Most read articles this month

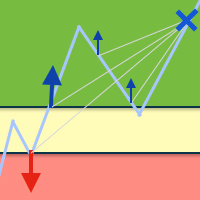

Night trading during the Asian session: How to stay profitable

The article deals with the concept of night trading, as well as trading strategies and their implementation in MQL5. We perform tests and make appropriate conclusions.

Momentum Pinball trading strategy

In this article, we continue to consider writing the code to trading systems described in a book by Linda B. Raschke and Laurence A. Connors “Street Smarts: High Probability Short-Term Trading Strategies”. This time we study Momentum Pinball system: there is described creation of two indicators, trade robot and signal block on it.

MetaTrader 4 on Mac OS

Apple products have become very popular. MetaQuotes Software Corp. attentively follows the progress of the IT industry and has already released the special mobile applications for iOS-based devices - MetaTrader 4 for iPhone and MetaTrader 5 for iPhone.There are many topics on the MQL4.community forum, where people are seeking a solution for running MetaTrader 4 under the Mac OS operating system. In this article, you will find out how to work in MetaTrader 4 via the Apple's popular operating system.