USD/JPY - Strong Buy - Focus Currencies and Technical Analysis (1-Hour Chart) September 2, 2024

USD/JPY - Strong Buy - Focus Currencies and Technical Analysis (1-Hour Chart) September 2, 2024

EUR/USD - Sell

The EUR/USD pair has seen slight growth around 1.1050, correcting from the local low of August 19. With the U.S. market closed for Labor Day, technical factors are supporting a "bullish" stance. Last Friday's inflation data showed that the Eurozone core Consumer Price Index (CPI) was adjusted from 2.9% to 2.8% year-on-year. This has increased the likelihood that the European Central Bank (ECB) will decide on further monetary easing by the end of the year or early next year. In the U.S., the Core Personal Consumption Expenditures (PCE) Price Index came in at 2.6% year-on-year, below expectations, leading the market to believe that the Federal Reserve is more likely to adopt a "dovish" stance.

GBP/USD - Strong Sell

The GBP/USD pair is trading sideways around 1.3130. At the start of the week, market activity is subdued due to the U.S. Labor Day holiday, but the data released last Friday from the U.S. and the UK have influenced trading trends. In the U.S., the PCE Price Index increased slightly to 2.5% year-on-year, and Core PCE to 2.6%, raising the possibility that the Fed might lower rates more swiftly at its September meeting. In the UK, consumer credit for July fell short of expectations, but personal loans and mortgage approvals increased.

AUD/USD - Strong Sell

The AUD/USD pair is attempting uncertain growth around 0.6765. After last week's "bearish" close, the pair has corrected, supported by macroeconomic statistics from Australia and China. In Australia, building permits for July increased by 10.4%, and year-on-year by 14.3%, but the Manufacturing PMI decreased to 48.5 points. In China, the Manufacturing PMI for August rose to 50.4 points, but the Australian dollar is still under pressure due to zero growth in retail sales.

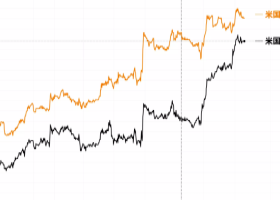

USD/JPY - Strong Buy

The USD/JPY pair is showing mixed movements around 146.00. Although "bullish" pressure is present at the start of the week due to the U.S. market being closed, the U.S. employment report for August is scheduled to be released later this week. This data could significantly influence the Fed's upcoming monetary policy decisions. The market consensus is that the September rate cut will remain at 25 basis points, but following Friday's inflation data release, the possibility of a 50 basis point cut has increased.

XAU/USD (Gold) - Sell

The XAU/USD pair is declining around 2500.00, continuing the "bearish" trend from last week. With the U.S. market closed, market activity is subdued, but investors are assessing the U.S. PCE Price Index released last Friday. This data has slightly increased the possibility that the Fed might lower rates by 50 basis points at its September meeting, although a 25 basis point adjustment remains the mainstream scenario. The U.S. employment report, due at the end of the week, could affect gold demand.