Piyush Lalsingh Ratnu / 个人资料

- 信息

|

不

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

3

信号

|

1

订阅者

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

USDJPY and XAUUSD I expect correction/rally at or before 6.30 PM today, I will avoid big lots till then.

Piyush Lalsingh Ratnu

🆘 BoJ to maintain the status quo and remain dovish

The Bank of Japan (BoJ) will hold its Monetary Policy Committee (MPC) on Tuesday, January 23 The BoJ will release its Outlook for Economic Activity and Prices, i.e. its Outlook Report at the same time.

No tweak in the Yield Curve Control (YCC) and no change in easy monetary policy are anticipated by market participants as recent events put the BoJ in a difficult spot to advocate any significant shift in its ultra-easy monetary stance.

The Bank of Japan (BoJ) will hold its Monetary Policy Committee (MPC) on Tuesday, January 23 The BoJ will release its Outlook for Economic Activity and Prices, i.e. its Outlook Report at the same time.

No tweak in the Yield Curve Control (YCC) and no change in easy monetary policy are anticipated by market participants as recent events put the BoJ in a difficult spot to advocate any significant shift in its ultra-easy monetary stance.

Piyush Lalsingh Ratnu

🔷 USDJPY under PPZ | (D1 setting)

S2: 147.565

S3: 147.145

S4: 146.885

S5: 146.465

R2: 148.665

R3: 149.085

R4: 149.345

R5: 149.765

S2: 147.565

S3: 147.145

S4: 146.885

S5: 146.465

R2: 148.665

R3: 149.085

R4: 149.345

R5: 149.765

Piyush Lalsingh Ratnu

🆘 End OF trading session for today.

Next Trading session tomorrow at 06.00 AM, before BOJ IR.

Next Trading session tomorrow at 06.00 AM, before BOJ IR.

Piyush Lalsingh Ratnu

Auto-Copy our trades on your MT4/MT5 accounts with any broker. Connect with us for more details at https://t.me/PiyushRatnuOfficial

Check Track Record at: https://bit.ly/PR10kHFT

Check Track Record at: https://bit.ly/PR10kHFT

Piyush Lalsingh Ratnu

Ongoing co-relations:

US10YT -1.28%

DXY 102.985

XAUXAG 91.86 (indicating volatility)

USD S 55

AUD S 33

JPY S 75 (indicating + XAUUSD)

USDJPY CMP $147.800 (17 Jan lows)

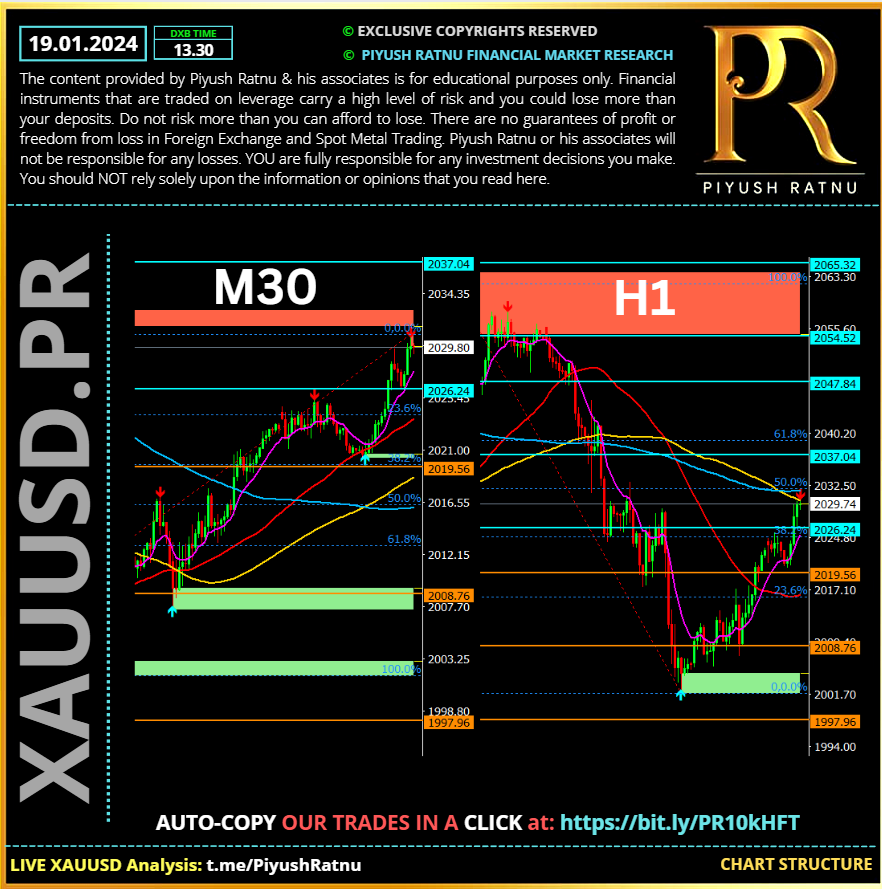

XAUUSD Range: $2027- $2002

Way ahead:

+ USDJPY might push XAUUSD to $2009 zone 🍎

- USDJPY, US10YT, DXY might push XAUUSD towards $2036/2042⚠️ once again.

CMP $2021

US10YT -1.28%

DXY 102.985

XAUXAG 91.86 (indicating volatility)

USD S 55

AUD S 33

JPY S 75 (indicating + XAUUSD)

USDJPY CMP $147.800 (17 Jan lows)

XAUUSD Range: $2027- $2002

Way ahead:

+ USDJPY might push XAUUSD to $2009 zone 🍎

- USDJPY, US10YT, DXY might push XAUUSD towards $2036/2042⚠️ once again.

CMP $2021

Piyush Lalsingh Ratnu

Global equities powered higher, as expectations of resilient US economic growth and solid company earnings pointed to another record high for Wall Street.

Nasdaq 100 Index futures rose 0.6% and S&P 500 contracts climbed 0.4%. Micron Technology Inc. and PayPal Holdings Inc. were among the tech names to advance in US pre-market trading. In bond markets, Italy’s yield premium over Germany tightened to the narrowest in almost two years.

Meanwhile, the rout in Chinese stocks intensified. The Hang Seng China Enterprises Index fell 2.4%, approaching a 2005 low. Chinese commercial lenders held their benchmark lending rates on Monday, disappointing investors hoping for more aggressive stimulus.

In Europe, shares in Swedish online gambling firm Kindred Group Plc jumped 19% after a $2.7 billion offer from La Francaise des Jeux SA, while Worldline SA rose after Credit Agricole acquired a 7% stake to help stabilize its struggling payments partner.

♾ Investor attention turns now to meetings at the Bank of Japan on Tuesday and the European Central Bank Thursday, with both institutions expected to leave their policy settings unchanged.

♾ The US fourth-quarter GDP report on Thursday could offer clues on the timing of the Fed’s first rate cut.

Key events this week:

• US Conference Board leading index, Monday

• Bank of Japan rate decision, Tuesday

• Eurozone consumer confidence, Tuesday

• Netflix Inc. to report earnings; the streaming service is set to post a strong finish to 2023, Tuesday

• Japan trade, Wednesday

• Eurozone S&P Global Services & Manufacturing PMI, Wednesday

• UK S&P Global / CIPS Manufacturing PMI, Wednesday

• US S&P Global Services & Manufacturing PMI, Wednesday

• Tesla Inc., International Business Machines Corp. (IBM) to report earnings, Wednesday

• European Central Bank rate decision, Thursday

• Germany IFO business climate, Thursday

• US GDP, initial jobless claims, durable goods, wholesale inventories, new home sales, Thursday

• LVMH, Northrop Grumman Corp., SK Hynix Inc. to report earnings, Thursday

• Japan Tokyo CPI, Friday

• Bank of Japan issues minutes of policy meeting, Friday

• US personal income & spending, Friday

• In China, the holiday rush starts ahead of next month’s Lunar New Year, Friday

Nasdaq 100 Index futures rose 0.6% and S&P 500 contracts climbed 0.4%. Micron Technology Inc. and PayPal Holdings Inc. were among the tech names to advance in US pre-market trading. In bond markets, Italy’s yield premium over Germany tightened to the narrowest in almost two years.

Meanwhile, the rout in Chinese stocks intensified. The Hang Seng China Enterprises Index fell 2.4%, approaching a 2005 low. Chinese commercial lenders held their benchmark lending rates on Monday, disappointing investors hoping for more aggressive stimulus.

In Europe, shares in Swedish online gambling firm Kindred Group Plc jumped 19% after a $2.7 billion offer from La Francaise des Jeux SA, while Worldline SA rose after Credit Agricole acquired a 7% stake to help stabilize its struggling payments partner.

♾ Investor attention turns now to meetings at the Bank of Japan on Tuesday and the European Central Bank Thursday, with both institutions expected to leave their policy settings unchanged.

♾ The US fourth-quarter GDP report on Thursday could offer clues on the timing of the Fed’s first rate cut.

Key events this week:

• US Conference Board leading index, Monday

• Bank of Japan rate decision, Tuesday

• Eurozone consumer confidence, Tuesday

• Netflix Inc. to report earnings; the streaming service is set to post a strong finish to 2023, Tuesday

• Japan trade, Wednesday

• Eurozone S&P Global Services & Manufacturing PMI, Wednesday

• UK S&P Global / CIPS Manufacturing PMI, Wednesday

• US S&P Global Services & Manufacturing PMI, Wednesday

• Tesla Inc., International Business Machines Corp. (IBM) to report earnings, Wednesday

• European Central Bank rate decision, Thursday

• Germany IFO business climate, Thursday

• US GDP, initial jobless claims, durable goods, wholesale inventories, new home sales, Thursday

• LVMH, Northrop Grumman Corp., SK Hynix Inc. to report earnings, Thursday

• Japan Tokyo CPI, Friday

• Bank of Japan issues minutes of policy meeting, Friday

• US personal income & spending, Friday

• In China, the holiday rush starts ahead of next month’s Lunar New Year, Friday

Piyush Lalsingh Ratnu

🆘 Co-relations Alert: USDJPY crashing to 18.01.2024 price zone: 147.900-147.600, XAUUSD as a result might march towards 18.01.2024 price zone: 2048-2054.

US10YT -

USDJPY -

USD S 27

JPY S 60

AUD S 90

XAUXAG 89.24

Avoid Big lots, implement risk management.

US10YT -

USDJPY -

USD S 27

JPY S 60

AUD S 90

XAUXAG 89.24

Avoid Big lots, implement risk management.

Piyush Lalsingh Ratnu

Fresh reports hit the wires earlier this morning that Iran-backed Houthi terrorists launched two anti-ship ballistic missiles at M/V Chem Ranger, a Marshall Island-flagged, U.S.-Owned, Greek-operated tanker ship. This comes after the United States (US) launched new strikes against Houthi anti-ship missiles aimed at the Red Sea on Thursday.

Escalating geopolitical tensions in the Red Sea fuels worries of the strife becoming a wider regional conflict, underpinning the safe-haven demand for the Gold price.

Despite traders cutting bets for aggressive US Federal Reserve (Fed) interest rate cuts this year, Gold price stands resilient.

Easing Fed rate cut bets got bolstered after strong US jobs data on Thursday, which showed weekly Initial Jobless Claims fell to their lowest level in nearly 1-1/2 years, suggesting tighter labor market conditions. The tempered Fed rate cut outlook offered a fresh life to the US Dollar notwithstanding the tech rally on Wall Street.

The probability for a March Fed rate cut is now below 60%, the CME Group’s FedWatch Tool, as against a roughly 75% chance seen at the start of the week. Strong Retail Sales data from the US and the recent hawkish Fed commentary have also contributed to the change in the Fed expectations.

Escalating geopolitical tensions in the Red Sea fuels worries of the strife becoming a wider regional conflict, underpinning the safe-haven demand for the Gold price.

Despite traders cutting bets for aggressive US Federal Reserve (Fed) interest rate cuts this year, Gold price stands resilient.

Easing Fed rate cut bets got bolstered after strong US jobs data on Thursday, which showed weekly Initial Jobless Claims fell to their lowest level in nearly 1-1/2 years, suggesting tighter labor market conditions. The tempered Fed rate cut outlook offered a fresh life to the US Dollar notwithstanding the tech rally on Wall Street.

The probability for a March Fed rate cut is now below 60%, the CME Group’s FedWatch Tool, as against a roughly 75% chance seen at the start of the week. Strong Retail Sales data from the US and the recent hawkish Fed commentary have also contributed to the change in the Fed expectations.

Piyush Lalsingh Ratnu

As projected yesterday at 17.30 hours: XAUUSD target price $2028 achieved. CMP $2029.

Piyush Lalsingh Ratnu

Co-relations Alert:

600 pips crash witnessed in USDJPY

Projected Impact on XAUUSD: $15

Price rise witnessed in XAUUSD: $9

600 pips crash witnessed in USDJPY

Projected Impact on XAUUSD: $15

Price rise witnessed in XAUUSD: $9

Piyush Lalsingh Ratnu

USDJPY CMP $148.350

XAUUSD CMP $2014

XAUUSD: S2 on Radar (2002)

USDJPY: R2 on radar (148.555)

XAUUSD CMP $2014

XAUUSD: S2 on Radar (2002)

USDJPY: R2 on radar (148.555)

Piyush Lalsingh Ratnu

16.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

: