If you are using technical analysis to make trading decisions you may be using Multi Timeframe concept

I will share my experience on Mutli Timeframe

Why people use multitimeframe?

First we need to know that multi timeframes are divided in two parts. Parent and Child. Parent is always more accurate than child. e.g. D1 and H4

Its also possible to divide them in three parts such as grand parent, parent and child e.g. W1, D1 and H4

The main purpose to categorize timeframes is to watch action and find entry.

Lets take example of Parent and Child

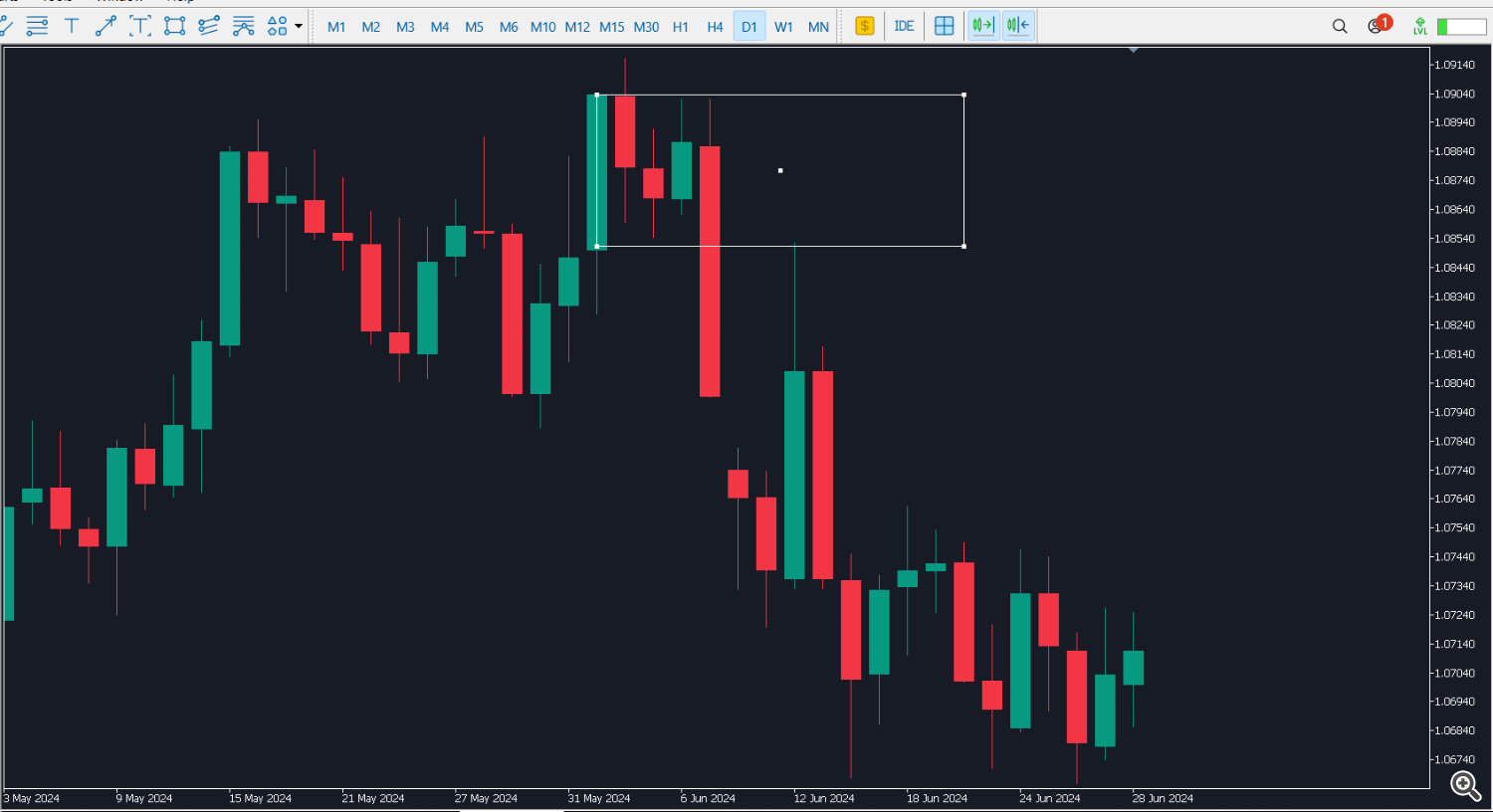

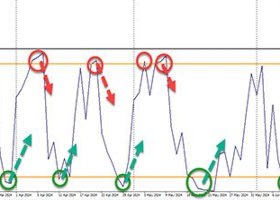

D1 = Parent in EurUSD A bearish Harami pattern was found

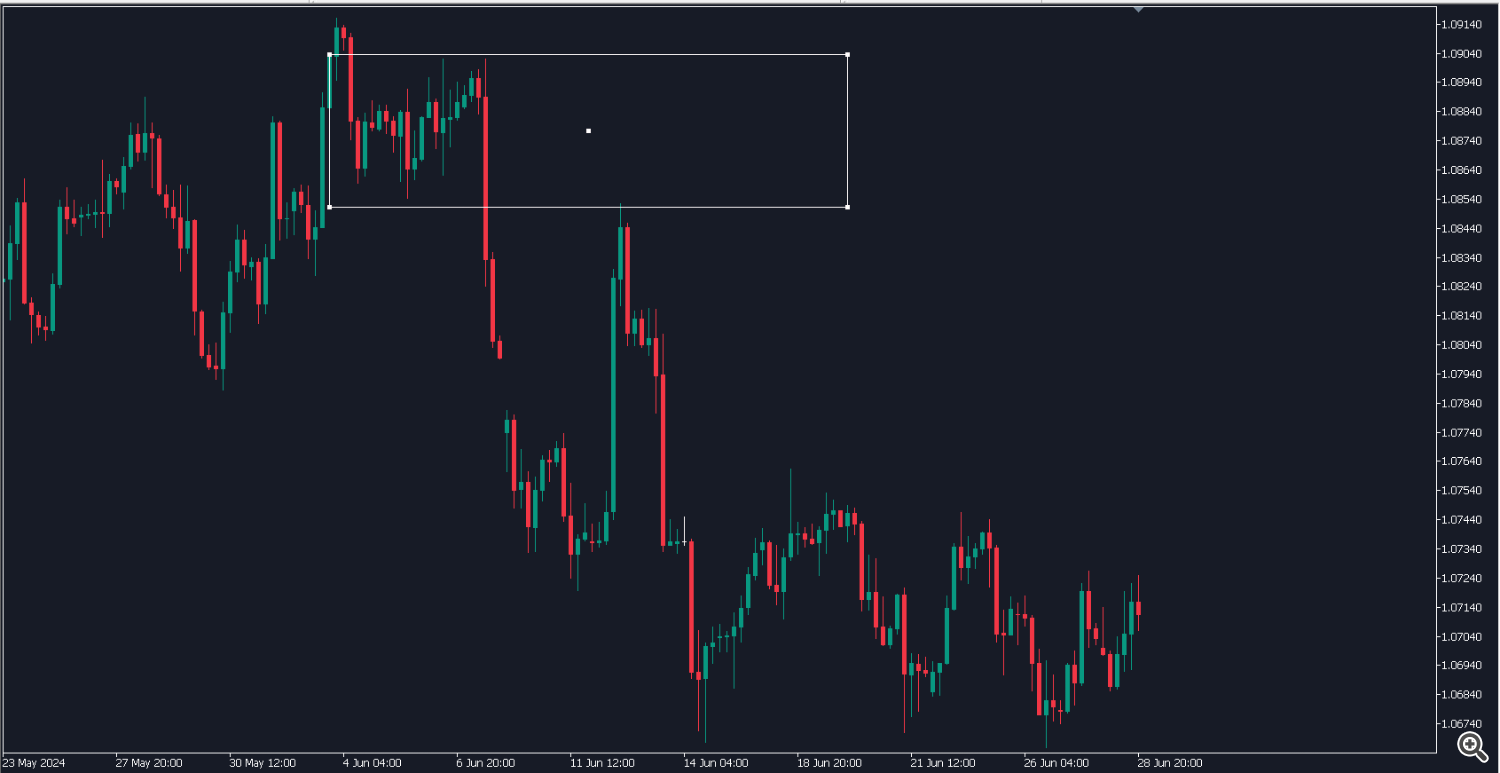

Now trader found an event in chart, now they look for entries to sell in lower timeframe which is H4 = Child Chart

They switch to H4 and after a closing below D1 Harami pattern lower body they look for entry in the same area. As soon as price comes back there is another Bearish Engulfing, the moment bearish engulfing is formed in H4 chart, trader rushed to sell. Had they been watching only D1 chart it was impossible to confirm a signal to sell or would be too risky.

This is the result

Now you know that if you are watching a single timeframe there are rare strategies which works with high accuracy in single timeframe, so its must to watch minimum 2 or 3 timeframe to fine tune your strategies. Behind this logic there is a reason. There are dozens of timeframe available in MT5, but most popular one are W1 D1 H4 H1 M30 M15 M5

which is widely followed by traders but some premium trading apps do not provide this for Free such as they lock M2 M4 and other timeframes and only provide this in paid version, because they have something better info. For intraday professional trader may use custom timeframe and even seconds timeframe to find best trading strategies.

People may also create custom timeframe which you may have not heard such as 2 minutes and 35 seconds timeframe, the reason for creating such timeframe is only becuase their strategy must be performing better on that.

It all depends on research. I believe 3 6 9 minutes timeframe may be good. These ideas just comes from calculations which are based on some logic.

For example in India market operates for 375 minutes. If we keep dividing it by 2, 0.73 seconds timeframe may be best timeframe for intraday instead of 1minute timeframe

If we divide 375 by 3, we get 75, 15 and 3 so watching 3 and 15m timeframe may have some logical meaning, we also get 0.6 means 36 seconds of timeframe may have some clues in which trader may find it interesting to test their strategies

You may comment down your best timeframe combinations you find useful in your day trading.