You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I think if you choose the lesser of two evils it is probably safer to lock the purchase. Then, according to your chosen strategy, you need to reach a certain target upwards and release the lock, fixing the profit, so far imaginary. Strengthen the DP and wait for the price to fall. If the price goes up again, not to renew the loss, and only to strengthen the deposit, keeping in mind that in any case, the spent money sooner or later will return, because there is no depreciation of funds, as in the case, if you would lock the sale. This is, of course, my opinion.

You may or may not lock the market, you will get ... lousy.

Lock is from not knowing how to trade and wanting to hide drawdowns on the balance line. Buy 1 kg of potatoes and sell the same amount and then wait until you have a profit from a change in the price of potatoes.

You can lock or unlock it, you will still get ... ...lousy.

Lock is from not knowing how to trade and wanting to hide drawdowns on the balance line. Buy 1 kg of potatoes and sell the same amount, and then wait for a profit from a change in the price of potatoes.

However, 97% of traders get bumps precisely from "knowing how to trade", in my opinion. In the case of the above locking option, failure is ruled out and there is more peace of mind. Unexpected price declines, i.e. depreciation of funds, only benefit. Point out the disadvantages of this locking option.

If you close the position you immediately eliminate the possibility of failure and you become calm.

However, 97% of traders get bumps precisely from "knowing how to trade", in my opinion. In the case of the above locking option, failures are ruled out and there is more peace of mind. Unexpected price declines, i.e. depreciation of funds, only benefit. Point out the disadvantage or inferiority of this locking option.

I'm out ..... Yusufkhoja, expecting you to be incapable of using a calculator is the height of cynicism, especially considering the article you posted on this forum. Pull yourself together and use a search engine and a calculator - you trust mathematical estimations, this topic has been discussed and recalculated many times.

The disadvantage is that in some brokerage companies the trader will pay extra spread and swaps for nothing. There is no advantage.

However, 97% of traders get bumps precisely from "knowing how to trade", in my opinion. In the case of the above locking option, failure is ruled out and there is more peace of mind. Unexpected price declines, i.e. depreciation of funds, only benefit. Point out the disadvantage or inadequacy of this locking variant.

Admittedly, showing balance reports on the charts instead of equity is a good drug for the fevered brain of the grail seeker.

Gentlemen, if this topic comes up, I'd like to hear your feedback on one tactic... I'll give it below.

I would like to point out right away that I have a negative attitude towards lots and think they are nonsense, because when you use them, equity is the same as if you had just closed the position. In the case of the lot, we are freezing the deposit's equity and paying the spread and swaps. So, of course, it is much better to move everything to netting.

Anyway, there is such a tactic... all of the below is a quote:

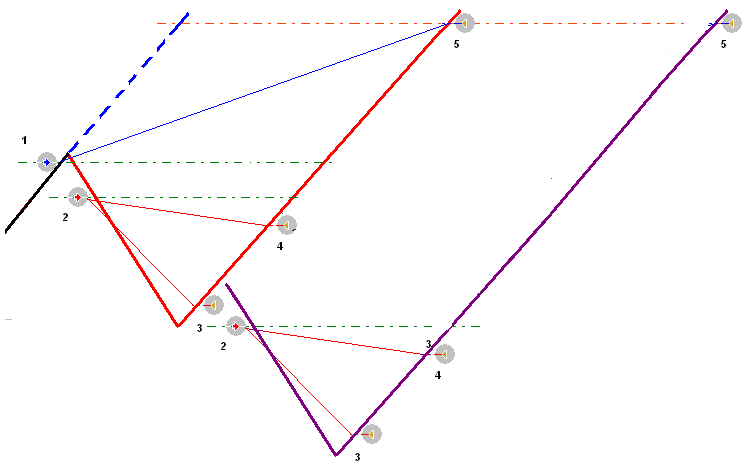

Point 1: Based on a combination of signals from the strategy you are using, your tactics, the behaviour of your pet cat and the location of program shortcuts on your desktop, you decide and open a BUY order with parameters such as those shown in the image below.

When placing orders, I believe it would be reasonable to use a trawl which would be able to transfer a deal to Breakeven directly, i.e. without using an unprofitable Stop Loss. Again, automation is needed, which I mentioned earlier.

After opening a buy order at a distance, depending on the traded currency pair and your personal preferences, we set a pending Sell Stop order(point 2) using it as locking against the open Buy order.

And then the price, as it often happens with beginner traders, decided to turn against us!

A pending Sell Stop locking order with the parameters shown in the picture was triggered, I should immediately mention that the Take Profit parameter of this order is deliberately large (obviously unreachable by the price).

The price goes down and we have a certain fixed drawdown which nevertheless allows us to open sell orders at this time in order to take advantage of the downtrend movement and do our usual work. But surely sooner or later the moment will come when the price turns, somewhat above the turning point, we close one tenth (in our case 0.1 lot) of Sell Stop order and take a certain amount of profit points with a 0.1 lot at Sell Stop order (point 3), then Sell Stop order works with a lot equal to 0.9 (we have closed from it 0.1 lots) at approaching of the price to level of opening of the order Sell Stop, or rather at some distance from it we close this order (manually or Stop Loss-ohm established in advance) having some more points of profit from it. And after it is closed at a distance from the point of closing, we again place the locking Sell Stop order (in general, as in the pictures below) in order to protect ourselves from possible downward movements of the trend.

Sootvetochitelno, we lock at such trend movement, but here you can not lock, as Sell Stop order still works with a lot equal to 0.9.

Accordingly, after full closing of the locking order, we set one more Sell Stop pending order as a locking order as a precaution against the trend behaviour shown above.

And finally, here are a few points:

- when automating a non-stop trade, the function of deleting a pending (locking) order when the main order reaches the Breakeven level is advisable.

- when using the locking textics, find out completely and thoroughly the possible trend behavior options and ways to fight them.

- And, accordingly, weigh the pros and cons before using this tactic; perhaps in your case it is preferable to use the usual Stop Loss.

.

Close the position and you too will immediately avoid failures and gain peace of mind.

I'm out ..... Yusufkhoja, expecting you to be incapable of using a calculator is the height of cynicism, especially considering the article you posted on this forum. Pull yourself together and use a search engine and a calculator - you do trust mathematical estimations, this topic has been discussed and recalculated many times.

The disadvantage is that in some brokerage companies the trader will pay extra spread and swaps for nothing. There are no advantages.

It's not him, it's his son who's having fun on the forum, by the looks of it...

Gentlemen, if this topic comes up, I'd like to hear your feedback on one tactic... I'll give it below.

I would like to point out right away that I have a negative attitude towards lots and think they are nonsense, because when you use them, equity is the same as if you had just closed the position. In the case of the lot, we are freezing the deposit's equity and paying the spread and swaps. So, of course, it is much better to move everything to netting.

Anyway, there is such a tactic... all of the above is a quote:

Point 1: based on a combination of signals of the strategy used, tactics, your pet cat's behaviour and shortcuts on your desktop, you decide and open a BUY order with parameters like those shown in the image below.

When placing orders, I believe it would be reasonable to use a trawl which would be able to transfer a deal to Breakeven directly, i.e. without using an unprofitable Stop Loss. Again, automation is needed, which I mentioned earlier.

After opening a buy order at a distance, depending on the traded currency pair and your personal preferences, we set a pending Sell Stop order(point 2) using it as locking against the open Buy order.

And then the price, as it often happens with beginner traders, decided to turn against us!

A pending Sell Stop locking order with the parameters shown in the picture was triggered, I should immediately mention that the Take Profit parameter of this order is deliberately large (obviously unreachable by the price).

The price goes down and we have a certain fixed drawdown which nevertheless allows us to open sell orders at this time in order to take advantage of the downtrend movement and do our usual work. But surely sooner or later the moment will come when the price turns, somewhat above the turning point, we close one tenth (in our case 0.1 lot) of Sell Stop order and take a certain amount of profit points with a 0.1 lot by Sell Stop order (point number 3), then Sell Stop order works with a lot equal to 0.9 (we have closed from it 0.1 lots) at approaching of the price to level of opening of the order Sell Stop, or rather at some distance from it we close this order (manually or Stop Loss-ohm established in advance) having some more points of profit from it. And after closing at a distance from the point of closing, we again place the locking Sell Stop order (in general, as in the pictures below) in order to protect ourselves from possible downward movements of the trend.

So we lock at such a trend movement, but we may not lock here as Sell Stop order still works with 0.9 lot.

Accordingly, after the full closing of the locking order, we place one more pending Sell Stop as a locking order as a hedge against the depicted trend behavior.

And finally, here are a few points:

- when automating a non-stop trade, the function of deleting a pending (locking) order when the main order reaches the Breakeven level is advisable.

- when using the locking textics, find out completely and thoroughly the possible trend behavior options and ways to fight them.

- If you are using a locking tactic, you should thoroughly understand the possible trend behavior and ways to counteract it.

Gentlemen, if this topic has been broached, I would like to hear your feedback on one tactic... I will give it below.

I have personally recalculated a similar or similar (i.e. with similar lock orders) example several times in public at the request of lock supporters, by the way, I am not the only one who has done it. Search the threads - I'm bored.

If the brokerage company does not take an additional spread, if it does, the profit from a loss on this amount is less profitable than the profit from a stop. If the position is held for several days, a lock is even less profitable.