Piyush Lalsingh Ratnu / プロファイル

- 情報

|

no

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

XAUUSD: 30.04.2024: Analysis Review: as on 01.05.2024

Buying at $2300/2288 gave us good returns: CMP $2300

100$RT achieved | Net Profit achieved: $12 | 1200 P

Buying at $2300/2288 gave us good returns: CMP $2300

100$RT achieved | Net Profit achieved: $12 | 1200 P

Piyush Lalsingh Ratnu

🟢 XAUUSD: Current Status

M5V100 achieved

M15V100 2301

M30V236 2298 achieved

M30V382 2311 crucial

M30V618 2323

H1V236 achieved

H1VS5 2311

H4VS5 2330

DXY 106.130 (+)

US10YT RT (-)

XAUXAG 86.63

USDJPY crashing: today's rise: 400, crash: 200 in progress

Conclusion: BUY LOWS at PZ only | Exit NAP.

🆘 My Trading Plan:

DS2@2260

WS3@2252

MNS1@2271

🔻So buying from 2260 keeping gaps of 5$ can crash till 2222

(As DS4@2228/ W1S4 u/2229 / MNS2 at 2223

——————————————————————————————--

🔺Selling from 2332/2342 keeping in mind 2385, PG $10

DR3@2330

W1R1@2349

MNR2@2348

Monthly R5@2474 and S5 at 2097

Weekly R5 @ 2483 and S5 at 2197

M5V100 achieved

M15V100 2301

M30V236 2298 achieved

M30V382 2311 crucial

M30V618 2323

H1V236 achieved

H1VS5 2311

H4VS5 2330

DXY 106.130 (+)

US10YT RT (-)

XAUXAG 86.63

USDJPY crashing: today's rise: 400, crash: 200 in progress

Conclusion: BUY LOWS at PZ only | Exit NAP.

🆘 My Trading Plan:

DS2@2260

WS3@2252

MNS1@2271

🔻So buying from 2260 keeping gaps of 5$ can crash till 2222

(As DS4@2228/ W1S4 u/2229 / MNS2 at 2223

——————————————————————————————--

🔺Selling from 2332/2342 keeping in mind 2385, PG $10

DR3@2330

W1R1@2349

MNR2@2348

Monthly R5@2474 and S5 at 2097

Weekly R5 @ 2483 and S5 at 2197

Piyush Lalsingh Ratnu

🟢 XAUUSD: Current Status

M5V100 achieved

M15V100 2301

M30V236 2298 achieved

M30V382 2311 crucial

M30V618 2323

H1V236 achieved

H1VS5 2311

H4VS5 2330

DXY 106.130 (+)

US10YT RT (-)

XAUXAG 86.63

USDJPY crashing: today's rise: 400, crash: 200 in progress

Conclusion: BUY LOWS at PZ only | Exit NAP.

M5V100 achieved

M15V100 2301

M30V236 2298 achieved

M30V382 2311 crucial

M30V618 2323

H1V236 achieved

H1VS5 2311

H4VS5 2330

DXY 106.130 (+)

US10YT RT (-)

XAUXAG 86.63

USDJPY crashing: today's rise: 400, crash: 200 in progress

Conclusion: BUY LOWS at PZ only | Exit NAP.

Piyush Lalsingh Ratnu

XAUUSD under PPZ

Avoid Entries

Ideal Entries:

BZ S2 $2266 zone

SZ R2 $2313 zone

#PRDXB #PiyushRatnu #XAUUSD #forextrading

Avoid Entries

Ideal Entries:

BZ S2 $2266 zone

SZ R2 $2313 zone

#PRDXB #PiyushRatnu #XAUUSD #forextrading

Piyush Lalsingh Ratnu

XAUUSD back to $2306 | H1A100 zone, RT from $2298 post CB CC. #PiyushRatnu #XAUUSD #PRDXB

Piyush Lalsingh Ratnu

$2300 BZ Target achieved as projected at 11.20 AM today. #XAUUSD #PiyushRatnu #PRDXB

Piyush Lalsingh Ratnu

XAUUSD

M5VS5

M5V382

M15VE10

M30VE10

$2303-2311 achieved | CMP $2310.50

Exit LONG POSITIONS.

M5VS5

M5V382

M15VE10

M30VE10

$2303-2311 achieved | CMP $2310.50

Exit LONG POSITIONS.

Piyush Lalsingh Ratnu

Co- relations in process:

USDJPY: 1000 P +

Possible impact on XAUUSD: - $30

Today's High: $2336

Today's Low: $2310

$26 price movement already completed.

It will be wise to wait till S2-6/10 or R1 +3/6/9 before entering in a set of trades.

USDJPY: 1000 P +

Possible impact on XAUUSD: - $30

Today's High: $2336

Today's Low: $2310

$26 price movement already completed.

It will be wise to wait till S2-6/10 or R1 +3/6/9 before entering in a set of trades.

Piyush Lalsingh Ratnu

30.04.2024 | XAUUSD: Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

2024.05.01

XAUUSD: 30.04.2024: Analysis Review: as on 01.05.2024 Buying at $2300/2288 gave us good returns: CMP $2300 100$RT achieved | Net Profit achieved: $12 | 1200 P

Piyush Lalsingh Ratnu

Piyush Lalsingh Ratnu

2024.04.30

$2296 target achieved | BZ projected at 07.07 hours today morning, CMP $2300 #XAUUSD #PiyushRatnu #PRDXB #Gold

Piyush Lalsingh Ratnu

#XAUUSD #NFP #forex #forextrading #ForexMarket

Key Economic Data This Week:

Tuesday, April 30, 2024

📷18:00 USD CB Consumer Confidence (Apr)

Wednesday, May 1, 2024

All Day Holiday China - Labor Day

16:15 USD ADP Nonfarm Employment Change (Apr) 179K 184K

17:45 USD S&P Global US Manufacturing PMI (Apr) 49.9 51.9

18:00 USD Construction Spending (MoM) (Mar) 0.3% -0.3%

18:00 USD ISM Manufacturing Employment (Apr) 47.4

18:00 USD ISM Manufacturing PMI (Apr) 50.1 50.3

18:00 USD ISM Manufacturing Prices (Apr) 55.6 55.8

18:00 USD JOLTs Job Openings (Mar) 8.680M 8.756M

📷

22:00 USD FOMC Statement

22:00 USD Fed Interest Rate Decision 5.50% 5.50%

22:30 USD FOMC Press Conference

Thursday, May 2, 2024

All Day Holiday China - Labor Day

📷03:50 JPY Monetary Policy Meeting Minutes

16:30 USD Continuing Jobless Claims 1,781K

16:30 USD Exports 263.00B

16:30 USD Imports 331.90B

16:30 USD Initial Jobless Claims 212K 207K

16:30 USD Nonfarm Productivity (QoQ) (Q1) 0.8% 3.2%

16:30 USD Trade Balance (Mar) -69.30B -68.90B

16:30 USD Unit Labor Costs (QoQ) (Q1) 3.2% 0.4%

18:00 USD Factory Orders (MoM) (Mar) 1.6% 1.4%

Friday, May 3, 2024

All Day Holiday China - Labor Day

All Day Holiday China - Labor Day

All Day Holiday Japan - Constitution Day

16:30 USD Average Hourly Earnings (MoM) (Apr) 0.3% 0.3%

16:30 USD Average Hourly Earnings (YoY) (YoY) (Apr) 4.1%

📷16:30 USD Nonfarm Payrolls (Apr) 243K 303K

16:30 USD Participation Rate (Apr) 62.7%

16:30 USD Private Nonfarm Payrolls (Apr) 180K 232K

16:30 USD U6 Unemployment Rate (Apr) 7.3%

16:30 USD Unemployment Rate (Apr) 3.8% 3.8%

17:45 USD S&P Global Composite PMI (Apr) 50.9 52.1

17:45 USD S&P Global Services PMI (Apr) 50.9 51.7

18:00 USD ISM Non-Manufacturing Employment (Apr) 48.5

Kindly note:

Lower volumes due to holidays in China and Japan might trigger high volatility price action, hence kindly implement risk management strictly, do not risk more than 5% of your principal till Wednesday 08 May, 2024. Avoid martingale, maintain price gaps and prefer to exit in each set of trade in NAP.

XAUUSD: Crucial Price Zones: Next 10 Trading Days

🔺 SZ $2385/2424/2442/2484/2500

🔻 BZ $ 2288/2266/2244/2222/2196

As usual, I will BUY lows at my target BZ and will SELL highs at my target SZ.

All the best to all of us!

#PiyushRatnu #PRDXB #Xauusdgold

Key Economic Data This Week:

Tuesday, April 30, 2024

📷18:00 USD CB Consumer Confidence (Apr)

Wednesday, May 1, 2024

All Day Holiday China - Labor Day

16:15 USD ADP Nonfarm Employment Change (Apr) 179K 184K

17:45 USD S&P Global US Manufacturing PMI (Apr) 49.9 51.9

18:00 USD Construction Spending (MoM) (Mar) 0.3% -0.3%

18:00 USD ISM Manufacturing Employment (Apr) 47.4

18:00 USD ISM Manufacturing PMI (Apr) 50.1 50.3

18:00 USD ISM Manufacturing Prices (Apr) 55.6 55.8

18:00 USD JOLTs Job Openings (Mar) 8.680M 8.756M

📷

22:00 USD FOMC Statement

22:00 USD Fed Interest Rate Decision 5.50% 5.50%

22:30 USD FOMC Press Conference

Thursday, May 2, 2024

All Day Holiday China - Labor Day

📷03:50 JPY Monetary Policy Meeting Minutes

16:30 USD Continuing Jobless Claims 1,781K

16:30 USD Exports 263.00B

16:30 USD Imports 331.90B

16:30 USD Initial Jobless Claims 212K 207K

16:30 USD Nonfarm Productivity (QoQ) (Q1) 0.8% 3.2%

16:30 USD Trade Balance (Mar) -69.30B -68.90B

16:30 USD Unit Labor Costs (QoQ) (Q1) 3.2% 0.4%

18:00 USD Factory Orders (MoM) (Mar) 1.6% 1.4%

Friday, May 3, 2024

All Day Holiday China - Labor Day

All Day Holiday China - Labor Day

All Day Holiday Japan - Constitution Day

16:30 USD Average Hourly Earnings (MoM) (Apr) 0.3% 0.3%

16:30 USD Average Hourly Earnings (YoY) (YoY) (Apr) 4.1%

📷16:30 USD Nonfarm Payrolls (Apr) 243K 303K

16:30 USD Participation Rate (Apr) 62.7%

16:30 USD Private Nonfarm Payrolls (Apr) 180K 232K

16:30 USD U6 Unemployment Rate (Apr) 7.3%

16:30 USD Unemployment Rate (Apr) 3.8% 3.8%

17:45 USD S&P Global Composite PMI (Apr) 50.9 52.1

17:45 USD S&P Global Services PMI (Apr) 50.9 51.7

18:00 USD ISM Non-Manufacturing Employment (Apr) 48.5

Kindly note:

Lower volumes due to holidays in China and Japan might trigger high volatility price action, hence kindly implement risk management strictly, do not risk more than 5% of your principal till Wednesday 08 May, 2024. Avoid martingale, maintain price gaps and prefer to exit in each set of trade in NAP.

XAUUSD: Crucial Price Zones: Next 10 Trading Days

🔺 SZ $2385/2424/2442/2484/2500

🔻 BZ $ 2288/2266/2244/2222/2196

As usual, I will BUY lows at my target BZ and will SELL highs at my target SZ.

All the best to all of us!

#PiyushRatnu #PRDXB #Xauusdgold

Piyush Lalsingh Ratnu

#XAUUSD Co-relation: ALERT:

A correction in USDJPY might result in + XAUUSD

It will be wise to avoid trades till R2/S2 is achieved.

#PRDXB #PiyushRatnu #XAUUSDAnalysis #forextrading

A correction in USDJPY might result in + XAUUSD

It will be wise to avoid trades till R2/S2 is achieved.

#PRDXB #PiyushRatnu #XAUUSDAnalysis #forextrading

Piyush Lalsingh Ratnu

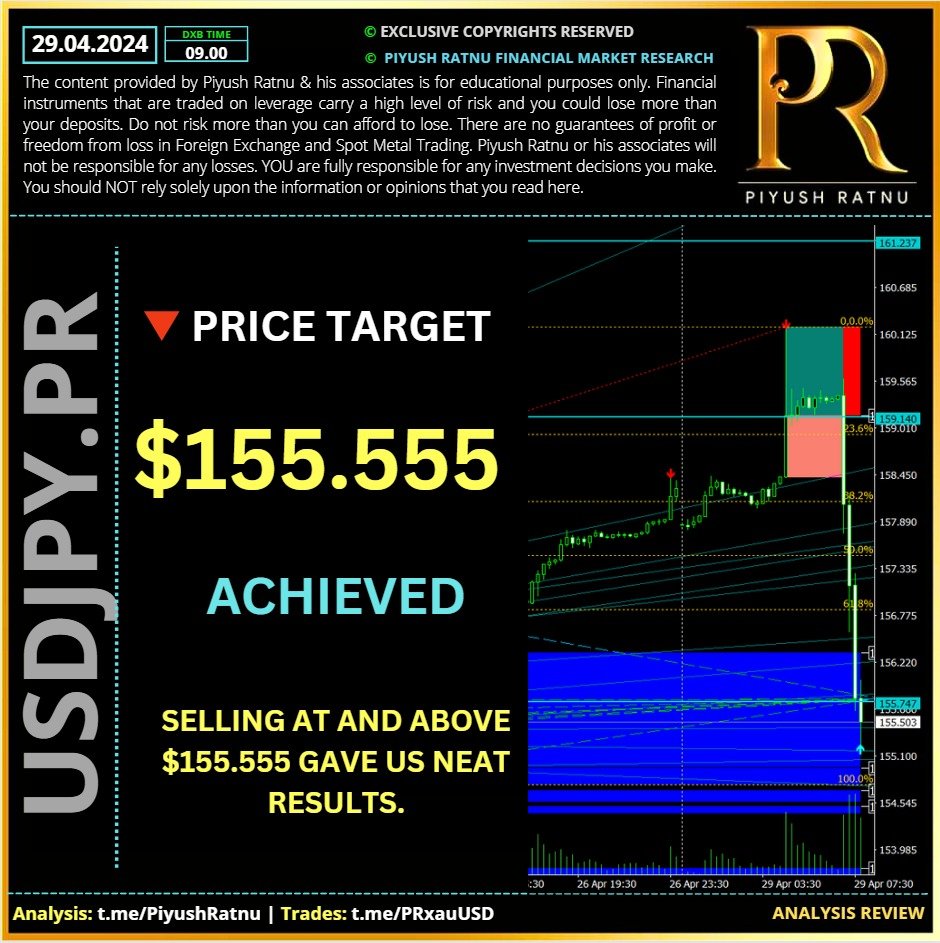

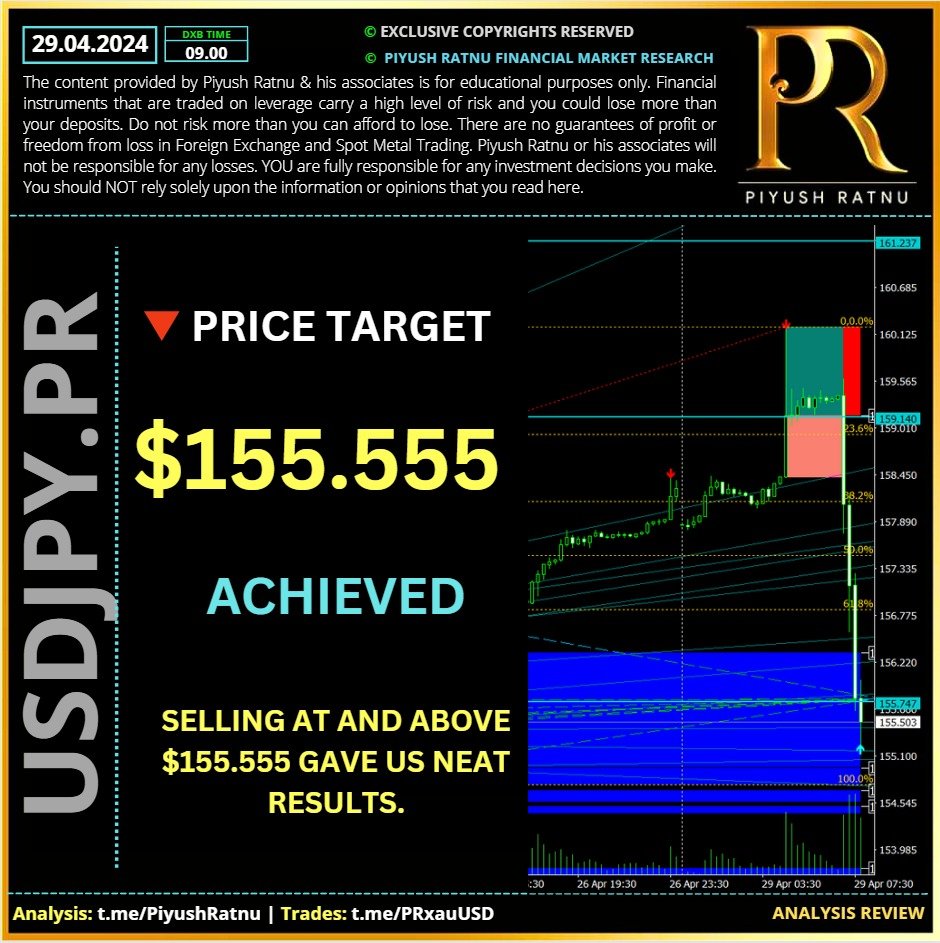

Crash in USDJPY from 160.000 - 155.300 observed.

|

CMP 155.555

Traced by our algorithm in advance.

5000 PIPS traced in 2 trading days!

#PiyushRatnu #PRDXB #USDJPY #Forex #ForexTrading

|

CMP 155.555

Traced by our algorithm in advance.

5000 PIPS traced in 2 trading days!

#PiyushRatnu #PRDXB #USDJPY #Forex #ForexTrading

Piyush Lalsingh Ratnu

🆘 ALERT:

Crash in #USDJPY from 160,000 - 155.300 observed.

|

CMP 155.450

Traced by our algorithm in advance.

Crash in #USDJPY from 160,000 - 155.300 observed.

|

CMP 155.450

Traced by our algorithm in advance.

Piyush Lalsingh Ratnu

Monday is holiday for Japanese

We might face High volatility / Dead trap on Monday, kindly avoid big lots, prefer to close trades today itself.

We might face High volatility / Dead trap on Monday, kindly avoid big lots, prefer to close trades today itself.

Piyush Lalsingh Ratnu

#XAUUSD

M30A100 H1A100 next BZ

$2323 $2313

#PiyushRatnu #PRDXB #XAUUSD #Gold #Forex #PRXAUUSD #2424in2024

M30A100 H1A100 next BZ

$2323 $2313

#PiyushRatnu #PRDXB #XAUUSD #Gold #Forex #PRXAUUSD #2424in2024

Piyush Lalsingh Ratnu

US10YT -

DXY RT-

USDJPY RT +

XAUUSD stable (expected PA in 30 min.)

XAUXAG 85.00

#XAUUSD

DXY RT-

USDJPY RT +

XAUUSD stable (expected PA in 30 min.)

XAUXAG 85.00

#XAUUSD

Piyush Lalsingh Ratnu

XAUUSD: $2323/2300/2288 or $2387/2407/2424 next week after PCE Data? | Analysis by Piyush Ratnu

Gold price attracts buyers, cooling US economy growth, albeit lacks follow-through.

Gold price (XAU/USD) gains some positive traction for the second successive day on Friday and climbs to the $2,350 level, or a multi-day peak during the first half of the European session.

The US Dollar (USD) adds to the previous day's weaker US GDP-inspired losses and turns out be a key factor acting as a tailwind for the commodity. Any meaningful appreciating move for the precious metal, however, still seems elusive in the wake of hawkish Federal Resreve (Fed) expectations.

• The US GDP report released on Thursday showed a sharp deceleration in economic growth and stubborn inflation, which, in turn, is seen as a key factor lending support to the Gold price.

• According to the data published by the US Commerce Department, the world’s largest economy grew by 1.6% at an annualized rate in the first quarter, marking the weakest reading since mid-2022.

• Additional details of the report revealed that underlying inflation rose more than expected, by 3.7%, in the first quarter, reaffirming bets that the Federal Reserve will keep rates higher for longer.

• The yield on the benchmark 10-year US government bond shot to the highest level in more than five months in reaction to the mixed data and acts as a headwind for the non-yielding yellow metal.

• This, along with easing fears about a further escalation of geopolitical tensions in the Middle East, undermines the safe-haven precious metal and should contribute to capping the upside.

• The US Dollar bulls, meanwhile, prefer to wait for more cues about the Fed’s rate cut path, putting the focus squarely on the release of the Personal Consumption Expenditures (PCE) Price Index.

• The crucial inflation data will play a key role in influencing the Fed’s future policy decisions and driving the USD demand, which should help in determining the near-term trajectory for the commodity.

🟢 XAUUSD: Crucial Price Zones:

🔺SZ $2387/2407/2424

🔻BZ $2323/2300/2288

CMP XAUUSD $2350

Current Status:

H4VS5 H1AS2

Approaching D1PRSR R2

R3 2388 /S2 2300 S3 2275 crucial.

Kindly wait for 45 minutes after Core PCE Data is released before taking a decision.

#PiyushRatnu #PRDXB #XAUUSD #Gold #Forex #PRXAUUSD #2424in2024

Gold price attracts buyers, cooling US economy growth, albeit lacks follow-through.

Gold price (XAU/USD) gains some positive traction for the second successive day on Friday and climbs to the $2,350 level, or a multi-day peak during the first half of the European session.

The US Dollar (USD) adds to the previous day's weaker US GDP-inspired losses and turns out be a key factor acting as a tailwind for the commodity. Any meaningful appreciating move for the precious metal, however, still seems elusive in the wake of hawkish Federal Resreve (Fed) expectations.

• The US GDP report released on Thursday showed a sharp deceleration in economic growth and stubborn inflation, which, in turn, is seen as a key factor lending support to the Gold price.

• According to the data published by the US Commerce Department, the world’s largest economy grew by 1.6% at an annualized rate in the first quarter, marking the weakest reading since mid-2022.

• Additional details of the report revealed that underlying inflation rose more than expected, by 3.7%, in the first quarter, reaffirming bets that the Federal Reserve will keep rates higher for longer.

• The yield on the benchmark 10-year US government bond shot to the highest level in more than five months in reaction to the mixed data and acts as a headwind for the non-yielding yellow metal.

• This, along with easing fears about a further escalation of geopolitical tensions in the Middle East, undermines the safe-haven precious metal and should contribute to capping the upside.

• The US Dollar bulls, meanwhile, prefer to wait for more cues about the Fed’s rate cut path, putting the focus squarely on the release of the Personal Consumption Expenditures (PCE) Price Index.

• The crucial inflation data will play a key role in influencing the Fed’s future policy decisions and driving the USD demand, which should help in determining the near-term trajectory for the commodity.

🟢 XAUUSD: Crucial Price Zones:

🔺SZ $2387/2407/2424

🔻BZ $2323/2300/2288

CMP XAUUSD $2350

Current Status:

H4VS5 H1AS2

Approaching D1PRSR R2

R3 2388 /S2 2300 S3 2275 crucial.

Kindly wait for 45 minutes after Core PCE Data is released before taking a decision.

#PiyushRatnu #PRDXB #XAUUSD #Gold #Forex #PRXAUUSD #2424in2024

: