Globus.AI: The most wanted trading strategy for current global trend

Hello guys!

Lately, trading on the forex market has become quite complex especially in this time of uncertainty, with the war in Ukraine ranging and the war in the middle east, the paradigm of global trading has changed dramatically with unprecedent events since last 2 decades. The dollarization of nations and the formation of BRICS payment system has made US currency an alternative, and this has affected global trading in general. How can Globus.AI be a game changer in the forex market?

For decades, the US dollar has enjoyed unparalleled dominance as the world's leading reserve currency. According to the US Federal Reserve, between 1999 and 2019, the dollar was used in 96 percent of international trade invoicing in the Americas, 74 percent in the Asia-Pacific region and 79 percent in the rest of the world.

The BRICS nations have a slew of reasons for wanting to set up a new currency. Recent global financial challenges and aggressive US foreign policies have prompted the BRICS countries to explore the possibility. They want to better serve their own economic interests while reducing global dependence on the US dollar and the euro.

The potential impact of a new BRICS currency on the US dollar remains uncertain, with experts debating its potential to challenge the dollar's dominance. However, if a new BRICS currency was to stabilize against the dollar, it could weaken the power of US sanctions, leading to a further decline in the dollar's value. It could also cause an economic crisis affecting American households. Aside from that, this new currency could accelerate the trend toward de-dollarization.

The potential BRICS currency would allow these nations to assert their economic independence while competing with the existing international financial system. The current system is dominated by the US dollar, which accounts for about 90 percent of all currency trading. Until recently, nearly 100 percent of oil trading was conducted in US dollars; however, in 2023 one-fifth of oil trades were reportedly made using non-US dollar currencies.

Central to this ongoing situation is the US trade war with China, as well as US sanctions on China and Russia. Should the BRICS nations establish a new reserve currency, it would likely significantly impact the US dollar, potentially leading to a decline in demand, or what's known as de-dollarization. In turn, this would have implications for the United States and global economies.

How would a BRICS currency impact the economy?

A potential shift toward a new BRICS currency could have significant implications for the North American economy and investors operating within it. Some of the most affected sectors and industries include:

· Oil and gas

· Banking and finance

· Commodities

· International trade

· Technology

· Tourism and travel

· The Foreign exchange market

A new BRICS currency would also introduce new trading pairs, alter currency correlations and affect market volatility, requiring investors to adapt their strategies accordingly.

the possibility of challenging the dollar's dominance as a reserve currency remains. And as countries continue to diversify their reserve holdings, the US dollar could face increasing competition from emerging currencies, potentially altering the balance of power in global markets.

Excepts from the: https://investingnews.com/brics-currency

Is War in Europe is destroying European economy?

Before the war, the European economy was experiencing a heady recovery. The one-two punch of higher energy prices and trade disruptions, however, could destabilise EU firms already weakened by the pandemic, according to a new report published by the European Investment Bank.

Simulations by the European Investment Bank find that the share of EU firms losing in money could rise, particularly among businesses hit by lower exports to Ukraine, Russia and Belarus and those exposed to higher energy prices. At the same time, rising inflation could push more Europeans under the poverty line.

the war in Ukraine risks upending Europe’s economic recovery. The Russian invasion caused a massive humanitarian crisis – almost seven million Ukrainians have fled the country. The conflict and resulting sanctions have disrupted exports from the region for commodities like metals, food, oil and gas, pushing up inflation to levels not seen in decades.

Real economic growth in the European Union is now expected to fall well below 3% in 2022, down from the 4% estimated by the European Commission before the war. Further trade disruptions or increased economic sanctions could plunge the European economy into recession.

The slowdown in growth is particularly pronounced in countries in close proximity to Ukraine, like Poland and Hungary – countries that are also hosting large numbers of Ukrainian refugees. Italy and Germany, which are heavily dependent on Russian oil and gas, are feeling the pressure as well.

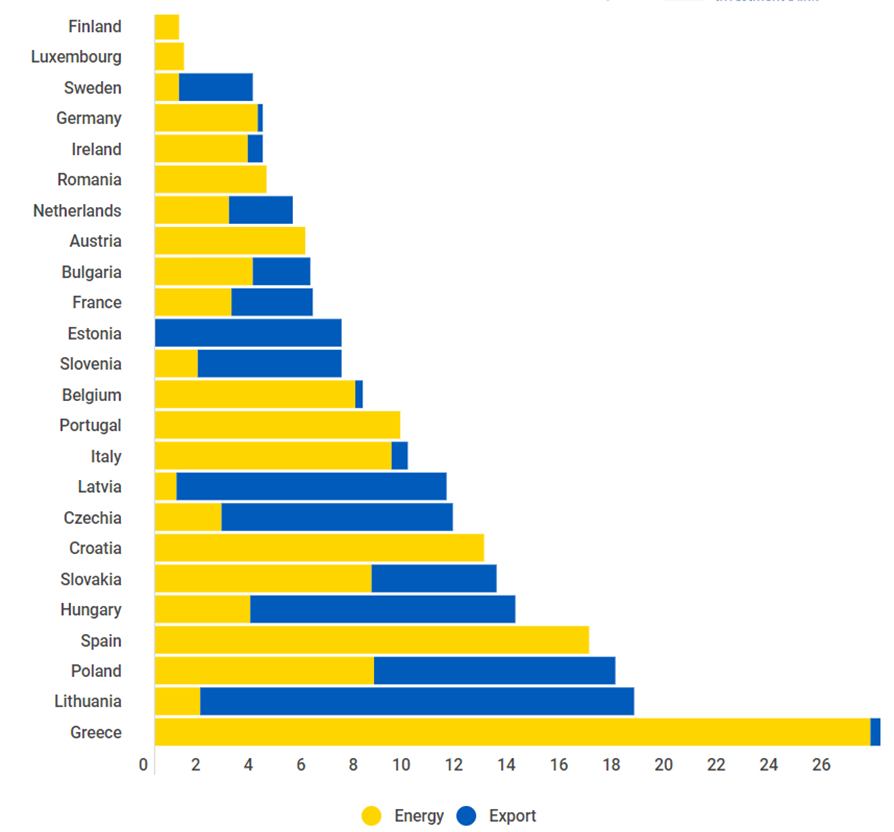

Notes: Energy refers to the number of losses caused by higher energy prices, and exports refers to the losses resulting from the suspension of exports to Ukraine, Russia and Belarus.

the share of EU firms losing money rises from the normal average of 8% to 15% in the year after the start of the invasion. The share of firms that risk defaulting on their debt also surges from 10% to 17% in the same period. Firms in sectors like transport, chemicals and pharmaceuticals, and food and agriculture suffer the most. Firms located in countries close to Ukraine, such as Poland, Latvia and Lithuania, are also hard hit, as are firms in Greece, Croatia and Spain.

Banks under pressure

The conflict has forced some European banks, like Raiffeisen, to consider pulling out of Russia. Overall, however, European banks’ direct exposure to Russia and Ukraine is relatively low. At the end of 2021, European banks’ exposure to Russia (loans, advances and debt securities) was €76 billion, while exposure to Ukraine was €11 billion, according to the European Banking Authority.

Austrian, French and Italian banks were the most active in Russia, while French, Austrian and Hungarian banks were heavily involved in Ukraine. Yet only Austrian and Hungarian banks reported that the two countries represented more than 2% of their total lending. In general, banks have shored up their capital reserves sufficiently in recent years to be able to absorb any losses in the region.

Right now, the biggest source of risk is banks’ exposure to the sectors – chemicals, transport, and food and agriculture – most affected by trade disruptions. On average, however, only 30% of EU bank loans went to sectors at risk.

Excerpts from the European Investment Bank / https://www.eib.org/en/stories/ukraine-trade-inflation

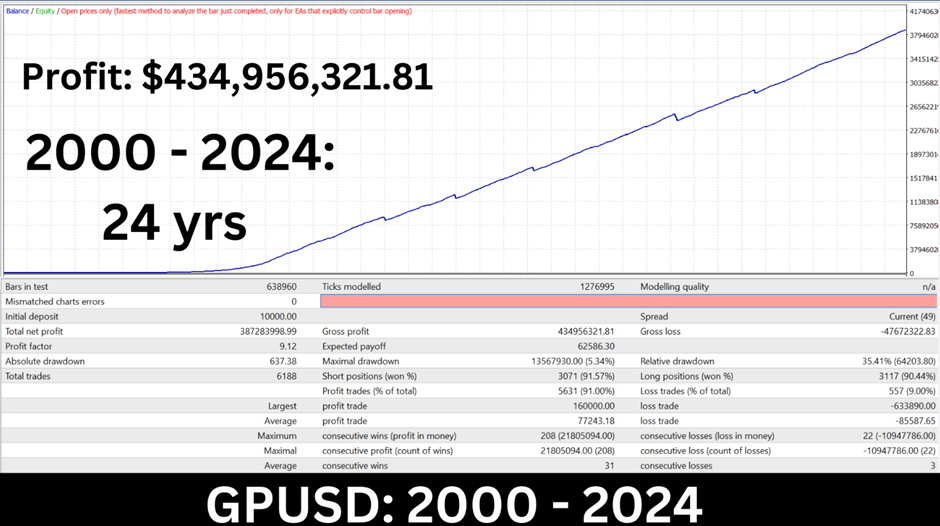

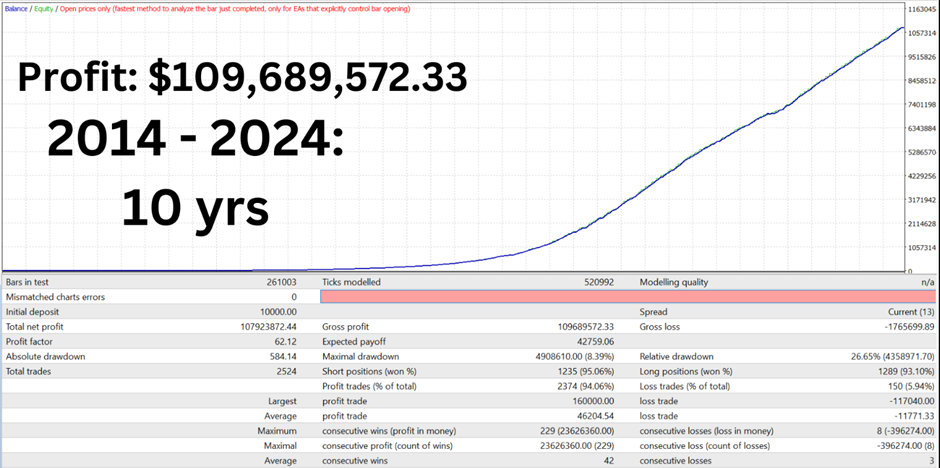

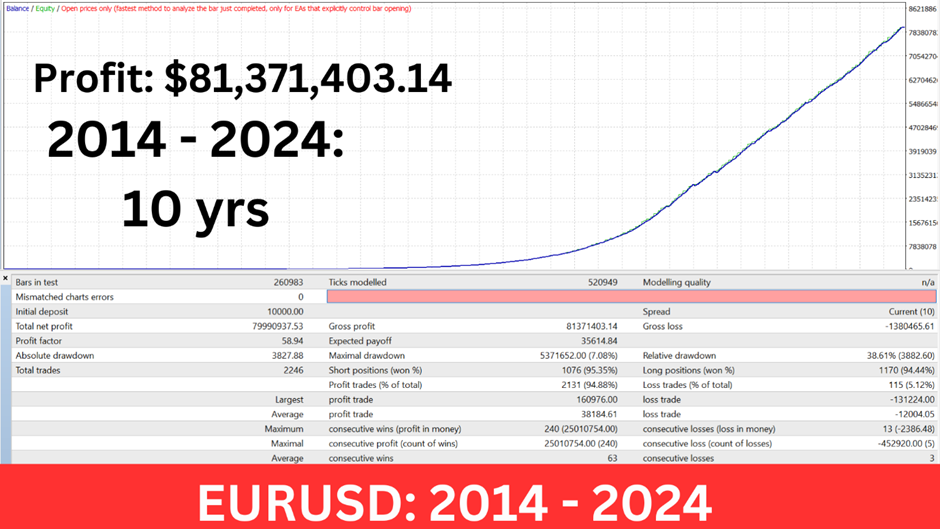

The Globus EA is the designed with the advance AI algorithms that analyse market uncertainties. Globus is developed with machine learning systems that can adapt to news update and dynamically ride the market as changes remains constant. Trade signals are updated in line with the global economic events, news and turns.

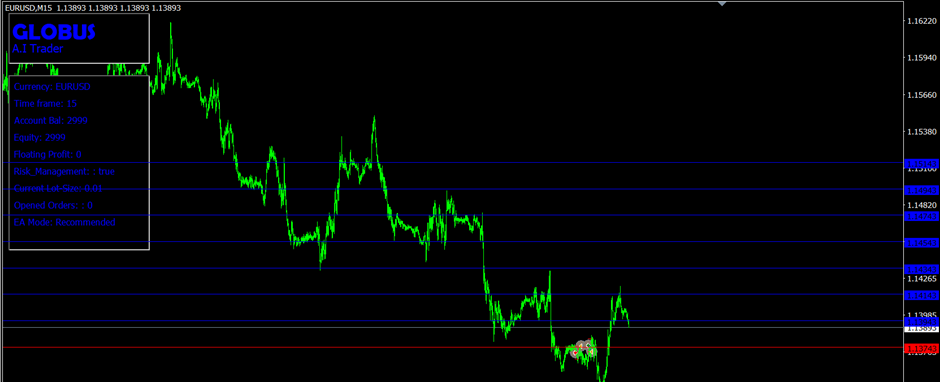

The Globus.AI limits equity drawdown to a minimum level by using a stoploss, a grid system and learning prevalent conditions using horizontal trend lines to estimate the supply and demand level and comparing price action analysis from D1 time frame and H1 timeframe.

In sync with predictive AI a machine learning algorithm is used to pick out extreme higher lows, higher highs, lower high and lower low of the market within a period and check for similar repetitions, it goes further to study the chart at real time by using price action and horizontal lines.

It also adapts to new updates and economic events using special AI rational logic reasoning system. Factually, the current price is decided by previous prices, this is a fairly basic way of technical analysis and a highly effective trading style that allows for the identification of a specific entry price as well as a supply or demand zone.

It also considers the market volatility using employing the average true range indicator, the EA adjusts it strategy when the market is highly volatile or when less. Oversold and over bought conditions are confirmed using the moving average Convergence and Divergence indicator to comply with data compiled by the chart trend lines. The combination of these algorithmic instruments creates a unique entry and exit point that most favour trading accounts.

In contrast to other EA that require huge capital size, the Euro Bullion EA has been developed with the best machine learning technology to accommodate changes in market events and new update.

The Recommended pair: GBPUSD, EURUSD

Time Frame: 15mins

Start Trade: $1,000.

Input Setting

sinput string Globus_Settings;

Fiat Currency = GBPUSD or EURUSD;

MagicNumber = 5005 (must be unique for each chart);

EA_Mode_Settings = Recommended;

Risk_Managment = true;

RiskLevel = Low_Risk;

Signal_Accuracy = HIGH;

Use_Stoploss = true;

LotSize_Multiple = Automatic;

Fixed_Lot_Multiple = 1;

Risk and warning:

Forex trading is highly speculative and risky. It is only suitable for those people who understand, and are willing to take on, the financial and other risks involved.