Piyush Lalsingh Ratnu / 个人资料

- 信息

|

不

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

🆘 The Fed is widely expected to hold interest rates steady for a fifth straight meeting when policymakers gather March 19-20. Much of the focus by investors will be on the Federal Open Market Committee’s quarterly forecasts for rates, including whether fresh employment and inflation figures have prompted any changes.

Piyush Lalsingh Ratnu

Crucial Economic Data today:

18:30 USD Crude Oil Inventories 0.900M1.367M

18:30 USD Cushing Crude Oil Inventories 0.701M

21:00 USD 30-Year Bond Auction 4.360%

#XAUUSD #forex #piyushratnu #gold #goldtrading

18:30 USD Crude Oil Inventories 0.900M1.367M

18:30 USD Cushing Crude Oil Inventories 0.701M

21:00 USD 30-Year Bond Auction 4.360%

#XAUUSD #forex #piyushratnu #gold #goldtrading

Piyush Lalsingh Ratnu

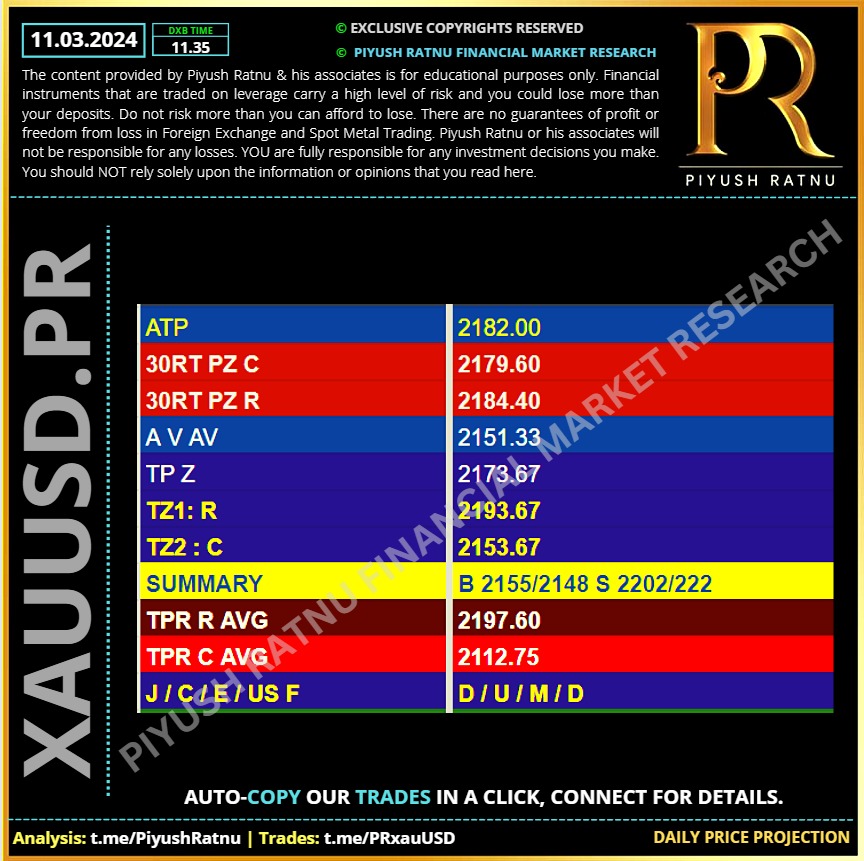

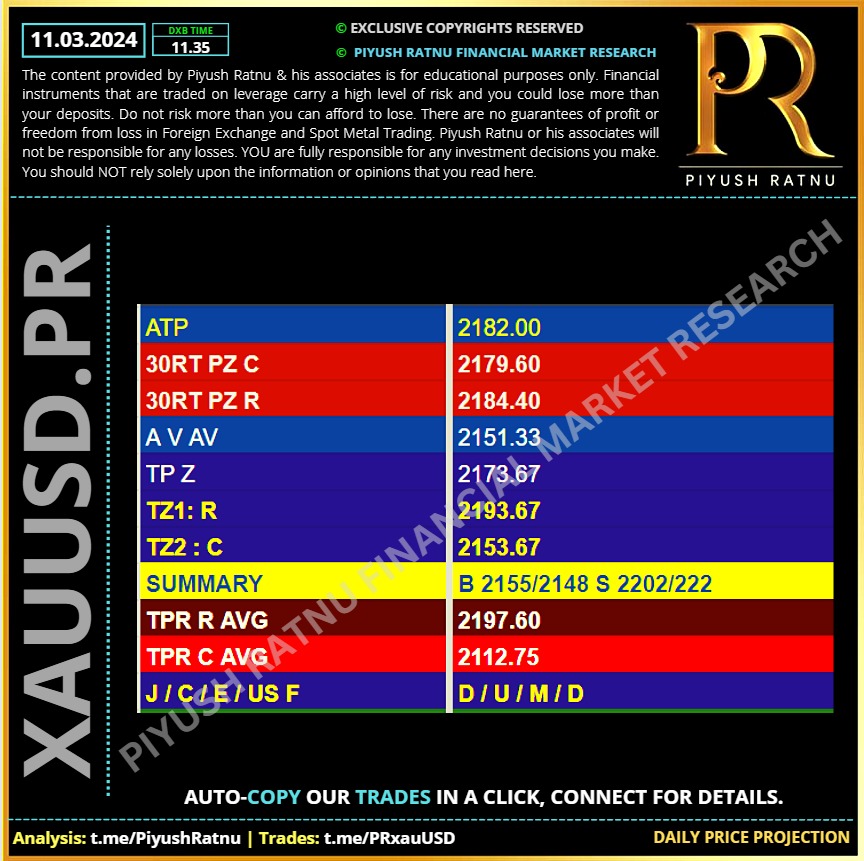

11.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 Key Events today:

16:00 USD OPEC Monthly Report

16:30 USD Core CPI (MoM) (Feb) 0.3% 0.4%

16:30 USD Core CPI (YoY) (Feb) 3.7% 3.9%

16:30 USD CPI (MoM) (Feb) 0.4% 0.3%

16:30 USD CPI (YoY) (Feb) 3.1% 3.1%

20:00 USD EIA Short-Term Energy Outlook

21:00 USD 10-Year Note Auction 4.093%

22:00 USD Federal Budget Balance (Feb) -298.5B -22.0B

The US Dollar has entered a phase of downside consolidation heading into the all-important US Consumer Price Index (CPI) inflation data release on Tuesday at 12:30 GMT. The focus remains on the key inflation gauge, especially after a sharp downward revision to the January Nonfarm Payrolls number and a slew of disappointing economic data from the United States (US).

Markets are currently pricing in about a 70% chance that the Fed could begin easing rates in June, a tad lower than a 75% probability seen on Monday, according to the CME FedWatch Tool.

📌 Check CME FedWatch Tool here:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The annual US CPI is seen rising 3.1% in February, at the same pace as seen in January while the core inflation is seen easing from 3.9% in January to 3.7% YoY in the reported period. The more important monthly CPI is expected to rise 0.4% last month vs. a 0.3% increase in January. The Core CPI inflation is foreseen at 0.3% MoM vs. 0.4% in the first month of the year.

A downside surprise in the monthly headline and core CPI inflation is likely to seal in a June interest rate cut by the US Federal Reserve (Fed), triggering a fresh sell-off in the US Dollar while sending Gold price to a new record high. US Treasury bond yields will come under intense bearish pressure on a US CPI negative surprise, initiating a fresh uptrend in the non-interest-bearing Gold price.

On the other hand, Gold price could see a sharp correction if the US Inflation data comes in hotter-than-expected and weighs heavily on the expectations of a dovish Fed policy pivot as early as in June.

In the run-up to the US CPI release, Gold price is likely to maintain its cautious trading momentum, as risk sentiment remains slightly upbeat.

🟢 Summary:

🔺A downside surprise in the US CPI numbers could propel Gold price toward the all-time high of $2,195, above which a sustained break above the $2,200 threshold is needed to take on the $2222 and 2,244 price targets.

🔻On the flip side, hot US inflation data is likely to extend the Gold price correction toward the March 8 low of $2,154 and 6 March low $2121.

16:00 USD OPEC Monthly Report

16:30 USD Core CPI (MoM) (Feb) 0.3% 0.4%

16:30 USD Core CPI (YoY) (Feb) 3.7% 3.9%

16:30 USD CPI (MoM) (Feb) 0.4% 0.3%

16:30 USD CPI (YoY) (Feb) 3.1% 3.1%

20:00 USD EIA Short-Term Energy Outlook

21:00 USD 10-Year Note Auction 4.093%

22:00 USD Federal Budget Balance (Feb) -298.5B -22.0B

The US Dollar has entered a phase of downside consolidation heading into the all-important US Consumer Price Index (CPI) inflation data release on Tuesday at 12:30 GMT. The focus remains on the key inflation gauge, especially after a sharp downward revision to the January Nonfarm Payrolls number and a slew of disappointing economic data from the United States (US).

Markets are currently pricing in about a 70% chance that the Fed could begin easing rates in June, a tad lower than a 75% probability seen on Monday, according to the CME FedWatch Tool.

📌 Check CME FedWatch Tool here:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The annual US CPI is seen rising 3.1% in February, at the same pace as seen in January while the core inflation is seen easing from 3.9% in January to 3.7% YoY in the reported period. The more important monthly CPI is expected to rise 0.4% last month vs. a 0.3% increase in January. The Core CPI inflation is foreseen at 0.3% MoM vs. 0.4% in the first month of the year.

A downside surprise in the monthly headline and core CPI inflation is likely to seal in a June interest rate cut by the US Federal Reserve (Fed), triggering a fresh sell-off in the US Dollar while sending Gold price to a new record high. US Treasury bond yields will come under intense bearish pressure on a US CPI negative surprise, initiating a fresh uptrend in the non-interest-bearing Gold price.

On the other hand, Gold price could see a sharp correction if the US Inflation data comes in hotter-than-expected and weighs heavily on the expectations of a dovish Fed policy pivot as early as in June.

In the run-up to the US CPI release, Gold price is likely to maintain its cautious trading momentum, as risk sentiment remains slightly upbeat.

🟢 Summary:

🔺A downside surprise in the US CPI numbers could propel Gold price toward the all-time high of $2,195, above which a sustained break above the $2,200 threshold is needed to take on the $2222 and 2,244 price targets.

🔻On the flip side, hot US inflation data is likely to extend the Gold price correction toward the March 8 low of $2,154 and 6 March low $2121.

Piyush Lalsingh Ratnu

🟢 XAUUSD: Crucial Zones:

C: $2145/2121

R: $2190/2222

This week, attention shifts to the US CPI print, due tomorrow. The headline inflation is expected to steady near 3.1% on a yearly basis, core inflation is expected to have eased from 3.9% to 3.7%. But the monthly figures could print another strong month. If that’s the case, we shall see a softening in dovish Fed expectations. Remember, Fed Chair Powell said last week that the Fed ‘can and will’ start cutting the rates this year, but he also said that they are in no rush.

Inflation in China rose for the first time in 6 months thanks to the Lunar New Year holiday boost in spending, but producer prices fell 2.7%. Nearby, the Japanese stocks fell as the USDJPY sank below 147 on rising speculation that the BoJ could exit the negative rates as soon as this month.

📌 Gold traders will focus on the US CPI and Retail Sales for February for fresh impetus, due later this week. The CPI inflation figure is expected to show an increase of 0.4% MoM and 3.1 YoY in February, while the Retail Sales is forecast to climb 0.7% MoM in the same period.

C: $2145/2121

R: $2190/2222

This week, attention shifts to the US CPI print, due tomorrow. The headline inflation is expected to steady near 3.1% on a yearly basis, core inflation is expected to have eased from 3.9% to 3.7%. But the monthly figures could print another strong month. If that’s the case, we shall see a softening in dovish Fed expectations. Remember, Fed Chair Powell said last week that the Fed ‘can and will’ start cutting the rates this year, but he also said that they are in no rush.

Inflation in China rose for the first time in 6 months thanks to the Lunar New Year holiday boost in spending, but producer prices fell 2.7%. Nearby, the Japanese stocks fell as the USDJPY sank below 147 on rising speculation that the BoJ could exit the negative rates as soon as this month.

📌 Gold traders will focus on the US CPI and Retail Sales for February for fresh impetus, due later this week. The CPI inflation figure is expected to show an increase of 0.4% MoM and 3.1 YoY in February, while the Retail Sales is forecast to climb 0.7% MoM in the same period.

Piyush Lalsingh Ratnu

🔺 Six central banks increased their gold reserves (of a tonne or more) during the month; all six have been regular buyers of late:

• The Central Bank of Turkey was the largest buyer, increasing official gold holdings by 12t.2 This helped lift total gold holdings to 552 tonnes, just 6% off the all-time high of 587 tonnes back in February 2023

• Gold reserves at the People’s Bank of China rose by 10t – the 15th consecutive month of additions. Total gold holdings now stand at 2,245t, nearly 300t higher than at the end of October 2022 when the bank resumed reporting gold purchases

• The Reserve Bank of India added nearly 9t. This is the first monthly increase in its gold reserves since October 2023 and the largest since July 2022; its gold holdings now total 812t

• The National Bank of Kazakhstan bought 6t of gold, the first monthly addition since January 2023

• The Central Bank of Jordan bought 3t in January, the second consecutive month of additions, lifting total gold holdings to 75t

• The Czech National Bank added nearly 2t – the eleventh consecutive month of buying. Over that period gold reserves have surged from 12t to more than 32t (+170%).

https://www.gold.org/goldhub/gold-focus/2024/03/central-banks-accumulate-more-gold-january-starting-2024-they-mean-go

• The Central Bank of Turkey was the largest buyer, increasing official gold holdings by 12t.2 This helped lift total gold holdings to 552 tonnes, just 6% off the all-time high of 587 tonnes back in February 2023

• Gold reserves at the People’s Bank of China rose by 10t – the 15th consecutive month of additions. Total gold holdings now stand at 2,245t, nearly 300t higher than at the end of October 2022 when the bank resumed reporting gold purchases

• The Reserve Bank of India added nearly 9t. This is the first monthly increase in its gold reserves since October 2023 and the largest since July 2022; its gold holdings now total 812t

• The National Bank of Kazakhstan bought 6t of gold, the first monthly addition since January 2023

• The Central Bank of Jordan bought 3t in January, the second consecutive month of additions, lifting total gold holdings to 75t

• The Czech National Bank added nearly 2t – the eleventh consecutive month of buying. Over that period gold reserves have surged from 12t to more than 32t (+170%).

https://www.gold.org/goldhub/gold-focus/2024/03/central-banks-accumulate-more-gold-january-starting-2024-they-mean-go

Piyush Lalsingh Ratnu

🆘 XAUUSD UPTREND PATTERNS / RT PATTERNS

1966-1985

2069-2085

2169-2185

🔷 REPETITION OF NUMBERS OBSERVED

1966-1985

2069-2085

2169-2185

🔷 REPETITION OF NUMBERS OBSERVED

Piyush Lalsingh Ratnu

🍎 #XAUUSD CMP $2157

Gold buyers are trading with caution early Friday, as a correction could be in the offing after the recent upsurge and on another upside in the US NFP headline figure. The US #economy is likely to have added 200K jobs last month, as against a surprise gain of 353K in January. Average Hourly Earnings are set to rise at an annual pace of 4.4% in the reported period, down from the 4.5% registered previously.

Spot #Gold reached a fresh all-time high of $2,164.76 a troy ounce on Thursday, as speculative interest kept selling the US Dollar. The bright metal lost momentum early in the American session, and XAU/USD currently trades at around $2,155, holding on to modest intraday gains. Across the board, however, the US Dollar extended its slump to reach fresh multi-week lows against most major rivals.

Several factors affected the USD. On the one hand, Bank of #Japan (BoJ) policymakers offered some relatively hawkish comments on monetary policy that boosted the Japanese Yen (JPY) against the Greenback. Governor Kazuo Ueda said it is “fully possible to seek an exit from stimulus while striving to achieve the 2% inflation target.” Additionally, BoJ’s Board member Junko Nakagawa said the local economy is making steady progress toward achieving its price goal, backed by solid wage growth.

It is worth adding that Treasury yields remained under modest pressure, falling to fresh multi-week lows ahead of Wall Street’s opening. The 10-year Treasury note currently yields 4.11%, pretty much flat for the day after trimming early losses, while the 2-year note offers 4.52%, down 3 basis points (bps).

🟢 ALERT:

Disappointing US labor #market report is likely to exacerbate the pain in the US #Dollar while lifting Gold price to a fresh lifetime high, as it could affirm the increasing expectations of a US Federal Reserve (Fed) interest rates cut in June.

Fed policymakers are still not convinced that continued progress toward their 2% inflation objective is “assured,” and that it won’t make sense to cut interest rates until they are confident. The day of Powell’s testimony accentuated the decline in the US Dollar, as it hit the lowest level in two months against its major counterparts.

Gold #traders also remain wary of the end-of-the-week flows and profit-taking the bright metal, as they gear up for next week’s Consumer Price Index (CPI) inflation data from the United States.

🆘 Crucial #Price Zones: in next 7 days subject to NFP data

🔺 R: $2185/2200/2222

🔻 C: $2121/2109/2085

#PiyushRatnu #ForexMarket #NonfarmPayrolls #NFP

Gold buyers are trading with caution early Friday, as a correction could be in the offing after the recent upsurge and on another upside in the US NFP headline figure. The US #economy is likely to have added 200K jobs last month, as against a surprise gain of 353K in January. Average Hourly Earnings are set to rise at an annual pace of 4.4% in the reported period, down from the 4.5% registered previously.

Spot #Gold reached a fresh all-time high of $2,164.76 a troy ounce on Thursday, as speculative interest kept selling the US Dollar. The bright metal lost momentum early in the American session, and XAU/USD currently trades at around $2,155, holding on to modest intraday gains. Across the board, however, the US Dollar extended its slump to reach fresh multi-week lows against most major rivals.

Several factors affected the USD. On the one hand, Bank of #Japan (BoJ) policymakers offered some relatively hawkish comments on monetary policy that boosted the Japanese Yen (JPY) against the Greenback. Governor Kazuo Ueda said it is “fully possible to seek an exit from stimulus while striving to achieve the 2% inflation target.” Additionally, BoJ’s Board member Junko Nakagawa said the local economy is making steady progress toward achieving its price goal, backed by solid wage growth.

It is worth adding that Treasury yields remained under modest pressure, falling to fresh multi-week lows ahead of Wall Street’s opening. The 10-year Treasury note currently yields 4.11%, pretty much flat for the day after trimming early losses, while the 2-year note offers 4.52%, down 3 basis points (bps).

🟢 ALERT:

Disappointing US labor #market report is likely to exacerbate the pain in the US #Dollar while lifting Gold price to a fresh lifetime high, as it could affirm the increasing expectations of a US Federal Reserve (Fed) interest rates cut in June.

Fed policymakers are still not convinced that continued progress toward their 2% inflation objective is “assured,” and that it won’t make sense to cut interest rates until they are confident. The day of Powell’s testimony accentuated the decline in the US Dollar, as it hit the lowest level in two months against its major counterparts.

Gold #traders also remain wary of the end-of-the-week flows and profit-taking the bright metal, as they gear up for next week’s Consumer Price Index (CPI) inflation data from the United States.

🆘 Crucial #Price Zones: in next 7 days subject to NFP data

🔺 R: $2185/2200/2222

🔻 C: $2121/2109/2085

#PiyushRatnu #ForexMarket #NonfarmPayrolls #NFP

Piyush Lalsingh Ratnu

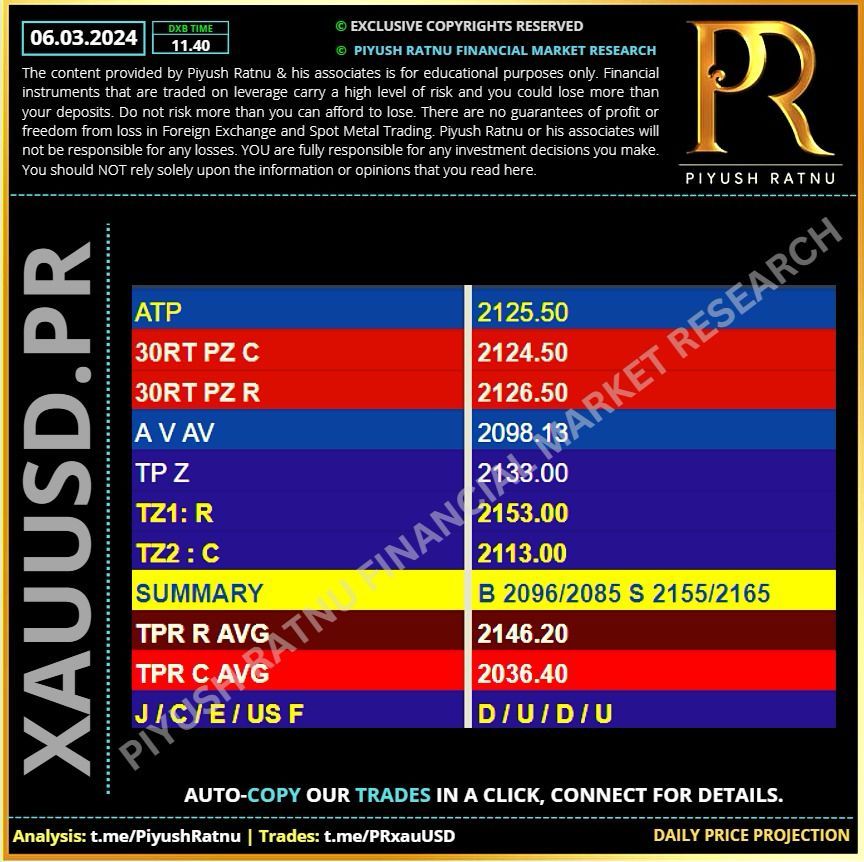

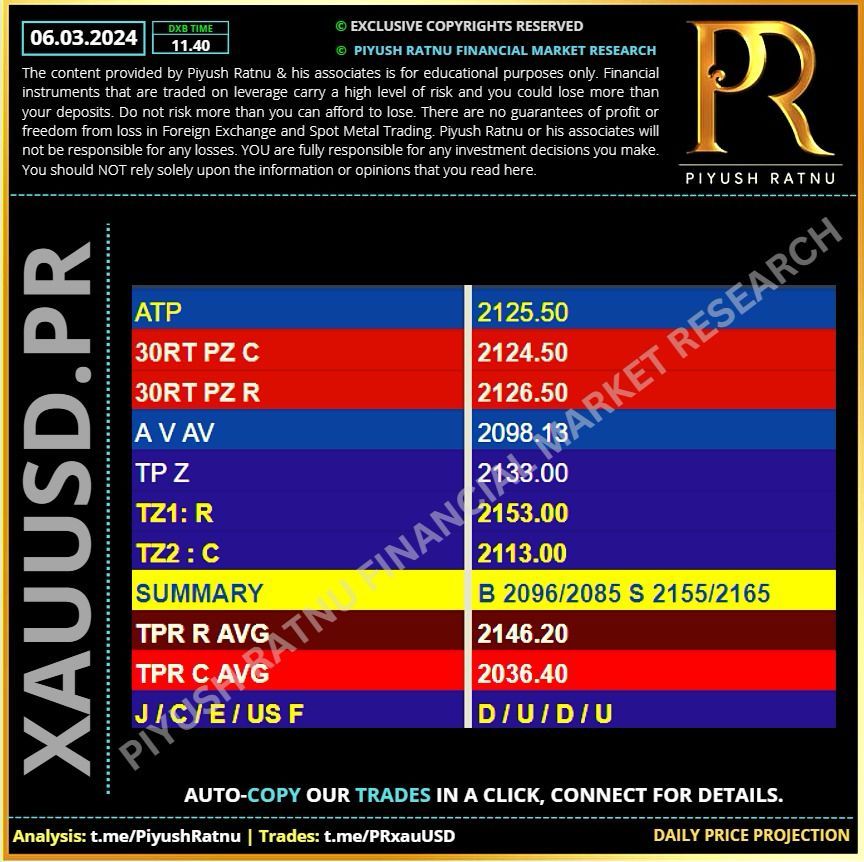

06.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🟢 Key Events today:

29 min USD Continuing Jobless Claims 1,889K 1,905K

29 min USD Exports 258.20B

29 min USD Imports 320.40B

29 min USD Initial Jobless Claims 217K 215K

29 min USD Nonfarm Productivity (QoQ) (Q4) 3.1% 3.2%

29 min USD Trade Balance (Jan) -63.40B -62.20B

29 min USD Unit Labor Costs (QoQ) (Q4) 0.7% 0.5%

19:00 USD Fed Chair Powell Testifies

20:30 USD Atlanta Fed GDPNow (Q1) 2.5% 2.5%

20:30 USD FOMC Member Mester Speaks

29 min USD Continuing Jobless Claims 1,889K 1,905K

29 min USD Exports 258.20B

29 min USD Imports 320.40B

29 min USD Initial Jobless Claims 217K 215K

29 min USD Nonfarm Productivity (QoQ) (Q4) 3.1% 3.2%

29 min USD Trade Balance (Jan) -63.40B -62.20B

29 min USD Unit Labor Costs (QoQ) (Q4) 0.7% 0.5%

19:00 USD Fed Chair Powell Testifies

20:30 USD Atlanta Fed GDPNow (Q1) 2.5% 2.5%

20:30 USD FOMC Member Mester Speaks

Piyush Lalsingh Ratnu

🆘 Co-relation Alert:

🔻 USDJPY Net Crash in last 72 hours:

150.600 - 148.500 = 2000 pips+

🔺Expected + Impact on XAUUSD: $60-75

Price zone on 04.03.2024: 2085 + 70= $2155

CMP $2156

🔺USDJPY + scenario:

Reversal in USDJPY might put negative pressure on XAUUSD resulting in $2145, 2121, 2109, 2085, 2069.

As per our analysis: XAUUSD might crash till $2048 before 18.03.2024 | Subject to NFP Data/ geo - political tensions.

🆘 Current Status of Positions and Drawdown (DD):

We have taken SHORT positions from $2116 on $10k portfolios with NAP at $2132, DD less than 1% and SHORTS from $2090 have been activated on the Type 2 portfolios with NAP at $2104 and DD 2%.

🟢 Further Plan of action:

We will SHORT from $ 2190 with PG 30 to elevate NAP at $2130, DD 4%.

📌 XAUUSD currently near PPZ D1 | CMP $2155

R2 2171

R3 2189

R4 2200

R5 2218

USD S 39

AUD S 56

JPY S 74

XAUXAG 89.65

US10YT 4.120 (-)

DXY 103.245 (-)

US F 1 2 3 Below H1S5

🟢 Ideal Scenario: Avoid Trades till NFP Data.

🔻 USDJPY Net Crash in last 72 hours:

150.600 - 148.500 = 2000 pips+

🔺Expected + Impact on XAUUSD: $60-75

Price zone on 04.03.2024: 2085 + 70= $2155

CMP $2156

🔺USDJPY + scenario:

Reversal in USDJPY might put negative pressure on XAUUSD resulting in $2145, 2121, 2109, 2085, 2069.

As per our analysis: XAUUSD might crash till $2048 before 18.03.2024 | Subject to NFP Data/ geo - political tensions.

🆘 Current Status of Positions and Drawdown (DD):

We have taken SHORT positions from $2116 on $10k portfolios with NAP at $2132, DD less than 1% and SHORTS from $2090 have been activated on the Type 2 portfolios with NAP at $2104 and DD 2%.

🟢 Further Plan of action:

We will SHORT from $ 2190 with PG 30 to elevate NAP at $2130, DD 4%.

📌 XAUUSD currently near PPZ D1 | CMP $2155

R2 2171

R3 2189

R4 2200

R5 2218

USD S 39

AUD S 56

JPY S 74

XAUXAG 89.65

US10YT 4.120 (-)

DXY 103.245 (-)

US F 1 2 3 Below H1S5

🟢 Ideal Scenario: Avoid Trades till NFP Data.

Piyush Lalsingh Ratnu

⏰ XAUUSD: Past 3 years Track Record:

in the month of MARCH

🟢 2021: 01 March: $1730 | 30 March: $1730

L: $1673 (08.03.2021) | H: $1757 (17.03.2021)

🟢 2022: 01 March: $1926 | 31 March: $1931

L: $1896 (16.03.2022) | H: $2073 (08.03.2022)

🟢 2023: 01 March: $1836 | 31 March: $1985

L: $1888 (15.03.2023) | H: $2009 (20.03.2023)

in the month of MARCH

🟢 2021: 01 March: $1730 | 30 March: $1730

L: $1673 (08.03.2021) | H: $1757 (17.03.2021)

🟢 2022: 01 March: $1926 | 31 March: $1931

L: $1896 (16.03.2022) | H: $2073 (08.03.2022)

🟢 2023: 01 March: $1836 | 31 March: $1985

L: $1888 (15.03.2023) | H: $2009 (20.03.2023)

Piyush Lalsingh Ratnu

Federal Reserve Chair Jerome Powell plans to tell House lawmakers Wednesday that interest rate cuts are likely "at some point" in 2024, but that the central bank will proceed cautiously as it evaluates whether inflation is cooling appropriately.

Piyush Lalsingh Ratnu

🆘 Monetary Policy

⏰March 06, 2024

📌 Semiannual Monetary Policy Report to the Congress

Chair Jerome H. Powell

Before the Committee on Financial Services, U.S. House of Representatives

After significantly tightening the stance of monetary policy since early 2022, the FOMC has maintained the target range for the federal funds rate at 5-1/4 to 5-1/2 percent since its meeting last July. We have also continued to shrink our balance sheet at a brisk pace and in a predictable manner. Our restrictive stance of monetary policy is putting downward pressure on economic activity and inflation.

We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year. But the economic outlook is uncertain, and ongoing progress toward our 2 percent inflation objective is not assured. Reducing policy restraint too soon or too much could result in a reversal of progress we have seen in inflation and ultimately require even tighter policy to get inflation back to 2 percent. At the same time, reducing policy restraint too late or too little could unduly weaken economic activity and employment. In considering any adjustments to the target range for the policy rate, we will carefully assess the incoming data, the evolving outlook, and the balance of risks. The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

We remain committed to bringing inflation back down to our 2 percent goal and to keeping longer-term inflation expectations well anchored. Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run.

To conclude, we understand that our actions affect communities, families, and businesses across the country. Everything we do is in service to our public mission. We at the Federal Reserve will do everything we can to achieve our maximum employment and price stability goals.

Read more at:

https://www.federalreserve.gov/newsevents/testimony/powell20240306a.htm

Expected impact as per Economics:

USD +

XAUUSD -

JPY +

♾ 🟢 I expect A pattern to be formed, subject to NFP data and FOMC Statements before 18 March 2024.

⏰March 06, 2024

📌 Semiannual Monetary Policy Report to the Congress

Chair Jerome H. Powell

Before the Committee on Financial Services, U.S. House of Representatives

After significantly tightening the stance of monetary policy since early 2022, the FOMC has maintained the target range for the federal funds rate at 5-1/4 to 5-1/2 percent since its meeting last July. We have also continued to shrink our balance sheet at a brisk pace and in a predictable manner. Our restrictive stance of monetary policy is putting downward pressure on economic activity and inflation.

We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year. But the economic outlook is uncertain, and ongoing progress toward our 2 percent inflation objective is not assured. Reducing policy restraint too soon or too much could result in a reversal of progress we have seen in inflation and ultimately require even tighter policy to get inflation back to 2 percent. At the same time, reducing policy restraint too late or too little could unduly weaken economic activity and employment. In considering any adjustments to the target range for the policy rate, we will carefully assess the incoming data, the evolving outlook, and the balance of risks. The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

We remain committed to bringing inflation back down to our 2 percent goal and to keeping longer-term inflation expectations well anchored. Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run.

To conclude, we understand that our actions affect communities, families, and businesses across the country. Everything we do is in service to our public mission. We at the Federal Reserve will do everything we can to achieve our maximum employment and price stability goals.

Read more at:

https://www.federalreserve.gov/newsevents/testimony/powell20240306a.htm

Expected impact as per Economics:

USD +

XAUUSD -

JPY +

♾ 🟢 I expect A pattern to be formed, subject to NFP data and FOMC Statements before 18 March 2024.

Piyush Lalsingh Ratnu

🆘 Alert:

Change in Market Movements from 11.03.2024:

10 Mar 2024 - Daylight Saving Time Starts

When local standard time is about to reach

Sunday, 10 March 2024, 02:00:00 clocks are turned forward 1 hour to Sunday, 10 March 2024, 03:00:00 local daylight time instead.

https://www.timeanddate.com/time/change/usa

Change in Market Movements from 11.03.2024:

10 Mar 2024 - Daylight Saving Time Starts

When local standard time is about to reach

Sunday, 10 March 2024, 02:00:00 clocks are turned forward 1 hour to Sunday, 10 March 2024, 03:00:00 local daylight time instead.

https://www.timeanddate.com/time/change/usa

Piyush Lalsingh Ratnu

🔘 XAUUSD CMP $2133.33

Gold buyers take a breather after the recent relentless surge, backed by heightened expectations of aggressive interest rate cuts expectations from the US Federal Reserve (Fed), in the face of a series of soft US economic data, which fuels concerns regarding a ‘soft-landing’.

🟢 What Is a Soft Landing?

A soft landing, in economics, is a cyclical slowdown in economic growth that avoids recession. A soft landing is the goal of a central bank when it seeks to raise interest rates just enough to stop an economy from overheating and experiencing high inflation, without causing a severe downturn. Soft landing may also refer to a gradual, relatively painless slowdown in a particular industry or economic sector.

KEY OBSERVATION

🔘A soft landing refers to a moderate economic slowdown following a period of growth.

🔘The Federal Reserve and other central banks aim for a soft landing when they raise interest rates to curb inflation.

🔘The Fed has a mixed record in accomplishing a soft landing during past rate hiking cycles.

Point to be noted:

🔘The Fed's soft landings record is, at best, mixed because the central bank doesn't exercise nearly the same control over the course of the economy as a pilot has over aircraft.

🔘The Fed's main policy tools—interest rates and asset holdings—are blunt instruments not designed to solve supply chain disruptions or pandemics.

🔘The likelihood of a soft landing is reduced by the time lags associated with monetary policy.

🟢 What Is a Soft Landing vs. a Hard Landing in Economics?

A country's central bank adjusts interest rates to manage the economy. If inflation is too high, a central bank will increase interest rates with the goal of slowing down spending. If the central bank raises interest rates too high or too soon, that would be a hard landing. If the central bank raises interests slowly or by a small amount, that is a soft landing. There is a fine line between the two and how the raising of interest rates will impact the economy. A central bank would not want a hard landing as it could have serious negative repercussions.

Gold buyers take a breather after the recent relentless surge, backed by heightened expectations of aggressive interest rate cuts expectations from the US Federal Reserve (Fed), in the face of a series of soft US economic data, which fuels concerns regarding a ‘soft-landing’.

🟢 What Is a Soft Landing?

A soft landing, in economics, is a cyclical slowdown in economic growth that avoids recession. A soft landing is the goal of a central bank when it seeks to raise interest rates just enough to stop an economy from overheating and experiencing high inflation, without causing a severe downturn. Soft landing may also refer to a gradual, relatively painless slowdown in a particular industry or economic sector.

KEY OBSERVATION

🔘A soft landing refers to a moderate economic slowdown following a period of growth.

🔘The Federal Reserve and other central banks aim for a soft landing when they raise interest rates to curb inflation.

🔘The Fed has a mixed record in accomplishing a soft landing during past rate hiking cycles.

Point to be noted:

🔘The Fed's soft landings record is, at best, mixed because the central bank doesn't exercise nearly the same control over the course of the economy as a pilot has over aircraft.

🔘The Fed's main policy tools—interest rates and asset holdings—are blunt instruments not designed to solve supply chain disruptions or pandemics.

🔘The likelihood of a soft landing is reduced by the time lags associated with monetary policy.

🟢 What Is a Soft Landing vs. a Hard Landing in Economics?

A country's central bank adjusts interest rates to manage the economy. If inflation is too high, a central bank will increase interest rates with the goal of slowing down spending. If the central bank raises interest rates too high or too soon, that would be a hard landing. If the central bank raises interests slowly or by a small amount, that is a soft landing. There is a fine line between the two and how the raising of interest rates will impact the economy. A central bank would not want a hard landing as it could have serious negative repercussions.

Piyush Lalsingh Ratnu

💠XAUUSD Trading Scenarios:

🟢The break above 2120 saw us retest the all time high at 2135. But we did not sustained the break & reversed from 2141.

🟢A break above here is another buy signal initially targeting 2146/49, perhaps as far as 2160/62, but is possible gains will be more limited in severely overbought conditions.

🟢I remain a buyer on any weakness (profit taking) although it is difficult to identify short term support levels because the move higher has been so fast on Friday & Monday. Hence I am on SHORT from $2085 onwards with a PG $30.

🟢We should have some support at the psychological number of 2105/2100 but I see the best support at 2085 & longs need stops below 2069/2048.

🟢The break above 2120 saw us retest the all time high at 2135. But we did not sustained the break & reversed from 2141.

🟢A break above here is another buy signal initially targeting 2146/49, perhaps as far as 2160/62, but is possible gains will be more limited in severely overbought conditions.

🟢I remain a buyer on any weakness (profit taking) although it is difficult to identify short term support levels because the move higher has been so fast on Friday & Monday. Hence I am on SHORT from $2085 onwards with a PG $30.

🟢We should have some support at the psychological number of 2105/2100 but I see the best support at 2085 & longs need stops below 2069/2048.

Piyush Lalsingh Ratnu

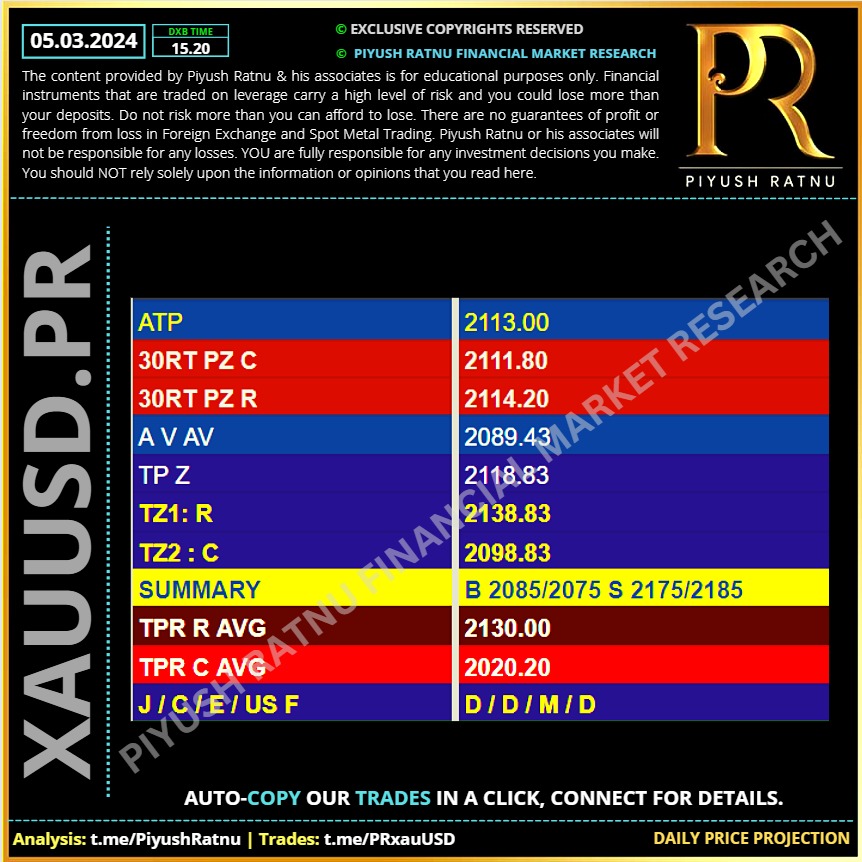

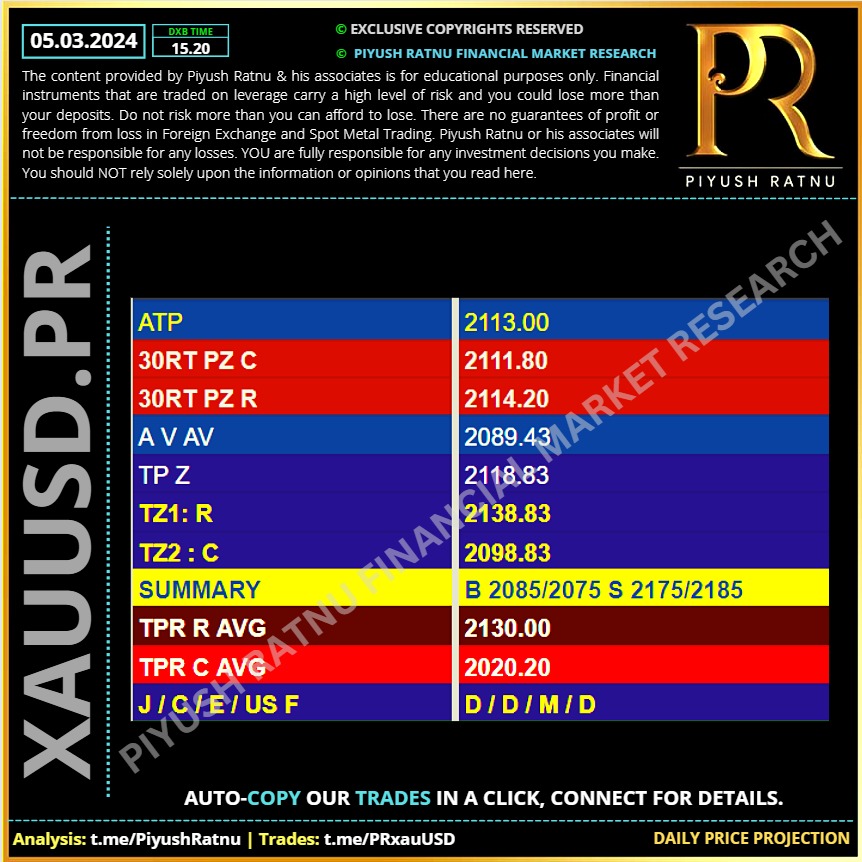

05.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

♾ The politics / manipulation speculation of rate cuts

Democratic voices are increasingly advocating for policy shifts to address the persistently high costs and inflationary pressures. Senator Sherrod Brown recently emphasized the need for alternative approaches, suggesting that traditional restrictive monetary policy may no longer be effective against inflation. He expressed concerns about the impact on working Americans and small businesses, highlighting the challenges posed by rising housing costs and reduced credit access.

This sentiment sets the stage for this week for Federal Reserve Chair Jerome Powell's appearances before the House and Senate. Republican lawmakers are expected to focus on inflation and deficits, pressing Powell for insights and responses. Powell is likely to acknowledge the unsustainability of the nation's fiscal trajectory while adhering to appropriate decorum and leave it at that.

However, Powell and his colleagues will likely maintain their stance against immediate rate cuts, reiterating that such measures are not imminent. Despite Democratic calls for action, the Fed is unlikely to implement rate cuts during the upcoming policy meeting or in May, barring unforeseen adverse developments in the labour market or the financial sector.

Democratic voices are increasingly advocating for policy shifts to address the persistently high costs and inflationary pressures. Senator Sherrod Brown recently emphasized the need for alternative approaches, suggesting that traditional restrictive monetary policy may no longer be effective against inflation. He expressed concerns about the impact on working Americans and small businesses, highlighting the challenges posed by rising housing costs and reduced credit access.

This sentiment sets the stage for this week for Federal Reserve Chair Jerome Powell's appearances before the House and Senate. Republican lawmakers are expected to focus on inflation and deficits, pressing Powell for insights and responses. Powell is likely to acknowledge the unsustainability of the nation's fiscal trajectory while adhering to appropriate decorum and leave it at that.

However, Powell and his colleagues will likely maintain their stance against immediate rate cuts, reiterating that such measures are not imminent. Despite Democratic calls for action, the Fed is unlikely to implement rate cuts during the upcoming policy meeting or in May, barring unforeseen adverse developments in the labour market or the financial sector.

Piyush Lalsingh Ratnu

Gold price (XAU/USD) continues its winning spell for the fifth trading session on Tuesday. The precious metal approaches its all-time high of around 🔺$2,145, seen in December 2023. Gold’s advance happens amid a cautious market sentiment and increased bets that the Federal Reserve (Fed) will cut interest rates in the June policy meeting.

: