Aleksey Ivanov / プロファイル

- 情報

|

6+ 年

経験

|

32

製品

|

140

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

----------------------------------------------------------------------

💰 生産された製品:

1) 🏆 市場ノイズの最適なフィルタリングを備えたインジケーター(開始位置と終了位置のポイントを選択するため)。

2) 🏆 統計的指標(世界的な傾向を決定するため)。

3) 🏆 市場調査指標(価格の微細構造を明確にし、チャネルを構築し、トレンドの逆転と引き戻しの違いを特定するため)。

---------------------------------------------------------------------

☛ ブログの詳細 https://www.mql5.com/en/blogs/post/741637

はじめに StatPredictインディケータは、一般的なトレンドのトレンドとこのトレンドの周りのそれ自身の小さな統計的な価格変動に従って価格を予測します。 StatPredictでは、予測の期間を設定する必要があります。予測期間は、インジケーター設定の「バーの予測の長さ」パラメーターで設定されます。 (« Length of forecast in bars» ) 予測期間は、現在のトレンドトレンドの特徴的な時間スケールに対応する必要があります。トレンドのタイムスケールは、指標ProfitMACDによって最もよく測定されます。 チャートにインストールした後の指標の読みの最終計算は、新しいティックが到着したときに行われます。

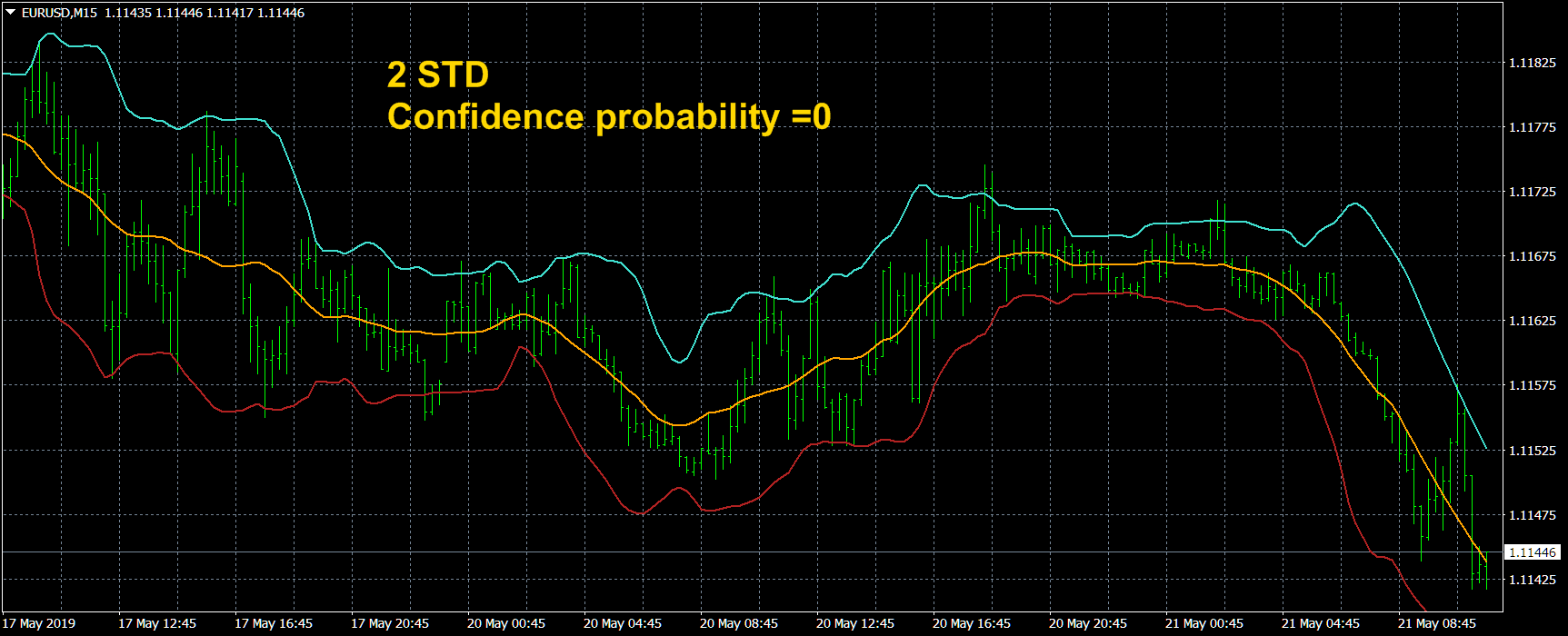

The StatChannel indicator is constructed in the same way as a classic Bollinger Bands indicator, but only on the basis of the non-lagging moving average. Such a curve is calculated at points (Inf, n + 1], as a moving average at the segment (Inf, 0], where 0 is the number of the last bar, shifted back by n bars, and at the points of the segment [n, 0] it is estimated. The estimate is a curvilinear sector (sweeping confidence interval) in which the line of the non-lagging moving average is laid with a given confidence level. The non-lagging average is also surrounded by non-lagging std, which is determined at points at points (Inf, n + 1) in the same way as the non-lagging moving average, and at points of the segment [n, 0] - by a special algorithm that calculates the set of values std, that will be within the specified value of the confidence interval.

Added global shift to start calculating indicator readings (for visual estimation of the accuracy of its work).

(1) Added push and mail alert types.

(2) The number of signal identification methods have been introduced.

https://www.mql5.com/en/market/product/36336

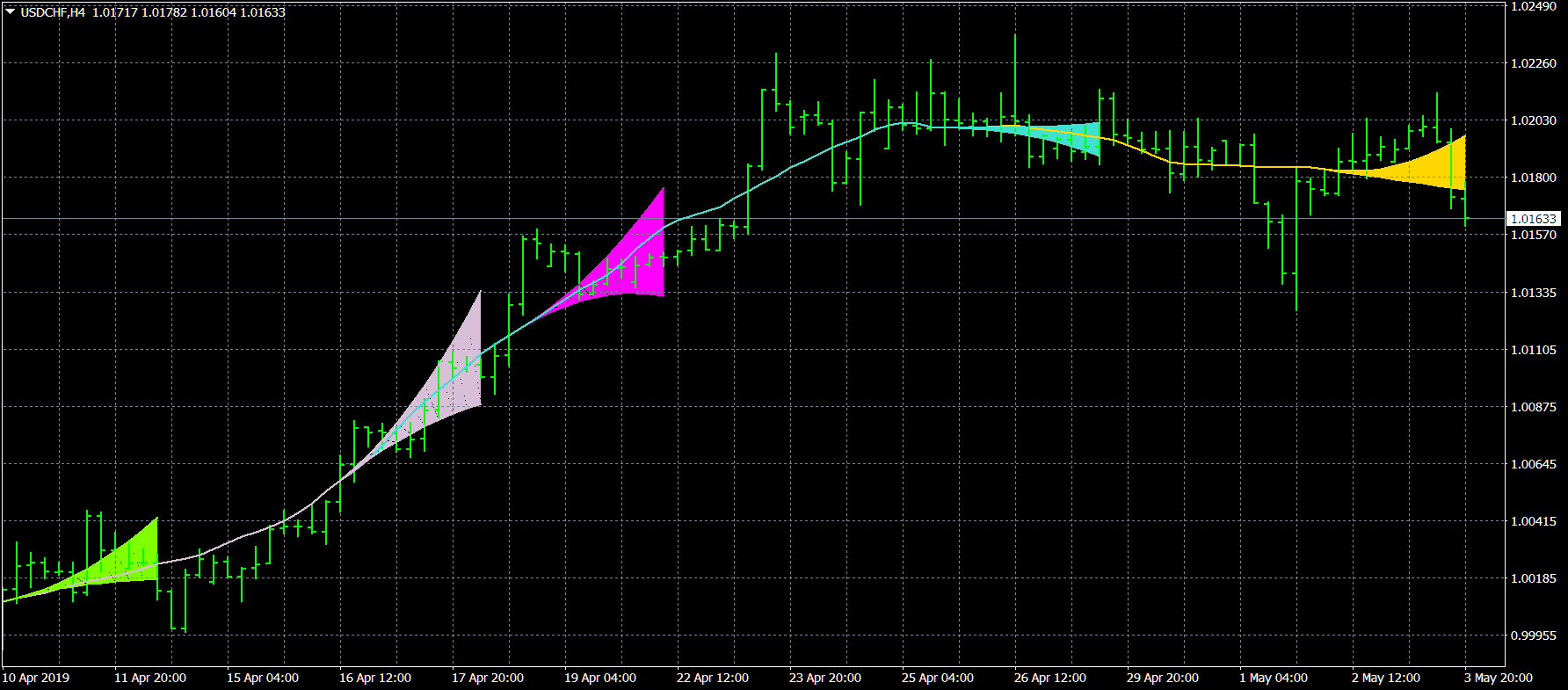

The Estimation moving average without lag (EMAWL) indicator calculates the non-lagging moving average, which is calculated at the points (Inf, n + 1) in the usual way, and at the points of the [n, 0] segment, where 0 is the last bar number, is algorithmically and there is a curvilinear sector (cover out the confidence interval) in which the line of the non-lagging moving average fits with the confidence level specified in the indicator settings. It is clear that the more the confidence probability value is taken (which by default is equal to 0.67), the wider the curvilinear sector of the confidence interval is obtained. If we take the confidence probability equal to zero, then the sector of the indicator readings at points [n, 0] will shrink to a curve, which will pass through the most probable values of the non-lagging average. Statistical studies show that the price around the non-remaining average is distributed according to the Laplace law. Knowledge of the distribution law and the algorithm for calculating the most likely non-lagging average on the [n, 0] segment allow us to calculate the confidence interval sector.

I present an indicator for professionals. ProfitMACD is very similar to classic MACD in appearance and its functions. However, ProfitMACD is based on completely new algorithms (for example, it has only one averaging period) and is more robust, especially on small timeframes, since it filters random price walks.

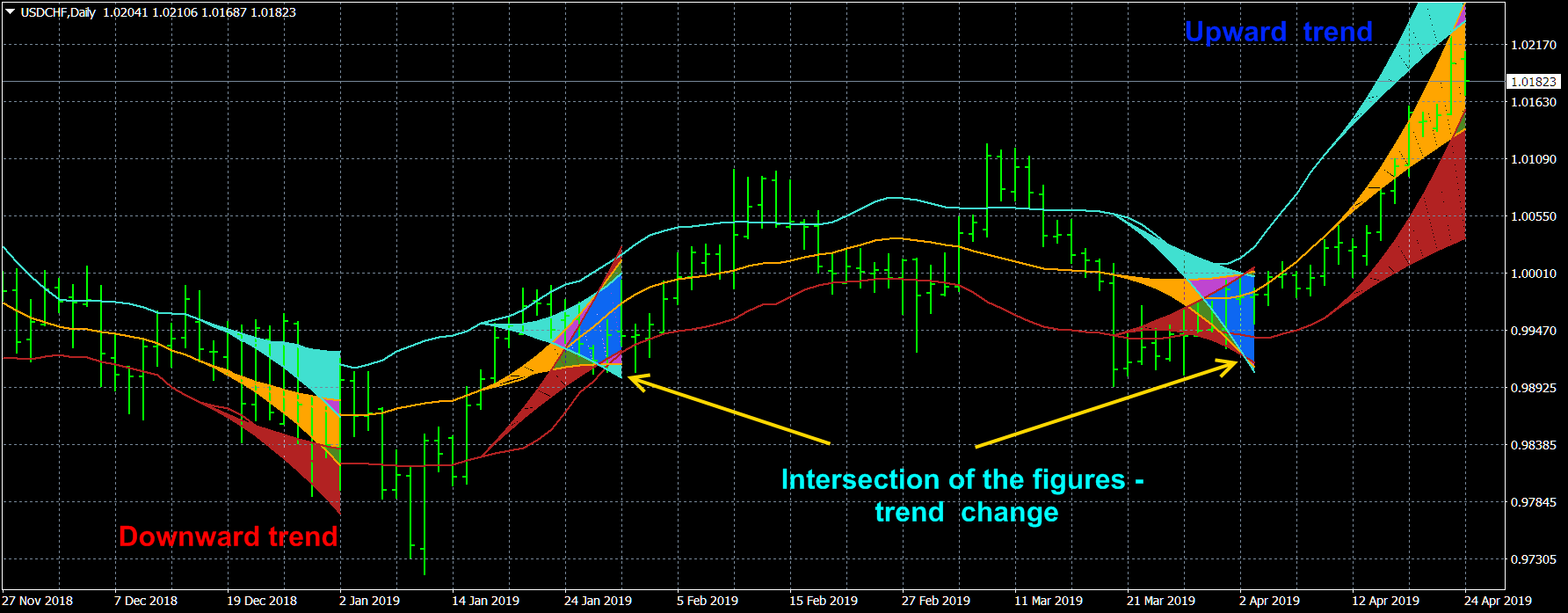

The StatChannel indicator builds the distribution patterns of the current channels, into which all price fluctuations fit in heap and evenly. The figure of the middle line gives directly those values for the current price that fit into the given (in the settings) confidence level. The figures of the upper and lower lines describe the allowable variations in price fluctuations at the top and bottom, respectively.

The principle of the indicator. The StatChannel ( SC ) indicator is a development of the Bollinger Bands indicator ( ВВ ). BB is a moving average, on both sides of which two lines are drawn, separated from it by standard deviations std multiplied by the corresponding coefficient. At the same time, a moving average with an averaging period (2n + 1) bars is always obtained lagging behind n bars. Sliding std