Piyush Lalsingh Ratnu / プロファイル

- 情報

|

no

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

As projected on 02.12.2022: A pattern completed third time at 1777 in last four trading days. 1777 proved a major hurdle in up/down price shifts proving a major price trap just like last times.

Piyush Lalsingh Ratnu

U.S. stocks slumped amid downbeat economic warnings from bank chiefs at a time when concerns about the impacts of Federal Reserve policy on growth and corporate earnings are running rampant.

A selloff in tech giants like Apple Inc. and Tesla Inc. weighed heavily on the market, with the S&P 500 falling for a fourth straight day. Meta Platforms Inc. sank 6 per cent on a report the European Union is targeting the Facebook owner’s ad model. As traders sought safety, the dollar rose with Treasuries.

Morgan Stanley Wealth Management’s Lisa Shalett said some of the biggest companies may see earnings hit far more than expected next year as economic growth slows and inflation erodes the purchasing power of consumers.

“Markets have never bottomed before a recession has begun,” said David Bailin, chief investment officer at Citi Global Wealth. “If there is in fact going to be a recession next year, if we are going to see a period of unemployment rising in the country, then we would expect that markets would have to settle down from where they are today over the course of the next several months.”

A selloff in tech giants like Apple Inc. and Tesla Inc. weighed heavily on the market, with the S&P 500 falling for a fourth straight day. Meta Platforms Inc. sank 6 per cent on a report the European Union is targeting the Facebook owner’s ad model. As traders sought safety, the dollar rose with Treasuries.

Morgan Stanley Wealth Management’s Lisa Shalett said some of the biggest companies may see earnings hit far more than expected next year as economic growth slows and inflation erodes the purchasing power of consumers.

“Markets have never bottomed before a recession has begun,” said David Bailin, chief investment officer at Citi Global Wealth. “If there is in fact going to be a recession next year, if we are going to see a period of unemployment rising in the country, then we would expect that markets would have to settle down from where they are today over the course of the next several months.”

Piyush Lalsingh Ratnu

Some of the main moves in markets:

Stocks

The S&P 500 fell 1.6 per cent as of 1:53 p.m. New York time

The Nasdaq 100 fell 1.9 per cent

The Dow Jones Industrial Average fell 1.2 per cent

The MSCI World index fell 1.4 per cent

Currencies

The euro fell 0.2 per cent to US$1.0468

The British pound fell 0.3 per cent to US$1.2150

The Japanese yen fell 0.2 per cent to 136.98 per dollar

Cryptocurrencies

Bitcoin was little changed at US$16,972.68

Ether fell 0.7 per cent to US$1,250.59

Bonds

The yield on 10-year Treasuries declined two basis points to 3.56 per cent

Germany’s 10-year yield declined eight basis points to 1.80 per cent

Britain’s 10-year yield declined three basis points to 3.08 per cent

Stocks

The S&P 500 fell 1.6 per cent as of 1:53 p.m. New York time

The Nasdaq 100 fell 1.9 per cent

The Dow Jones Industrial Average fell 1.2 per cent

The MSCI World index fell 1.4 per cent

Currencies

The euro fell 0.2 per cent to US$1.0468

The British pound fell 0.3 per cent to US$1.2150

The Japanese yen fell 0.2 per cent to 136.98 per dollar

Cryptocurrencies

Bitcoin was little changed at US$16,972.68

Ether fell 0.7 per cent to US$1,250.59

Bonds

The yield on 10-year Treasuries declined two basis points to 3.56 per cent

Germany’s 10-year yield declined eight basis points to 1.80 per cent

Britain’s 10-year yield declined three basis points to 3.08 per cent

Piyush Lalsingh Ratnu

As an ugly memory: on 06.08.2021

XAUUSD had crashed from 1808 to 1790-1777-1756 and on 09.08.2022 (Monday) extended the crash till 1735/1717/1680.

Moral of the story: dont be overconfident: same can get repeated again!

Trade with money management and patience.

XAUUSD had crashed from 1808 to 1790-1777-1756 and on 09.08.2022 (Monday) extended the crash till 1735/1717/1680.

Moral of the story: dont be overconfident: same can get repeated again!

Trade with money management and patience.

Piyush Lalsingh Ratnu

XAUUSD currently at W1S5

H1S5 H4S5 looks a possible target after movement.

As projected at 17.23

7 minutes before NFP at

https://t.me/PR4xAnalysis/2128 M30 and H1 A pattern completed I had mentioned in my today’s analysis: I expect A pattern today. Read here: https://bit.ly/02122022NFP 1804-1777 history repeated. Well alerted by us in advance.

H1S5 H4S5 looks a possible target after movement.

As projected at 17.23

7 minutes before NFP at

https://t.me/PR4xAnalysis/2128 M30 and H1 A pattern completed I had mentioned in my today’s analysis: I expect A pattern today. Read here: https://bit.ly/02122022NFP 1804-1777 history repeated. Well alerted by us in advance.

Piyush Lalsingh Ratnu

02.12.2022

NFP Day: XAUUSD Price Projection and Analysis by Piyush Ratnu

Read at https://bit.ly/02122022NFP

How to trade XAUUSD on NFP DAY (today).

NFP Day: XAUUSD Price Projection and Analysis by Piyush Ratnu

Read at https://bit.ly/02122022NFP

How to trade XAUUSD on NFP DAY (today).

Piyush Lalsingh Ratnu

10 MINUTES to GO!

DXY104.500

US10YT 3.510

USDJPY 134.160

XAUXAG 78.94

AAAU 17.90

XAUUSD 1798

CRUCIAL: 1808-1818 or 1777

XAUUSD currently in PIVOT ZONE PPZ

VAST GAP between S and R ideal zones: S2 1774 / R2 1831

What this indicates:

it indicates high volatility price rally HVPR, if not today then Monday market opening and onwards till Tuesday.

14.12.2022 is FED IR Day, another set of reversal or continuation might be witnessed.

Hence entry on correct price zones and RT FIB looks like a solid plan, risky trades in lack of trade and money management might result in margin calls, I expect a movement of $12/24/36 in sets, with A formation as ultimate goal.

ALL THE BEST!

02.12.2022

NFP Day: XAUUSD Price Projection and Analysis by Piyush Ratnu

Read at https://bit.ly/02122022NFP

How to trade XAUUSD on NFP DAY (today).

DXY104.500

US10YT 3.510

USDJPY 134.160

XAUXAG 78.94

AAAU 17.90

XAUUSD 1798

CRUCIAL: 1808-1818 or 1777

XAUUSD currently in PIVOT ZONE PPZ

VAST GAP between S and R ideal zones: S2 1774 / R2 1831

What this indicates:

it indicates high volatility price rally HVPR, if not today then Monday market opening and onwards till Tuesday.

14.12.2022 is FED IR Day, another set of reversal or continuation might be witnessed.

Hence entry on correct price zones and RT FIB looks like a solid plan, risky trades in lack of trade and money management might result in margin calls, I expect a movement of $12/24/36 in sets, with A formation as ultimate goal.

ALL THE BEST!

02.12.2022

NFP Day: XAUUSD Price Projection and Analysis by Piyush Ratnu

Read at https://bit.ly/02122022NFP

How to trade XAUUSD on NFP DAY (today).

Piyush Lalsingh Ratnu

Traders should pay close attention to the OPEC+ meeting on Sunday, Dec. 4. Even though markets are closed that day, OPEC+ plans to meet virtually. Last week, it seemed the group might be discussing a supply increase but this week the rumors are that OPEC+ is discussing a supply cut.

Goldman Sachs thinks that OPEC+ producers are concerned about the recent price declines and will act to cut production in order to shore up prices. However, five OPEC+ delegates said that OPEC+ will likely decide not to change production quotas at all. According to two other OPEC+ sources, the group will discuss cutting production quotas, but it is more likely that the group will keep quotas unchanged.

Since OPEC+’s meeting will take place the day before the implementation of Russian oil sanctions and the price cap, OPEC+ is likely to avoid making any changes to production quotas until it has had time to observe how the market reacts. OPEC+ can call an “extraordinary” meeting to change production quotas if they believe that is needed.

THIS might impact Inflation related data, USD and GOLD too.

Goldman Sachs thinks that OPEC+ producers are concerned about the recent price declines and will act to cut production in order to shore up prices. However, five OPEC+ delegates said that OPEC+ will likely decide not to change production quotas at all. According to two other OPEC+ sources, the group will discuss cutting production quotas, but it is more likely that the group will keep quotas unchanged.

Since OPEC+’s meeting will take place the day before the implementation of Russian oil sanctions and the price cap, OPEC+ is likely to avoid making any changes to production quotas until it has had time to observe how the market reacts. OPEC+ can call an “extraordinary” meeting to change production quotas if they believe that is needed.

THIS might impact Inflation related data, USD and GOLD too.

Piyush Lalsingh Ratnu

CHINESE Stocks + +

USD - -

Reason: Strikes | Authorities' commitment to re-opening

YEN 64

AUD 78 (strongly co-related to CHINA)

NZD 83 (strong impact of CHINA)

In addition to US weakness

USDJPY -

US10YT -

DXY -

Impact: XAUUSD +

USD - -

Reason: Strikes | Authorities' commitment to re-opening

YEN 64

AUD 78 (strongly co-related to CHINA)

NZD 83 (strong impact of CHINA)

In addition to US weakness

USDJPY -

US10YT -

DXY -

Impact: XAUUSD +

Piyush Lalsingh Ratnu

USD S @ 4%

JPY 37

AUD 93

EUR 67

DXY 106.100

US10YT 3.707

USDJPY 138.400

XAUXAG 82.18

AAAU 17.26

POF

China COVID Cases (+ for $)

Amidst market unrest and panic, the US Dollar’s demand as a safe-haven shot through the roof, weighing on the US Dollar dominated Gold price.

FOMC Statements: Impact

The US Federal Reserve minutes showed in the previous that a “substantial majority” of Federal Reserve policymakers agreed it would “likely soon be appropriate” to slow the pace of rate hikes.

BOE speech+ CB Consumer Confidence | 19.00 hours

Week ahead:

Wednesday’s United States ADP Employment Change and the second estimate of the US Gross Domestic Product (GDP) will be closely scrutinized ahead of Federal Reserve Chair Jerome Powell’s speech. Fed Chair Powell is due to speak about the economic outlook, inflation, and the labor market at the Brooking Institution, in Washington, DC. Powell’s words will hold significant relevance before Friday’s all-important US Nonfarm Payrolls release.

JPY 37

AUD 93

EUR 67

DXY 106.100

US10YT 3.707

USDJPY 138.400

XAUXAG 82.18

AAAU 17.26

POF

China COVID Cases (+ for $)

Amidst market unrest and panic, the US Dollar’s demand as a safe-haven shot through the roof, weighing on the US Dollar dominated Gold price.

FOMC Statements: Impact

The US Federal Reserve minutes showed in the previous that a “substantial majority” of Federal Reserve policymakers agreed it would “likely soon be appropriate” to slow the pace of rate hikes.

BOE speech+ CB Consumer Confidence | 19.00 hours

Week ahead:

Wednesday’s United States ADP Employment Change and the second estimate of the US Gross Domestic Product (GDP) will be closely scrutinized ahead of Federal Reserve Chair Jerome Powell’s speech. Fed Chair Powell is due to speak about the economic outlook, inflation, and the labor market at the Brooking Institution, in Washington, DC. Powell’s words will hold significant relevance before Friday’s all-important US Nonfarm Payrolls release.

Piyush Lalsingh Ratnu

As projected and indicated after completion of A pattern at 1746: XAUUSD moved from 1746 to 1756-1764 today.

XAUUSD under PPZ currently.

S2/R2 +/-3/6/9 crucial and ideal entries.

POF:

ECB + FOMC statements today eve

Post holiday sessions: HVPR expected

Next two weeks are extremely volatile weeks

This is NFP week, 14.12.2022: FOMC

15.12.2022: CRS

$1735/1717 and 1777/1818 crucial stops

XAUUSD under PPZ currently.

S2/R2 +/-3/6/9 crucial and ideal entries.

POF:

ECB + FOMC statements today eve

Post holiday sessions: HVPR expected

Next two weeks are extremely volatile weeks

This is NFP week, 14.12.2022: FOMC

15.12.2022: CRS

$1735/1717 and 1777/1818 crucial stops

Piyush Lalsingh Ratnu

CHINA: Bank RRR cut by 0.25

Meaning:

The reserve ratio/requirements set by the central bank are the amount of funds that a bank holds in reserve to ensure that it is able to meet liabilities in case of sudden withdrawals.

Reserve requirement ratio is a tool used by the central bank to increase or decrease the money supply in the economy and influence interest rates.

This means: more monetary stimulus = Higher Inflation

China’s economic outlook is darkening as Covid cases climb to a record and cities tighten restrictions to combat the spread of infections. Even with a RRR cut and more monetary stimulus, the economy is still likely to be pressured by Covid Zero.

China’s benchmark CSI 300 Index of stocks fell 0.5% as of 1:16 p.m. local time as the country reported a record high number of Covid cases. The yield on 10-year government bonds rose 4 basis points after a decline of 7 basis points in the previous session. The onshore yuan traded 0.28% stronger at 7.1378 per dollar.

Releasing more low-cost cash via a RRR reduction could encourage banks to lend to ailing developers as China takes more concerted steps to put a floor under the property crisis. Regulators this week asked banks to stabilize lending to the firms, a call that’s been heeded by major state-owned banks, who are offering at least 220 billion yuan ($31 billion) in new credit to developers.

Meaning:

The reserve ratio/requirements set by the central bank are the amount of funds that a bank holds in reserve to ensure that it is able to meet liabilities in case of sudden withdrawals.

Reserve requirement ratio is a tool used by the central bank to increase or decrease the money supply in the economy and influence interest rates.

This means: more monetary stimulus = Higher Inflation

China’s economic outlook is darkening as Covid cases climb to a record and cities tighten restrictions to combat the spread of infections. Even with a RRR cut and more monetary stimulus, the economy is still likely to be pressured by Covid Zero.

China’s benchmark CSI 300 Index of stocks fell 0.5% as of 1:16 p.m. local time as the country reported a record high number of Covid cases. The yield on 10-year government bonds rose 4 basis points after a decline of 7 basis points in the previous session. The onshore yuan traded 0.28% stronger at 7.1378 per dollar.

Releasing more low-cost cash via a RRR reduction could encourage banks to lend to ailing developers as China takes more concerted steps to put a floor under the property crisis. Regulators this week asked banks to stabilize lending to the firms, a call that’s been heeded by major state-owned banks, who are offering at least 220 billion yuan ($31 billion) in new credit to developers.

Piyush Lalsingh Ratnu

Gold price eyes more upside amid light trading on Thanksgiving Day. STAY ALERT.

Gold price is rejoicing fresh bids above the $1,750 psychological level in what seems to be another down day for the United States Dollar (USD). Investors are likely to hold the recent upside in Gold price amid holiday-thinned light trading conditions on account of Thanksgiving Day in the United States this Thursday.

United States data, Federal Reserve minutes smash US Dollar

The US Dollar and US Treasury bond yields are reeling from the pain inflicted by the dovish US Federal Reserve (Fed) November meeting minutes and discouraging top-tier United States economic releases. The FOMC minutes read: "A substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate" adding that “a slower pace in these circumstances would better allow the Committee to assess progress toward its goals of maximum employment and price stability.”

China covid woes affect physical Gold demand

Amidst a dovish Federal Reserve pivot, Gold price has ignored China’s covid resurgence and fresh restrictions even though these factors have impacted the physical gold demand in Asia this week. Gold premiums in top hub China have eased further while higher domestic prices have curbed the demand for the yellow metal in India. Note that India and China are the world’s top two Gold consumers. China's daily coronavirus cases hit a record high since the beginning of the pandemic, the official data showed Thursday. The country recorded 31,454 domestic cases, with major cities back under lockdown restrictions.

The market sentiment remains cautiously optimistic, as the Federal Reserve’s dovishness overshadows China’s covid concerns, as traders from the United States move on the sidelines to celebrate Thanksgiving Day.

Gold price is rejoicing fresh bids above the $1,750 psychological level in what seems to be another down day for the United States Dollar (USD). Investors are likely to hold the recent upside in Gold price amid holiday-thinned light trading conditions on account of Thanksgiving Day in the United States this Thursday.

United States data, Federal Reserve minutes smash US Dollar

The US Dollar and US Treasury bond yields are reeling from the pain inflicted by the dovish US Federal Reserve (Fed) November meeting minutes and discouraging top-tier United States economic releases. The FOMC minutes read: "A substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate" adding that “a slower pace in these circumstances would better allow the Committee to assess progress toward its goals of maximum employment and price stability.”

China covid woes affect physical Gold demand

Amidst a dovish Federal Reserve pivot, Gold price has ignored China’s covid resurgence and fresh restrictions even though these factors have impacted the physical gold demand in Asia this week. Gold premiums in top hub China have eased further while higher domestic prices have curbed the demand for the yellow metal in India. Note that India and China are the world’s top two Gold consumers. China's daily coronavirus cases hit a record high since the beginning of the pandemic, the official data showed Thursday. The country recorded 31,454 domestic cases, with major cities back under lockdown restrictions.

The market sentiment remains cautiously optimistic, as the Federal Reserve’s dovishness overshadows China’s covid concerns, as traders from the United States move on the sidelines to celebrate Thanksgiving Day.

Piyush Lalsingh Ratnu

DXY 106.250

AAAU 17.32

US10YT 3.743

US F - in RT + zone

US S 19

AUD 69

JPY 69

EUR 50

XAUXAG 81.51

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/DailyGoldPriceForecastbyPR

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

AAAU 17.32

US10YT 3.743

US F - in RT + zone

US S 19

AUD 69

JPY 69

EUR 50

XAUXAG 81.51

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/DailyGoldPriceForecastbyPR

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Piyush Lalsingh Ratnu

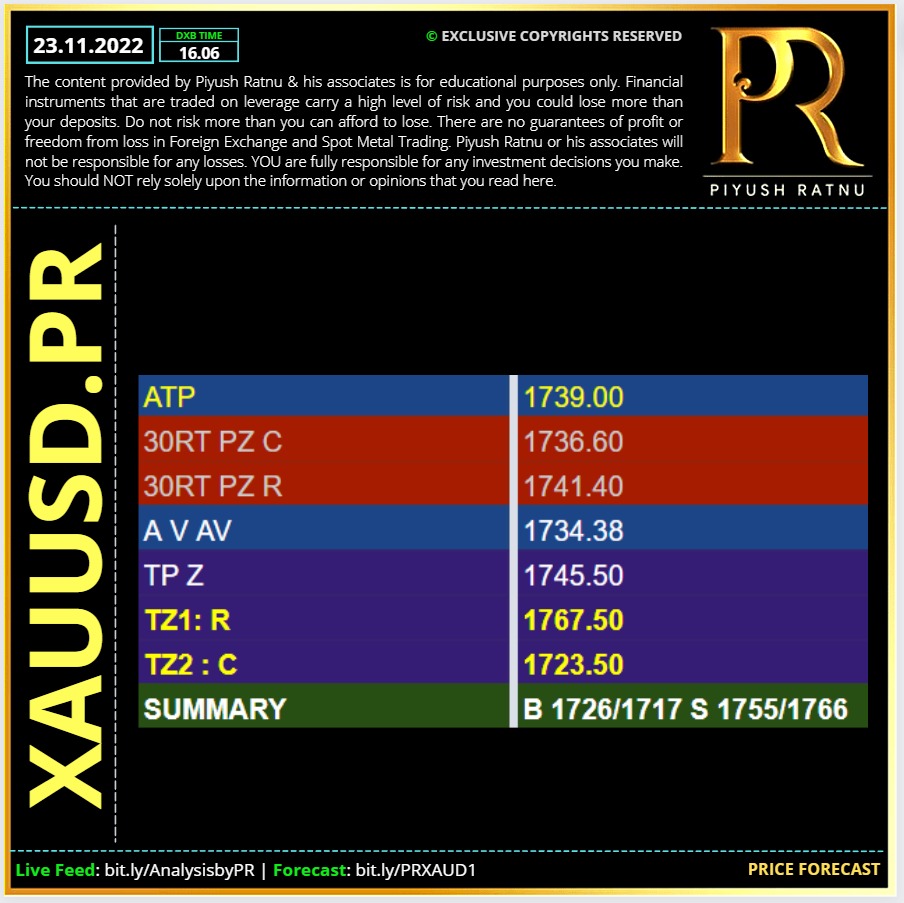

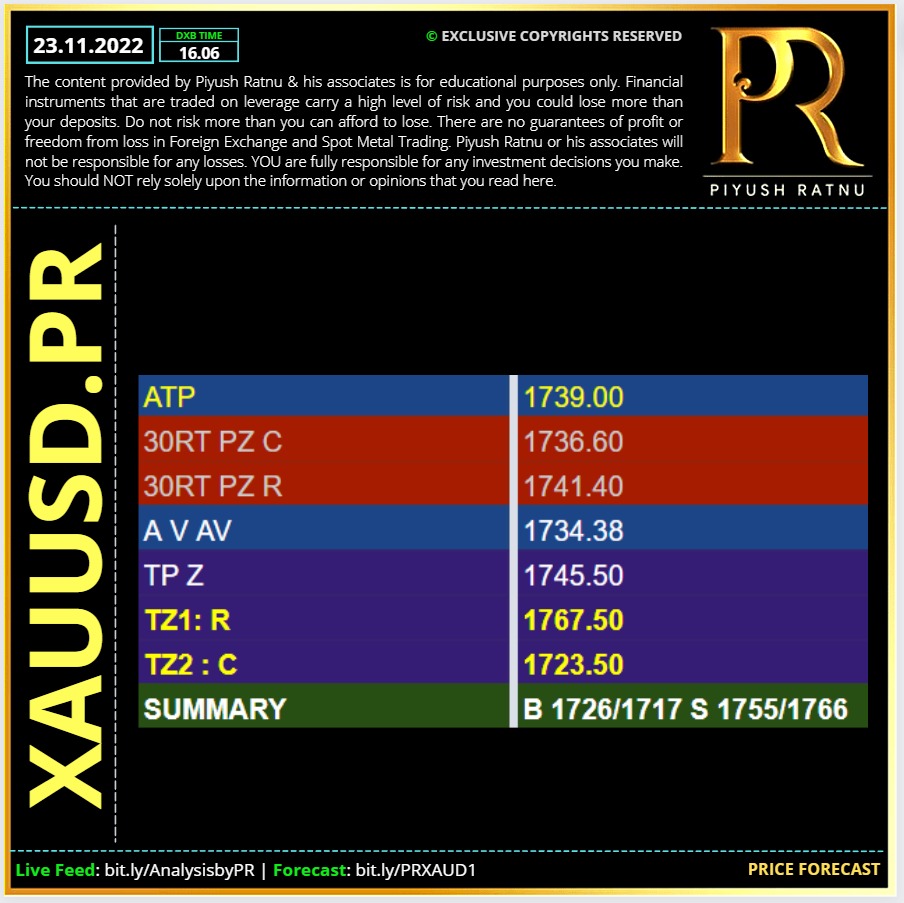

23.11.2022 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/DailyGoldPriceForecastbyPR

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/DailyGoldPriceForecastbyPR

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Piyush Lalsingh Ratnu

What Happens When A Crypto Exchange Goes Bankrupt?

Cryptocurrency users have limited recourse if the cryptocurrency company that they use goes bankrupt.

After the bankruptcies of crypto firms Celsius and Voyager, investors have a reason for concern.

Cryptocurrency holdings are not protected by government-backed insurance.

Key Examples:

Celsius Network, a large cryptocurrency lending platform, filed for bankruptcy protection on July 13, 2022. The filing came about a month after Celsius paused all withdrawals, swaps, and transfers among customer accounts. In a filing with the U.S. Bankruptcy Court in New York, Celsius shared that it owes roughly $1.2 billion more than it has on hand.

How to Recover Funds from a Bankrupt Cryptocurrency Company

If you followed know your customer (KYC) requirements and created your account with legitimate information, the crypto company should have your contact information and an accounting of what you’re owed on file. If the company goes bankrupt, you should ideally hear from them right away with information on recovering funds.

Most companies will employ their own process to distribute funds to customers. That may require you to follow up by completing forms, confirming your address or payment information, and keeping up with any other necessary paperwork to get your crypto or cash returned.

While there’s a risk that cryptocurrency investors could get no money or crypto back after bankruptcy, there’s also a chance that they will get something back—even if it’s just a portion of their original investment.

Are cryptocurrencies backed by other assets?

Each cryptocurrency is unique and follows its own set of rules and features. Some cryptocurrencies, like stablecoins, have assets backing them, while others don’t.

Cryptocurrency users have limited recourse if the cryptocurrency company that they use goes bankrupt.

After the bankruptcies of crypto firms Celsius and Voyager, investors have a reason for concern.

Cryptocurrency holdings are not protected by government-backed insurance.

Key Examples:

Celsius Network, a large cryptocurrency lending platform, filed for bankruptcy protection on July 13, 2022. The filing came about a month after Celsius paused all withdrawals, swaps, and transfers among customer accounts. In a filing with the U.S. Bankruptcy Court in New York, Celsius shared that it owes roughly $1.2 billion more than it has on hand.

How to Recover Funds from a Bankrupt Cryptocurrency Company

If you followed know your customer (KYC) requirements and created your account with legitimate information, the crypto company should have your contact information and an accounting of what you’re owed on file. If the company goes bankrupt, you should ideally hear from them right away with information on recovering funds.

Most companies will employ their own process to distribute funds to customers. That may require you to follow up by completing forms, confirming your address or payment information, and keeping up with any other necessary paperwork to get your crypto or cash returned.

While there’s a risk that cryptocurrency investors could get no money or crypto back after bankruptcy, there’s also a chance that they will get something back—even if it’s just a portion of their original investment.

Are cryptocurrencies backed by other assets?

Each cryptocurrency is unique and follows its own set of rules and features. Some cryptocurrencies, like stablecoins, have assets backing them, while others don’t.

Piyush Lalsingh Ratnu

CMP 1755

As projected on 04.11.2022

Breach of 1692 = 1717/1735/1755

Read analysis at https://bit.ly/04112022NFPAnalysisPR

As projected on 04.11.2022

Breach of 1692 = 1717/1735/1755

Read analysis at https://bit.ly/04112022NFPAnalysisPR

Piyush Lalsingh Ratnu

As projected in NFP Analysis: https://bit.ly/04112022NFPAnalysisPR

IF Gold breaches 1692: 1717.1735,1755 NEXT | Friday high: 1772

See analysis on Instagram: @prgoldanalysis | Copy and paste this url in browser: bit.ly/PRXAUD1

IF Gold breaches 1692: 1717.1735,1755 NEXT | Friday high: 1772

See analysis on Instagram: @prgoldanalysis | Copy and paste this url in browser: bit.ly/PRXAUD1

: