PureMath EA introduction:

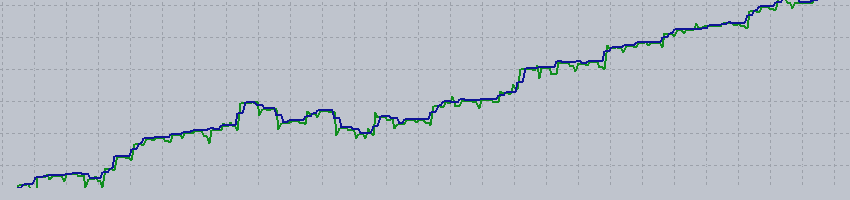

PureMath is based on real day trading strategy. This EA does not use AI that cannot see the future anyways or Neural Networks that can be trained on historical data and have nice backtests because of that. PureMath EA will outperform most if not all EAs based on Neural Network learning or AI bots on this market. This EA is based on a proven trend detection breakout strategy that has high enough winrate over long run and even in shorter time periods. Each trade decision this EA makes is verified by 3 independant algorithms to calculate the best entry positions. We do not use any dangerous money management systems like grid or martingale. Do not expect trades on the day 1, this EA will choose the entry point very carefully.

Why PureMath:

PureMath came to MT5 mainly because many people in the trading community started to believe that AI and Neural Networks training will completely replace traditional strategies based on indicators that even professional traders use. I am here to prove you that this EA can outperform most if not all AI EAs available on the market. Of course there are some scam EAs that are producing fake backtest results to attract more buyers, those backtests probably wont be outperformed by PureMath EA. But other than that I believe that PureMath will stand in the top performing EAs out there.

Many AI or Neural Network bases EAs have pretty decent backtests, because they have been trained on that data, so of course the backtest will be good, but when the EA is installed into a real-time trading it's performance is usually very poor. PureMath EA does not use any training or AI to learn the past data so as long as you have quality data for backtest the reality should be very closely comparable to backtest data.

Features:

- No grid

- No martingale

- Works with hedging account but it is not requirement

- No AI or Neural Networks or fake backtest history readers

- Pure Math

- Configurable lot size or dynamic lot calculation

- Configurable to open only short or long trades or both

- Low drowdowns

- Low minimum deposit - 200 USD is enough for default settings

- Trading days filter

- Default settings works (no set files needed)

How to install the robot:

To install PureMath EA, you need to purchase it from here. Then you will have access to directly install it into your MetaTrader 5 instance. Then drag and drop the EA into EURUSD H1 chart. In the input settings, select Entry position mode IC_BALANCED for IC Markets or one of the modes starting with FM_ prefix for fusion markets, but FM_SCALPING is recommended for best performance. Default risk in % per trade is 2%, you can specify different value but keep in mind the risk involved. The risk % greatly depends on your account leverage.

The more leverage, the more of your capital is at risk. Below you can find a table to choose apropiate risk, however keep in mind that this is not my financial advice to you and you should always perform your own backtest with the given risk % to see actual DD and potentional risk involed with choosing a certain value.

This EA is supposed to be running nonstop to it can keep managing trades and calculate best entry positions all the time. Turning off the EA for certain time during open day trading can lead to poor performance and lost trades that would have been won otherwise.

Recommended Maximum Risk per Trade for Different Leverage Levels

| Leverage | |

|---|---|

| 1:25 | 6% |

| 1:30 | 6% |

| 1:50 | 5% |

| 1:100 | 3% |

| 1:200 | 3% |

| 1:500 | 2% |

Recommended brokers:

This EA will of course run on all low spreads ECN MT5 brokers, however I have chosen these 2 brokers for testing. That is why these brokers are recomended.

- IC Markets

- Fusion Markets

Options explained:

| Setting | Default | Description |

|---|---|---|

| Static lot size | 0 | 0 = dynamic lot size calculation 0.01 = fixed lot size of 0.01 for each trade (minimum value) |

| Risk in % per transaction | 2 | Risk in % (for leverage 1:500, keep 1.5-2% max, for lower leverage like 1:30 this can be increased up to 10%, but keep in mind the risks involved) |

| Max dynamic lot size | 0 | Maximum allowed lot size per trade, no effect for static lot sizes (0 = maximum size defined by your broker) |

| Entry position mode | IC_BALANCED | FM_SCALPING (optimized for FusionMarkets) = maximum number of trades, 60-70% wins expected, higher risk FM_BALANCED (optimized for FusionMarkets) = less trades, 65-75% wins expected, more risk FM_ACCURATE (optimized for FusionMarkets) = minimum number of trades 75%+ wins expected, moderate risk, less profits, positions can be held for several months IC_BALANCED (optimized for IC_Markets) = 65%+ Winrate, optimized for ICMarkets H1 EURUSD |

| Close trades only in profit | false | experimental feature, do not turn on, keep it false for now |

| Allow buy positions | true | allow opening of new long trades |

| Allow sell positions | true | allow opening of new short trades |

| Trading days | true | select specific trading days (recommended to keep all on true) |

I will expand this blog post once in a while because the robot is still evolving and more options and configuration options will be available in the future.

In case of any questions you can always message me directly here on mql5. Or join the public channel to discuss this EA: https://www.mql5.com/en/channels/puremathea