Piyush Lalsingh Ratnu / 个人资料

- 信息

|

不

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

3

信号

|

1

订阅者

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

Gold price (XAU/USD) attracts some dip-buyers during the early European trading bours on Monday and recovers a part of its retracement slide from a two-week high touched on Friday. Despite the Federal Reserve's (Fed) hawkish surprise, forecasting only one rate cut in 2024, the markets are still pricing in the possibility of two rate cuts this year amid signs of easing inflationary pressures. This, in turn, is seen weighing on the US Treasury bond yields, which, along with a softer risk tone, geopolitical tensions and political uncertainty in Europe, lend support to the safe-haven commodity.

Persistent US Dollar strength and a 🔺sharp upsurge in Palladium price weighed heavily on Gold price last Friday. The Greenback extended its recovery momentum alongside the US Treasury bond yields after the S&P Global preliminary US business activity jumped to a 26-month high. The Composite PMI Output Index that tracks the manufacturing and services sectors rose to the highest level since April 2022 at 54.6 this month. The final reading in May was at 54.5.

📌 Gold-Palladium Ratio:

When the ratio is low, it means that gold is undervalued relative to palladium. When the ratio is high, it means that gold is overvalued relative to palladium. Investors can thus use the ratio as a timing indicator deciding when to rebalance their positions in gold and palladium.

🔘 Check Gold:Palladium Ratios at:

https://www.gold.co.uk/price-ratio/gold/palladium/10year/

🔘 Check Gold:Silver Ratios at:

https://www.gold.co.uk/price-ratio/gold/palladium/10year/

Co-relations:

XAUXPD -8.0%

XAUXAG 78.45

XAUUSD $2330

US10YT 4.247

USDJPY 159.770

US F 1 - 2 3 + (MR)

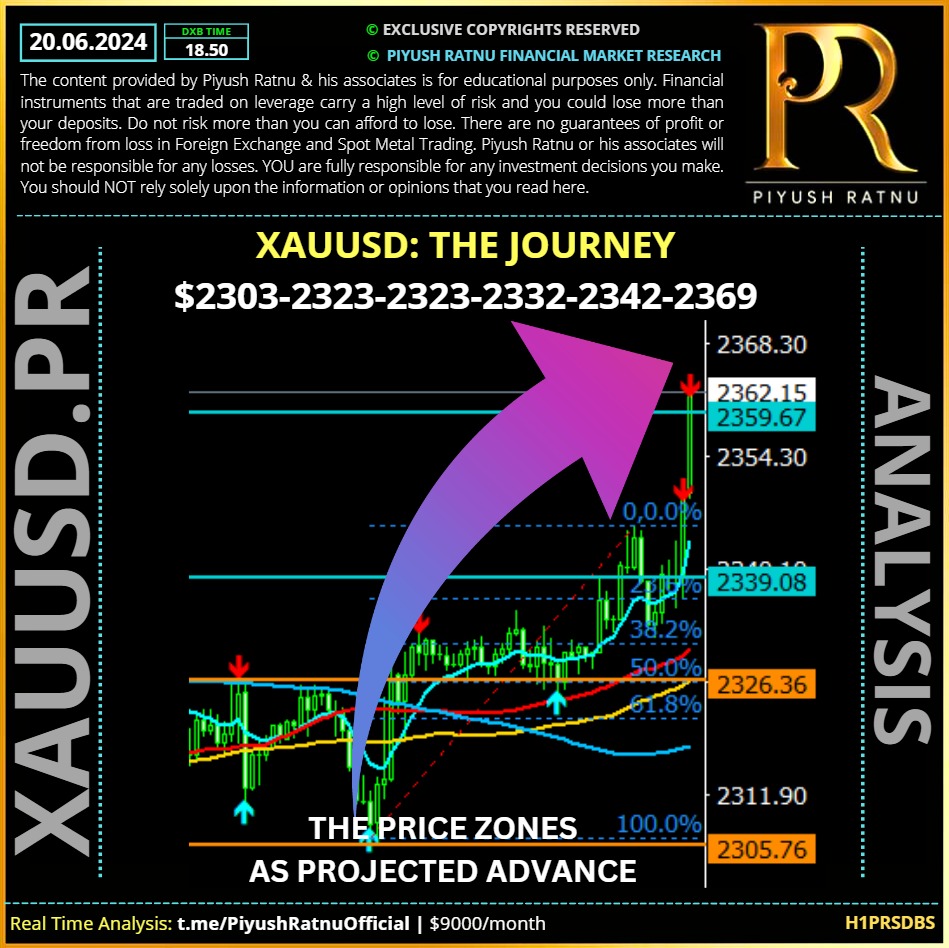

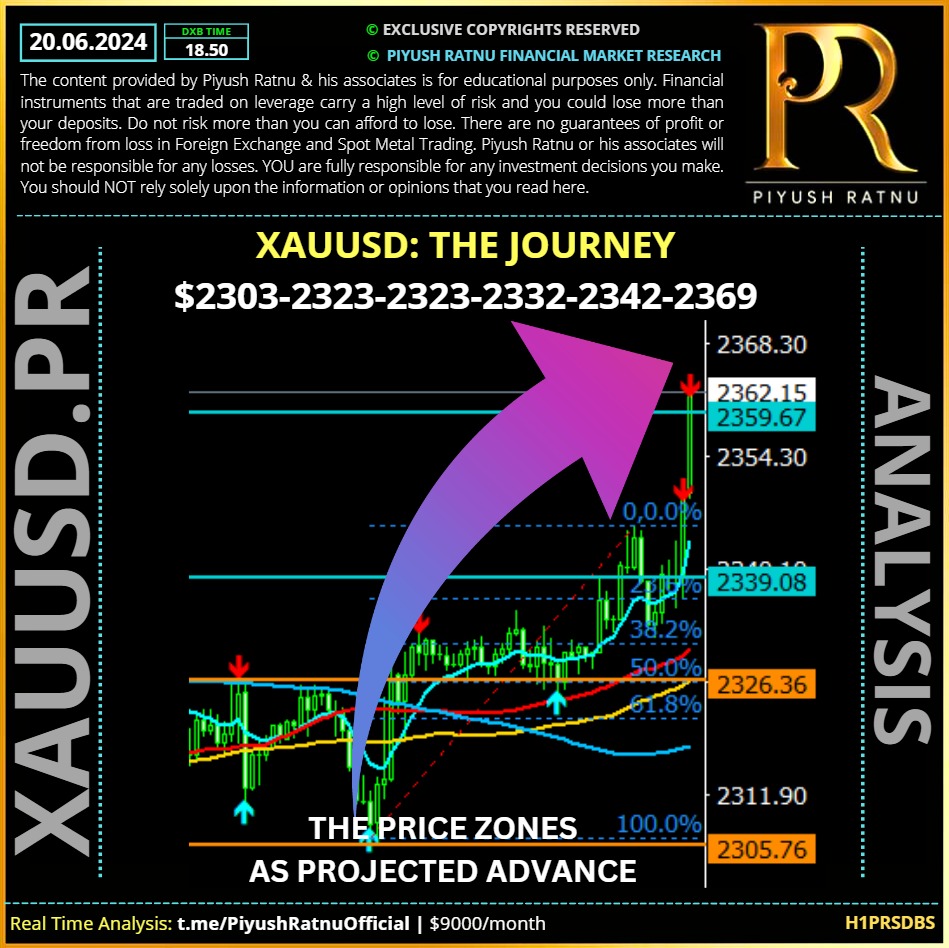

🟢 XAUUSD: Crucial Price Zones today:

🔺 SZ $2342 2369 2385

🔻 BZ $2313 2288 2266

🟢 USDJPY under heavy SHORT ORDER ZONE

I expected a correction till$ 158.588 / 156.566

Persistent US Dollar strength and a 🔺sharp upsurge in Palladium price weighed heavily on Gold price last Friday. The Greenback extended its recovery momentum alongside the US Treasury bond yields after the S&P Global preliminary US business activity jumped to a 26-month high. The Composite PMI Output Index that tracks the manufacturing and services sectors rose to the highest level since April 2022 at 54.6 this month. The final reading in May was at 54.5.

📌 Gold-Palladium Ratio:

When the ratio is low, it means that gold is undervalued relative to palladium. When the ratio is high, it means that gold is overvalued relative to palladium. Investors can thus use the ratio as a timing indicator deciding when to rebalance their positions in gold and palladium.

🔘 Check Gold:Palladium Ratios at:

https://www.gold.co.uk/price-ratio/gold/palladium/10year/

🔘 Check Gold:Silver Ratios at:

https://www.gold.co.uk/price-ratio/gold/palladium/10year/

Co-relations:

XAUXPD -8.0%

XAUXAG 78.45

XAUUSD $2330

US10YT 4.247

USDJPY 159.770

US F 1 - 2 3 + (MR)

🟢 XAUUSD: Crucial Price Zones today:

🔺 SZ $2342 2369 2385

🔻 BZ $2313 2288 2266

🟢 USDJPY under heavy SHORT ORDER ZONE

I expected a correction till$ 158.588 / 156.566

Piyush Lalsingh Ratnu

Friday’s US options expiration may provide volatility-starved traders with some short-term market swings. The so-called ‘triple-witching’ will see some $5.5 trillion worth of options tied to indexes, stocks, and exchange-traded funds fall off the board, according to an estimate from options platform SpotGamma. As the contracts disappear, investors will adjust their positions, adding a burst of volume capable of swinging individual holdings.

After the positions roll off, taking with it an estimated $5 billion in so-called “long gamma,” the market could be set for a touch of turbulence. Friday’s confluence of events as well as next Friday’s session, which will see the Russell indexes reshuffle, “will be explosive trading sessions as we have seen classic asset managers more actively take advantage of excess volumes and tactically trade positions around. - Scott Rubner, Goldman Sachs.

While mom-and-pop investors may hardly notice the events, dealers certainly will. For them, large expiries mean tough choices: roll or offset positions, or close them out entirely. The twists and turns can spur added gyrations, particularly in the final hour of trading, known — fittingly — as the ‘triple-witching hour.

After the positions roll off, taking with it an estimated $5 billion in so-called “long gamma,” the market could be set for a touch of turbulence. Friday’s confluence of events as well as next Friday’s session, which will see the Russell indexes reshuffle, “will be explosive trading sessions as we have seen classic asset managers more actively take advantage of excess volumes and tactically trade positions around. - Scott Rubner, Goldman Sachs.

While mom-and-pop investors may hardly notice the events, dealers certainly will. For them, large expiries mean tough choices: roll or offset positions, or close them out entirely. The twists and turns can spur added gyrations, particularly in the final hour of trading, known — fittingly — as the ‘triple-witching hour.

Piyush Lalsingh Ratnu

🔺WHY GOLD PRICE is rising? Analysis by Piyush Ratnu

Gold price is consolidating weekly gains near the highest level in nine days at $2,366, despite the US Dollar sticking to its recovery momentum alongside the US Treasury bond yields. Gold price looks forward to the preliminary business PMI data from both sides of the Atlantic for a fresh trading impetus.

Gold price remains on track to book the second weekly gain in a row, notwithstanding the late rebound in the US Dollar, as buyers continue to cheer increased interest rate cut bets by the US Federal Reserve (Fed) in September.

🔺US Data

Data released on Thursday pointed to a slowing US economy, as Initial Jobless Claims declined 5,000 to a seasonally adjusted 238,000 for the week ended June 15, retreating from a ten-month high. Meanwhile, Housing Starts fell 5.5% to a seasonally adjusted annual rate of 1.277 million units last month, the lowest since June 2020, below the expected 1.37 million units.

🔺Rate Cuts pushing GOLD price higher

A rate reduction by the Swiss National Bank (SNB) for the second consecutive meeting on Thursday, following the rate cuts deployed by the Bank of Canada (BoC) and the European Central Bank (ECB) reinforced the narrative that the era of lower borrowing costs is already underway, helping keep Gold price afloat amid underlying geopolitical tensions.

Signs of cooling US labor and housing market keep the hopes for a September Fed rate cut alive and kicking, benefiting the non-interest-bearing Gold price.

🔺Geo-political tension driving GOLD Price higher

Nevertheless, the Greenback managed to turn higher against other major currencies and remained pressured against Gold amid a bout of risk aversion triggered by Russia. President Vladimir Putin said the country is considering introducing changes to its nuclear doctrine, including lowering the threshold for the use of such weapons in the West.

🟢 Additionally, Putin said that Russia could provide other countries with its weapons as the West does to Ukraine.

Gold price lures buyers as investors remain wary following the meeting between Russia’s President Vladimir Putin and North Korean leader Kim Jong Un earlier this week, as Middle East tensions continue. Gold is considered the ultimate traditional safe-haven asset.

🔺Rising Gold Demand

Strengthening Gold demand from India, the world’s second-largest Gold consumer, renders positive for the bright metal. “Gold buying exceeded expectations leading up to the Akshaya Tritiya festival. The festival took place on May 10 and is a traditional auspicious day for gold purchases.

🟢 According to the World Gold Council, buying was surprisingly strong given that prices were 23 percent higher than they were during the 2023 festival,” Mike Maharrey at Money Metals Exchange explained.

Today, S&P Global will release the preliminary estimates of the US June PMIs, which are expected to indicate a slight contraction in business growth. The economy, however, is expected to remain in expansion territory.

🆘 Key Economic Data today:

10:00 GBP Core Retail Sales (MoM) (May) 1.3% -2.0%

10:00 GBP Core Retail Sales (YoY) (May) -0.8% -3.0%

10:00 GBP Retail Sales (YoY) (May) -0.9% -2.7%

10:00 GBP Retail Sales (MoM) (May) 1.6% -2.3%

17:45 USD S&P Global US Manufacturing PMI (Jun) 51.0 51.3

17:45 USD S&P Global Composite PMI (Jun) 54.5

17:45 USD S&P Global Services PMI (Jun) 53.4 54.8

18:00 USD Existing Home Sales (MoM) (May) -1.9%

18:00 USD Existing Home Sales (May) 4.08M 4.14M

18:00 USD US Leading Index (MoM) (May) -0.4% -0.6%

19:00 USD Fed Monetary Policy Report

⏰ Crucial Price Zones Ahead:

🔻BZ $2342/2323/2303/2288

🔺SZ $2385/2407/2424/2442

Refer: PRSRD1

#XAUUSD #PiyushRatnu #PRDXB #Forex #Gold

Gold price is consolidating weekly gains near the highest level in nine days at $2,366, despite the US Dollar sticking to its recovery momentum alongside the US Treasury bond yields. Gold price looks forward to the preliminary business PMI data from both sides of the Atlantic for a fresh trading impetus.

Gold price remains on track to book the second weekly gain in a row, notwithstanding the late rebound in the US Dollar, as buyers continue to cheer increased interest rate cut bets by the US Federal Reserve (Fed) in September.

🔺US Data

Data released on Thursday pointed to a slowing US economy, as Initial Jobless Claims declined 5,000 to a seasonally adjusted 238,000 for the week ended June 15, retreating from a ten-month high. Meanwhile, Housing Starts fell 5.5% to a seasonally adjusted annual rate of 1.277 million units last month, the lowest since June 2020, below the expected 1.37 million units.

🔺Rate Cuts pushing GOLD price higher

A rate reduction by the Swiss National Bank (SNB) for the second consecutive meeting on Thursday, following the rate cuts deployed by the Bank of Canada (BoC) and the European Central Bank (ECB) reinforced the narrative that the era of lower borrowing costs is already underway, helping keep Gold price afloat amid underlying geopolitical tensions.

Signs of cooling US labor and housing market keep the hopes for a September Fed rate cut alive and kicking, benefiting the non-interest-bearing Gold price.

🔺Geo-political tension driving GOLD Price higher

Nevertheless, the Greenback managed to turn higher against other major currencies and remained pressured against Gold amid a bout of risk aversion triggered by Russia. President Vladimir Putin said the country is considering introducing changes to its nuclear doctrine, including lowering the threshold for the use of such weapons in the West.

🟢 Additionally, Putin said that Russia could provide other countries with its weapons as the West does to Ukraine.

Gold price lures buyers as investors remain wary following the meeting between Russia’s President Vladimir Putin and North Korean leader Kim Jong Un earlier this week, as Middle East tensions continue. Gold is considered the ultimate traditional safe-haven asset.

🔺Rising Gold Demand

Strengthening Gold demand from India, the world’s second-largest Gold consumer, renders positive for the bright metal. “Gold buying exceeded expectations leading up to the Akshaya Tritiya festival. The festival took place on May 10 and is a traditional auspicious day for gold purchases.

🟢 According to the World Gold Council, buying was surprisingly strong given that prices were 23 percent higher than they were during the 2023 festival,” Mike Maharrey at Money Metals Exchange explained.

Today, S&P Global will release the preliminary estimates of the US June PMIs, which are expected to indicate a slight contraction in business growth. The economy, however, is expected to remain in expansion territory.

🆘 Key Economic Data today:

10:00 GBP Core Retail Sales (MoM) (May) 1.3% -2.0%

10:00 GBP Core Retail Sales (YoY) (May) -0.8% -3.0%

10:00 GBP Retail Sales (YoY) (May) -0.9% -2.7%

10:00 GBP Retail Sales (MoM) (May) 1.6% -2.3%

17:45 USD S&P Global US Manufacturing PMI (Jun) 51.0 51.3

17:45 USD S&P Global Composite PMI (Jun) 54.5

17:45 USD S&P Global Services PMI (Jun) 53.4 54.8

18:00 USD Existing Home Sales (MoM) (May) -1.9%

18:00 USD Existing Home Sales (May) 4.08M 4.14M

18:00 USD US Leading Index (MoM) (May) -0.4% -0.6%

19:00 USD Fed Monetary Policy Report

⏰ Crucial Price Zones Ahead:

🔻BZ $2342/2323/2303/2288

🔺SZ $2385/2407/2424/2442

Refer: PRSRD1

#XAUUSD #PiyushRatnu #PRDXB #Forex #Gold

Piyush Lalsingh Ratnu

Selling at and above $2359 R2 PRSRW1 and $2356 R5 PRSRD1 gave us neat exit.

CMP $2356.60

All trades closed.

KINDLY close all SHORT positions. XAUUSD.

#XAUUSD #GOLD #PiyushRatnu

CMP $2356.60

All trades closed.

KINDLY close all SHORT positions. XAUUSD.

#XAUUSD #GOLD #PiyushRatnu

Piyush Lalsingh Ratnu

Gold price is finding fresh demand early Thursday, having witnessed a muted Wednesday because of the Juneteenth holiday in the United States (US).

The US Dollar (USD) has paused its downside momentum, helped by a risk-averse market environment and a modest upswing in the US Treasury bond yields, underpinning the sentiment around the USD-denominated Gold price.

Investors seem to have turned cautious in the Asian trading hours after the People’s Bank of China (PBOC) left the key Loan Prime Rates unchanged, raising concerns over a lack of policy support to boost economic growth.

The sentiment around the Fed rate-cut expectations will continue to dominate the US Dollar price action, eventually influencing the latest uptick in Gold price. Should risk aversion intensify in the upcoming sessions, investors will likely flock to the safe-haven US Dollar, limiting the Gold price upside.

However, if the US Jobless Claims and housing data disappoint and add to the renewed dovish Fed bets, fuelled by weaker-than-expected US Retail Sales data, the US Dollar could see a fresh selling interest, providing extra legs to the Gold price advance.

Geo-political tension might trigger +rally in XAUUSD.

ISRAEL: https://www.bloomberg.com/news/articles/2024-06-18/netanyahu-tells-us-give-us-the-tools-we-ll-finish-the-job?srnd=homepage-middle-east

RUSSIA: https://www.bloomberg.com/news/articles/2024-06-20/putin-s-hybrid-war-opens-second-front-on-russia-s-border-with-nato?srnd=homepage-middle-east

IRAN: https://www.middleeastmonitor.com/20240619-iran-warns-hezbollah-about-israels-attempt-to-assassinate-nasrallah/

LEBANON: https://www.aljazeera.com/news/2024/6/19/israel-ready-for-all-out-war-in-lebanon

? Crucial Price Zones:

🔻SZ $2385/2407/2424/2442/2469

🔺BZ $$2307/2288/2266/2244/2222

#PiyushRatnu #XAUUSD #Gold #Forex #PRDXB

The US Dollar (USD) has paused its downside momentum, helped by a risk-averse market environment and a modest upswing in the US Treasury bond yields, underpinning the sentiment around the USD-denominated Gold price.

Investors seem to have turned cautious in the Asian trading hours after the People’s Bank of China (PBOC) left the key Loan Prime Rates unchanged, raising concerns over a lack of policy support to boost economic growth.

The sentiment around the Fed rate-cut expectations will continue to dominate the US Dollar price action, eventually influencing the latest uptick in Gold price. Should risk aversion intensify in the upcoming sessions, investors will likely flock to the safe-haven US Dollar, limiting the Gold price upside.

However, if the US Jobless Claims and housing data disappoint and add to the renewed dovish Fed bets, fuelled by weaker-than-expected US Retail Sales data, the US Dollar could see a fresh selling interest, providing extra legs to the Gold price advance.

Geo-political tension might trigger +rally in XAUUSD.

ISRAEL: https://www.bloomberg.com/news/articles/2024-06-18/netanyahu-tells-us-give-us-the-tools-we-ll-finish-the-job?srnd=homepage-middle-east

RUSSIA: https://www.bloomberg.com/news/articles/2024-06-20/putin-s-hybrid-war-opens-second-front-on-russia-s-border-with-nato?srnd=homepage-middle-east

IRAN: https://www.middleeastmonitor.com/20240619-iran-warns-hezbollah-about-israels-attempt-to-assassinate-nasrallah/

LEBANON: https://www.aljazeera.com/news/2024/6/19/israel-ready-for-all-out-war-in-lebanon

? Crucial Price Zones:

🔻SZ $2385/2407/2424/2442/2469

🔺BZ $$2307/2288/2266/2244/2222

#PiyushRatnu #XAUUSD #Gold #Forex #PRDXB

Piyush Lalsingh Ratnu

⚡️⚡️⚡️⚡️⚡️⚡️

Key Economic Data today:

16:30 USD Core Retail Sales (MoM) (May) 0.2% 0.2%

16:30 USD Retail Control (MoM) (May) -0.3%

16:30 USD Retail Sales (MoM) (May) 0.3% 0.0%

Gold price has been tracking the moves in the US Treasury bond yields so far this week, pausing its previous decline amid a modest weakness in the US Treasury bond yields. With an extension of the Wall Street risk rally into Asia, however, it remains to be seen if Gold price remains supported in the lead-up to the US economic docket.

Additionally, if the US Dollar rebound gains traction on robust Retail Sales data or hawkish remarks from Fed policymakers, Gold price could come under renewed selling pressure. US Retail Sales are expected to rise 0.2% MoM in May after reporting no growth in April. The core Retail Sales are likely to increase by 0.2% in May, at the same pace seen in April.

Meanwhile, the Fed speakers include Barkin, Kugler, Logan, Musalem and Goolsbee. Any hints from the officials warranting caution on inflation or pushing back against rate cuts will inject a fresh bout of strength into the US Dollar at the expense of Gold price.

Crucial Price Zones:

🔻BZ $2300/2288/2266

🔺SZ $2342/2369/2385

Key Economic Data today:

16:30 USD Core Retail Sales (MoM) (May) 0.2% 0.2%

16:30 USD Retail Control (MoM) (May) -0.3%

16:30 USD Retail Sales (MoM) (May) 0.3% 0.0%

Gold price has been tracking the moves in the US Treasury bond yields so far this week, pausing its previous decline amid a modest weakness in the US Treasury bond yields. With an extension of the Wall Street risk rally into Asia, however, it remains to be seen if Gold price remains supported in the lead-up to the US economic docket.

Additionally, if the US Dollar rebound gains traction on robust Retail Sales data or hawkish remarks from Fed policymakers, Gold price could come under renewed selling pressure. US Retail Sales are expected to rise 0.2% MoM in May after reporting no growth in April. The core Retail Sales are likely to increase by 0.2% in May, at the same pace seen in April.

Meanwhile, the Fed speakers include Barkin, Kugler, Logan, Musalem and Goolsbee. Any hints from the officials warranting caution on inflation or pushing back against rate cuts will inject a fresh bout of strength into the US Dollar at the expense of Gold price.

Crucial Price Zones:

🔻BZ $2300/2288/2266

🔺SZ $2342/2369/2385

Piyush Lalsingh Ratnu

Possible impact of BOND crash = uncertainty and panic, resulting in XAUUSD + | CMP $2320

Piyush Lalsingh Ratnu

Gold price is reversing a part of Friday’s upswing, having faced rejection once again above the $2,330 level early Monday. Gold price fails to benefit from a pause in the US Dollar (USD) upsurge, as the US Treasury bond yields recover after last week’s downward spiral.

On Friday, Gold price staged a rebound, courtesy of the continued decline in the US yields and mounting political uncertainty in the Euro area, as France is heading closer to the snap elections due on June 30. Gold traders overlooked the increase in the University of Michigan Inflation Expectations data for June amid mixed messages from the Fed policymakers.

Hawkish comments from Fed policymaker Kashkari combined with unimpressive Chinese economic data contributes to the renewed downside in Gold price. 🔻 China’s House Price Index declined 3.9% in May while Industrial Production fell more than expected. China’s Retail Sales rose 3.7% YoY in the same period, compared to a 3.0% increase expected.

Later in the day, traders will keep an eye on the Euro area political developments, which could have a significant impact on risk sentiment and the US Dollar price action, eventually influencing the USD-denominated Gold price moves. Speeches by Fed officials will be also closely scrutinized to gauge the timing of te interest rate cut.

🟢 Markets are currently pricing in about 62% odds of a rate cut by the Fed in September while that for December is seen at 27%.

🟢 Key Economic Events today:

12:00 EUR ECB's Lane Speaks

13:00 EUR ECB President Lagarde Speaks

13:00 EUR Wages in euro zone (YoY) (Q1) 3.10%

14:00 EUR Eurogroup Meetings

15:30 EUR ECB's De Guindos Speaks

16:30 USD NY Empire State Manufacturing Index (Jun) -12.50 -15.60

20:00 USD FOMC Member Williams Speaks

21:00 USD FOMC Member Harker Speaks

🍎 Crucial Price Zones: XAUUSD:

🔻BZ $2300/2288

🔺SZ $2342/2350

🟢 Refer Algo: PRSRL set D1

On Friday, Gold price staged a rebound, courtesy of the continued decline in the US yields and mounting political uncertainty in the Euro area, as France is heading closer to the snap elections due on June 30. Gold traders overlooked the increase in the University of Michigan Inflation Expectations data for June amid mixed messages from the Fed policymakers.

Hawkish comments from Fed policymaker Kashkari combined with unimpressive Chinese economic data contributes to the renewed downside in Gold price. 🔻 China’s House Price Index declined 3.9% in May while Industrial Production fell more than expected. China’s Retail Sales rose 3.7% YoY in the same period, compared to a 3.0% increase expected.

Later in the day, traders will keep an eye on the Euro area political developments, which could have a significant impact on risk sentiment and the US Dollar price action, eventually influencing the USD-denominated Gold price moves. Speeches by Fed officials will be also closely scrutinized to gauge the timing of te interest rate cut.

🟢 Markets are currently pricing in about 62% odds of a rate cut by the Fed in September while that for December is seen at 27%.

🟢 Key Economic Events today:

12:00 EUR ECB's Lane Speaks

13:00 EUR ECB President Lagarde Speaks

13:00 EUR Wages in euro zone (YoY) (Q1) 3.10%

14:00 EUR Eurogroup Meetings

15:30 EUR ECB's De Guindos Speaks

16:30 USD NY Empire State Manufacturing Index (Jun) -12.50 -15.60

20:00 USD FOMC Member Williams Speaks

21:00 USD FOMC Member Harker Speaks

🍎 Crucial Price Zones: XAUUSD:

🔻BZ $2300/2288

🔺SZ $2342/2350

🟢 Refer Algo: PRSRL set D1

Piyush Lalsingh Ratnu

#XAUUSD #Gold #PiyushRatnu

The initial market reaction to the softer US consumer inflation data on Wednesday faded rather quickly after the Federal Reserve said that it sees only one rate cut this year, which, in turn, is seen undermining the non-yielding Gold price.

Gold prices (XAU/USD) gained positive traction for the third successive day on Wednesday and touched a fresh weekly peak, around the $2,341-2,342 area in reaction to softer US consumer inflation figures. The momentum, however, ran out of steam in the vicinity of the 50-day Simple Moving Average (SMA) support-turned-resistance after the Federal Reserve's (Fed) hawkish surprise. In fact, policymakers now see just one rate cut in 2024 as compared to three projected in March, which, in turn, is seen exerting some follow-through pressure on the non-yielding yellow metal during the Asian session on Thursday.

Meanwhile, the shift in the Fed's projections, which led to a modest uptick in the US Treasury bond yields, assists the US Dollar (USD) to build on the overnight bounce from a multi-day low and further undermines the Gold price. That said, geopolitical tension in the Middle East and political uncertainty in Europe should lend some support to the XAU/USD. Nevertheless, the broader fundamental backdrop suggests that the path of least resistance for the XAU/USD is to the downside. Traders now look to Thursday's US economic docket – featuring the Producer Price Index (PPI) and Weekly Initial Jobless Claims data.

The initial market reaction to the softer US consumer inflation data on Wednesday faded rather quickly after the Federal Reserve said that it sees only one rate cut this year, which, in turn, is seen undermining the non-yielding Gold price.

Gold prices (XAU/USD) gained positive traction for the third successive day on Wednesday and touched a fresh weekly peak, around the $2,341-2,342 area in reaction to softer US consumer inflation figures. The momentum, however, ran out of steam in the vicinity of the 50-day Simple Moving Average (SMA) support-turned-resistance after the Federal Reserve's (Fed) hawkish surprise. In fact, policymakers now see just one rate cut in 2024 as compared to three projected in March, which, in turn, is seen exerting some follow-through pressure on the non-yielding yellow metal during the Asian session on Thursday.

Meanwhile, the shift in the Fed's projections, which led to a modest uptick in the US Treasury bond yields, assists the US Dollar (USD) to build on the overnight bounce from a multi-day low and further undermines the Gold price. That said, geopolitical tension in the Middle East and political uncertainty in Europe should lend some support to the XAU/USD. Nevertheless, the broader fundamental backdrop suggests that the path of least resistance for the XAU/USD is to the downside. Traders now look to Thursday's US economic docket – featuring the Producer Price Index (PPI) and Weekly Initial Jobless Claims data.

Piyush Lalsingh Ratnu

#XAUUSD #FOMC #Latest

USDJPY marching towards 10-11 June highs

XAUUSD lows on 10-11 June: $2288 zone

USDJPY marching towards 10-11 June highs

XAUUSD lows on 10-11 June: $2288 zone

Piyush Lalsingh Ratnu

#XAUUSD #Trading

Key Economic Data today:

16:30 USD Continuing Jobless Claims 1,800K 1,792K

16:30 USD Core PPI (MoM) (May) 0.3% 0.5%

16:30 USD Initial Jobless Claims 225K 229K

16:30 USD PPI (MoM) (May) 0.1% 0.5%

Key Economic Data today:

16:30 USD Continuing Jobless Claims 1,800K 1,792K

16:30 USD Core PPI (MoM) (May) 0.3% 0.5%

16:30 USD Initial Jobless Claims 225K 229K

16:30 USD PPI (MoM) (May) 0.1% 0.5%

Piyush Lalsingh Ratnu

Federal Reserve officials’ collective forecast for interest rates now implies only one quarter-point cut by the end of 2024.

That is a significant shift. It is two fewer reductions than the median estimate in the quarterly Summary of Economic Projections showed in March. Before the SEP was made public on Wednesday, interest-rate futures markets were pricing in the greatest probability of two cuts this year from the current target range of 5.25% to 5.5% for the federal-funds rate.

The SEP, known informally as the “dot plot,” is a collection of forecasts for the economy, inflation, the labor market, and interest rates offered by the seven Fed governors and 12 regional Fed presidents. It isn’t a formal plan, by any means, but rather an anonymous snapshot of top officials’ current thinking.

In aggregate, officials significantly dialed back their forecasts for rate cuts this year. The March SEP had 10 of 19 dots implying at least three cuts this year. In Wednesday’s dot plot, eight officials penciled in two cuts, seven had one cut, and four predicted no change in the fed-funds rate this year.

The median estimates for the fed-funds rate target range at the end of 2025 also moved higher by a quarter of a percentage point, to 4% to 4.25%, implying a cumulative percentage-point of cuts next year. For the end of 2026, the median dot on Wednesday showed an unchanged target range of 3% to 3.25%.

Officials’ median longer-run estimate of the fed-funds rate moved up by a quarter of a point for the second straight month, to 2.75% to 3.0%. That figure is seen as officials’ collective estimate of the so-called neutral rate of interest—the level that neither stimulates nor restricts economic activity.

That is a significant shift. It is two fewer reductions than the median estimate in the quarterly Summary of Economic Projections showed in March. Before the SEP was made public on Wednesday, interest-rate futures markets were pricing in the greatest probability of two cuts this year from the current target range of 5.25% to 5.5% for the federal-funds rate.

The SEP, known informally as the “dot plot,” is a collection of forecasts for the economy, inflation, the labor market, and interest rates offered by the seven Fed governors and 12 regional Fed presidents. It isn’t a formal plan, by any means, but rather an anonymous snapshot of top officials’ current thinking.

In aggregate, officials significantly dialed back their forecasts for rate cuts this year. The March SEP had 10 of 19 dots implying at least three cuts this year. In Wednesday’s dot plot, eight officials penciled in two cuts, seven had one cut, and four predicted no change in the fed-funds rate this year.

The median estimates for the fed-funds rate target range at the end of 2025 also moved higher by a quarter of a percentage point, to 4% to 4.25%, implying a cumulative percentage-point of cuts next year. For the end of 2026, the median dot on Wednesday showed an unchanged target range of 3% to 3.25%.

Officials’ median longer-run estimate of the fed-funds rate moved up by a quarter of a point for the second straight month, to 2.75% to 3.0%. That figure is seen as officials’ collective estimate of the so-called neutral rate of interest—the level that neither stimulates nor restricts economic activity.

Piyush Lalsingh Ratnu

#XAUUSD #FOMC #Forex #Powell

Power of disinflation has been unwinding pandemic shocks - POWELL

FAQ: What is disinflation?

Disinflation is a temporary slowing of the pace of price inflation. The term is used to describe occasions when the inflation rate has reduced marginally over the short term. Unlike inflation and deflation, which refer to the direction of prices, disinflation refers to the rate of change in the rate of inflation.

Power of disinflation has been unwinding pandemic shocks - POWELL

FAQ: What is disinflation?

Disinflation is a temporary slowing of the pace of price inflation. The term is used to describe occasions when the inflation rate has reduced marginally over the short term. Unlike inflation and deflation, which refer to the direction of prices, disinflation refers to the rate of change in the rate of inflation.

Piyush Lalsingh Ratnu

Federal Reserve issues FOMC statement

12 June 2024

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee's 2 percent inflation objective.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Philip N. Jefferson; Adriana D. Kugler; Loretta J. Mester; and Christopher J. Waller.

12 June 2024

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee's 2 percent inflation objective.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Philip N. Jefferson; Adriana D. Kugler; Loretta J. Mester; and Christopher J. Waller.

Piyush Lalsingh Ratnu

🆘 USDPY approaching H1A100

🟢 XAUUSD H1V100 @ 2385

🔺Crucial + stops: $2369/2385/2407/2424

🔻Crucial - stops: $2313/2288/2266/2244

Key Economic Data Ahead:

22:00 USD Federal Budget Balance (May) -279.6B 210.0B

22:00 USD Interest Rate Projection - 1st Yr (Q2) 3.9%

22:00 USD Interest Rate Projection - 2nd Yr (Q2) 3.1%

22:00 USD Interest Rate Projection - 3rd Yr 2.9%

22:00 USD Interest Rate Projection - Current (Q2) 4.6%

22:00 USD Interest Rate Projection - Longer (Q2) 2.6%

22:00 USD FOMC Economic Projections

22:00 USD FOMC Statement

22:00 USD Fed Interest Rate Decision 5.50% 5.50%

22:30 USD FOMC Press Conference

🟢 XAUUSD H1V100 @ 2385

🔺Crucial + stops: $2369/2385/2407/2424

🔻Crucial - stops: $2313/2288/2266/2244

Key Economic Data Ahead:

22:00 USD Federal Budget Balance (May) -279.6B 210.0B

22:00 USD Interest Rate Projection - 1st Yr (Q2) 3.9%

22:00 USD Interest Rate Projection - 2nd Yr (Q2) 3.1%

22:00 USD Interest Rate Projection - 3rd Yr 2.9%

22:00 USD Interest Rate Projection - Current (Q2) 4.6%

22:00 USD Interest Rate Projection - Longer (Q2) 2.6%

22:00 USD FOMC Economic Projections

22:00 USD FOMC Statement

22:00 USD Fed Interest Rate Decision 5.50% 5.50%

22:30 USD FOMC Press Conference

Piyush Lalsingh Ratnu

#XAUUSD under PPZ R2/S2 crucial entry zones.

#PiyushRatnu #PRDXb #Forex #Gold #Fx

#PiyushRatnu #PRDXb #Forex #Gold #Fx

Piyush Lalsingh Ratnu

H1V236 achieved $2309 CMP

+ Target $2323

- Target $2288

#XAUUSD #PiyushRatnu #PRDXB #Forex

+ Target $2323

- Target $2288

#XAUUSD #PiyushRatnu #PRDXB #Forex

Piyush Lalsingh Ratnu

Critical Week Ahead

This week promises another critical data event with the release of the Consumer Price Index (CPI) on Wednesday. This data, followed immediately by the Federal Reserve's interest rate decision, will significantly impact market volatility.

The contrasting data releases, with weak ADP data followed by strong Nonfarm Payrolls, have been mixed. While expectations of robust US employment solidified, the rising unemployment rate presents another data point leaving investors uncertain.

This week's CPI release could provide some clarity. A higher-than-expected CPI could prompt a cautious statement from the Fed, potentially bolstering the dollar's appeal as a safe haven asset. Conversely, lower-than-expected CPI would ease pressure on the Fed, potentially paving the way for a future rate cut.

The Fed initially anticipated three rate cuts in 2024, but current forecasts suggest only one. The exact timing of this cut remains speculative and will significantly impact markets.

The week began with subdued risk appetite due to the lingering effects of the employment data. The dollar maintained its positive momentum against other major currencies, pushing towards the 105 level on the DXY.

This week's economic data, particularly the CPI and Fed decision, will be crucial in determining the dollar's near-term trajectory and providing further clues about the Fed's future monetary policy actions.

A strong US NFP headline print and the wage inflation data drove the US Treasury bond yields sharply higher across the curve, with the 2-year Treasury yields, which is sensitive to Fed policy expectations, shooting up by the most in two months. The US Dollar followed the upsurge in the US Treasury bond yields on a significant decline in the bets for a US Federal Reserve (Fed) interest rate cut in September, weighing heavily on the non-interest-bearing Gold price.

Markets dialed down bets of a 25 basis points (bps) rate cut in September to about 43% from about 55% before the report, according to the CME Group’s FedWatch Tool, and now see roughly an even chance of two rate cuts by the end of 2024, versus about a 68% chance seen before the NFP release, per Reuters.

The US Dollar upside gains renewed traction early Monday, as markets ramp up their bets on delayed Fed rate cuts heading into the US Consumer Price Index (CPI) data and the Fed policy announcements due on Wednesday.

Further, traders also digest mounting political tension in the Euro area, especially after French President Emmanuel Macron announced snap elections on Sunday, dissolving parliament after exit polls showed his alliance suffered a heavy defeat in European elections to Marine Le Pen’s far-right National Rally (RN) party.

The French political uncertainty could continue to exert downside pressure on the EUR/USD pair, adding extra legs to the US Dollar at the expense of the Gold price.

Meanwhile, in the absence of top-tier US economic data on Monday, all eyes will remain on risk sentiment and the US Dollar dynamics for fresh trading impetus on Gold price.

This week promises another critical data event with the release of the Consumer Price Index (CPI) on Wednesday. This data, followed immediately by the Federal Reserve's interest rate decision, will significantly impact market volatility.

The contrasting data releases, with weak ADP data followed by strong Nonfarm Payrolls, have been mixed. While expectations of robust US employment solidified, the rising unemployment rate presents another data point leaving investors uncertain.

This week's CPI release could provide some clarity. A higher-than-expected CPI could prompt a cautious statement from the Fed, potentially bolstering the dollar's appeal as a safe haven asset. Conversely, lower-than-expected CPI would ease pressure on the Fed, potentially paving the way for a future rate cut.

The Fed initially anticipated three rate cuts in 2024, but current forecasts suggest only one. The exact timing of this cut remains speculative and will significantly impact markets.

The week began with subdued risk appetite due to the lingering effects of the employment data. The dollar maintained its positive momentum against other major currencies, pushing towards the 105 level on the DXY.

This week's economic data, particularly the CPI and Fed decision, will be crucial in determining the dollar's near-term trajectory and providing further clues about the Fed's future monetary policy actions.

A strong US NFP headline print and the wage inflation data drove the US Treasury bond yields sharply higher across the curve, with the 2-year Treasury yields, which is sensitive to Fed policy expectations, shooting up by the most in two months. The US Dollar followed the upsurge in the US Treasury bond yields on a significant decline in the bets for a US Federal Reserve (Fed) interest rate cut in September, weighing heavily on the non-interest-bearing Gold price.

Markets dialed down bets of a 25 basis points (bps) rate cut in September to about 43% from about 55% before the report, according to the CME Group’s FedWatch Tool, and now see roughly an even chance of two rate cuts by the end of 2024, versus about a 68% chance seen before the NFP release, per Reuters.

The US Dollar upside gains renewed traction early Monday, as markets ramp up their bets on delayed Fed rate cuts heading into the US Consumer Price Index (CPI) data and the Fed policy announcements due on Wednesday.

Further, traders also digest mounting political tension in the Euro area, especially after French President Emmanuel Macron announced snap elections on Sunday, dissolving parliament after exit polls showed his alliance suffered a heavy defeat in European elections to Marine Le Pen’s far-right National Rally (RN) party.

The French political uncertainty could continue to exert downside pressure on the EUR/USD pair, adding extra legs to the US Dollar at the expense of the Gold price.

Meanwhile, in the absence of top-tier US economic data on Monday, all eyes will remain on risk sentiment and the US Dollar dynamics for fresh trading impetus on Gold price.

Piyush Lalsingh Ratnu

After NFP: $2388-2288 achieved, After FOMC: $2244/2222 or $2400/2424 next? Analysis by Piyush Ratnu

A strong US NFP headline print and the wage inflation data drove the US Treasury bond yields sharply higher across the curve, with the 2-year Treasury yields, which is sensitive to Fed policy expectations, shooting up by the most in two months. The US Dollar followed the upsurge in the US Treasury bond yields on a significant decline in the bets for a US Federal Reserve (Fed) interest rate cut in September, weighing heavily on the non-interest-bearing 🔻 Gold price.

Markets dialed down bets of a 25 basis points (bps) rate cut in September to about 43% from about 55% before the report, according to the CME Group’s FedWatch Tool, and now see roughly an even chance of two rate cuts by the end of 2024, versus about a 68% chance seen before the NFP release, per Reuters.

Furthermore, reports that the People's Bank of China (PBoC) paused gold purchases to its reserves in May, ending a massive buying spree that ran for 18 months, further seem to undermine the Gold price. That said, a cautious market mood lends some support to the safe-haven XAU/USD and helps limit deeper losses. Traders also seem reluctant to place aggressive directional bets ahead of this week's key US data and central bank event risk – the release of the latest US consumer inflation figures and the outcome of the two-day FOMC policy meeting on Wednesday. This, in turn, warrants caution before positioning for further losses.

The US Dollar 🔺 upside gains renewed traction early Monday, as markets ramp up their bets on delayed Fed rate cuts heading into the US Consumer Price Index (CPI) data and the Fed policy announcements due on Wednesday.⚠️

XAUUSD/Spot GOLD: Crucial Price zones today:

XAUUSD under PPZ

🔻 S2 $2244 zone

🔺 R2 $2342 zone

AVOID Big Lots.

Wednesday 12.06.2024 will mark another $100 movement in the following days.

I had alerted $100 price action is expected last week, verify here: https://t.me/c/1654158888/9313: where in $2387-$2287 price crash was observed in a single day before and after NFP data was published.

As usual, justifying a price crash after the crash or rise is too convenient for media houses, however what needs to be noticed here is that we alert and project price movements in advance, where in traders get enough time to encash it / save their account from higher drawdowns.

🟢 Hence trade wisely, at price zones projected by us and avoid taking high risks in between the price zones mentioned by me, to keep low drawdowns and higher ROI like this:

https://bit.ly/PRtrackRecord

A strong US NFP headline print and the wage inflation data drove the US Treasury bond yields sharply higher across the curve, with the 2-year Treasury yields, which is sensitive to Fed policy expectations, shooting up by the most in two months. The US Dollar followed the upsurge in the US Treasury bond yields on a significant decline in the bets for a US Federal Reserve (Fed) interest rate cut in September, weighing heavily on the non-interest-bearing 🔻 Gold price.

Markets dialed down bets of a 25 basis points (bps) rate cut in September to about 43% from about 55% before the report, according to the CME Group’s FedWatch Tool, and now see roughly an even chance of two rate cuts by the end of 2024, versus about a 68% chance seen before the NFP release, per Reuters.

Furthermore, reports that the People's Bank of China (PBoC) paused gold purchases to its reserves in May, ending a massive buying spree that ran for 18 months, further seem to undermine the Gold price. That said, a cautious market mood lends some support to the safe-haven XAU/USD and helps limit deeper losses. Traders also seem reluctant to place aggressive directional bets ahead of this week's key US data and central bank event risk – the release of the latest US consumer inflation figures and the outcome of the two-day FOMC policy meeting on Wednesday. This, in turn, warrants caution before positioning for further losses.

The US Dollar 🔺 upside gains renewed traction early Monday, as markets ramp up their bets on delayed Fed rate cuts heading into the US Consumer Price Index (CPI) data and the Fed policy announcements due on Wednesday.⚠️

XAUUSD/Spot GOLD: Crucial Price zones today:

XAUUSD under PPZ

🔻 S2 $2244 zone

🔺 R2 $2342 zone

AVOID Big Lots.

Wednesday 12.06.2024 will mark another $100 movement in the following days.

I had alerted $100 price action is expected last week, verify here: https://t.me/c/1654158888/9313: where in $2387-$2287 price crash was observed in a single day before and after NFP data was published.

As usual, justifying a price crash after the crash or rise is too convenient for media houses, however what needs to be noticed here is that we alert and project price movements in advance, where in traders get enough time to encash it / save their account from higher drawdowns.

🟢 Hence trade wisely, at price zones projected by us and avoid taking high risks in between the price zones mentioned by me, to keep low drawdowns and higher ROI like this:

https://bit.ly/PRtrackRecord

: