DoEasy. Controls (Part 18): Functionality for scrolling tabs in TabControl

In this article, I will place header scrolling control buttons in TabControl WinForms object in case the header bar does not fit the size of the control. Besides, I will implement the shift of the header bar when clicking on the cropped tab header.

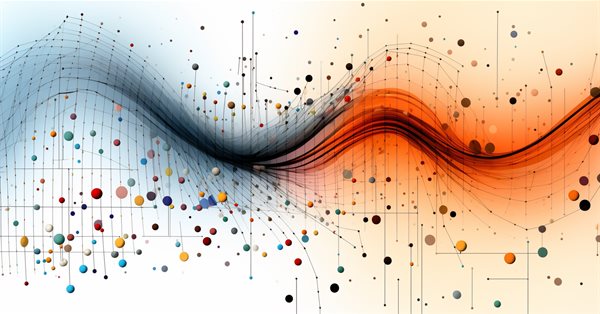

Fallacies, Part 2. Statistics Is a Pseudo-Science, or a Chronicle of Nosediving Bread And Butter

Numerous attempts to apply statistical methods to the objective reality, i.e. to financial series, crash when met with the nonstationarity of processes, "fat tails" of accompanying probability distributions, and insufficient volume of financial data.In this publication I will try to refer not to the financial series as such, but to their subjective presentation - in this case, to the way a trader tries to halter the series, i.e. to the trading system. The eduction of statistical regularities of the trading results process is a rather enthralling task. In some cases quite true conclusions about the model of this process can be made, and these can be applied to the trading system.

DoEasy. Controls (Part 9): Re-arranging WinForms object methods, RadioButton and Button controls

In this article, I will fix the names of WinForms object class methods and create Button and RadioButton WinForms objects.

How to add Trailing Stop using Parabolic SAR

When creating a trading strategy, we need to test a variety of protective stop options. Here is where a dynamic pulling up of the Stop Loss level following the price comes to mind. The best candidate for this is the Parabolic SAR indicator. It is difficult to think of anything simpler and visually clearer.

Developing a Replay System (Part 38): Paving the Path (II)

Many people who consider themselves MQL5 programmers do not have the basic knowledge that I will outline in this article. Many people consider MQL5 to be a limited tool, but the actual reason is that they do not have the required knowledge. So, if you don't know something, don't be ashamed of it. It's better to feel ashamed for not asking. Simply forcing MetaTrader 5 to disable indicator duplication in no way ensures two-way communication between the indicator and the Expert Advisor. We are still very far from this, but the fact that the indicator is not duplicated on the chart gives us some confidence.

Gain An Edge Over Any Market (Part V): FRED EURUSD Alternative Data

In today’s discussion, we used alternative Daily data from the St. Louis Federal Reserve on the Broad US-Dollar Index and a collection of other macroeconomic indicators to predict the EURUSD future exchange rate. Unfortunately, while the data appears to have almost perfect correlation, we failed to realize any material gains in our model accuracy, possibly suggesting to us that investors may be better off using ordinary market quotes instead.

DoEasy. Controls (Part 7): Text label control

In the current article, I will create the class of the WinForms text label control object. Such an object will have the ability to position its container anywhere, while its own functionality will repeat the functionality of the MS Visual Studio text label. We will be able to set font parameters for a displayed text.

Developing a trading Expert Advisor from scratch (Part 17): Accessing data on the web (III)

In this article we continue considering how to obtain data from the web and to use it in an Expert Advisor. This time we will proceed to developing an alternative system.

Price Action Analysis Toolkit Development (Part 27): Liquidity Sweep With MA Filter Tool

Understanding the subtle dynamics behind price movements can give you a critical edge. One such phenomenon is the liquidity sweep, a deliberate strategy that large traders, especially institutions, use to push prices through key support or resistance levels. These levels often coincide with clusters of retail stop-loss orders, creating pockets of liquidity that big players can exploit to enter or exit sizeable positions with minimal slippage.

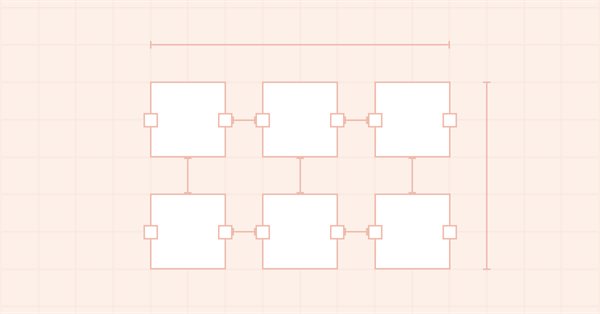

DoEasy. Controls (Part 4): Panel control, Padding and Dock parameters

In this article, I will implement handling Padding (internal indents/margin on all sides of an element) and Dock parameters (the way an object is located inside its container).

Filtering and feature extraction in the frequency domain

In this article we explore the application of digital filters on time series represented in the frequency domain so as to extract unique features that may be useful to prediction models.

DoEasy. Controls (Part 8): Base WinForms objects by categories, GroupBox and CheckBox controls

The article considers creation of 'GroupBox' and 'CheckBox' WinForms objects, as well as the development of base objects for WinForms object categories. All created objects are still static, i.e. they are unable to interact with the mouse.

DoEasy. Controls (Part 20): SplitContainer WinForms object

In the current article, I will start developing the SplitContainer control from the MS Visual Studio toolkit. This control consists of two panels separated by a vertical or horizontal movable separator.

From Novice to Expert: Support and Resistance Strength Indicator (SRSI)

In this article, we will share insights on how to leverage MQL5 programming to pinpoint market levels—differentiating between weaker and strongest price levels. We will fully develop a working, Support and Resistance Strength Indicator (SRSI).

Developing a Replay System — Market simulation (Part 04): adjusting the settings (II)

Let's continue creating the system and controls. Without the ability to control the service, it is difficult to move forward and improve the system.

The Statistic Analysis of Market Movements and Their Prognoses

The present article contemplates the wide opportunities of the statistic approach to marketing. Unfortunately, beginner traders deliberately fail to apply the really mighty science of statistics. Meanwhile, it is the only thing they use subconsciously while analyzing the market. Besides, statistics can give answers to many questions.

Build Self Optimizing Expert Advisors in MQL5 (Part 6): Stop Out Prevention

Join us in our discussion today as we look for an algorithmic procedure to minimize the total number of times we get stopped out of winning trades. The problem we faced is significantly challenging, and most solutions given in community discussions lack set and fixed rules. Our algorithmic approach to solving the problem increased the profitability of our trades and reduced our average loss per trade. However, there are further advancements to be made to completely filter out all trades that will be stopped out, our solution is a good first step for anyone to try.

Three-Dimensional Graphs - a Professional Tool of Market Analyzing

In this article we will write a simple library for the construction of 3D graphs and their further viewing in Microsoft Excel. We will use standard MQL4 options to prepare and export data into *.csv file.

Population optimization algorithms: Invasive Weed Optimization (IWO)

The amazing ability of weeds to survive in a wide variety of conditions has become the idea for a powerful optimization algorithm. IWO is one of the best algorithms among the previously reviewed ones.

Build Self Optimizing Expert Advisors With MQL5 And Python

In this article, we will discuss how we can build Expert Advisors capable of autonomously selecting and changing trading strategies based on prevailing market conditions. We will learn about Markov Chains and how they can be helpful to us as algorithmic traders.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 7): ZigZag with Awesome Oscillator Indicators Signal

The multi-currency expert advisor in this article is an expert advisor or automated trading that uses ZigZag indicator which are filtered with the Awesome Oscillator or filter each other's signals.

Graphics in DoEasy library (Part 99): Moving an extended graphical object using a single control point

In the previous article, I implemented the ability to move pivot points of an extended graphical object using control forms. Now I am going to implement the ability to move a composite graphical object using a single graphical object control point (form).

Frequency domain representations of time series: The Power Spectrum

In this article we discuss methods related to the analysis of timeseries in the frequency domain. Emphasizing the utility of examining the power spectra of time series when building predictive models. In this article we will discuss some of the useful perspectives to be gained by analyzing time series in the frequency domain using the discrete fourier transform (dft).

Graphics in DoEasy library (Part 84): Descendant classes of the abstract standard graphical object

In this article, I will consider creation of descendant objects for the terminal abstract standard graphical object. The class object describes the properties that are common for all graphical objects. So, it is simply some kind of a graphical object. To clarify its affiliation with a real graphical object, we need to set the properties inherent in this particular graphical object in the descendant object class.

Tricolor Indicators and Some Opportunities for Maximal Simplification of Writing Indicators

In this article the author dwells on some means of increasing indicators' informational value for visual trading. The author analyzes the realization of tricolor indicators, indicators, for building which data from other timeframes is used, and continues to dwell on the library of indicators, described in the article "Effective Averaging Algorithms with Minimal Lag: Use in Indicators"

Secrets of MetaTrader 4 Client Terminal: File Library in MetaEditor

When creating custom programs, code editor is of great importance. The more functions are available in the editor, the faster and more convenient is creation of the program. Many programs are created on basis of an already existing code. Do you use an indicator or a script that does not fully suit your purposes? Download the code of this program from our website and customize it for yourselves.

Population optimization algorithms: Shuffled Frog-Leaping algorithm (SFL)

The article presents a detailed description of the shuffled frog-leaping (SFL) algorithm and its capabilities in solving optimization problems. The SFL algorithm is inspired by the behavior of frogs in their natural environment and offers a new approach to function optimization. The SFL algorithm is an efficient and flexible tool capable of processing a variety of data types and achieving optimal solutions.

Graphics in DoEasy library (Part 92): Standard graphical object memory class. Object property change history

In the article, I will create the class of the standard graphical object memory allowing the object to save its states when its properties are modified. In turn, this allows retracting to the previous graphical object states.

Build Self Optimizing Expert Advisors in MQL5 (Part 3): Dynamic Trend Following and Mean Reversion Strategies

Financial markets are typically classified as either in a range mode or a trending mode. This static view of the market may make it easier for us to trade in the short run. However, it is disconnected from the reality of the market. In this article, we look to better understand how exactly financial markets move between these 2 possible modes and how we can use our new understanding of market behavior to gain confidence in our algorithmic trading strategies.

Population optimization algorithms: ElectroMagnetism-like algorithm (ЕМ)

The article describes the principles, methods and possibilities of using the Electromagnetic Algorithm in various optimization problems. The EM algorithm is an efficient optimization tool capable of working with large amounts of data and multidimensional functions.

A Non-Trading EA Testing Indicators

All indicators can be divided into two groups: static indicators, the displaying of which, once shown, always remains the same in history and does not change with new incoming quotes, and dynamic indicators that display their status for the current moment only and are fully redrawn when a new price comes. The efficiency of a static indicator is directly visible on the chart. But how can we check whether a dynamic indicator works ok? This is the question the article is devoted to.

Requirements Applicable to Articles Offered for Publishing at MQL4.com

Requirements Applicable to Articles Offered for Publishing at MQL4.com

Timeseries in DoEasy library (part 51): Composite multi-period multi-symbol standard indicators

In the article, complete development of objects of multi-period multi-symbol standard indicators. Using Ichimoku Kinko Hyo standard indicator example, analyze creation of compound custom indicators which have auxiliary drawn buffers for displaying data on the chart.

A Trader's Assistant Based on Extended MACD Analysis

Script 'Trader's Assistant' helps you to make a decision on opening positions, based on the extended analysis of the MACD status for the last three bars in the real-time trading on any timeframe. It can also be used for back testing.

Сode Lock Algorithm (CLA)

In this article, we will rethink code locks, transforming them from security mechanisms into tools for solving complex optimization problems. Discover the world of code locks viewed not as simple security devices, but as inspiration for a new approach to optimization. We will create a whole population of "locks", where each lock represents a unique solution to the problem. We will then develop an algorithm that will "pick" these locks and find optimal solutions in a variety of areas, from machine learning to trading systems development.

Developing a Replay System (Part 53): Things Get Complicated (V)

In this article, we'll cover an important topic that few people understand: Custom Events. Dangers. Advantages and disadvantages of these elements. This topic is key for those who want to become a professional programmer in MQL5 or any other language. Here we will focus on MQL5 and MetaTrader 5.

Building a Candlestick Trend Constraint Model (Part 9): Multiple Strategies Expert Advisor (III)

Welcome to the third installment of our trend series! Today, we’ll delve into the use of divergence as a strategy for identifying optimal entry points within the prevailing daily trend. We’ll also introduce a custom profit-locking mechanism, similar to a trailing stop-loss, but with unique enhancements. In addition, we’ll upgrade the Trend Constraint Expert to a more advanced version, incorporating a new trade execution condition to complement the existing ones. As we move forward, we’ll continue to explore the practical application of MQL5 in algorithmic development, providing you with more in-depth insights and actionable techniques.

DoEasy. Controls (Part 32): Horizontal ScrollBar, mouse wheel scrolling

In the article, we will complete the development of the horizontal scrollbar object functionality. We will also make it possible to scroll the contents of the container by moving the scrollbar slider and rotating the mouse wheel, as well as make additions to the library, taking into account the new order execution policy and new runtime error codes in MQL5.

Measuring Indicator Information

Machine learning has become a popular method for strategy development. Whilst there has been more emphasis on maximizing profitability and prediction accuracy , the importance of processing the data used to build predictive models has not received a lot of attention. In this article we consider using the concept of entropy to evaluate the appropriateness of indicators to be used in predictive model building as documented in the book Testing and Tuning Market Trading Systems by Timothy Masters.

Considering Orders in a Large Program

General principles of considering orders in a large and complex program are discussed.