Data label for timeseries mining (Part 2):Make datasets with trend markers using Python

Introduction

In the previous article, we introduced how to Label your data by observing trends on chart and save the data into a "csv" file. In this part let's think differently: start with the data itself.

We will process the data using Python. Why Python? Because it's convenient and fast, it's not means it runs fast, but Python's massive library can help us greatly reduce the development cycle.

So, let's go!

Table of contents:

- Which Python library to choose

- Get data from MT5 client using MetaTrader5 library

- Data format conversion

- Label data

- Manual proofreading

- Summary

Which Python library to choose

We all know that Python has a lot of excellent developers to provide a large variety of libraries, which makes it easy for us to develop, saving us a lot of development time. The following is my collection of some related python libraries, some of which are based on different architectures, some can be used for trading, some can be used for backtesting. It's including but not limited to labeled data, interested can try to study it, this article does not do a detailed introduction.

- statsmodels - Python module that allows users to explore data, estimate statistical models, and perform statistical tests:http://statsmodels.sourceforge.net

- dynts - Python package for timeseries analysis and manipulation:https://github.com/quantmind/dynts

- PyFlux - Python library for timeseries modelling and inference (frequentist and Bayesian) on models:https://github.com/RJT1990/pyflux

- tsfresh - Automatic extraction of relevant features from time series:https://github.com/blue-yonder/tsfresh

- hasura/quandl-metabase - Hasura quickstart to visualize Quandl's timeseries datasets with Metabase:https://platform.hasura.io/hub/projects/anirudhm/quandl-metabase-time-series

- Facebook Prophet - Tool for producing high quality forecasts for time series data that has multiple seasonality with linear or non-linear growth:https://github.com/facebook/prophet

- tsmoothie - A python library for time-series smoothing and outlier detection in a vectorized way:https://github.com/cerlymarco/tsmoothie

- pmdarima - A statistical library designed to fill the void in Python's time series analysis capabilities, including the equivalent of R's auto.arima function:https://github.com/alkaline-ml/pmdarima

- gluon-ts - vProbabilistic time series modeling in Python:https://github.com/awslabs/gluon-ts

- gs-quant - Python toolkit for quantitative finance:https://github.com/goldmansachs/gs-quant

- willowtree - Robust and flexible Python implementation of the willow tree lattice for derivatives pricing:https://github.com/federicomariamassari/willowtree

- financial-engineering - Applications of Monte Carlo methods to financial engineering projects, in Python:https://github.com/federicomariamassari/financial-engineering

- optlib - A library for financial options pricing written in Python:https://github.com/dbrojas/optlib

- tf-quant-finance - High-performance TensorFlow library for quantitative finance:https://github.com/google/tf-quant-finance

- Q-Fin - A Python library for mathematical finance:https://github.com/RomanMichaelPaolucci/Q-Fin

- Quantsbin - Tools for pricing and plotting of vanilla option prices, greeks and various other analysis around them:https://github.com/quantsbin/Quantsbin

- finoptions - Complete python implementation of R package fOptions with partial implementation of fExoticOptions for pricing various options:https://github.com/bbcho/finoptions-dev

- pypme - PME (Public Market Equivalent) calculation:https://github.com/ymyke/pypme

- Blankly - Fully integrated backtesting, paper trading, and live deployment:https://github.com/Blankly-Finance/Blankly

- TA-Lib - Python wrapper for TA-Lib (http://ta-lib.org/):https://github.com/mrjbq7/ta-lib

- zipline - Pythonic algorithmic trading library:https://github.com/quantopian/zipline

- QuantSoftware Toolkit - Python-based open source software framework designed to support portfolio construction and management:https://github.com/QuantSoftware/QuantSoftwareToolkit

- finta - Common financial technical analysis indicators implemented in Pandas:https://github.com/peerchemist/finta

- Tulipy - Financial Technical Analysis Indicator Library (Python bindings for tulipindicators):https://github.com/cirla/tulipy

- lppls - A Python module for fitting the Log-Periodic Power Law Singularity (LPPLS) model:https://github.com/Boulder-Investment-Technologies/lppls

Get data from MT5 client using MetaTrader5 library

Of course, the most basic thing is that python is already installed on your PC, if not, the author does not recommend installing the official version of python, but prefers to use Anaconda, which is easy to maintain. But the normal version of Anaconda is huge, integrates rich content, including visual management, editor, etc., embarrassingly I hardly use them, so I highly recommend mininconda, short and concise, simple and practical.Miniconda official website address: Miniconda :: Anaconda.org

1. Basic environment initialization

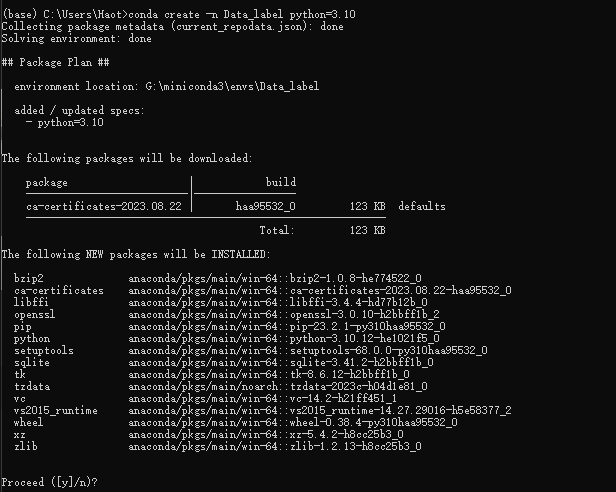

Start by creating a virtual environment and open the Anaconda Promote type:

conda create -n Data_label python=3.10

Enter "y" and wait for the environment to be created,then type:

conda activate Data_label

Note:When we create the conda virtual environment, remember to add python=x.xx, otherwise we will encounter inexplicable trouble during use, which is a suggestion from a person who has suffered from it!

2. Install necessary library

Install our essential library MetaTrader 5, type in the conda Promote:

pip install MetaTrader5

Install pytrendseries, type in the conda Promote:

pip install pytrendseries

3. Create python file

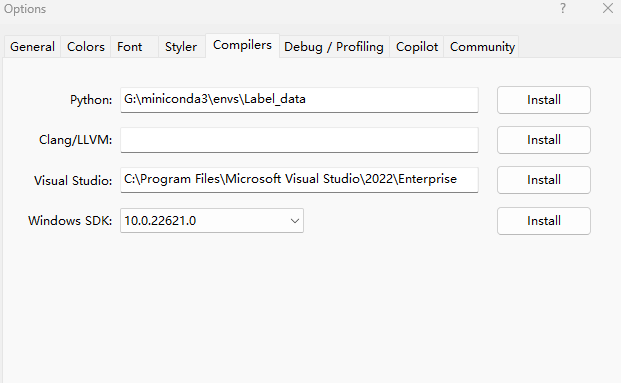

Open MetaEditor, find Tools->Options, fill in your python path in the python column of the Compilers option, my own path is "G:miniconda3\envs\Data_label":

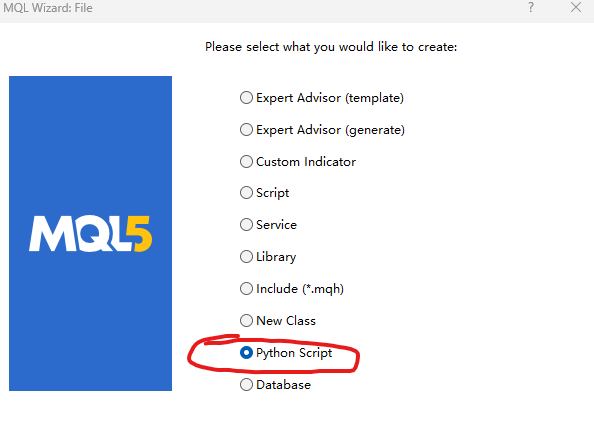

After completion, select File->New (or Ctrl + N) to create a new file, and select Python Script in the pop-up window, like this:

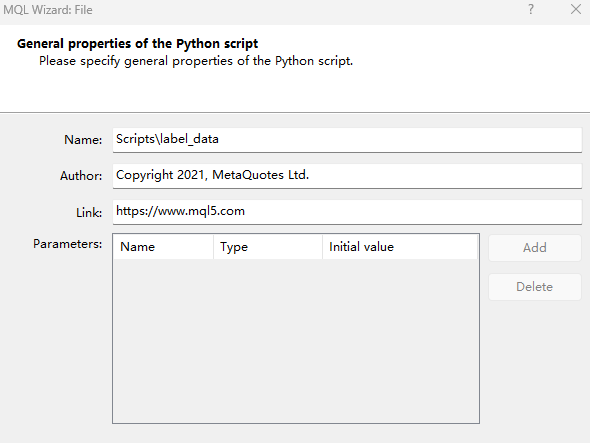

Click Next and type a file name,like this:

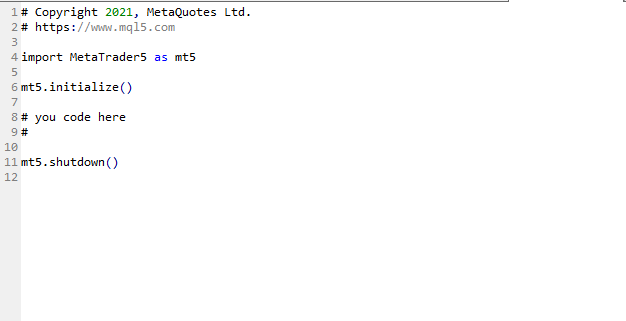

After clicking OK, the window below is shown:

4. Connecting the client and gets data

Delete the original auto-generated code and replace it with the following code:

# Copyright 2021, MetaQuotes Ltd. # https://www.mql5.com import MetaTrader5 as mt if not mt.initialize(): print('initialize() failed!') else: print(mt.version()) mt.shutdown()

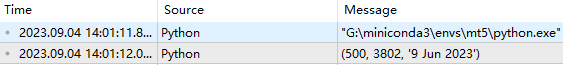

Compile and run to see if any error is reported, and if there is no problem, the following output will appear:

If you prompt "initialize() failed!", please add the parameter path in the initialize() function, which is the path to the client executable, as shown in the following color-weighted code:

# Copyright 2021, MetaQuotes Ltd. # https://www.mql5.com import MetaTrader5 as mt if not mt.initialize("D:\\Project\\mt\\MT5\\terminal64.exe"): print('initialize() failed!') else: print(mt.version()) mt.shutdown()Everything is ready, let's get the data:

# Copyright 2021, MetaQuotes Ltd. # https://www.mql5.com import MetaTrader5 as mt if not mt.initialize("D:\\Project\\mt\\MT5\\terminal64.exe"): print('initialize() failed!') else: sb=mt.symbols_total() rts=None if sb > 0: rts=mt.copy_rates_from_pos("GOLD_micro",mt.TIMEFRAME_M15,0,10000) mt.shutdown() print(rts[0:5])

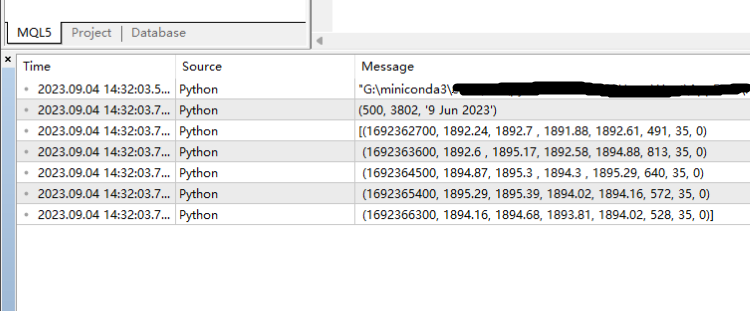

In the above code we added "sb=mt.symbols_total()" to prevent the error from being reported because no symbols were detected, and "copy_rates_from_pos("GOLD_micro", mt. TIMEFRAME_M15,0,10000)" means copying 10,000 bars from the GOLD_micro's M15 period, and the following output will be produced after compilation:

So far, we have successfully obtained the data from the client.

Data format conversion

Although we have obtained the data from the client, the data format is not we need.The data is "numpy.ndarray",like this:

"[(1692368100, 1893.51, 1893.97,1893.08,1893.88,548, 35, 0)

(1692369000, 1893.88, 1894.51, 1893.41, 1894.51, 665, 35, 0)

(1692369900, 1894.5, 1894.91, 1893.25, 1893.62, 755, 35, 0)

(1692370800, 1893.68, 1894.7 , 1893.16, 1893.49, 1108, 35, 0)

(1692371700, 1893.5 , 1893.63, 1889.43, 1889.81, 1979, 35, 0)

(1692372600, 1889.81, 1891.23, 1888.51, 1891.04, 2100, 35, 0)

(1692373500, 1891.04, 1891.3 , 1889.75, 1890.07, 1597, 35, 0)

(1692374400, 1890.11, 1894.03, 1889.2, 1893.57, 2083, 35, 0)

(1692375300, 1893.62, 1894.94, 1892.97, 1894.25, 1692, 35, 0)

(1692376200, 1894.25, 1894.88, 1890.72, 1894.66, 2880, 35, 0)

(1692377100, 1894.67, 1896.69, 1892.47, 1893.68, 2930, 35, 0)

...(1693822500, 1943.97, 1944.28, 1943.24, 1943.31, 883, 35, 0)

(1693823400, 1943.25, 1944.13, 1942.95, 1943.4 , 873, 35, 0)

(1693824300, 1943.4, 1944.07, 1943.31, 1943.64, 691, 35, 0)

(1693825200, 1943.73, 1943.97, 1943.73, 1943.85, 22, 35, 0)]"

So let's use pandas to convert it,the added code is marked in green:

# Copyright 2021, MetaQuotes Ltd. # https://www.mql5.com import MetaTrader5 as mt import pandas as pd if not mt.initialize("D:\\Project\\mt\\MT5\\terminal64.exe"): print('initialize() failed!') else: print(mt.version()) sb=mt.symbols_total() rts=None if sb > 0: rts=mt.copy_rates_from_pos("GOLD_micro",mt.TIMEFRAME_M15,0,1000) mt.shutdown() rts_fm=pd.DataFrame(rts)

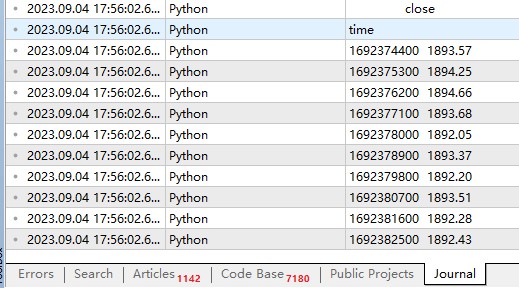

Now look at the data format again as below:

print(rts_fm.head(10))

td_data=rts_fm[['time','close']].set_index('time') Let's see what the first 10 rows of data look like:

print(td_data.head(10))

Note: The "td_data" is not our last data style, it is just a transition product for us to obtain data trends.

Now,our data is fully usable,but for the sake of subsequent operations, it is better to convert our date format to a dataframe, so we should add the following code before the "td_data=rts_fm[['time','close']].set_index('time')":

rts_fm['time']=pd.to_datetime(rts_fm['time'], unit='s')

And our output will look like this:

| time | close |

|---|---|

| 2023-08-18 20:45:00 | 1888.82000 |

| 2023-08-18 21:00:00 | 1887.53000 |

| 2023-08-18 21:15:00 | 1888.10000 |

| 2023-08-18 21:30:00 | 1888.98000 |

| 2023-08-18 21:45:00 | 1888.37000 |

| 2023-08-18 22:00:00 | 1887.51000 |

| 2023-08-18 22:15:00 | 1888.21000 |

| 2023-08-18 22:30:00 | 1888.73000 |

| 2023-08-18 22:45:00 | 1889.12000 |

| 2023-08-18 23:00:00 | 1889.20000 |

The complete code for this section:

# Copyright 2021, MetaQuotes Ltd. # https://www.mql5.com import MetaTrader5 as mt import pandas as pd if not mt.initialize("D:\\Project\\mt\\MT5\\terminal64.exe"): print('initialize() failed!') else: print(mt.version()) sb=mt.symbols_total() rts=None if sb > 0: rts=mt.copy_rates_from_pos("GOLD_micro",mt.TIMEFRAME_M15,0,1000) mt.shutdown() rts_fm=pd.DataFrame(rts) rts_fm['time']=pd.to_datetime(rts_fm['time'], unit='s') td_data=rts_fm[['time','close']].set_index('time') print(td_data.head(10))

Label data

1. Get trend data

First import the "pytrendseries" package:

import pytrendseries as pts We use the "pts.detecttrend()" function to find trend, then define "td" variable for this function and there are two options for this parameter-"downtrend" or "uptrend":

td='downtrend' # or "uptrend"

We need another parameter "wd" as maximum period of a trend:

wd=120 There is also a parameter that may or may not be defined, but I personally think it is better to define it,this parameter specifies the minimum period of the trend:

limit=6 Now we can fill the parameters into the function to get the trend:

trends=pts.detecttrend(td_data,trend=td,limit=limit,window=wd)

Then check the result:

print(trends.head(15))

| from | to | price0 | price1 | index_from | index_to | time_span | drawdown | |

|---|---|---|---|---|---|---|---|---|

| 1 | 2023-08-21 01:00:00 | 2023-08-21 02:15:00 | 1890.36000 | 1889.24000 | 13 | 18 | 5 | 0.00059 |

| 2 | 2023-08-21 03:15:00 | 2023-08-21 04:45:00 | 1890.61000 | 1885.28000 | 22 | 28 | 6 | 0.00282 |

| 3 | 2023-08-21 08:00:00 | 2023-08-21 13:15:00 | 1893.30000 | 1886.86000 | 41 | 62 | 21 | 0.00340 |

| 4 | 2023-08-21 15:45:00 | 2023-08-21 17:30:00 | 1896.99000 | 1886.16000 | 72 | 79 | 7 | 0.00571 |

| 5 | 2023-08-21 20:30:00 | 2023-08-21 22:30:00 | 1894.77000 | 1894.12000 | 91 | 99 | 8 | 0.00034 |

| 6 | 2023-08-22 04:15:00 | 2023-08-22 05:45:00 | 1896.19000 | 1894.31000 | 118 | 124 | 6 | 0.00099 |

| 7 | 2023-08-22 06:15:00 | 2023-08-22 07:45:00 | 1896.59000 | 1893.80000 | 126 | 132 | 6 | 0.00147 |

| 8 | 2023-08-22 13:00:00 | 2023-08-22 16:45:00 | 1903.38000 | 1890.17000 | 153 | 168 | 15 | 0.00694 |

| 9 | 2023-08-22 19:00:00 | 2023-08-22 21:15:00 | 1898.08000 | 1896.25000 | 177 | 186 | 9 | 0.00096 |

| 10 | 2023-08-23 04:45:00 | 2023-08-23 06:00:00 | 1901.46000 | 1900.25000 | 212 | 217 | 5 | 0.00064 |

| 11 | 2023-08-23 11:30:00 | 2023-08-23 13:30:00 | 1904.84000 | 1901.42000 | 239 | 247 | 8 | 0.00180 |

| 12 | 2023-08-23 19:45:00 | 2023-08-23 23:30:00 | 1919.61000 | 1915.05000 | 272 | 287 | 15 | 0.00238 |

| 13 | 2023-08-24 09:30:00 | 2023-08-25 09:45:00 | 1921.91000 | 1912.93000 | 323 | 416 | 93 | 0.00467 |

| 14 | 2023-08-25 15:00:00 | 2023-08-25 16:30:00 | 1919.88000 | 1913.30000 | 437 | 443 | 6 | 0.00343 |

| 15 | 2023-08-28 04:15:00 | 2023-08-28 07:15:00 | 1916.92000 | 1915.07000 | 486 | 498 | 12 | 0.00097 |

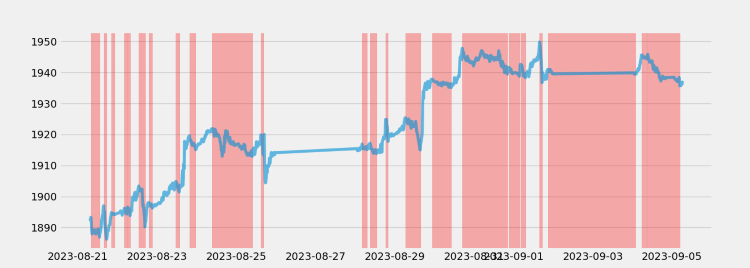

You can also visualize the result through the function "pts.vizplot.plot_trend()":

pts.vizplot.plot_trend(td_data,trends)

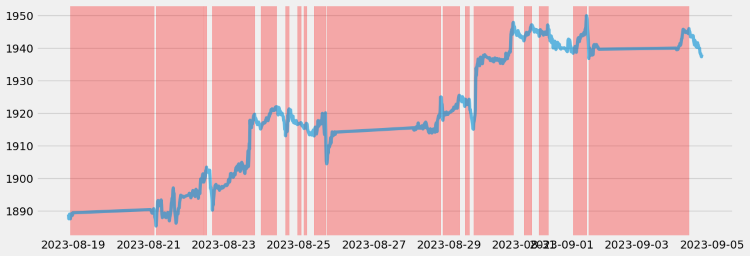

Similarly, we can look at the uptrend by code:

td="uptrend" wd=120 limit=6 trends=pts.detecttrend(td_data,trend=td,limit=limit,window=wd) print(trends.head(15)) pts.vizplot.plot_trend(td_data,trends)

The result is this:

| from | to | price0 | price1 | index_from | index_to | time_span | drawup | |

|---|---|---|---|---|---|---|---|---|

| 1 | 2023-08-18 22:00:00 | 2023-08-21 03:15:00 | 1887.51000 | 1890.61000 | 5 | 22 | 17 | 0.00164 |

| 2 | 2023-08-21 04:45:00 | 2023-08-22 10:45:00 | 1885.28000 | 1901.35000 | 28 | 144 | 116 | 0.00852 |

| 3 | 2023-08-22 11:15:00 | 2023-08-22 13:00:00 | 1898.78000 | 1903.38000 | 146 | 153 | 7 | 0.00242 |

| 4 | 2023-08-22 16:45:00 | 2023-08-23 19:45:00 | 1890.17000 | 1919.61000 | 168 | 272 | 104 | 0.01558 |

| 5 | 2023-08-23 23:30:00 | 2023-08-24 09:30:00 | 1915.05000 | 1921.91000 | 287 | 323 | 36 | 0.00358 |

| 6 | 2023-08-24 15:30:00 | 2023-08-24 17:45:00 | 1912.97000 | 1921.24000 | 347 | 356 | 9 | 0.00432 |

| 7 | 2023-08-24 23:00:00 | 2023-08-25 01:15:00 | 1916.41000 | 1917.03000 | 377 | 382 | 5 | 0.00032 |

| 8 | 2023-08-25 03:15:00 | 2023-08-25 04:45:00 | 1915.20000 | 1916.82000 | 390 | 396 | 6 | 0.00085 |

| 9 | 2023-08-25 09:45:00 | 2023-08-25 17:00:00 | 1912.93000 | 1920.03000 | 416 | 445 | 29 | 0.00371 |

| 10 | 2023-08-25 17:45:00 | 2023-08-28 18:30:00 | 1904.37000 | 1924.86000 | 448 | 543 | 95 | 0.01076 |

| 11 | 2023-08-28 20:00:00 | 2023-08-29 06:30:00 | 1917.74000 | 1925.41000 | 549 | 587 | 38 | 0.00400 |

| 12 | 2023-08-29 10:00:00 | 2023-08-29 12:45:00 | 1922.00000 | 1924.21000 | 601 | 612 | 11 | 0.00115 |

| 13 | 2023-08-29 15:30:00 | 2023-08-30 17:00:00 | 1914.98000 | 1947.79000 | 623 | 721 | 98 | 0.01713 |

| 14 | 2023-08-30 23:45:00 | 2023-08-31 04:45:00 | 1942.09000 | 1947.03000 | 748 | 764 | 16 | 0.00254 |

| 15 | 2023-08-31 09:30:00 | 2023-08-31 15:00:00 | 1943.52000 | 1947.00000 | 783 | 805 | 22 | 0.00179 |

2. Label the data

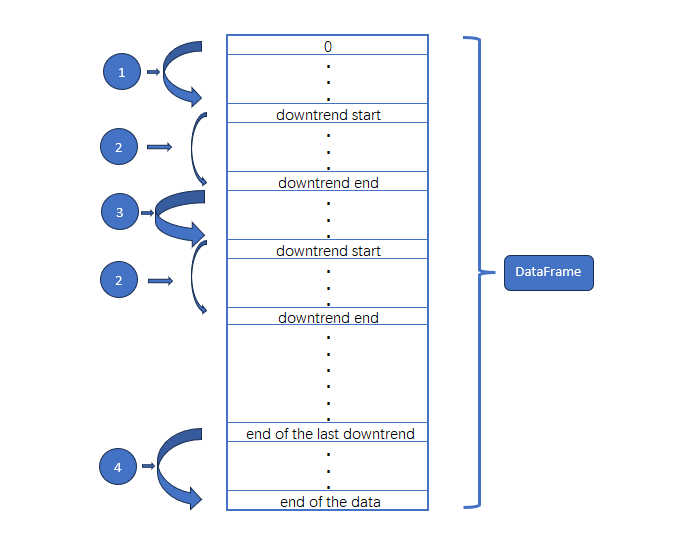

1). Parse the data format

① means the beginning of the data to the beginning of the first downtrend,let's assume this is an uptrend;

② means the downtrend;

③ means the uptrend in the middle of the data;

④ means the end of last downtrend.

So we must implement the label logic for these four parts.

2). label logic

Let's start by defining some basic variables:

rts_fm['trend']=0 rts_fm['trend_index']=0 max_len_rts=len(rts_fm) max_len=len(trends) last_start=0 last_end=0

Traverse the "trends" variable with a for loop to get the beginning and end of each piece of data:

for trend in trends.iterrows():

pass Gets the start and end indexes for each segment:

for trend in trends.iterrows(): start=trend[1]['index_from'] end=trend[1]['index_to']

Because the rts_fm["trend"] itself has been initialized to 0, there is no need to change the "trend" column of the uptrend, but we need to see if the start of the data is a downtrend,if it is not a downtrend, we assumed it to be an uptrend:

for trend in trends.iterrows(): start=trend[1]['index_from'] end=trend[1]['index_to'] if trend[0]==1 and start!=0: # Since the rts_fm["trend"] itself has been initialized to 0, there is no need to change the "trend" column rts_fm['trend_index'][0:start]=list(range(0,start))

As the same as the beginning of the data, we need to see if it ends in a downtrend at the end of the data:

for trend in trends.iterrows(): start=trend[1]['index_from'] end=trend[1]['index_to'] if trend[0]==1 and start!=0: # Since the rts_fm["trend"] itself has been initialized to 0, there is no need to change the "trend" column rts_fm['trend_index'][0:start]=list(range(0,start)) elif trend[0]==max_len and end!=max_len_rts-1: #we need to see if it ends in a downtrend at the end of the data rts_fm['trend_index'][last_end+1:len(rts_fm)]=list(range(0,max_len_rts-last_end-1))

Process the uptrend segments other than the beginning and end of the data:

for trend in trends.iterrows(): start=trend[1]['index_from'] end=trend[1]['index_to'] if trend[0]==1 and start!=0: # Since the rts_fm["trend"] itself has been initialized to 0, there is no need to change the "trend" column rts_fm['trend_index'][0:start]=list(range(0,start)) elif trend[0]==max_len and end!=max_len_rts-1: #we need to see if it ends in a downtrend at the end of the data rts_fm['trend_index'][last_end+1:len(rts_fm)]=list(range(0,max_len_rts-last_end-1)) else: #Process the uptrend segments other than the beginning and end of the data rts_fm["trend_index"][last_end+1:start]=list(range(0,start-last_end-1))

Process each segments of the downtrend:

for trend in trends.iterrows(): start=trend[1]['index_from'] end=trend[1]['index_to'] if trend[0]==1 and start!=0: # Since the rts_fm["trend"] itself has been initialized to 0, there is no need to change the "trend" column rts_fm['trend_index'][0:start]=list(range(0,start)) elif trend[0]==max_len and end!=max_len_rts-1: #we need to see if it ends in a downtrend at the end of the data rts_fm['trend_index'][last_end+1:len(rts_fm)]=list(range(0,max_len_rts-last_end-1)) else: #Process the uptrend segments other than the beginning and end of the data rts_fm["trend_index"][last_end+1:start]=list(range(0,start-last_end-1)) #Process each segments of the downtrend rts_fm["trend"][start:end+1]=1 rts_fm["trend_index"][start:end+1]=list(range(0,end-start+1)) last_start=start last_end=end

3). supplement

We assume that the beginning and end of the data are uptrending, and if you think this is not precise enough, you can also remove the beginning and ending parts. To do this, add the following code after the for loop ends:

rts_fm['trend']=0 rts_fm['trend_index']=0 max_len_rts=len(rts_fm) max_len=len(trends) last_start=0 last_end=0 for trend in trends.iterrows(): start=trend[1]['index_from'] end=trend[1]['index_to'] if trend[0]==1 and start!=0: # Since the rts_fm["trend"] itself has been initialized to 0, there is no need to change the "trend" column rts_fm['trend_index'][0:start]=list(range(0,start)) elif trend[0]==max_len and end!=max_len_rts-1: #we need to see if it ends in a downtrend at the end of the data rts_fm['trend_index'][last_end+1:len(rts_fm)]=list(range(0,max_len_rts-last_end-1)) else: #Process the uptrend segments other than the beginning and end of the data rts_fm["trend_index"][last_end+1:start]=list(range(0,start-last_end-1)) #Process each segments of the downtrend rts_fm["trend"][start:end+1]=1 rts_fm["trend_index"][start:end+1]=list(range(0,end-start+1)) last_start=start last_end=end rts_fm=rts_fm.iloc[trends.iloc[0,:]['index_from']:end,:]

3.Check

Once we've done that, let's see if our data meets our expectations(The example looks only at the first 25 pieces of data):

rts_fm.head(25) | time | open | high | low | close | tick_volume | spread | real_volume | trend | trend_index | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2023-08-22 11:30:00 | 1898.80000 | 1899.72000 | 1898.22000 | 1899.30000 | 877 | 35 | 0 | 0 | 0 |

| 1 | 2023-08-22 11:45:00 | 1899.31000 | 1899.96000 | 1898.84000 | 1899.81000 | 757 | 35 | 0 | 0 | 1 |

| 2 | 2023-08-22 12:00:00 | 1899.86000 | 1900.50000 | 1899.24000 | 1900.01000 | 814 | 35 | 0 | 0 | 2 |

| 3 | 2023-08-22 12:15:00 | 1900.05000 | 1901.26000 | 1899.99000 | 1900.48000 | 952 | 35 | 0 | 0 | 3 |

| 4 | 2023-08-22 12:30:00 | 1900.48000 | 1902.44000 | 1900.17000 | 1902.19000 | 934 | 35 | 0 | 0 | 4 |

| 5 | 2023-08-22 12:45:00 | 1902.23000 | 1903.59000 | 1902.21000 | 1902.64000 | 891 | 35 | 0 | 0 | 5 |

| 6 | 2023-08-22 13:00:00 | 1902.69000 | 1903.94000 | 1902.24000 | 1903.38000 | 873 | 35 | 0 | 1 | 0 |

| 7 | 2023-08-22 13:15:00 | 1903.40000 | 1904.29000 | 1901.71000 | 1902.08000 | 949 | 35 | 0 | 1 | 1 |

| 8 | 2023-08-22 13:30:00 | 1902.10000 | 1903.37000 | 1902.08000 | 1902.63000 | 803 | 35 | 0 | 1 | 2 |

| 9 | 2023-08-22 13:45:00 | 1902.64000 | 1902.75000 | 1901.75000 | 1901.80000 | 1010 | 35 | 0 | 1 | 3 |

| 10 | 2023-08-22 14:00:00 | 1901.79000 | 1902.47000 | 1901.33000 | 1901.96000 | 800 | 35 | 0 | 1 | 4 |

| 11 | 2023-08-22 14:15:00 | 1901.94000 | 1903.04000 | 1901.72000 | 1901.73000 | 785 | 35 | 0 | 1 | 5 |

| 12 | 2023-08-22 14:30:00 | 1901.71000 | 1902.62000 | 1901.66000 | 1902.38000 | 902 | 35 | 0 | 1 | 6 |

| 13 | 2023-08-22 14:45:00 | 1902.38000 | 1903.23000 | 1901.96000 | 1901.96000 | 891 | 35 | 0 | 1 | 7 |

| 14 | 2023-08-22 15:00:00 | 1901.94000 | 1903.25000 | 1901.64000 | 1902.41000 | 1209 | 35 | 0 | 1 | 8 |

| 15 | 2023-08-22 15:15:00 | 1902.39000 | 1903.00000 | 1898.97000 | 1899.87000 | 1971 | 35 | 0 | 1 | 9 |

| 16 | 2023-08-22 15:30:00 | 1899.86000 | 1901.17000 | 1896.72000 | 1896.85000 | 2413 | 35 | 0 | 1 | 10 |

| 17 | 2023-08-22 15:45:00 | 1896.85000 | 1898.15000 | 1896.12000 | 1897.26000 | 2010 | 35 | 0 | 1 | 11 |

| 18 | 2023-08-22 16:00:00 | 1897.29000 | 1897.45000 | 1895.52000 | 1895.97000 | 2384 | 35 | 0 | 1 | 12 |

| 19 | 2023-08-22 16:15:00 | 1895.96000 | 1896.31000 | 1893.87000 | 1894.48000 | 1990 | 35 | 0 | 1 | 13 |

| 20 | 2023-08-22 16:30:00 | 1894.43000 | 1894.60000 | 1892.64000 | 1893.38000 | 2950 | 35 | 0 | 1 | 14 |

| 21 | 2023-08-22 16:45:00 | 1893.48000 | 1894.17000 | 1888.94000 | 1890.17000 | 2970 | 35 | 0 | 1 | 15 |

| 22 | 2023-08-22 17:00:00 | 1890.19000 | 1894.53000 | 1889.94000 | 1894.20000 | 2721 | 35 | 0 | 0 | 0 |

| 23 | 2023-08-22 17:15:00 | 1894.18000 | 1894.73000 | 1891.51000 | 1891.71000 | 1944 | 35 | 0 | 0 | 1 |

| 24 | 2023-08-22 17:30:00 | 1891.74000 | 1893.70000 | 1890.91000 | 1893.59000 | 2215 | 35 | 0 | 0 | 2 |

You can see that we successfully added trend types and trend index markers to the data.

4. Save the file

We can save the data in most file formats that we want,you can save as a JSON file using the to_json() method, you can save as an HTML file using the to_html() method, and so on.Only saving as a CSV file is used here as a demonstration,at the end of the code to add:

rts_fm.to_csv('GOLD_micro_M15.csv') Manual proofreading

At this point, we have done the basic work,but if we want to get more precise data, we need further human intervention, we will only point out a few directions here, and will not make a detailed demonstration.

1.Data integrity checks

Completeness refers to whether data information is missing, which may be the absence of the entire data or the absence of a field in the data. Data integrity is one of the most fundamental evaluation criteria for data quality.For example,if the previous data in the M15 period stock market data differs by 2 hours from the next data, then we need to use the corresponding tools to complete the data.Of course, it is generally difficult to get foreign exchange data or stock market data obtained from our client terminal, but if you get time series from other sources such as traffic data or weather data , you need to pay special attention to this situation.

The integrity of data quality is relatively easy to assess, and can generally be evaluated by the recorded and unique values in the data statistics. For example, if a stock price data in the previous period the Close price is 1000, but the Open price becomes 10 in the next period, you need to check if the data is missing.

2.Check the accuracy of data labeling

From the perspective of this article, the data labeling method we implemented above may have certain vulnerabilities, we can not only rely on the methods provided in the pytrendseries library to obtain accurate labeling data, but also need to visualize the data, observe whether the trend classification of the data is too susceptible or dullness, so that some key information is missed, at this time we need to analyze the data, if should be broken down then broken down , if should be merged needs to be merged.This work requires a lot of effort and time to complete, and concrete examples are not provided here for the time being.

Accuracy refers to whether the information recorded in the data and whether the data is accurate, and whether the information recorded in the data is abnormal or wrong. Unlike consistency, data with accuracy issues is not just inconsistencies in rules. Consistency issues can be caused by inconsistent rules for data logging, but not necessarily errors.

3.Do some basic statistical verification to see if the labels are reasonable

- Integrity Distribution:Quickly and intuitively see the completeness of the data set.

- Heatmap:Heat maps make it easy to observe the correlation between two variables.

- Hierarchical Clustering:You can see whether the different classes of your data are closely related or scattered.

Summary

Reference: GitHub - rafa-rod/pytrendseries

The complete code is shown below:

# Copyright 2021, MetaQuotes Ltd. # https://www.mql5.com import MetaTrader5 as mt import pandas as pd import pytrendseries as pts if not mt.initialize("D:\\Project\\mt\\MT5\\terminal64.exe"): print('initialize() failed!') else: print(mt.version()) sb=mt.symbols_total() rts=None if sb > 0: rts=mt.copy_rates_from_pos("GOLD_micro",mt.TIMEFRAME_M15,0,1000) mt.shutdown() rts_fm=pd.DataFrame(rts) rts_fm['time']=pd.to_datetime(rts_fm['time'], unit='s') td_data=rts_fm[['time','close']].set_index('time') # print(td_data.head(10)) td='downtrend' # or "uptrend" wd=120 limit=6 trends=pts.detecttrend(td_data,trend=td,limit=limit,window=wd) # print(trends.head(15)) # pts.vizplot.plot_trend(td_data,trends) rts_fm['trend']=0 rts_fm['trend_index']=0 max_len_rts=len(rts_fm) max_len=len(trends) last_start=0 last_end=0 for trend in trends.iterrows(): start=trend[1]['index_from'] end=trend[1]['index_to'] if trend[0]==1 and start!=0: # Since the rts_fm["trend"] itself has been initialized to 0, there is no need to change the "trend" column rts_fm['trend_index'][0:start]=list(range(0,start)) elif trend[0]==max_len and end!=max_len_rts-1: #we need to see if it ends in a downtrend at the end of the data rts_fm['trend_index'][last_end+1:len(rts_fm)]=list(range(0,max_len_rts-last_end-1)) else: #Process the uptrend segments other than the beginning and end of the data rts_fm["trend_index"][last_end+1:start]=list(range(0,start-last_end-1)) #Process each segments of the downtrend rts_fm["trend"][start:end+1]=1 rts_fm["trend_index"][start:end+1]=list(range(0,end-start+1)) last_start=start last_end=end #rts_fm=rts_fm.iloc[trends.iloc[0,:]['index_from']:end,:] rts_fm.to_csv('GOLD_micro_M15.csv')

Note:

1.Remember that if you add path in the mt.initialize() function like this: mt.initialize("D:\\Project\\mt\\MT5\\terminal64.exe"), be sure to replace it with the location of your own client executable, not mine.

2.If you can't find the 'GOLD_micro_M15.csv' file, look for it in the client root, e.g. my file is in the path:"D:\\Project\\mt\\MT5\\".

Thank you for your patience in reading, I hope you gain something and wish you a happy life, and see you in the next chapter!

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use