Piyush Lalsingh Ratnu / プロファイル

- 情報

|

no

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

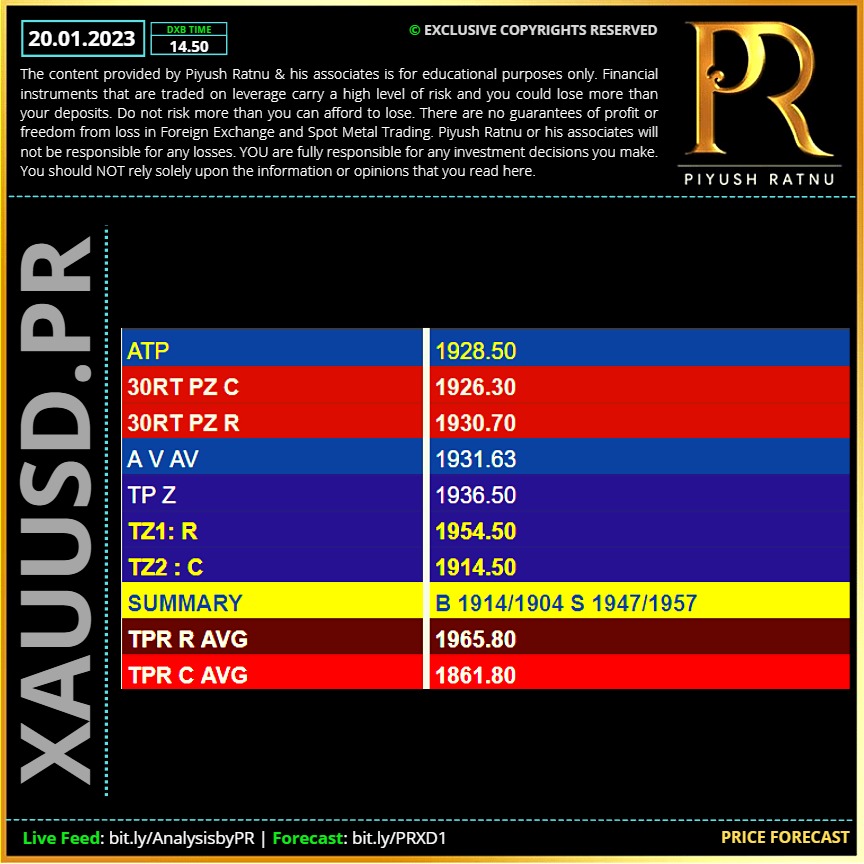

20.01.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #Analysis

Piyush Lalsingh Ratnu

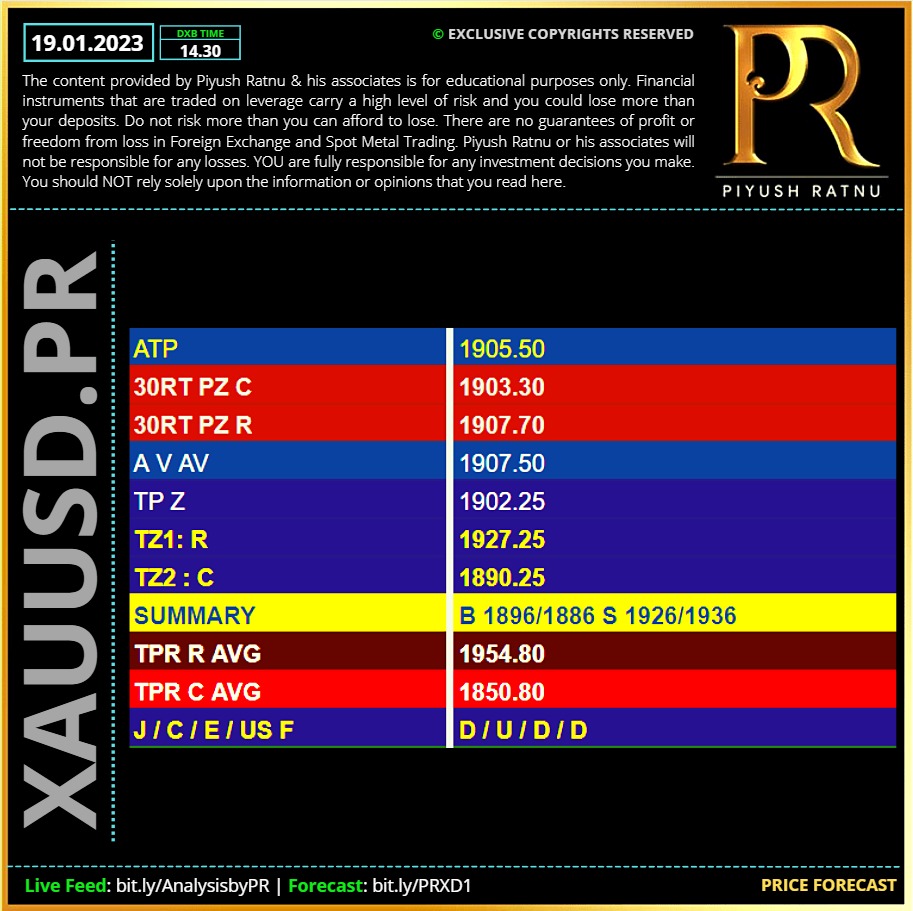

19.01.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #Analysis

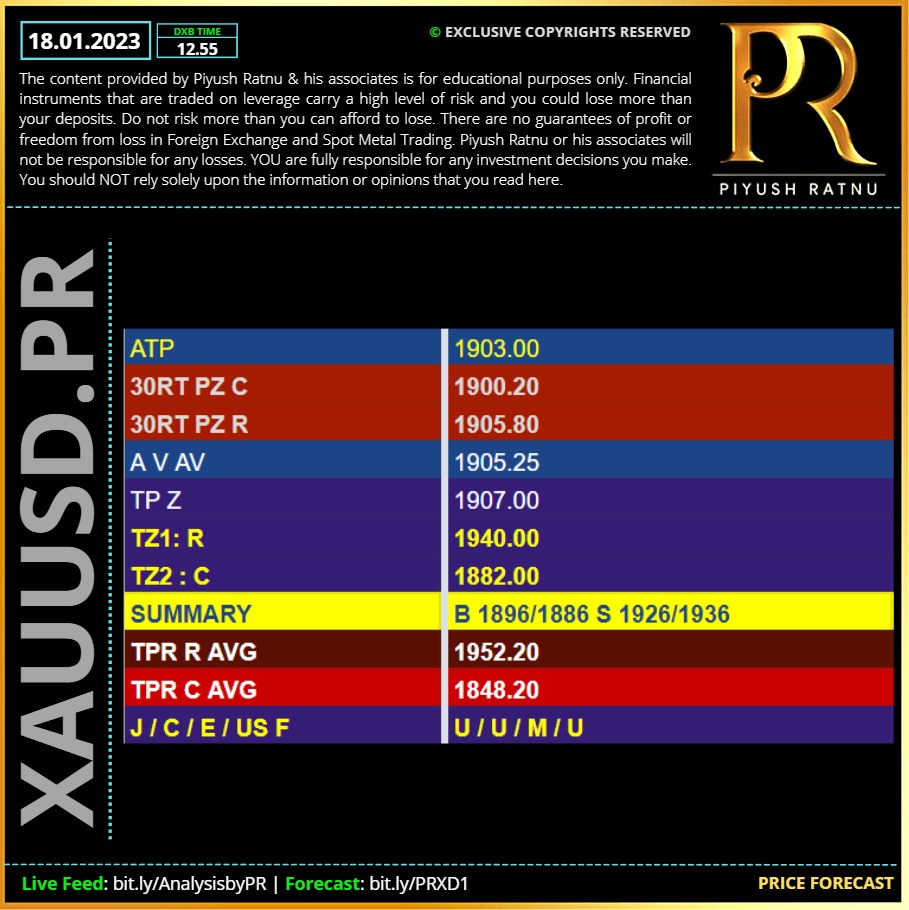

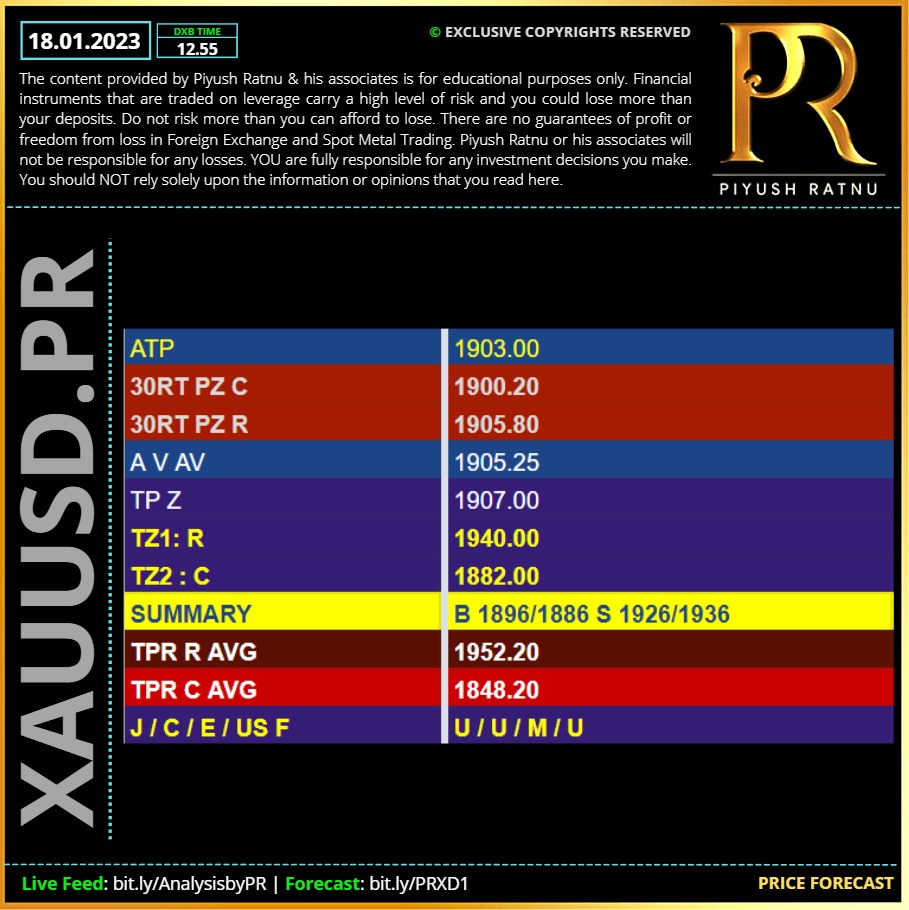

Piyush Lalsingh Ratnu

18.01.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #Analysis

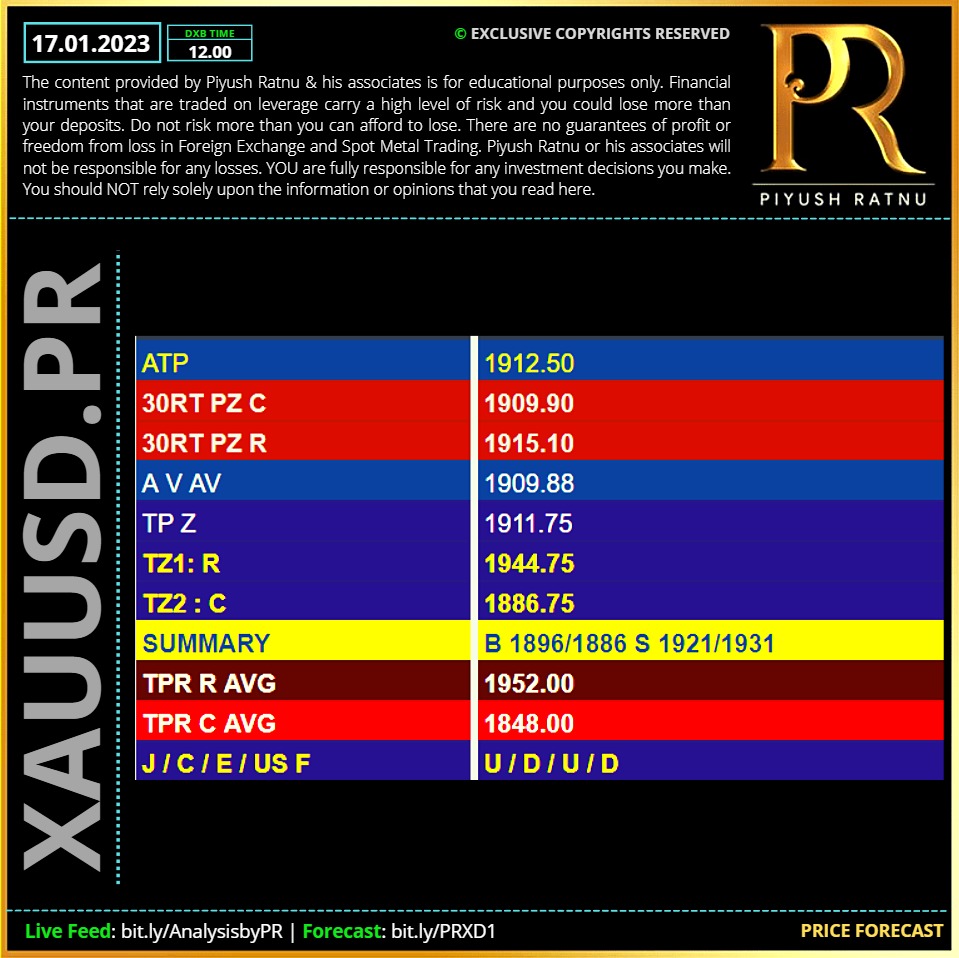

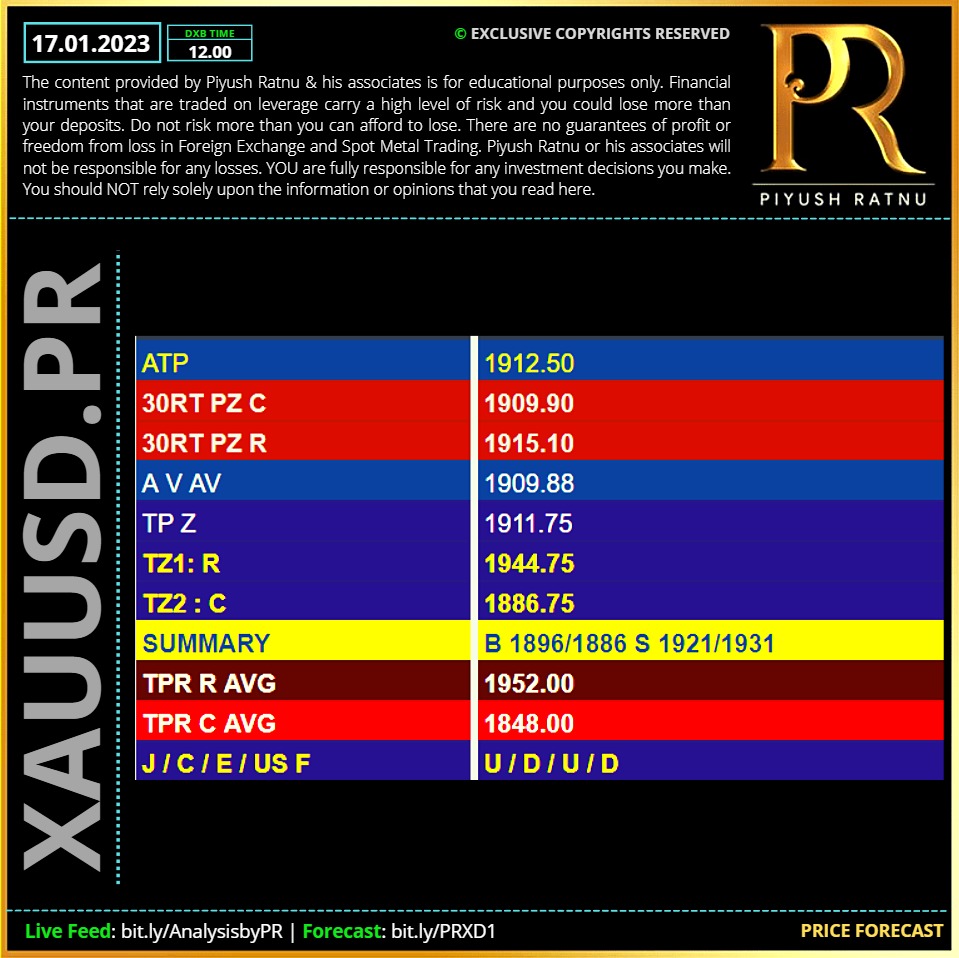

Piyush Lalsingh Ratnu

17.01.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Piyush Lalsingh Ratnu

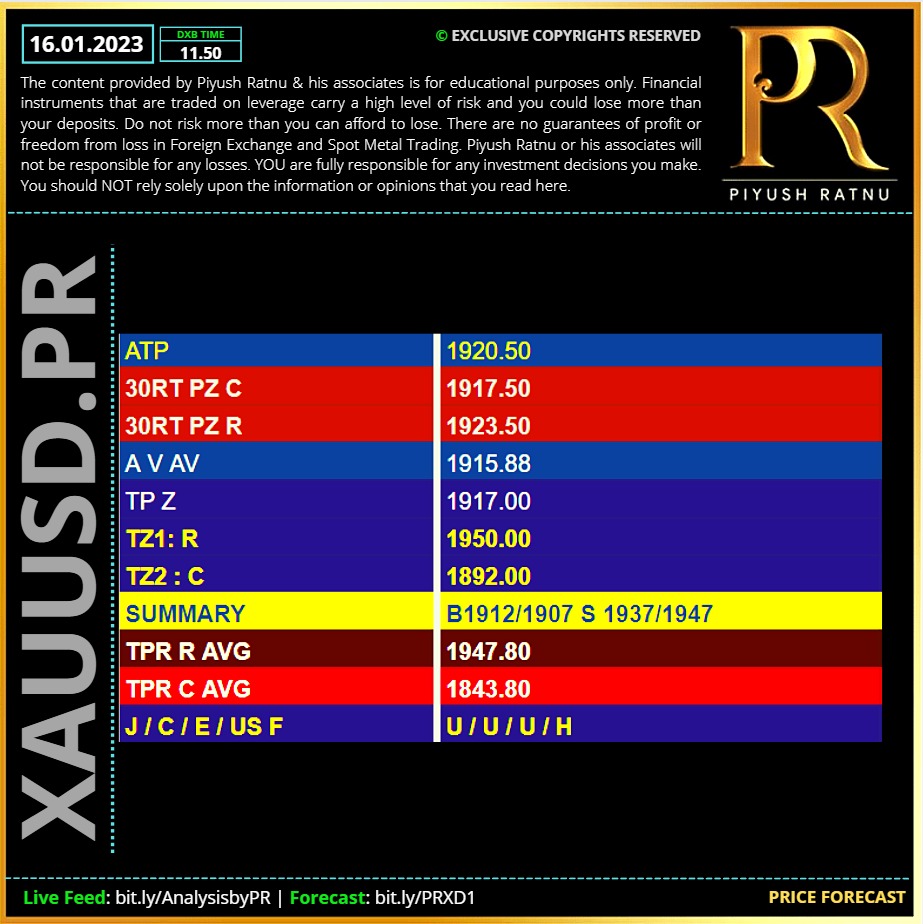

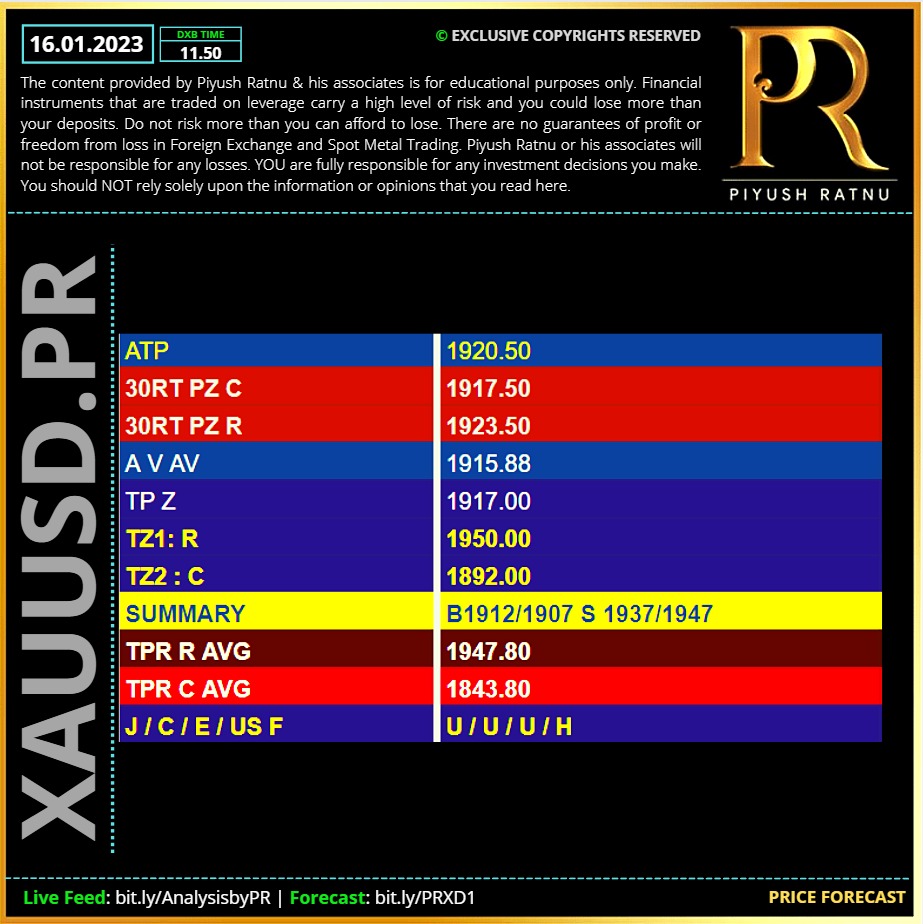

16.01.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/PRXD1

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/PRXD1

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Piyush Lalsingh Ratnu

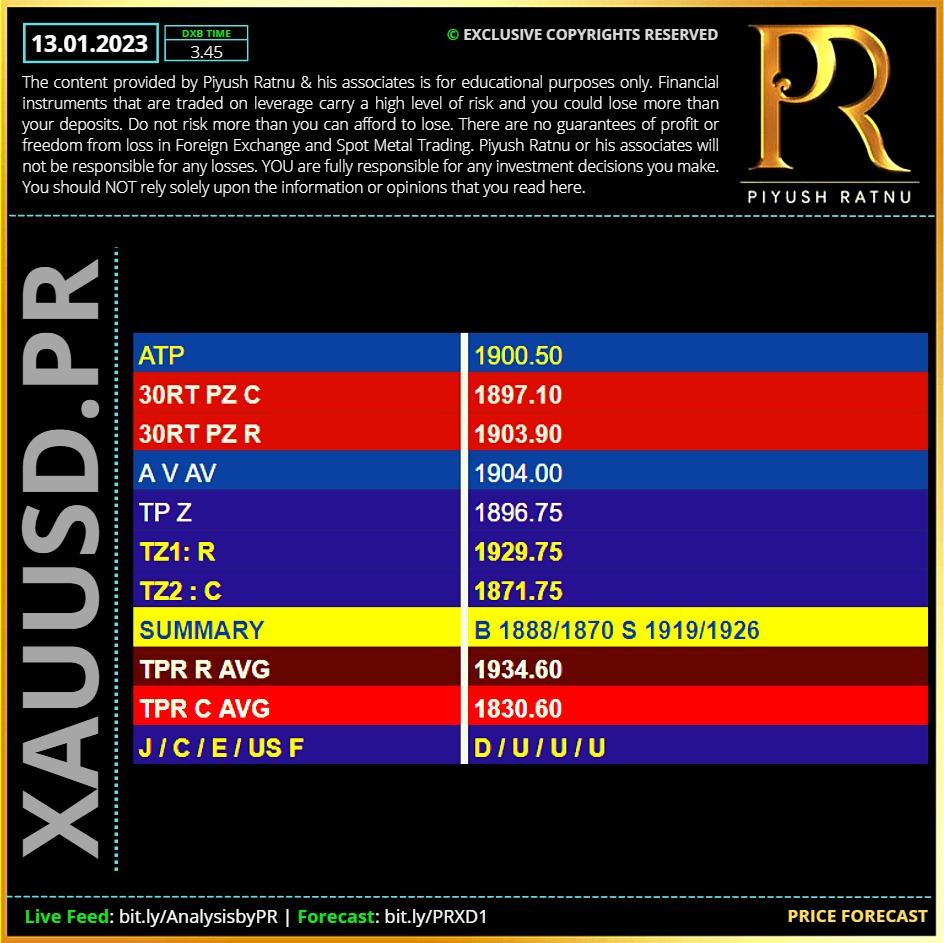

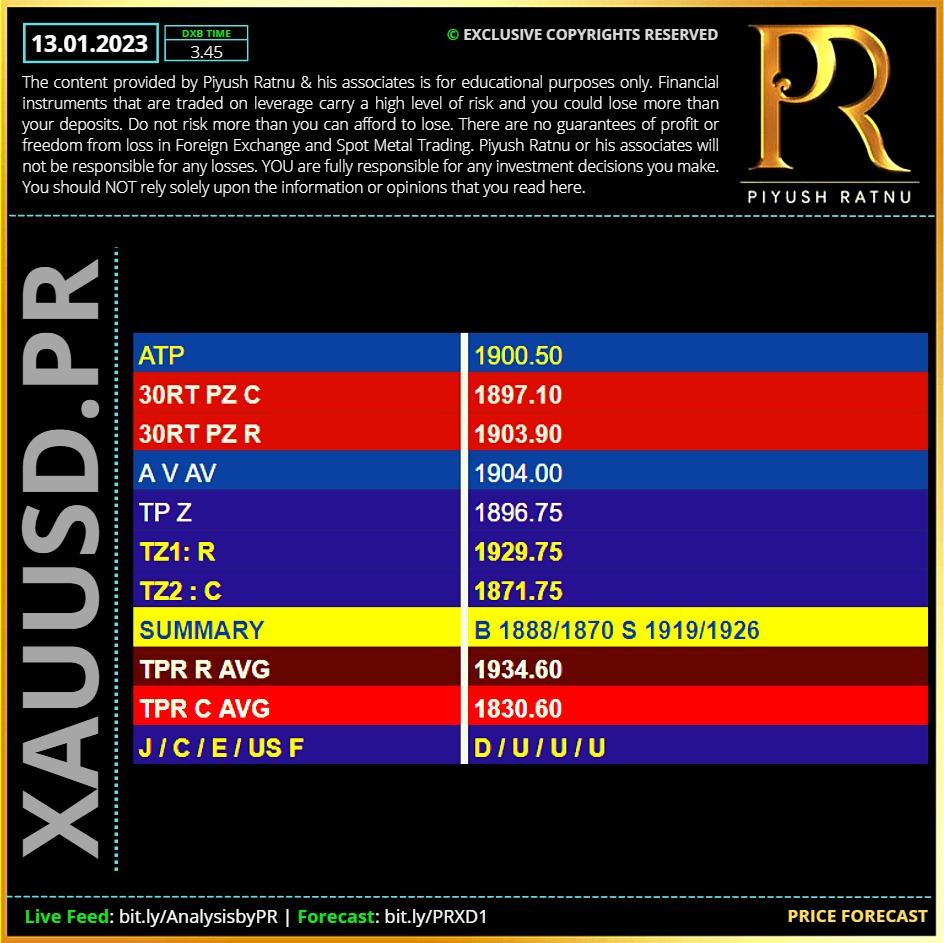

13.01.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/PRXD1

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/PRXD1

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Piyush Lalsingh Ratnu

Last Nov. and Dec. months:

Core CPI

CPI MoM

CPI YoY

All 3 (-)

In November, Gold price moved + from 1709 - 1757 but did not retrace on the same day and was under price trap, and retraced 30% after 1 week.

In December, Spot Gold Price shot up from 1787-1823, and retraced 30% same day and 100% next day.

Past data is not an absolute guarantee of future performance, however it is wise to refer and keep in mind the possibilities based on past data.

Do not risk more than you can afford to lose.

Core CPI

CPI MoM

CPI YoY

All 3 (-)

In November, Gold price moved + from 1709 - 1757 but did not retrace on the same day and was under price trap, and retraced 30% after 1 week.

In December, Spot Gold Price shot up from 1787-1823, and retraced 30% same day and 100% next day.

Past data is not an absolute guarantee of future performance, however it is wise to refer and keep in mind the possibilities based on past data.

Do not risk more than you can afford to lose.

Piyush Lalsingh Ratnu

Traders from New York to Chicago to London will be glued to their screens Thursday morning waiting for the latest consumer price index reading from the Labor Department, which is due at 8:30 a.m. in Washington.

In fact, many will be watching trading closely before the numbers even hit — because of what happened last month.

On Dec. 13, the monthly CPI, one of the Federal Reserve’s favored inflation measures, was scheduled to be released precisely at 8:30 a.m. as usual. But something odd happened in the 60 seconds leading up to it.

Trading volume in 10-year Treasury futures soared, reaching three times the level seen a minute before the release of any of the last 24 CPI reports.

The Labor Department dismissed the possibility of a data leak after conducting an initial investigation. There’s been no indication that regulators such as the Commodity Futures Trading Commission or Securities and Exchange Commission are digging into the situation.

On December, 14: Karine Jean-Pierre, the press secretary for President Joe Biden, quickly brushed off the question when it came in toward the end of her daily press conference Tuesday. No, she said, there was no chance that anyone in the White House leaked the November inflation report before its 8:30 a.m. publication. Too much fuss was being made, as she saw it, over what were just “minor market movements.”

In fact, many will be watching trading closely before the numbers even hit — because of what happened last month.

On Dec. 13, the monthly CPI, one of the Federal Reserve’s favored inflation measures, was scheduled to be released precisely at 8:30 a.m. as usual. But something odd happened in the 60 seconds leading up to it.

Trading volume in 10-year Treasury futures soared, reaching three times the level seen a minute before the release of any of the last 24 CPI reports.

The Labor Department dismissed the possibility of a data leak after conducting an initial investigation. There’s been no indication that regulators such as the Commodity Futures Trading Commission or Securities and Exchange Commission are digging into the situation.

On December, 14: Karine Jean-Pierre, the press secretary for President Joe Biden, quickly brushed off the question when it came in toward the end of her daily press conference Tuesday. No, she said, there was no chance that anyone in the White House leaked the November inflation report before its 8:30 a.m. publication. Too much fuss was being made, as she saw it, over what were just “minor market movements.”

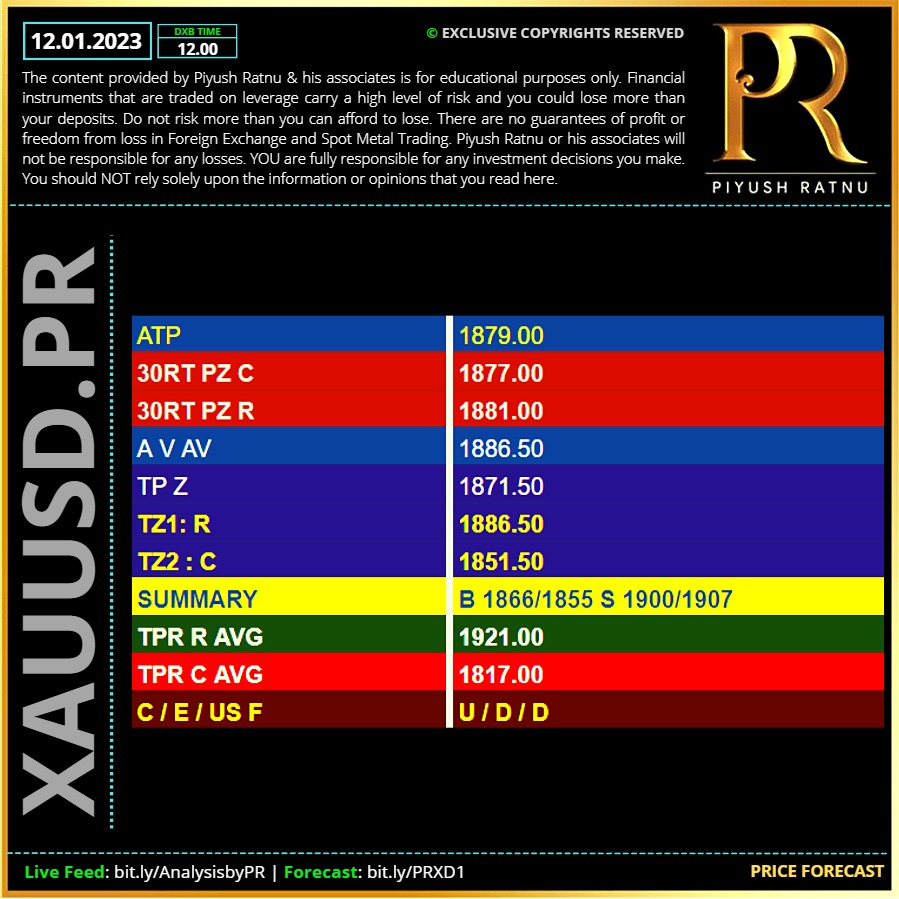

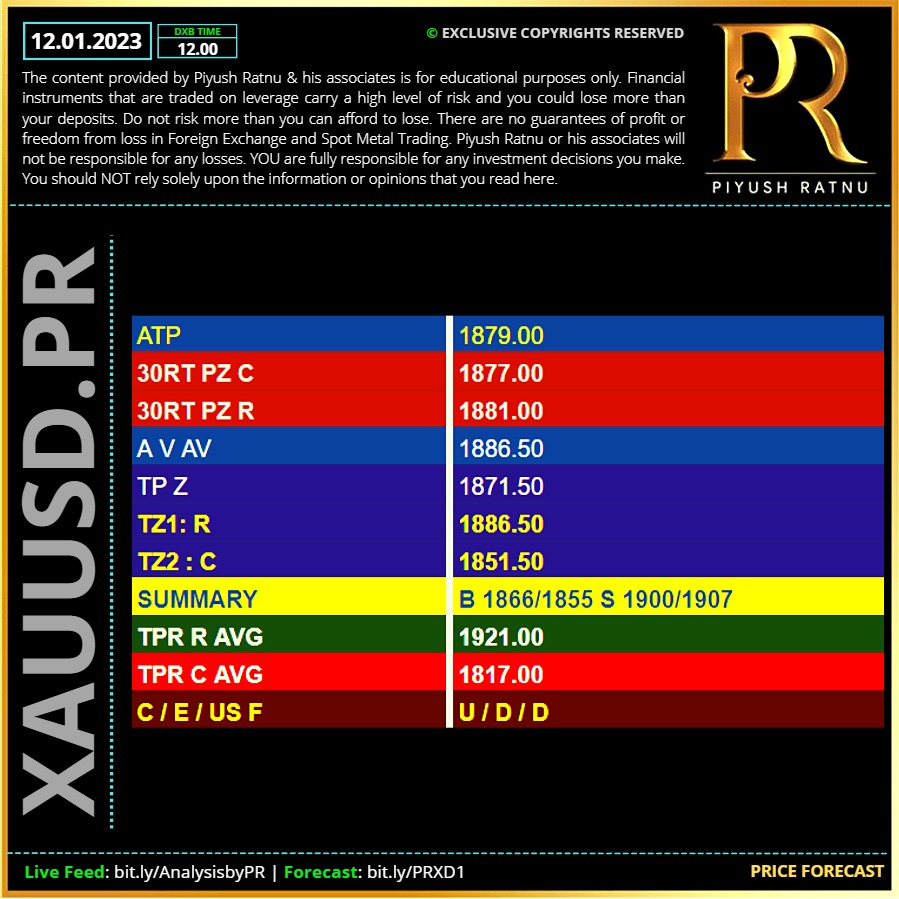

Piyush Lalsingh Ratnu

12.01.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/PRXD1

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/PRXD1

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Piyush Lalsingh Ratnu

11.01.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/DailyGoldPriceForecastbyPR

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/DailyGoldPriceForecastbyPR

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Piyush Lalsingh Ratnu

Fed Chairman Jerome Powell on Tuesday noted that stabilizing prices requires making tough decisions that can be unpopular politically.

In other remarks, the central bank leader said the Fed is “not, and will not be, a ‘climate policymaker.’”

“Price stability is the bedrock of a healthy economy and provides the public with immeasurable benefits over time. But restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy,” the chair said in prepared remarks.

The Fed this year will, however, launch a pilot program that calls for the nation’s six biggest banks to take part in a “scenario analysis” aimed at testing institutions’ stability in the event of major climate events.

The exercise will take place apart from the so-called stress tests that the Fed uses to test how banks would fare under hypothetical economic downturns. Participating institutions are Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo.

In other remarks, the central bank leader said the Fed is “not, and will not be, a ‘climate policymaker.’”

“Price stability is the bedrock of a healthy economy and provides the public with immeasurable benefits over time. But restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy,” the chair said in prepared remarks.

The Fed this year will, however, launch a pilot program that calls for the nation’s six biggest banks to take part in a “scenario analysis” aimed at testing institutions’ stability in the event of major climate events.

The exercise will take place apart from the so-called stress tests that the Fed uses to test how banks would fare under hypothetical economic downturns. Participating institutions are Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo.

Piyush Lalsingh Ratnu

Impact of Hawkish FED Members' Comments on GOLD

The yellow metal loves doves, but hates hawks.

Gold is a non-interest bearing asset, so higher interest rates make it less attractive compared to interest-bearing assets. Gold is also believed to be an inflation hedge, so hawkish monetary policy implemented to keep inflation in check reduces the need to use gold for that purpose.

Hence, hawkish comments are generally deadly for gold, while dovish signals are invigorating for the yellow metal. The example may be the surprisingly hawkish Fed monetary policy meeting in October 2015. The released statement from that meeting opened doors for an interest rate hike in December, which strengthened the U.S. dollar and sent gold prices south

In theory, hawkish comments about the monetary policy are negative for the precious metals. It is generally true, but reality is complex and that relationship doesn’t always hold. Gold and silver sometimes shrug off hawkish comments from the Fed, if there are present some bullish factors at play.

Another problem is with the interpretation of the Fed’s signals. Central banks don’t speak English, but they use cloudy newspeak, often sending contradictory signals. Precious metals traders may thus differ in their interpretation of the comments – and gold prices may not react in line with expectations.

Apropos expectations: they are very important. Precious metals only react if the Fed’s communication is more hawkish or less hawkish than expected. What really matters is not reality, but how the real events deviate from expectations. And very often the strategy “buy the rumor, sell the fact” works very well – gold and silver respond badly to hawkish comments, but they flourish after hawkish actions.

The yellow metal loves doves, but hates hawks.

Gold is a non-interest bearing asset, so higher interest rates make it less attractive compared to interest-bearing assets. Gold is also believed to be an inflation hedge, so hawkish monetary policy implemented to keep inflation in check reduces the need to use gold for that purpose.

Hence, hawkish comments are generally deadly for gold, while dovish signals are invigorating for the yellow metal. The example may be the surprisingly hawkish Fed monetary policy meeting in October 2015. The released statement from that meeting opened doors for an interest rate hike in December, which strengthened the U.S. dollar and sent gold prices south

In theory, hawkish comments about the monetary policy are negative for the precious metals. It is generally true, but reality is complex and that relationship doesn’t always hold. Gold and silver sometimes shrug off hawkish comments from the Fed, if there are present some bullish factors at play.

Another problem is with the interpretation of the Fed’s signals. Central banks don’t speak English, but they use cloudy newspeak, often sending contradictory signals. Precious metals traders may thus differ in their interpretation of the comments – and gold prices may not react in line with expectations.

Apropos expectations: they are very important. Precious metals only react if the Fed’s communication is more hawkish or less hawkish than expected. What really matters is not reality, but how the real events deviate from expectations. And very often the strategy “buy the rumor, sell the fact” works very well – gold and silver respond badly to hawkish comments, but they flourish after hawkish actions.

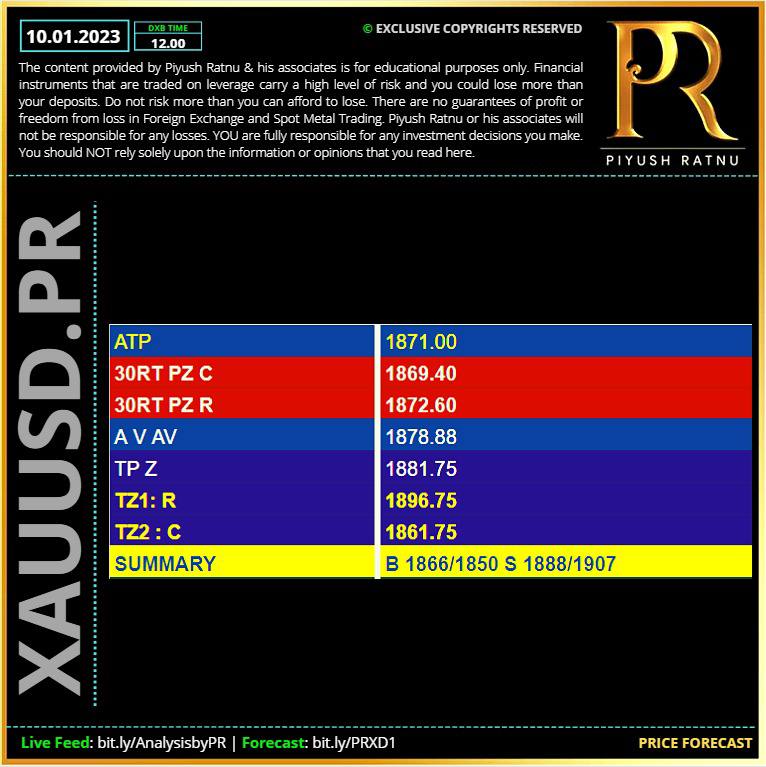

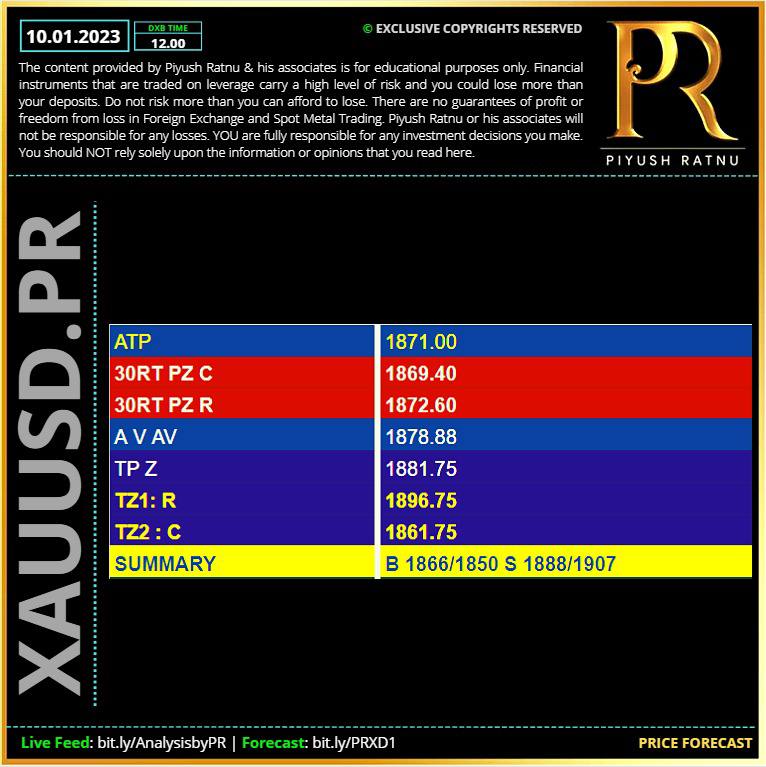

Piyush Lalsingh Ratnu

10.01.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/DailyGoldPriceForecastbyPR

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram:

https://www.instagram.com/prgoldanalysis

You Tube Channel:

https://bit.ly/PRGOLDYT

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Track Daily: Spot Gold: XAUUSD Price Forecast

https://bit.ly/DailyGoldPriceForecastbyPR

Telegram LIVE Trade FEED:

https://t.me/PiyushRatnuGoldAnalysis

10 days complimentary.

Annual Package: contact for charges

(Indicators + EAs + Analysis)

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD

Piyush Lalsingh Ratnu

The Swiss National Bank posted an annual loss of 132 billion Swiss francs ($143 billion) in 2022, it said on Monday, the biggest in its 115-year history as falling stock and fixed-income markets hit the value of its share and bond portfolio.

A strengthening Swiss franc also had a negative impact.

Monday's provisional figure, which marked a reverse from a 26 billion franc profit in 2021, was far bigger than the previous record loss of 23 billion francs chalked up in 2015. It is equivalent to slightly more than the annual GDP of Morocco.

The SNB will release detailed annual figures on March 6.

It made a loss of 131 billion francs from its foreign currency positions - the more than 800 billion francs in stocks and bonds it bought during a long campaign to weaken the Swiss franc.

Global stock markets weakened and bond prices fell last year as central banks around the world, including the SNB, hiked interest rates to combat inflation.

The strong Swiss franc - it rose above parity versus against the euro in July - led to exchange rate-related losses.

Impact on GOLD:

How are the Swiss Franc and Gold Prices Related?

Both the Swiss Franc (CHF) and physical gold have acted as reserve 'currencies' thereby establishing a relationship between the gold price and Swiss Franc. Despite some differences, the Swiss Franc and the gold price are correlated and the similarities shared by the two can be clearly identified.

The first factor that binds these two key variables (Swiss Franc and Gold Prices) together is the huge amount of Gold Reserves. The Swiss National Bank, or SNB, is one of the largest possessors of gold reserves worldwide. This comes after legislation passed by the government that the Swiss Franc must be backed by gold. This new law was voted into place after the country decided to sell some of its gold holdings. Even though the SNB sold a large part of its gold reserves the bank still holds maintains enough reserves to back approximately 10% of Swiss Francs in circulation through gold. The rise in the prices of gold through 2020 has been of immense benefit for the Swiss Franc; proving the close-knitted relationship between the two.

The second influential factor is the safe-haven status enjoyed by the Swiss banking system. This is what has influenced the positive correlation between the Swiss Franc and Gold prices. Gold reserves are said to act as an inflation hedge and it is no wonder that due to this very reason, Switzerland has faced a very low rate of inflation. Switzerland was able to maintain its Consumer Price Index at 0.5% for 25 years and, for 10 to 12 years commencing in 2008, price levels in Switzerland remained unchanged. The SNB tried to stimulate inflation or lower the value of CHF by reducing the interest rates but this action did not yield any positive results. It was so driven to bring change in the inflation rate that the bank tried to introduce a negative interest rate of -0.75%. This also proved to be futile. Thus Switzerland chose to operate on 0% interest rate.

Switzerland benefits from the prices of gold as a custodian of high gold reserves, showcasing a positive relationship between the Swiss franc and gold prices.

A strengthening Swiss franc also had a negative impact.

Monday's provisional figure, which marked a reverse from a 26 billion franc profit in 2021, was far bigger than the previous record loss of 23 billion francs chalked up in 2015. It is equivalent to slightly more than the annual GDP of Morocco.

The SNB will release detailed annual figures on March 6.

It made a loss of 131 billion francs from its foreign currency positions - the more than 800 billion francs in stocks and bonds it bought during a long campaign to weaken the Swiss franc.

Global stock markets weakened and bond prices fell last year as central banks around the world, including the SNB, hiked interest rates to combat inflation.

The strong Swiss franc - it rose above parity versus against the euro in July - led to exchange rate-related losses.

Impact on GOLD:

How are the Swiss Franc and Gold Prices Related?

Both the Swiss Franc (CHF) and physical gold have acted as reserve 'currencies' thereby establishing a relationship between the gold price and Swiss Franc. Despite some differences, the Swiss Franc and the gold price are correlated and the similarities shared by the two can be clearly identified.

The first factor that binds these two key variables (Swiss Franc and Gold Prices) together is the huge amount of Gold Reserves. The Swiss National Bank, or SNB, is one of the largest possessors of gold reserves worldwide. This comes after legislation passed by the government that the Swiss Franc must be backed by gold. This new law was voted into place after the country decided to sell some of its gold holdings. Even though the SNB sold a large part of its gold reserves the bank still holds maintains enough reserves to back approximately 10% of Swiss Francs in circulation through gold. The rise in the prices of gold through 2020 has been of immense benefit for the Swiss Franc; proving the close-knitted relationship between the two.

The second influential factor is the safe-haven status enjoyed by the Swiss banking system. This is what has influenced the positive correlation between the Swiss Franc and Gold prices. Gold reserves are said to act as an inflation hedge and it is no wonder that due to this very reason, Switzerland has faced a very low rate of inflation. Switzerland was able to maintain its Consumer Price Index at 0.5% for 25 years and, for 10 to 12 years commencing in 2008, price levels in Switzerland remained unchanged. The SNB tried to stimulate inflation or lower the value of CHF by reducing the interest rates but this action did not yield any positive results. It was so driven to bring change in the inflation rate that the bank tried to introduce a negative interest rate of -0.75%. This also proved to be futile. Thus Switzerland chose to operate on 0% interest rate.

Switzerland benefits from the prices of gold as a custodian of high gold reserves, showcasing a positive relationship between the Swiss franc and gold prices.

Piyush Lalsingh Ratnu

It has not attracted much attention in the financial press but the World Gold Council (WGC), a think tank and lobby group for the industry, has reported that purchases of the precious metal, once the basis of the international monetary system, were the highest in 2022 for 55 years. (hence GOLD was pulled down to lowest in last two years?)

The buying surge has been led by Russia and China with a number of smaller countries also increasing their holdings. It appears to be a response to two developments—the freezing of the Russian central bank’s dollar holdings after the invasion in Ukraine and growing uncertainty over the stability of US financial markets and its political system.

The People’s Bank of China reported that in November it made its first increase in gold holdings since 2019, buying 32 tonnes worth around $1.8 billion. Major buyers in the third quarter were Turkey, Uzbekistan and Qatar.

The buying surge has been led by Russia and China with a number of smaller countries also increasing their holdings. It appears to be a response to two developments—the freezing of the Russian central bank’s dollar holdings after the invasion in Ukraine and growing uncertainty over the stability of US financial markets and its political system.

The People’s Bank of China reported that in November it made its first increase in gold holdings since 2019, buying 32 tonnes worth around $1.8 billion. Major buyers in the third quarter were Turkey, Uzbekistan and Qatar.

Piyush Lalsingh Ratnu

U.S. stock futures rose at Asia open on follow-through from a relatively benign PCE last Friday, but this is the time of year when more questions are asked than quality answers provided

Any sign of ebbing of inflation constraint for U.S. equities is incredibly significant; remember, as recently as late summer, it was not evident that inflation was under control.

However, should the recession theme take on more weight in 2023, S&P 500 is undoubtedly NOT priced for a hard landing, which is still a base case on Wall Street?

China continues to fast-track the border reopening, no longer subjecting inbound travellers to quarantine in early January. Tacitly, policymakers have decided to accept a sizeable Covid wave.

US economic growth for 2022 was better than everyone feared. The bad news, however, is weaker figures will show in early 2023. This uncertainty makes central bankers' jobs much more difficult as they navigate the waters of high inflation (both headline and core) and tight job markets, all while growth slows. And not too surprising the year is ending with an unusual twist as policymakers are in a state of disorder, with some super hawkish and others less so.

Gold remains supported by seasonal trends and central bank buying, and as people start to recalibrate the 2023 portfolio with investment confidence tapering off, gold is getting bought as a keen diversifier.

Any sign of ebbing of inflation constraint for U.S. equities is incredibly significant; remember, as recently as late summer, it was not evident that inflation was under control.

However, should the recession theme take on more weight in 2023, S&P 500 is undoubtedly NOT priced for a hard landing, which is still a base case on Wall Street?

China continues to fast-track the border reopening, no longer subjecting inbound travellers to quarantine in early January. Tacitly, policymakers have decided to accept a sizeable Covid wave.

US economic growth for 2022 was better than everyone feared. The bad news, however, is weaker figures will show in early 2023. This uncertainty makes central bankers' jobs much more difficult as they navigate the waters of high inflation (both headline and core) and tight job markets, all while growth slows. And not too surprising the year is ending with an unusual twist as policymakers are in a state of disorder, with some super hawkish and others less so.

Gold remains supported by seasonal trends and central bank buying, and as people start to recalibrate the 2023 portfolio with investment confidence tapering off, gold is getting bought as a keen diversifier.

Piyush Lalsingh Ratnu

US10YT -

DXY -

US F - (RT+)

USDJPY 135.00

US S 43

GBP 89

EUR 54

JPY 47

AUD 44

XAUUSD under price trap of 1808

R stops: 1818/1836-1846/1866/1888

C: 1777/1735/1717

I expect A pattern formation.

Exit point: M5.236 in 60 minutes.

DXY -

US F - (RT+)

USDJPY 135.00

US S 43

GBP 89

EUR 54

JPY 47

AUD 44

XAUUSD under price trap of 1808

R stops: 1818/1836-1846/1866/1888

C: 1777/1735/1717

I expect A pattern formation.

Exit point: M5.236 in 60 minutes.

: