The Big Market Trader is the ultimate AI trade assistance tool that can help you stay ahead of the market. It is designed with the best technology and has a high frequency response rate for timely trading.

It is equipped with dynamic AI automation, which we will go see already. We have an advanced risk management system. Equity stop option, trailing stop system, time stop and spread technology used by traders all of the world. It is suitable for prop firm traders, traditional traders, high and low capital trading and what have you.

It places all kinds of trade orders namely:

buy orders, sell orders, buy stop orders, sell stop orders, buy limit orders, and sell limit orders. There are so many unique features to this AI machine. And to also mention, it is designed to suit all types of traders, be it scalpers trader, day trader and swing trader.

Let’s look at the user interface.

It is designed with a user-friendly aesthetic display that helps users clearly analysis the market, place trade and also monitor trades seamless just with a click of a button.

There three display panel namely:

- 1. The primary panel,

- 2. The monitor Panel

- 3. The Order Placement panel

The Primary Panel is the top panel at the top left, here you see the show button, hide button and the adjust button, if you tap the hide button it hides both the trade monitor panel and the order placement panel.

This helps you to clearly Analysis the market as you deem fit.

But if you want to further check things out, for a clear vision of the market and further accurate analysis of the price chart, you can click the adjust button which minimises the primary panel.

When you click again on the adjust button the primary panel shows back on the screen. When you click on the show button the monitor panel and order placement panel is displayed again. therefore, you can try that dynamically as you deem fit.

The Close button is used to close market orders (sell and Close orders only) and pending orders are deleted in split seconds using the delete button.

The Monitor panel displays several parameters that add value to the trader’s experience. The account the account balance and equity level of the overall trade on the trading terminal is displayed on this panel, giving the user an ultimate overview of the amount of equity used for currently opened orders with respect to the user total capital. The Dynamic AI is used in this system to manage traders’ risk by creating a grid system and modifying trade limits at high frequency.

User can choose to set is on or off while using the tradition trading method of fixing Lot size, take profit and stoploss values in split seconds. when the inbuilt system is turned on, the red colour signifies its active status to the user while white colour lets the user know that such a system is not in use. You can watch attached video to see Dynamic AI in action time.

The floating profit displays the net profit of currently opened orders on the trade terminal, while the current lot size, stoploss, and take profit are displayed for the trader’s knowledge. Trailing stop, equity stop, and time stop functions will be explained in a moment.

In trading there are two major types of order placement, they are:

1. Market orders

2. pending orders

Market orders are orders placed at the market current price, buy orders are paced at eh current ask price while sell orders are placed on the current bid price.

These orders are placed below or above the existing bid or ask prices, they are predictive prices that are triggered when the current market price is equal to the set price. The pending Pip. determines the distance a pending order will be placed above or below the current price.

There two types pending orders:

Buy Stop orders are pending orders placed above the Ask price, a buy order is trigger when the current market price is same with the set price.

Sell Stop orders are pending Orders Placed below the Current Bid Price, a sell order is triggered when the current market price is same with the set price.

The Buy Limit orders are pending orders placed below the current bid price, it works like the buy stop order however the difference is that buy stops orders are placed above the current market price.

Sell limit orders is similar to the sell stop in operation however the difference is that sell limit orders are placed above the ask price while sell stop are place below the current market price.

Just Click the button, watch attached video for comprehension.

The identification number is an important feature used to distinguish multiple trades opened on a trade terminal. When attaching this Big Market trader on different charts, it is important you assign different ID number for each chart, this will help distinguish orders and trade operation of each market orders for accurate trade management.

To allow BMT AI machine to place Market and Pending orders, use the setting above, the Pending_Pips variable specifies the distance of pending orders from the current market price.

Send Customised Messages on Telegram

Great news! You can now create your own community on Telegram and send them customized messages and analytics using the Big Market Trader. You can also send real trading news and signals to friends and colleagues using the BMT.

On the input option, just enter your Chart Bot token and your Chat ID.

Send a custom message to your Telegram community. When new orders are open (set the Send_On_Open_Order to true), you can also send messages on the close of an order after profit is made in the market (set the Send_On_Close_Order to true).

You can now send Full details of a new Order Per trade by setting the Order_Properties to true

- Order Ticket

- Order Type

- Order Profit

- Order Open price

- Order Close Price

- Order Take Profit

- Order Stop loss

- Order Time frame

- Chart Symbol

Remember to add “ https://api.telegram.org “to the web request list on your Trading App. Go to Tools >> Options >> Experts advisors >> Allow Web Request for Listed UrL.

This allows a seamless integration Between the BMT and Telegram.

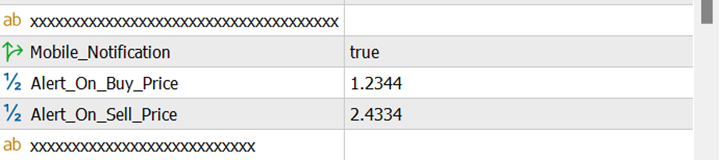

Send Mobile Notification at Predicted Market Price

You Can Send Mobile Notification to Your phone Seamless from Meta Trader with the BMT especially when you predetermine a support and resistance level. Big Market trader sends push notification to your phone when a custom predicted price is equal to the market price. You can now receive alerts for more accurate signal and trade execution.

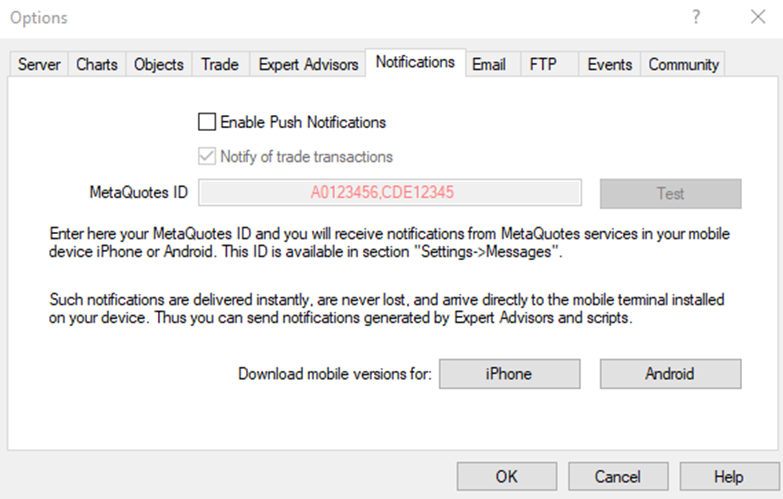

Remember to use the following settings on your Meta Trader: On the tool menu, click Options, and then you will go to the mobile notification tab to add your Meta Quotes ID. Make sure you enable push notifications.

While trading traditionally, market price may deviate often from what we presumed after much analysis. in some occasions it deviates from the take profit, hits out the stoploss and returns back to the assumed price as predicted. A trader can incur losses when stop loss limits are not well placed though the market moves in a favourable condition. How can we solve this problem? The dynamic AI set up a grid system ranging from 2 to 5, it opens up new orders when there is a market price deviation. with incremental lots of : 0.01, 0.02, 0.03, 0.05 and 0.10. with a default lot multiplier setting of 1. The market moves in an up and down wave form and sometime never return to certain support and resistance level, the Dynamic AI helps traders ride the market wave and still end up making profits 8 or 9 times out 10, depending on your strategy and setting. The grid Spacing is used to setup new support and resistance levels for market price reversals, see attached video for more action.

The trader can specify the first take profit of the first trader order using the First_GridTakeProfit setting while the take profit and stoploss limits of subsequent orders are manged by the dynamic AI system.

The maximum grid number is 5 and the lowest is 2, you can also set the grid spacing in pips based on your trading style or strategy.

One of the most, crucial subjects in trading is trade risk management. While traders aim to extract as much potential profit as they can from each trade, they also desire to minimize any potential losses.

Risk management includes recognizing, evaluating, and reacting to risk elements that are inherent in the forex market. efficient risk management has the ability to lessen a risk's likelihood of happening as well as its possible effects.

overleveraging by many traders has caused a landslide of money losses. Risk management is important to protect your equity and create predefined and well-managed account growth while trading. Let's see how it works.

With the inbuilt AI management system trade orders will be placed at 3% (default setting) of equity per trade. having this system will have your account trade more resources as your account grows and commit fewer resources when the account is low. This Amazing tool helps traders make split seconds decision with out delay because of trade calculations. It determines the lot size with relation to the market tick value and stoploss of each trade. No More missing out on trade Opportunities.

To use the Risk management system, Dynamic AI and the ATR trade limit settings should be turned off.

| Use Risk Management | True |

|

| Dynamic AI | False |

|

| Use ATR for trade Limits | False |

|

The Traditional method of specifying trade stoploss, take profit and lot size is readily available on the BMT AI machine, use the following settings.

| Use Fixed Trade Settings | ------- |

|

| Dynamic AI | False |

|

| Use Risk Management | False |

|

| Use ATR for trade Limits | False |

|

The Average True Range (ATR) indicator can also be used to determine average volatility. This is a widely used indicator that is very simple to use and can be found on most charting platforms. To compute the average range, all the ATR needs is the "period," which can be any number of bars, candlesticks, or time it looks back. For instance, if you enter "20" into the parameters when viewing a one-hour chart, the ATR indicator will automatically determine the pair's average range over the previous 20 hours.

The average true range is one of the best tools for placing profits and reducing losses. The average true range calculates the volatility of the market concerning price range per time. Using the ATR to place take profit and stop loss limits is popular among traders because it calculates these variables based on price data and places trade limits not too close or too far from the price range. This creates a better chance for your take profit to be hit and reduces the probability of trades hitting the stop loss.

To use the ATR as trade limits, use the following settings:

| Use ATR as Trade Limits | True |

| Dynamic AI | False |

| Use Risk Management | False |

Instead of the a fixed stoploss, a trailing stop is a dynamic Stoploss

How does it work? As the price rises, the trailing stop moves up as well. When the price eventually stops rising, the new stop-loss price remains where it was drawn, protecting investors from losing money when the market reaches new highs or lows.

In the default setting, we have a minimum profit of 10 pips and a trailing stop of 50 pips. This implies that the stop loss will trail 50 pips to the current price when a profit level of 10 pips is attained or

If the market price climbs to 10 pips, your trailing stop value will rise 50 pips to the current price, setting a new stop loss level. If the current price drops back, the stop level remains intact.

To sue the trailing stop system, use the following settings:

| Use Trailing Stop | True |

|

| Dynamic AI | False |

|

The equity stop is comparable to the risk management system; however, the distinction is that the risk management system utilizes percentage of capital per trade, whereas in equity stop, the minimum amount of equity tolerance per risk is specified.

By setting a defined exit point on each trade, equity stop trading is a proactive method to risk management that focuses on safeguarding your capital. It enables you to place a cap on possible losses and keeps emotions out of your head during bad market conditions.

If your trade order is placed at a specific price and you incur a $45 loss, you may easily exit the deal by utilizing the BMT AI machine. By using this methodical strategy, you may be sure to close a trade before your losses get out of hand.

To use the equity-stop, simply set the use equity stop settings to true and specify the amount that, if lost, should close trades. To use the equity-stop, simply set the use equity stop settings to true and specify the amount that, if lost, should close trades.

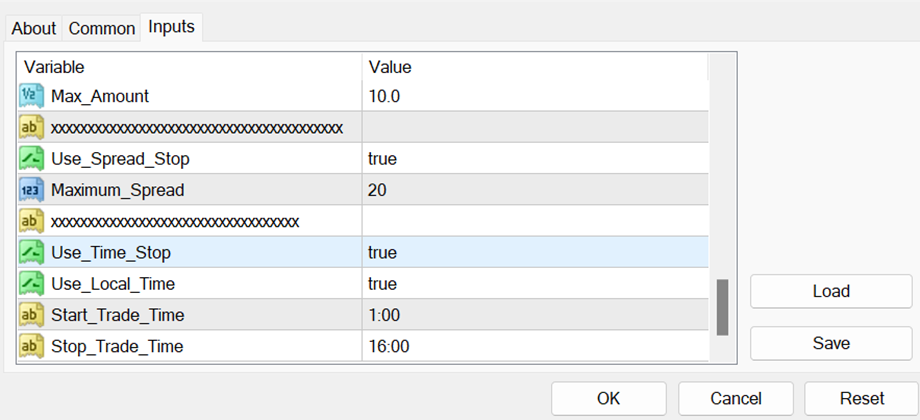

Time stops and spread are trade restriction system that permits trades when desired condition set by the user is met.

Losses could occur and the probability that the market will meet your profit target could be impacted by a wide spread. If you are accustomed to a specific spread range for trading or as a strategy, you can control trade activities by setting the maximum spread, which, if surpassed, will stop all trading operations. During certain hours of the day, the spread may increase and decrease. We refer to this as spread-based trading limitation. To use simply set Use_Spread_Stop to true and Specify the maximum spread for trade placement.

Time is a component that influences everything we do on Earth; some activities are more beneficial at specific times of the day, and we do certain things at specific times of the day. By employing the time stop mechanism, you can limit your trading to specific hours. The time on this time regulator matches the time in your area. It assists you in maintaining discipline to set aside the time that is most advantageous for you as a trader, enabling you to execute the appropriate trade orders at the appropriate times.

To use Simply set the Use_Time_Stop variable to true, set the specified time type to either your country’s local time (true) or trade server time (local time-false), and finally specify time limits (using a 24-hour clock).

Please watch Video for more action and if you have further question be quick to send me a message, many thanks you all.