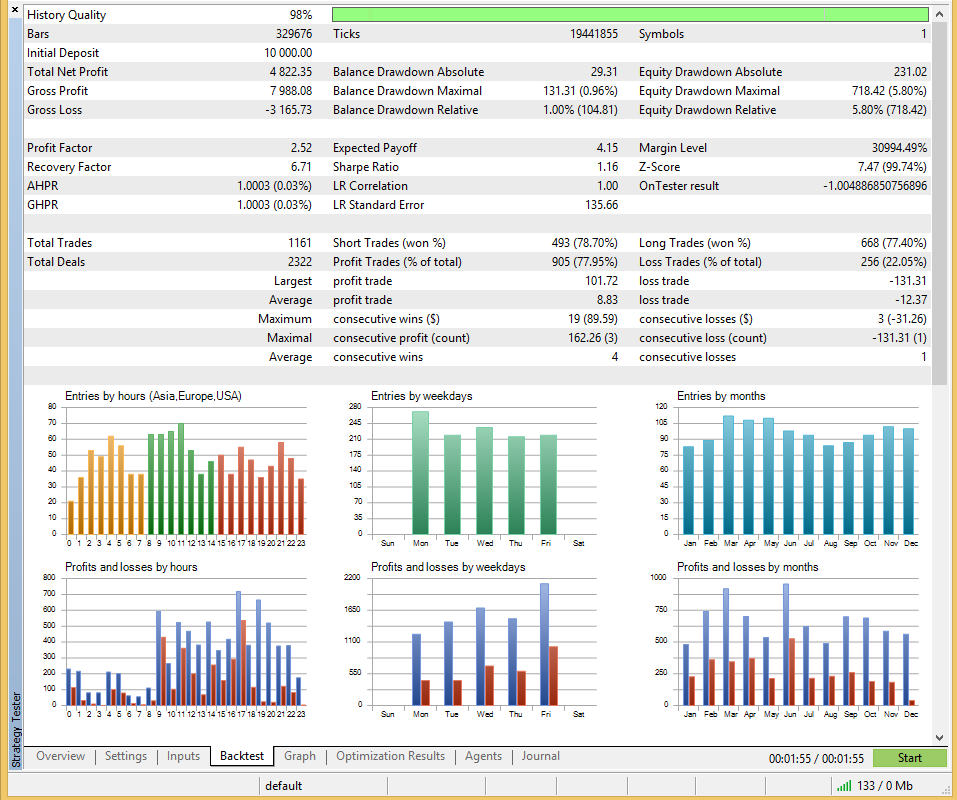

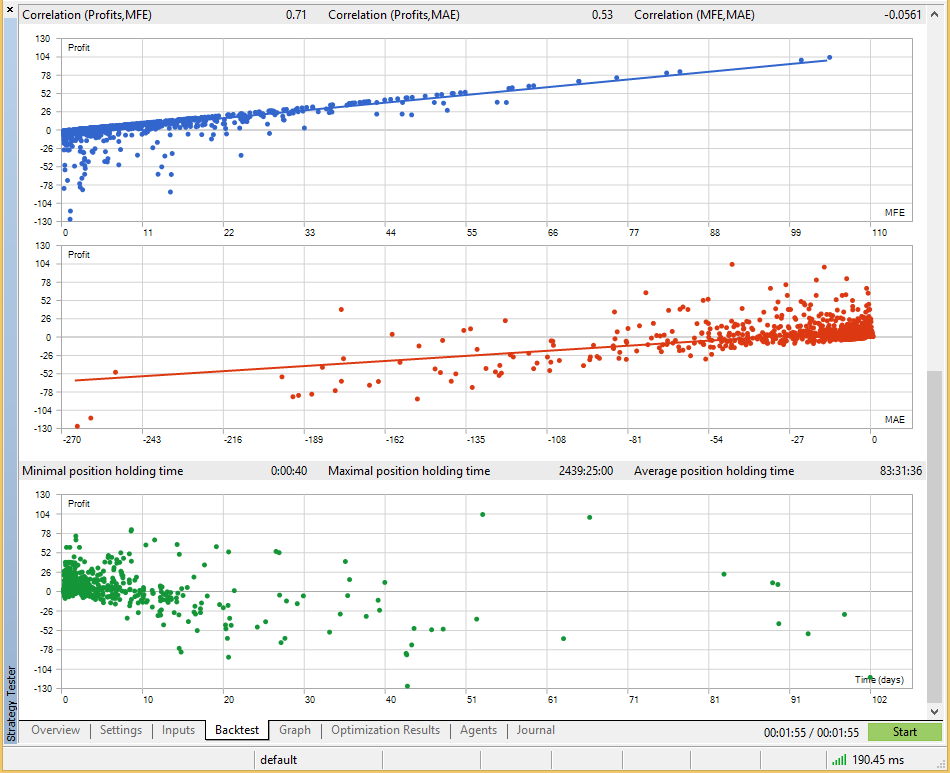

This is the final result