Piyush Lalsingh Ratnu / Profilo

- Informazioni

|

no

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

Yesterday's news resulted in price moves that were likely to happen, not because of "magic", but because reversals were likely to happen anyway. The news just happened to fit. However, since it's not as simple as "gold reverses on Pelosi visit," the majority of people writing about markets won't be able to forecast the reversal beforehand.

The USD Index declined quite visibly yesterday, almost reached its 50-day moving average, and then rallied back up - very close to the turn of the month. Was that the final short-term bottom? It might have been, but it could still be the case that it moves to 104 in order to bottom there.

The bump is probably over – the visit had already started and there were no military repercussions.

If Biden is going to lift China’s tariffs, it’s likely to contribute to further declines in the precious metals sector. Why? Because it means greater cooperation and peace in general. Geopolitical conflicts tend to cause gold to rally, at least temporarily. Consequently, when conflicts de-escalate, it’s likely to remove some of the safe-haven appeal that gold (and the rest of the sector) has.

It is not the news itself that drives the price, but rather the news that is filtered through what people want to react to based on emotional/technical grounds.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

The USD Index declined quite visibly yesterday, almost reached its 50-day moving average, and then rallied back up - very close to the turn of the month. Was that the final short-term bottom? It might have been, but it could still be the case that it moves to 104 in order to bottom there.

The bump is probably over – the visit had already started and there were no military repercussions.

If Biden is going to lift China’s tariffs, it’s likely to contribute to further declines in the precious metals sector. Why? Because it means greater cooperation and peace in general. Geopolitical conflicts tend to cause gold to rally, at least temporarily. Consequently, when conflicts de-escalate, it’s likely to remove some of the safe-haven appeal that gold (and the rest of the sector) has.

It is not the news itself that drives the price, but rather the news that is filtered through what people want to react to based on emotional/technical grounds.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

China's largest-ever military exercises encircling Taiwan kicked off Thursday, in a show of force straddling vital international shipping lanes after a visit to the island by US House Speaker Nancy Pelosi.

Pelosi left Taiwan Wednesday after a trip that defied a series of stark threats from Beijing, which views the self-ruled island as its territory.

Pelosi was the highest-profile elected US official to visit Taiwan in 25 years, and said her trip made it "unequivocally clear" that the United States would not abandon a democratic ally.

It sparked a furious reaction from Beijing, which vowed "punishment" and announced military drills in the seas around Taiwan -- some of the world's busiest waterways.

China’s military fired missiles into the sea as it kicked off three days of live-fire military exercises around the island in response to US House Speaker Nancy Pelosi’s visit, even as Taipei played down the impact on flights and shipping.

China tested several Dongfeng missiles near Taiwan from 13:56 pm local time, according to a statement from Taiwan’s Defense Ministry. China confirmed the strikes, saying separately they hit targets accurately. Earlier Chinese state media said live-fire drills began as planned in six areas surrounding the island.

Chinese President Xi Jinping is under pressure to give a strong response to the trip, particularly after some local nationalists were disappointed that Beijing wasn’t able to deter Pelosi from visiting. She left Taiwan on Wednesday and is holding meetings in South Korea on Thursday before heading next to Japan.

Handles to monitor:

https://twitter.com/MoNDefense

https://twitter.com/USCC_GOV

https://twitter.com/SpokespersonCHN

https://twitter.com/MFA_China

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Pelosi left Taiwan Wednesday after a trip that defied a series of stark threats from Beijing, which views the self-ruled island as its territory.

Pelosi was the highest-profile elected US official to visit Taiwan in 25 years, and said her trip made it "unequivocally clear" that the United States would not abandon a democratic ally.

It sparked a furious reaction from Beijing, which vowed "punishment" and announced military drills in the seas around Taiwan -- some of the world's busiest waterways.

China’s military fired missiles into the sea as it kicked off three days of live-fire military exercises around the island in response to US House Speaker Nancy Pelosi’s visit, even as Taipei played down the impact on flights and shipping.

China tested several Dongfeng missiles near Taiwan from 13:56 pm local time, according to a statement from Taiwan’s Defense Ministry. China confirmed the strikes, saying separately they hit targets accurately. Earlier Chinese state media said live-fire drills began as planned in six areas surrounding the island.

Chinese President Xi Jinping is under pressure to give a strong response to the trip, particularly after some local nationalists were disappointed that Beijing wasn’t able to deter Pelosi from visiting. She left Taiwan on Wednesday and is holding meetings in South Korea on Thursday before heading next to Japan.

Handles to monitor:

https://twitter.com/MoNDefense

https://twitter.com/USCC_GOV

https://twitter.com/SpokespersonCHN

https://twitter.com/MFA_China

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

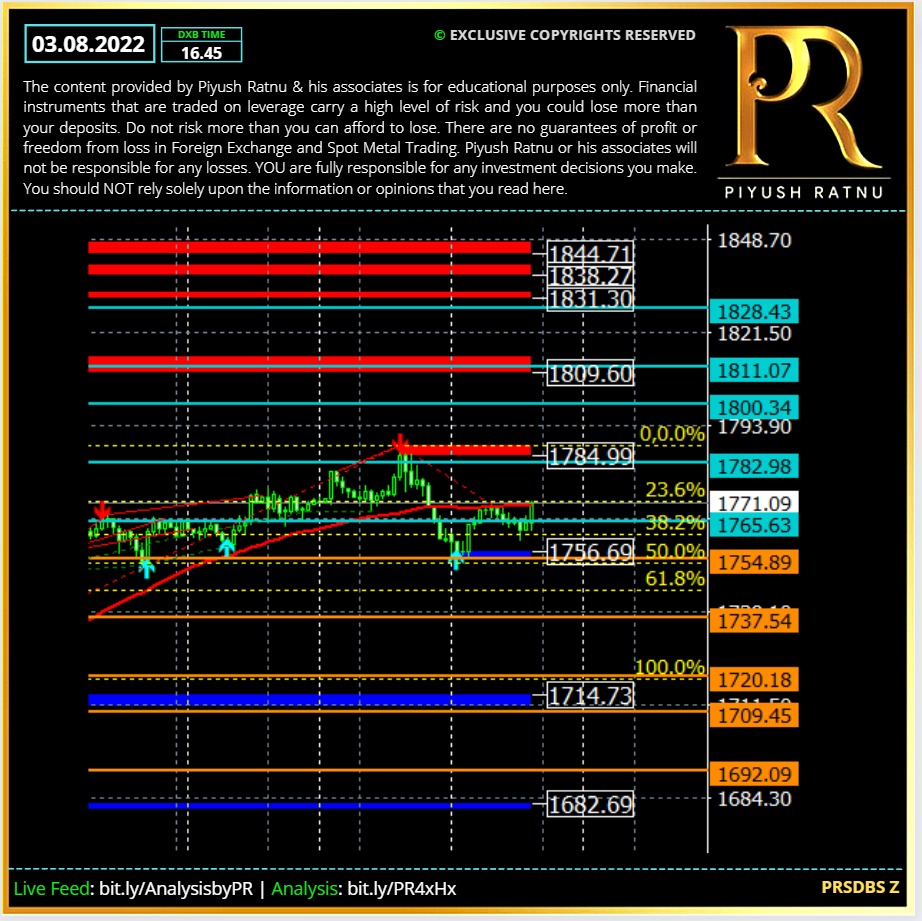

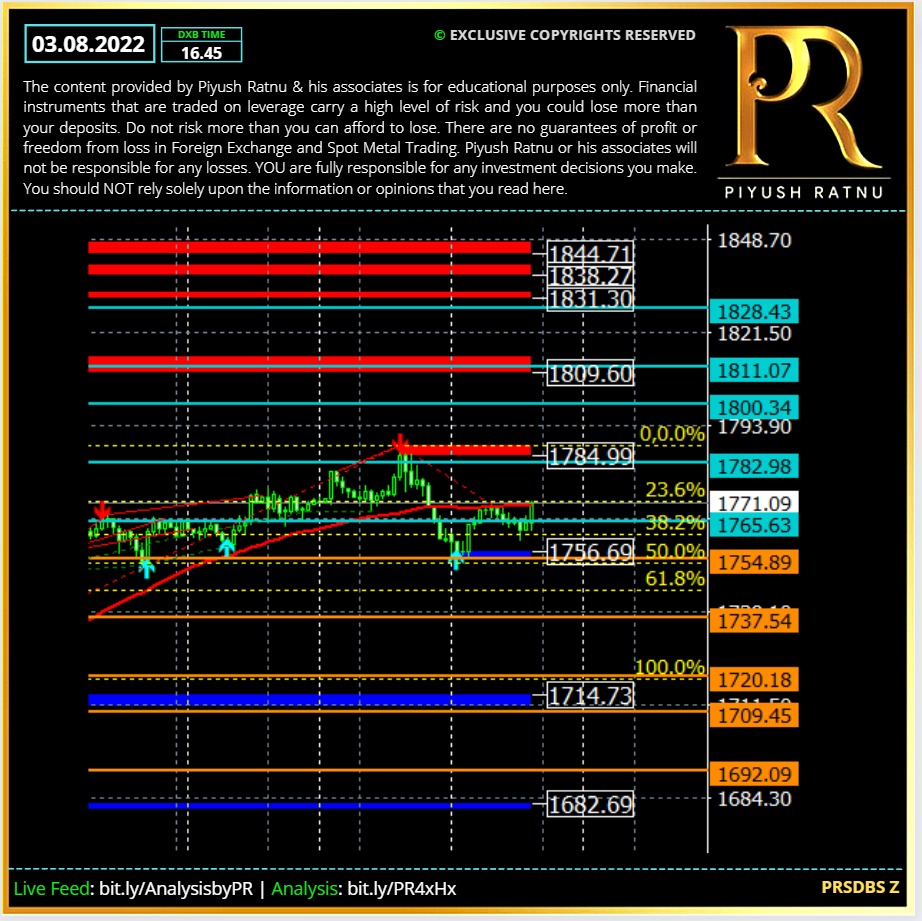

03.08.2022 | Spot Gold Buying and Selling Zones | XAUUSD Analysis | Commodities Analysis | GOLD Analysis | PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

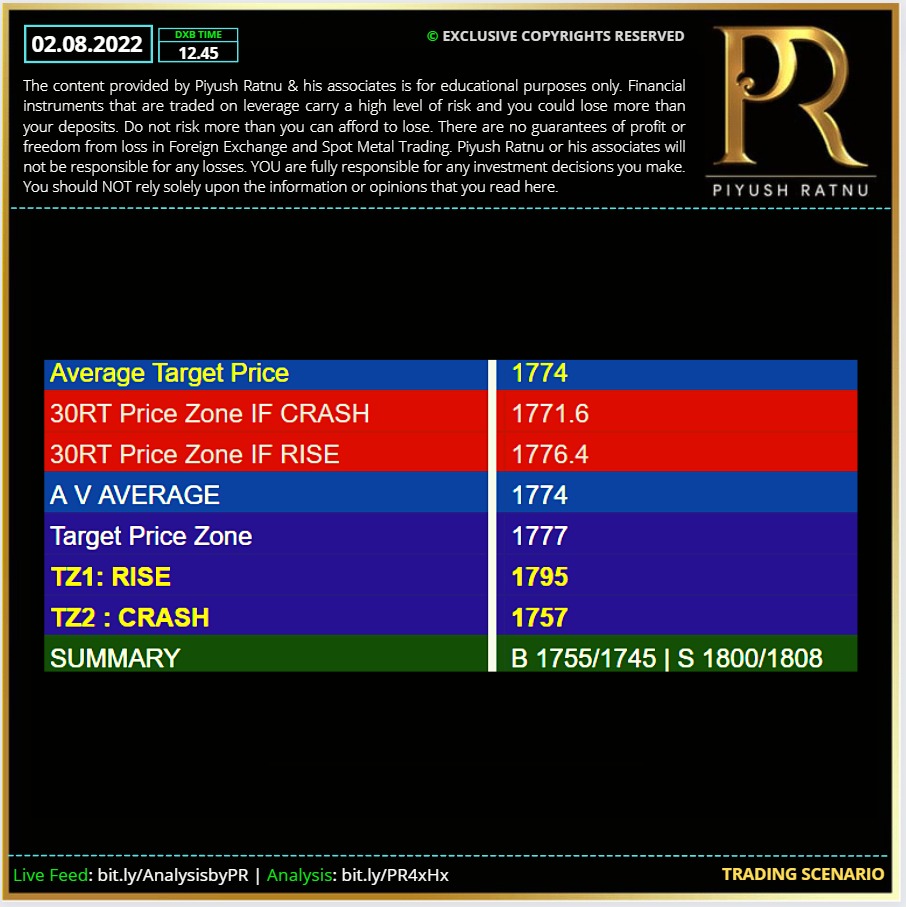

03.08.2022 | Trading Scenario | XAUUSD Analysis | Commodities Analysis | GOLD Analysis | PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

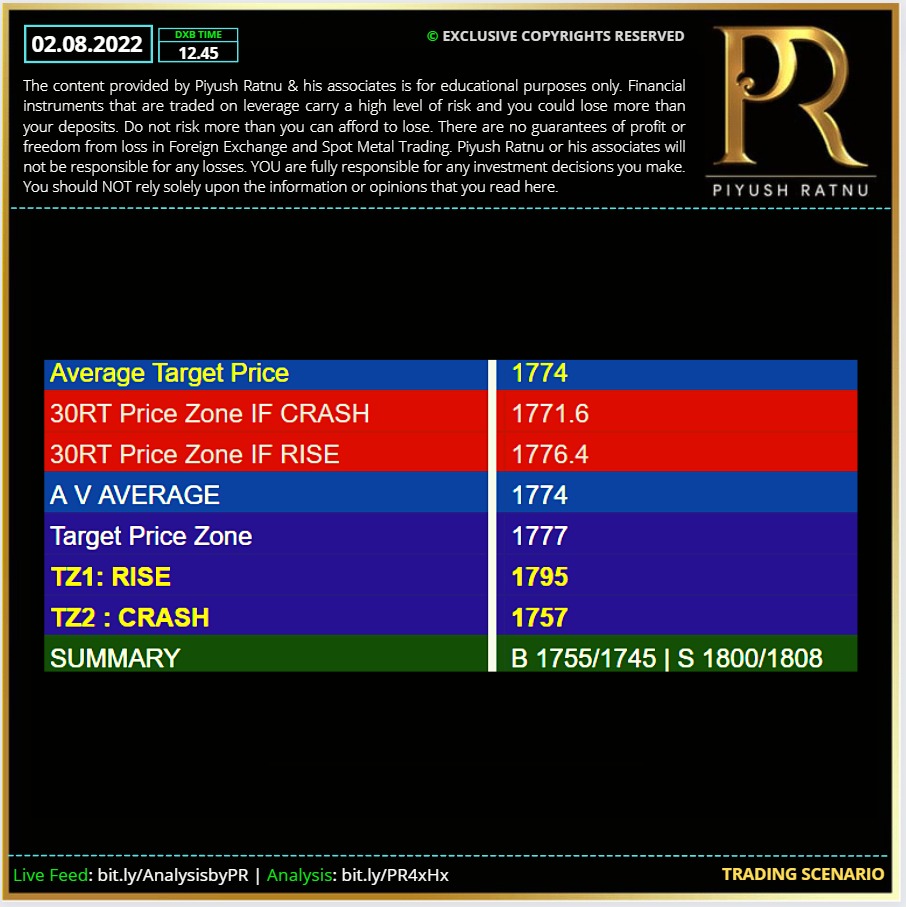

02.08.2022 | Trading Scenario | XAUUSD Analysis | Commodities Analysis | GOLD Analysis | PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

29.07.2022 | Market Reversal was well alerted in advance on 19th July | XAUUSD Analysis | Commodities Analysis | GOLD Analysis | PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

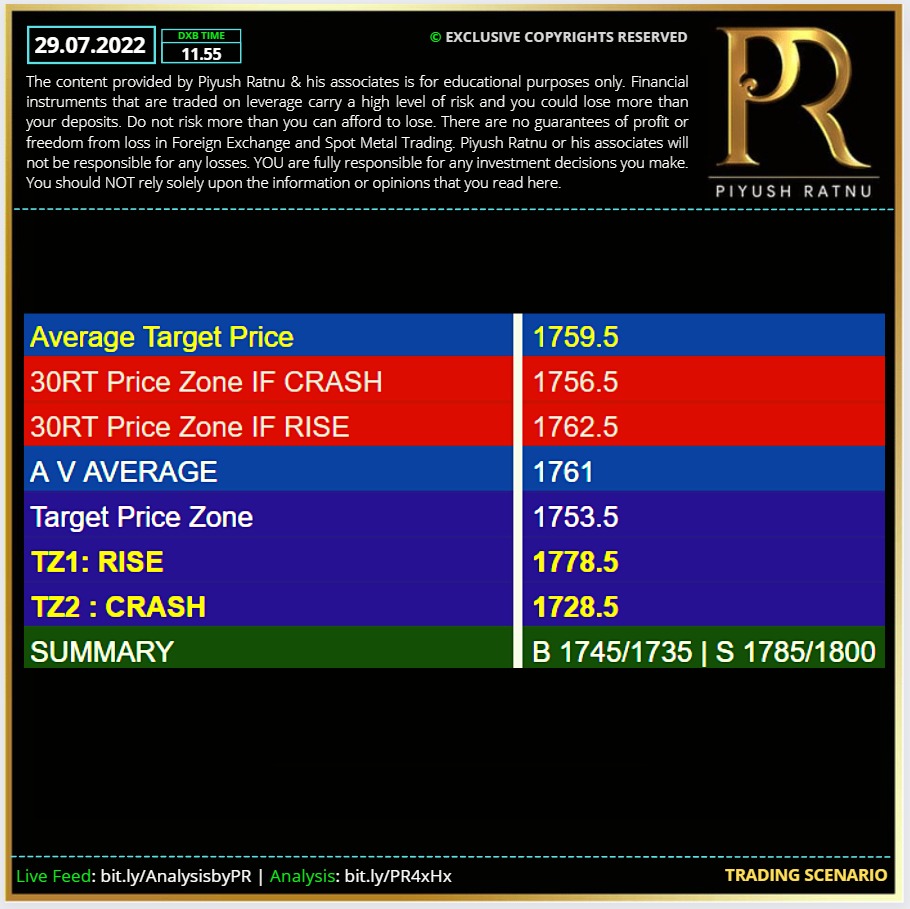

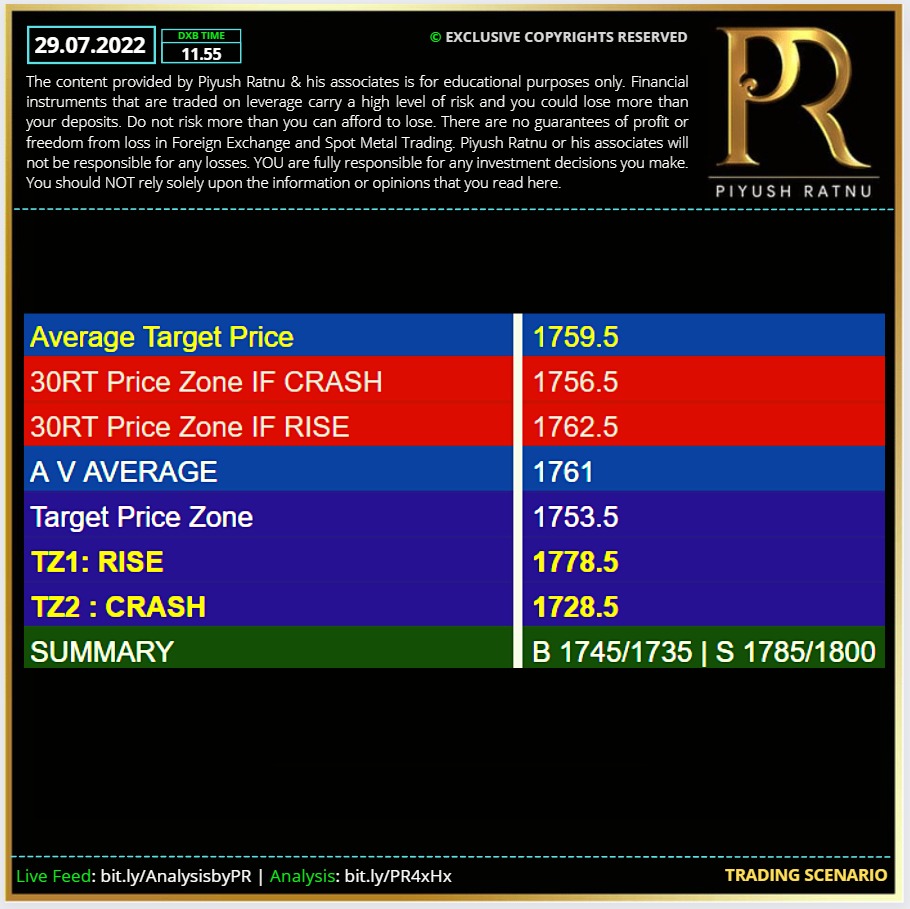

29.07.2022 | Spot Gold Trading Scenario| XAUUSD Analysis | Commodities Analysis | GOLD Analysis | PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

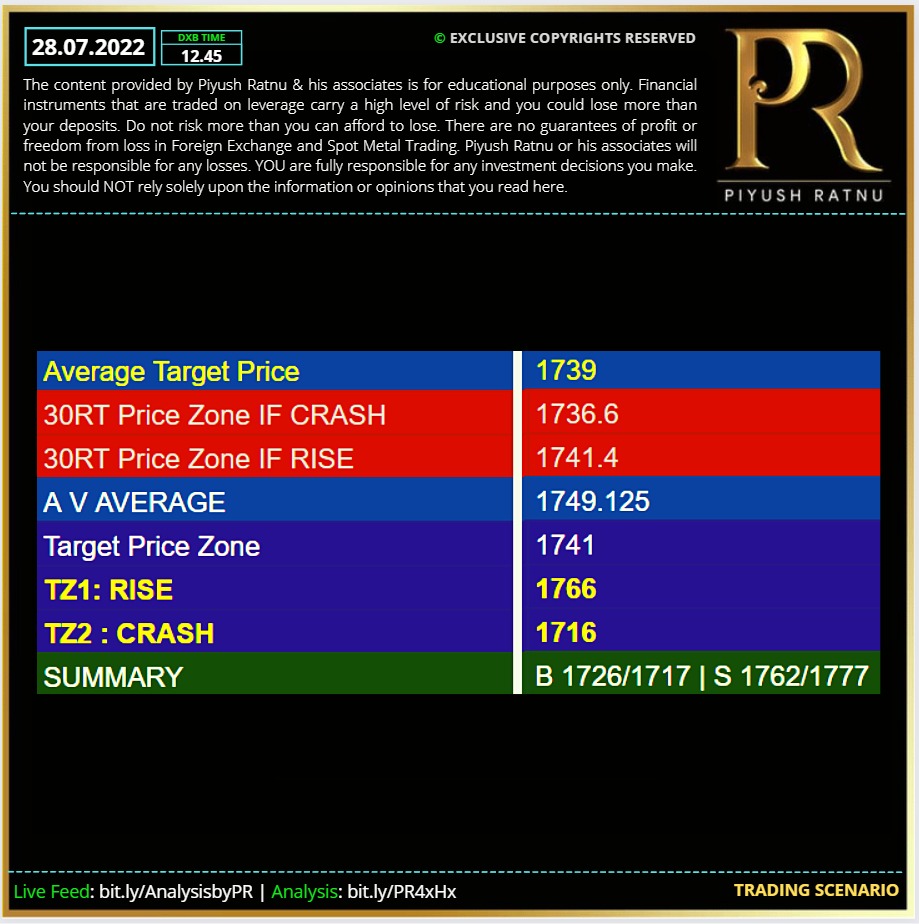

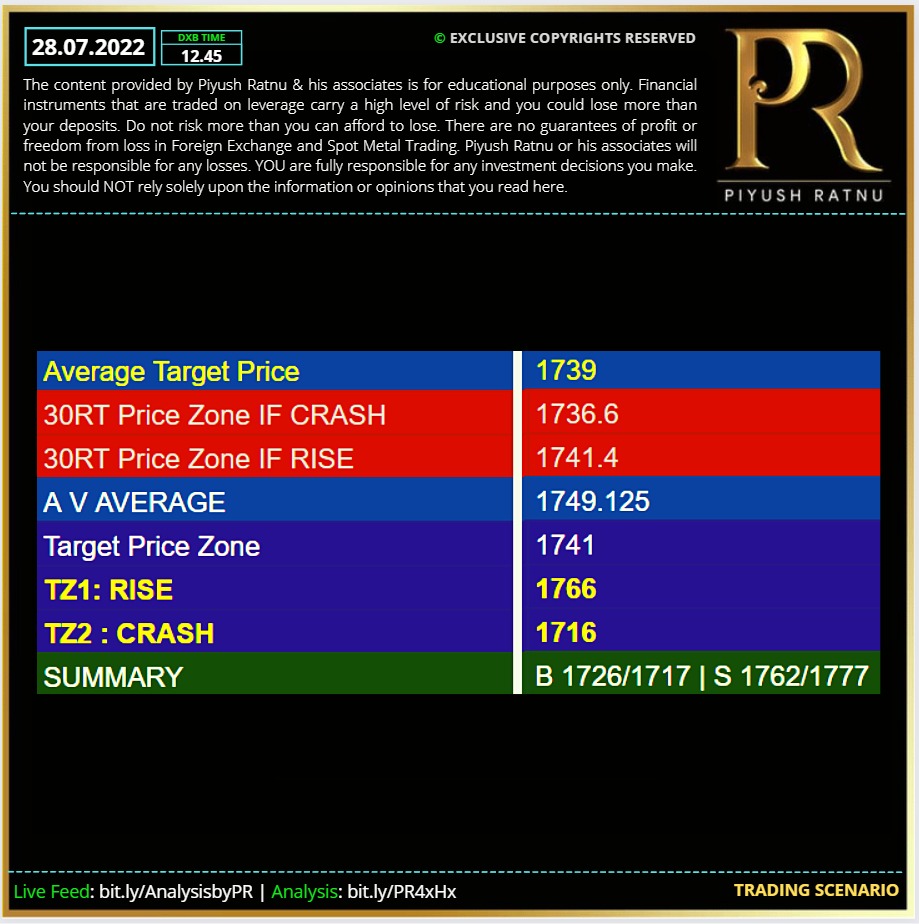

28.07.2022 | Gold Trading Scenario| XAUUSD Analysis | Commodities Analysis | GOLD Analysis | PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

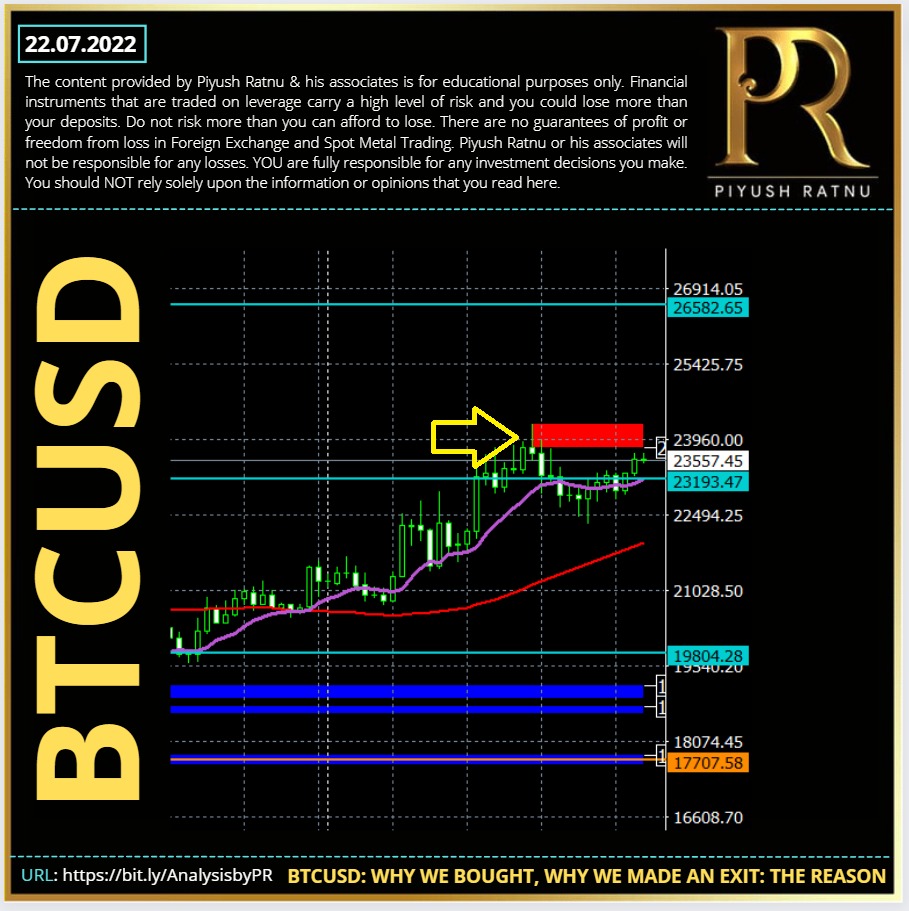

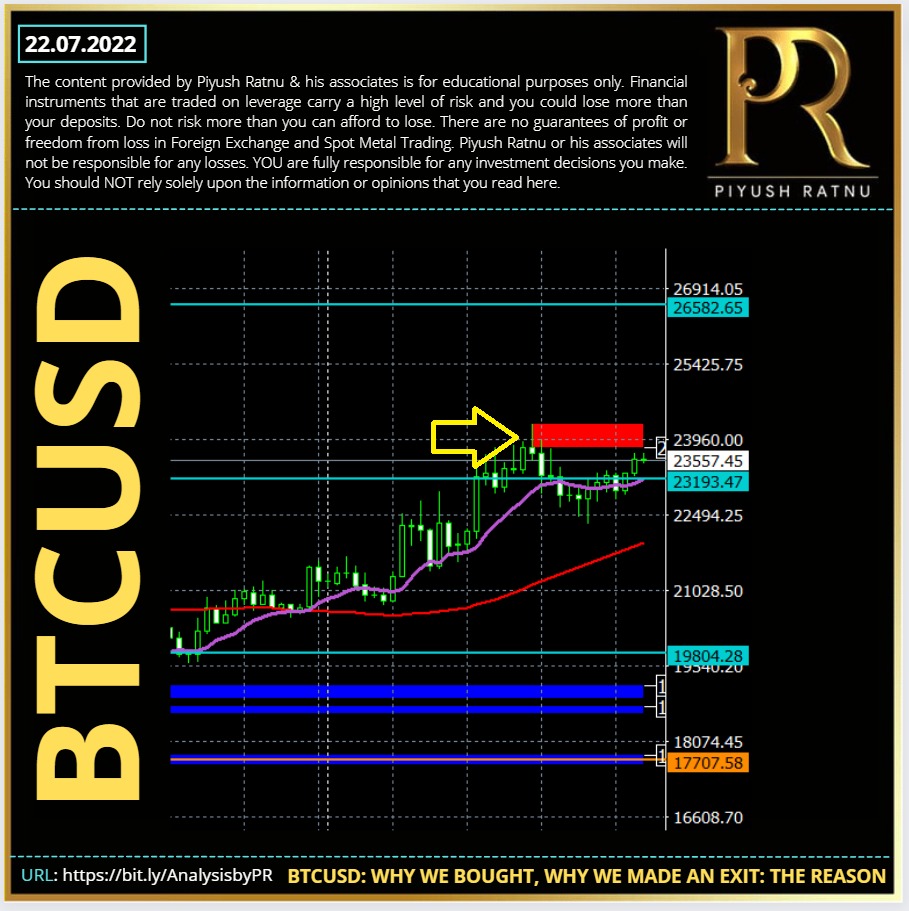

BTCUSD: Why we bought at 17500 range, and why we booked profits at 24000 range: The Reason.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

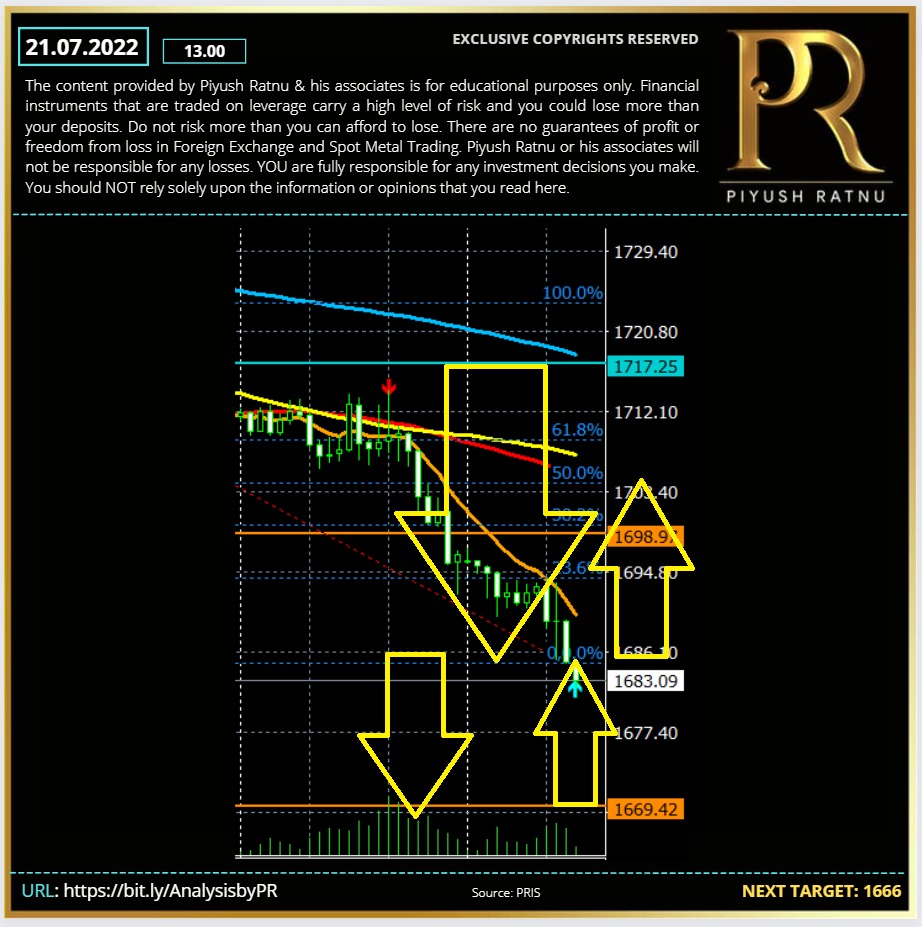

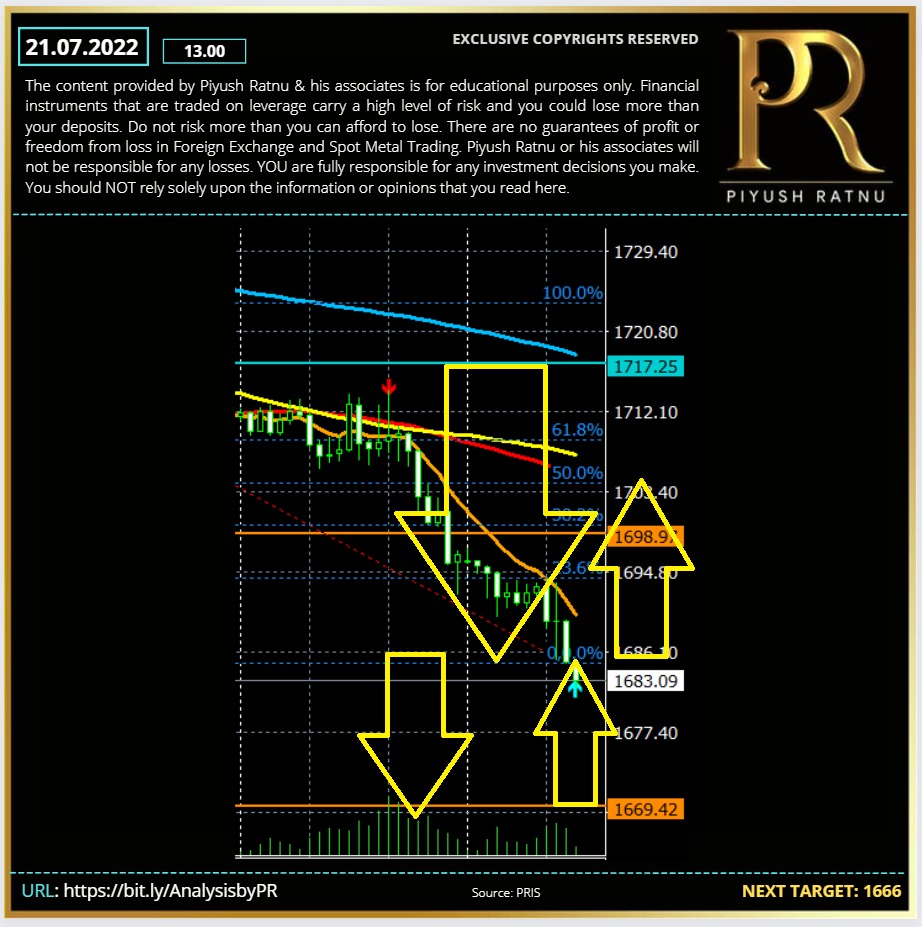

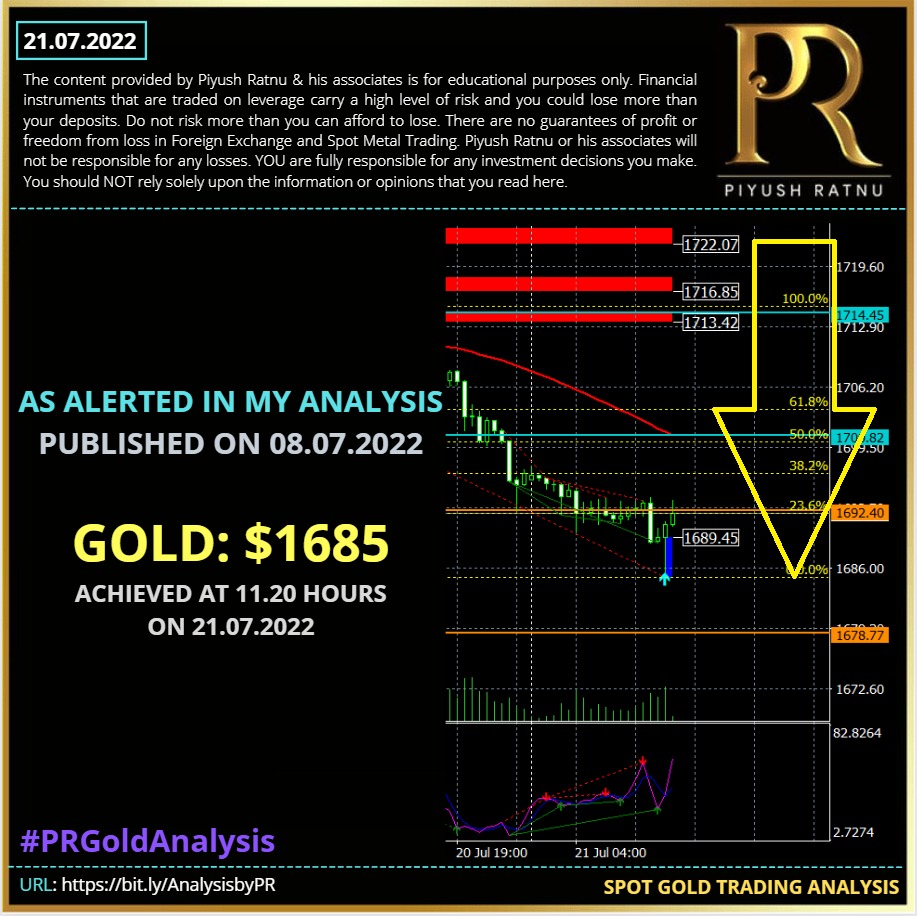

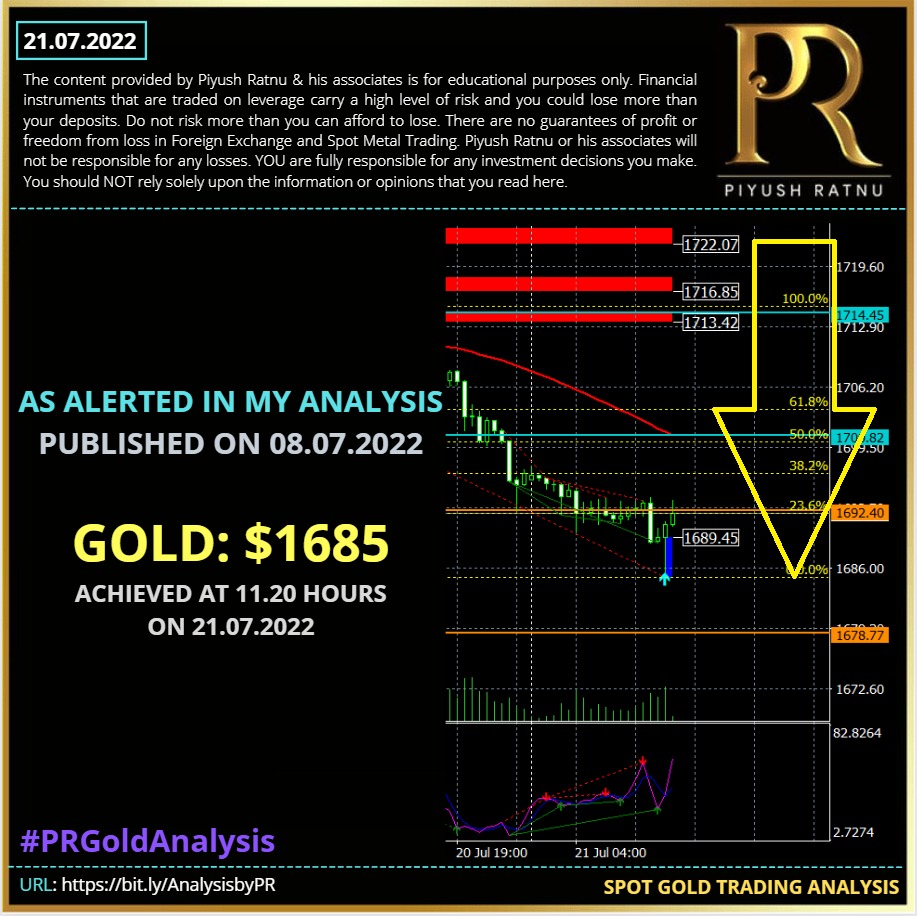

21.07.2022 | XAUUSD Next Target :1666| XAUUSD Analysis | Commodities Analysis | GOLD Analysis | PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

Zones mentioned in my analysis:

I expect V pattern in next 9 trading days. XAUUSD CMP $1735

D1 TF PRSR: BUY/SELL STOPS | BUY/SELL LIMITS: TARGET NAP200P ( Net Average Profit):

S4 ZONE 1717 | DOWN TREND (Below 1721) : 1717/1707/1685/1666/1636 BUY LIMITS

R2 ZONE 1750| UP TREND (After 1758) : 1777/1808/1818 SELL LIMITS

Check the price mapping done on 08.07.2022 at:

https://bit.ly/08JulyPriceMappingPR

1685 AS NEXT TARGET: well highlighted in advance multiple times, was finally achieved today at 11.20 hours DXB.

Gold to hit 1685: I alerted well in advance: Read my analysis review:

Analysis: https://bit.ly/NFPJuly2022PRGoldAnalysis

Review: https://www.piyushratnu.com/piyush-ratnu-spot-gold-analysis-review-july-2022/

I expect V pattern in next 9 trading days. XAUUSD CMP $1735

D1 TF PRSR: BUY/SELL STOPS | BUY/SELL LIMITS: TARGET NAP200P ( Net Average Profit):

S4 ZONE 1717 | DOWN TREND (Below 1721) : 1717/1707/1685/1666/1636 BUY LIMITS

R2 ZONE 1750| UP TREND (After 1758) : 1777/1808/1818 SELL LIMITS

Check the price mapping done on 08.07.2022 at:

https://bit.ly/08JulyPriceMappingPR

1685 AS NEXT TARGET: well highlighted in advance multiple times, was finally achieved today at 11.20 hours DXB.

Gold to hit 1685: I alerted well in advance: Read my analysis review:

Analysis: https://bit.ly/NFPJuly2022PRGoldAnalysis

Review: https://www.piyushratnu.com/piyush-ratnu-spot-gold-analysis-review-july-2022/

Piyush Lalsingh Ratnu

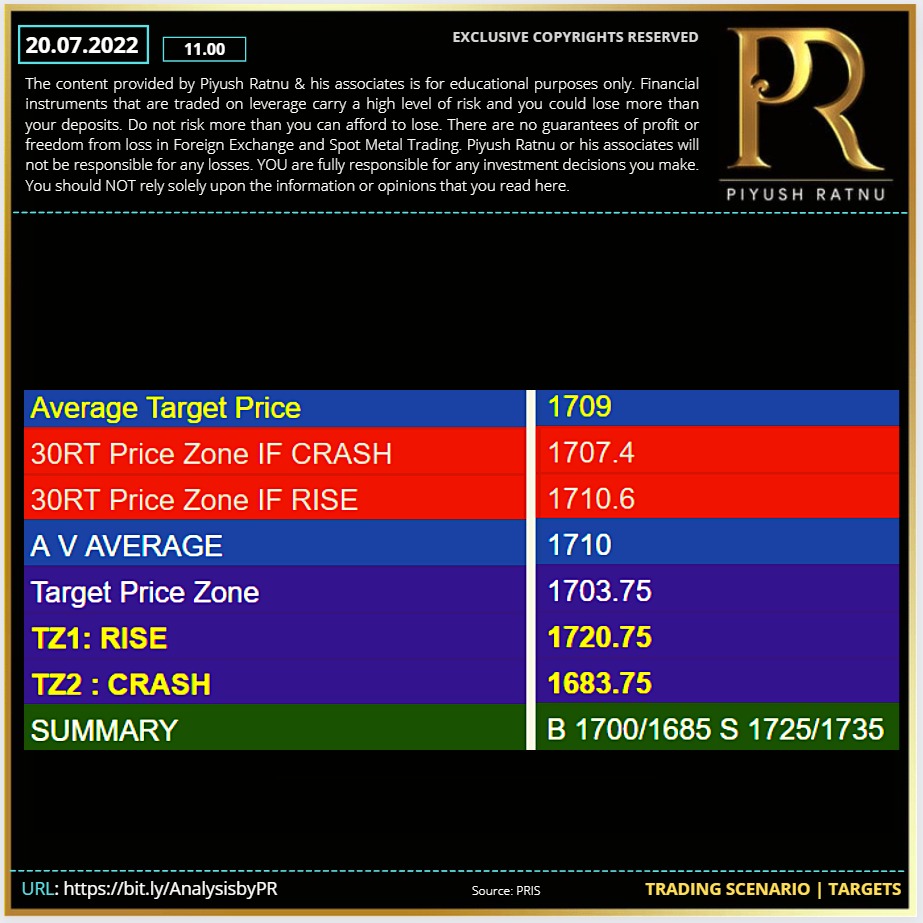

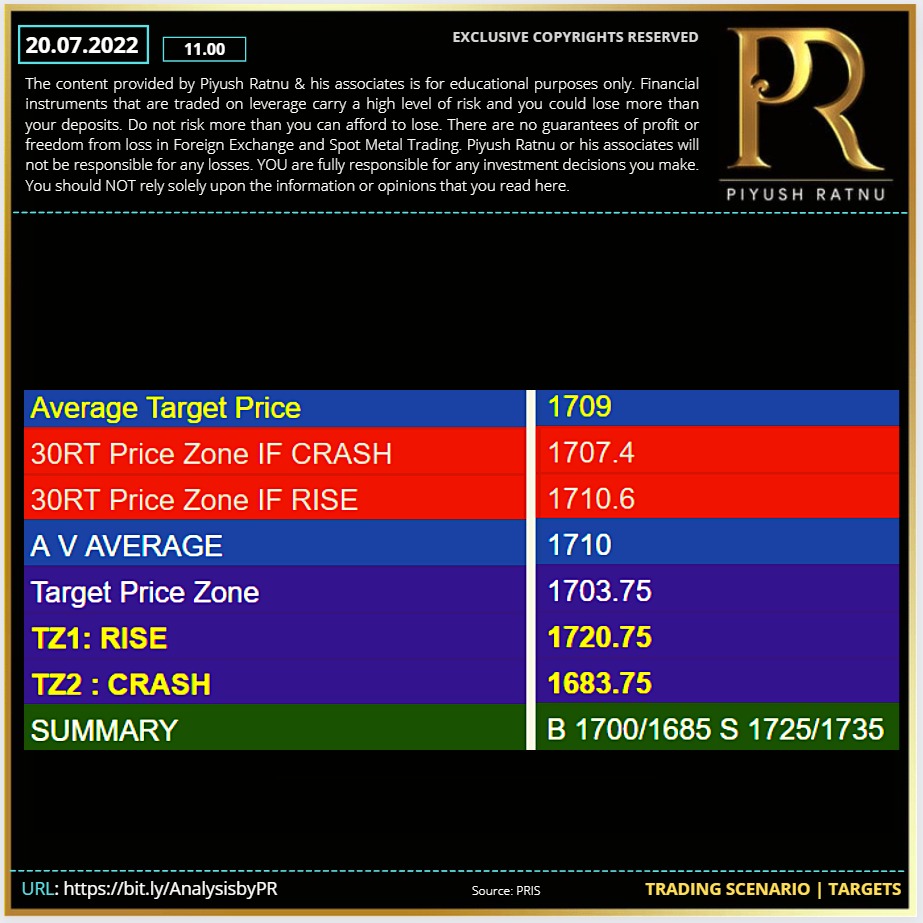

20.07.2022 | XAUUSD Trading Scenario and Targets| XAUUSD Analysis | Commodities Analysis | GOLD Analysis | PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

19.07.2022 | XAUUSD Trading Scenarios| XAUUSD Analysis | Commodities Analysis | GOLD Analysis | PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

++ ECB New Bond Tool & Monetary Policy Changes

Tightening + YCC

++ Russia meeting with Iran and Turkey

++Draghi + UK

++ A slippage in odds of a 1% rate hike by the Fed has failed to support the gold bulls.

++ Lower consensus for S&P PMI data may bring a sell-off in the DXY

++ Higher inflation rates have weighed pressure on the margins of the companies and have impacted the earnings of the households. WORLD ECONOMICS refer: https://tradingeconomics.com/matrix | HICP: https://www.ecb.europa.eu/stats/macroeconomic_and_sectoral/hicp/html/index.en.html

++ Gold price is expected to face tremendous pressures this week as monetary policies announcement from the European Central Bank (ECB) and the Bank of Japan (BOJ) will remain focused. EU Stats: https://www.ecb.europa.eu/stats/html/index.en.html

++ The market participants are expecting a rate hike by the ECB for the first time in 11 years. Taking into account the soaring inflation rate due to higher energy bills, ECB President Christine Lagarde will announce a rate hike this time.

++The minutes from RBA remained hawkish for further guidance. Therefore, the broader environment of policy tightening by the Western leaders will keep gold prices under heavy pressure: https://www.rba.gov.au/media-releases/2022/mr-22-20.html

++Bank of Japan (BOJ) will continue with its dovish tone and will discuss measures on flushing liquidity into the economy to spurt the aggregate demand. : + JPY = - USD | Refer: https://www.boj.or.jp/en/mopo/mpmsche_minu/index.htm/

++ The Services PMI is expected to display a mild correction to 52.6 against the former figure of 52.7. This will keep the DXY on the back foot and may support the gold bulls. Refer: https://www.pmi.spglobal.com/Public/Release/ReleaseDates?language=en

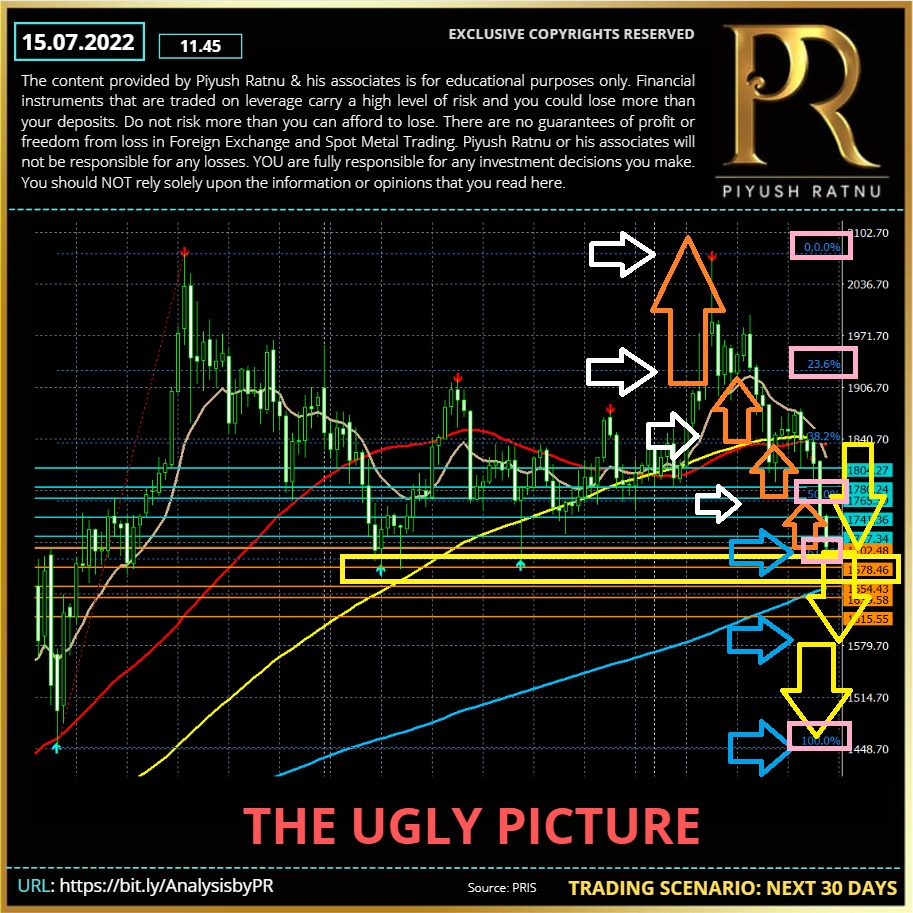

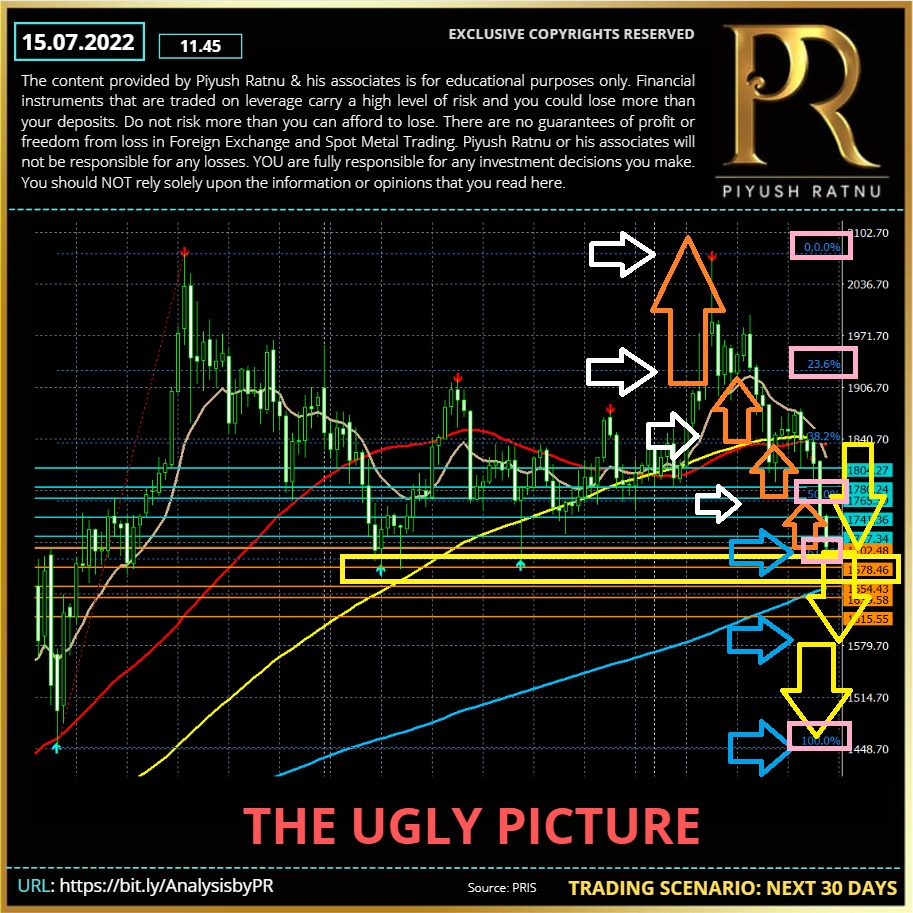

XAUUSD Bearish Scenario: $1717/1666, once again?

If the bearish momentum extends, gold price may fall further towards 1666 zone (after 1721) with 1717/1700/1685/1666 as next stops, if Gold crash halts at 1717/1666 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 9 trading days.

Read my analysis here: https://bit.ly/NFPJuly2022PRGoldAnalysis

Tightening + YCC

++ Russia meeting with Iran and Turkey

++Draghi + UK

++ A slippage in odds of a 1% rate hike by the Fed has failed to support the gold bulls.

++ Lower consensus for S&P PMI data may bring a sell-off in the DXY

++ Higher inflation rates have weighed pressure on the margins of the companies and have impacted the earnings of the households. WORLD ECONOMICS refer: https://tradingeconomics.com/matrix | HICP: https://www.ecb.europa.eu/stats/macroeconomic_and_sectoral/hicp/html/index.en.html

++ Gold price is expected to face tremendous pressures this week as monetary policies announcement from the European Central Bank (ECB) and the Bank of Japan (BOJ) will remain focused. EU Stats: https://www.ecb.europa.eu/stats/html/index.en.html

++ The market participants are expecting a rate hike by the ECB for the first time in 11 years. Taking into account the soaring inflation rate due to higher energy bills, ECB President Christine Lagarde will announce a rate hike this time.

++The minutes from RBA remained hawkish for further guidance. Therefore, the broader environment of policy tightening by the Western leaders will keep gold prices under heavy pressure: https://www.rba.gov.au/media-releases/2022/mr-22-20.html

++Bank of Japan (BOJ) will continue with its dovish tone and will discuss measures on flushing liquidity into the economy to spurt the aggregate demand. : + JPY = - USD | Refer: https://www.boj.or.jp/en/mopo/mpmsche_minu/index.htm/

++ The Services PMI is expected to display a mild correction to 52.6 against the former figure of 52.7. This will keep the DXY on the back foot and may support the gold bulls. Refer: https://www.pmi.spglobal.com/Public/Release/ReleaseDates?language=en

XAUUSD Bearish Scenario: $1717/1666, once again?

If the bearish momentum extends, gold price may fall further towards 1666 zone (after 1721) with 1717/1700/1685/1666 as next stops, if Gold crash halts at 1717/1666 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 9 trading days.

Read my analysis here: https://bit.ly/NFPJuly2022PRGoldAnalysis

Piyush Lalsingh Ratnu

Buyers need acceptance above the convergence of the Fibonacci 161.8% one-day and Fibonacci 61.8% one-week at $1,727. The pivot point one-day R3 at $1,735 will be the last line of defense for XAU sellers.

Alternatively, a sustained move below the powerful cluster of support levels around $1,717 will fizzle out the recovery momentum. That level is the confluence of the previous day’s high, Fibonacci 38.2% one-week and pivot point one-day R1.

The next support awaits at the intersection of the Fibonacci 23.6% one-week and the SMA10 four-hour. The Fibonacci 38.2% one-day at $1,707 will be next on my radar.

Post 15 July, GOLD generally rises from the lows of first two weeks of July, and same can be observed right now.

Mid June: Crash

Mid July RT Reversal

August first week crash

As per past trend mapping.

M30 H1 H4 V completed.

I had mentioned in my analysis:

I expect V pattern in next 9 trading days. XAUUSD CMP $1735

Date of Analysis 08.07.2022

Date of achievement: 13.07.2022 and 18.07.2022

Analysis accuracy: 90%

Highs achieved: 1745/1719

Lows achieved: 1707/1697

Zones mentioned in my analysis:

I expect V pattern in next 9 trading days. XAUUSD CMP $1735

D1 TF PRSR: BUY/SELL STOPS | BUY/SELL LIMITS: TARGET NAP200P ( Net Average Profit):

S4 ZONE 1717 | DOWN TREND (Below 1721) : 1717/1707/1685/1666/1636 BUY LIMITS

R2 ZONE 1750| UP TREND (After 1758) : 1777/1808/1818 SELL LIMITS

Check the price mapping done on 08.07.2022 at:

https://bit.ly/08JulyPriceMappingPR

Tracer Algo stetting:

PRSR zone D1 | C/R RT zones D1 TF

XAUUSD Bearish Scenario: $1717/1666, once again?

If the bearish momentum extends, gold price may fall further towards 1666 zone (after 1721) with 1717/1700/1685/1666 as next stops, if Gold crash halts at 1717/1666 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 9 trading days.

Read my analysis here: https://bit.ly/NFPJuly2022PRGoldAnalysis

Summary: GOLD crashed till 1697 and reversed back to 1735/1717 zone, more than three times, giving enough space to exit in net average in the BUY positions taken below 1717.

CMP 1717

Alternatively, a sustained move below the powerful cluster of support levels around $1,717 will fizzle out the recovery momentum. That level is the confluence of the previous day’s high, Fibonacci 38.2% one-week and pivot point one-day R1.

The next support awaits at the intersection of the Fibonacci 23.6% one-week and the SMA10 four-hour. The Fibonacci 38.2% one-day at $1,707 will be next on my radar.

Post 15 July, GOLD generally rises from the lows of first two weeks of July, and same can be observed right now.

Mid June: Crash

Mid July RT Reversal

August first week crash

As per past trend mapping.

M30 H1 H4 V completed.

I had mentioned in my analysis:

I expect V pattern in next 9 trading days. XAUUSD CMP $1735

Date of Analysis 08.07.2022

Date of achievement: 13.07.2022 and 18.07.2022

Analysis accuracy: 90%

Highs achieved: 1745/1719

Lows achieved: 1707/1697

Zones mentioned in my analysis:

I expect V pattern in next 9 trading days. XAUUSD CMP $1735

D1 TF PRSR: BUY/SELL STOPS | BUY/SELL LIMITS: TARGET NAP200P ( Net Average Profit):

S4 ZONE 1717 | DOWN TREND (Below 1721) : 1717/1707/1685/1666/1636 BUY LIMITS

R2 ZONE 1750| UP TREND (After 1758) : 1777/1808/1818 SELL LIMITS

Check the price mapping done on 08.07.2022 at:

https://bit.ly/08JulyPriceMappingPR

Tracer Algo stetting:

PRSR zone D1 | C/R RT zones D1 TF

XAUUSD Bearish Scenario: $1717/1666, once again?

If the bearish momentum extends, gold price may fall further towards 1666 zone (after 1721) with 1717/1700/1685/1666 as next stops, if Gold crash halts at 1717/1666 zone a reversal can be expected with a RT 23.6 on M5 and M15 30% RT before/in next 9 trading days.

Read my analysis here: https://bit.ly/NFPJuly2022PRGoldAnalysis

Summary: GOLD crashed till 1697 and reversed back to 1735/1717 zone, more than three times, giving enough space to exit in net average in the BUY positions taken below 1717.

CMP 1717

Piyush Lalsingh Ratnu

FED: 75 BP HIKE

An attempt to kill inflation or boost recession?

This is a million dollar question right now, in my view inflation will rise more to higher numbers resulting in higher rates and panic selling, though media and FED will try to highlight that the era of recession has begun.

I won't be surprised with the the repetition of the pattern observed in last two years, where in FED tried it's best to prove that inflation is temporary and not a concerning factor, however this year Mr. Powell was kind enough to accept that FED miscalculated the risks and the rising inflation in last few months, and that precautionary and necessary tools have to be exercised inorder to control the rising inflation.

A big DOWN rally in first week of August after a RT till 1735/1777 is what I expect as per market cycles and past trend. Currently GOLD is trapped in the price range of 1707-1717, a breach towards down will result in 1685/1666, a reversal will push the price to 1777, if GOLD manages to breach 1735-1745 zone before 25 July, 2022.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

An attempt to kill inflation or boost recession?

This is a million dollar question right now, in my view inflation will rise more to higher numbers resulting in higher rates and panic selling, though media and FED will try to highlight that the era of recession has begun.

I won't be surprised with the the repetition of the pattern observed in last two years, where in FED tried it's best to prove that inflation is temporary and not a concerning factor, however this year Mr. Powell was kind enough to accept that FED miscalculated the risks and the rising inflation in last few months, and that precautionary and necessary tools have to be exercised inorder to control the rising inflation.

A big DOWN rally in first week of August after a RT till 1735/1777 is what I expect as per market cycles and past trend. Currently GOLD is trapped in the price range of 1707-1717, a breach towards down will result in 1685/1666, a reversal will push the price to 1777, if GOLD manages to breach 1735-1745 zone before 25 July, 2022.

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

11.07.2022 | XAUUSD Trading Scenarios for next 30 days| XAUUSD Analysis | Commodities Analysis |PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

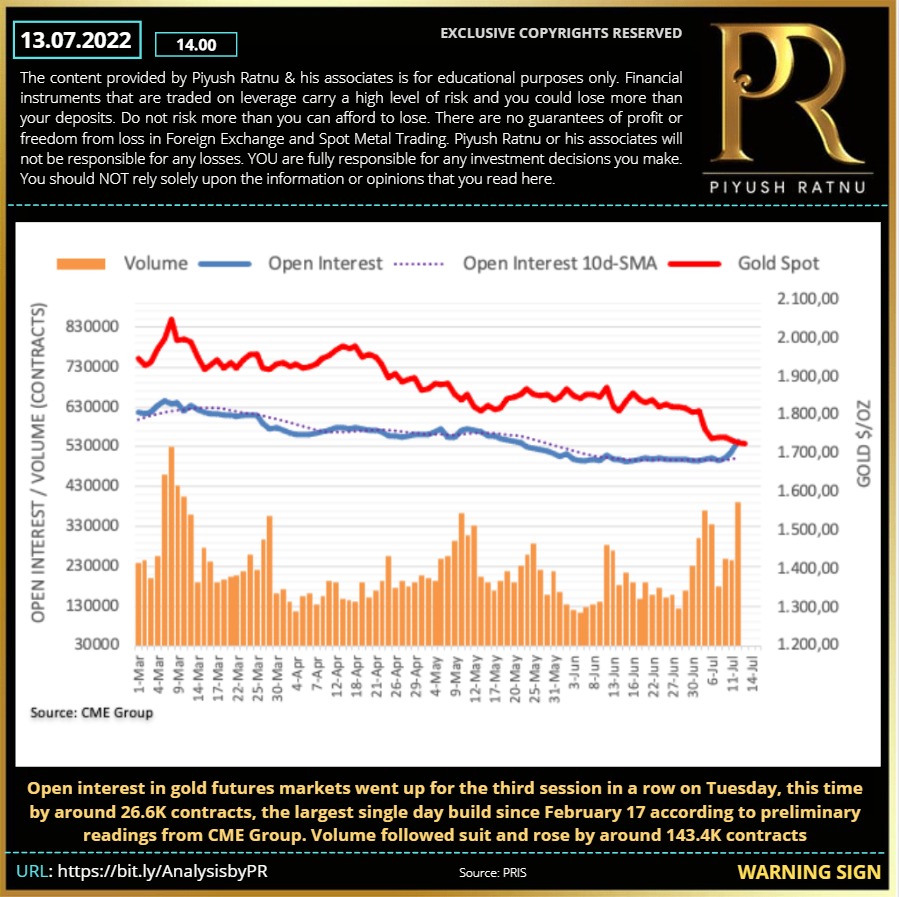

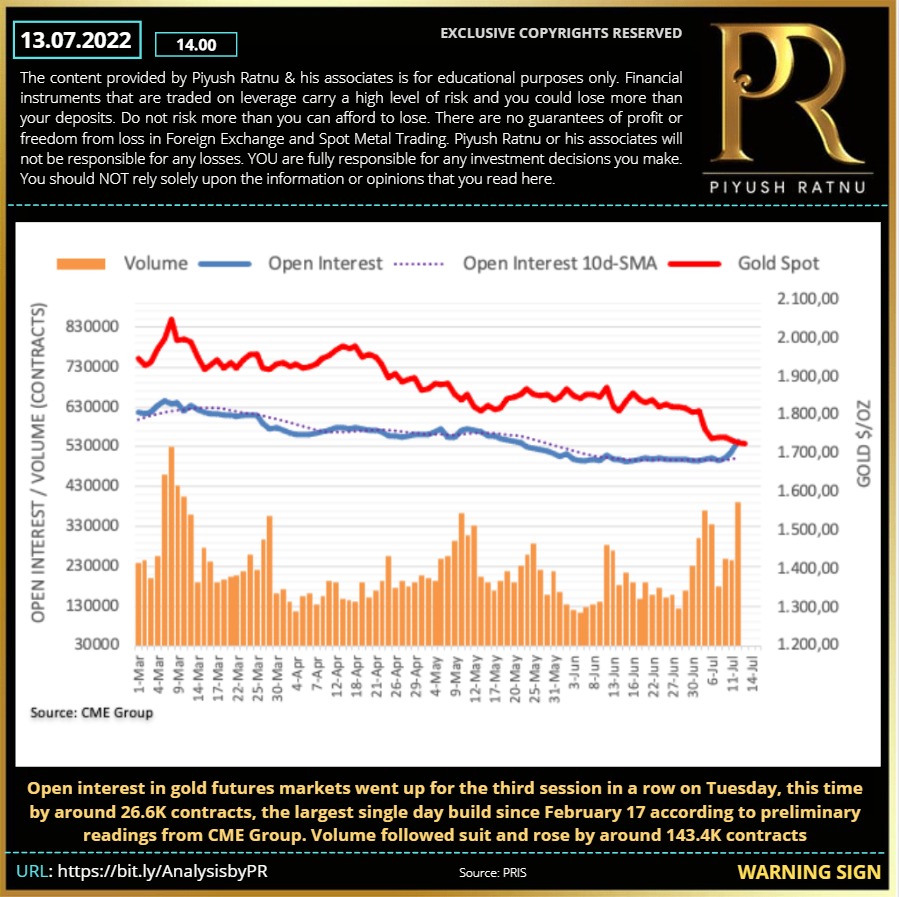

Piyush Lalsingh Ratnu

13.07.2022 | Warning Sign - Open interest in Gold Futures markets went up for the third session in a row on Tuesday, this time by around 26.6K contracts, the largest single day build since February 17 according to preliminary readings from CME Group. Volume followed suit and rose by around 143.4k contacts | XAUUSD Analysis | Commodities Analysis |PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

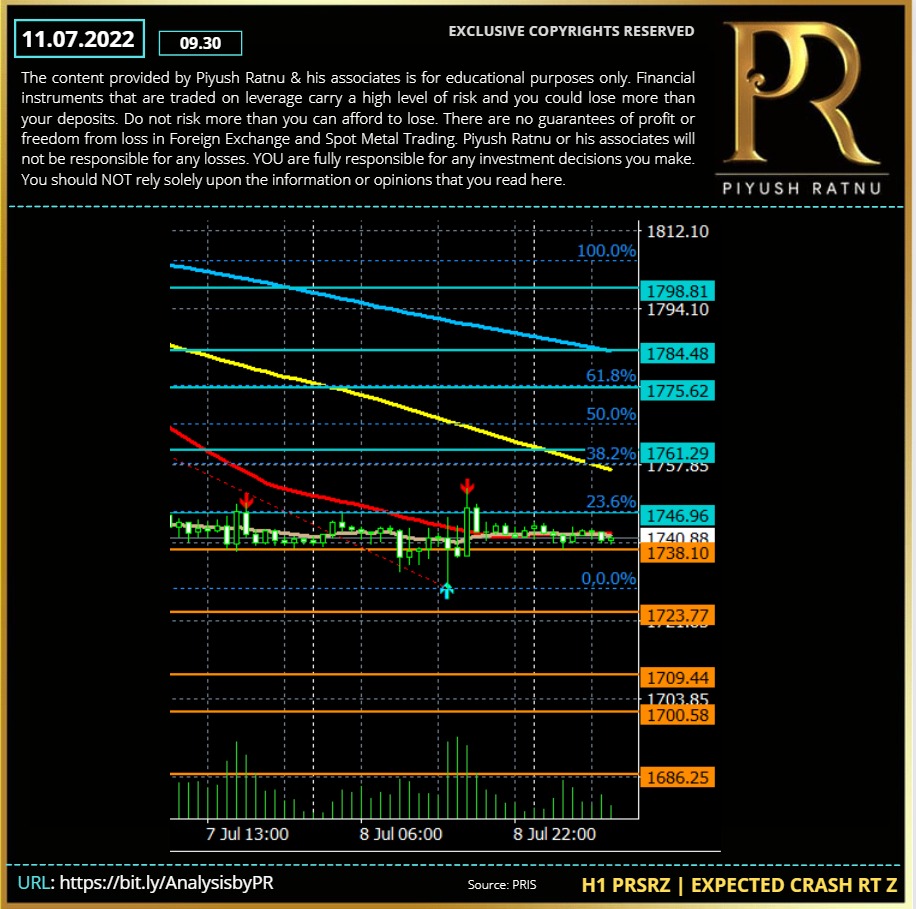

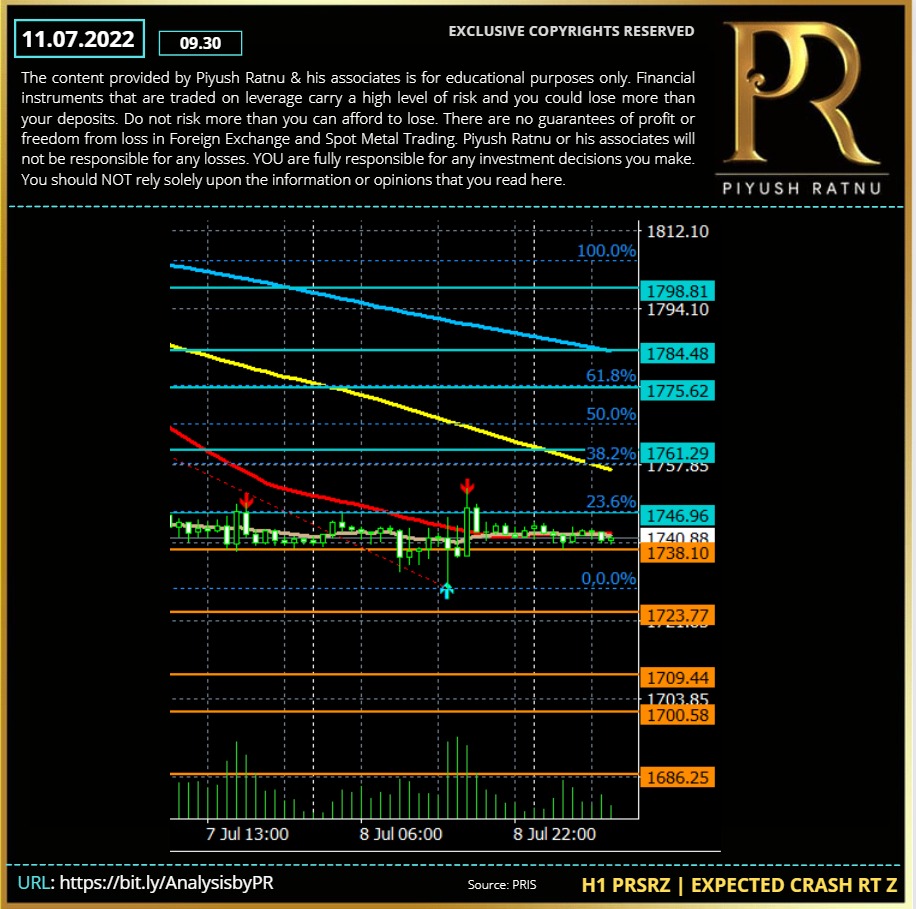

11.07.2022 | H1 PRSRZ | Expected Crash RT Z | XAUUSD Analysis | Commodities Analysis |PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Piyush Lalsingh Ratnu

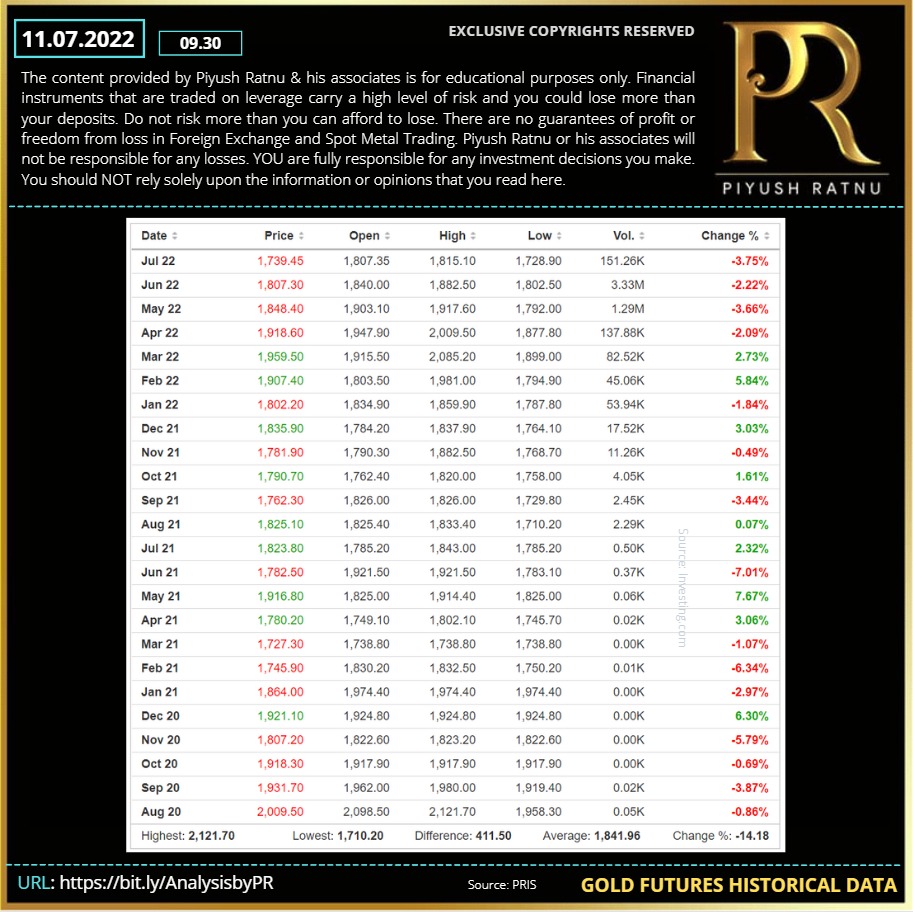

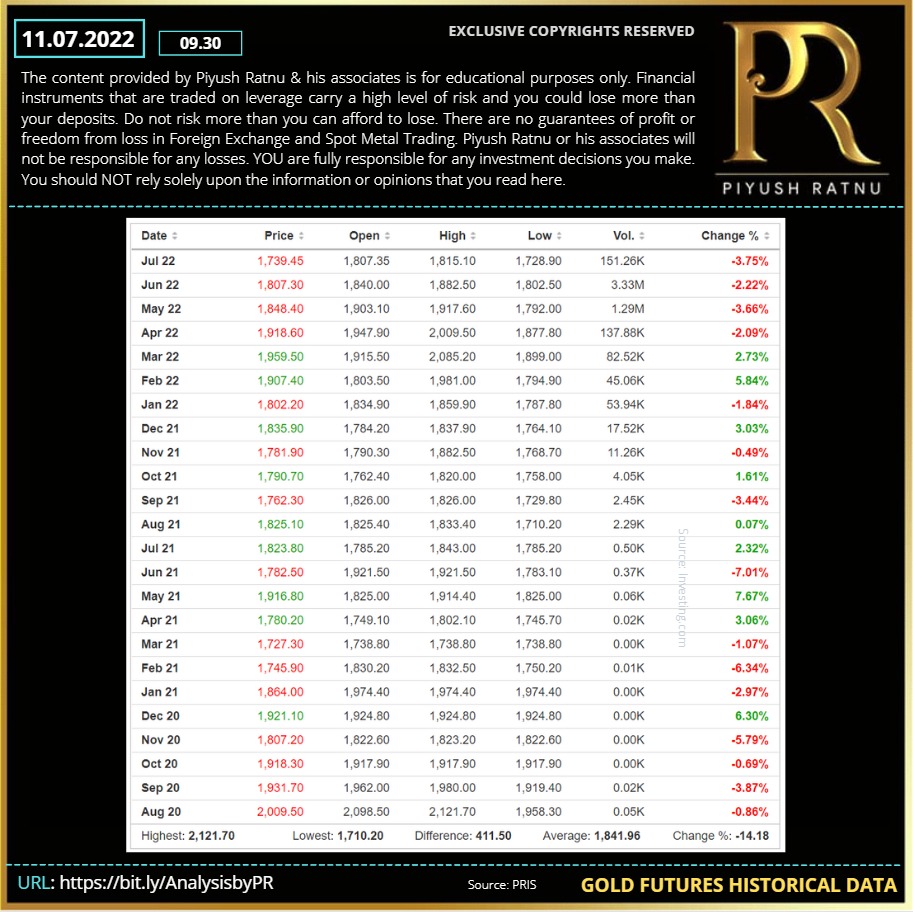

11.07.2022 | Gold Futures Historical Data | XAUUSD Analysis | Commodities Analysis |PR Gold Analysis

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

Join TELEGRAM channel for latest updates and market analysis:

If you are on Telegram,

Copy this url and paste in browser: https://bit.ly/AnalysisbyPR

#PiyushRatnu #BullionTrading #Trading #Dubai

: