Interview with Valery Mazurenko (ATC 2010)

Interview on Automated Trading Championship 2010 from 13.10.2010.

Valery, how did you come to trading forex?

I've been working as a programmer in a dealing center for about two years. I had known nothing about financial markets before that. In the DC I was one of the two programmers to develop two versions of a client trading platform. By the way, I am still using one of them. I opened my first real account to use my robot – this was at times of MQL2. For six years I have written a lot of different Expert Advisors. Looking at all of them, I've come to a conclusion: no need to complicate an EA, the simpler the idea is the more stable the result is!

I haven't thought of financial markets as of a job until recently – trading was only a hobby for me. However, for about half a year I've been seriously trying to monetize this hobby and create a stable-operating Expert Advisor to then trade real.

Was your first robot successful?

I wouldn't let it trade real today. It was trading with various success, but after my deposit increased by 50% for a month, the dealing center disabled the automated trading option, though my deposit was not large. After that, using manual trading I lost it.

What do you do besides trading?

I'm a technical director in a small IT company that deals with different areas – from creating websites to encryption and secure data transfer. In addition I'm finishing postgraduate study of "Mathematical modeling and computational methods". My scientific work is mainly connected with fuzzy logic.

How important is mathematics for successful trading?

Serious mathematics is absolutely necessary for building money management and risk management strategies. But to create a relatively lossless system, you don't have to be a mathematician. This requires two qualities: a sensible view and clear mind. For instance, on many forums you meet hot discussions like "Locks (Martingale, averaging, grid EAs, scalping) - good or bad?" For me the answers are obvious. But many traders seeing a beautiful picture in a tester or on demo fall into a trance.

To develop a profitable strategy, you need many months of trial and testing. But if you have such a target, you can do that. And ignorance of math is not a problem.

Besides I'd like to mention a harmful assumption about money

management - for example, that drawdown should not exceed 30% of a

deposit. Well, you can use Stop Out for Stop Loss. And instead of

freezing 70% of your account, deposit it in any bank and have your

interest. Any way money management needs to be calculated separately for

each individual strategy. Unfortunately, not anyone can do that. That's

what the bad results occur from.

What currencies do your prefer to trade?

I don't have such pairs. Any idea that I implement is tested on random currency pairs (not only currencies, but also CFD) from the list. If unsuccessful, the idea goes into a trash. After two years of my hobby I've come to a conclusion that multicurrency EAs must be more stable. Strictly speaking, it's not a fact, but I somehow feel that. That's why any idea is admitted valid for further operation only if it shows good results on several random pairs.Actually, I've always set up my EAs for multi currency. It's more interesting to write multcurrency EAs - a wide scope for a programmer. And I believe such EAs have more chances in the long run. In the ATC 2006 I had a one-currency Expert Advisor. For ATC 2007 and 2008, as well as this year I submitted multicurrency EAs.

Valery, you are a regular participant of the Automated Trading Championship. What experience have you got from the previous contests?

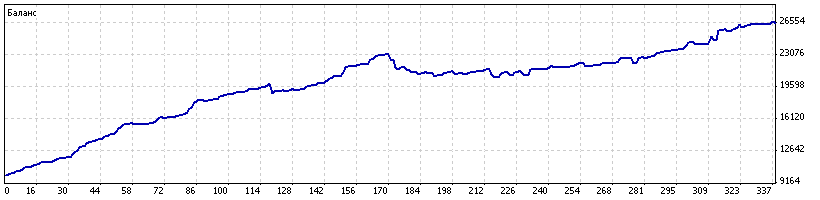

The first and most important – fall is a trend season, and flat strategies will have no effect (see 2006 and 2007). Nevertheless, sooner or later rollbacks and trend reversals appear (like in 2008), which kill a trading system that is not able to react to it. I don't think my past contesting experience was unsuccessful, because I always try to find the positive. This year my robot can repeat the fate of my previous developments. This is not because of high risks, but with a constant lot of 0.1 per a pair, with no averaging the EA gives almost a tripling since the beginning of this year (with a maximal drawdown of 33%). So I have a small reason to believe that I'll have positive results by the end of the Championship.

What is the trading principle of your Expert Advisor?

In addition to the principle of "Trend is my friend" I intentionally use two factors of randomness (fuzziness). This makes it kind of "rough".

Experienced developers will quickly find the first factor of fuzziness. And let the second factor be a secret. Besides it uses position averaging. But it's not a part of the strategy, but an aggressive money management for the Championship.

What money management system do you use in your Expert Advisor?

I don't use any serious money management for the Championship. It trades 1/15 of free margin at the moment when a pending order is placed. There is a small airbag: if lots are less than 0.1, they are not rounded to 0.1 as long as there are other open orders and positions. This airbag can be easily extended if added a condition not to open orders as long as there are other open orders and FreeMargin < 0.7 * Balance (or 0.8, or as you like it).

If the EA shows good results in the Championship, I'll work on its money management and risk management properly. First of all I'm interested in the applicability of investigations of Ralf Vince to this Expert Advisor. His principle of "optimal F" is not so hard to calculate for strategies that trade one currency and don't use averaging. And I was wondering out of curiosity to understand the optimal F when applied to multicurrency EAs.

You are actively using pending orders. What is the principle of placing them?

Almost right after getting acquainted with trading I decided that I'll work only with limit orders - no slippage, requote or similar problems. This greatly simplifies the code of the Expert Advisor. Limit orders are placed with trend - waiting for a small rollback. And orders for averaging are always behind the position open price.

Was it easy to learn MQL5? What was the process of adaptation?

I am programming several languages (mainly C/C++ and Delphi, I've used other languages, but don't know them well). I studied the required volume of MQL5 in two nights, writing the contest EA at the same time. The first night I sketched a prototype; the second night I was trying to find out why it was not working the way I wanted it to work. For the contesting EA I took away the standard library (five digit quotes – need to save time, and extra function calls mean extra expenditures). Unfortunately, it seemed not very convenient to use to me.

I don't feel discomfort using the new language version. I think access to bar data is not very convenient, but that's not a big problem. While the OOP is very convenient to use for multicurrency EAs. In MQL4 I had to deal with groups of arrays where appropriate EA settings were stored. Using them was not very convenient, and the entire code contained lots of cycles searching through currency pairs. In MQL5 all you need to do is declare a class, set operating logics for one pair and easily, by a simple declaration of class instance, setting of initial values and calling of appropriate functions the EA becomes multicurrency. While the logics of the EA operation stays clear.

Other useful features that I like are access to all symbols, even those unavailable in Market Watch, introduction of the __LINE__ macro and timer events. Another important function – the possibility to calculate the optimization criterion. What I really miss is interrupting of the optimization process in a program way upon a custom criterion. I guess there are many more innovations, but I didn't have time to try them yet, cause I've developed only one EA in MQL5.

And I'd like to thank all the members of the MQL community. Thanks to them it was swift to move to MQL5.

How do you assess your chances of winning the Championship?

I can't yet. In one of the Championships my EA got featured on the second place but finally finished at the end of the rating list. If the Expert Advisor earns more than $75,000 I'll be able to estimate chances then. With a smaller sum it can simply lose everything.

Do you like any of participating Expert Advisors?

Well, I like rho2010. Now it has a small profit factor, and it sets Stop Losses (which is not common of the championship). I hope it will be one of the leaders. Another one is DEDMOROZ, but it has large drawdowns; and -BerKut- that is aggressive enough but is still pretty accurate.

Generally speaking I like that there were no participants with Stop Out the first days of ATC 2010, like it had been in previous Championships.

Thank you for the interview and good luck!

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/531

Interview with Boris Odintsov (ATC 2010)

Interview with Boris Odintsov (ATC 2010)

Guide to Testing and Optimizing of Expert Advisors in MQL5

Guide to Testing and Optimizing of Expert Advisors in MQL5

Growing Neural Gas: Implementation in MQL5

Growing Neural Gas: Implementation in MQL5

The "New Bar" Event Handler

The "New Bar" Event Handler

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use