Piyush Lalsingh Ratnu / Profilo

Piyush Lalsingh Ratnu

- Trader & Analyst al Piyush Ratnu XAUUSD Spot Gold Research

- Emirati Arabi Uniti

- 156

- Informazioni

|

no

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

3

segnali

|

1

iscritti

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

Downtrend traced at 1885 on 15 Jan 2021.

|

Alerted by us on 18.01.2021 and 28.01.2021

|

Target price 1800 and 1732 achieved successfully on 01 March, 02 March and 03 March 2021.

|

Total pips encashed: 10,000+

|

To receive trading analysis and trading algorithm signals in advance, contact us for more details.

#PiyushRatnu #Bullion #Gold #Forex #Trading

|

Alerted by us on 18.01.2021 and 28.01.2021

|

Target price 1800 and 1732 achieved successfully on 01 March, 02 March and 03 March 2021.

|

Total pips encashed: 10,000+

|

To receive trading analysis and trading algorithm signals in advance, contact us for more details.

#PiyushRatnu #Bullion #Gold #Forex #Trading

Piyush Lalsingh Ratnu

GOLD: M Scenario based on Yield and Debt

At a 1.1% yield on the 10-year note, the annual servicing payment would amount to roughly $370 billion. Right now, U.S. national debt is approaching $28 trillion, and total debt-to-GDP sits at a stunning 146%.

The U.S. federal budget deficit itself is already at $4.5 trillion or so, after adding the Trump administration’s $3 trillion plus COVID-19 stimulus for last year.

If the 10-year note’s yield rate stands at 2%, coupled with a $30 trillion national debt, annual servicing payments alone would amount to $660 billion roughly.

Annual deficits will continue to make the national debt stack ever higher.

And while the United States appears to be in the relatively early stages of a monetary expansion cycle, money supply could still increase substantially and set the country up for a return to the 2008/2009 financial crisis days.

With the dilution of the fiat monetary system, higher inflation is most certainly on the way. Historically, gold prices have a very strong correlation on a long-term basis with monetary base expansion.

#XAUUSD #GOLD #PiyushRatnu

At a 1.1% yield on the 10-year note, the annual servicing payment would amount to roughly $370 billion. Right now, U.S. national debt is approaching $28 trillion, and total debt-to-GDP sits at a stunning 146%.

The U.S. federal budget deficit itself is already at $4.5 trillion or so, after adding the Trump administration’s $3 trillion plus COVID-19 stimulus for last year.

If the 10-year note’s yield rate stands at 2%, coupled with a $30 trillion national debt, annual servicing payments alone would amount to $660 billion roughly.

Annual deficits will continue to make the national debt stack ever higher.

And while the United States appears to be in the relatively early stages of a monetary expansion cycle, money supply could still increase substantially and set the country up for a return to the 2008/2009 financial crisis days.

With the dilution of the fiat monetary system, higher inflation is most certainly on the way. Historically, gold prices have a very strong correlation on a long-term basis with monetary base expansion.

#XAUUSD #GOLD #PiyushRatnu

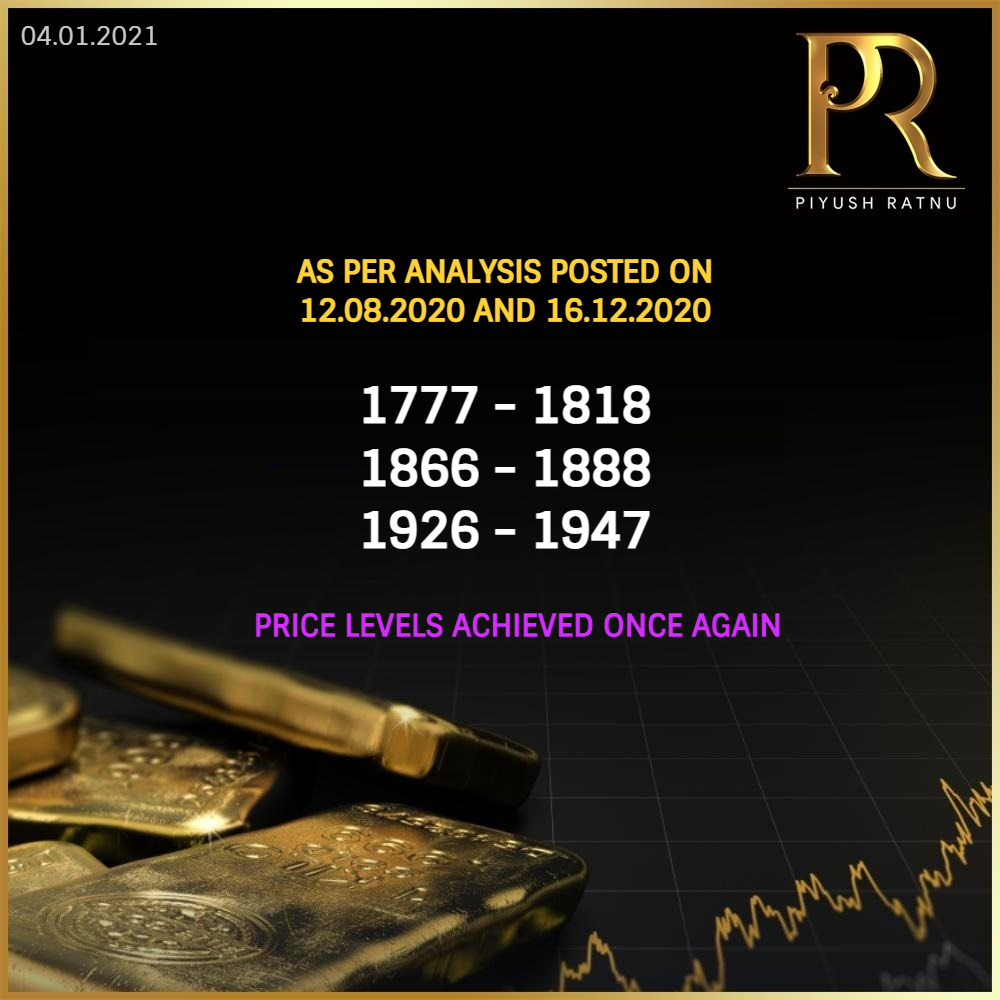

Piyush Lalsingh Ratnu

As per analysis dated 12.08.2020 and 16.12.2020, Gold touched the level of 1888, 1926 and 1947, after crashing till 1777.Accuracy of analysis in Gold proven once again. In the analysis dated 12.08.2020 crash till 1777 was well mentioned with crucial levels of 1926, 1888, 1866, 1818 and 1777.

On 16.12.2020 I had published my analysis mentioning the strong possibility of rise in Gold prices after 16.12.2020 as per past data, history, trend, dollar weakness and growing uncertainty + miner stocks, ETF volumes and volume - momentum based open contracts ratio.

I am sure, those who believed in me and in my analysis have made handsome profits today. The reversal from 1777 to CMP 1926 gives an opportunity to encash 108$ movement in the last 4 months + last 15 days repeatedly. On 1 lot it gives a profit of $10,800, 10 lot- $1,08,000 and on 100 lot: $ 1.8 Million on single trades, and the proof of the same can be seen in the video posted below.

Subscribe to our analysis and trading algorithms to trade Forex and Bullion markets with confidence and accuracy.

For more trading ideas, email at piyushratnu@gmail.com

#PiyushRatnu #Forex #Bullion #Gold

On 16.12.2020 I had published my analysis mentioning the strong possibility of rise in Gold prices after 16.12.2020 as per past data, history, trend, dollar weakness and growing uncertainty + miner stocks, ETF volumes and volume - momentum based open contracts ratio.

I am sure, those who believed in me and in my analysis have made handsome profits today. The reversal from 1777 to CMP 1926 gives an opportunity to encash 108$ movement in the last 4 months + last 15 days repeatedly. On 1 lot it gives a profit of $10,800, 10 lot- $1,08,000 and on 100 lot: $ 1.8 Million on single trades, and the proof of the same can be seen in the video posted below.

Subscribe to our analysis and trading algorithms to trade Forex and Bullion markets with confidence and accuracy.

For more trading ideas, email at piyushratnu@gmail.com

#PiyushRatnu #Forex #Bullion #Gold

Piyush Lalsingh Ratnu

Gold is starting to now enter its strong time of the year. From December 16 through to February 24 gold has risen eight times out of the last 10 years. The largest gain was in 2015 with a +16.23% profit. The largest loss was in 2012 with a -6.46% loss. The annualised rate of return is +39.73% for this period.

So, with an 80% win rate this could be a great time at the end of next week to start buying gold. Mark it in your diary. Dollar strength and Lack of perceived action Federal Reserve can invalidate this outlook.

For more trading ideas, email at piyushratnu@gmail.com

#PiyushRatnu #BullionTrading #Forex #Analysis #FinancialMarkets

So, with an 80% win rate this could be a great time at the end of next week to start buying gold. Mark it in your diary. Dollar strength and Lack of perceived action Federal Reserve can invalidate this outlook.

For more trading ideas, email at piyushratnu@gmail.com

#PiyushRatnu #BullionTrading #Forex #Analysis #FinancialMarkets

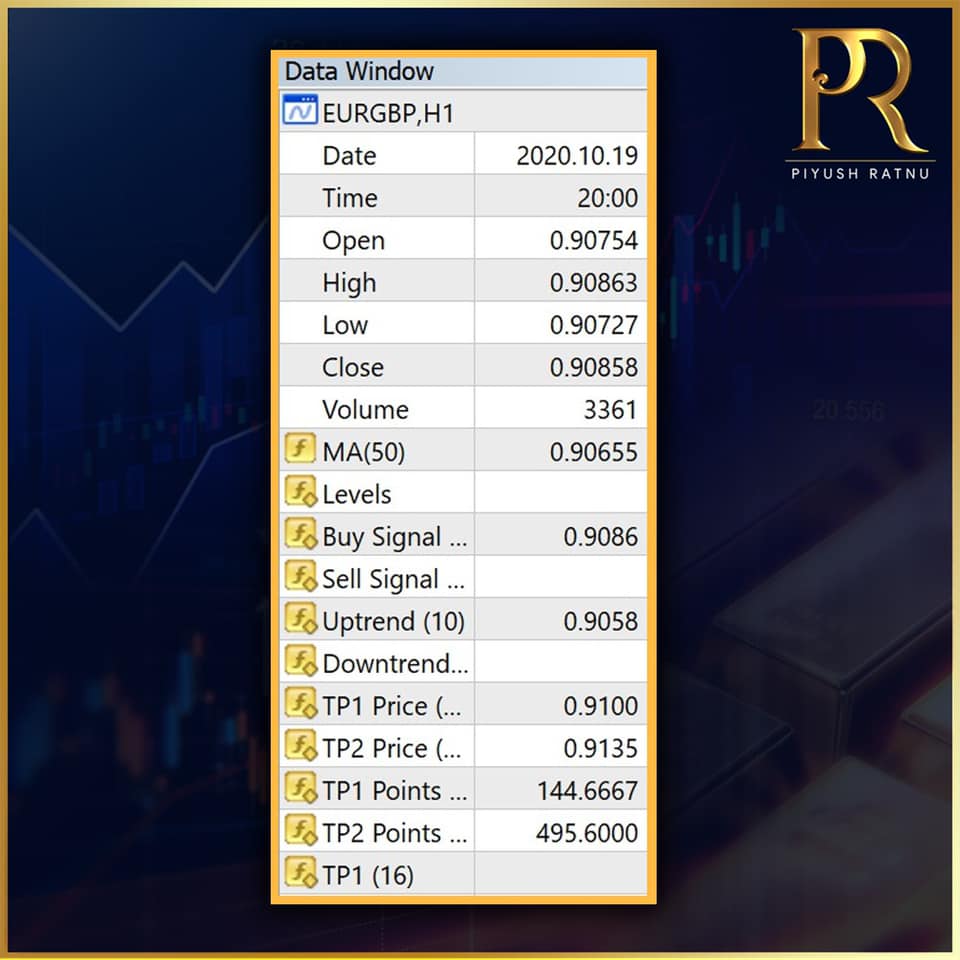

Piyush Lalsingh Ratnu

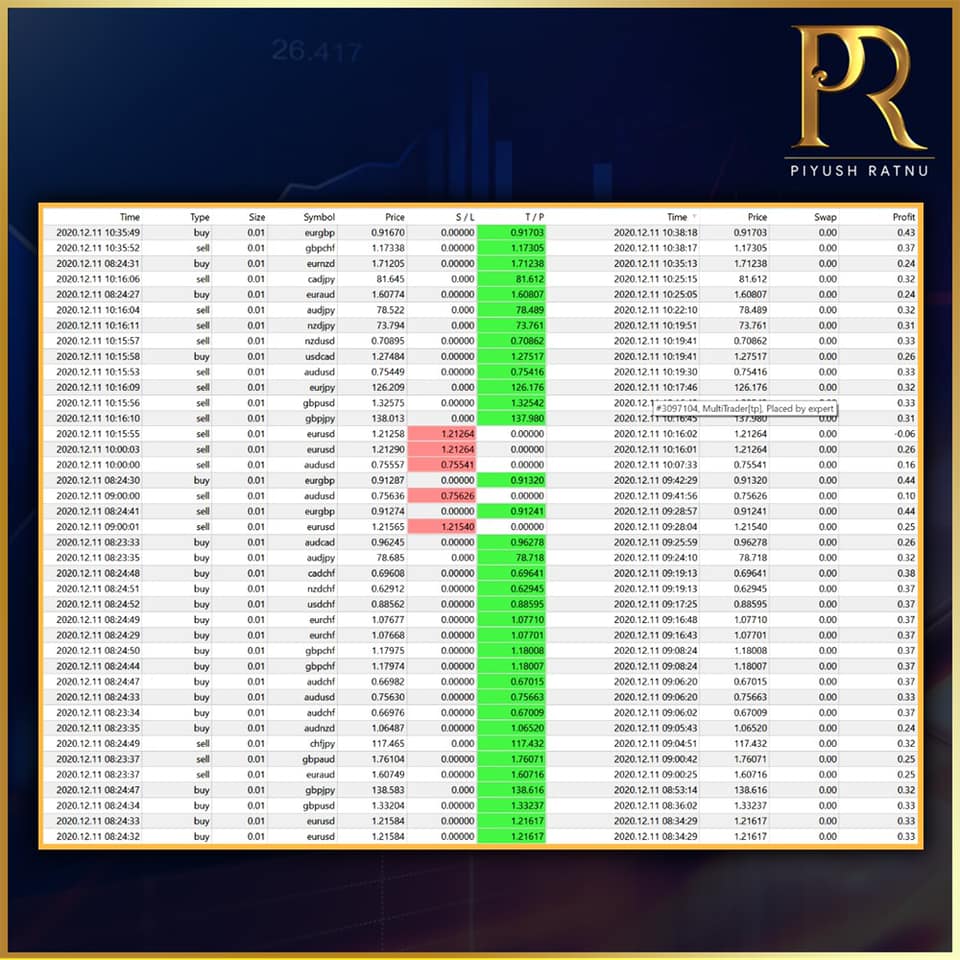

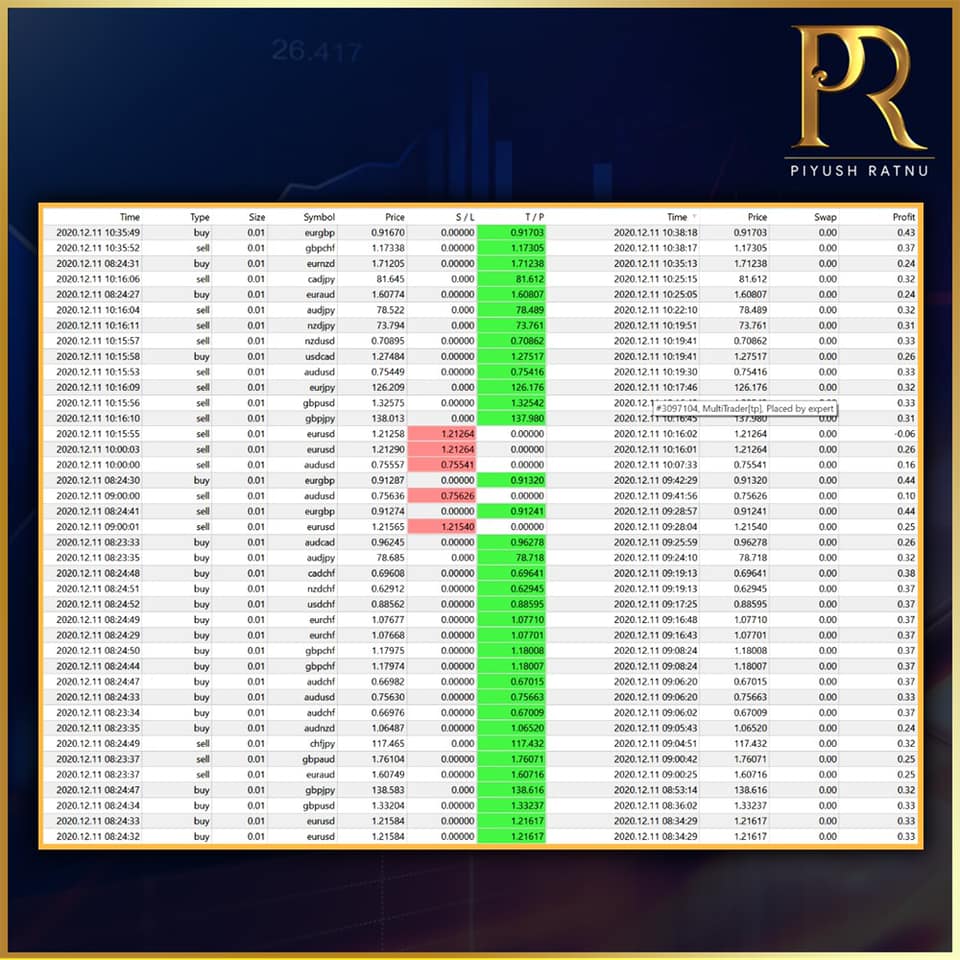

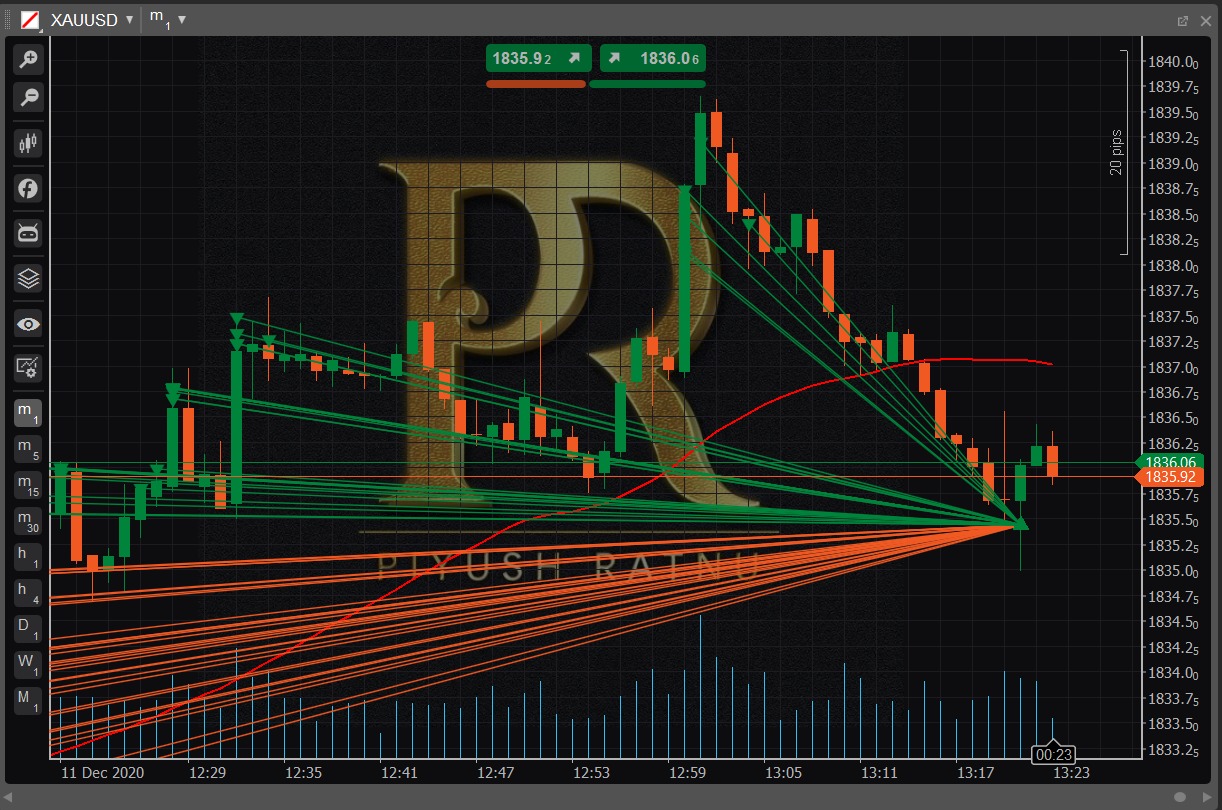

11.12.2020

EURGBP | Trading Direction Alert by Algorithm | BUY from 0.89200 level

CMP: 0.92100 | Target Price achieved | For more trading ideas, email at piyushratnu@gmail.com

#PiyushRatnu #BullionTrading #Forex #Analysis #FinancialMarkets

EURGBP | Trading Direction Alert by Algorithm | BUY from 0.89200 level

CMP: 0.92100 | Target Price achieved | For more trading ideas, email at piyushratnu@gmail.com

#PiyushRatnu #BullionTrading #Forex #Analysis #FinancialMarkets

Piyush Lalsingh Ratnu

11.12.2020

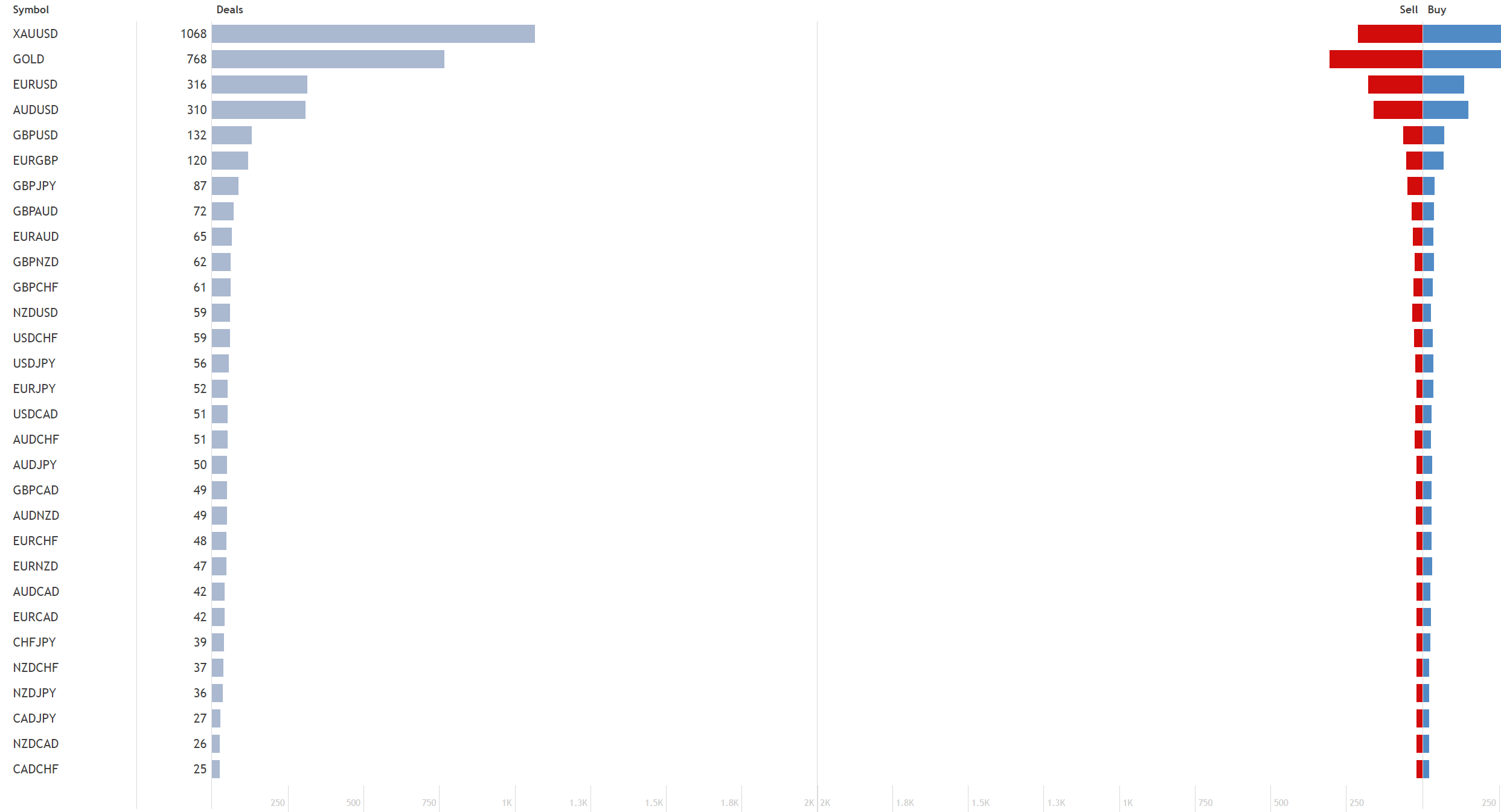

27 currencies trades. 98% TP Hit.

Algorithm: $AMG

#PiyushRatnu #forextrading #bulliontrading

27 currencies trades. 98% TP Hit.

Algorithm: $AMG

#PiyushRatnu #forextrading #bulliontrading

Piyush Lalsingh Ratnu

Date of analysis: 08 12 2020

Today GBPUSD has crashed to 1.31500 levels.

As per our trading algorithm $AMG, SELL signal on H4 chart, with target price of 1.31500 level was well declared on 08.12.2020

#Brexit #GBPUSD #forex #fx #PiyushRatnu

Today GBPUSD has crashed to 1.31500 levels.

As per our trading algorithm $AMG, SELL signal on H4 chart, with target price of 1.31500 level was well declared on 08.12.2020

#Brexit #GBPUSD #forex #fx #PiyushRatnu

Piyush Lalsingh Ratnu

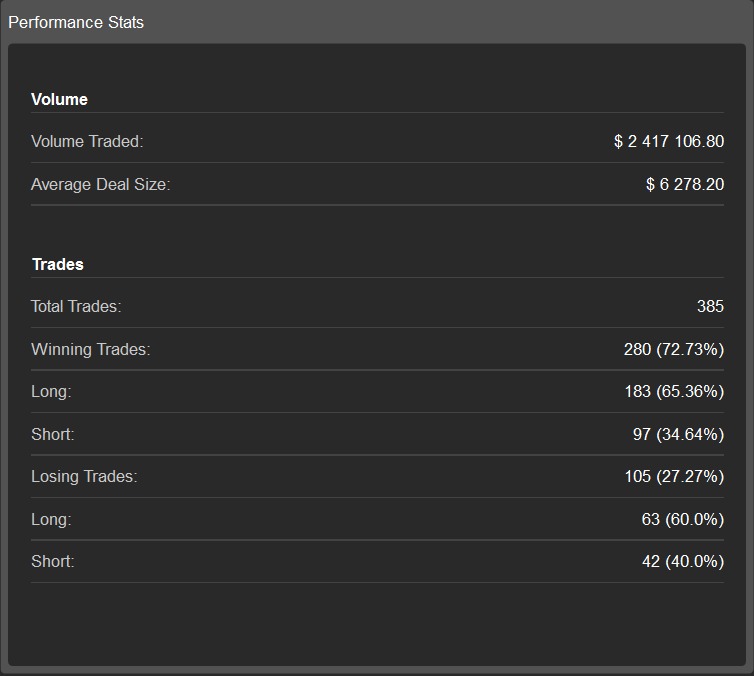

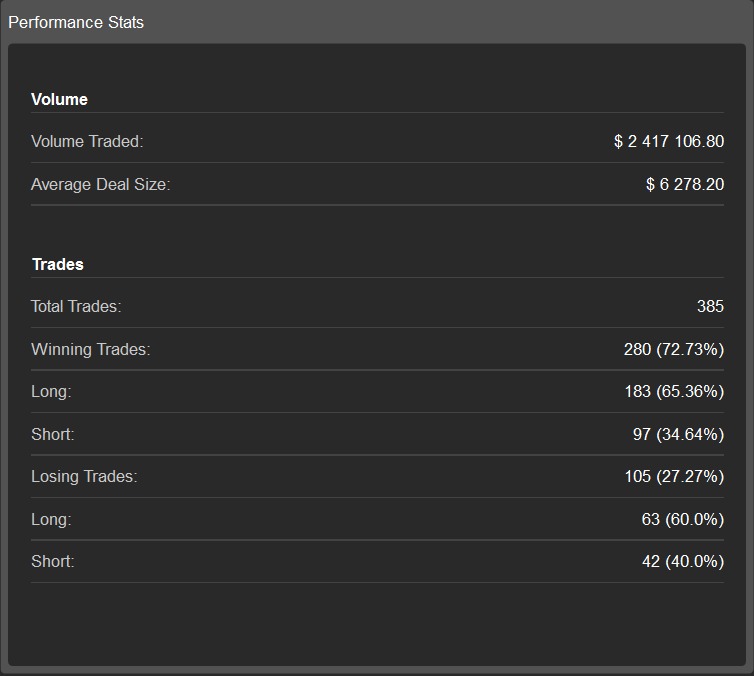

11.12.2020 | Trading: Financials Summary |Platform: Ctrader

Total Volume Traded: $ 2,417,106 | Average Deal size: $ 6,278 | Accuracy: 72.7%

To subscribe my analysis & signals: Email: piyushratnu@gmail.com

#PiyushRatnu #BullionTrading #Forex #Analysis #FinancialMarkets

Total Volume Traded: $ 2,417,106 | Average Deal size: $ 6,278 | Accuracy: 72.7%

To subscribe my analysis & signals: Email: piyushratnu@gmail.com

#PiyushRatnu #BullionTrading #Forex #Analysis #FinancialMarkets

Piyush Lalsingh Ratnu

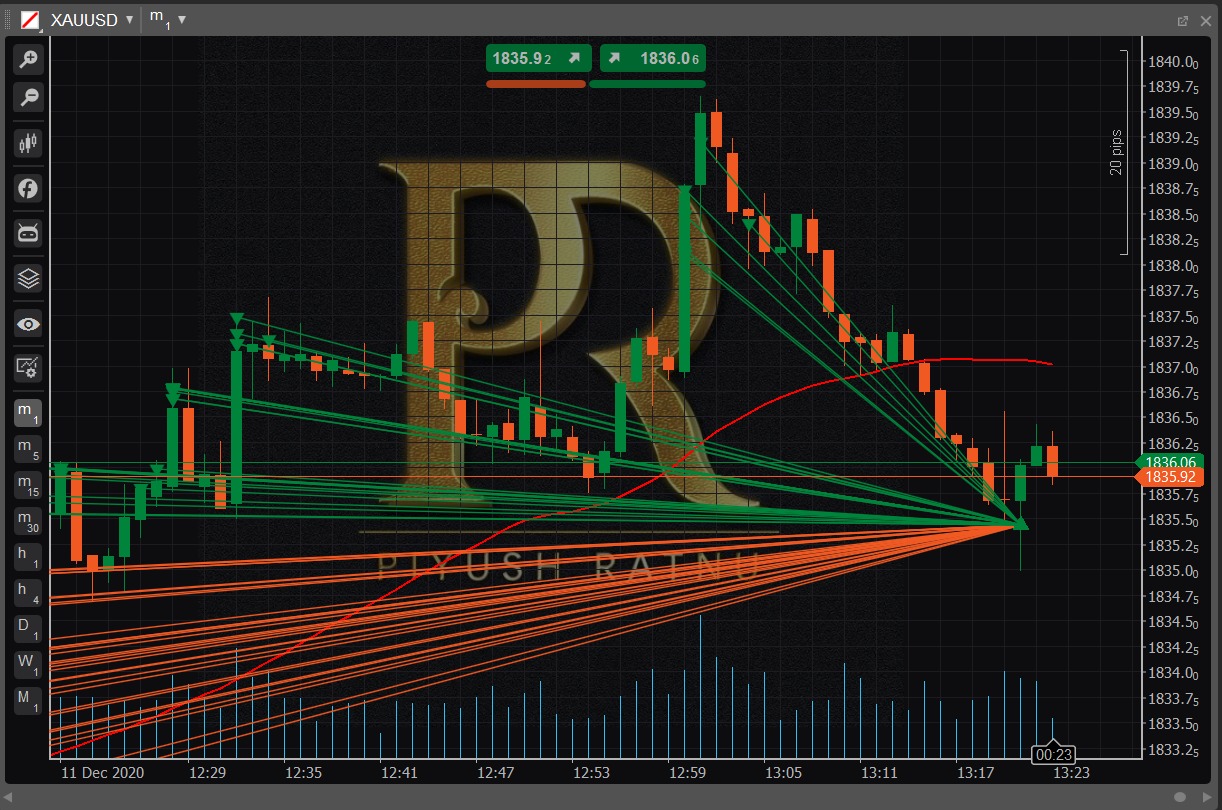

11.12.2020 | Trading Summary | XAUUSD | Platform: CTrader

Death CROSS Alert was posted by me on 19 Nov. 2020 on Whatsapp and T Channel.

Gold Crashed from 1877 to 1760.00 Price Range. Accuracy Proven Once Again.

#PiyushRatnu #Forex #Bullion #Gold

Death CROSS Alert was posted by me on 19 Nov. 2020 on Whatsapp and T Channel.

Gold Crashed from 1877 to 1760.00 Price Range. Accuracy Proven Once Again.

#PiyushRatnu #Forex #Bullion #Gold

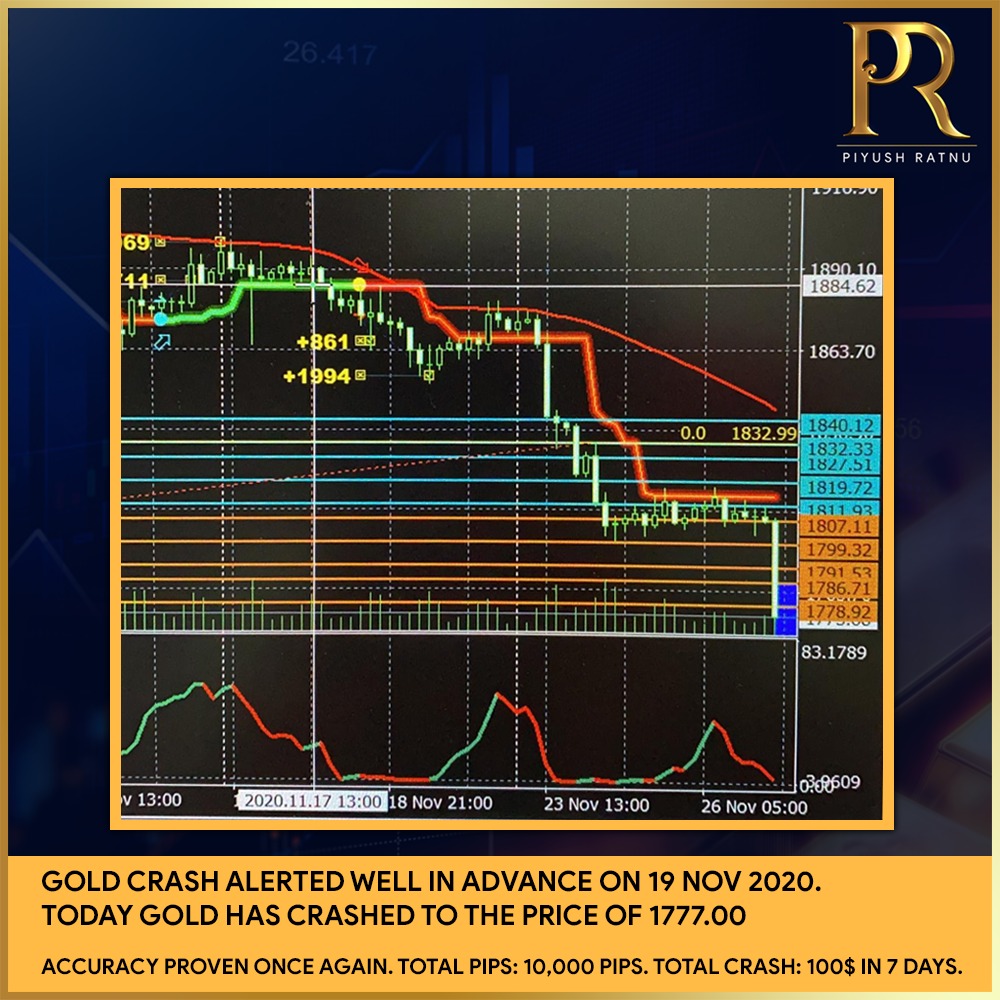

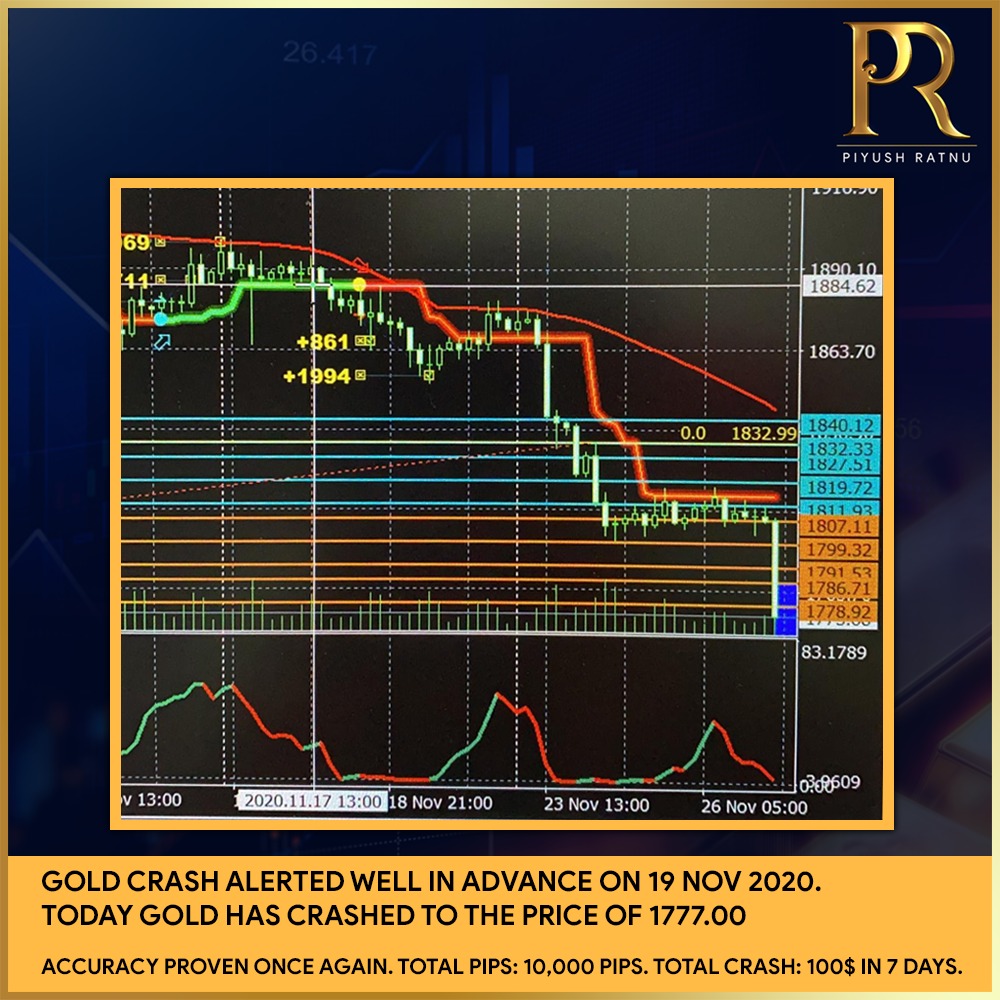

Piyush Lalsingh Ratnu

Accuracy at it's best! GOLD Crash Target 1777.0 achieved today.

Alert was posted by me on 19 Nov. 2020 on Whatsapp and T Channel.

#PiyushRatnu #Forex #Bullion #Gold

Alert was posted by me on 19 Nov. 2020 on Whatsapp and T Channel.

#PiyushRatnu #Forex #Bullion #Gold

Piyush Lalsingh Ratnu

Gold crash alerted well in advance on 19 Nov 2020.

Today Gold has crashed to the price of 1777.00

Accuracy proven once again.

Total pips: 10,000 pips. Total crash: 100$ in 7 days.

#PiyushRatnu #Gold #Bullion #ForexTrading

Today Gold has crashed to the price of 1777.00

Accuracy proven once again.

Total pips: 10,000 pips. Total crash: 100$ in 7 days.

#PiyushRatnu #Gold #Bullion #ForexTrading

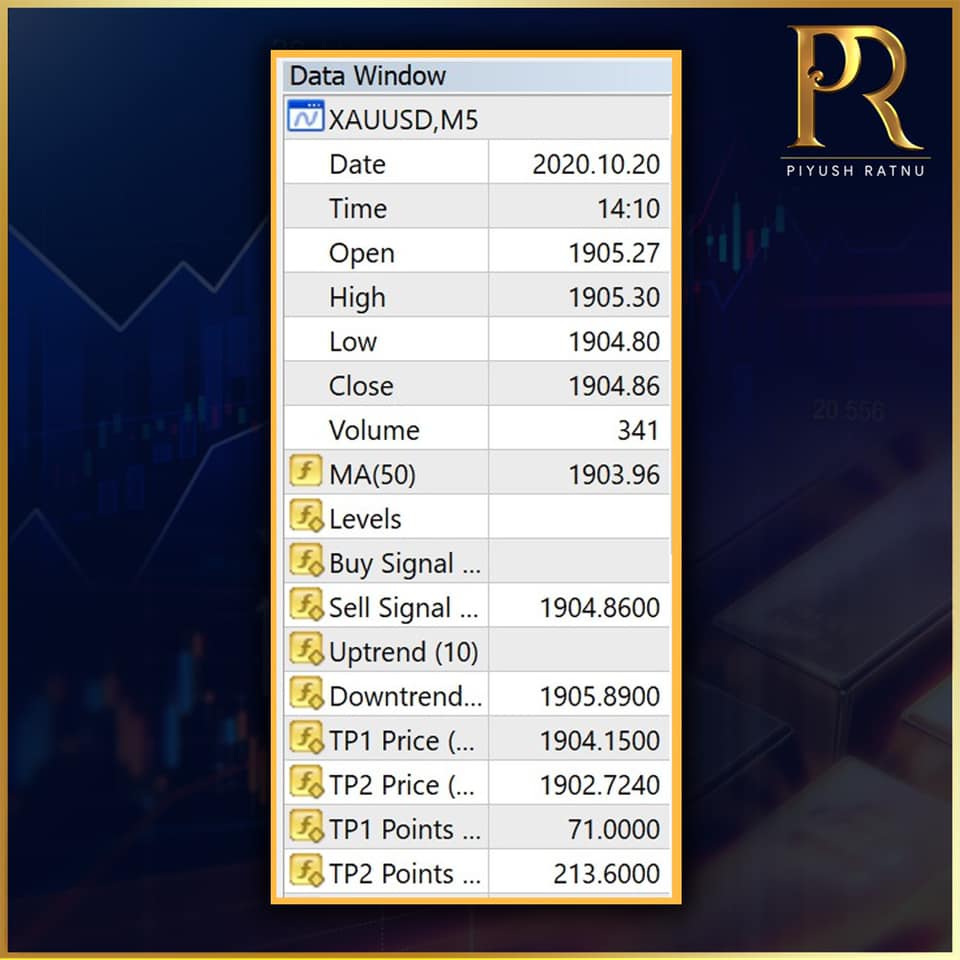

Piyush Lalsingh Ratnu

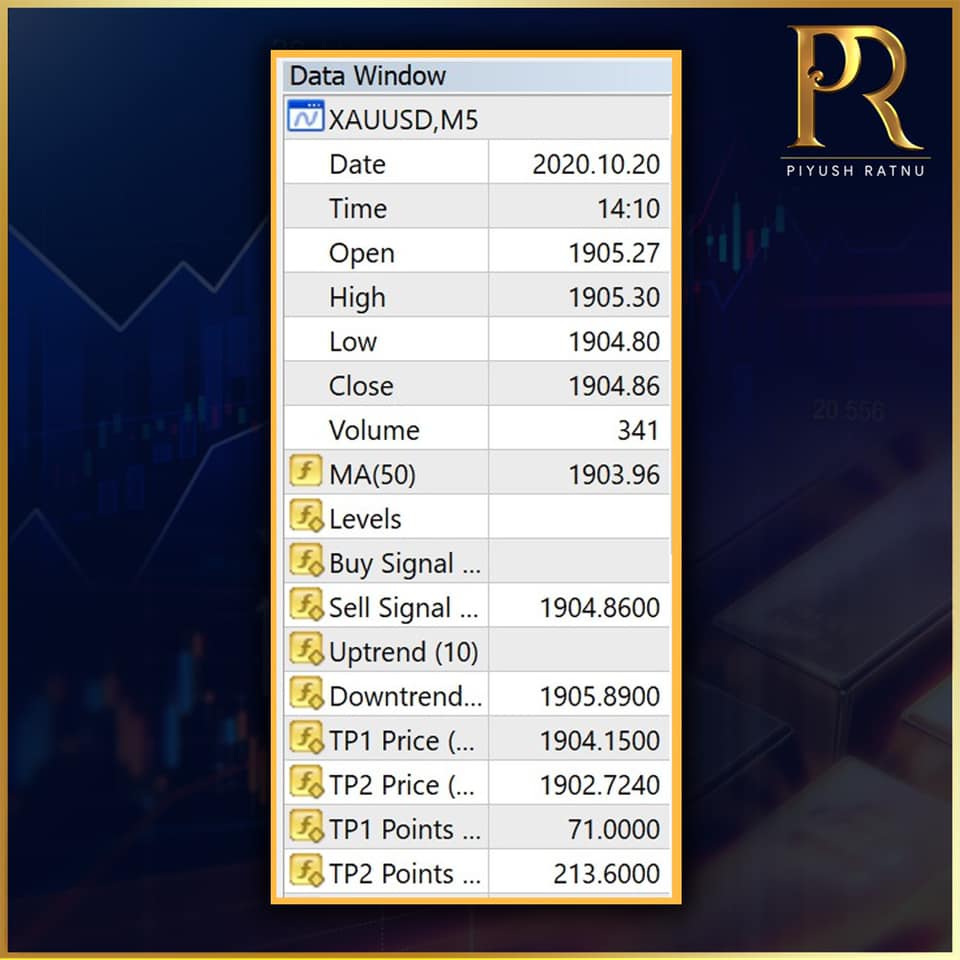

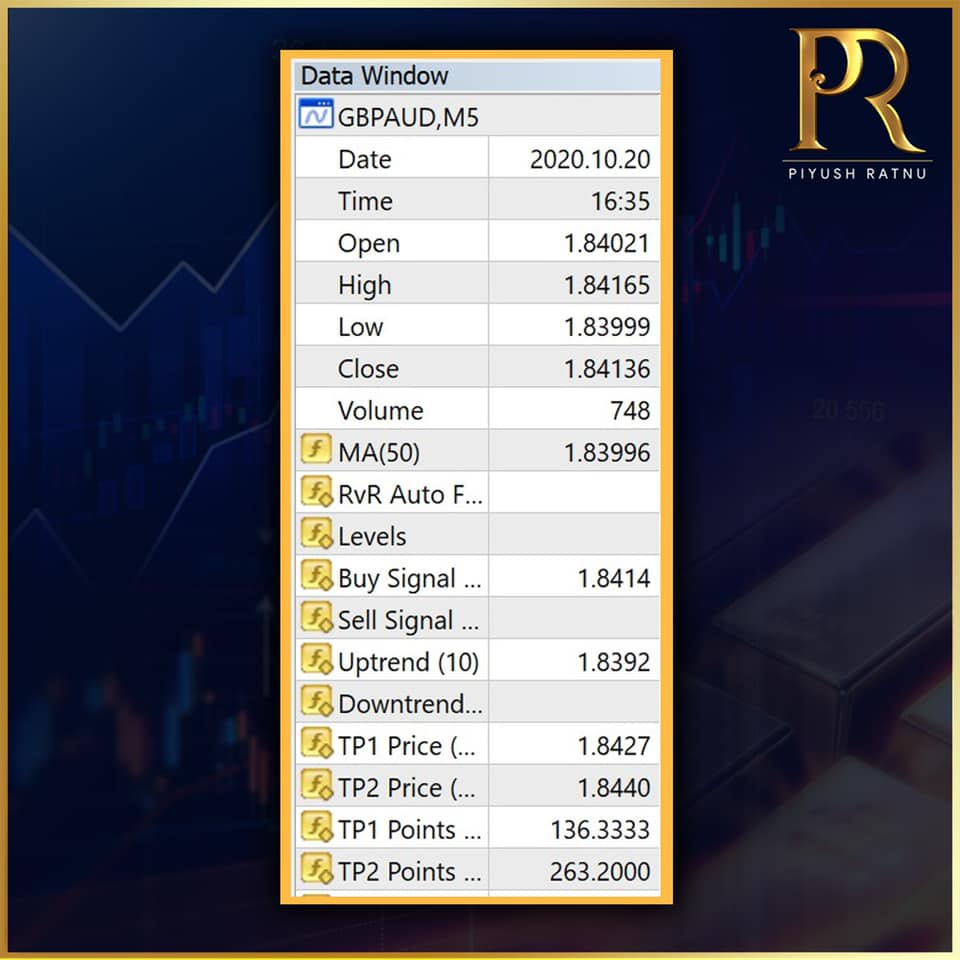

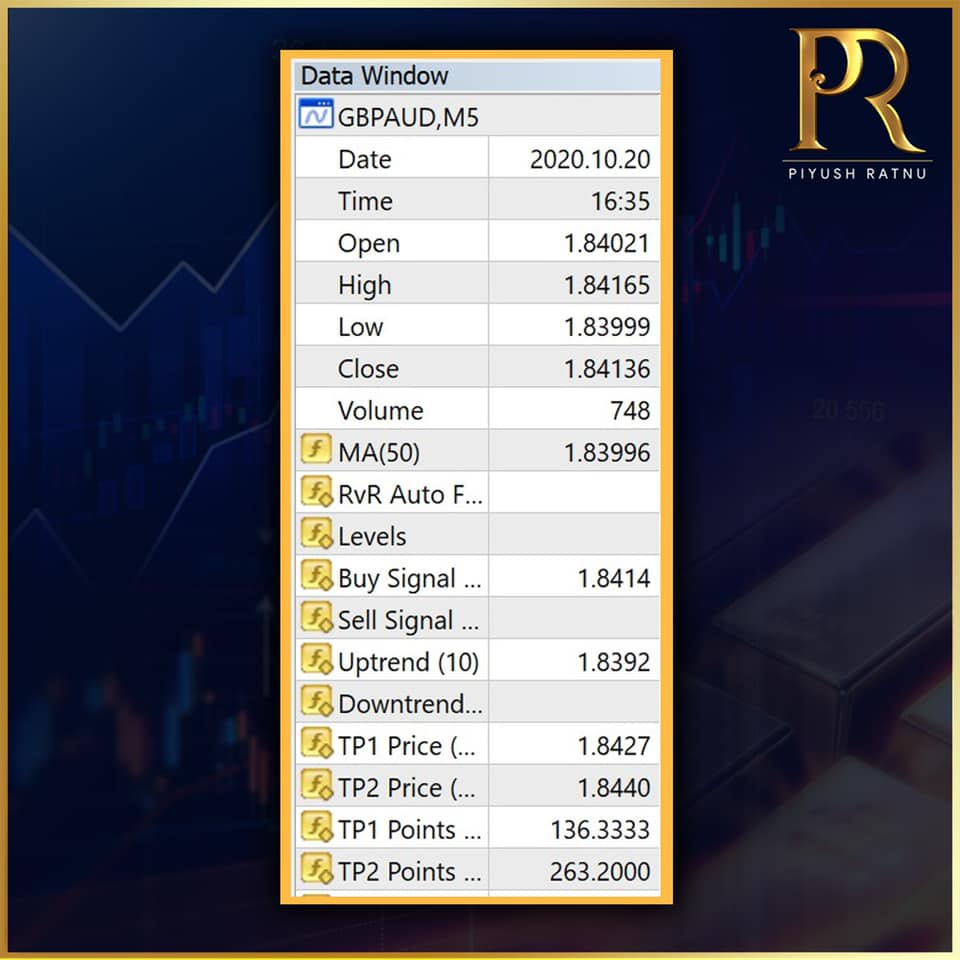

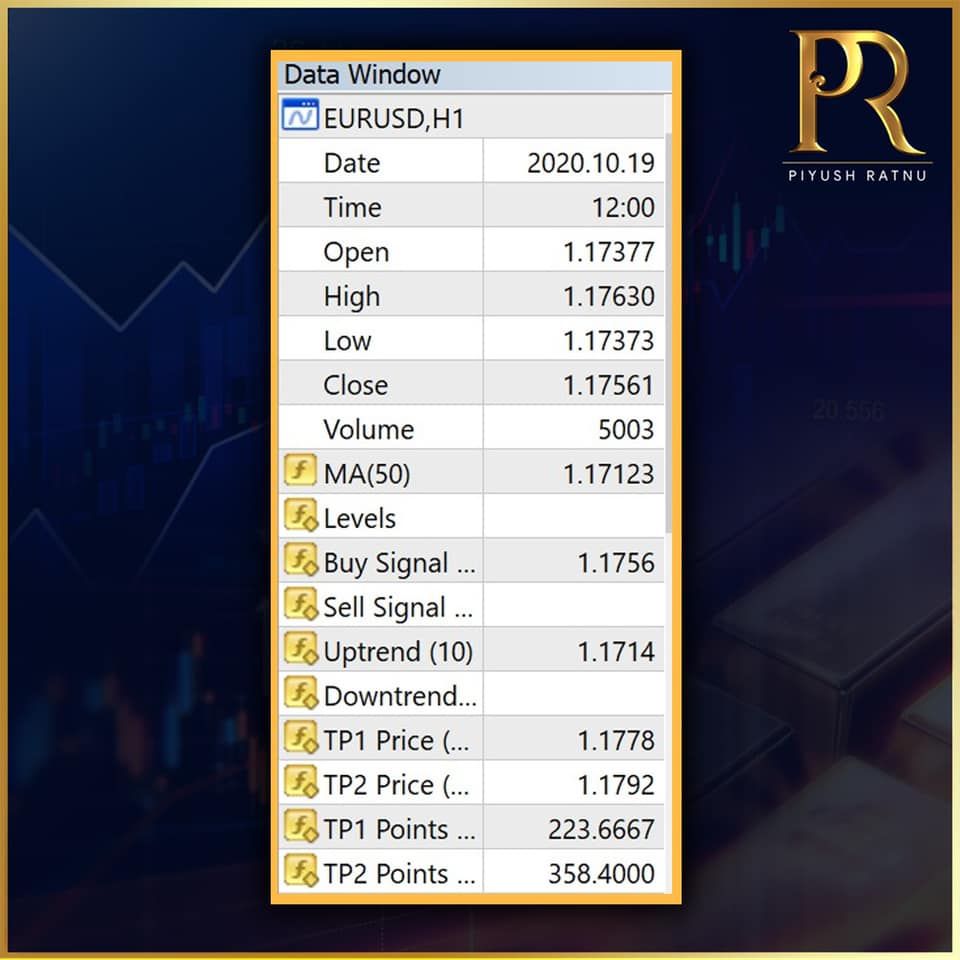

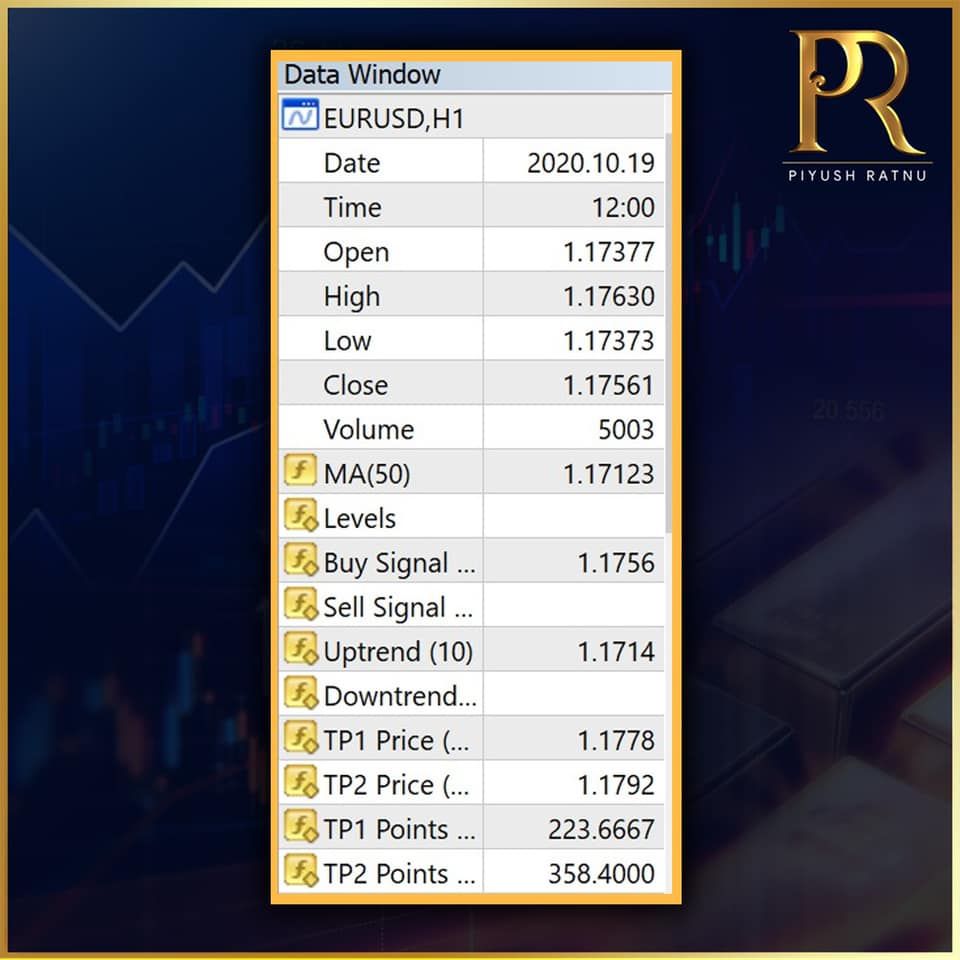

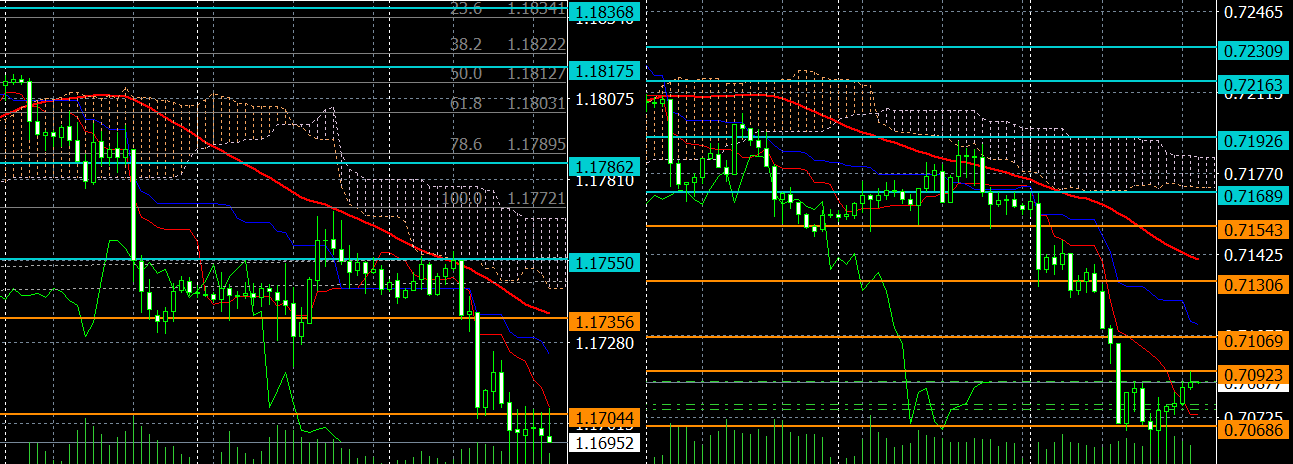

20.10.2020

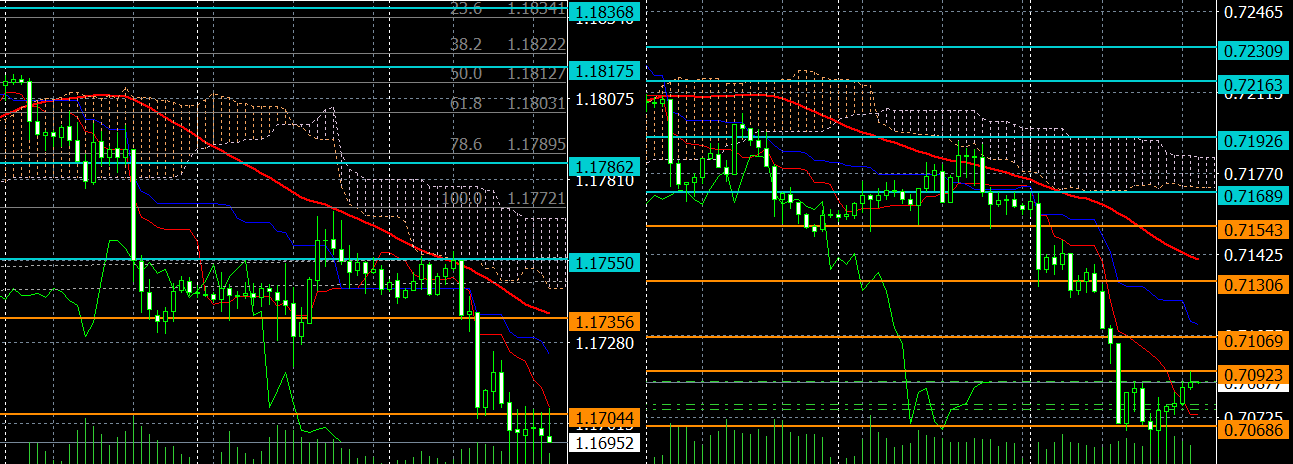

Today’s 12 trade signals and analysis. Accuracy: 89%

#PiyushRatnu #Analysis #Trade #Forex #fx

Today’s 12 trade signals and analysis. Accuracy: 89%

#PiyushRatnu #Analysis #Trade #Forex #fx

Piyush Lalsingh Ratnu

20.10.2020

Today’s 12 trade signals and analysis. Accuracy: 89%

#PiyushRatnu #Analysis #Trade #Forex #fx

Today’s 12 trade signals and analysis. Accuracy: 89%

#PiyushRatnu #Analysis #Trade #Forex #fx

Piyush Lalsingh Ratnu

20.10.2020

Today’s 12 trade signals and analysis. Accuracy: 89%

#PiyushRatnu #Analysis #Trade #Forex #fx

Today’s 12 trade signals and analysis. Accuracy: 89%

#PiyushRatnu #Analysis #Trade #Forex #fx

Piyush Lalsingh Ratnu

20.10.2020

Today’s 12 trade signals and analysis. Accuracy: 89%

#PiyushRatnu #Analysis #Trade #Forex #fx

Today’s 12 trade signals and analysis. Accuracy: 89%

#PiyushRatnu #Analysis #Trade #Forex #fx

Piyush Lalsingh Ratnu

20.10.2020

Today’s 12 trade signals and analysis. Accuracy: 89%

#PiyushRatnu #Analysis #Trade #Forex #fx

Today’s 12 trade signals and analysis. Accuracy: 89%

#PiyushRatnu #Analysis #Trade #Forex #fx

Piyush Lalsingh Ratnu

Why EURUSD and AUDUSD crashed today?

A combination of the surging virus, threatening the slow recovery that was already losing momentum, the lack of new stimulus in the US, and market positioning is seeing risk unwind in a big way today.

In Germany, Angela Merkel announced that those cases were in an exponential growth phase as she limited the number of gatherings to 10 people. The country confirmed more than 5,132 cases, the highest reading since April.

European stocks declined sharply as investors reacted to the rising number of Covid-19 cases in Europe.

The Australian dollar declined sharply as the market reacted to the country’s jobs numbers. The numbers showed that the unemployment rate rose from 6.8% to 6.9% as the country lost close to 30,000 jobs.

Benchmark 10-year yields are lower, led by Australia's seven basis point decline.

#dollar #trading #markets #forex #currency #forextrading #gold #fx #tradingforex #bullion #bullion #financialmarkets #analysis

A combination of the surging virus, threatening the slow recovery that was already losing momentum, the lack of new stimulus in the US, and market positioning is seeing risk unwind in a big way today.

In Germany, Angela Merkel announced that those cases were in an exponential growth phase as she limited the number of gatherings to 10 people. The country confirmed more than 5,132 cases, the highest reading since April.

European stocks declined sharply as investors reacted to the rising number of Covid-19 cases in Europe.

The Australian dollar declined sharply as the market reacted to the country’s jobs numbers. The numbers showed that the unemployment rate rose from 6.8% to 6.9% as the country lost close to 30,000 jobs.

Benchmark 10-year yields are lower, led by Australia's seven basis point decline.

#dollar #trading #markets #forex #currency #forextrading #gold #fx #tradingforex #bullion #bullion #financialmarkets #analysis

Piyush Lalsingh Ratnu

15.10.2020

Today’s 8 trade signals and analysis. Accuracy: 95%

Signals in: GBPAUD XAUUSD AUDUSD EURJPY USDCAD EURCAD CADJPY BTCUSD

#PiyushRatnu #Analysis #Trade #Forex #fx

Today’s 8 trade signals and analysis. Accuracy: 95%

Signals in: GBPAUD XAUUSD AUDUSD EURJPY USDCAD EURCAD CADJPY BTCUSD

#PiyushRatnu #Analysis #Trade #Forex #fx

: