Piyush Lalsingh Ratnu / Профиль

- Информация

|

нет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

*Gold price uptrend continues despite shrinking volatility.

*US PCE inflation data on Friday has huge market implications.

*Federal Reserve future rate hike bets are shaping precious metal markets.

*Gold price (XAU/USD) continues to trade within a solid uptrend, even in a calmer week in the financial markets.

Things could get lively again on Friday as the market gets ready for the biggest data release of the week, the United States Personal Consumption Expenditures (PCE) inflation numbers, scheduled to be released at 16.30 hours DXB

On the contrary, if the Core PCE eases, it would be great news for the Fed, but not for the Dollar. Signs that inflation continued to slowdown would alleviate the pressure for the Fed to do more. US bond yields could resume the slide and the US Dollar print fresh monthly lows.

Gold price uptrend has slowed down in the past days, but bulls still keep the edge, with the bright metal comfortably trading above $1,980 currently.

“Gold is well supported by US recession fears, easing inflationary pressure and more dovish monetary policy. Nevertheless, the upside looks limited in the near term amid easing banking risks and further Fed rate hikes.” - ANZ Bank

Gold price can target $2,000 on lower-than-expected PCE inflation

Gold is trading within a solid uptrend, making relative highs and lows in several timeframes. Despite the XAU/USD price action having calmed down this week on easing bank fears and a light economic calendar, it found solid support at the 23.6% Fibonacci retracement level from the March 8-17 rally early in the week. Since then, Gold bulls have slowly resumed the uptrend ahead of crucial US PCE inflation data.

Immediate resistance target for Gold bulls is located at the $2,000 round and psychological level, which has acted as a difficult level to break already three times in the last 10 days. That could be reached on a lower-than-expected US PCE release. With the Relative Strength Index (RSI) still short of overbought territory, it adds credence to such a potential rally (always data dependant, of course.)

On the other hand, a higher-than-expected Fed preferred inflation measure could trigger a correction on the bright metal, and immediate support would be right back at the aforementioned 23.6% Fibonacci retracement, located at $1,951.

*US PCE inflation data on Friday has huge market implications.

*Federal Reserve future rate hike bets are shaping precious metal markets.

*Gold price (XAU/USD) continues to trade within a solid uptrend, even in a calmer week in the financial markets.

Things could get lively again on Friday as the market gets ready for the biggest data release of the week, the United States Personal Consumption Expenditures (PCE) inflation numbers, scheduled to be released at 16.30 hours DXB

On the contrary, if the Core PCE eases, it would be great news for the Fed, but not for the Dollar. Signs that inflation continued to slowdown would alleviate the pressure for the Fed to do more. US bond yields could resume the slide and the US Dollar print fresh monthly lows.

Gold price uptrend has slowed down in the past days, but bulls still keep the edge, with the bright metal comfortably trading above $1,980 currently.

“Gold is well supported by US recession fears, easing inflationary pressure and more dovish monetary policy. Nevertheless, the upside looks limited in the near term amid easing banking risks and further Fed rate hikes.” - ANZ Bank

Gold price can target $2,000 on lower-than-expected PCE inflation

Gold is trading within a solid uptrend, making relative highs and lows in several timeframes. Despite the XAU/USD price action having calmed down this week on easing bank fears and a light economic calendar, it found solid support at the 23.6% Fibonacci retracement level from the March 8-17 rally early in the week. Since then, Gold bulls have slowly resumed the uptrend ahead of crucial US PCE inflation data.

Immediate resistance target for Gold bulls is located at the $2,000 round and psychological level, which has acted as a difficult level to break already three times in the last 10 days. That could be reached on a lower-than-expected US PCE release. With the Relative Strength Index (RSI) still short of overbought territory, it adds credence to such a potential rally (always data dependant, of course.)

On the other hand, a higher-than-expected Fed preferred inflation measure could trigger a correction on the bright metal, and immediate support would be right back at the aforementioned 23.6% Fibonacci retracement, located at $1,951.

Piyush Lalsingh Ratnu

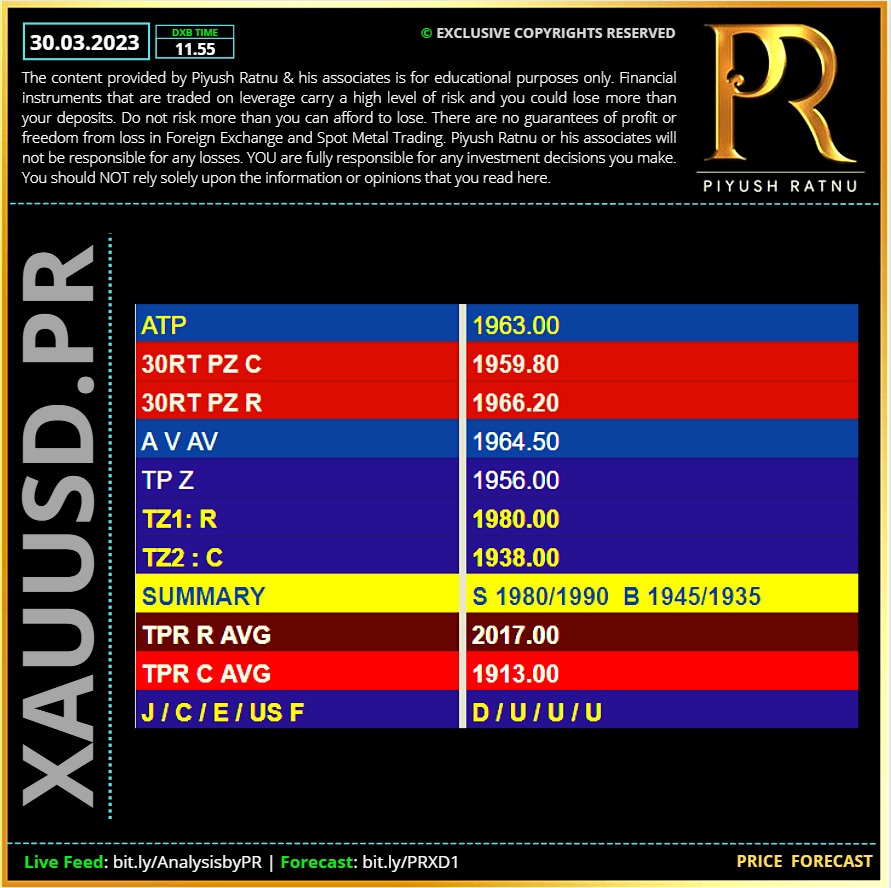

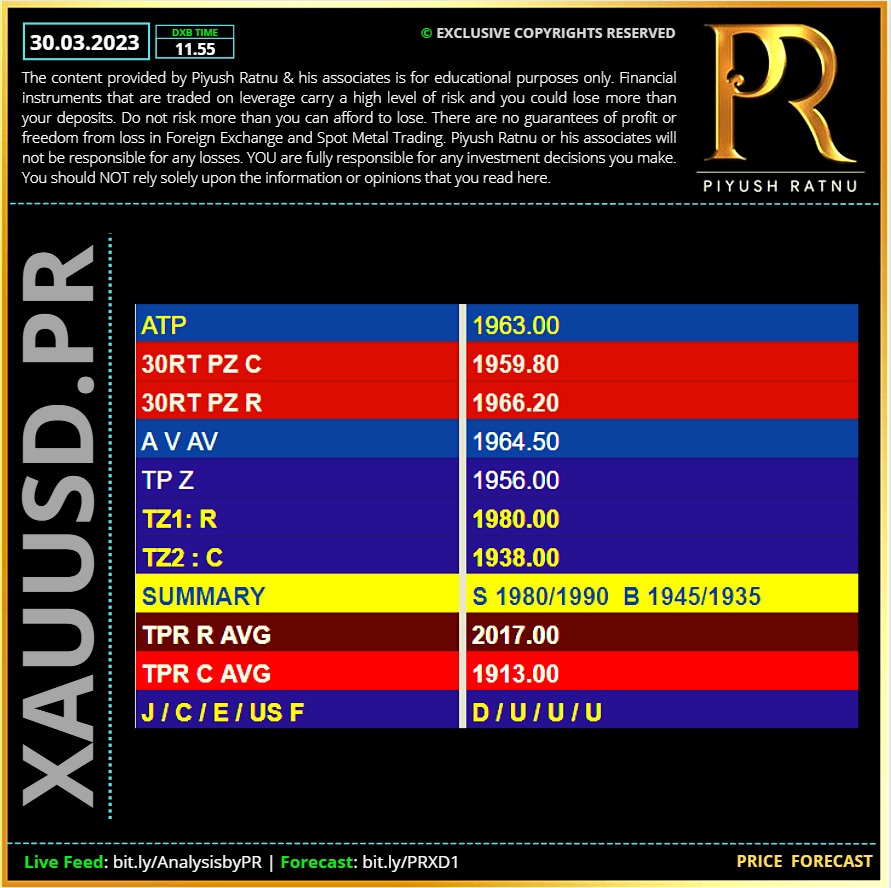

30.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

Alert: BOJ is Buying Bonds! BOJ Bought $3.4 T in Govt. Bonds.🆘

Bank of Japan Governor Haruhiko Kuroda changed the course of global markets when he unleashed a $3.4 trillion firehose of Japanese cash on the investment world. Now Kazuo Ueda is likely to dismantle his legacy, setting the stage for a flow reversal that risks sending shockwaves through the global economy.

Just over a week before a momentous leadership change at the BOJ, investors are gearing up for the seemingly inevitable end to a decade of ultra-low interest rates that punished domestic savers and sent a wall of money overseas. The exodus accelerated after Kuroda moved to suppress bond yields in 2016, culminating in a mountain of offshore investments worth more than two-thirds Japan’s economy.

All this risks unraveling under the new governor Ueda, who may have little choice but to end the world’s boldest easy-money experiment just as rising interest rates elsewhere are already jolting the international banking sector and threatening financial stability. The stakes are enormous: Japanese investors are the biggest foreign holders of US government bonds and own everything from Brazilian debt to European power stations to bundles of risky loans stateside.

An increase in Japan’s borrowing costs threatens to amplify the swings in global bond markets, which are being rocked by the Federal Reserve’s year-long campaign to combat inflation and the new danger of a credit crunch. Against this backdrop, tighter monetary policy by the BOJ is likely to intensify scrutiny of its country’s lenders in the wake of recent bank turmoil in the US and Europe.

Ueda, the first ever academic to captain the BOJ, is largely expected to speed up the pace of policy tightening sometime later this year. Part of that may include further loosening the central bank’s control on yields and unwinding a titanic bond-buying program designed to suppress borrowing costs and boost Japan’s moribund economy.

The BOJ has bought 465 trillion yen ($3.55 trillion) of Japanese government bonds since Kuroda implemented quantitative easing a decade ago, according to central bank data, depressing yields and fueling unprecedented distortions in the sovereign debt market. As a result, local funds sold 206 trillion yen of the securities during the period to seek better returns elsewhere.

Impact might be seen on:

USDJPY NZDUSD NZDJPY EURJPY AUDJPY AUDUSD XAUUSD

Algorithm Setting: PR S W1 🆘

Bank of Japan Governor Haruhiko Kuroda changed the course of global markets when he unleashed a $3.4 trillion firehose of Japanese cash on the investment world. Now Kazuo Ueda is likely to dismantle his legacy, setting the stage for a flow reversal that risks sending shockwaves through the global economy.

Just over a week before a momentous leadership change at the BOJ, investors are gearing up for the seemingly inevitable end to a decade of ultra-low interest rates that punished domestic savers and sent a wall of money overseas. The exodus accelerated after Kuroda moved to suppress bond yields in 2016, culminating in a mountain of offshore investments worth more than two-thirds Japan’s economy.

All this risks unraveling under the new governor Ueda, who may have little choice but to end the world’s boldest easy-money experiment just as rising interest rates elsewhere are already jolting the international banking sector and threatening financial stability. The stakes are enormous: Japanese investors are the biggest foreign holders of US government bonds and own everything from Brazilian debt to European power stations to bundles of risky loans stateside.

An increase in Japan’s borrowing costs threatens to amplify the swings in global bond markets, which are being rocked by the Federal Reserve’s year-long campaign to combat inflation and the new danger of a credit crunch. Against this backdrop, tighter monetary policy by the BOJ is likely to intensify scrutiny of its country’s lenders in the wake of recent bank turmoil in the US and Europe.

Ueda, the first ever academic to captain the BOJ, is largely expected to speed up the pace of policy tightening sometime later this year. Part of that may include further loosening the central bank’s control on yields and unwinding a titanic bond-buying program designed to suppress borrowing costs and boost Japan’s moribund economy.

The BOJ has bought 465 trillion yen ($3.55 trillion) of Japanese government bonds since Kuroda implemented quantitative easing a decade ago, according to central bank data, depressing yields and fueling unprecedented distortions in the sovereign debt market. As a result, local funds sold 206 trillion yen of the securities during the period to seek better returns elsewhere.

Impact might be seen on:

USDJPY NZDUSD NZDJPY EURJPY AUDJPY AUDUSD XAUUSD

Algorithm Setting: PR S W1 🆘

Piyush Lalsingh Ratnu

Surprises Ahead! Geo-political Drama awaits HVPR!🆘

Russia will no longer give the U.S. advance notice about its missile tests, a senior Moscow diplomat said Wednesday, as its military deployed mobile launchers in Siberia in a show of the country’s massive nuclear capability amid fighting in Ukraine.

Deputy Foreign Minister Sergei Ryabkov said in remarks carried by Russian news agencies that Moscow has halted all information exchanges with Washington after previously suspending its participation in the last remaining nuclear arms pact with the U.S.

long with the data about the current state of the countries’ nuclear forces routinely released every six months in compliance with the treaty, the parties also have exchanged advance warnings about test launches. Such notices have been an essential element of strategic stability for decades, allowing Russia and the United States to correctly interpret each other’s moves and make sure that neither country mistakes a test launch for a missile attack.

The termination of missile test warnings marks yet another attempt by Moscow to discourage the West from ramping up its support for Ukraine by pointing to Russia’s massive nuclear arsenal. In recent days, President Vladimir Putin announced the deployment of tactical nuclear weapons to the territory of Moscow’s ally Belarus.

Patrushev alleged that some American politicians believe the U.S. could launch a preventative missile strike on Russia to which Moscow would be unable to respond, a purported belief that he described as “short-sighted stupidity, which is very dangerous.”🆘

Russia will no longer give the U.S. advance notice about its missile tests, a senior Moscow diplomat said Wednesday, as its military deployed mobile launchers in Siberia in a show of the country’s massive nuclear capability amid fighting in Ukraine.

Deputy Foreign Minister Sergei Ryabkov said in remarks carried by Russian news agencies that Moscow has halted all information exchanges with Washington after previously suspending its participation in the last remaining nuclear arms pact with the U.S.

long with the data about the current state of the countries’ nuclear forces routinely released every six months in compliance with the treaty, the parties also have exchanged advance warnings about test launches. Such notices have been an essential element of strategic stability for decades, allowing Russia and the United States to correctly interpret each other’s moves and make sure that neither country mistakes a test launch for a missile attack.

The termination of missile test warnings marks yet another attempt by Moscow to discourage the West from ramping up its support for Ukraine by pointing to Russia’s massive nuclear arsenal. In recent days, President Vladimir Putin announced the deployment of tactical nuclear weapons to the territory of Moscow’s ally Belarus.

Patrushev alleged that some American politicians believe the U.S. could launch a preventative missile strike on Russia to which Moscow would be unable to respond, a purported belief that he described as “short-sighted stupidity, which is very dangerous.”🆘

Piyush Lalsingh Ratnu

XAUUSD is currently under the price trap of $1966

Breach of $1966 zone will result in $1985-2020-2060

Reversal from $1966 will result in 1947-1926-1907

USD Fundamentals, Geo-political tensions and JPY policy, BOJ's Bond scheme (1182B - P), Inflow in JPY Bonds: these factors are playing a major role in holding GOLD prices above 1950 psychological level.

US F +

USDJPY 132.540 (+)

NK25 (-) GAP observed retracement expected

DXY 102.345 (stable)

USD S 38 (weak)

JPY (60) strong

AUD 85 (supports XAUUSD)

M30A100 achieved

H1A236 achieved

H4236 achieved

D1236 achieved

1947/1926 - 1985/2020 on radar. 🆘

Breach of $1966 zone will result in $1985-2020-2060

Reversal from $1966 will result in 1947-1926-1907

USD Fundamentals, Geo-political tensions and JPY policy, BOJ's Bond scheme (1182B - P), Inflow in JPY Bonds: these factors are playing a major role in holding GOLD prices above 1950 psychological level.

US F +

USDJPY 132.540 (+)

NK25 (-) GAP observed retracement expected

DXY 102.345 (stable)

USD S 38 (weak)

JPY (60) strong

AUD 85 (supports XAUUSD)

M30A100 achieved

H1A236 achieved

H4236 achieved

D1236 achieved

1947/1926 - 1985/2020 on radar. 🆘

Piyush Lalsingh Ratnu

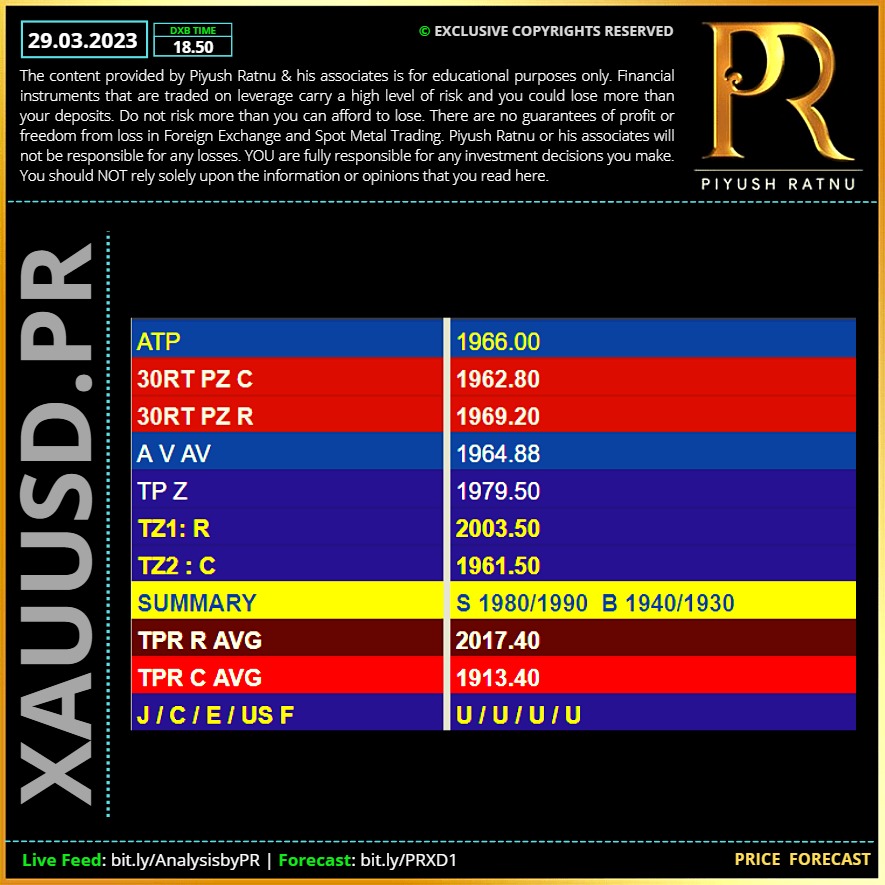

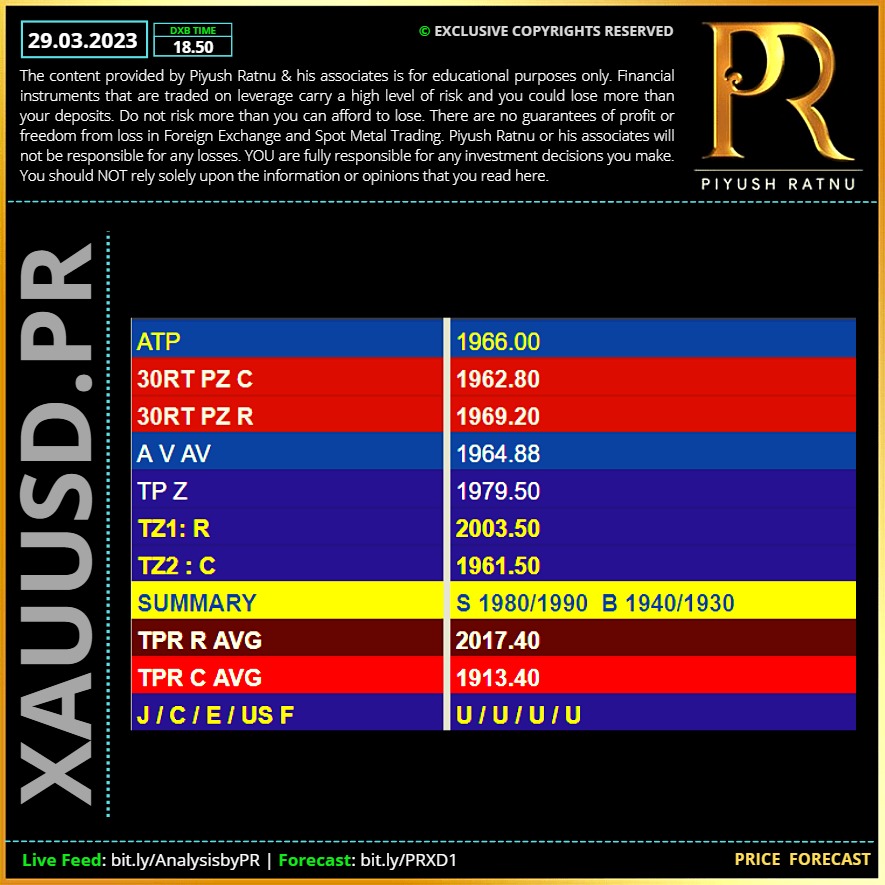

29.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

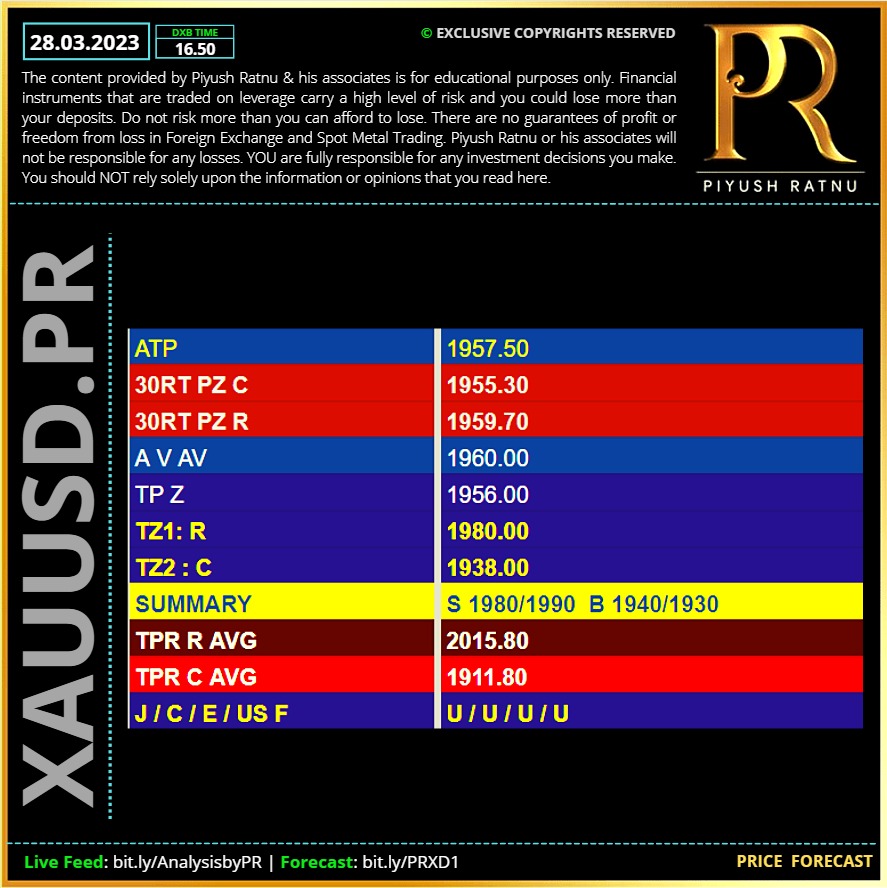

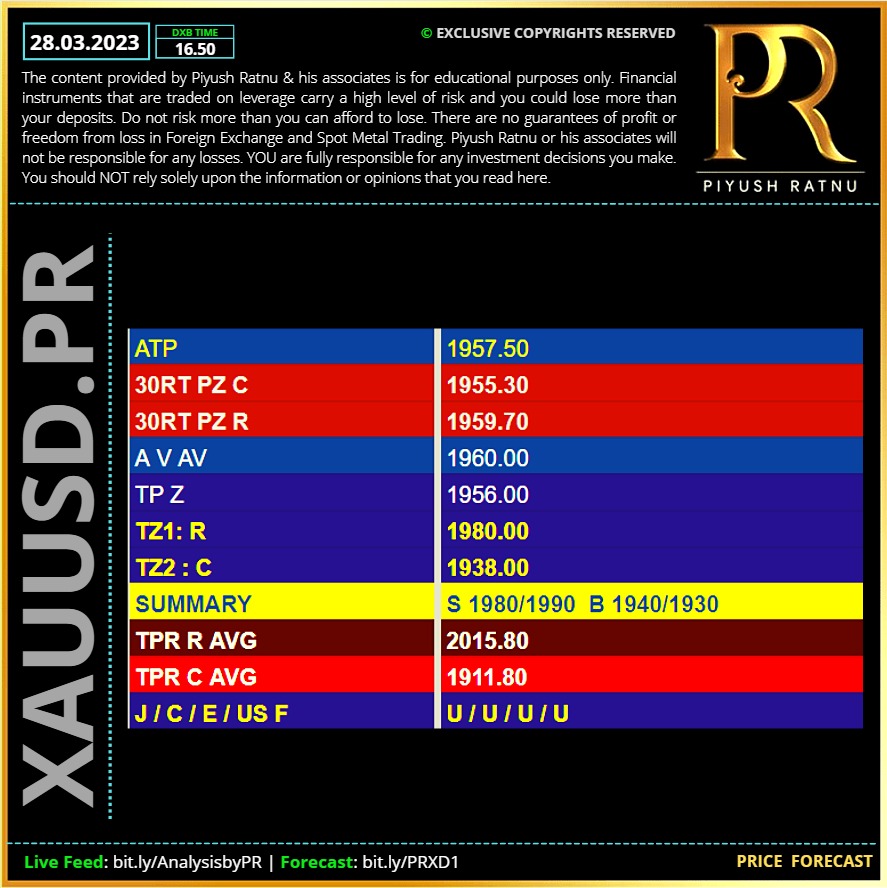

28.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

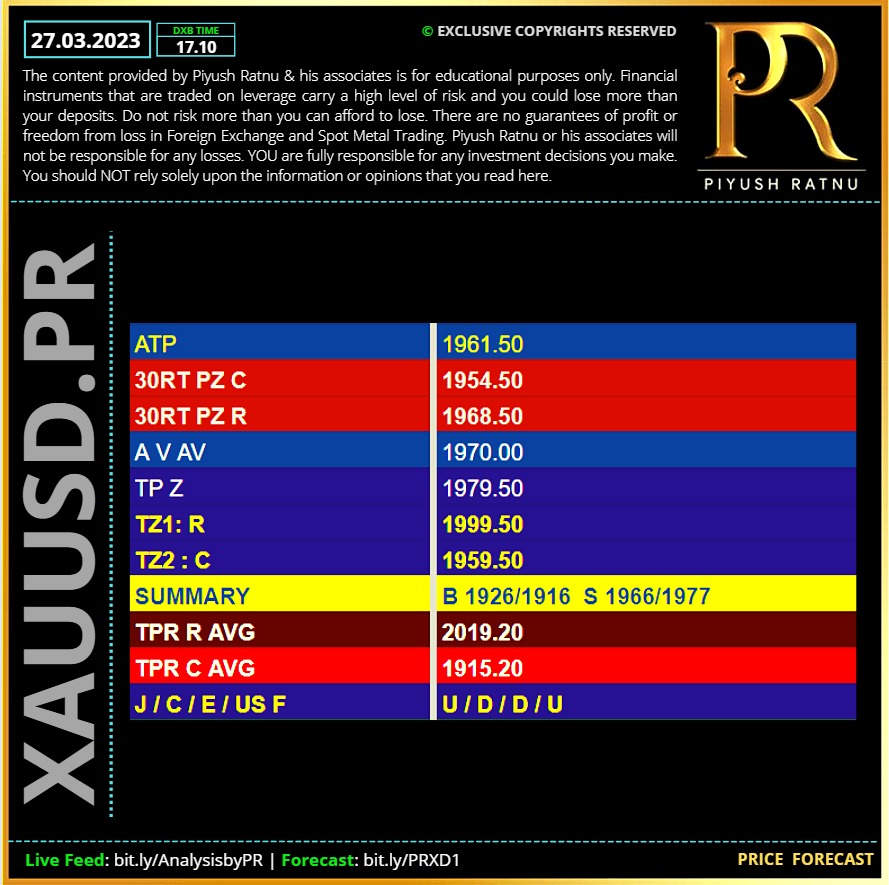

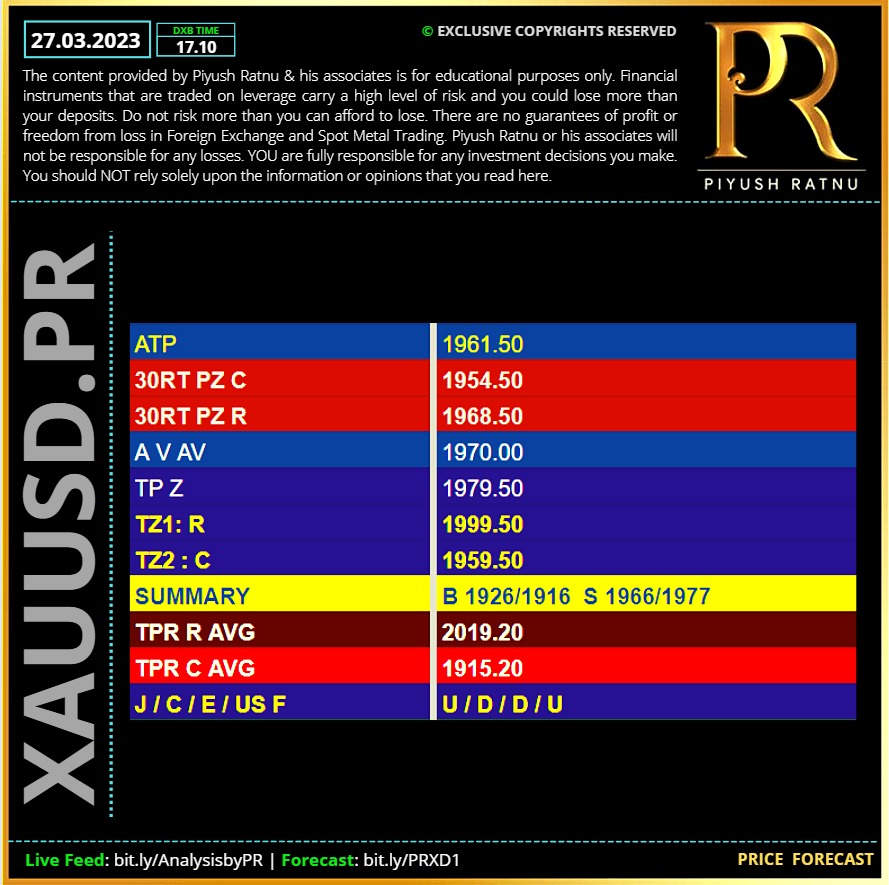

27.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

DID Hedge funds made a dramatic mistake in early spring? Speculators bet on the continuation of the Fed's monetary tightening cycle and on the unwillingness of the new governor of the Bank of Japan, Kazuo Ueda, to change something and extended the yen net shorts to a maximum since June. However, the banking crisis sent the USDJPY down 4%, driving hedge funds, which entered longs, into massive losses. The exiting of their positions allowed the pair to reach the targets on the previously entered shorts at 132 and 130. Anyone could be wrong. The speculators were not totally wrong. The bankruptcy of three US banks and the takeover of Credit Suisse have increased the risks of the completion of monetary restriction cycles by the Fed and other world’s leading central banks. According to SMBC Nikko Securities, the BoJ has little chance of making adjustments to its yield curve control policy in April due to the uncertainty the Fed is facing. Furthermore, consumer prices in Japan fell by more than 1% in February to 3.1% due to a decline in energy costs. The main argument in favour of the yen rising versus the US dollar is the expectations of a recession in the US economy, which increases the demand for safe-haven assets and presses down Treasury yields. The US-Japan yield spread is narrowing, leading to capital repatriation by Japanese investors and strengthening the yen. Hopes for a dovish shift lead Morgan Stanley to talk about the fall of the US dollar to ¥120 by the end of December. MUFG also sees the greenback as vulnerable and recommends selling USDJPY towards 127-128. Credit Agricole, on the other hand, advises caution. Its historical analysis shows that selling US currency before the Fed stops raising borrowing costs is dangerous. Will the dollar strengthen again? 🆘 USDJPY CMP 131.700

Piyush Lalsingh Ratnu

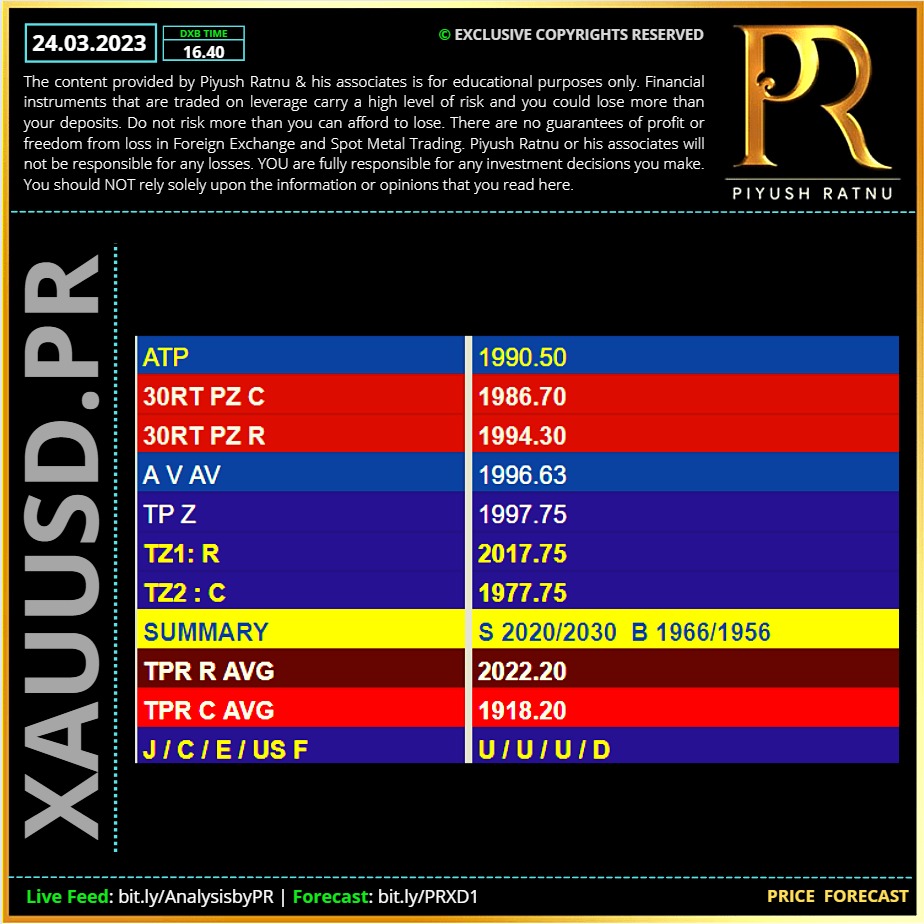

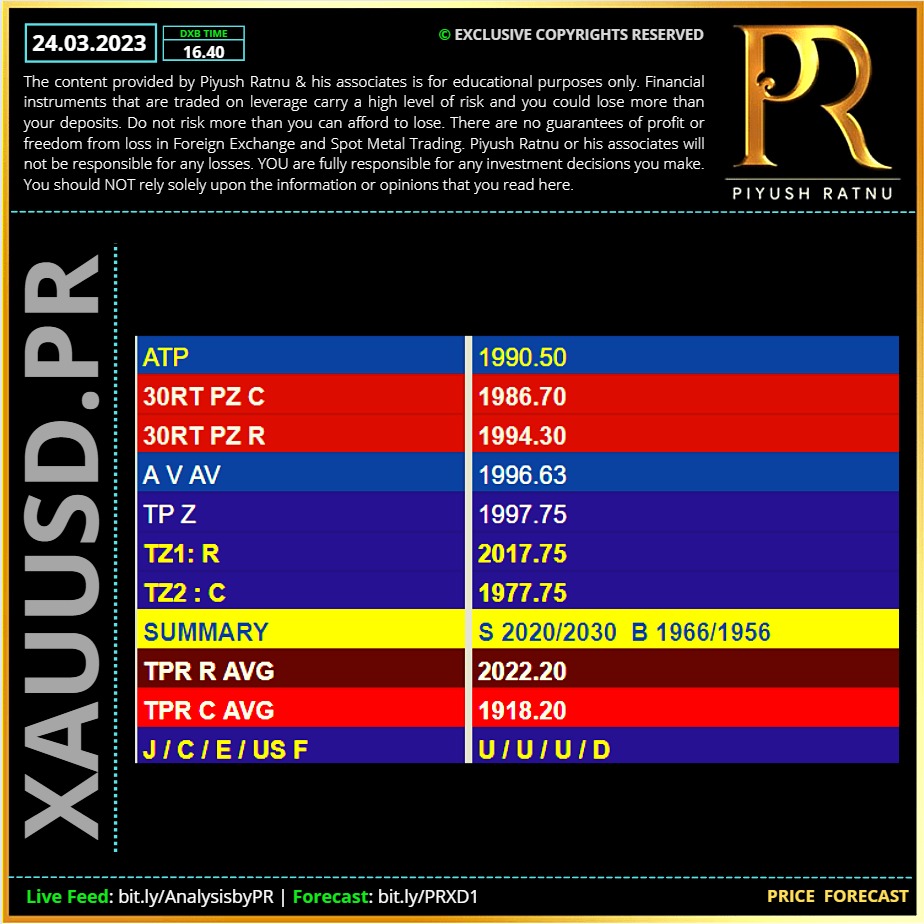

24.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

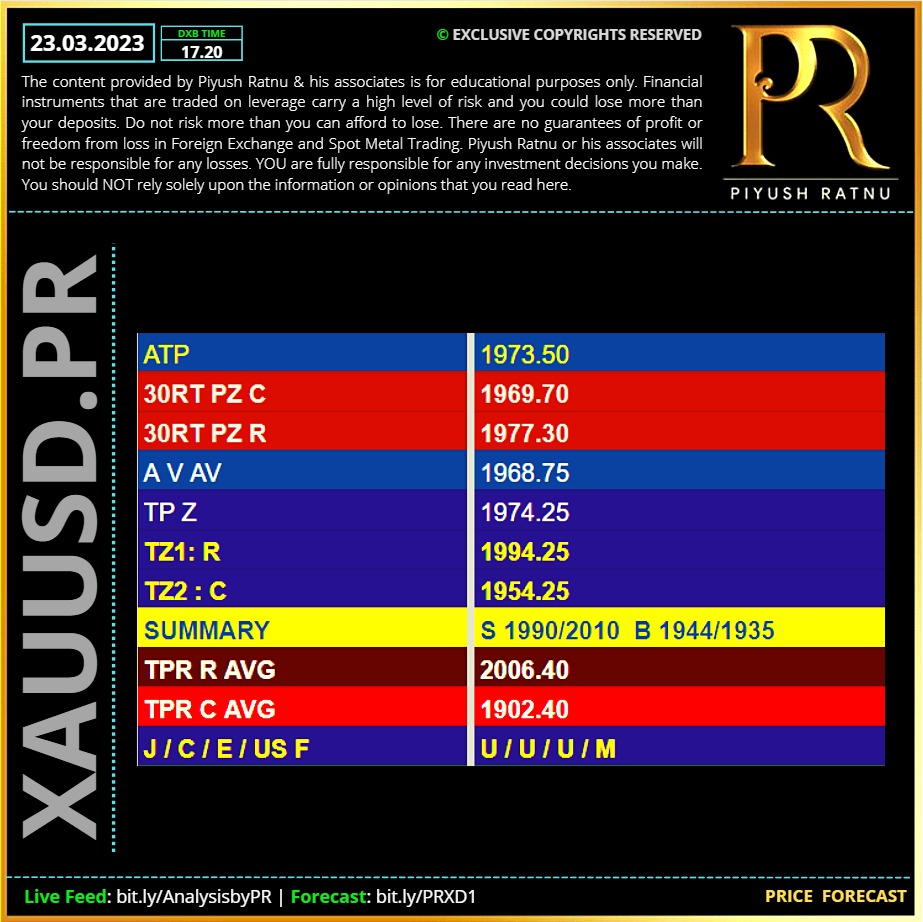

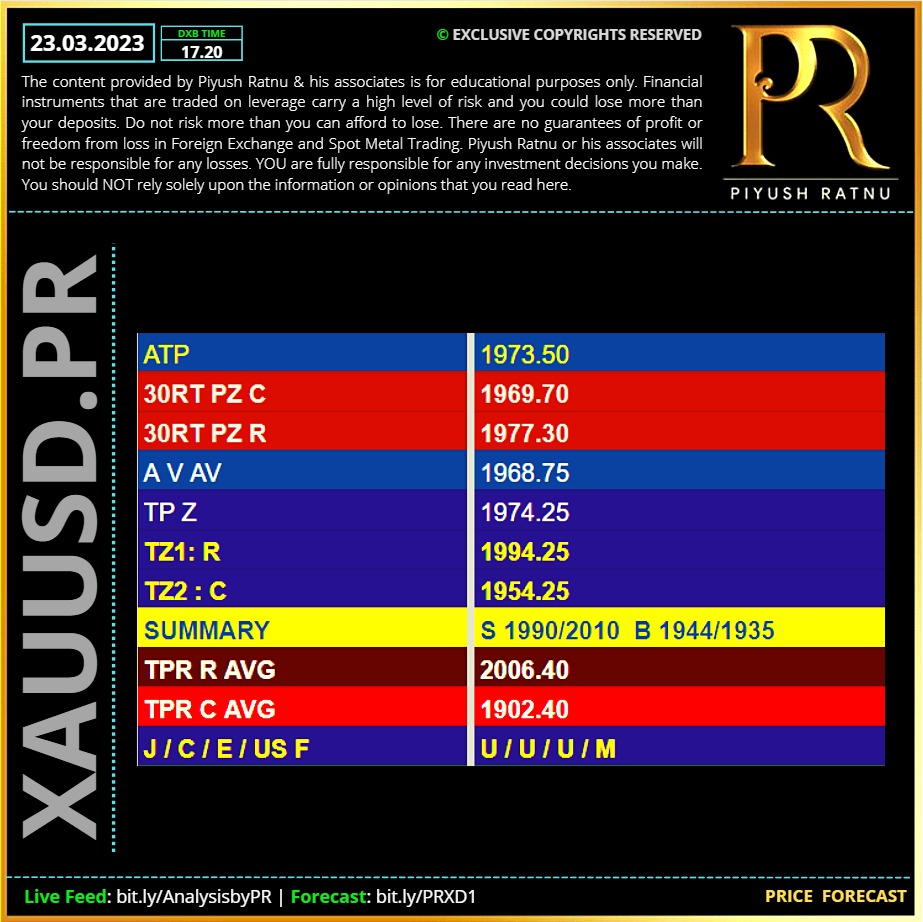

23.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

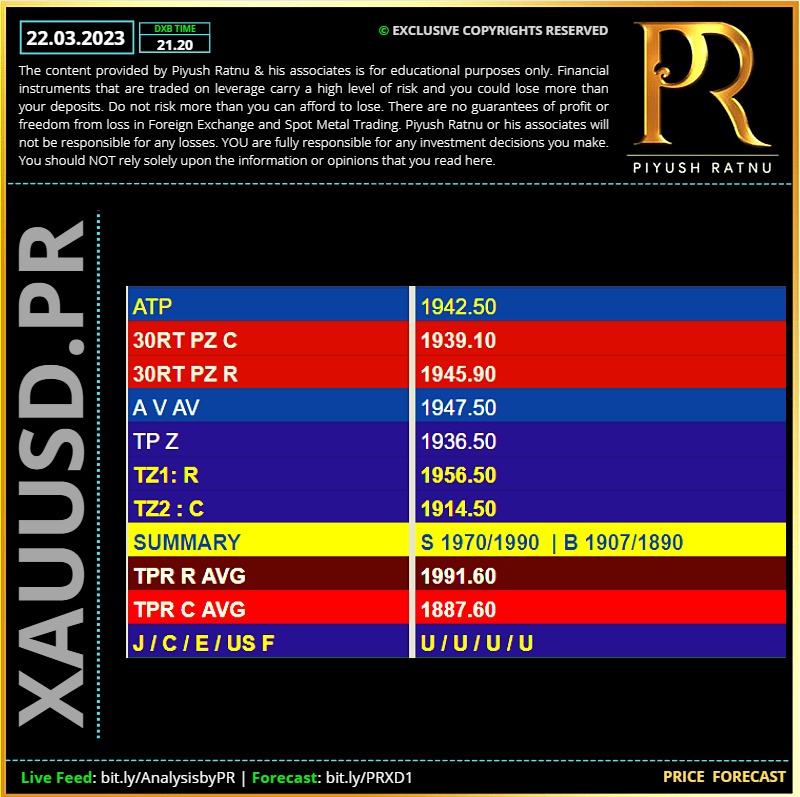

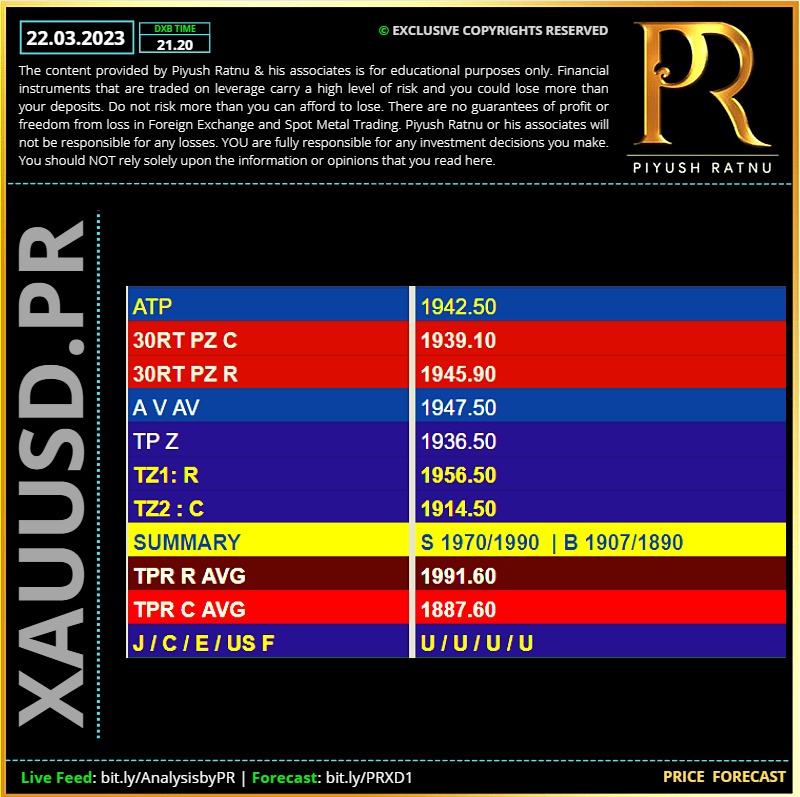

22.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

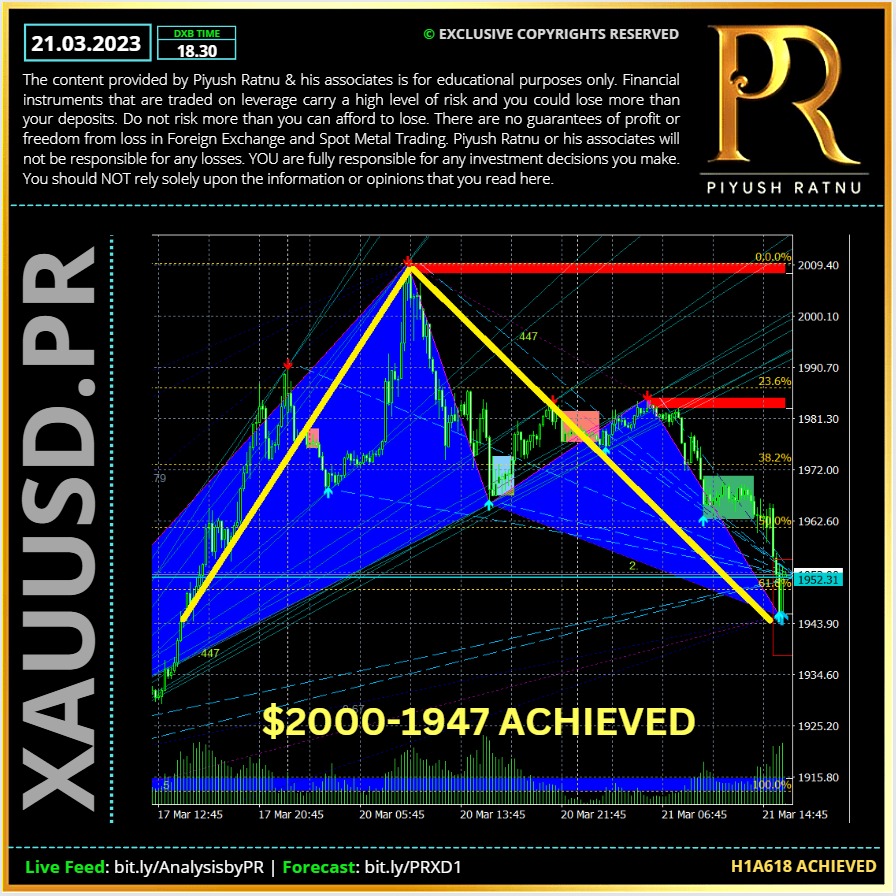

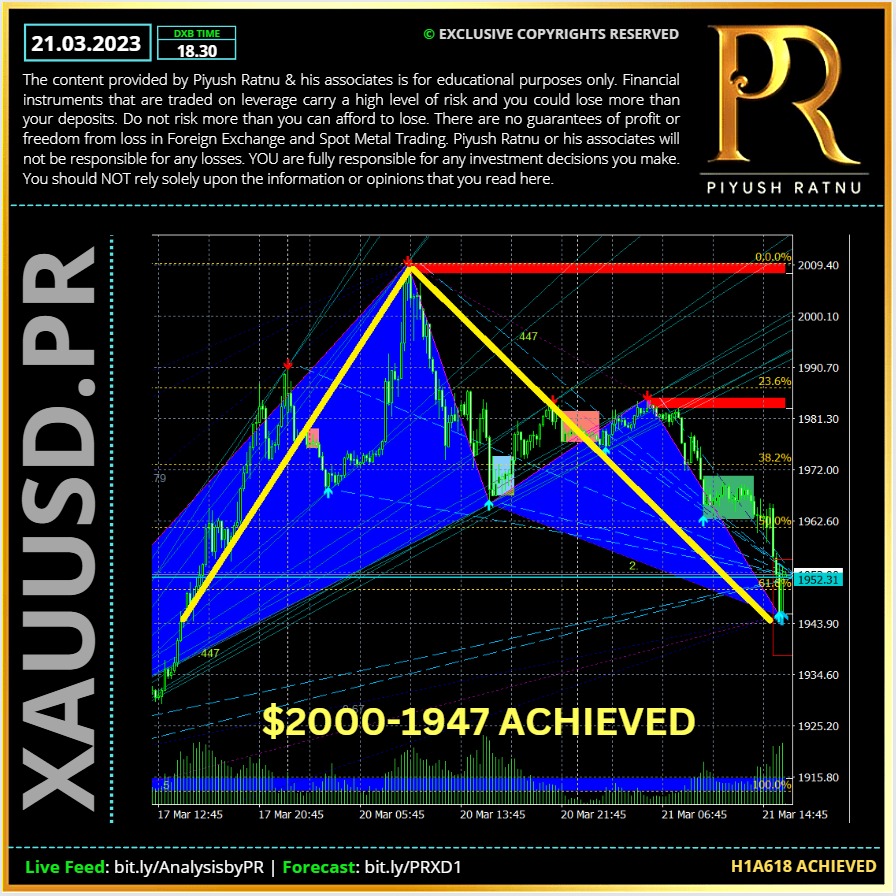

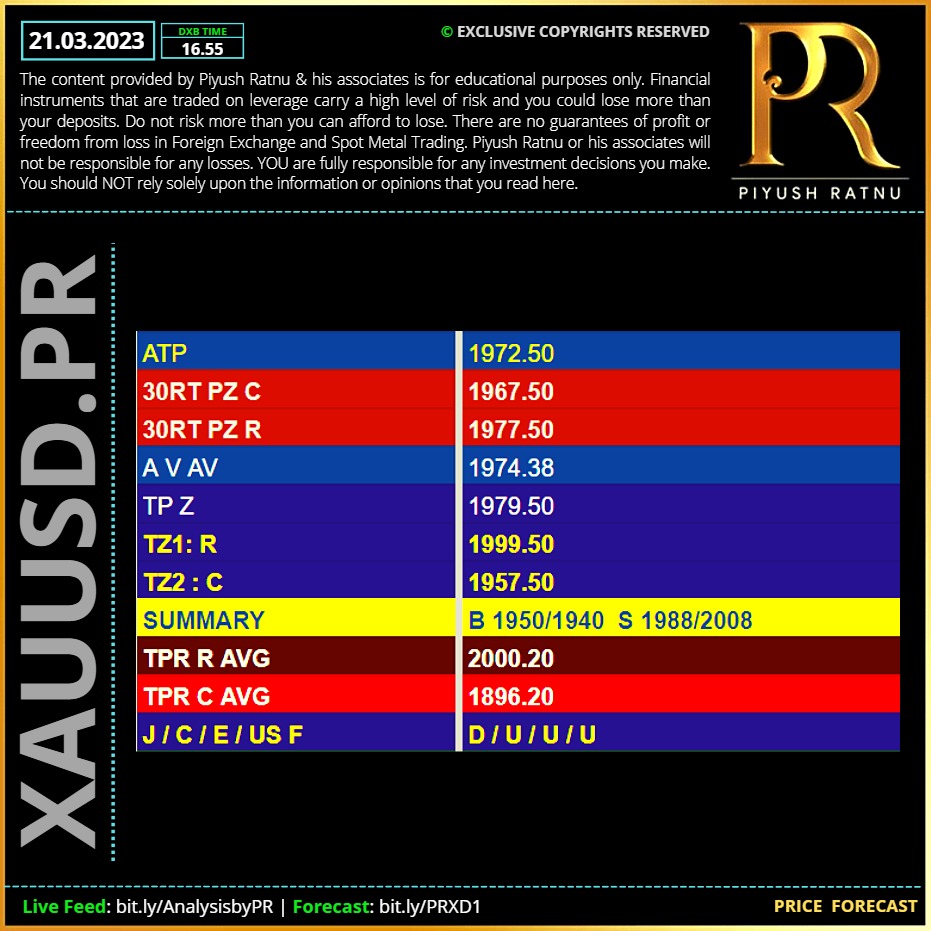

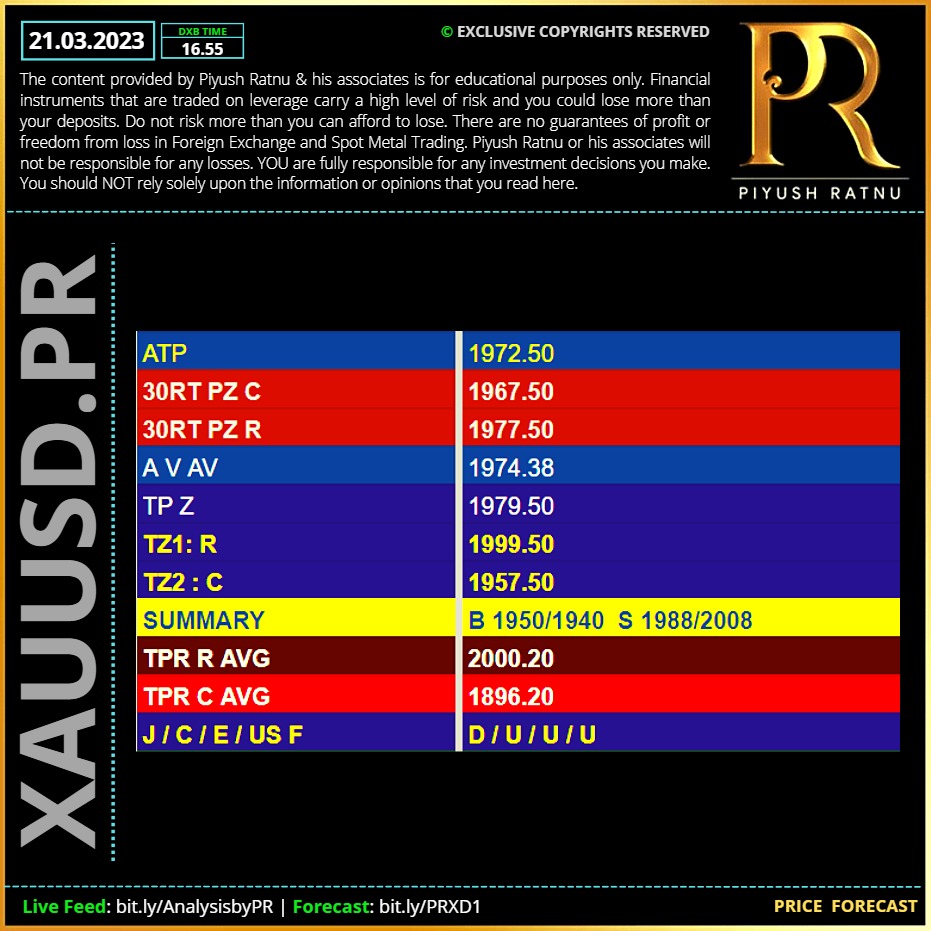

XAUUSD Spot GOLD: Price crashed from $2000-1947: As alerted in Advance | Piyush Ratnu

I had suggested Shorting XAUUSD at 1990 zone, GOLD touched the mark of 2009 and retraced back to $1950 in 48 hours.

Net pips achieved: $40= 4000 pips

XAUUSD CMP $1951.00

I had suggested Shorting XAUUSD at 1990 zone, GOLD touched the mark of 2009 and retraced back to $1950 in 48 hours.

Net pips achieved: $40= 4000 pips

XAUUSD CMP $1951.00

Piyush Lalsingh Ratnu

21.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

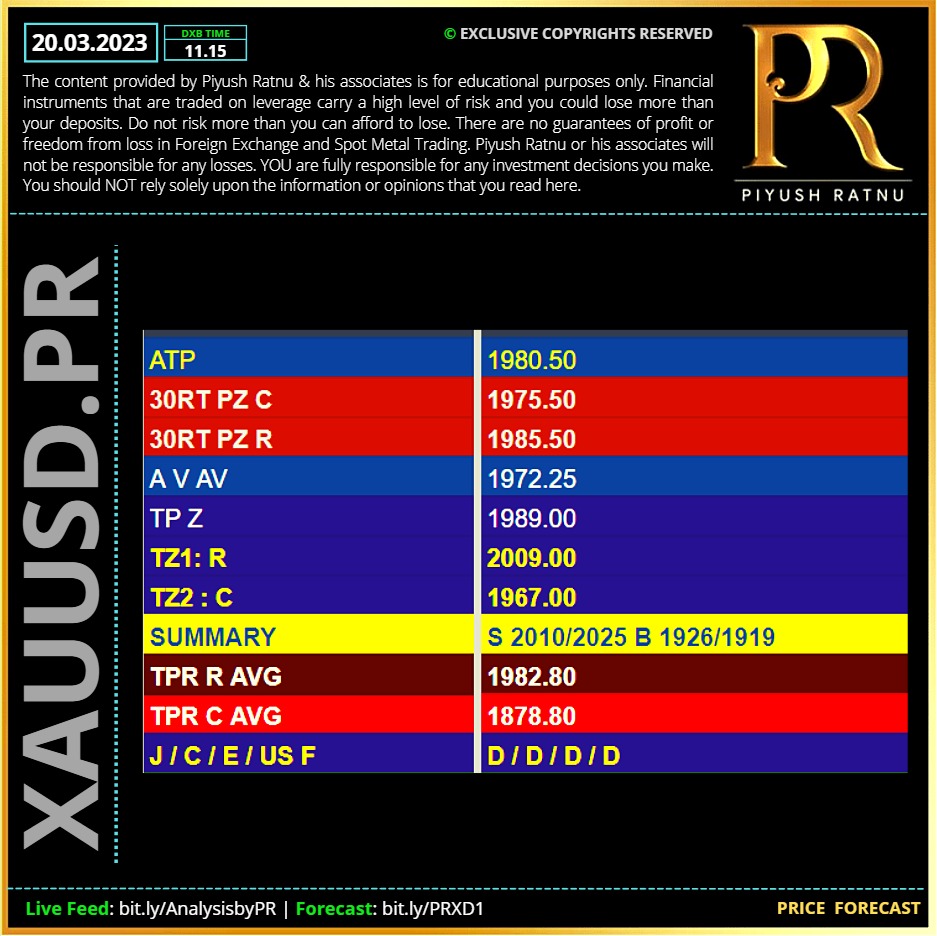

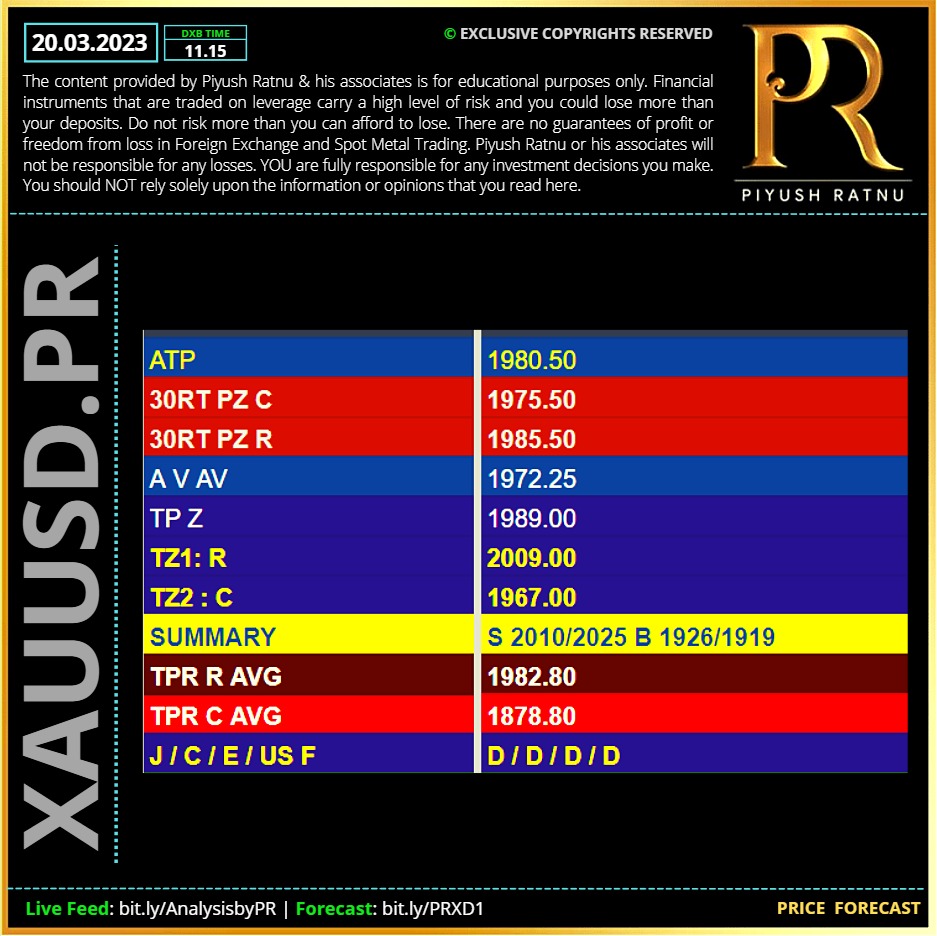

20.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

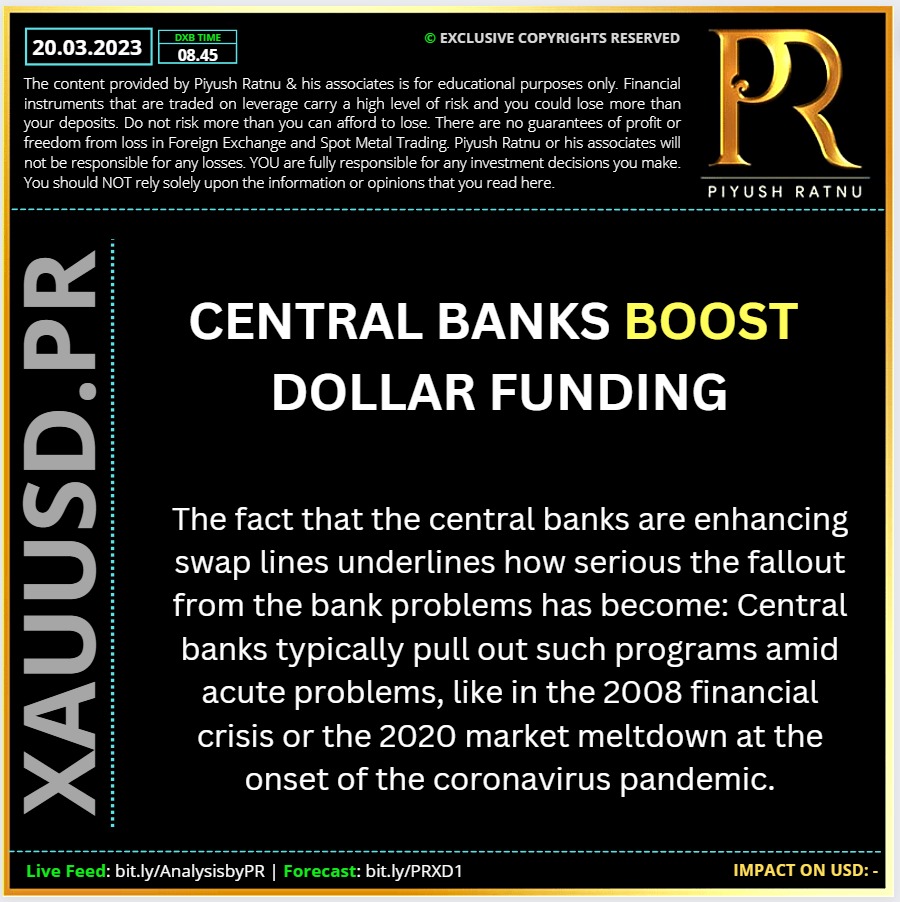

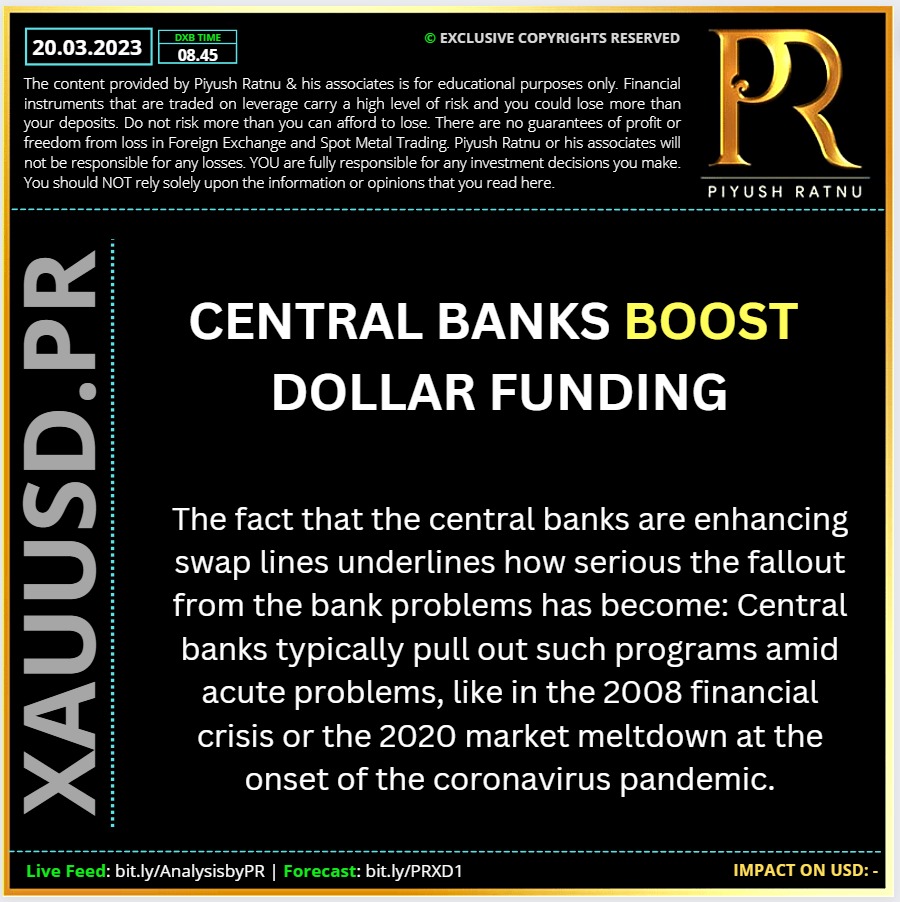

Important update: Central Banks Boost Dollar Funding.

The Federal Reserve and other major global central banks on Sunday announced that they would work to make sure dollars remain readily available across the global financial system as bank blowups in America and banking issues in Europe create a strain.

The Fed, the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank announced that they would more frequently offer so-called swap operations — which help foreign banks to get weeklong access to U.S. dollar financing — through April. Instead of being weekly, the offerings will for now be daily.

The point of the move is to try to prevent tumultuous conditions in markets as jittery investors react to the blowups of Silicon Valley Bank and Signature Bank in the United States and the arranged takeover of Credit Suisse by UBS in Europe. Upheaval in the financial sector can easily turn worse if investors struggle to move around their money — something that often happens because of a shortage of dollar funding in moments of stress. Swap lines can help to release those pressures.

Still, the fact that the central banks are enhancing swap lines underlines how serious the fallout from the bank problems has become: Central banks typically pull out such programs amid acute problems, like in the 2008 financial crisis or the 2020 market meltdown at the onset of the coronavirus pandemic.

The Federal Reserve and other major global central banks on Sunday announced that they would work to make sure dollars remain readily available across the global financial system as bank blowups in America and banking issues in Europe create a strain.

The Fed, the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank announced that they would more frequently offer so-called swap operations — which help foreign banks to get weeklong access to U.S. dollar financing — through April. Instead of being weekly, the offerings will for now be daily.

The point of the move is to try to prevent tumultuous conditions in markets as jittery investors react to the blowups of Silicon Valley Bank and Signature Bank in the United States and the arranged takeover of Credit Suisse by UBS in Europe. Upheaval in the financial sector can easily turn worse if investors struggle to move around their money — something that often happens because of a shortage of dollar funding in moments of stress. Swap lines can help to release those pressures.

Still, the fact that the central banks are enhancing swap lines underlines how serious the fallout from the bank problems has become: Central banks typically pull out such programs amid acute problems, like in the 2008 financial crisis or the 2020 market meltdown at the onset of the coronavirus pandemic.

Piyush Lalsingh Ratnu

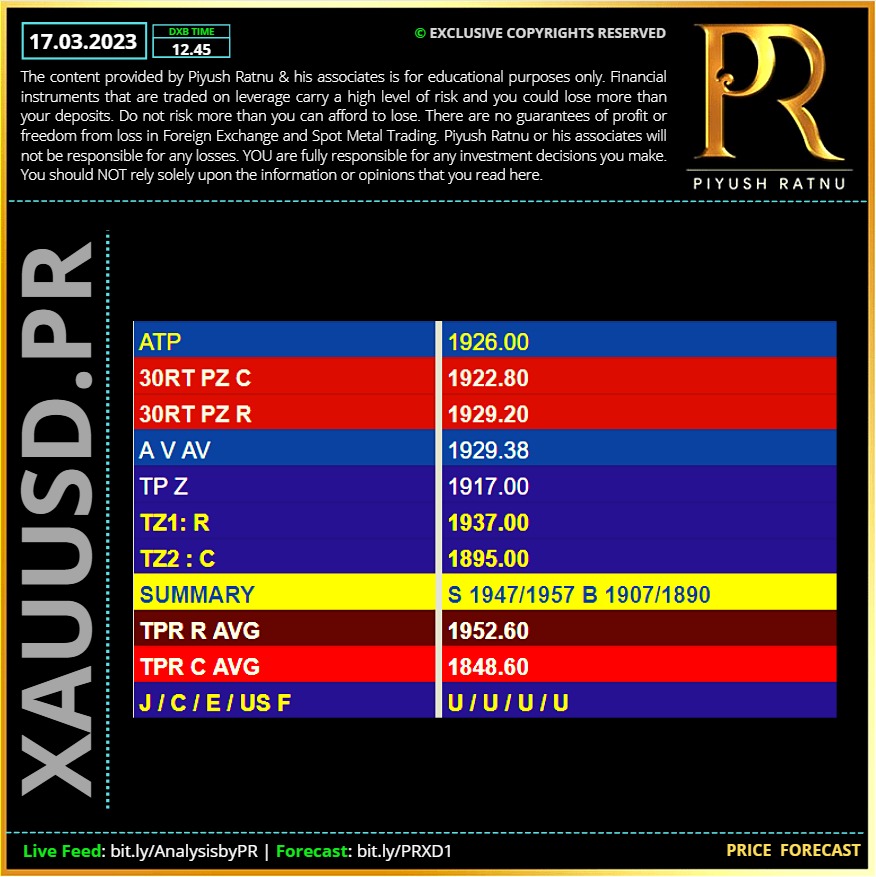

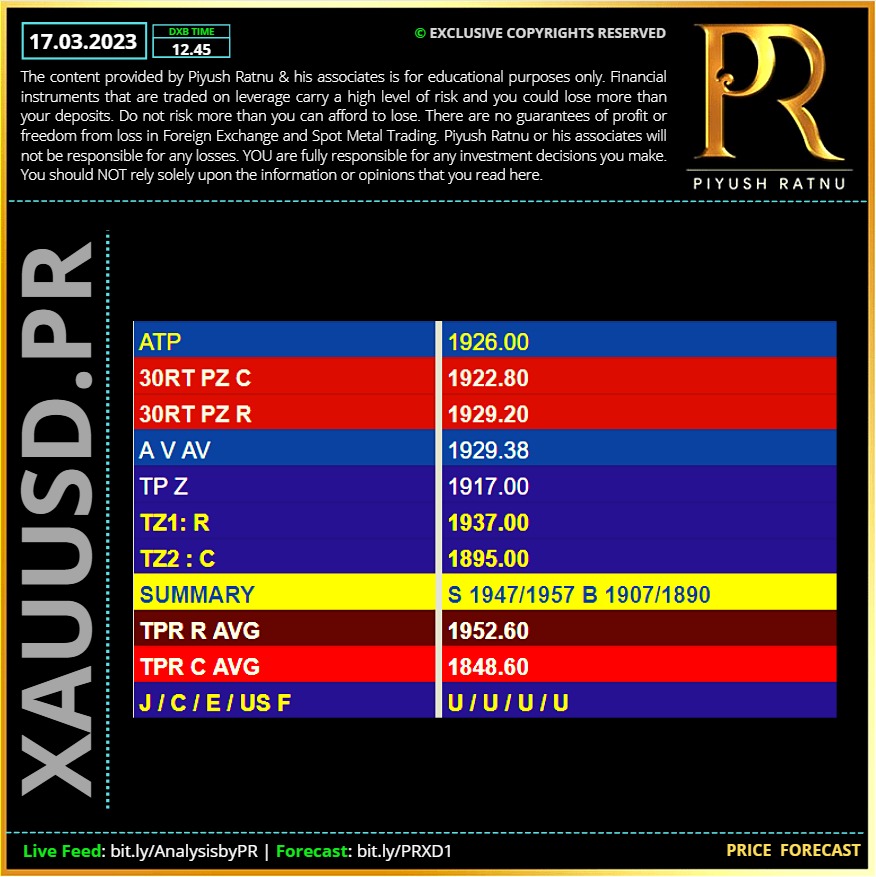

17.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

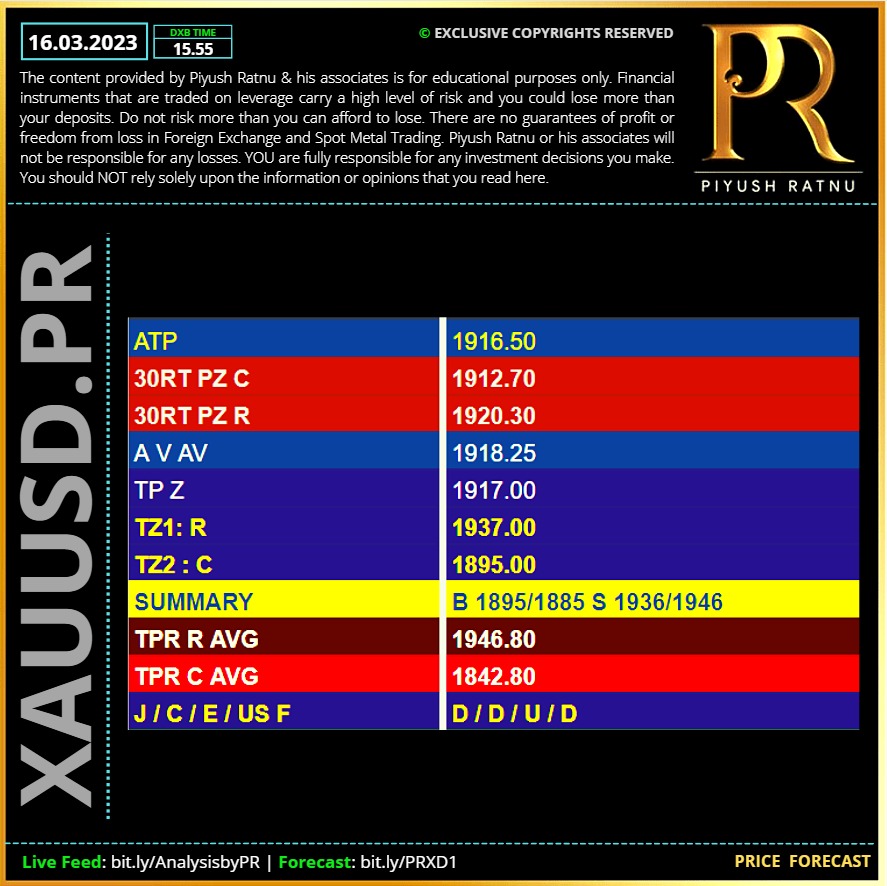

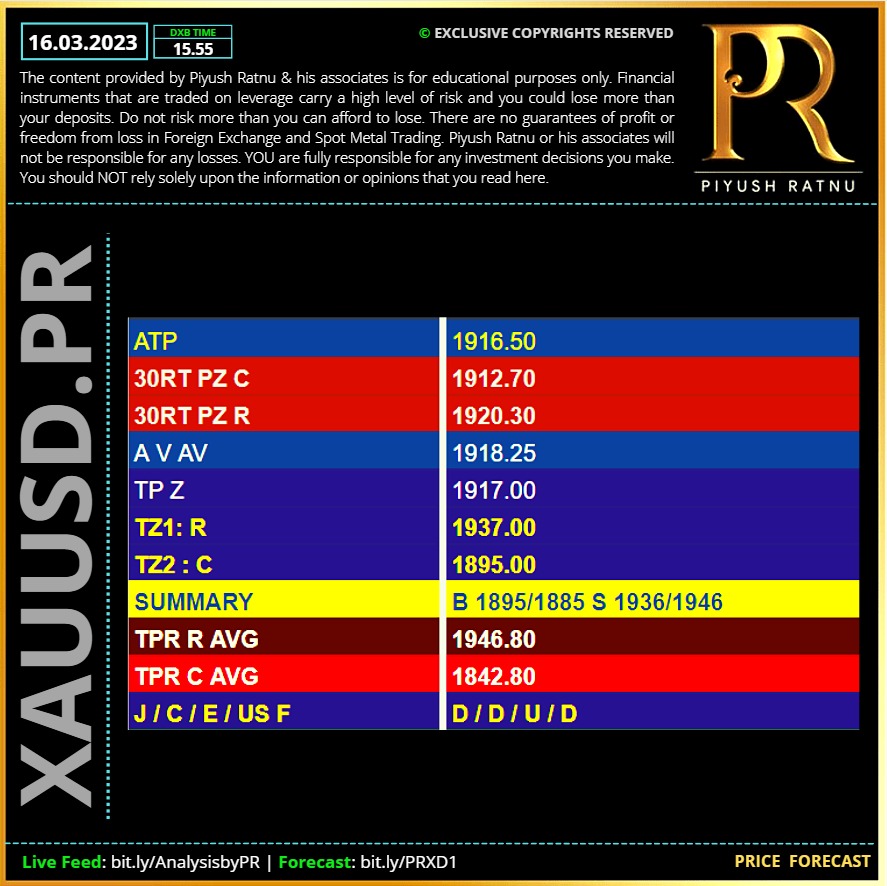

16.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

POF

US Economic Data at 16.30 hours:

Building Permits

Import/Export Price Index

Initial Jobless Claims

Philadelphia Fed Manufacturing Index

Philly Fed Employment

EUR Interest Rate Decision: 17.15 hours

ECB Press Conference: 17.45 hours

ECB Head Speech: 19.15 hours

High Volatility Price Rally (HVPR) expected.

Avoid big lots, exit in NAP, trades based on price zones ideal.🟢

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

US Economic Data at 16.30 hours:

Building Permits

Import/Export Price Index

Initial Jobless Claims

Philadelphia Fed Manufacturing Index

Philly Fed Employment

EUR Interest Rate Decision: 17.15 hours

ECB Press Conference: 17.45 hours

ECB Head Speech: 19.15 hours

High Volatility Price Rally (HVPR) expected.

Avoid big lots, exit in NAP, trades based on price zones ideal.🟢

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

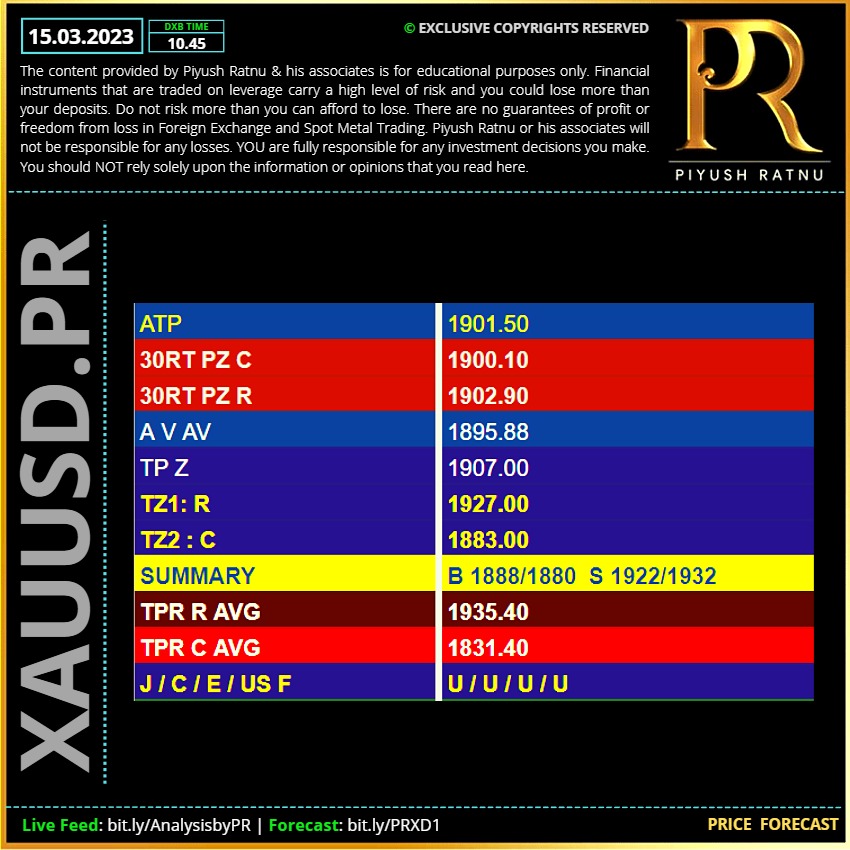

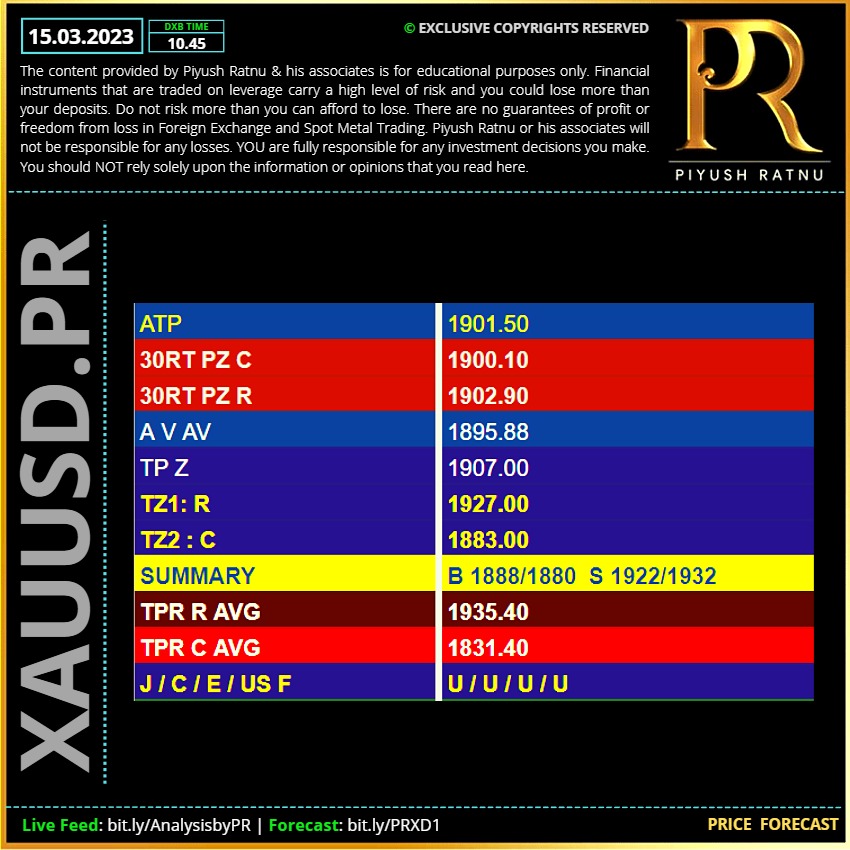

15.03.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

: