Piyush Lalsingh Ratnu / Профиль

- Информация

|

нет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

3

сигналов

|

1

подписчиков

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

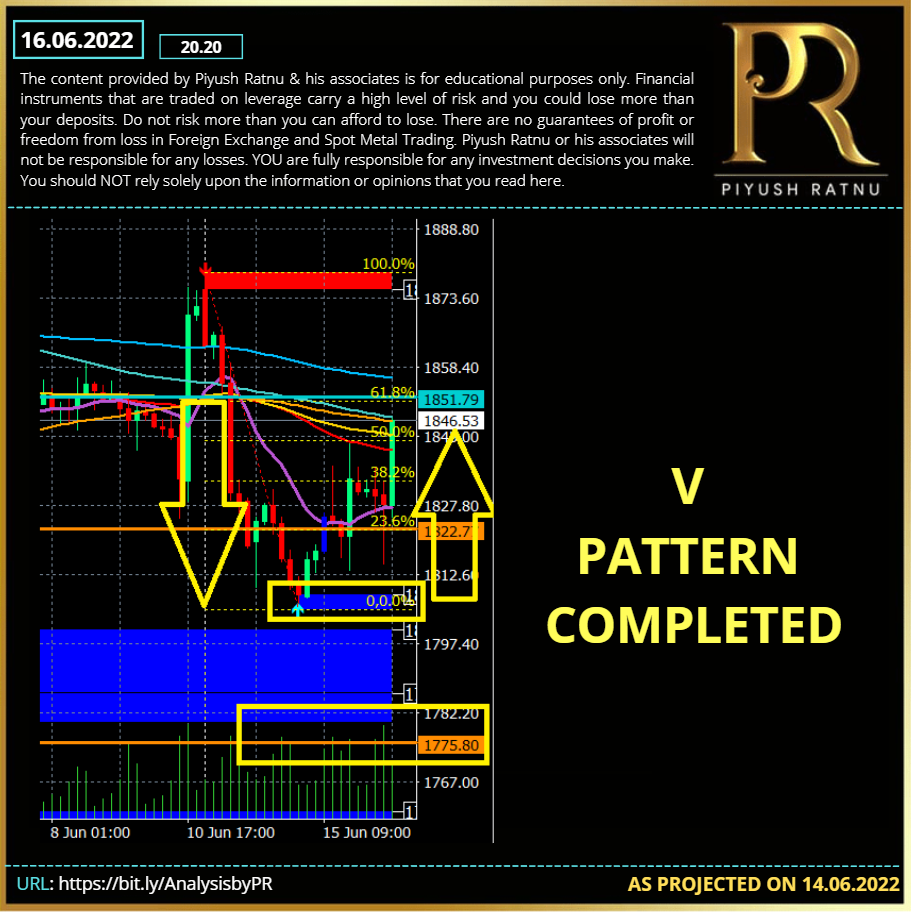

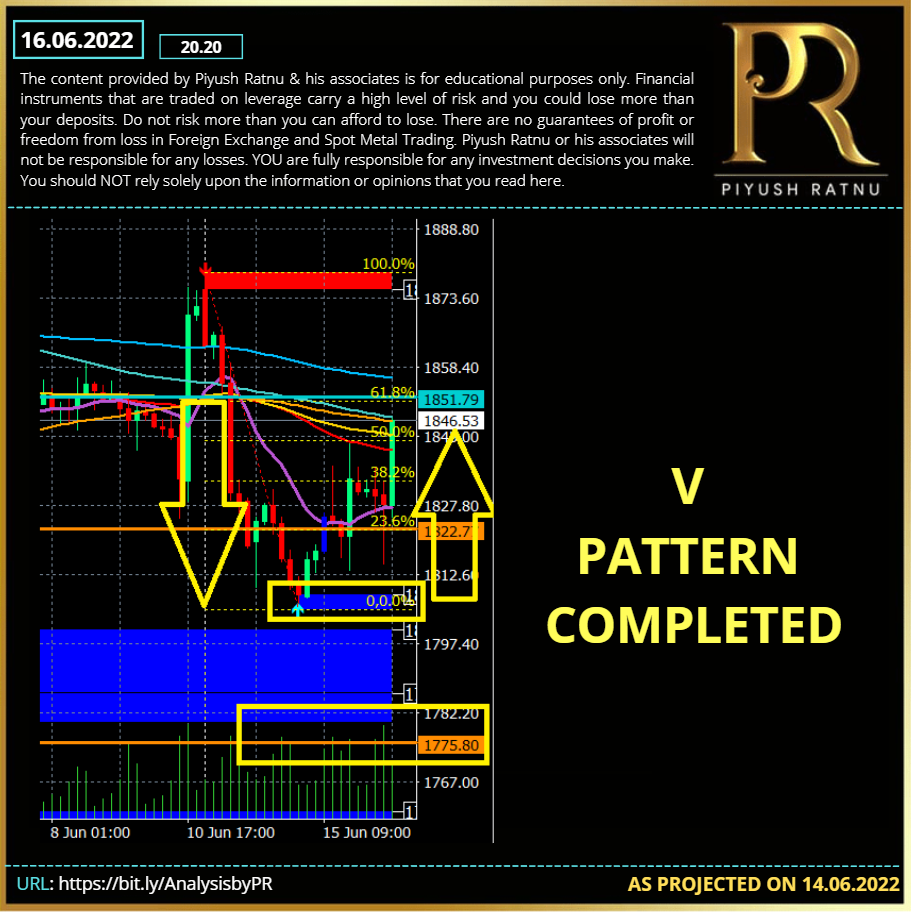

As alerted on 14.06.2022: 1818-1808 was the BUY zone, followed by 1790/1777 zone, however GOLD price retraced from 1808 and on FED DAY, 1841 high was achieved, followed by a repeated attempts to crash below 1818, however 1818 proved a major support zone, and today GOLD price crossed 1836 barrier and achieved 1847, from where GOLD price had crashed on 13 June 2022 during US Session.

One fact was pretty clear: It was a BUY direction in GOLD, the crash may have sustained for a few days, however facts, parameters and data cannot lie and fail, unless a global speculation and manipulation is implemented by market makers.

Current scenario:

M30 H1 V pattern completed, extension in process: H4 V pattern 1855/1880 *(1888 zone ahead).

Most of the analysts in the world had predicted/published analysis of a crash until $1630/1700 hence I was all prepared for an ugly crash, though our trades were on hold in BUY direction from 1846 till 1836 zone, as per my analysis 1836/145 was a zone to be achieved first, even if an ugly crash looks like a high possibility in the coming week(s).

Many of our esteem traders, respected clients criticised my decision to hold trades in BUY position from 1826/1836 zone. Many of you all shared your concerns regarding my analysis and buy direction.

And here is the result, once again, my BUY positions proved correct and today GOLD completed the V pattern at 1847 CMP.

The art of trading and analysis may look like an illusion for a few days for those who lack knowledge and experience, however patience and knowledge always win, and saving principle amount has always been my top priority.

From today, all the accounts below $1.0 Million will not be allowed to copy the trades in any condition(s).

I thank you all for your kind comments, messages and emails.

I am sure it was a learning journey for all, including me.

Thank you.

One fact was pretty clear: It was a BUY direction in GOLD, the crash may have sustained for a few days, however facts, parameters and data cannot lie and fail, unless a global speculation and manipulation is implemented by market makers.

Current scenario:

M30 H1 V pattern completed, extension in process: H4 V pattern 1855/1880 *(1888 zone ahead).

Most of the analysts in the world had predicted/published analysis of a crash until $1630/1700 hence I was all prepared for an ugly crash, though our trades were on hold in BUY direction from 1846 till 1836 zone, as per my analysis 1836/145 was a zone to be achieved first, even if an ugly crash looks like a high possibility in the coming week(s).

Many of our esteem traders, respected clients criticised my decision to hold trades in BUY position from 1826/1836 zone. Many of you all shared your concerns regarding my analysis and buy direction.

And here is the result, once again, my BUY positions proved correct and today GOLD completed the V pattern at 1847 CMP.

The art of trading and analysis may look like an illusion for a few days for those who lack knowledge and experience, however patience and knowledge always win, and saving principle amount has always been my top priority.

From today, all the accounts below $1.0 Million will not be allowed to copy the trades in any condition(s).

I thank you all for your kind comments, messages and emails.

I am sure it was a learning journey for all, including me.

Thank you.

Piyush Lalsingh Ratnu

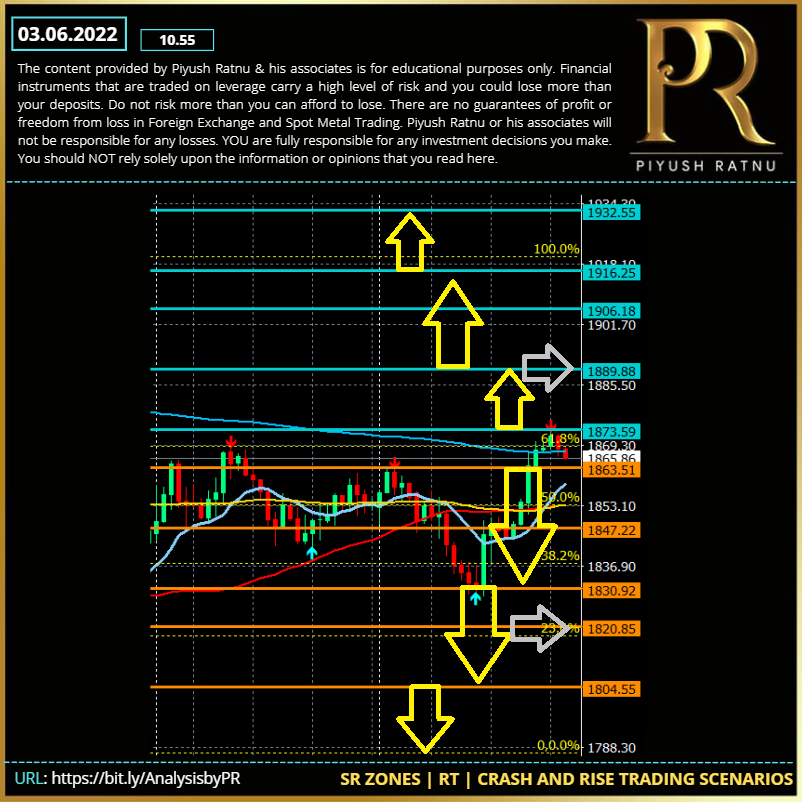

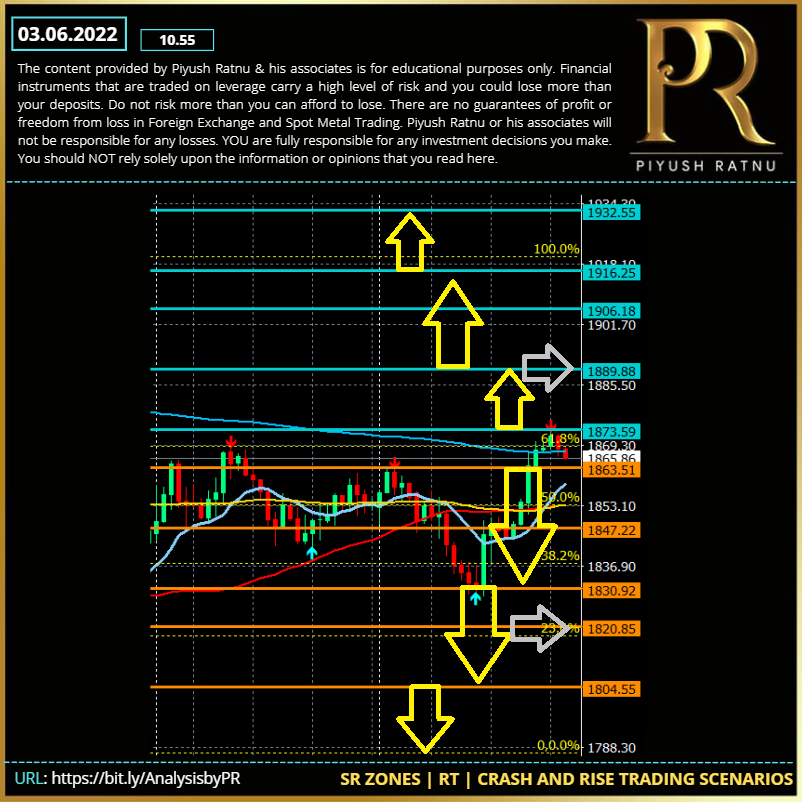

June Non Farm Payrolls Day | XAUUSD Analysis: The Golden Barricades at $1907/1926

Spot Gold (XAUUSD) price is back to $1866 zone, where it was on 06 May, 2022 on NFP Day. In my analysis published last month, this is what I had mentioned: Non Farm Payrolls Day May 2022: Spot Gold Analysis: XAUUSD: $1866/1836 or $1907/1926? Result: Gold touched the mark of 1907 and then crashed till $1787 mark in less than 10 days. BUY/SELL STOPS | BUY/SELL LIMITS: TARGET NAP ( Net Average Profit):

S2 ZONE 1846 | DOWN TREND (Below 1840) : 1836/1818/1800/1777 stops

R2 ZONE 1907 | UP TREND (After 1909) : 1916-1926-1947 stops

Analysis 06.05.2022 Review:

1909 was well achieved, hence sell limits hit at 1909 gave handsome profits at 1836. 1836/1818/1800 buy limits hit on 11 May – 16 May, 2022, and today GOLD is at 1866, proving accuracy of our analysis once again. Following the key levels mentioned in my analysis dated 06.05.2022: buying Gold at following price zones in last one month gave good returns:

($) 1836, 1818, 1808, 1790 and made an exit in net average profit of all trades

Selling Gold at following price zones in last three days proved a wise idea:

($) 1855, 1866 and made an exit in net average profit of all trades

FUNDAMENTAL ANALYSIS | CMP $1866 | 03.06.2022

Thursday’s strong advance in XAUUSD was on the back of rising open interest and opens the door to further gains in the very near term. Against that, the precious metal faces a tough resistance around the $1,866 level per ounce troy.

Gold traders are facing barricades at around $1,866.00 amid cautious trading added with risk-on mood sentiments over the US NFP. The DXY has slipped below 101.70 on positive market sentiment. The ADP Research Institute has reported addition of 128k jobs in the labour market, significantly lower than the estimates of 300k. It is worth noting that the US labour market is at its peak levels and employment generation may get slower amid less scope for growth. Therefore, investors should brace for a slower job growth rate.

As per the market consensus, the US NFP is seen at 325k. The gold price is performing well against the greenback as investors are expecting that the actual NFP figure won’t even justify the consensus. A lower than expected job addition will fetch significant offers to the US dollar index (DXY). Currently, the DXY is oscillating below 101.70, and more downside looks possible considering the strength of the bears on the counter.

The greenback changed course on Thursday and gave up all of its Wednesday gains and more. Easing government bond yields and tepid US employment-related figures put pressure on the American currency, later weighed by the positive tone of Wall Street. However, it is always wise to stay cautious, as they say: Don’t always believe in what they show you, be cautious, implement money management and be ready for a reversal which may come as a surprise resulting in heavy drawdown.

US 10 Year yields stand at 2.915, USDJPY at 129.94, XAUXAG ratio at 83.50 and Dollar Index at 101.737 at the time of writing.

How to trade Spot Gold XAUUSD on NFP data today?

Bearish Scenario: Gold Stops: $1836/1818/1777, once again?

If the bearish momentum extends, gold price could fall further towards 1836 (after 1842) with 1818/1777 as final destination, if Gold crash halts at 1836 or 1818 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 12 trading days.

Bullish Scenario: Gold Stops: $1907/1926/1947?

If the Bullish momentum pushes Gold price across $1888 barrier, $1907 and $1926 can be the next target for Gold, opening way to $1947.

Heading into the NFP showdown today, gold price is under a price trap of 1836-1866 zone, as investors are less hesitant to place fresh bets due to ongoing saga of risk-on mood. The US NFP will emerge as the main market driver for gold price today.

A break above $1907 after M1 M5 23.6 retracement format, might result in price trap of $1926-$1947 on a longer run and a further bullish trend might help GOLD bulls to achieve $1947-1966 zone. However a crash below $1842 might open gates for $1836 (after S2), $1818/1777 zone before retracement is achieved at 23.6 M5, M15/M30 in next 12 days.

TRADING STRATEGY:

Observe price at US OPENING SS1 and then US SS2

Observe S2-S3/S4 zone and R2-R3 zone for reversals/retracement, Target NAP

Do not enter between the S/R zones or in pivot zone

Observe: FIB 23.6% on M5 and M15 TF for NAP target price

after 30/60/90/120 minutes of NFP

Price of Focus (POF)

Crash scenario:

S2 -6/9 RT NAP

S3 -3/6 RT NAP

S4 -6 RT NAP

Rise scenario:

R2+6/9 RT NAP

R3+3/6 RT NAP

R4+6 RT NAP

Implement RM till 30 after 15/30 min. and price gap 12/18/24 after NFP

Implement GR/SM after $25/40 price movement from CMP at NFP data

Golden Ratio based money management should not be used at least till $24 price movement in any direction, if SM needs to be ignored.

Kindly observe the crucial limits/stops levels mentioned by me in this analysis in addition to possible crash and rise zones highlighted in

Today, I will prefer to BUY session/daily lows below Support zone (-3/6/9 pattern) S3 and S4, and I will prefer to SELL above Resistance zones 2 and 3 with a target of NET average profit, if fundamentals support and favour the same.

Movement of 25/40 or 60 dollars on Gold price is not something unexpected nowadays, and a surprise on Monday during early trading hours can not be ruled out too, so closing all positions today in net average profit is always the best trading strategy for every trader who wants to safeguard his principle. I expect A pattern in next 12 days.

BUY/SELL STOPS | BUY/SELL LIMITS: TARGET NAP ( Net Average Profit):

S2 ZONE 1847 | DOWN TREND (Below 1842) : 1836/1818/1800/1777 BUY LIMITS

R2 ZONE 1907 | UP TREND (After 1911) : 1916-1926-1947 SELL LIMITS

It is always wise to first PLAN THE TRADE, and then TRADE THE PLAN! Hence, it is suggested to first observe the crash or rise with specific zones and levels in mind on the basis of various fundamental and technical parameters mentioned above, before entering a trade in a specific direction with a target of net average profit in a specific set of trades.

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

RISK WARNING | DISCLAIMER

Information on this Channel/Page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Information or opinions provided by us should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

The analysis and trading suggestions published by Piyush Ratnu does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Piyush Ratnu does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Piyush Ratnu shall not be responsible under any circumstances for the consequences of such activities. Piyush Ratnu and its affiliates, in no event, be liable to users or any third parties for any consequential damages or losses in any direct or indirect manner, however arising, including but not limited to damages caused by negligence or Force Majeure whether such damages were foreseen or unforeseen.

The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. You should not buy a warrant unless you are prepared to sustain a total loss of the money you have invested plus any commission or other transaction charges. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you hence implement risk management and money management strictly to safeguard your investment. Do not risk more than .10% of your principle amount in a single trade set.

Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore, you should not invest money that you cannot afford to lose. In some cases, it is possible to lose more than your initial investment as it is not always possible to exit a market at the price you intend upon doing so. There are also risks associated with utilizing an Internet-based trade execution software application including, but not limited to, the failure of hardware and software. You should be aware of all the risks associated with investing in foreign exchange, indices and commodities and seek advice from an independent financial advisor if you have any doubts.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu or his associates will not accept any liability for any loss or damage, including but without limitation to, any financial, emotional loss, which may arise directly or indirectly due to your decision. If you do not agree to the above terms, conditions and disclaimer YOU MUST leave this group with immediate effect and YOU MUST not act as per the information provided in this document.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai Read more at: https://bit.ly/03062022NFPAnalysisPR

Spot Gold (XAUUSD) price is back to $1866 zone, where it was on 06 May, 2022 on NFP Day. In my analysis published last month, this is what I had mentioned: Non Farm Payrolls Day May 2022: Spot Gold Analysis: XAUUSD: $1866/1836 or $1907/1926? Result: Gold touched the mark of 1907 and then crashed till $1787 mark in less than 10 days. BUY/SELL STOPS | BUY/SELL LIMITS: TARGET NAP ( Net Average Profit):

S2 ZONE 1846 | DOWN TREND (Below 1840) : 1836/1818/1800/1777 stops

R2 ZONE 1907 | UP TREND (After 1909) : 1916-1926-1947 stops

Analysis 06.05.2022 Review:

1909 was well achieved, hence sell limits hit at 1909 gave handsome profits at 1836. 1836/1818/1800 buy limits hit on 11 May – 16 May, 2022, and today GOLD is at 1866, proving accuracy of our analysis once again. Following the key levels mentioned in my analysis dated 06.05.2022: buying Gold at following price zones in last one month gave good returns:

($) 1836, 1818, 1808, 1790 and made an exit in net average profit of all trades

Selling Gold at following price zones in last three days proved a wise idea:

($) 1855, 1866 and made an exit in net average profit of all trades

FUNDAMENTAL ANALYSIS | CMP $1866 | 03.06.2022

Thursday’s strong advance in XAUUSD was on the back of rising open interest and opens the door to further gains in the very near term. Against that, the precious metal faces a tough resistance around the $1,866 level per ounce troy.

Gold traders are facing barricades at around $1,866.00 amid cautious trading added with risk-on mood sentiments over the US NFP. The DXY has slipped below 101.70 on positive market sentiment. The ADP Research Institute has reported addition of 128k jobs in the labour market, significantly lower than the estimates of 300k. It is worth noting that the US labour market is at its peak levels and employment generation may get slower amid less scope for growth. Therefore, investors should brace for a slower job growth rate.

As per the market consensus, the US NFP is seen at 325k. The gold price is performing well against the greenback as investors are expecting that the actual NFP figure won’t even justify the consensus. A lower than expected job addition will fetch significant offers to the US dollar index (DXY). Currently, the DXY is oscillating below 101.70, and more downside looks possible considering the strength of the bears on the counter.

The greenback changed course on Thursday and gave up all of its Wednesday gains and more. Easing government bond yields and tepid US employment-related figures put pressure on the American currency, later weighed by the positive tone of Wall Street. However, it is always wise to stay cautious, as they say: Don’t always believe in what they show you, be cautious, implement money management and be ready for a reversal which may come as a surprise resulting in heavy drawdown.

US 10 Year yields stand at 2.915, USDJPY at 129.94, XAUXAG ratio at 83.50 and Dollar Index at 101.737 at the time of writing.

How to trade Spot Gold XAUUSD on NFP data today?

Bearish Scenario: Gold Stops: $1836/1818/1777, once again?

If the bearish momentum extends, gold price could fall further towards 1836 (after 1842) with 1818/1777 as final destination, if Gold crash halts at 1836 or 1818 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 12 trading days.

Bullish Scenario: Gold Stops: $1907/1926/1947?

If the Bullish momentum pushes Gold price across $1888 barrier, $1907 and $1926 can be the next target for Gold, opening way to $1947.

Heading into the NFP showdown today, gold price is under a price trap of 1836-1866 zone, as investors are less hesitant to place fresh bets due to ongoing saga of risk-on mood. The US NFP will emerge as the main market driver for gold price today.

A break above $1907 after M1 M5 23.6 retracement format, might result in price trap of $1926-$1947 on a longer run and a further bullish trend might help GOLD bulls to achieve $1947-1966 zone. However a crash below $1842 might open gates for $1836 (after S2), $1818/1777 zone before retracement is achieved at 23.6 M5, M15/M30 in next 12 days.

TRADING STRATEGY:

Observe price at US OPENING SS1 and then US SS2

Observe S2-S3/S4 zone and R2-R3 zone for reversals/retracement, Target NAP

Do not enter between the S/R zones or in pivot zone

Observe: FIB 23.6% on M5 and M15 TF for NAP target price

after 30/60/90/120 minutes of NFP

Price of Focus (POF)

Crash scenario:

S2 -6/9 RT NAP

S3 -3/6 RT NAP

S4 -6 RT NAP

Rise scenario:

R2+6/9 RT NAP

R3+3/6 RT NAP

R4+6 RT NAP

Implement RM till 30 after 15/30 min. and price gap 12/18/24 after NFP

Implement GR/SM after $25/40 price movement from CMP at NFP data

Golden Ratio based money management should not be used at least till $24 price movement in any direction, if SM needs to be ignored.

Kindly observe the crucial limits/stops levels mentioned by me in this analysis in addition to possible crash and rise zones highlighted in

Today, I will prefer to BUY session/daily lows below Support zone (-3/6/9 pattern) S3 and S4, and I will prefer to SELL above Resistance zones 2 and 3 with a target of NET average profit, if fundamentals support and favour the same.

Movement of 25/40 or 60 dollars on Gold price is not something unexpected nowadays, and a surprise on Monday during early trading hours can not be ruled out too, so closing all positions today in net average profit is always the best trading strategy for every trader who wants to safeguard his principle. I expect A pattern in next 12 days.

BUY/SELL STOPS | BUY/SELL LIMITS: TARGET NAP ( Net Average Profit):

S2 ZONE 1847 | DOWN TREND (Below 1842) : 1836/1818/1800/1777 BUY LIMITS

R2 ZONE 1907 | UP TREND (After 1911) : 1916-1926-1947 SELL LIMITS

It is always wise to first PLAN THE TRADE, and then TRADE THE PLAN! Hence, it is suggested to first observe the crash or rise with specific zones and levels in mind on the basis of various fundamental and technical parameters mentioned above, before entering a trade in a specific direction with a target of net average profit in a specific set of trades.

WARNING: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The author will not be held responsible for information that is found at the end of links posted on this page. The author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. The author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author is not a registered investment advisor and nothing in this article is intended to be investment advice. All performance information reflects past performance and is presented on a total return basis. Past performance is no guarantee of future results. Current performance may differ from the performance shown.

RISK WARNING | DISCLAIMER

Information on this Channel/Page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Information or opinions provided by us should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

The analysis and trading suggestions published by Piyush Ratnu does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Piyush Ratnu does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Piyush Ratnu shall not be responsible under any circumstances for the consequences of such activities. Piyush Ratnu and its affiliates, in no event, be liable to users or any third parties for any consequential damages or losses in any direct or indirect manner, however arising, including but not limited to damages caused by negligence or Force Majeure whether such damages were foreseen or unforeseen.

The capital value of units in the fund can fluctuate and the price of units can go down as well as up and is not guaranteed. You should not buy a warrant unless you are prepared to sustain a total loss of the money you have invested plus any commission or other transaction charges. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you hence implement risk management and money management strictly to safeguard your investment. Do not risk more than .10% of your principle amount in a single trade set.

Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore, you should not invest money that you cannot afford to lose. In some cases, it is possible to lose more than your initial investment as it is not always possible to exit a market at the price you intend upon doing so. There are also risks associated with utilizing an Internet-based trade execution software application including, but not limited to, the failure of hardware and software. You should be aware of all the risks associated with investing in foreign exchange, indices and commodities and seek advice from an independent financial advisor if you have any doubts.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu or his associates will not accept any liability for any loss or damage, including but without limitation to, any financial, emotional loss, which may arise directly or indirectly due to your decision. If you do not agree to the above terms, conditions and disclaimer YOU MUST leave this group with immediate effect and YOU MUST not act as per the information provided in this document.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai Read more at: https://bit.ly/03062022NFPAnalysisPR

Piyush Lalsingh Ratnu

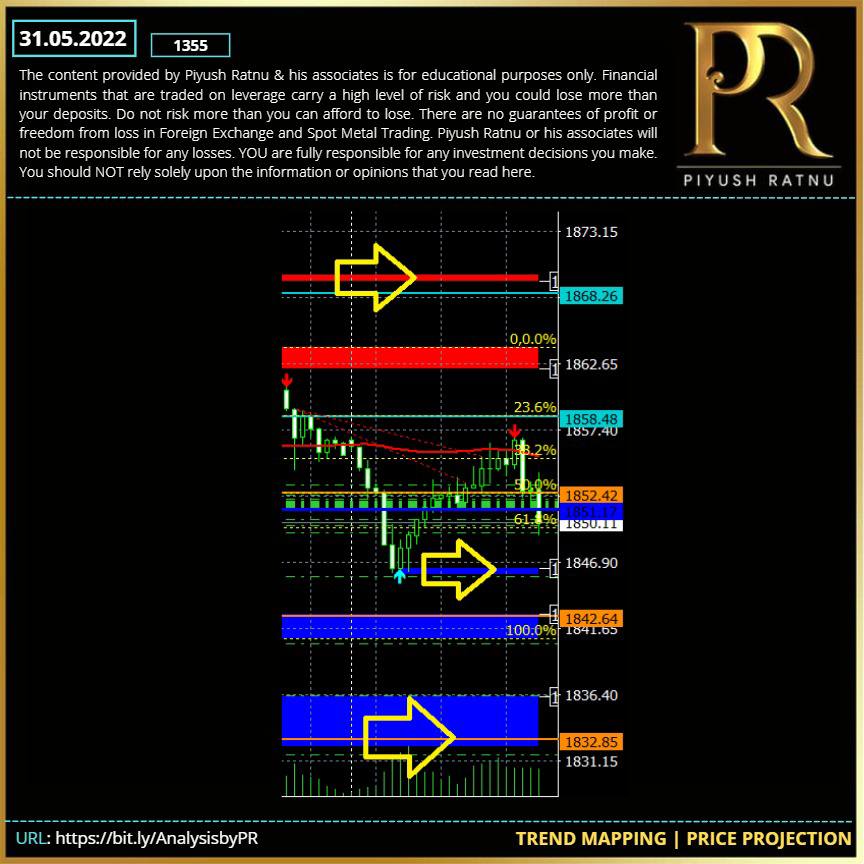

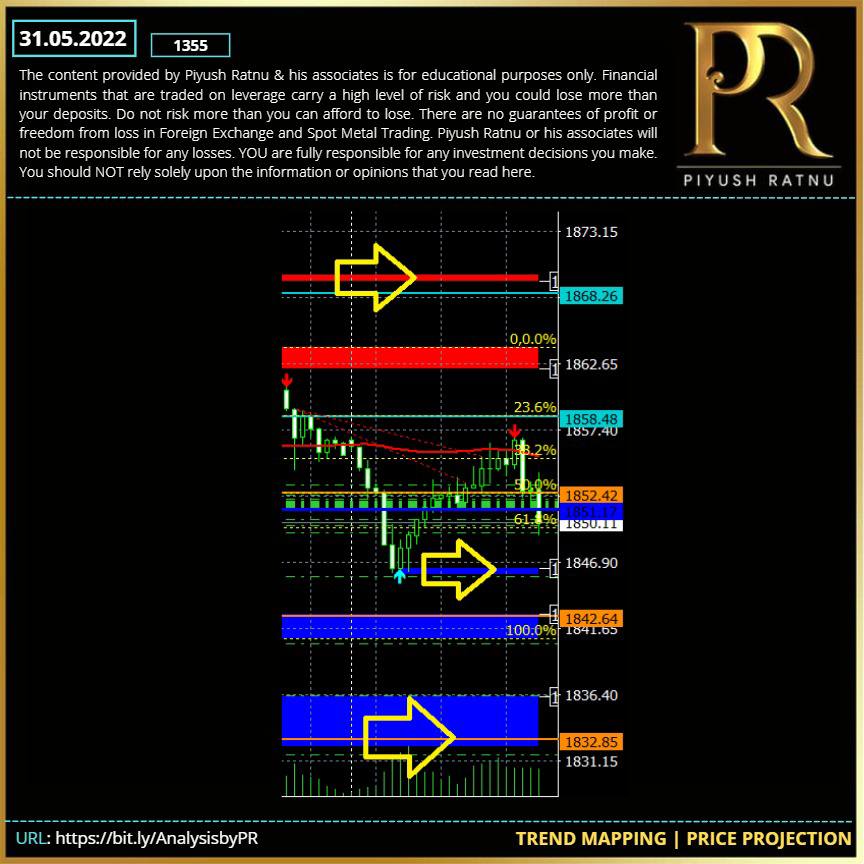

$1836-1832 : AS ALERTED YESTERDAY:

Acceptance below the 21-DMA at $1,848 will trigger a fresh drop towards the horizontal 200-DMA at $1,840. Daily closing below the latter is needed to fade the recovery and turn the focus back on the May 18 low of $1,808/1,777.

Recapturing the daily highs of $1,866 is critical to take on the upside towards the previous day’s high of $1,864. Further up, the two-week highs at $1,875 will be next on the buyers’ radars, above which the mildly bullish 100-DMA at $1,888 will be challenged.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Acceptance below the 21-DMA at $1,848 will trigger a fresh drop towards the horizontal 200-DMA at $1,840. Daily closing below the latter is needed to fade the recovery and turn the focus back on the May 18 low of $1,808/1,777.

Recapturing the daily highs of $1,866 is critical to take on the upside towards the previous day’s high of $1,864. Further up, the two-week highs at $1,875 will be next on the buyers’ radars, above which the mildly bullish 100-DMA at $1,888 will be challenged.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

Gold attracted some dip-buying near the $1,846 region on Tuesday and climbed back closer to the daily peak during the early European session.

The overnight optimism led by the easing of COVID-19 lockdowns in China turned out to be short-lived amid doubts if central banks can hike interest rates to curb inflation without impacting economic growth.

The worries resurface following the release of official Chinese PMIs, which showed contraction in both manufacturing and services sectors during May. This, along with concerns that the global supply chain disruption would continue to push consumer prices even higher, weighed on investors' sentiment and benefitted the safe-haven precious metal.

Gold is facing headwind from the firmer US dollar and significantly rising bond yields

After German inflation surged unexpectedly steeply to 7.9% in May, the EU-wide rate of inflation is also likely to have risen further. In this environment, gold should really be in demand as a store of value. However, such a high inflation rate could also reignite the debate about whether the ECB should perhaps increase interest rates more quickly or sharply.

Calls for a 50 basis point hike at the meeting in July could become louder, in which case gold might come under pressure.

This week's rather busy US economic docket kicks off with the release of the Conference Board's Consumer Confidence Index. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to gold prices. Apart from this, traders will take cues from the broader market risk sentiment to grab short-term opportunities around the XAUUSD.

Acceptance below the 21-DMA at $1,848 will trigger a fresh drop towards the horizontal 200-DMA at $1,840. Daily closing below the latter is needed to fade the recovery and turn the focus back on the May 18 low of $1,808/1,777.

Recapturing the daily highs of $1,866 is critical to take on the upside towards the previous day’s high of $1,864. Further up, the two-week highs at $1,875 will be next on the buyers’ radars, above which the mildly bullish 100-DMA at $1,888 will be challenged.

#PiyushRatnu

The overnight optimism led by the easing of COVID-19 lockdowns in China turned out to be short-lived amid doubts if central banks can hike interest rates to curb inflation without impacting economic growth.

The worries resurface following the release of official Chinese PMIs, which showed contraction in both manufacturing and services sectors during May. This, along with concerns that the global supply chain disruption would continue to push consumer prices even higher, weighed on investors' sentiment and benefitted the safe-haven precious metal.

Gold is facing headwind from the firmer US dollar and significantly rising bond yields

After German inflation surged unexpectedly steeply to 7.9% in May, the EU-wide rate of inflation is also likely to have risen further. In this environment, gold should really be in demand as a store of value. However, such a high inflation rate could also reignite the debate about whether the ECB should perhaps increase interest rates more quickly or sharply.

Calls for a 50 basis point hike at the meeting in July could become louder, in which case gold might come under pressure.

This week's rather busy US economic docket kicks off with the release of the Conference Board's Consumer Confidence Index. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to gold prices. Apart from this, traders will take cues from the broader market risk sentiment to grab short-term opportunities around the XAUUSD.

Acceptance below the 21-DMA at $1,848 will trigger a fresh drop towards the horizontal 200-DMA at $1,840. Daily closing below the latter is needed to fade the recovery and turn the focus back on the May 18 low of $1,808/1,777.

Recapturing the daily highs of $1,866 is critical to take on the upside towards the previous day’s high of $1,864. Further up, the two-week highs at $1,875 will be next on the buyers’ radars, above which the mildly bullish 100-DMA at $1,888 will be challenged.

#PiyushRatnu

Piyush Lalsingh Ratnu

Strong signs of MARKET REVERSAL:

JPY S 84

USD S 86

AUD 8

US10YT -

USDJPY +

US F - after +

DXY RT 102.390 from 101.666

1866/1836: both spots might be next targets.

Since Gold is in S zones, I will still prefer to BUY bottoms at S2/S3 -6/12 zones with NAP as target.

Not to forget: NFP next week, FOMC approaching.

Getting stuck in one direction trades can be an extremely dangerous decision for account margin and safety of funds.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

JPY S 84

USD S 86

AUD 8

US10YT -

USDJPY +

US F - after +

DXY RT 102.390 from 101.666

1866/1836: both spots might be next targets.

Since Gold is in S zones, I will still prefer to BUY bottoms at S2/S3 -6/12 zones with NAP as target.

Not to forget: NFP next week, FOMC approaching.

Getting stuck in one direction trades can be an extremely dangerous decision for account margin and safety of funds.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

Retail Sales data will be published in 10 min.

Suggested strategy: Monitor the price movement till R or S zone, as NYSE opening pressures might add more volatility resulting in 15+15 price movement.

1856 | 1818 looks as crucial stops in up and down direction.

M1 M5 RT 236 will be core focus for NAP.

The markets seem convinced that the Fed would need to take more drastic action to bring inflation under control and have fully priced in at least a 50 bps rate hike at the next two policy meetings. This, along with the risk-on impulse, led to a fresh leg up in the US Treasury bond yields, which, in turn, should act as a headwind for the safe-haven gold.

Hence, the focus will remain glued to Fed Chair Jerome Powell's speech later this Thursday. Investors will look for clues about the possibility of a jumbo 75 bps rate hike in June, which will play a key role in driving the USD demand in the near term. This, in turn, would determine the next leg of a directional move for the non-yielding gold.

Shanghai conveyed plans to end the covid-linked lockdown after the third consecutive day of zero coronavirus cases outside the quarantine area. It’s worth noting that the latest comments from China State Planner, stating the increasing downside pressure on the economy, per Reuters, challenge the market’s optimism.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Suggested strategy: Monitor the price movement till R or S zone, as NYSE opening pressures might add more volatility resulting in 15+15 price movement.

1856 | 1818 looks as crucial stops in up and down direction.

M1 M5 RT 236 will be core focus for NAP.

The markets seem convinced that the Fed would need to take more drastic action to bring inflation under control and have fully priced in at least a 50 bps rate hike at the next two policy meetings. This, along with the risk-on impulse, led to a fresh leg up in the US Treasury bond yields, which, in turn, should act as a headwind for the safe-haven gold.

Hence, the focus will remain glued to Fed Chair Jerome Powell's speech later this Thursday. Investors will look for clues about the possibility of a jumbo 75 bps rate hike in June, which will play a key role in driving the USD demand in the near term. This, in turn, would determine the next leg of a directional move for the non-yielding gold.

Shanghai conveyed plans to end the covid-linked lockdown after the third consecutive day of zero coronavirus cases outside the quarantine area. It’s worth noting that the latest comments from China State Planner, stating the increasing downside pressure on the economy, per Reuters, challenge the market’s optimism.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

13.05.2022: GOLD's dead cat bounce

Markets went into a tailspin after hot US inflation data renewed fears over global economic slowdown, as the data bolstered the Fed’s tightening expectations. Aggressive Fed’s rate hike outlook, China’s covid lockdowns and the Ukraine crisis threatened a likely recession, fuelling a classic risk-off market profile. ‘Sell everything’ mode remained in vogue, as investors trusted the only safety net in the dollar to protect their capital. The tech stocks-led rebound in Wall Street indices also failed to calm nerves, keeping the dollar dominance intact at gold’s expense.

M15S5 achieved

M30 S5 H1 S5 ahead

M1 M5 M15 M30 236 RT achieved

A sudden crash was observed today, and we indicated a total $100++ rally on 22 March, for 12 May - 13 May.

Those who paid attention, am sure escaped huge losses.

I booked net loss of 1700 out of 3600 profit booked yesterday

Reason: Net Average Profit.

During high volatility event, I always prefer to protect principle and trade with minimum lot size to keep margin levels high.

In addition, today being Friday, a sudden crash or rise cannot be ruled out considering the ongoing market conditions.

A liquidity vacuum is dragging all assets lower, leaving gold to circle the drain in defiance of its safe-haven status, despite the fierce rally in Treasuries.

On the US dollar front, the US dollar index (DXY) has renewed its 19-year high at 104.93 after the US Bureau of Labor Statistics reported the yearly US PPI at 11%, higher than the forecasts of 10.7%

With CTA trend followers joining into the liquidation party, substantial selling flow continues to weigh on the yellow metal at a time when liquidity is scarce. Prices are now struggling to hold onto the bull-market-era defining uptrend in the yellow metal under the pressure of this selling flow.

We alerted 1836-1818 zone in advance on 06 May, 2022

Read the complete analysis here: https://bit.ly/06MayPRGoldAnalysisNFP

Markets went into a tailspin after hot US inflation data renewed fears over global economic slowdown, as the data bolstered the Fed’s tightening expectations. Aggressive Fed’s rate hike outlook, China’s covid lockdowns and the Ukraine crisis threatened a likely recession, fuelling a classic risk-off market profile. ‘Sell everything’ mode remained in vogue, as investors trusted the only safety net in the dollar to protect their capital. The tech stocks-led rebound in Wall Street indices also failed to calm nerves, keeping the dollar dominance intact at gold’s expense.

M15S5 achieved

M30 S5 H1 S5 ahead

M1 M5 M15 M30 236 RT achieved

A sudden crash was observed today, and we indicated a total $100++ rally on 22 March, for 12 May - 13 May.

Those who paid attention, am sure escaped huge losses.

I booked net loss of 1700 out of 3600 profit booked yesterday

Reason: Net Average Profit.

During high volatility event, I always prefer to protect principle and trade with minimum lot size to keep margin levels high.

In addition, today being Friday, a sudden crash or rise cannot be ruled out considering the ongoing market conditions.

A liquidity vacuum is dragging all assets lower, leaving gold to circle the drain in defiance of its safe-haven status, despite the fierce rally in Treasuries.

On the US dollar front, the US dollar index (DXY) has renewed its 19-year high at 104.93 after the US Bureau of Labor Statistics reported the yearly US PPI at 11%, higher than the forecasts of 10.7%

With CTA trend followers joining into the liquidation party, substantial selling flow continues to weigh on the yellow metal at a time when liquidity is scarce. Prices are now struggling to hold onto the bull-market-era defining uptrend in the yellow metal under the pressure of this selling flow.

We alerted 1836-1818 zone in advance on 06 May, 2022

Read the complete analysis here: https://bit.ly/06MayPRGoldAnalysisNFP

Piyush Lalsingh Ratnu

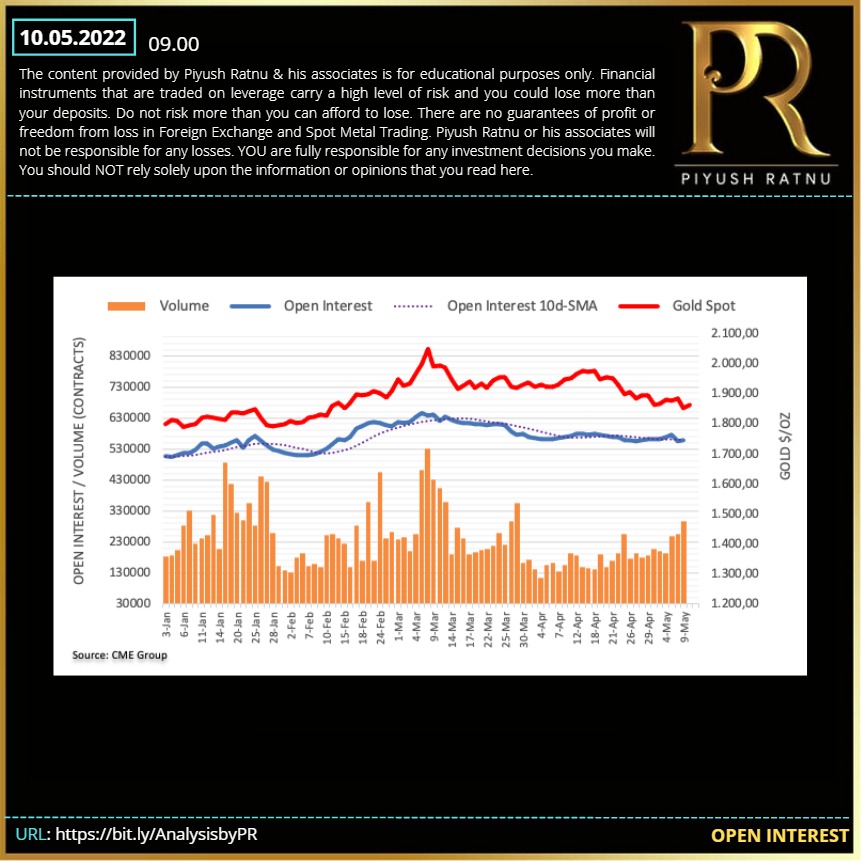

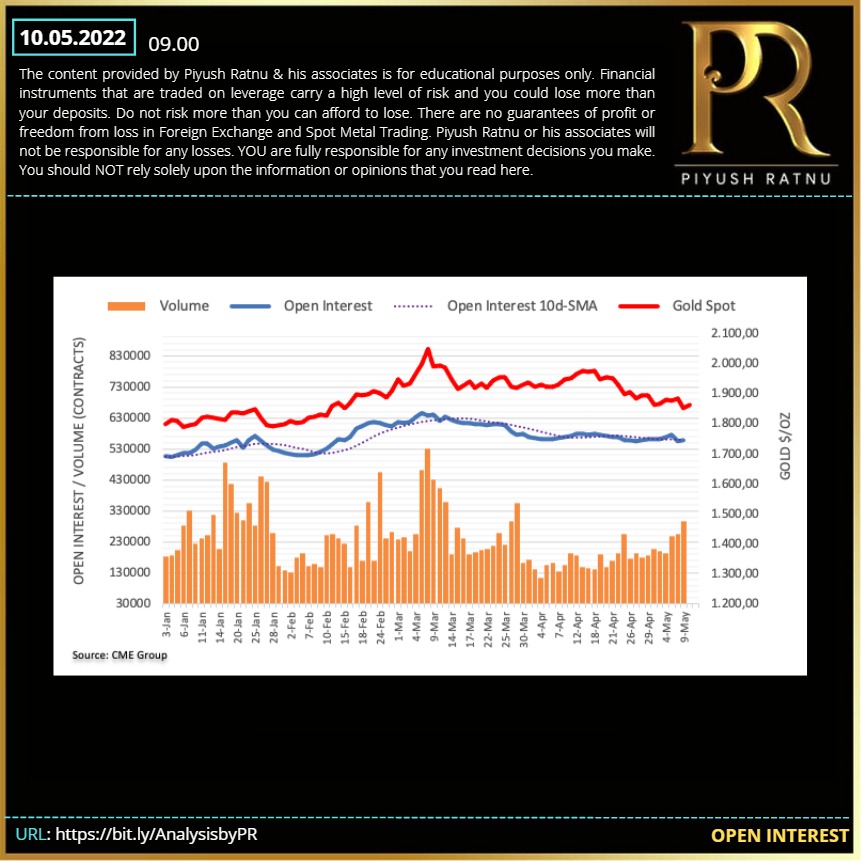

Open interest in gold futures markets resumed the uptrend and rose by around 2.6K contracts on Monday according to advanced prints from CME Group. In the same line, volume went up for the third session in a row, this time by around 41.5K contracts.

Having dropped the most in a week, gold (XAU/USD) prices seesaw around the short-term key horizontal support area near $1,850 as market sentiment dwindles during early Tuesday. Even so, the yellow metal remains on the bear’s radar as fears surrounding inflation and growth remain on the table.

Although the US stock futures track Wall Street’s losses by dropping half a percent by the press time, a pullback in the Treasury yields seemed to have probed the market pessimism of late. That said, the US 10-year Treasury yields drop back to sub-3.0% levels after rising to the fresh high since November 2018 the previous day.

GOLD @ PZ

US10YT 3.042 (-)

DXY 103.625

USDJPY 130.46

US S 27

JPY 9

AUD 78

EUR 46

CPI data tomorrow: STAY ALERT

HPV event.

POF

Crash stops: 1836/1818

Rise Stops: 1888/1907

Strategy:

Buy below S1 -3/6/9

In case of crash till S2 1818 zone RT point

Target NAP

Sell above 1880, price gap 4 | Ultimate RT zone: 1888+6/9

1907 a heavy resistance zone, for RT x3 GR can be taken

Target NAP | Ultimate R zone 1926 on CPI data ( above 1907)

Further down, the psychological $1,850 level will get tested, below which gold bulls will look out for the immediate support.

Looking forward, gold traders should pay attention to the risk catalysts for fresh impulse ahead of the US Consumer Price Index (CPI) data for April, scheduled for release on Wednesday.

oin TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Having dropped the most in a week, gold (XAU/USD) prices seesaw around the short-term key horizontal support area near $1,850 as market sentiment dwindles during early Tuesday. Even so, the yellow metal remains on the bear’s radar as fears surrounding inflation and growth remain on the table.

Although the US stock futures track Wall Street’s losses by dropping half a percent by the press time, a pullback in the Treasury yields seemed to have probed the market pessimism of late. That said, the US 10-year Treasury yields drop back to sub-3.0% levels after rising to the fresh high since November 2018 the previous day.

GOLD @ PZ

US10YT 3.042 (-)

DXY 103.625

USDJPY 130.46

US S 27

JPY 9

AUD 78

EUR 46

CPI data tomorrow: STAY ALERT

HPV event.

POF

Crash stops: 1836/1818

Rise Stops: 1888/1907

Strategy:

Buy below S1 -3/6/9

In case of crash till S2 1818 zone RT point

Target NAP

Sell above 1880, price gap 4 | Ultimate RT zone: 1888+6/9

1907 a heavy resistance zone, for RT x3 GR can be taken

Target NAP | Ultimate R zone 1926 on CPI data ( above 1907)

Further down, the psychological $1,850 level will get tested, below which gold bulls will look out for the immediate support.

Looking forward, gold traders should pay attention to the risk catalysts for fresh impulse ahead of the US Consumer Price Index (CPI) data for April, scheduled for release on Wednesday.

oin TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

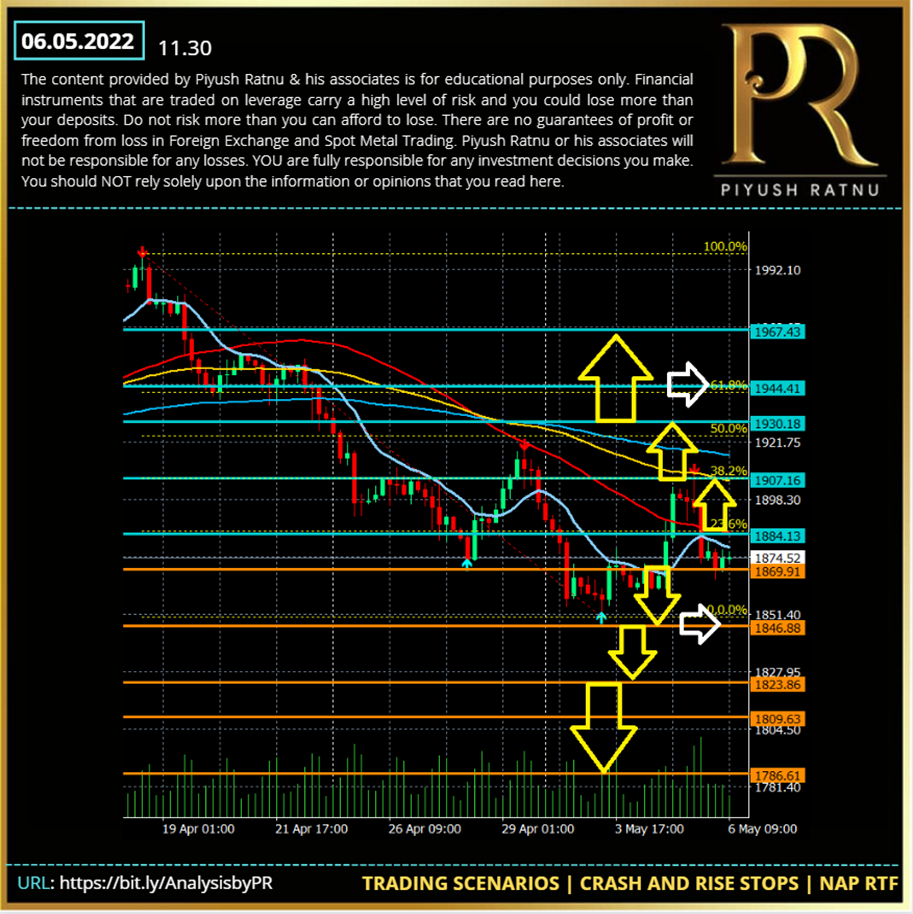

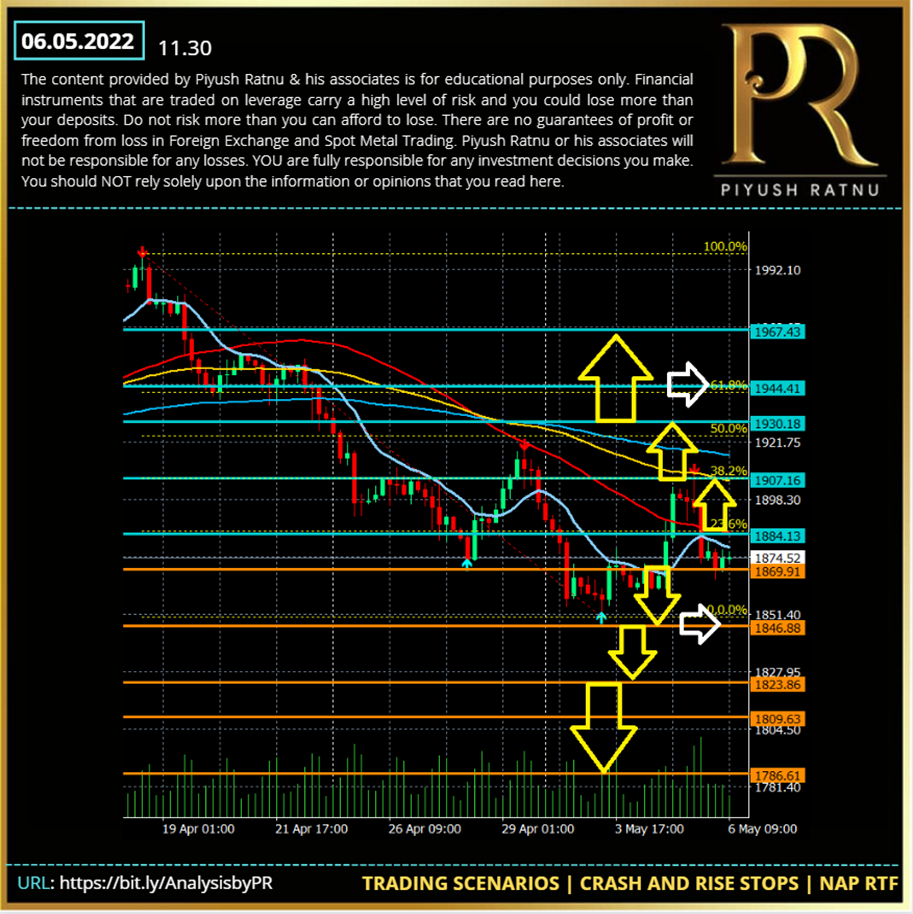

Non Farm Payrolls Day: Spot Gold Analysis: XAUUSD: $1866/1836 or $1907/1926?

FUNDAMENTAL ANALYSIS | CMP $1875

Gold Price was observed capitalizing on an overdue correction in the US dollar on 04 May 2022, as the Fed poured cold water on aggressive tightening bets. Fed Chair Jerome Powell explicitly said Wednesday that the US central bank is not considering a 75 bps rate hike in June, sounding a less hawkish tone than markets had expected. The US Treasury yields also took a beating while the Wall Street indices gallops on a risk-on market profile. The dollar also felt the pain from reduced demand for safe havens, aiding the Gold Price rebound on 04 May 2022.

However on 05 May, 2022 Gold crashed from 1907 resistance zone till 1888 and extended the losses till 1866 today early morning. I had mentioned in my FOMC Day analysis the possibility of crash till 1866/1830 zone, after rejection from 1907/1926 zone. Though Gold reversed from 1907 zone, further crash till 1866 is indicating the next crash junction as 1836/1818 zone, in reversal we may see a repetition of the upwards price movement till 1888/1907/1926 zones in sequence.

Looking forward, the US Nonfarm Payrolls will offer fresh insights on the Fed’s forward guidance. In the meantime, the broader market sentiment and China’s covid lockdowns-led growth fears will continue to influence gold trades.

Dow tumbled 1,000 points for the worst day since 2020, Nasdaq drops 5%

Stocks pulled back sharply on Thursday, completely erasing a rally from the prior session in a stunning reversal that delivered investors one of the worst days since 2020. The Dow Jones Industrial Average lost 1,063 points, or 3.12%, to close at 32,997.97. The tech-heavy Nasdaq Composite fell 4.99% to finish at 12,317.69, its lowest closing level since November 2020. Both of those losses were the worst single-day drops since 2020.

The S&P 500 fell 3.56% to 4,146.87, marking its second worst day of the year. A common warning on Wall Street for a decade is that trading desks have been overrun by people who are too young to know what it’s like to navigate a Federal Reserve tightening cycle. They’re finding out now. 100% reversal of the gains within half a day is just truly extraordinary, and I alerted this in advance in my last analysis.

In markets, there’s turbulence, then there’s whatever you call the last two days, when a 900-point Dow rally was followed 12 hours later by a 1,000-point decline. Hundreds of billions of dollars of value are conjured and incinerated across assets in the space of a day lately, a stark reversal from the straight-up trajectory of the post-pandemic era.

Where once every dip was bought, now every bounce is sold. Thursday was only the fourth day in 20 years in which stocks and bonds each posted 2%-plus declines, going by major exchange-traded funds that track them. Concerted cross-asset stress of that magnitude reliably spurs speculation that big funds are being forced to sell.

We bought Gold at following price zones in last three days:

1862/1866/1875/1885 (1866/1888 S zone)

We sold Gold at following price zones in last three days:

1909/1907/1896 (1907 R zone)

How to trade on NFP data today?

Scenario A: Gold: $1836/1818/1777?

If the bearish momentum extends, gold price could fall further towards 1866/1836 (after 1846 S2) with 1818/1777 as final destination, if Gold crash halts at 1836 or 1818 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 10 days.

Scenario B: Gold: $1907/1926/1947?

If the Bullish momentum pushes Gold price across $1888 barrier, $1907 and $1926 can be the next target for Gold, opening way to $1947.

Heading into the NFP showdown today, gold price is lacking a clear directional bias, as investors are hesitant to place fresh bets due to ongoing saga of high volatility. The US NFP will emerge as the main market driver for gold price today.

TRADING STRATEGY:

Observe price at US OPENING SS1 and then US SS2

Observe S2-S3 zone and R2-R3 zone for reversals/retracement, Target NAP

Do not enter between the S/R zones or in pivot zone

Observe: FIB 23.6% on M1 and M5 for NAP target price

after 30/60/90/120 minutes of NFP

Price of Focus (POF)

Crash scenario:

S2 -6/9 RT NAP

S3 -3/6 RT NAP

S4 -6 RT NAP

Rise scenario:

R2+6/9 RT NAP

R3+3/6 RT NAP

R4+6 RT NAP

Implement RM till 30 after 15/30 min. and price gap 12/18/24 after NFP

Implement GR/SM after 24/40 price movement

Golden Ratio based money management should not be used at least till $18 price movement in any direction, if SM needs to be ignored.

Read my analysis at:

https://www.piyushratnu.com/how-to-trade-spot-gold-xauusd-accurately-non-farm-payrolls-day/

FUNDAMENTAL ANALYSIS | CMP $1875

Gold Price was observed capitalizing on an overdue correction in the US dollar on 04 May 2022, as the Fed poured cold water on aggressive tightening bets. Fed Chair Jerome Powell explicitly said Wednesday that the US central bank is not considering a 75 bps rate hike in June, sounding a less hawkish tone than markets had expected. The US Treasury yields also took a beating while the Wall Street indices gallops on a risk-on market profile. The dollar also felt the pain from reduced demand for safe havens, aiding the Gold Price rebound on 04 May 2022.

However on 05 May, 2022 Gold crashed from 1907 resistance zone till 1888 and extended the losses till 1866 today early morning. I had mentioned in my FOMC Day analysis the possibility of crash till 1866/1830 zone, after rejection from 1907/1926 zone. Though Gold reversed from 1907 zone, further crash till 1866 is indicating the next crash junction as 1836/1818 zone, in reversal we may see a repetition of the upwards price movement till 1888/1907/1926 zones in sequence.

Looking forward, the US Nonfarm Payrolls will offer fresh insights on the Fed’s forward guidance. In the meantime, the broader market sentiment and China’s covid lockdowns-led growth fears will continue to influence gold trades.

Dow tumbled 1,000 points for the worst day since 2020, Nasdaq drops 5%

Stocks pulled back sharply on Thursday, completely erasing a rally from the prior session in a stunning reversal that delivered investors one of the worst days since 2020. The Dow Jones Industrial Average lost 1,063 points, or 3.12%, to close at 32,997.97. The tech-heavy Nasdaq Composite fell 4.99% to finish at 12,317.69, its lowest closing level since November 2020. Both of those losses were the worst single-day drops since 2020.

The S&P 500 fell 3.56% to 4,146.87, marking its second worst day of the year. A common warning on Wall Street for a decade is that trading desks have been overrun by people who are too young to know what it’s like to navigate a Federal Reserve tightening cycle. They’re finding out now. 100% reversal of the gains within half a day is just truly extraordinary, and I alerted this in advance in my last analysis.

In markets, there’s turbulence, then there’s whatever you call the last two days, when a 900-point Dow rally was followed 12 hours later by a 1,000-point decline. Hundreds of billions of dollars of value are conjured and incinerated across assets in the space of a day lately, a stark reversal from the straight-up trajectory of the post-pandemic era.

Where once every dip was bought, now every bounce is sold. Thursday was only the fourth day in 20 years in which stocks and bonds each posted 2%-plus declines, going by major exchange-traded funds that track them. Concerted cross-asset stress of that magnitude reliably spurs speculation that big funds are being forced to sell.

We bought Gold at following price zones in last three days:

1862/1866/1875/1885 (1866/1888 S zone)

We sold Gold at following price zones in last three days:

1909/1907/1896 (1907 R zone)

How to trade on NFP data today?

Scenario A: Gold: $1836/1818/1777?

If the bearish momentum extends, gold price could fall further towards 1866/1836 (after 1846 S2) with 1818/1777 as final destination, if Gold crash halts at 1836 or 1818 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 10 days.

Scenario B: Gold: $1907/1926/1947?

If the Bullish momentum pushes Gold price across $1888 barrier, $1907 and $1926 can be the next target for Gold, opening way to $1947.

Heading into the NFP showdown today, gold price is lacking a clear directional bias, as investors are hesitant to place fresh bets due to ongoing saga of high volatility. The US NFP will emerge as the main market driver for gold price today.

TRADING STRATEGY:

Observe price at US OPENING SS1 and then US SS2

Observe S2-S3 zone and R2-R3 zone for reversals/retracement, Target NAP

Do not enter between the S/R zones or in pivot zone

Observe: FIB 23.6% on M1 and M5 for NAP target price

after 30/60/90/120 minutes of NFP

Price of Focus (POF)

Crash scenario:

S2 -6/9 RT NAP

S3 -3/6 RT NAP

S4 -6 RT NAP

Rise scenario:

R2+6/9 RT NAP

R3+3/6 RT NAP

R4+6 RT NAP

Implement RM till 30 after 15/30 min. and price gap 12/18/24 after NFP

Implement GR/SM after 24/40 price movement

Golden Ratio based money management should not be used at least till $18 price movement in any direction, if SM needs to be ignored.

Read my analysis at:

https://www.piyushratnu.com/how-to-trade-spot-gold-xauusd-accurately-non-farm-payrolls-day/

Piyush Lalsingh Ratnu

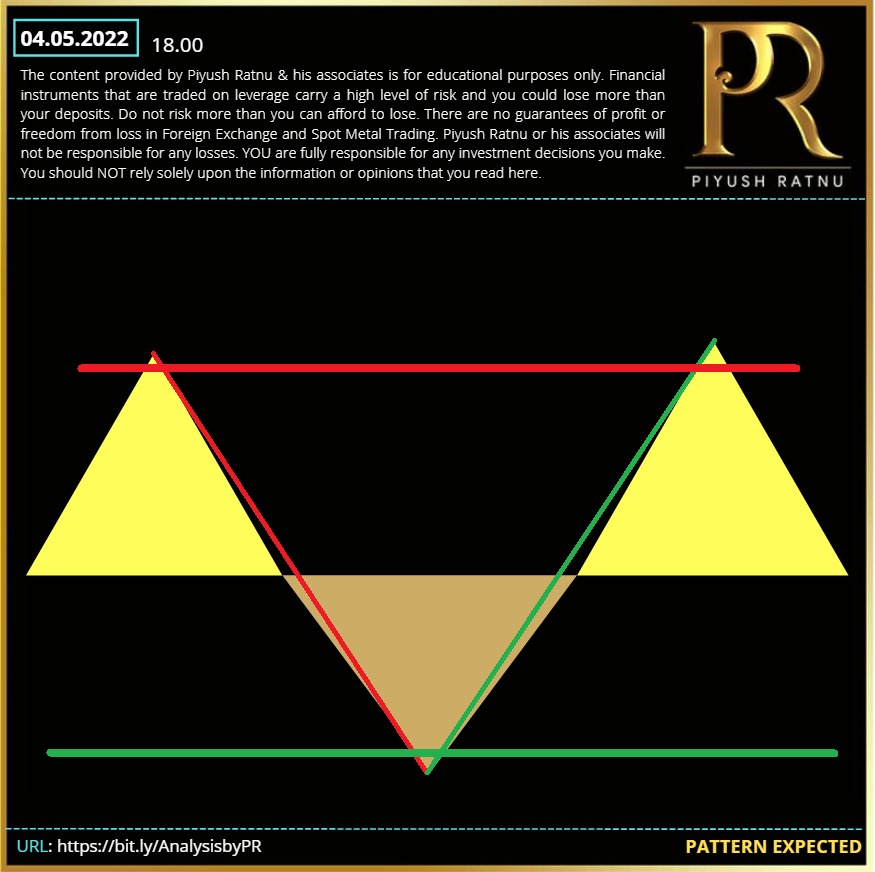

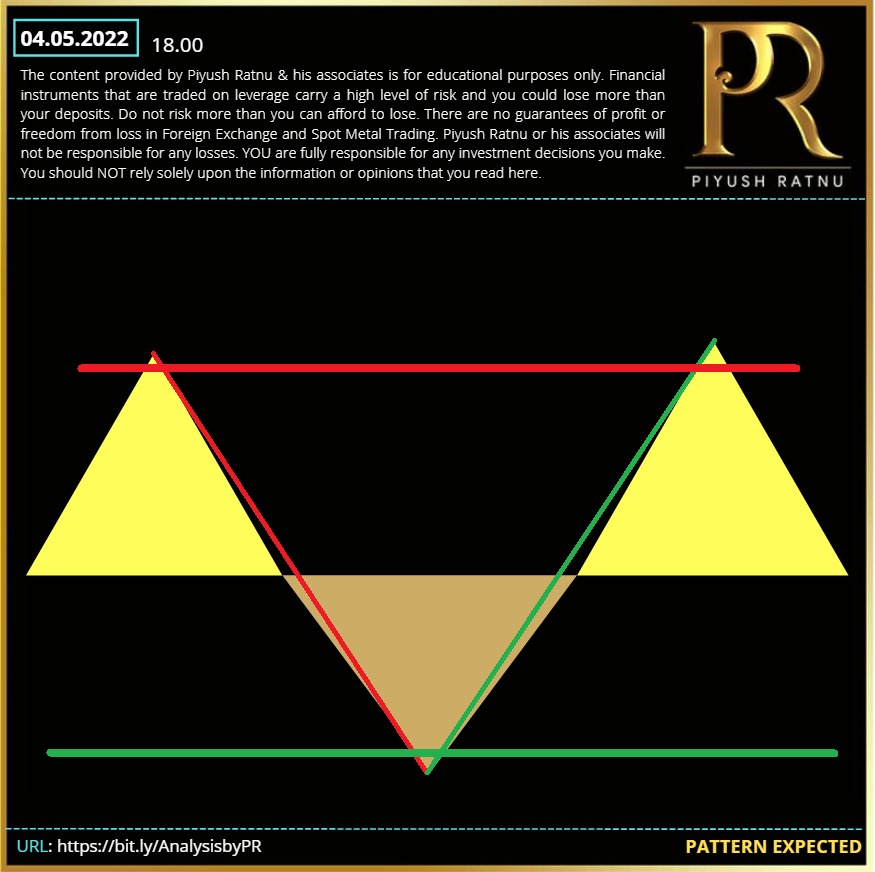

Gold Price rebounds as $ correction phase begins

Read my analysis dated 04 May 2022 (FOMC Day) here: https://bit.ly/04MayAnalysisReviewPR

Yesterday, I alerted in my analysis this pattern for traders:

Check here:https://t.me/PiyushRatnuGoldAnalysis/14907

Key Highlights for today:

Gold Price is capitalizing on an overdue correction in the US dollar, as the Fed poured cold water on aggressive tightening bets. Fed Chair Jerome Powell explicitly said Wednesday that the US central bank is not considering a 75 bps rate hike in June, sounding a less hawkish tone than markets had expected. The US Treasury yields also took a beating while the Wall Street indices gallops on a risk-on market profile. The dollar also felt the pain from reduced demand for safe havens, aiding the Gold Price rebound. Looking forward, the US Nonfarm Payrolls will offer fresh insights on the Fed’s forward guidance. In the meantime, the broader market sentiment and China’s covid lockdowns-led growth fears will continue to influence gold trades.

Technical:

GOLD approaching D1E1 CMP above H1E2 M5S5

M15 S5 E1 | M30 S5E1E2 | H1 E2 E2 S5 in sequence as next crash stops

(after rejection from 1907/1917-1926 zone)

1866 proved a major support yesterday, immediate FRT to 1888/1907 was well observed just like last week. V pattern completed: as alerted in my analysis dated 04 May 2022.

Formation of A pattern in process.

RT pattern

M15/M30 S5 might be next stops

SR Pattern

Currently at R2

+/-6: R2/R3 crucial zone for S entries

Crucial Stops:

GOLD still struggling to hold 1900 psychological level

As alerted in earlier posts, heavy selling below 1866 was observed

Today, 1907/1926 looks as rise stop | 1888-1866 well established as crash stops

06.05.2022: NFP: STAY ALERT

RTFIB

The Fibonacci 23.6% one-week at $1,888 zone will be on the sellers’ radars If the pullback gathers steam.

Today my POF will be selling above R2/R3 (above mentioned) zones, in case of reversal: buying below 1888-1866 (S1/S2 -6/9)

TARGET NAP

Currency Strength

ÜSD 75

JPY 40

AUD 23

CAD 85

EUR 61

GBP 20

Fundamental:

A sudden UP rally is quite possible due to uncertainty + Russia-Ukraine related statements | NFP Data might trigger HV event tomorrow at 16.30, it will be wise to avoid heavy lots, and will be worth waiting for NFP data based rally, considering yesterday ADP NFP was negative.

BOE Inflation Report

BOE Interest Rate today: 15.00 hours

Volatility of $6-10 expected, US pre opening pressures might add more volatility at 16.30 hours

Important Dates:

06 May 2022

A sudden trigger + rally in JPY possible on or before 12 May 2022 (completion of Market cycle M1, and earning season results + BOND BUYING cut off)

DXY 102.688 RT phase

US 10YT 2.940

USDJPY 129.40

XAUXAG 82.22

As alerted in advance:

After hitting the strong support zone of 1866, with a low at 1862 S zone, GOLD reversed furiously towards 1888/1907 zones, and was well alerted by me in advance as the rise stops: Gold struggled well at 1888 zone, before marching towards 1907 zone, CMP 1901, today’s high 1903

V pattern after completion of A pattern on M30 H1 H4 was well achieved yesterday with stops at 1888 followed by R2 + 6= 1896, and 1907 R zone. As quoted yesterday: The next upside target for buyers is envisioned $1,907/1926.

In addition, I also alerted on 27 April 2022: Dramatic rallies are on the way, APRIL end + first week of MAY always have been volatile for GOLD traders considering Rate Hike policy, NFP and monetary policy related statements on the way.

Date of Hike: 05 May 2022

XAUUSD on 01 May 2022: $1903

XAUUSD on 05 May 2022: $1890 (after FOMC) RT from S1 1862 (1866 zone)

XAUUSD on 06 May 2022: $1907

XAUUSD on 20 May 2022:

Pattern traced: V extension in 90 minutes after Fed Rate Decision and during FOMC

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Analytical explanation of the above: based on the price movement in GOLD on and after the rate hikes:

2016

Date of Hike: 14 Dec. 2016

XAUUSD on 01 Dec 2016: $1170

XAUUSD on 14 Dec. 2016: $ 1125

XAUUSD on 14 Jan. 2017: $1190

XAUUSD on 14 March 2017: $1188

Pattern traced: V extension in 90 days

2017

Date of Hike: 14 June 2017

XAUUSD on 01 June 2017: $1290

XAUUSD on 14 June 2017: $1240

XAUUSD on 14 July 2017: $1258

XAUUSD on 14 Sept. 2017: $1346

Pattern traced: V extension in 90 days

Date of Hike: 13 December 2017

XAUUSD on 01 December 2017: $1280

XAUUSD on 14 December 2017: $1236

XAUUSD on 14 January 2018: $1330

XAUUSD on 14 March. 2018: $1303

Pattern traced: V extension, A 30RT in 90 days

Date of Hike: 13 June 2018

XAUUSD on 01 June 2018: $1290

XAUUSD on 14 June 2018: $1279

XAUUSD on 14 July 2018: $1247

XAUUSD on 14 Aug. 2018: $1160 (year low)

XAUUSD on 130 Nov. 2018: $1260

Pattern traced: V pattern in 150+ days

Date of Hike: 19 December 2018

XAUUSD on 01 December 2018: $1230

XAUUSD on 19 December 2018: $1273

XAUUSD on 19 January 2018: $1300

XAUUSD on 14 March. 2018: $1330

Pattern traced: V extension in 90 days $100

Date of Hike: 05 May 2022

XAUUSD on 01 May 2022: $1903

XAUUSD on 05 May 2022: $1890 (after FOMC) RT from S1 1862 (1866 zone)

XAUUSD on 06 May 2022: $1907

XAUUSD on 20 May 2022:

Pattern traced: V extension in 90 minutes after Fed Rate Decision and during FOMC

Read my analysis dated 04 May 2022 (FOMC Day) here: https://bit.ly/04MayAnalysisReviewPR

Yesterday, I alerted in my analysis this pattern for traders:

Check here:https://t.me/PiyushRatnuGoldAnalysis/14907

Key Highlights for today:

Gold Price is capitalizing on an overdue correction in the US dollar, as the Fed poured cold water on aggressive tightening bets. Fed Chair Jerome Powell explicitly said Wednesday that the US central bank is not considering a 75 bps rate hike in June, sounding a less hawkish tone than markets had expected. The US Treasury yields also took a beating while the Wall Street indices gallops on a risk-on market profile. The dollar also felt the pain from reduced demand for safe havens, aiding the Gold Price rebound. Looking forward, the US Nonfarm Payrolls will offer fresh insights on the Fed’s forward guidance. In the meantime, the broader market sentiment and China’s covid lockdowns-led growth fears will continue to influence gold trades.

Technical:

GOLD approaching D1E1 CMP above H1E2 M5S5

M15 S5 E1 | M30 S5E1E2 | H1 E2 E2 S5 in sequence as next crash stops

(after rejection from 1907/1917-1926 zone)

1866 proved a major support yesterday, immediate FRT to 1888/1907 was well observed just like last week. V pattern completed: as alerted in my analysis dated 04 May 2022.

Formation of A pattern in process.

RT pattern

M15/M30 S5 might be next stops

SR Pattern

Currently at R2

+/-6: R2/R3 crucial zone for S entries

Crucial Stops:

GOLD still struggling to hold 1900 psychological level

As alerted in earlier posts, heavy selling below 1866 was observed

Today, 1907/1926 looks as rise stop | 1888-1866 well established as crash stops

06.05.2022: NFP: STAY ALERT

RTFIB

The Fibonacci 23.6% one-week at $1,888 zone will be on the sellers’ radars If the pullback gathers steam.

Today my POF will be selling above R2/R3 (above mentioned) zones, in case of reversal: buying below 1888-1866 (S1/S2 -6/9)

TARGET NAP

Currency Strength

ÜSD 75

JPY 40

AUD 23

CAD 85

EUR 61

GBP 20

Fundamental:

A sudden UP rally is quite possible due to uncertainty + Russia-Ukraine related statements | NFP Data might trigger HV event tomorrow at 16.30, it will be wise to avoid heavy lots, and will be worth waiting for NFP data based rally, considering yesterday ADP NFP was negative.

BOE Inflation Report

BOE Interest Rate today: 15.00 hours

Volatility of $6-10 expected, US pre opening pressures might add more volatility at 16.30 hours

Important Dates:

06 May 2022

A sudden trigger + rally in JPY possible on or before 12 May 2022 (completion of Market cycle M1, and earning season results + BOND BUYING cut off)

DXY 102.688 RT phase

US 10YT 2.940

USDJPY 129.40

XAUXAG 82.22

As alerted in advance:

After hitting the strong support zone of 1866, with a low at 1862 S zone, GOLD reversed furiously towards 1888/1907 zones, and was well alerted by me in advance as the rise stops: Gold struggled well at 1888 zone, before marching towards 1907 zone, CMP 1901, today’s high 1903

V pattern after completion of A pattern on M30 H1 H4 was well achieved yesterday with stops at 1888 followed by R2 + 6= 1896, and 1907 R zone. As quoted yesterday: The next upside target for buyers is envisioned $1,907/1926.

In addition, I also alerted on 27 April 2022: Dramatic rallies are on the way, APRIL end + first week of MAY always have been volatile for GOLD traders considering Rate Hike policy, NFP and monetary policy related statements on the way.

Date of Hike: 05 May 2022

XAUUSD on 01 May 2022: $1903

XAUUSD on 05 May 2022: $1890 (after FOMC) RT from S1 1862 (1866 zone)

XAUUSD on 06 May 2022: $1907

XAUUSD on 20 May 2022:

Pattern traced: V extension in 90 minutes after Fed Rate Decision and during FOMC

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

Analytical explanation of the above: based on the price movement in GOLD on and after the rate hikes:

2016

Date of Hike: 14 Dec. 2016

XAUUSD on 01 Dec 2016: $1170

XAUUSD on 14 Dec. 2016: $ 1125

XAUUSD on 14 Jan. 2017: $1190

XAUUSD on 14 March 2017: $1188

Pattern traced: V extension in 90 days

2017

Date of Hike: 14 June 2017

XAUUSD on 01 June 2017: $1290

XAUUSD on 14 June 2017: $1240

XAUUSD on 14 July 2017: $1258

XAUUSD on 14 Sept. 2017: $1346

Pattern traced: V extension in 90 days

Date of Hike: 13 December 2017

XAUUSD on 01 December 2017: $1280

XAUUSD on 14 December 2017: $1236

XAUUSD on 14 January 2018: $1330

XAUUSD on 14 March. 2018: $1303

Pattern traced: V extension, A 30RT in 90 days

Date of Hike: 13 June 2018

XAUUSD on 01 June 2018: $1290

XAUUSD on 14 June 2018: $1279

XAUUSD on 14 July 2018: $1247

XAUUSD on 14 Aug. 2018: $1160 (year low)

XAUUSD on 130 Nov. 2018: $1260

Pattern traced: V pattern in 150+ days

Date of Hike: 19 December 2018

XAUUSD on 01 December 2018: $1230

XAUUSD on 19 December 2018: $1273

XAUUSD on 19 January 2018: $1300

XAUUSD on 14 March. 2018: $1330

Pattern traced: V extension in 90 days $100

Date of Hike: 05 May 2022

XAUUSD on 01 May 2022: $1903

XAUUSD on 05 May 2022: $1890 (after FOMC) RT from S1 1862 (1866 zone)

XAUUSD on 06 May 2022: $1907

XAUUSD on 20 May 2022:

Pattern traced: V extension in 90 minutes after Fed Rate Decision and during FOMC

Piyush Lalsingh Ratnu

Buy the news, sell the fact. The matter is that investors are too nervous and could start sell-offs before the expected event happens. I call this a rehearsal of the performance.

It is what happened ahead of the release of the FOMC meeting outcomes. US stock indexes were up, and EURUSD featured great volatility, jumping up to 1.058 and going down to initial positions.

Based on the CME derivatives signals, the Fed will raise rates by 50 basis points, which has not happened since 2000. The rate is expected to rise by half a point not only in May, but also in June, and then in July. Moreover, traders are speculating about the possibility of a 75-basis-point rate hike, which last happened in 1994.

Simultaneously with the increase in the rate, the Fed intends to reduce the balance sheet, which is almost $9 trillion. It will be shrinking by $95 billion a month. In the previous monetary policy tightening cycle, even at the peak, it was almost half as much.

Market trends explain why the Fed got inflation so wrong in the last year. Some analysts criticise the Fed for wishful thinking slow and having to catch up with the reality now. For a long time, the Fed insisted higher inflation was “transitory” even as evidence accumulated that it was not. After the US central bankers had admitted the problem, they did not act as though they meant it. It took another four months to end its monthly injection of $40bn into the markets that were already booming. Even after proclaiming a turn in the cycle of interest rate hikes, Jerome Powell signalled the shift would be modest.

I suppose that the Fed was in no hurry to tighten its policy, being afraid of a taper tantrum, like in 2013.

As the hawkish stance has been expressed more and more often, investors are coming to expect three half-point rate hikes. Now, the odds for the Fed are that the American economy will either run too hot, in case the rate hikes fall short of the expectations, or too cold if the monetary tightening turns out too aggressive.

Facts:

• If a country's inflation rate is low, its currency is strong.

• Countries with higher interest rates have stronger currencies because lenders benefit more and foreign currency is attracted.

• Nations with a stable political and economic environment attract investors, who impact the currency exchange rate of the country.

• Foreign nations buying a country's products create high demand for its currency, i.e., if a country's goods are relatively inexpensive, foreign states will tend to purchase them. In order to purchase those items, they will need to buy the country's money. The currencies of the nations with the lowest prices are usually the most powerful.

• Countries with strict monetary policies reduce the supply of their currency, increasing its value.

According to a Reuters Poll of 31 analysts and traders, the median price of gold will rise to $1,920 an ounce during the April-June quarter. Despite the strongest $ in 20 years, which usually pressures the price of the yellow metal as the currency accelerates, it seems gold demand has been holding steady.

The result most likely of rising geopolitical risks such as the war in Ukraine and spiking global inflation which spotlights both the safe haven nature of the precious metal and its role as an inflation hedge.

Still, among those surveyed, there was a strong consensus that the price of gold will slump later this year as interest rates accelerate. However, there's another camp that believes that if the Fed's pace of hiking is aggressive, it could undermine economic growth which would be good for the yellow metal.

With gold fundamentals currently contradictory, it's difficult to forecast whether the price will rise on its haven or hedge status or fall amid a flurry of rate hikes.

However my stops remain same:

C RT NAP

1866/1836/1818

R RT NAP

1907/1926/1948

TAT

18 days/ 27 May, 2022

Given the contradictions, we don't know what will happen but we're attempting to trade within the most likely scenarios. It's expected there will be overall downside pressure on the commodity which will test the uptrend line at about the $1,836 level.

While we consider the current rally a return move that follows the completion of the preceding A, if sellers continue pressing, we could see gold tumble lower toward the $1,777/1735 levels.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://lnkd.in/dch4WQnk

#PiyushRatnu #BullionTrading #Trading #Dubai

It is what happened ahead of the release of the FOMC meeting outcomes. US stock indexes were up, and EURUSD featured great volatility, jumping up to 1.058 and going down to initial positions.