Piyush Lalsingh Ratnu / プロファイル

- 情報

|

no

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

♾ The politics / manipulation speculation of rate cuts

Democratic voices are increasingly advocating for policy shifts to address the persistently high costs and inflationary pressures. Senator Sherrod Brown recently emphasized the need for alternative approaches, suggesting that traditional restrictive monetary policy may no longer be effective against inflation. He expressed concerns about the impact on working Americans and small businesses, highlighting the challenges posed by rising housing costs and reduced credit access.

This sentiment sets the stage for this week for Federal Reserve Chair Jerome Powell's appearances before the House and Senate. Republican lawmakers are expected to focus on inflation and deficits, pressing Powell for insights and responses. Powell is likely to acknowledge the unsustainability of the nation's fiscal trajectory while adhering to appropriate decorum and leave it at that.

However, Powell and his colleagues will likely maintain their stance against immediate rate cuts, reiterating that such measures are not imminent. Despite Democratic calls for action, the Fed is unlikely to implement rate cuts during the upcoming policy meeting or in May, barring unforeseen adverse developments in the labour market or the financial sector.

Democratic voices are increasingly advocating for policy shifts to address the persistently high costs and inflationary pressures. Senator Sherrod Brown recently emphasized the need for alternative approaches, suggesting that traditional restrictive monetary policy may no longer be effective against inflation. He expressed concerns about the impact on working Americans and small businesses, highlighting the challenges posed by rising housing costs and reduced credit access.

This sentiment sets the stage for this week for Federal Reserve Chair Jerome Powell's appearances before the House and Senate. Republican lawmakers are expected to focus on inflation and deficits, pressing Powell for insights and responses. Powell is likely to acknowledge the unsustainability of the nation's fiscal trajectory while adhering to appropriate decorum and leave it at that.

However, Powell and his colleagues will likely maintain their stance against immediate rate cuts, reiterating that such measures are not imminent. Despite Democratic calls for action, the Fed is unlikely to implement rate cuts during the upcoming policy meeting or in May, barring unforeseen adverse developments in the labour market or the financial sector.

Piyush Lalsingh Ratnu

Gold price (XAU/USD) continues its winning spell for the fifth trading session on Tuesday. The precious metal approaches its all-time high of around 🔺$2,145, seen in December 2023. Gold’s advance happens amid a cautious market sentiment and increased bets that the Federal Reserve (Fed) will cut interest rates in the June policy meeting.

Piyush Lalsingh Ratnu

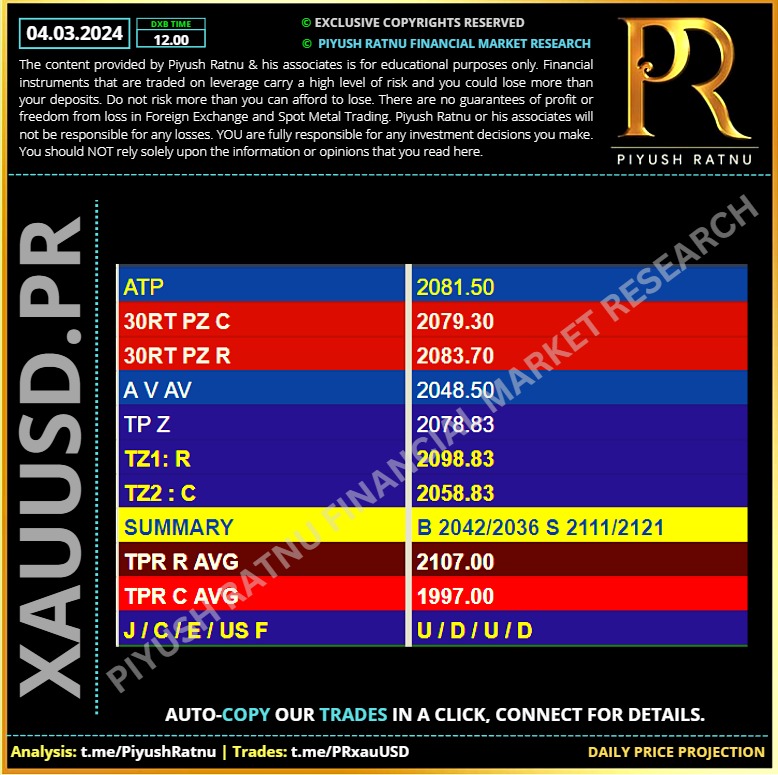

04.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 Key Data today:

18:45 USD S&P Global Composite PMI (Feb) 51.4 52.0

18:45 USD S&P Global Services PMI (Feb) 51.3 52.5

19:00 USD Factory Orders (MoM) (Jan) -3.1% 0.2%

19:00 USD ISM Non-Manufacturing Employment (Feb) 50.5

19:00 USD ISM Non-Manufacturing PMI (Feb) 53.0 53.4

19:00 USD ISM Non-Manufacturing Prices (Feb) 64.0

21:00 USD Fed Vice Chair for Supervision Barr Speaks

18:45 USD S&P Global Composite PMI (Feb) 51.4 52.0

18:45 USD S&P Global Services PMI (Feb) 51.3 52.5

19:00 USD Factory Orders (MoM) (Jan) -3.1% 0.2%

19:00 USD ISM Non-Manufacturing Employment (Feb) 50.5

19:00 USD ISM Non-Manufacturing PMI (Feb) 53.0 53.4

19:00 USD ISM Non-Manufacturing Prices (Feb) 64.0

21:00 USD Fed Vice Chair for Supervision Barr Speaks

Piyush Lalsingh Ratnu

🔺 XAU/USD rose above $2,100.00 on Monday as markets lean into Spot Gold bids. Investors are ramping up bets of a June rate cut from the Federal Reserve (Fed) after US economic data middled to softened last week.

Markets are jostling into risk-taking position ahead of this week’s key US Nonfarm Payrolls (NFP) report coming up on Friday. Traders will be looking for a softer labor figure to add to the rate cut puzzle, and broad-market hopes for a weakening US economic outlook are crystallizing into XAU/USD buying.

This week also sees the US ADP Employment Change for February as a labor data preview of Friday’s NFP, albeit one with a shaky connection in recent history. Fed Chairman Jerome Powell will also be speaking on Wednesday, testifying before the Financial Services Committee about the Semi-Annual Monetary Policy Report beginning at 15:00 GMT.

US economic data will kick the week off with Tuesday’s ISM Services Purchasing Managers Index for February, expected to soften to 53.0 from January’s 53.4.

Jerome Powell is expected to remain hawkish as Fed policymakers want to see inflation easing for months before changing their monetary policy stance. Strong labor market conditions allow them to patiently observe inflationary pressures and cut interest rates only after there is convincing evidence that inflation will decline to the desired target of 2%.

Apart from Fed Powell’s commentary, economic data such as the United States’ Institute of Supply Management (ISM) Services PMI, JOLTS Job Openings, and Nonfarm Payrolls data will remain in the spotlight.

Markets are jostling into risk-taking position ahead of this week’s key US Nonfarm Payrolls (NFP) report coming up on Friday. Traders will be looking for a softer labor figure to add to the rate cut puzzle, and broad-market hopes for a weakening US economic outlook are crystallizing into XAU/USD buying.

This week also sees the US ADP Employment Change for February as a labor data preview of Friday’s NFP, albeit one with a shaky connection in recent history. Fed Chairman Jerome Powell will also be speaking on Wednesday, testifying before the Financial Services Committee about the Semi-Annual Monetary Policy Report beginning at 15:00 GMT.

US economic data will kick the week off with Tuesday’s ISM Services Purchasing Managers Index for February, expected to soften to 53.0 from January’s 53.4.

Jerome Powell is expected to remain hawkish as Fed policymakers want to see inflation easing for months before changing their monetary policy stance. Strong labor market conditions allow them to patiently observe inflationary pressures and cut interest rates only after there is convincing evidence that inflation will decline to the desired target of 2%.

Apart from Fed Powell’s commentary, economic data such as the United States’ Institute of Supply Management (ISM) Services PMI, JOLTS Job Openings, and Nonfarm Payrolls data will remain in the spotlight.

Piyush Lalsingh Ratnu

In the week ahead, all eyes will be on the US Federal Reserve (Fed) Chairman Jerome Powell’s two-day testimony on the semi-annual Monetary Policy Report (MPR) before Congress. Further, the US labor market report will also keep markets in high anticipation, especially after the previous week’s disappointing economic data, which reinforced bets for a Fed policy pivot.

Markets are currently pricing in about a 30% chance that the Fed could begin easing rates in May, slightly higher than a 20% chance a week ago, according to the CME FedWatch Tool. For the June meeting, the probability for a rate cut now stands at about 71%, up from roughly 60% seen at the start of the previous week.

Renewed dovish Fed expectations took their toll on the US Dollar and the US Treasury bond yields, triggering a sharp sell-off on Friday, as Gold price soared to the highest level in three months beyond the $2,096 mark. 🟢 CMP $2098

In the lead-up to the key US economic data and Powell’s testimony, speeches by several Fed policymakers and the ISM Services PMI will keep Gold traders entertained. Also, of note will remain China’s Caixin Services PMI due on Tuesday for fresh signs on the state of the world’s top Gold consumer.

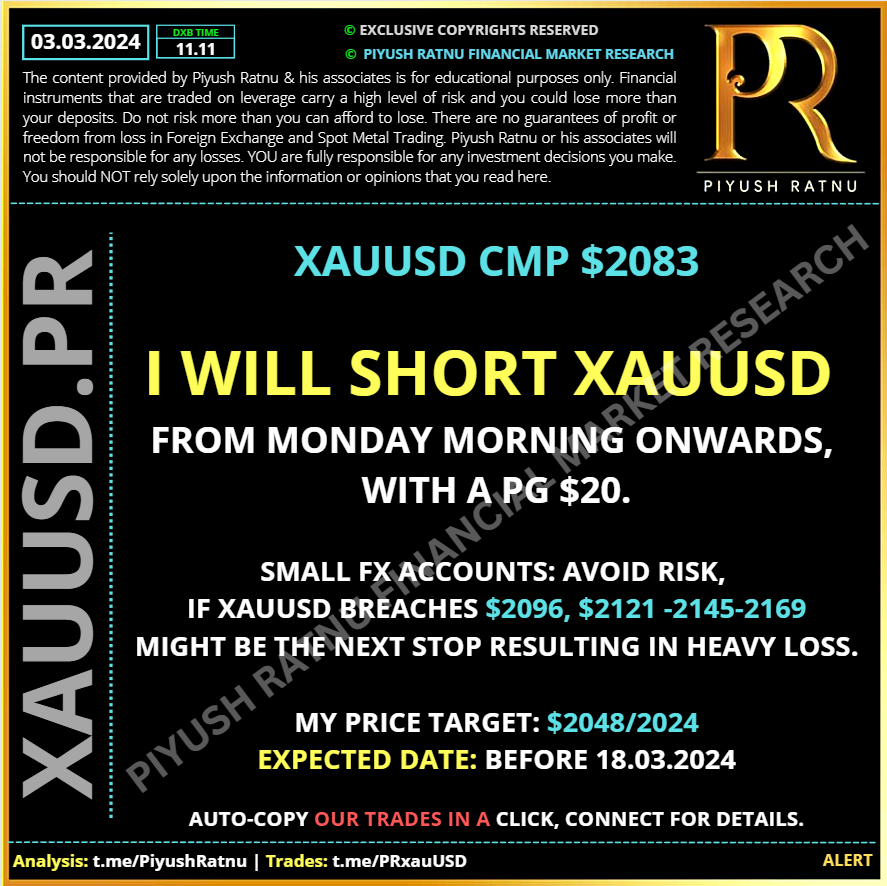

🆘 Crucial Price Zones:

R: $2096/2121/2145/2169

C: $2069/2048/2019/2009

Markets are currently pricing in about a 30% chance that the Fed could begin easing rates in May, slightly higher than a 20% chance a week ago, according to the CME FedWatch Tool. For the June meeting, the probability for a rate cut now stands at about 71%, up from roughly 60% seen at the start of the previous week.

Renewed dovish Fed expectations took their toll on the US Dollar and the US Treasury bond yields, triggering a sharp sell-off on Friday, as Gold price soared to the highest level in three months beyond the $2,096 mark. 🟢 CMP $2098

In the lead-up to the key US economic data and Powell’s testimony, speeches by several Fed policymakers and the ISM Services PMI will keep Gold traders entertained. Also, of note will remain China’s Caixin Services PMI due on Tuesday for fresh signs on the state of the world’s top Gold consumer.

🆘 Crucial Price Zones:

R: $2096/2121/2145/2169

C: $2069/2048/2019/2009

Piyush Lalsingh Ratnu

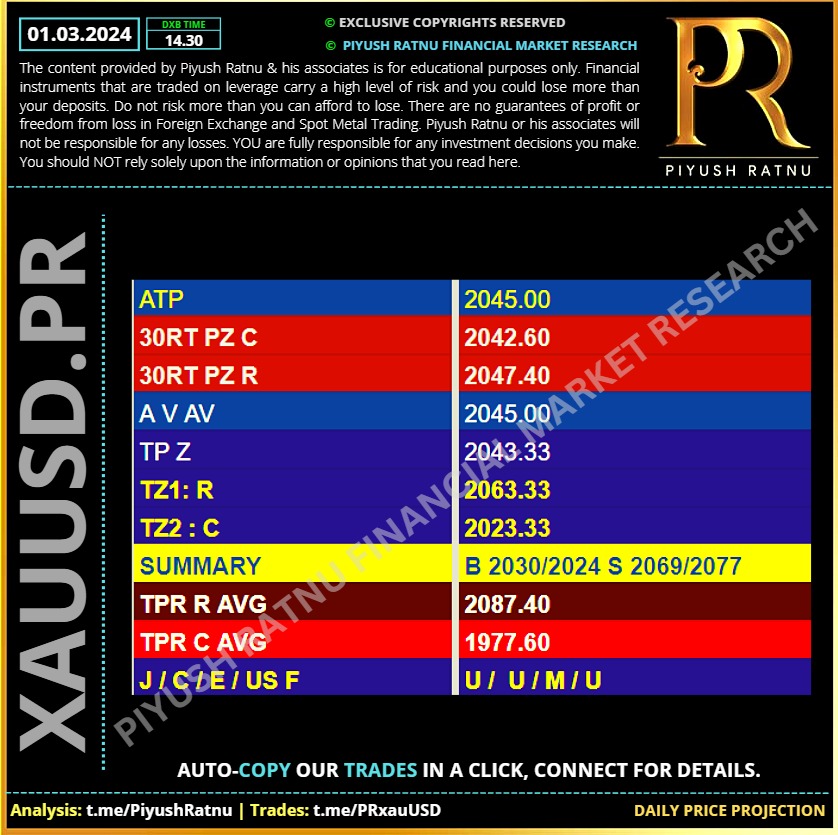

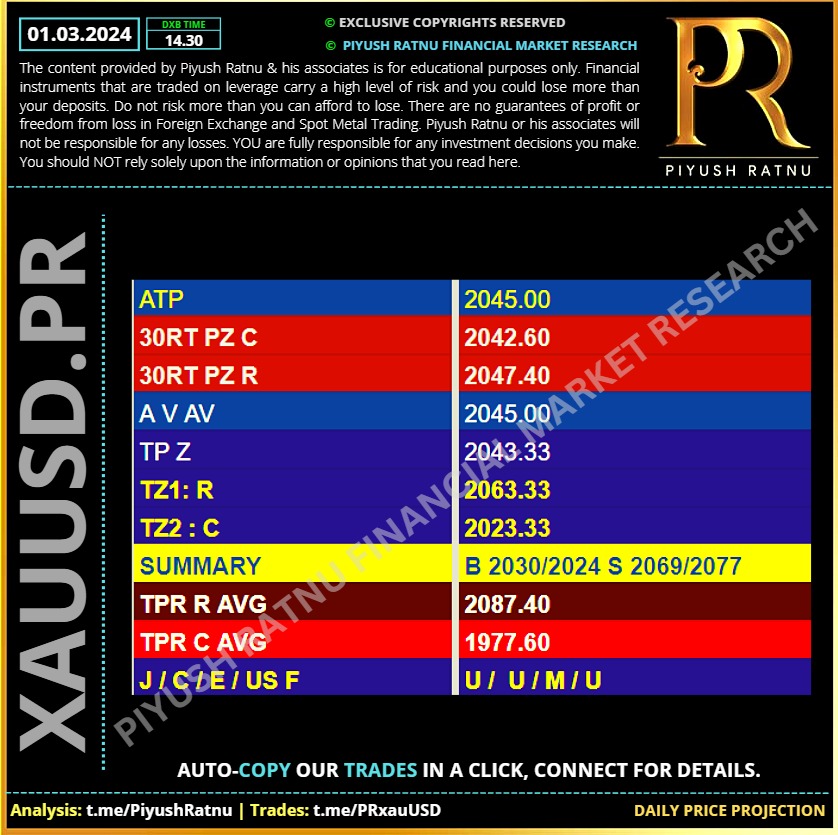

01.03.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

29.02.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

The United States government transferred $922 million worth of Bitcoin from two cryptocurrency wallets that held funds seized from Bitfinex in 2016.

The U.S. government’s transfers occurred the same day Bitcoin (BTC $63,008) breached $60,000 for the first time in over two years on Feb. 28. Bitcoin rose 5.52% in the 24 hours leading up to 9:45 pm UTC to trade at $62,507. The world’s first cryptocurrency is up over 20% in the past week.

The first test transfer, worth only 1 Bitcoin ($60,200 during the transfer), occurred at 3:39 pm on Feb. 28. Shortly after, the U.S. government-labeled wallet sent a second transaction worth 2,817 Bitcoin ($172.74 million), a third transaction worth 0.01 Bitcoin ($613.35) and a fourth transaction worth 12,267 Bitcoin ($748.46 million), according to Arkham Intelligence data.

The U.S. government’s transfers occurred the same day Bitcoin (BTC $63,008) breached $60,000 for the first time in over two years on Feb. 28. Bitcoin rose 5.52% in the 24 hours leading up to 9:45 pm UTC to trade at $62,507. The world’s first cryptocurrency is up over 20% in the past week.

The first test transfer, worth only 1 Bitcoin ($60,200 during the transfer), occurred at 3:39 pm on Feb. 28. Shortly after, the U.S. government-labeled wallet sent a second transaction worth 2,817 Bitcoin ($172.74 million), a third transaction worth 0.01 Bitcoin ($613.35) and a fourth transaction worth 12,267 Bitcoin ($748.46 million), according to Arkham Intelligence data.

Piyush Lalsingh Ratnu

28.02.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 Co-relations alert

USD JPY : 900 pips crash observed at CMP 149.810

Expected impact on XAUUSD: $25-30 from CMP 2035

USD JPY : 900 pips crash observed at CMP 149.810

Expected impact on XAUUSD: $25-30 from CMP 2035

Piyush Lalsingh Ratnu

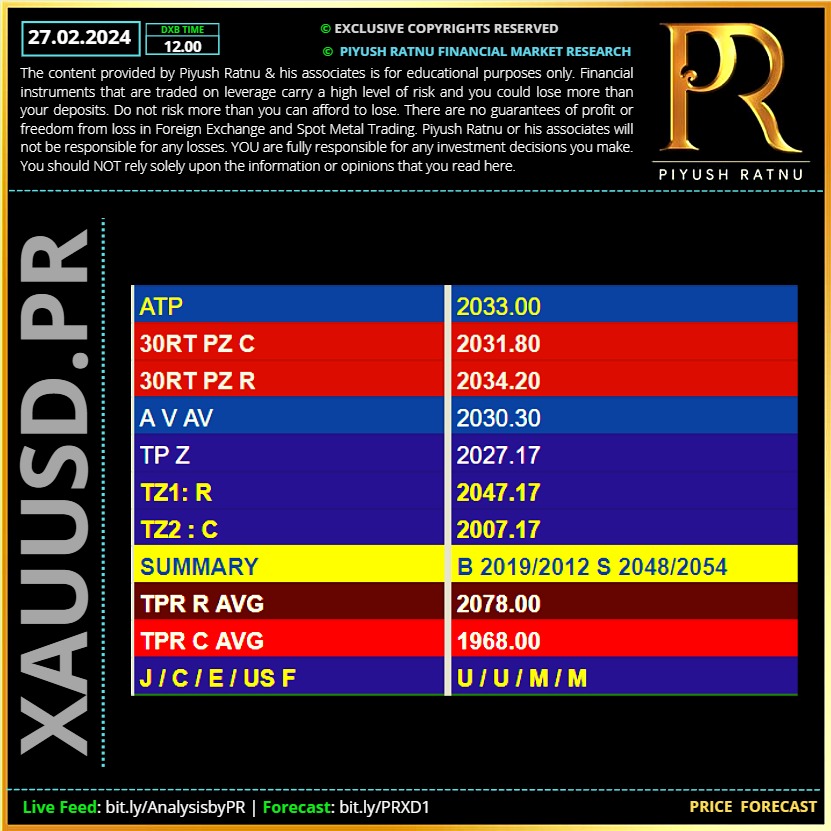

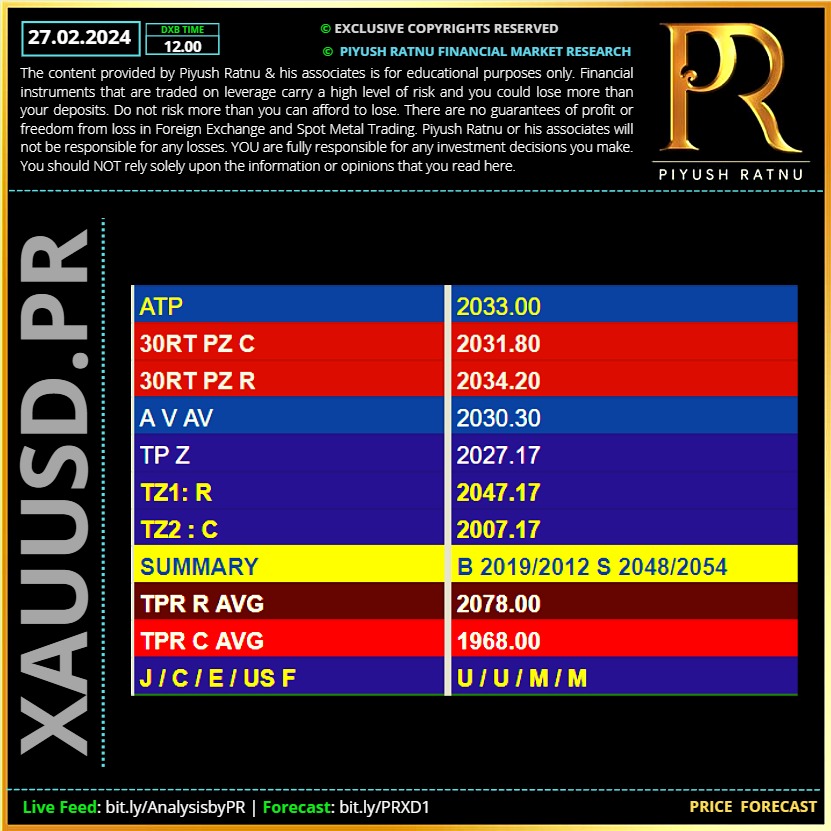

27.02.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

♾ Important Key Events today:

17:30 USD GDP (QoQ) (Q4) 3.3% 4.9%

17:30 USD GDP Price Index (QoQ) (Q4) 1.5% 3.3%

17:30 USD GDP Sales (Q4) 3.2% 3.6%

17:30 USD Goods Trade Balance (Jan) -88.40B -87.89B

21:00 USD FOMC Member Bostic Speaks

21:45 USD FOMC Member Williams Speaks

21:15 USD Fed Collins Speaks

17:30 USD GDP (QoQ) (Q4) 3.3% 4.9%

17:30 USD GDP Price Index (QoQ) (Q4) 1.5% 3.3%

17:30 USD GDP Sales (Q4) 3.2% 3.6%

17:30 USD Goods Trade Balance (Jan) -88.40B -87.89B

21:00 USD FOMC Member Bostic Speaks

21:45 USD FOMC Member Williams Speaks

21:15 USD Fed Collins Speaks

Piyush Lalsingh Ratnu

😵💫 XAUUSD | Gold price is duplicating the price action seen during Tuesday’s Asian trading, as bulls attempt another comeback early Wednesday. The US Dollar (USD) is building on the previous recovery, despite a minor pullback in the US Treasury bond yields, as markets turn tentative ahead of a fresh batch of US GDP and PCE data due later in the day.

✔️ XAUUSD | Gold price is duplicating the price action seen during Tuesday’s Asian trading, as bulls attempt another comeback early Wednesday. The US Dollar (USD) is building on the previous recovery, despite a minor pullback in the US Treasury bond yields, as markets turn tentative ahead of a fresh batch of US GDP and PCE data due later in the day. XAUUSD under PPZ.

🆘 XAUUSD: CMP Status:

M30AS2 H1AS1

M30A618 H1A50 H4A236

🆘 USDJPY:

M30V618 H1V618

🔻C: $2019 / 🔺R: $2042 crucial Price Zones: XAUUSD

🟢Net RISE in USDJPY since yesterday: 600 pips.

Expected Impact on XAUUSD: $20-25 crash

Crash witnessed since yesterday: $9

🔻 Pending crash: $10-15 (2019-2009 zone)

🔺 RT: USDJPY -500/1200 PIPS = XAUUSD: $2048 ZONE.

Most Asian stocks kept to a tight range on Wednesday amid persistent caution over higher-for-longer U.S. interest rates, with Japanese indexes pulling back from record highs as a tech-driven rally cooled.

Regional markets took a middling lead-in from Wall Street, as caution ahead of key PCE price index data- the Federal Reserve’s preferred inflation gauge- remained largely in play.

The reading is due on Thursday, and comes amid repeated warnings from Fed officials that sticky inflation will keep rates higher for longer. U.S. stock futures were mildly negative in Asian trade.

Higher-for-longer rates bode more near-term pressure for Asian stocks.

✔️ XAUUSD | Gold price is duplicating the price action seen during Tuesday’s Asian trading, as bulls attempt another comeback early Wednesday. The US Dollar (USD) is building on the previous recovery, despite a minor pullback in the US Treasury bond yields, as markets turn tentative ahead of a fresh batch of US GDP and PCE data due later in the day. XAUUSD under PPZ.

🆘 XAUUSD: CMP Status:

M30AS2 H1AS1

M30A618 H1A50 H4A236

🆘 USDJPY:

M30V618 H1V618

🔻C: $2019 / 🔺R: $2042 crucial Price Zones: XAUUSD

🟢Net RISE in USDJPY since yesterday: 600 pips.

Expected Impact on XAUUSD: $20-25 crash

Crash witnessed since yesterday: $9

🔻 Pending crash: $10-15 (2019-2009 zone)

🔺 RT: USDJPY -500/1200 PIPS = XAUUSD: $2048 ZONE.

Most Asian stocks kept to a tight range on Wednesday amid persistent caution over higher-for-longer U.S. interest rates, with Japanese indexes pulling back from record highs as a tech-driven rally cooled.

Regional markets took a middling lead-in from Wall Street, as caution ahead of key PCE price index data- the Federal Reserve’s preferred inflation gauge- remained largely in play.

The reading is due on Thursday, and comes amid repeated warnings from Fed officials that sticky inflation will keep rates higher for longer. U.S. stock futures were mildly negative in Asian trade.

Higher-for-longer rates bode more near-term pressure for Asian stocks.

Piyush Lalsingh Ratnu

Markets are currently pricing in about an 80% chance of a no rate cut by the Fed in the May meeting while the probability that the Fed will begin lowering rates in June stands at 60%, down from about 70% seen last week.

Hawkish commentaries from Fed policymakers continue to push back against rate cut expectations, helping the US Treasury bond yields find a floor

On Friday, New York Fed President John Williams said that “rate cuts are likely later this year, but only if appropriate.” Meanwhile, Fed Governor Christopher Waller said that there is no rush to begin cutting interest rates.

Early Tuesday, Kansas City Fed President Jeffrey Schmid, a new hawk, noted that there is “no need to preemptively adjust the stance of policy.” “Fed should be patient, wait for convincing evidence that inflation fight has been won,” Schmid added.

However, the US Dollar fails to draw any inspiration ahead of Thursday’s key inflation data release. Therefore, Gold price is looking to extend the previous rebound from the $2,025 support, as traders are likely to refrain from placing fresh bets on the US Dollar before the macro news trickles in.

🟢 Crucial Price Zones:

C: $2019/2009/1985

R: $2048/2054/2069

Hawkish commentaries from Fed policymakers continue to push back against rate cut expectations, helping the US Treasury bond yields find a floor

On Friday, New York Fed President John Williams said that “rate cuts are likely later this year, but only if appropriate.” Meanwhile, Fed Governor Christopher Waller said that there is no rush to begin cutting interest rates.

Early Tuesday, Kansas City Fed President Jeffrey Schmid, a new hawk, noted that there is “no need to preemptively adjust the stance of policy.” “Fed should be patient, wait for convincing evidence that inflation fight has been won,” Schmid added.

However, the US Dollar fails to draw any inspiration ahead of Thursday’s key inflation data release. Therefore, Gold price is looking to extend the previous rebound from the $2,025 support, as traders are likely to refrain from placing fresh bets on the US Dollar before the macro news trickles in.

🟢 Crucial Price Zones:

C: $2019/2009/1985

R: $2048/2054/2069

Piyush Lalsingh Ratnu

💎 Co-relations Summary:

USDJPY: net crash CMP 150.250: 550 pips

Expected impact on XAUUSD: $20-25+

+ observed till now: $6, $15-20 pending.

🔺 R: 2048/2054/2063

Data scheduled to be announced ahead might add additional + volatility.

Reversal of the scenario might push XAUUSD to:

🔻C: $2025 H1A618 and $2016 H1A100

at CMP:

XAUXAG 89.83 (+)

DXY 103.590

US 10YT 4.269 (-)

US F 1 2 3 (+) RT Mode @ S4

USDJPY 150.210

USD S 16

JPY S 62

AUD S 77

USDJPY: net crash CMP 150.250: 550 pips

Expected impact on XAUUSD: $20-25+

+ observed till now: $6, $15-20 pending.

🔺 R: 2048/2054/2063

Data scheduled to be announced ahead might add additional + volatility.

Reversal of the scenario might push XAUUSD to:

🔻C: $2025 H1A618 and $2016 H1A100

at CMP:

XAUXAG 89.83 (+)

DXY 103.590

US 10YT 4.269 (-)

US F 1 2 3 (+) RT Mode @ S4

USDJPY 150.210

USD S 16

JPY S 62

AUD S 77

: