Piyush Lalsingh Ratnu / 个人资料

- 信息

|

不

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

3

信号

|

1

订阅者

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

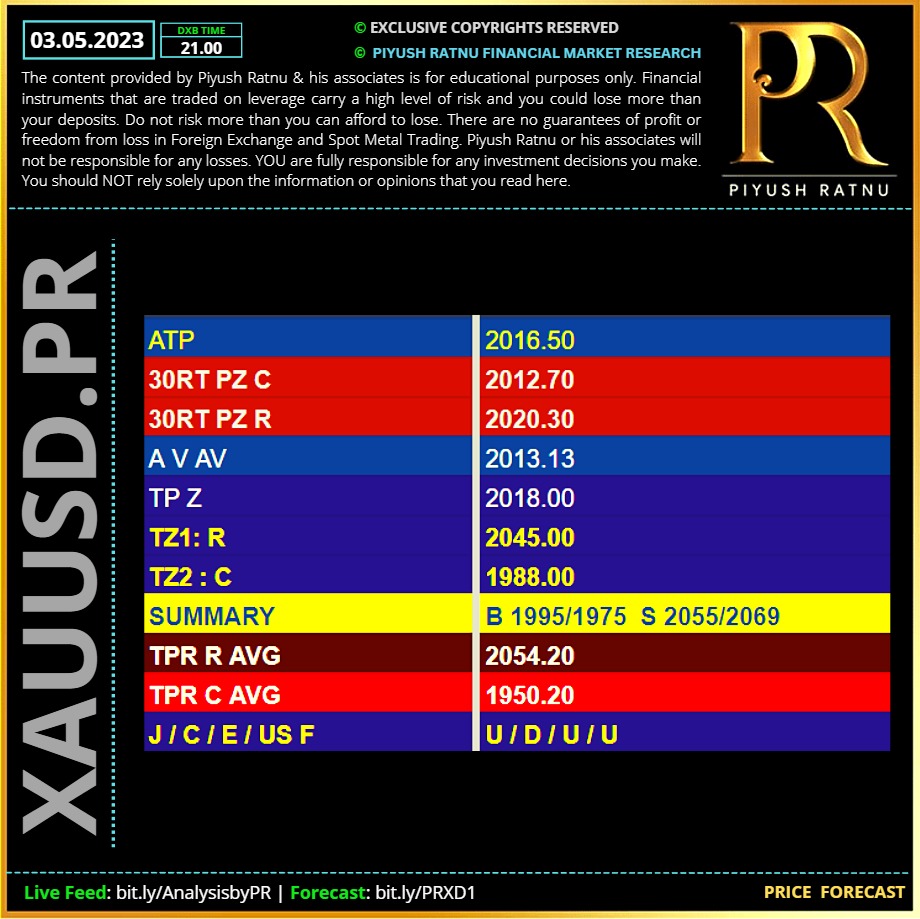

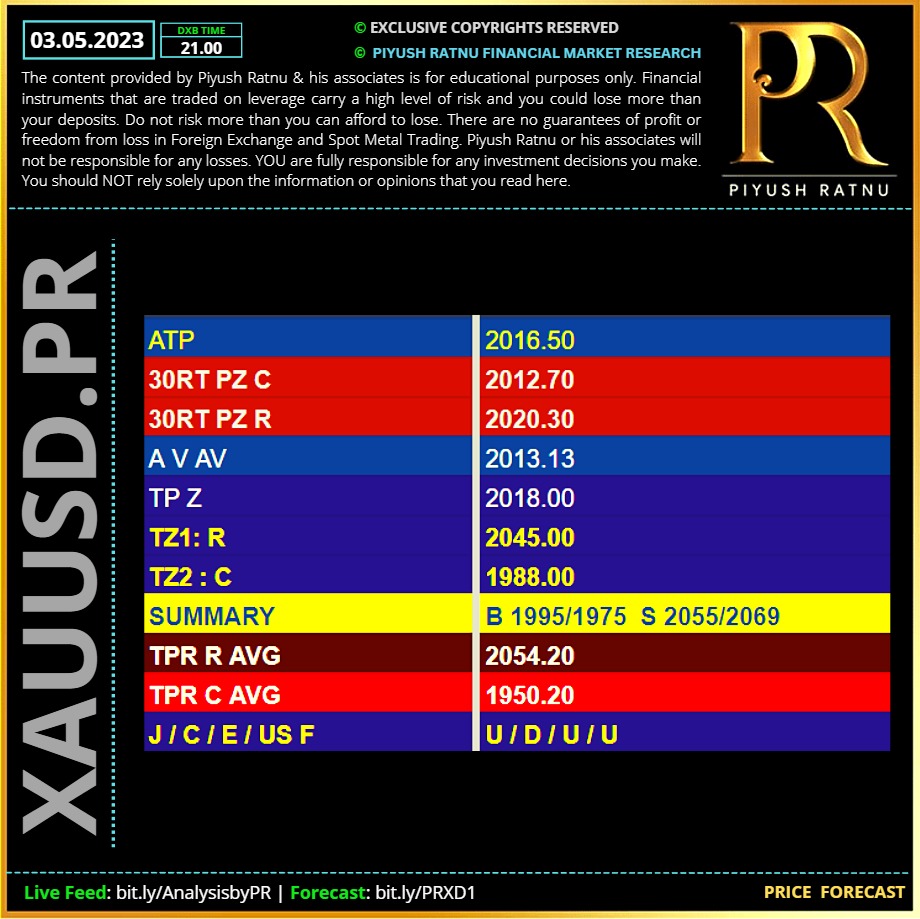

03.05.2023 | Price Forecast | Spot gold Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

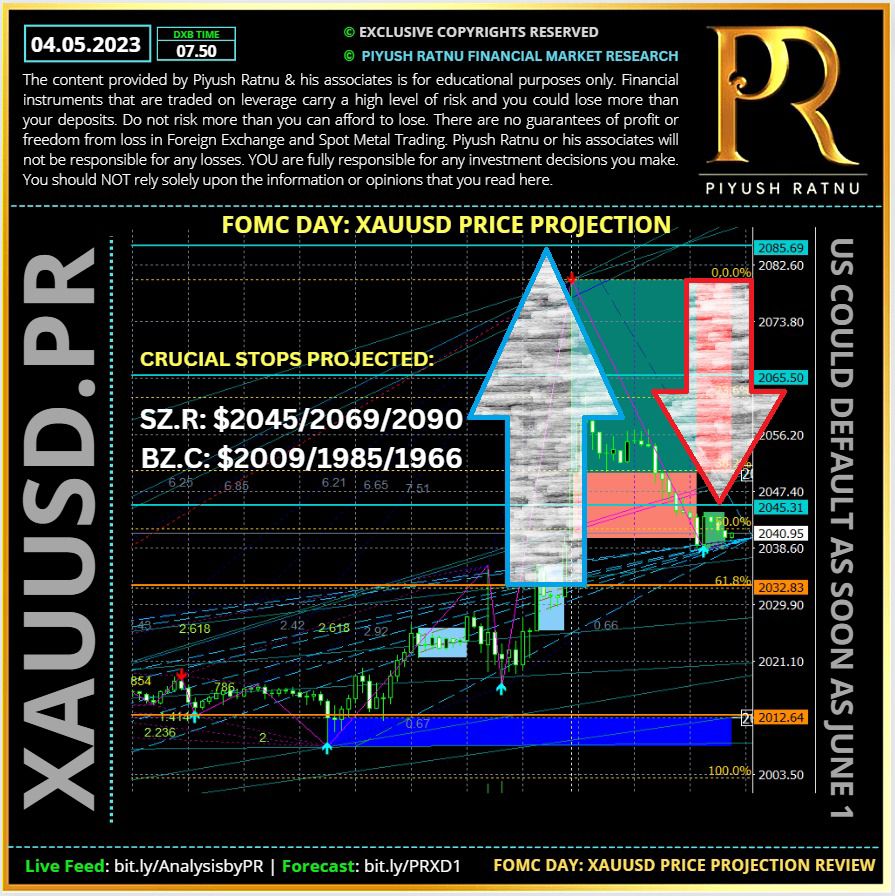

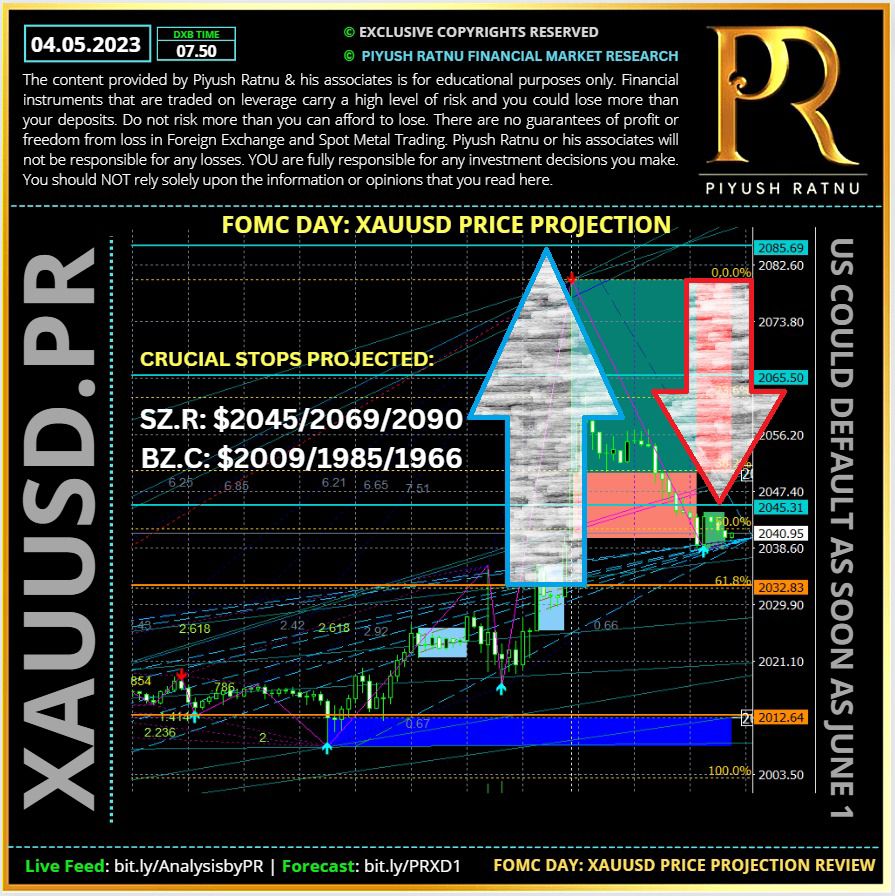

I had alerted yesterday that today morning we might experience gap at market opening due to Japanese holiday and lower volumes. A net gap of $50 was observed today: $2034-2084. XAUUSD retraced back to $2045 zone. Check here: https://t.me/PR4xAnalysis/4552

Those who believed in our analysis, am sure are celebrating today two things:

Their account is safe, where in many trades lost their entire principal amount today in today’s morning rally.

They made good profits, as we were able to alert the selling zones in advance before FOMC with targets $2045,2069 and $2090 zones.

Current Market Price: $2045 🆘

Subscribe our Telegram channel to receive the price projections and analysis in advance to stay alert and trade with better accuracy.

Check FOMC Day: Price Projection here:

https://t.me/PR4xAnalysis/4531

Check Selling Zones projected before FOMC here:

https://t.me/PR4xAnalysis/4530

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

Those who believed in our analysis, am sure are celebrating today two things:

Their account is safe, where in many trades lost their entire principal amount today in today’s morning rally.

They made good profits, as we were able to alert the selling zones in advance before FOMC with targets $2045,2069 and $2090 zones.

Current Market Price: $2045 🆘

Subscribe our Telegram channel to receive the price projections and analysis in advance to stay alert and trade with better accuracy.

Check FOMC Day: Price Projection here:

https://t.me/PR4xAnalysis/4531

Check Selling Zones projected before FOMC here:

https://t.me/PR4xAnalysis/4530

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

Piyush Lalsingh Ratnu

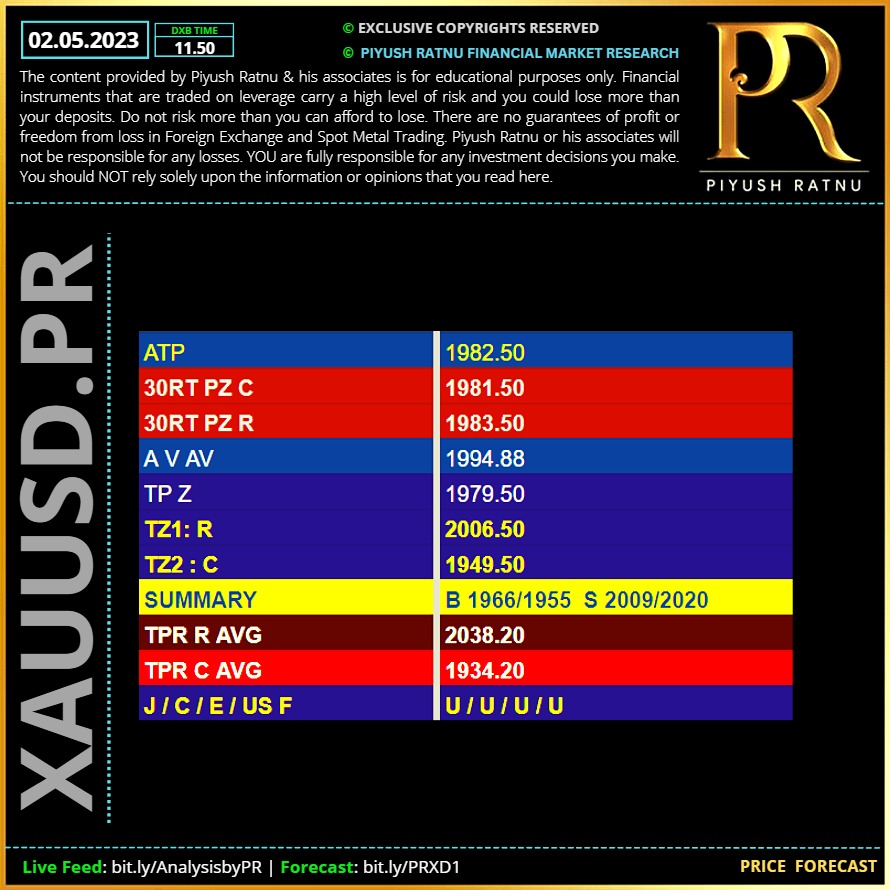

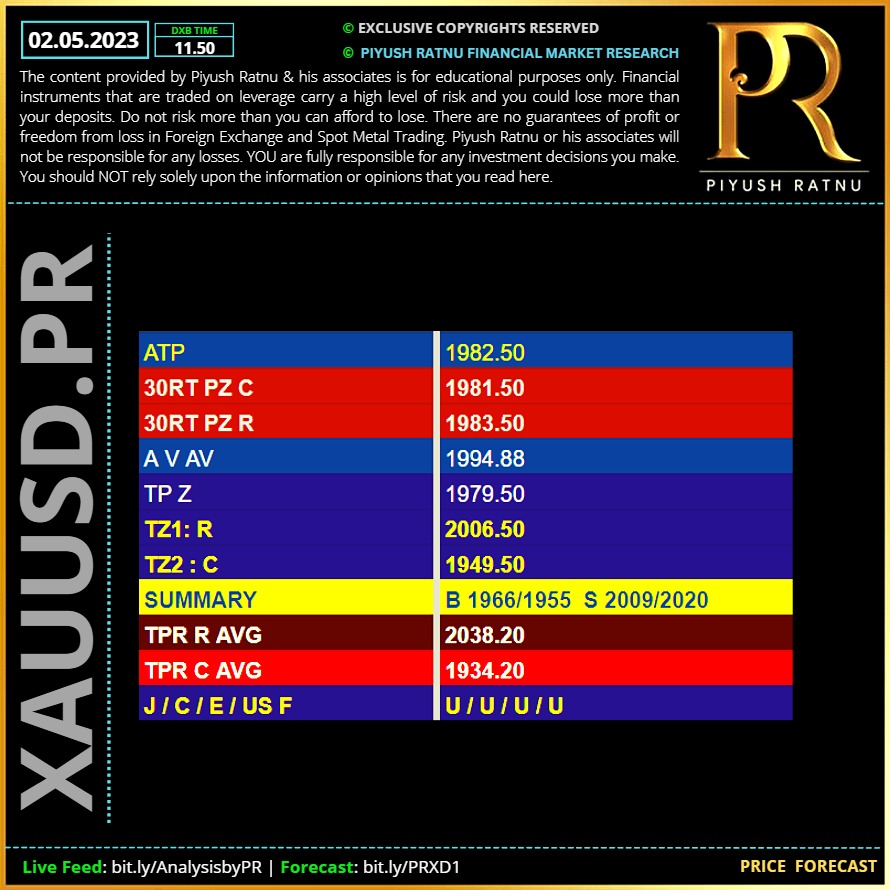

02.05.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

01.05.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

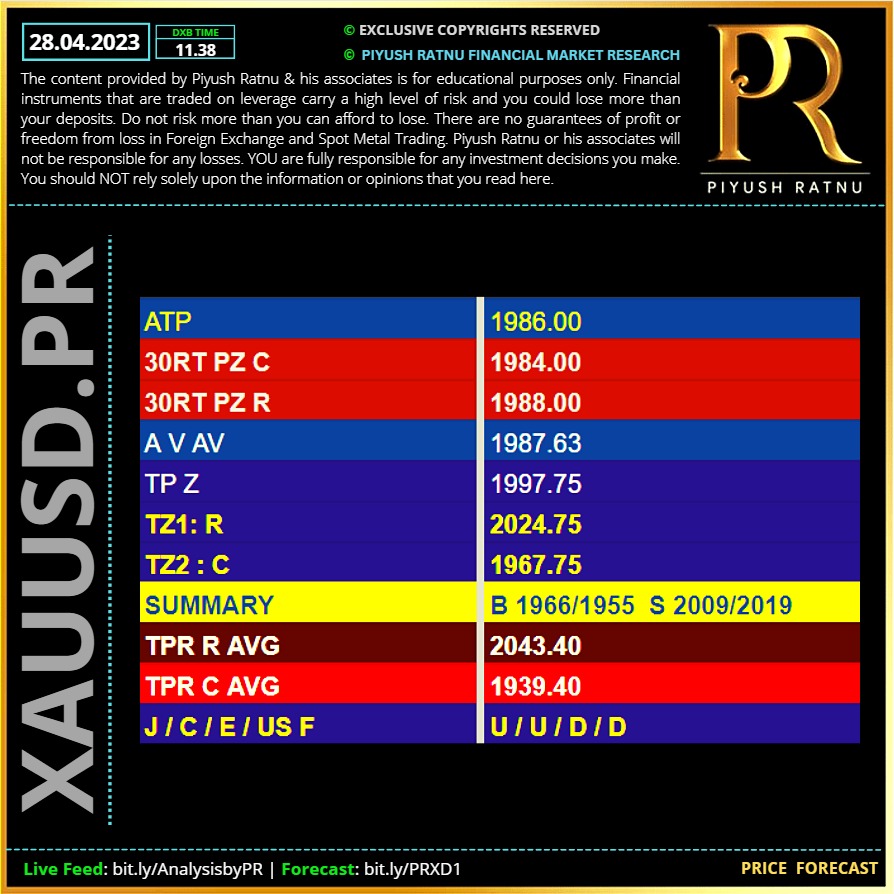

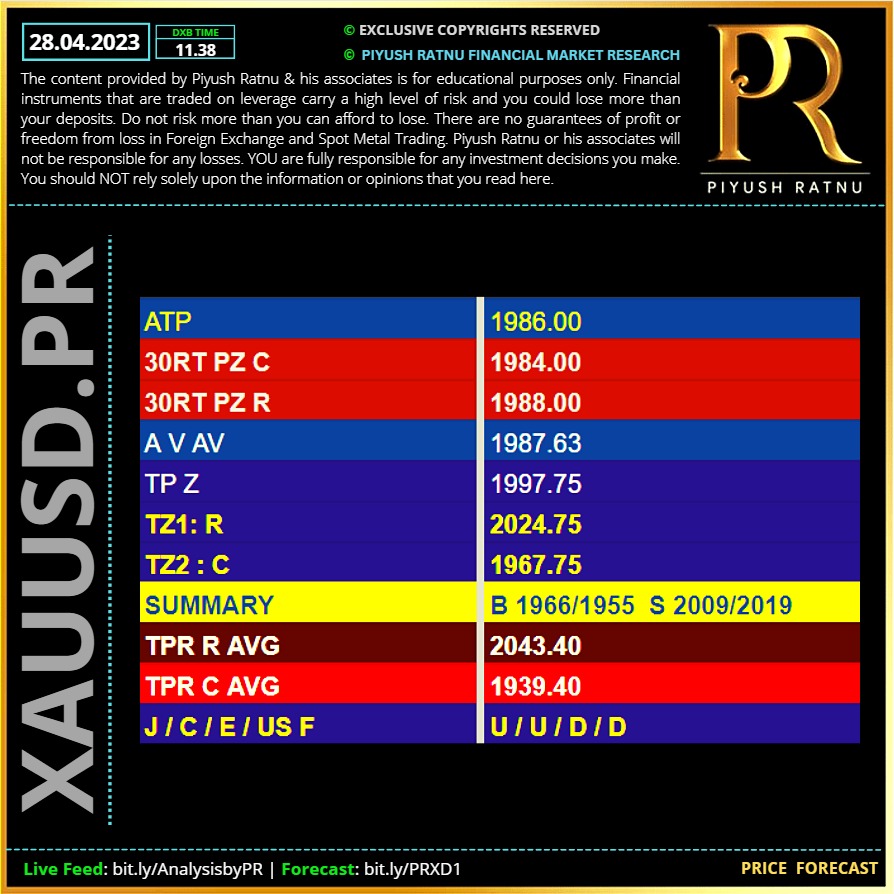

28.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

https://www.investing.com/economic-calendar/

🆘Check today's important economic data: 🆘

POF

16.30 hours

GDP

IJC

18.00 hours

PHS MoM

21.00

7 year note auction

Tomorrow 03.30

JPY CPI

JPY RS

07.00

BOJ Monetary Policy Statement

09.00

BOJ Press Conference

🆘Check today's important economic data: 🆘

POF

16.30 hours

GDP

IJC

18.00 hours

PHS MoM

21.00

7 year note auction

Tomorrow 03.30

JPY CPI

JPY RS

07.00

BOJ Monetary Policy Statement

09.00

BOJ Press Conference

Piyush Lalsingh Ratnu

Gold price is attempting a tepid rebound while holding below the $2,000 mark early Thursday. Despite the renewed uptick, Gold price continues to remain within this week’s trading range, yo-yo-ing around $2,000, awaiting the high-impact preliminary release of the United States Gross Domestic Product (GDP) for the first quarter.

Banking woes continue to cushion the US Dollar downside while weighing on Federal Reserve rate hike bets.

Gold price could extend the rebound beyond $2,000 if the US Dollar downside gathers steam on a sustained improvement in risk sentiment. US Q1 GDP preliminary figure is seen lower at 2.0% QoQ vs. 2.6% reported in the previous quarter. A weaker-than-expected GDP print will likely rekindle recession risks, boosting the safe-haven US Dollar at the expense of US stocks and Gold price. Although the rush to safety in the US government bonds could smash the US Treasury bond yields across the curve, limiting the downside in the Gold price.

Crucial Stops:

H4.V50 H4V618 | $2019 zone

H4A236 H4A0.0 | $1985, $1970 zone

To check the chart setup: kindly refer H4SRD1SQ

Banking woes continue to cushion the US Dollar downside while weighing on Federal Reserve rate hike bets.

Gold price could extend the rebound beyond $2,000 if the US Dollar downside gathers steam on a sustained improvement in risk sentiment. US Q1 GDP preliminary figure is seen lower at 2.0% QoQ vs. 2.6% reported in the previous quarter. A weaker-than-expected GDP print will likely rekindle recession risks, boosting the safe-haven US Dollar at the expense of US stocks and Gold price. Although the rush to safety in the US government bonds could smash the US Treasury bond yields across the curve, limiting the downside in the Gold price.

Crucial Stops:

H4.V50 H4V618 | $2019 zone

H4A236 H4A0.0 | $1985, $1970 zone

To check the chart setup: kindly refer H4SRD1SQ

Piyush Lalsingh Ratnu

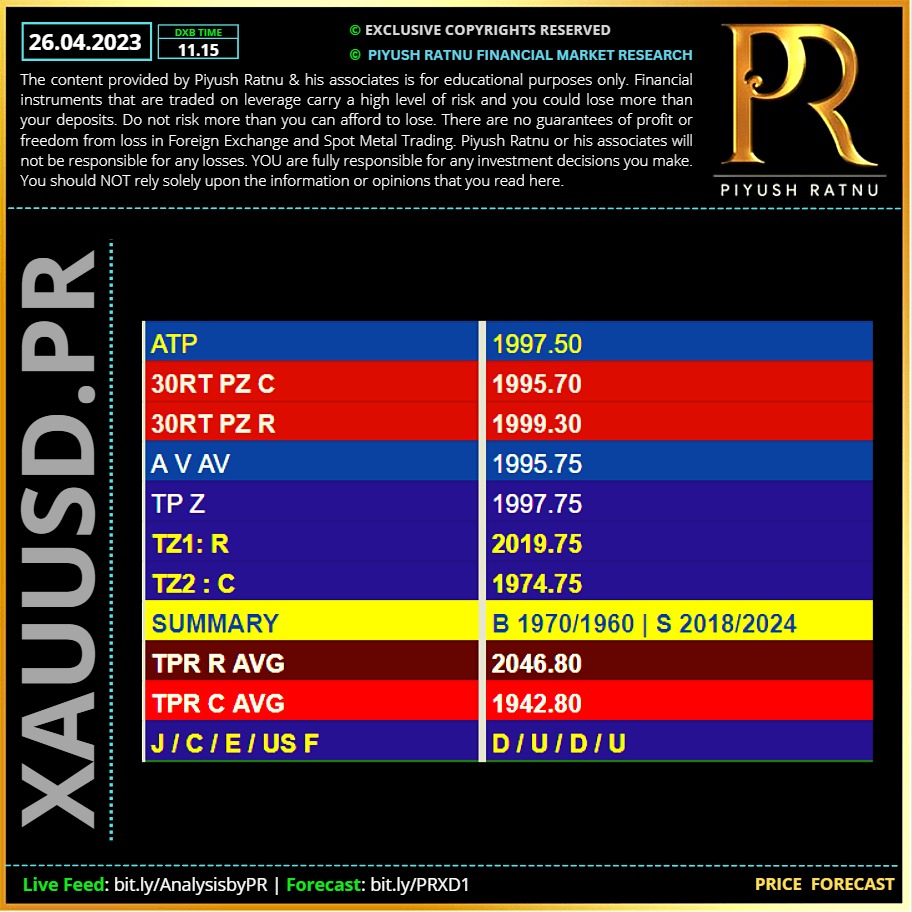

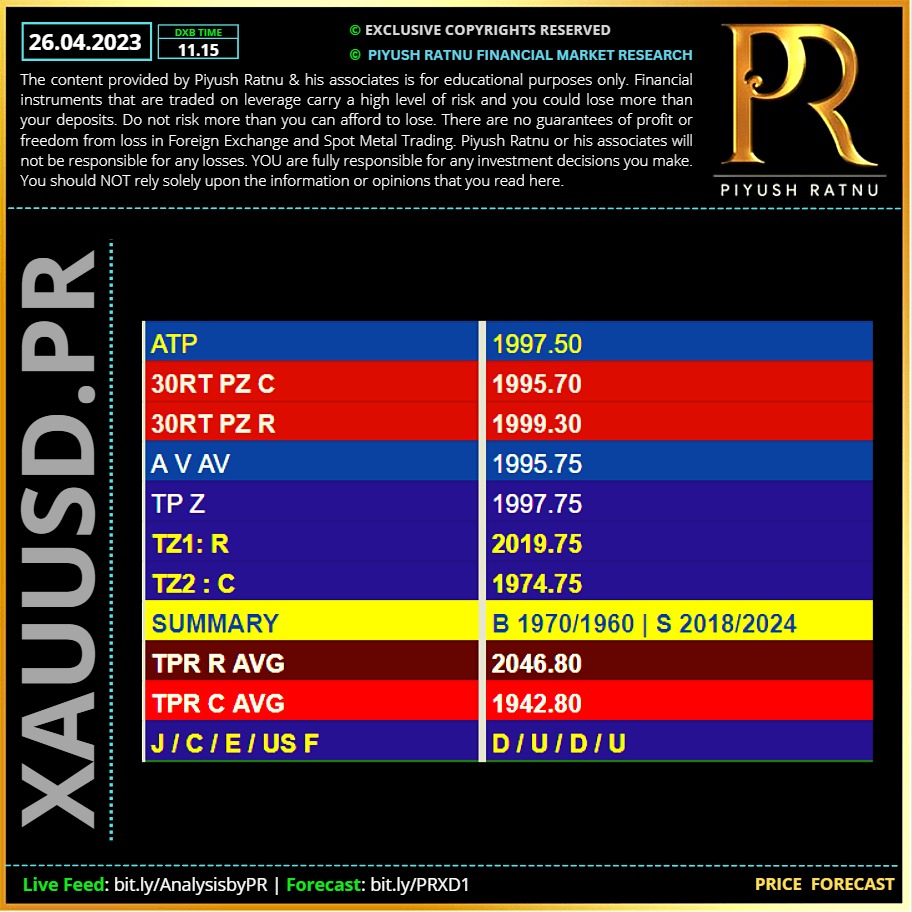

26.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

Short-term investors must always be aware that events of all kinds can cause stress on a daily basis, and human nature tends to be biased toward negative events, as mentioned many times in the field of behavioral finance.

On January 19, the US Treasury reached the debt ceiling, taking extraordinary measures to meet various government expenses. Let's be clear: this has happened before, but a lot also depends on the general sentiment, which continues to be negative.

Now, theoretically, August 18 is the key date when the funds are supposed to run out. So, it will be crucial for the Biden administration to find an agreement before this date.

Possible options would be:

Political solution (a deal is struck with the Republicans, who in return demand a reduction in federal spending)

New debt is issued in completely abnormal situations (perhaps above nominal, but I don't know how the markets would react to that and especially who would buy it)

Further extraordinary measures (President Biden could invoke the 14th Amendment to follow up on federal payments).

So the theme is that while everyone is still focused on inflation (which, in my view, will continue to fall, especially in June and July, where the base effects will be greater than 1 percent), the real and next short-term market mover will be the US debt ceiling and its resolution.

As always, these are just distractions for the medium- to the long-term investor, but human nature never changes.

On January 19, the US Treasury reached the debt ceiling, taking extraordinary measures to meet various government expenses. Let's be clear: this has happened before, but a lot also depends on the general sentiment, which continues to be negative.

Now, theoretically, August 18 is the key date when the funds are supposed to run out. So, it will be crucial for the Biden administration to find an agreement before this date.

Possible options would be:

Political solution (a deal is struck with the Republicans, who in return demand a reduction in federal spending)

New debt is issued in completely abnormal situations (perhaps above nominal, but I don't know how the markets would react to that and especially who would buy it)

Further extraordinary measures (President Biden could invoke the 14th Amendment to follow up on federal payments).

So the theme is that while everyone is still focused on inflation (which, in my view, will continue to fall, especially in June and July, where the base effects will be greater than 1 percent), the real and next short-term market mover will be the US debt ceiling and its resolution.

As always, these are just distractions for the medium- to the long-term investor, but human nature never changes.

Piyush Lalsingh Ratnu

Goldman to turn Short Seller.

Amid resurgent banking angst, rattled stock markets may have to live without a key source of buying power.

That’s the warning from Goldman Sachs Group Inc.’s Scott Rubner, whose data show systematic money managers have loaded up on more than $170 billion worth of global shares in the past month, driving the funds’ exposure to the highest level since early 2022.

Now, with their positioning near a peak, the group is more inclined to be sellers in coming weeks, according to the market veteran, who has studied flow of funds for two decades.

🆘From trend followers to traders who allocate assets based on volatility signals, quant funds would be forced to unwind as much as $276 billion of shares should the market sell off in the next month, according to Goldman’s model.

However, thanks to their elevated exposure, they would only need to purchase up to $25 billion if a big rally takes hold during the same time frame.

That’s potentially bad news for stock bulls who just got hit with the worst day for the S&P 500 in over a month after gloomy news from First Republic Bank rekindled worries that the lending crisis has not run its course. If sustained, the unwinding from quants has the potential to create additional pressure for a market where caution prevails amid recession concerns and a looming deadline for US government debt ceiling.

Amid resurgent banking angst, rattled stock markets may have to live without a key source of buying power.

That’s the warning from Goldman Sachs Group Inc.’s Scott Rubner, whose data show systematic money managers have loaded up on more than $170 billion worth of global shares in the past month, driving the funds’ exposure to the highest level since early 2022.

Now, with their positioning near a peak, the group is more inclined to be sellers in coming weeks, according to the market veteran, who has studied flow of funds for two decades.

🆘From trend followers to traders who allocate assets based on volatility signals, quant funds would be forced to unwind as much as $276 billion of shares should the market sell off in the next month, according to Goldman’s model.

However, thanks to their elevated exposure, they would only need to purchase up to $25 billion if a big rally takes hold during the same time frame.

That’s potentially bad news for stock bulls who just got hit with the worst day for the S&P 500 in over a month after gloomy news from First Republic Bank rekindled worries that the lending crisis has not run its course. If sustained, the unwinding from quants has the potential to create additional pressure for a market where caution prevails amid recession concerns and a looming deadline for US government debt ceiling.

Piyush Lalsingh Ratnu

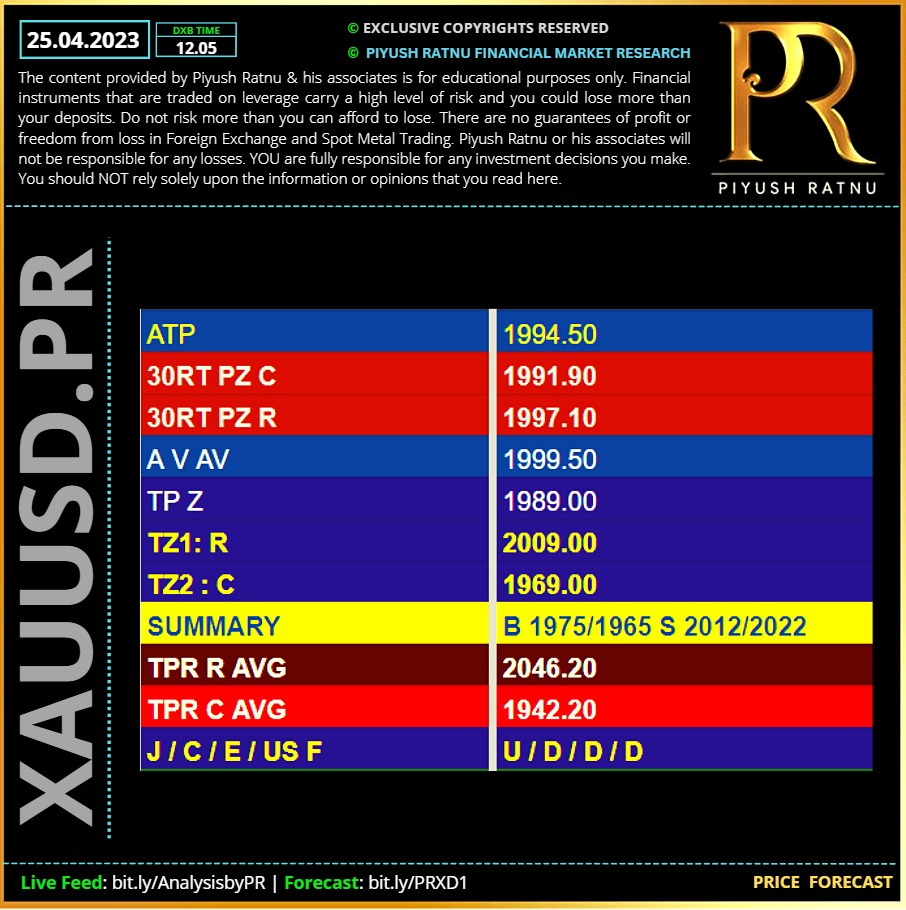

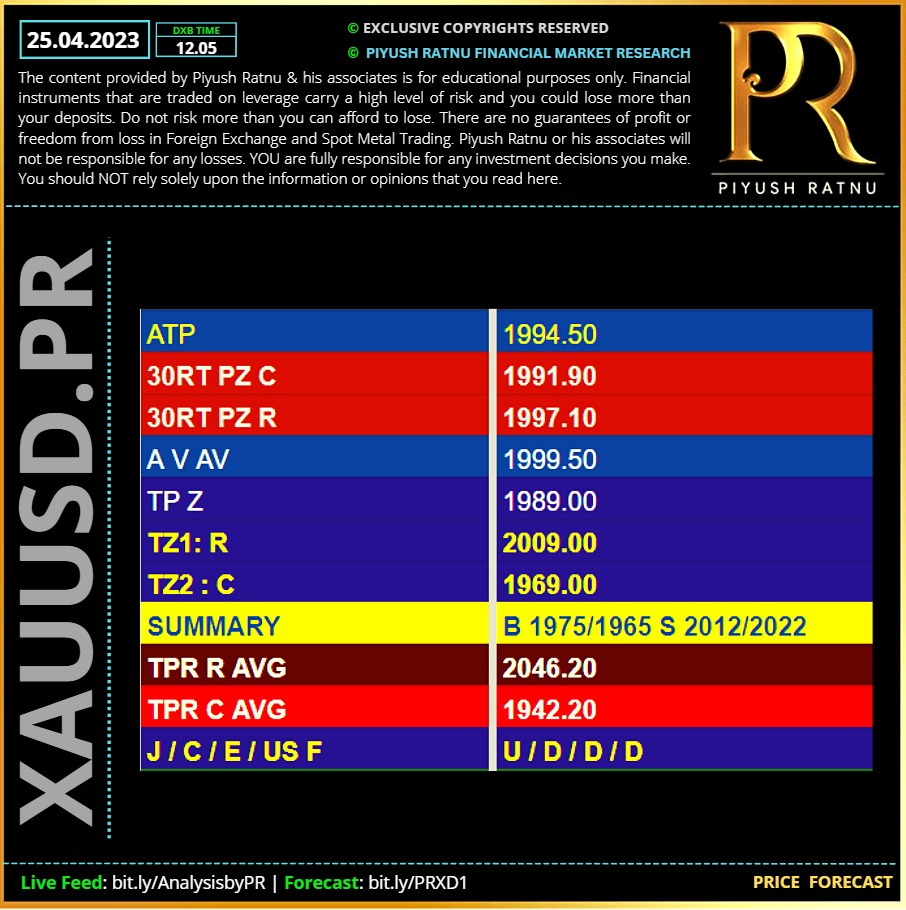

25.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

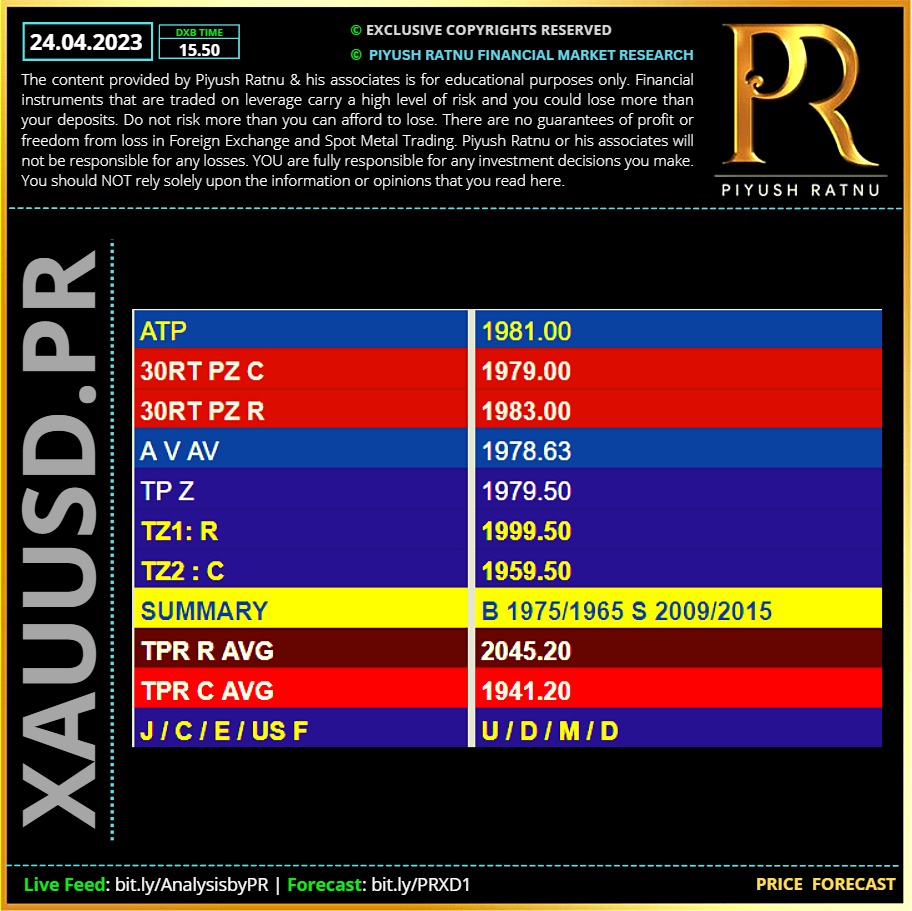

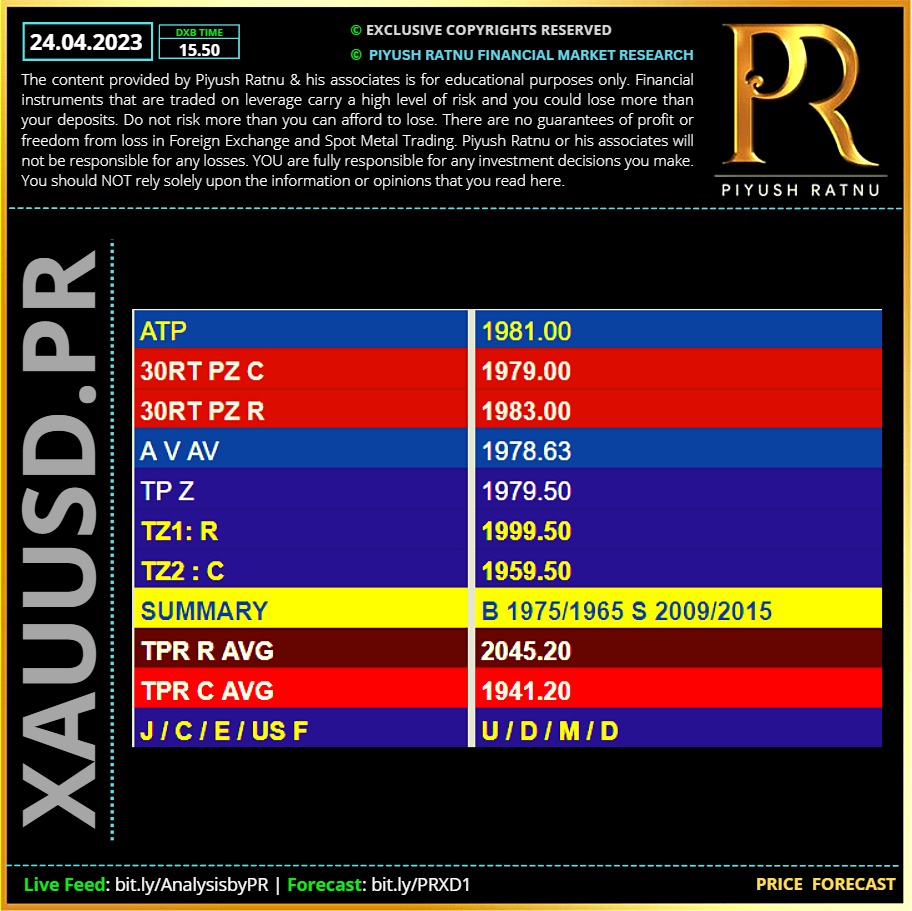

24.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

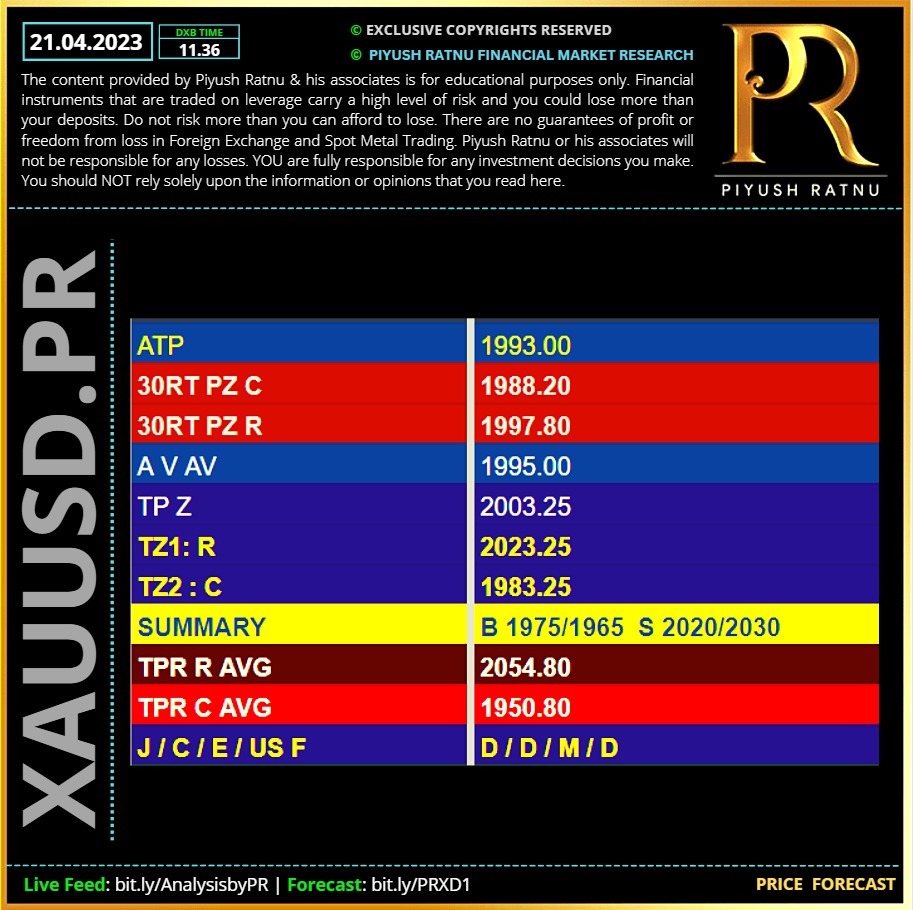

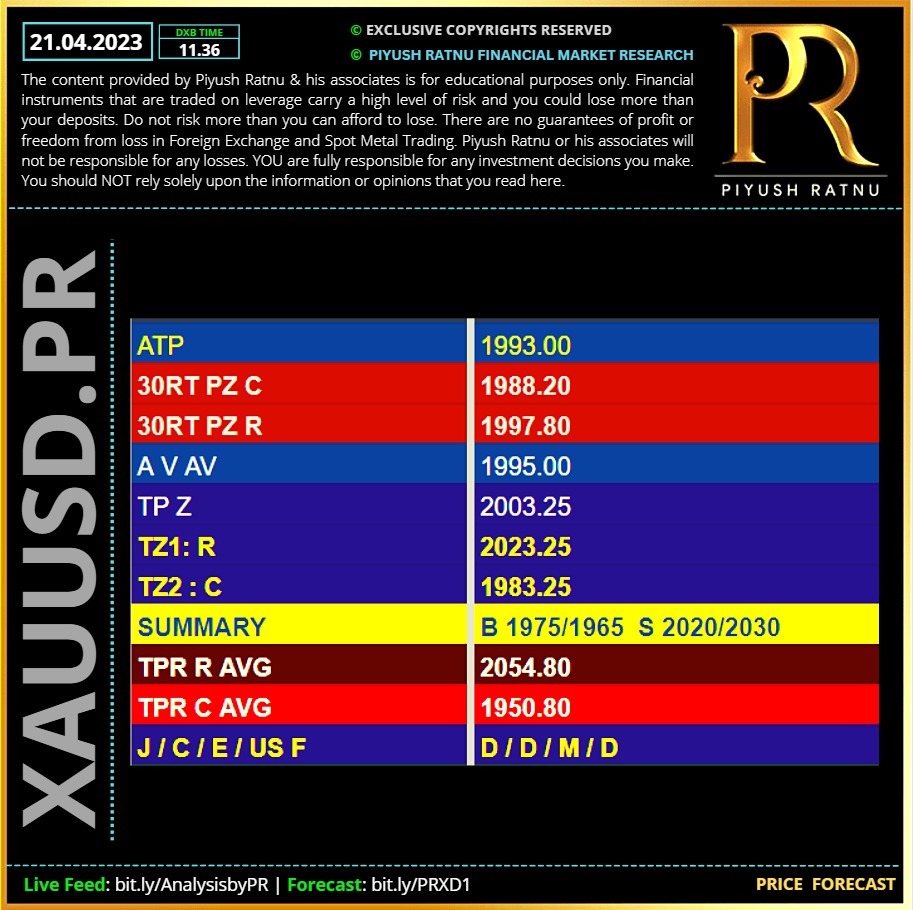

21.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

POF

Debt Ceiling Plan: might add volatility in Dollar.

The US Durable Goods Orders, advance Q1 Gross Domestic Product (GDP) and the Fed’s preferred inflation gauge – Core PCE inflation will be closely watched for any hints on the timing of the Fed rate cuts. Swaps markets continue to see Fed rate cuts as early as July.

All eyes now remain on the broader market sentiment, dynamics of the US Dollar and the US Treasury yields for fresh trading impetus on Gold price, as Monday is devoid of high-impact US economic data and any Fed speak. It is worth noting that the Federal Reserve has entered its ‘blackout period’ from April 22.

🟢 US F below H1S5 🟢

Leveraged investors boosted their net shorts on 10-year Treasury futures to a record 1.29 million contracts as of April 18, data from the Commodity Futures Trading Commission show.

Hedge Funds Place Biggest Ever Short on Benchmark Treasuries

Treasury yields have been whipsawed in recent weeks as traders engage in a tug-of-war with the Fed amid a growing debate about when policymakers will start cutting rates. Hedge funds will be vindicated if the US central bank prevails in its view that borrowing costs need to keep marching higher.

Another +100/150 volatility on the cards.

Kindly refer: US T-DXY-FC-XAUUSD-GF co-relations. 🆘

Leveraged funds have a checkered track record in Treasuries. Yields declined in 2019 after the previous record short. When leveraged longs hit a multi-year high in 2021, yields did move modestly lower soon after before surging as the Fed headed toward rate hikes.

The 10-year Treasury yield has advanced nine basis points this month to 3.56%, unwinding some of March’s 45-basis-point drop. The benchmark yield remains in a deep discount to two-year rates, suggesting that a downturn is on the cards. There may be another explanation for the moves. Short positions could be exaggerated by a revival of so-called basis trades, when hedge funds buy cash Treasuries and short the underlying futures.

The trades involve buying bonds that have become cheap relative to the underlying futures and then selling the futures to pocket the difference. The profit is usually small, hence the tendency to use leverage.

In a world of huge deficits and no more QE, leveraged funds have a lot more opportunities to reap profits by buying cash bonds and selling the underlying futures where arbitrage opportunities arise.

Fed Officials Back Another Hike

Federal Reserve officials backed another interest-rate increase as they monitor economic fallout from bank strains, while fresh emergency loan data showed financial stress continues to linger.

Cleveland Fed President Loretta Mester, typically among the more. Some Fed officials have said they’d like to pause at that point, though investors are pricing rate cuts by the end of the year. Fed officials have welcomed signs their aggressive tightening campaign is beginning to bite, with the housing sector cooling, a tight labor market moderating and inflation retreating from last year’s peaks. hawkish of policymakers, said she favored getting rates above 5% because inflation was still too high.

Debt Ceiling Plan: might add volatility in Dollar.

The US Durable Goods Orders, advance Q1 Gross Domestic Product (GDP) and the Fed’s preferred inflation gauge – Core PCE inflation will be closely watched for any hints on the timing of the Fed rate cuts. Swaps markets continue to see Fed rate cuts as early as July.

All eyes now remain on the broader market sentiment, dynamics of the US Dollar and the US Treasury yields for fresh trading impetus on Gold price, as Monday is devoid of high-impact US economic data and any Fed speak. It is worth noting that the Federal Reserve has entered its ‘blackout period’ from April 22.

🟢 US F below H1S5 🟢

Leveraged investors boosted their net shorts on 10-year Treasury futures to a record 1.29 million contracts as of April 18, data from the Commodity Futures Trading Commission show.

Hedge Funds Place Biggest Ever Short on Benchmark Treasuries

Treasury yields have been whipsawed in recent weeks as traders engage in a tug-of-war with the Fed amid a growing debate about when policymakers will start cutting rates. Hedge funds will be vindicated if the US central bank prevails in its view that borrowing costs need to keep marching higher.

Another +100/150 volatility on the cards.

Kindly refer: US T-DXY-FC-XAUUSD-GF co-relations. 🆘

Leveraged funds have a checkered track record in Treasuries. Yields declined in 2019 after the previous record short. When leveraged longs hit a multi-year high in 2021, yields did move modestly lower soon after before surging as the Fed headed toward rate hikes.

The 10-year Treasury yield has advanced nine basis points this month to 3.56%, unwinding some of March’s 45-basis-point drop. The benchmark yield remains in a deep discount to two-year rates, suggesting that a downturn is on the cards. There may be another explanation for the moves. Short positions could be exaggerated by a revival of so-called basis trades, when hedge funds buy cash Treasuries and short the underlying futures.

The trades involve buying bonds that have become cheap relative to the underlying futures and then selling the futures to pocket the difference. The profit is usually small, hence the tendency to use leverage.

In a world of huge deficits and no more QE, leveraged funds have a lot more opportunities to reap profits by buying cash bonds and selling the underlying futures where arbitrage opportunities arise.

Fed Officials Back Another Hike

Federal Reserve officials backed another interest-rate increase as they monitor economic fallout from bank strains, while fresh emergency loan data showed financial stress continues to linger.

Cleveland Fed President Loretta Mester, typically among the more. Some Fed officials have said they’d like to pause at that point, though investors are pricing rate cuts by the end of the year. Fed officials have welcomed signs their aggressive tightening campaign is beginning to bite, with the housing sector cooling, a tight labor market moderating and inflation retreating from last year’s peaks. hawkish of policymakers, said she favored getting rates above 5% because inflation was still too high.

Piyush Lalsingh Ratnu

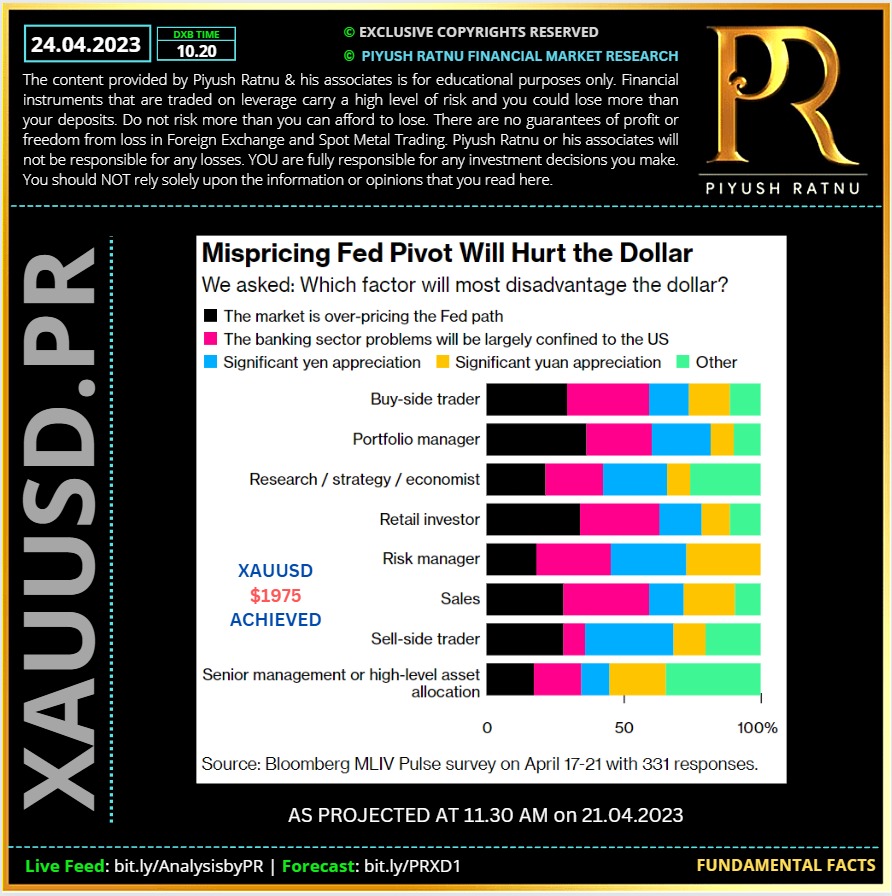

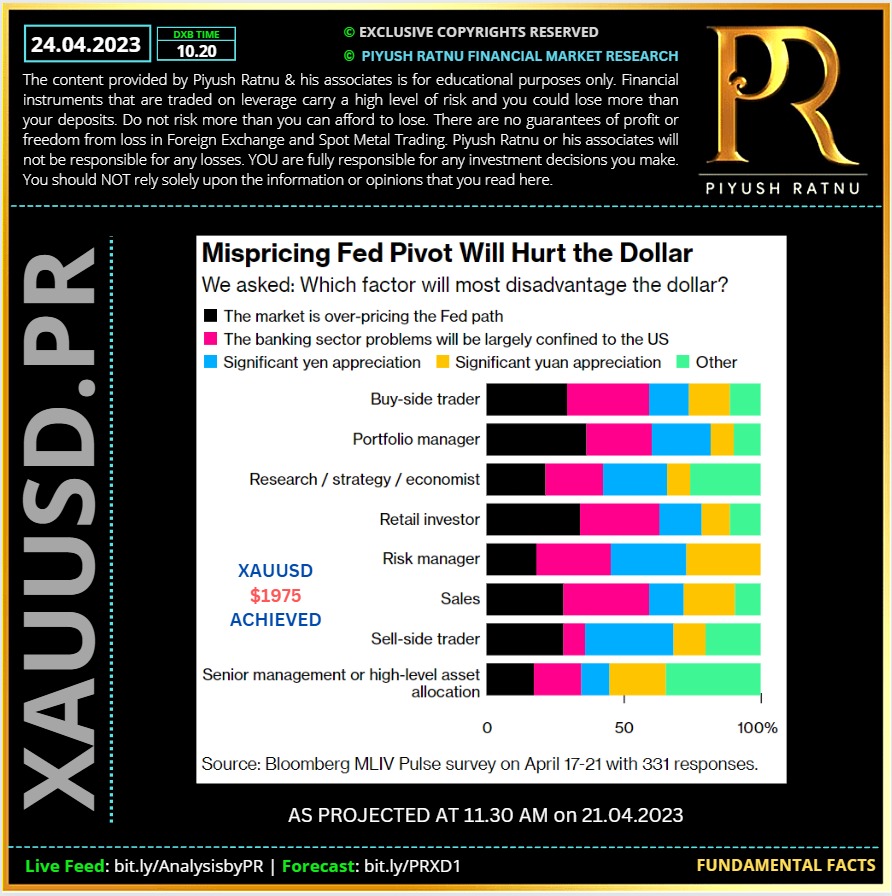

WHY Dollar might slide in coming weeks: (+XAUUSD)

De-dollarization

The risk of a more generalized pivot away from the greenback is something that investors are giving serious consideration. A majority of respondents see the dollar making up less than half of global reserves within a decade.

The dollar bulls, particularly among the retail community is a clear majority of those greenback lovers believe that the Fed rate path is actually underpriced, confirming that getting the currency direction correct will ultimately boil down to nailing the policy call.

Interestingly, the risk of a debt-ceiling debacle passes almost unmentioned. However, few would dispute that today’s political environment is extremely acrimonious and risks are as high as they have been for many years.

YEN: The king maker:

The new Bank of Japan Governor Kazuo Ueda has so far done his best to be as boring as possible, offering little hope to those betting on an end to the super-loose policy that has driven yen weakness. That said, Ueda has a convenient window to scrap yield curve control while there is minimal pressure on local rates markets. If he chooses to act, this would likely lead to substantial ⚠️ yen appreciation — there is evidence that even small BOJ policy changes can have an out-sized impact on the currency.

China: The Risk Taker:

The Citigroup’s Economic Surprise Index for China rose close to the highest since 2006 this month and yet the yuan is up only about 1% against its trade-weighted basket so far in 2023. The yuan should rise, but it’s worrying that the currency has been almost impervious to good news, as it’s hard to imagine what more the nation can do to impress. Aside from ongoing geopolitical risk, it may simply be that investors need time to get used to the idea that the China trade is back.

Professional investors see the dollar sliding even further from last year’s two-decade highs, as the market has underpriced the Federal Reserve’s oncoming easing cycle.

Correspondingly, professional investors are negative on the dollar, with a 17 percentage-point gap between bears and bulls. Many explicitly state that they are bearish because the yield path as priced is too high. Interestingly, the second most popular response is that banking sector stresses will largely be confined to the US, which further implies that the Fed will be forced to be more dovish than global peers.

🆘 MAY first and third week will be a major game changer MONTH, and GOLD might hit a new high very soon. Those who are assuming Gold price movement purely on the basis of the technicals, will soon regret their assumptions!

De-dollarization

The risk of a more generalized pivot away from the greenback is something that investors are giving serious consideration. A majority of respondents see the dollar making up less than half of global reserves within a decade.

The dollar bulls, particularly among the retail community is a clear majority of those greenback lovers believe that the Fed rate path is actually underpriced, confirming that getting the currency direction correct will ultimately boil down to nailing the policy call.

Interestingly, the risk of a debt-ceiling debacle passes almost unmentioned. However, few would dispute that today’s political environment is extremely acrimonious and risks are as high as they have been for many years.

YEN: The king maker:

The new Bank of Japan Governor Kazuo Ueda has so far done his best to be as boring as possible, offering little hope to those betting on an end to the super-loose policy that has driven yen weakness. That said, Ueda has a convenient window to scrap yield curve control while there is minimal pressure on local rates markets. If he chooses to act, this would likely lead to substantial ⚠️ yen appreciation — there is evidence that even small BOJ policy changes can have an out-sized impact on the currency.

China: The Risk Taker:

The Citigroup’s Economic Surprise Index for China rose close to the highest since 2006 this month and yet the yuan is up only about 1% against its trade-weighted basket so far in 2023. The yuan should rise, but it’s worrying that the currency has been almost impervious to good news, as it’s hard to imagine what more the nation can do to impress. Aside from ongoing geopolitical risk, it may simply be that investors need time to get used to the idea that the China trade is back.

Professional investors see the dollar sliding even further from last year’s two-decade highs, as the market has underpriced the Federal Reserve’s oncoming easing cycle.

Correspondingly, professional investors are negative on the dollar, with a 17 percentage-point gap between bears and bulls. Many explicitly state that they are bearish because the yield path as priced is too high. Interestingly, the second most popular response is that banking sector stresses will largely be confined to the US, which further implies that the Fed will be forced to be more dovish than global peers.

🆘 MAY first and third week will be a major game changer MONTH, and GOLD might hit a new high very soon. Those who are assuming Gold price movement purely on the basis of the technicals, will soon regret their assumptions!

Piyush Lalsingh Ratnu

Futures on the S&P 500 and Nasdaq 100 wavered after yesterday’s losses on Wall Street. PMI data from the eurozone and US later Friday will provide more clues on the state of the global economy after unprecedented tightening by monetary authorities to curb inflation.

Fed Bank of Cleveland President Loretta Mester signaled support for another rate hike to quell inflation while flagging the need to watch recent bank stress that may crimp credit and damp the economy.

S&P500 futures have added some gains in the Asian session after three back-to-back bearish settlements. he weak revenue guidance from 🆘 Tesla due to Elon Musk’s price-cutting spree dented market sentiment.

The US Dollar Index (DXY) has extended its correction to near 101.77. The USD Index is inside the woods, consolidating in a range of 100.90-102.03 for the past few trading sessions. Therefore, a move beyond the aforementioned boundary will be considered a decisive move.

Going forward, the release of the preliminary US S&P PMI data will dictate the impact on the scale of economic activities due to higher rates from the Fed. As per the estimates, Manufacturing and Services PMI will ease to 49.0 and 51.5 respectively. A weaker-than-projected preliminary PMI data could weigh heavily on the US Dollar.

The tech-heavy Nasdaq 100 declined on Thursday, with Tesla Inc. losing almost 10% after its founder Elon Musk signaled that it will keep cutting prices to stoke demand. The S&P 500 index also fell ahead of Friday’s options expiration.

🆘Meanwhile, China’s military said it plans to conduct at least five drills in various areas that include waters off its coast and in the South China Sea. This comes at a time when tensions are already simmering tensions with Taiwan and the US.

Fed Bank of Cleveland President Loretta Mester signaled support for another rate hike to quell inflation while flagging the need to watch recent bank stress that may crimp credit and damp the economy.

S&P500 futures have added some gains in the Asian session after three back-to-back bearish settlements. he weak revenue guidance from 🆘 Tesla due to Elon Musk’s price-cutting spree dented market sentiment.

The US Dollar Index (DXY) has extended its correction to near 101.77. The USD Index is inside the woods, consolidating in a range of 100.90-102.03 for the past few trading sessions. Therefore, a move beyond the aforementioned boundary will be considered a decisive move.

Going forward, the release of the preliminary US S&P PMI data will dictate the impact on the scale of economic activities due to higher rates from the Fed. As per the estimates, Manufacturing and Services PMI will ease to 49.0 and 51.5 respectively. A weaker-than-projected preliminary PMI data could weigh heavily on the US Dollar.

The tech-heavy Nasdaq 100 declined on Thursday, with Tesla Inc. losing almost 10% after its founder Elon Musk signaled that it will keep cutting prices to stoke demand. The S&P 500 index also fell ahead of Friday’s options expiration.

🆘Meanwhile, China’s military said it plans to conduct at least five drills in various areas that include waters off its coast and in the South China Sea. This comes at a time when tensions are already simmering tensions with Taiwan and the US.

Piyush Lalsingh Ratnu

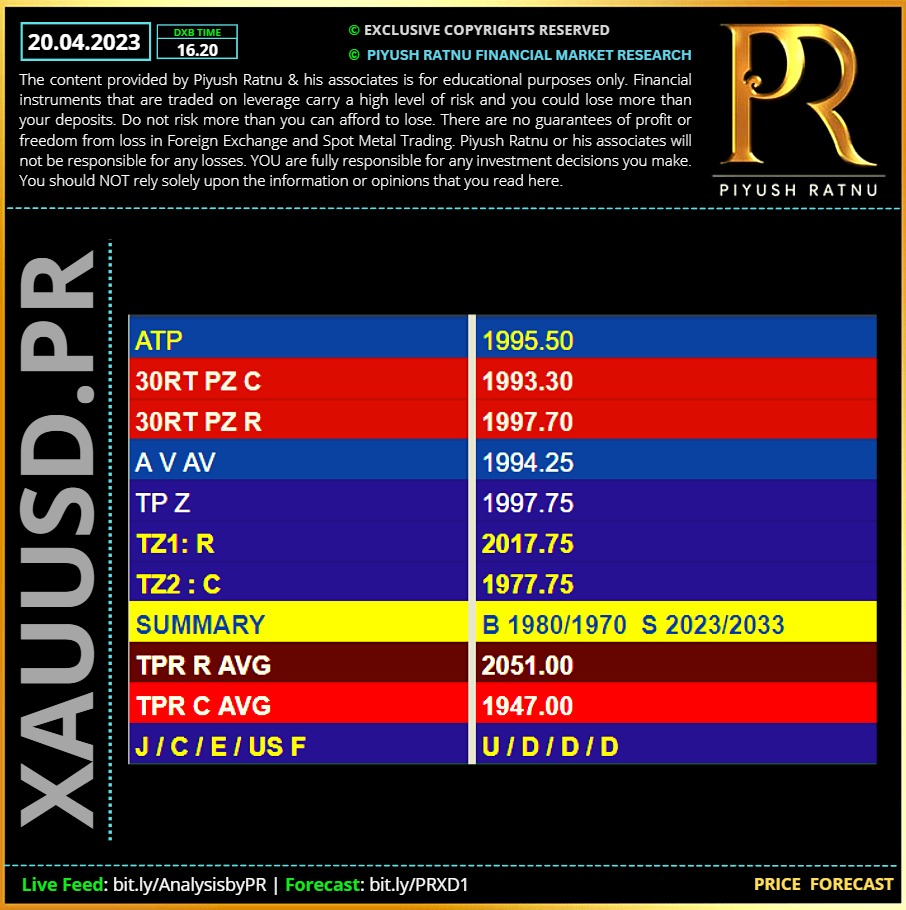

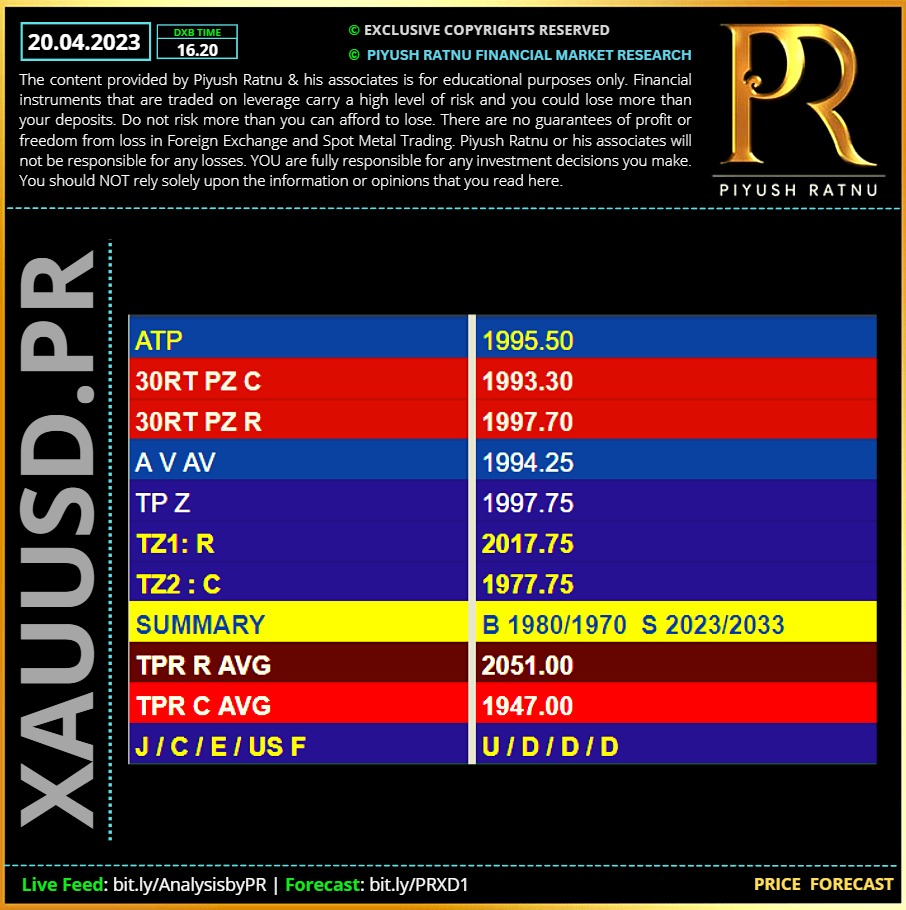

20.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

Important Economic Events today:

POF:

✦JPY CPI PMI

✦GBP Retail Sales

✦EUR G M PMI

✦GBP C+M PMI

✦USD S PMI S&P GC PMI

Check schedule at:

https://www.investing.com/economic-calendar/

🔷PRTPAlgo - Technical Status:

M15 S (A)

M30 S (R)

H1 S (P)

H4 S (P)

🔘PPZ:

R1: 2012-S1: 1996

XAUUSD Below D1 SR PPZ

🔘FIB Stats:

M15A618

M30A30

H1A30

H4A50

🔘S5

B M15

B M30

A H1

B H4

🔘Crucial Price Zones:

C: 1990-1985 | 1970-1966

R: 2009-2012 | 2026-2030

🔘Today's Trading Strategy:

BUY lows below S1 -6/9/12 GR NAP Exit.

SELL highs above R1 +6/9/12 GR NAP Exit.

🟢CMP $1999.33

POF:

✦JPY CPI PMI

✦GBP Retail Sales

✦EUR G M PMI

✦GBP C+M PMI

✦USD S PMI S&P GC PMI

Check schedule at:

https://www.investing.com/economic-calendar/

🔷PRTPAlgo - Technical Status:

M15 S (A)

M30 S (R)

H1 S (P)

H4 S (P)

🔘PPZ:

R1: 2012-S1: 1996

XAUUSD Below D1 SR PPZ

🔘FIB Stats:

M15A618

M30A30

H1A30

H4A50

🔘S5

B M15

B M30

A H1

B H4

🔘Crucial Price Zones:

C: 1990-1985 | 1970-1966

R: 2009-2012 | 2026-2030

🔘Today's Trading Strategy:

BUY lows below S1 -6/9/12 GR NAP Exit.

SELL highs above R1 +6/9/12 GR NAP Exit.

🟢CMP $1999.33

Piyush Lalsingh Ratnu

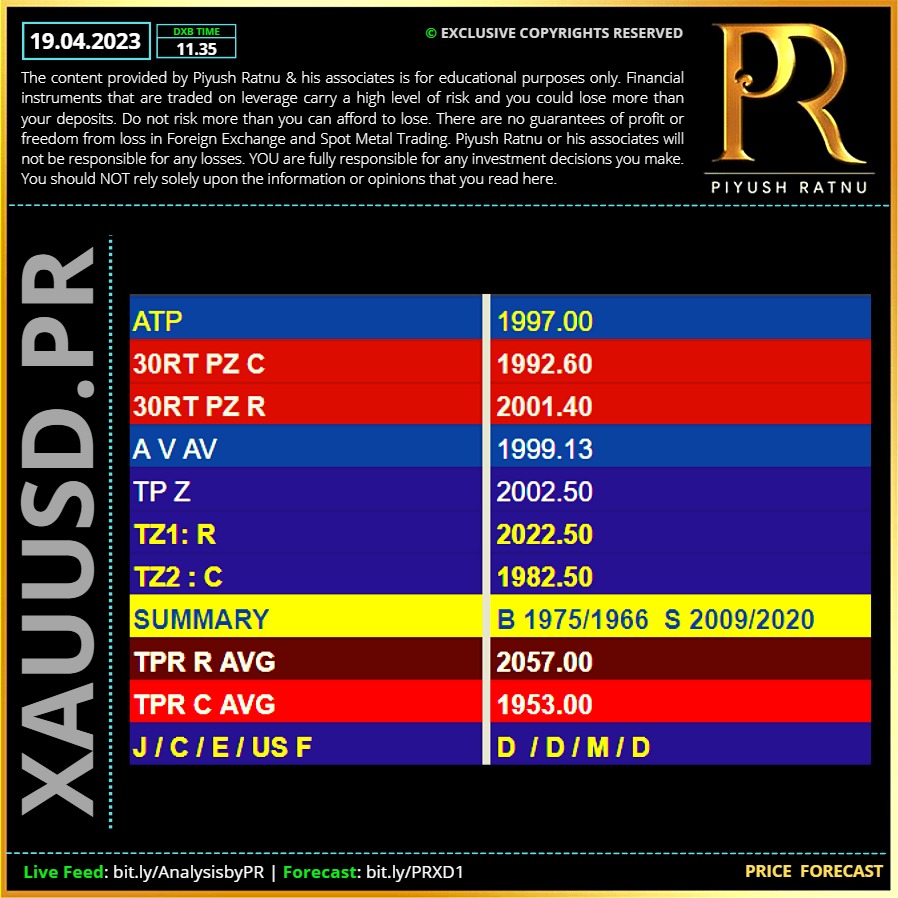

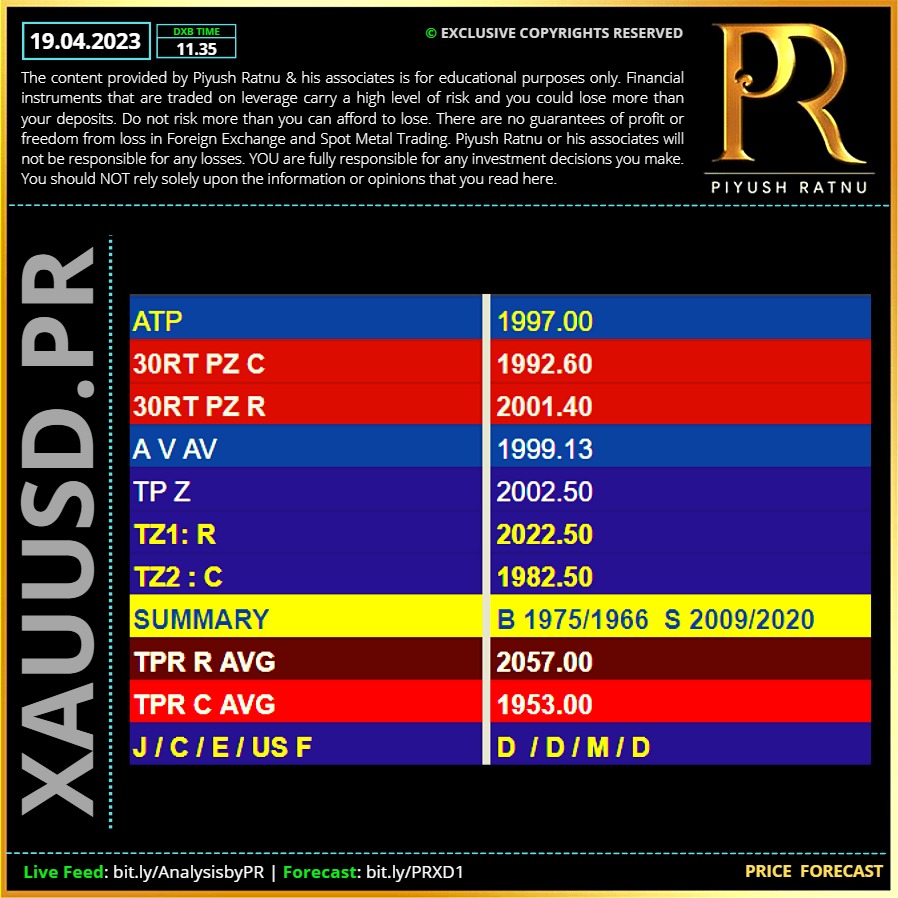

19.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Piyush Lalsingh Ratnu

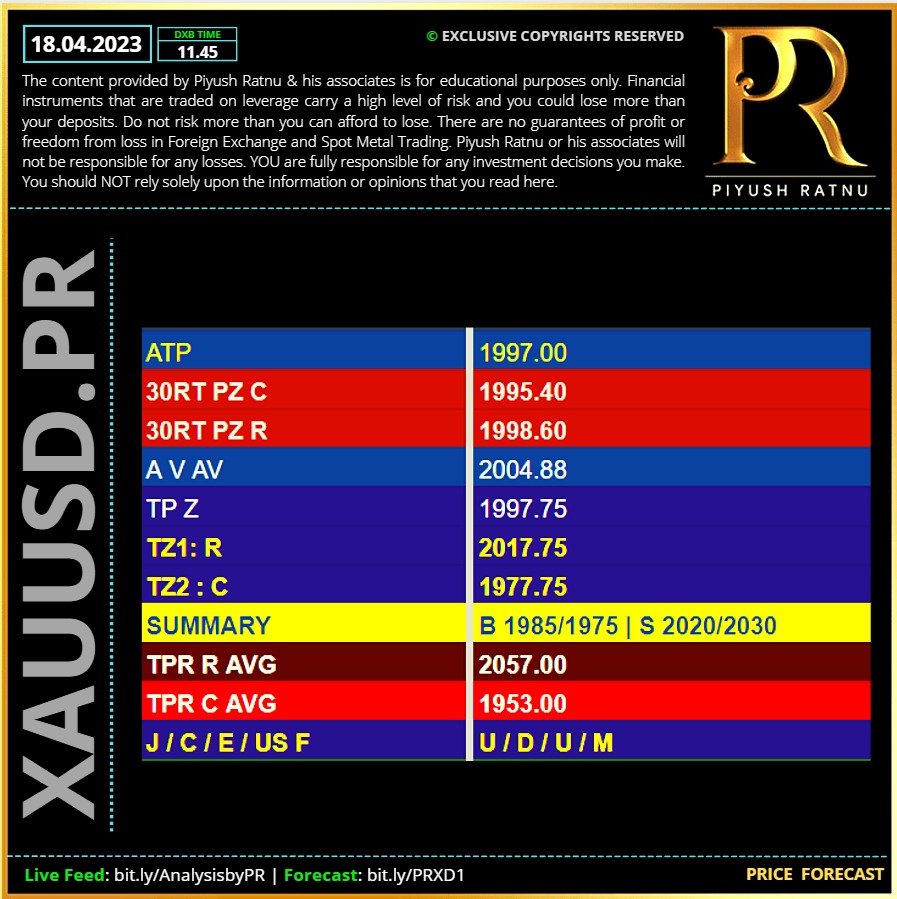

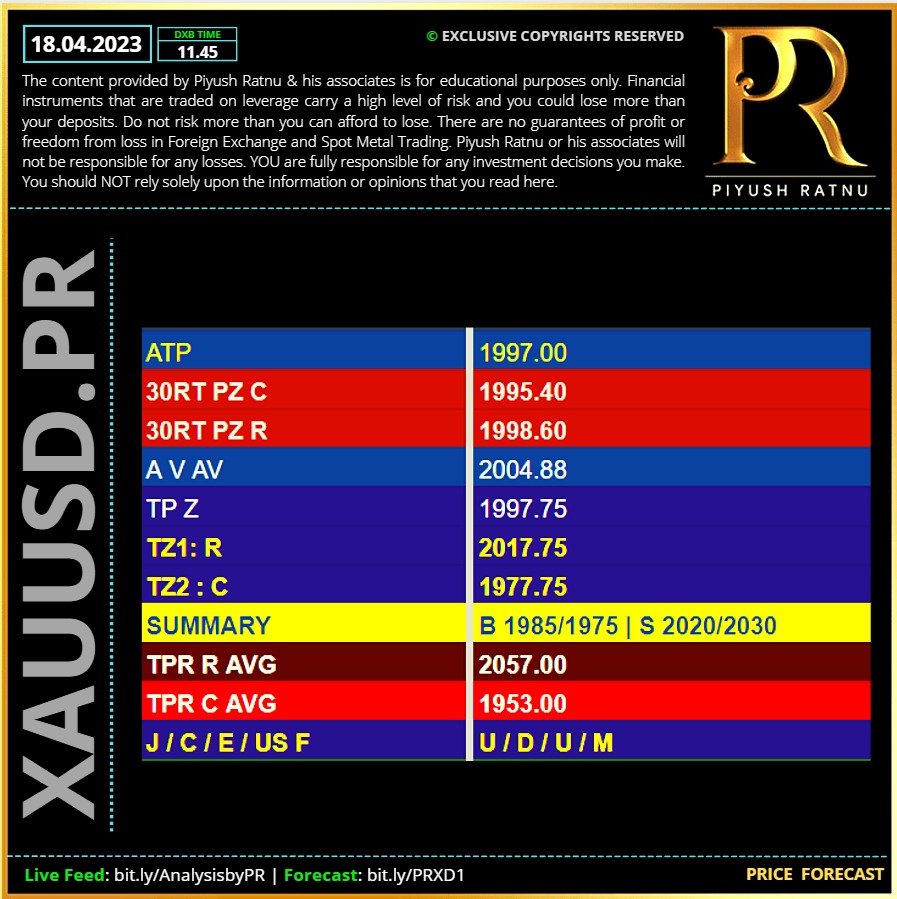

18.04.2023 | Price Forecast | Spot Gold Analysis | XAUUSD Analysis | PR Gold Analysis

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Business Queries:

WhatsApp: https://wa.me/971507196693

Telegram: https://t.me/PRGoldSupport

Email: info@piyushratnu.com

Reddit: https://www.reddit.com/r/prgoldanalysis/

#PiyushRatnu #BullionTrading #Trading #Dubai #Forex #SpotGold #XAUUSD #forexeducation

: