Piyush Lalsingh Ratnu / Profilo

- Informazioni

|

no

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

PRSRLVL zone status:

SRD1 XAUUSD @ above PPZ R1

SRW1 XAUUSD @ above PPZ R2

SRMN XAUUSD @ below PPZ S1

Crucial zones ahead:

R: $1966/1985/2009

C: $1926/1907/1888

USDJPY @H1V236

XAUUSD H1A236 pending

US 10YT 4.114

DXY 103.100

XAUXAG 79.10

⚠️USDJPY 145.90 (17.08 and 22.08 zone)

🔛XAUUSD on 17.08 and 22.08: $1888 zone

After breaching highs: lows in USDJPY are resulting in + XAUUSD, in addition to the bluff by FED and Bond market, traders are worried about the price zones, and increasing debt pressures.

All 3: US F: Ideal SELL entry: PG 50 | Exit NAP

SRD1 XAUUSD @ above PPZ R1

SRW1 XAUUSD @ above PPZ R2

SRMN XAUUSD @ below PPZ S1

Crucial zones ahead:

R: $1966/1985/2009

C: $1926/1907/1888

USDJPY @H1V236

XAUUSD H1A236 pending

US 10YT 4.114

DXY 103.100

XAUXAG 79.10

⚠️USDJPY 145.90 (17.08 and 22.08 zone)

🔛XAUUSD on 17.08 and 22.08: $1888 zone

After breaching highs: lows in USDJPY are resulting in + XAUUSD, in addition to the bluff by FED and Bond market, traders are worried about the price zones, and increasing debt pressures.

All 3: US F: Ideal SELL entry: PG 50 | Exit NAP

Piyush Lalsingh Ratnu

As alerted yesterday in advance at 18.16 hours, XAUUSD is under the price trap of $1932-1936 price zone since last 12 hours.

🟢Today's trading plan:

I will wait for $1947 or $1926 price targets to enter in short/long direction.

Important Economic date today

16.00: EUR German CPI

16.15: ADP NFP

16.30 GDP

18.00 Pending home sales

🟢Today's trading plan:

I will wait for $1947 or $1926 price targets to enter in short/long direction.

Important Economic date today

16.00: EUR German CPI

16.15: ADP NFP

16.30 GDP

18.00 Pending home sales

Piyush Lalsingh Ratnu

25.08.2023 | Tracer Vs Actual | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

#forex #XAUUSD #SpotGold #PiyushRatnu #Education #analysis #forextraining #forexcourse

#forex #XAUUSD #SpotGold #PiyushRatnu #Education #analysis #forextraining #forexcourse

Piyush Lalsingh Ratnu

#hiring #PiyushRatnu #forextrader #forexanalyst #salesexecutive #introductorybroker #jobs #jobvacancy

Piyush Lalsingh Ratnu

XAUUSD Projected BZ:

C 1907 | 1888 | 1866

XAUUSD Projected SZ:

R 1926 | 1947 | 1966

C 1907 | 1888 | 1866

XAUUSD Projected SZ:

R 1926 | 1947 | 1966

Piyush Lalsingh Ratnu

Jerome Powell speech in focus at the Jackson Hole Symposium

Gold price is struggling to extend the recent recovery momentum, as investors prefer to hold the US Dollar heading into the main event risk at the Fed’s annual economic conference at Jackson Hole, Chair Jerome Powell’s speech. A cautious market mood also favors the safe-haven demand for the US Dollar, limiting the upside in the Gold price.

Powell’s speech at the Jackson Hole event was previously a decisive one, as he delivered a strong message on the central bank’s commitment to fighting inflation, suggesting more interest rate hikes. At the 2023 symposium, Jerome Powell is likely to laud the US economic resilience, feeding into the rhetoric of a ‘higher for longer’ narrative. In such a case, markets are likely to read his message as hawkish, triggering a fresh upside in the US Dollar and the US Treasury bond yields at the expense of the Gold price.

Conversely, if Powell emphasizes the Fed’s data-dependent approach for future policy course and expresses concerns over economic growth and credit conditions, it could imply a less hawkish stance and smash the US Dollar across the board while providing the much-needed boost to the Gold price.

Meanwhile, the end-of-the-week flows combined with the pre-US Nonfarm Payrolls positioning could also influence the Gold price action heading into the weekly close.

Gold price is struggling to extend the recent recovery momentum, as investors prefer to hold the US Dollar heading into the main event risk at the Fed’s annual economic conference at Jackson Hole, Chair Jerome Powell’s speech. A cautious market mood also favors the safe-haven demand for the US Dollar, limiting the upside in the Gold price.

Powell’s speech at the Jackson Hole event was previously a decisive one, as he delivered a strong message on the central bank’s commitment to fighting inflation, suggesting more interest rate hikes. At the 2023 symposium, Jerome Powell is likely to laud the US economic resilience, feeding into the rhetoric of a ‘higher for longer’ narrative. In such a case, markets are likely to read his message as hawkish, triggering a fresh upside in the US Dollar and the US Treasury bond yields at the expense of the Gold price.

Conversely, if Powell emphasizes the Fed’s data-dependent approach for future policy course and expresses concerns over economic growth and credit conditions, it could imply a less hawkish stance and smash the US Dollar across the board while providing the much-needed boost to the Gold price.

Meanwhile, the end-of-the-week flows combined with the pre-US Nonfarm Payrolls positioning could also influence the Gold price action heading into the weekly close.

Piyush Lalsingh Ratnu

⚠️Past Track record:

2022: https://www.reuters.com/markets/europe/gold-falls-dollar-holds-ground-with-focus-powells-speech-2022-08-26/

Feed: https://www.youtube.com/watch?v=duUBLlLBcdg

Material: https://www.kansascityfed.org/research/jackson-hole-economic-policy-symposium-reassessing-constraints-on-the-economy-and-policy/

2021: https://www.bloomberg.com/news/articles/2021-08-27/powell-says-fed-could-begin-tapering-bond-purchases-this-year

Feed: https://www.youtube.com/watch?v=HIzCWQKmnTg

Material: https://www.kansascityfed.org/research/jackson-hole-economic-symposium/macroeconomic-policy-in-an-uneven-economy/

2020:

Feed: https://www.youtube.com/watch?v=D7xw7SPIDqM

Material: https://www.kansascityfed.org/research/jackson-hole-economic-symposium/navigating-decade-ahead-implications-monetary-policy/

Pre-COVID:

2019: https://www.kansascityfed.org/research/jackson-hole-economic-symposium/challenges-for-monetary-policy/

2022: https://www.reuters.com/markets/europe/gold-falls-dollar-holds-ground-with-focus-powells-speech-2022-08-26/

Feed: https://www.youtube.com/watch?v=duUBLlLBcdg

Material: https://www.kansascityfed.org/research/jackson-hole-economic-policy-symposium-reassessing-constraints-on-the-economy-and-policy/

2021: https://www.bloomberg.com/news/articles/2021-08-27/powell-says-fed-could-begin-tapering-bond-purchases-this-year

Feed: https://www.youtube.com/watch?v=HIzCWQKmnTg

Material: https://www.kansascityfed.org/research/jackson-hole-economic-symposium/macroeconomic-policy-in-an-uneven-economy/

2020:

Feed: https://www.youtube.com/watch?v=D7xw7SPIDqM

Material: https://www.kansascityfed.org/research/jackson-hole-economic-symposium/navigating-decade-ahead-implications-monetary-policy/

Pre-COVID:

2019: https://www.kansascityfed.org/research/jackson-hole-economic-symposium/challenges-for-monetary-policy/

Piyush Lalsingh Ratnu

XAUUSD: $1919-1926 or $1888/1880 today?

Gold price is sustaining the recovery from five-month lows, looking to recapture the $1,900 mark early Wednesday. A minor pullback in the United States Dollar (USD) and the US Treasury bond yields is helping Gold price find some support. All eyes now remain on the global preliminary PMI reports for fresh trading impetus in Gold price.

Investors also stay unnerved ahead of the key Manufacturing and Services PMI reports from the Euro area and the US due later in the day. The S&P Global US PMI is likely to show the factory sector remained in contraction this month. The global PMI data will help gauge the risks of a recession worldwide while driving the broader market sentiment. Worsening business conditions globally are likely to intensify risk-aversion and boost the US Dollar’s safe-haven demand, motivating the Greenback to resume the uptrend at the expense of Gold price.

Further, earnings results from the US chipmaker due late Wednesday are likely to have a significant impact on risk sentiment. Gold traders also remain wary of the US banking jitters, especially after S&P joined Moody's to downgrade multiple regional US banks. In other news, Swiss Gold exports fell 2% in July from June, keeping the Gold price rebound in check.

Gold price managed to settle Tuesday above the descending trendline resistance, then at $1,891, as it moved away from multi-month troughs. Gold buyers now need acceptance above the $1,900 round figure to take on the upward-sloping 200-Daily Moving Average (DMA) at $1,909.

A sustained move above the 200 DMA barrier will open doors for a test of the $1,920 round figure.

The 14-day Relative Strength Index (RSI) is inching higher but stays below the 50 level, limiting the upside attempts in Gold price.

On the downside, the immediate support is seen at the abovementioned descending trendline resistance-turned-support, now at $1,885, below which a test of the $1,870 static support will be on the cards.

Gold price is sustaining the recovery from five-month lows, looking to recapture the $1,900 mark early Wednesday. A minor pullback in the United States Dollar (USD) and the US Treasury bond yields is helping Gold price find some support. All eyes now remain on the global preliminary PMI reports for fresh trading impetus in Gold price.

Investors also stay unnerved ahead of the key Manufacturing and Services PMI reports from the Euro area and the US due later in the day. The S&P Global US PMI is likely to show the factory sector remained in contraction this month. The global PMI data will help gauge the risks of a recession worldwide while driving the broader market sentiment. Worsening business conditions globally are likely to intensify risk-aversion and boost the US Dollar’s safe-haven demand, motivating the Greenback to resume the uptrend at the expense of Gold price.

Further, earnings results from the US chipmaker due late Wednesday are likely to have a significant impact on risk sentiment. Gold traders also remain wary of the US banking jitters, especially after S&P joined Moody's to downgrade multiple regional US banks. In other news, Swiss Gold exports fell 2% in July from June, keeping the Gold price rebound in check.

Gold price managed to settle Tuesday above the descending trendline resistance, then at $1,891, as it moved away from multi-month troughs. Gold buyers now need acceptance above the $1,900 round figure to take on the upward-sloping 200-Daily Moving Average (DMA) at $1,909.

A sustained move above the 200 DMA barrier will open doors for a test of the $1,920 round figure.

The 14-day Relative Strength Index (RSI) is inching higher but stays below the 50 level, limiting the upside attempts in Gold price.

On the downside, the immediate support is seen at the abovementioned descending trendline resistance-turned-support, now at $1,885, below which a test of the $1,870 static support will be on the cards.

Piyush Lalsingh Ratnu

US Dollar keeps rallying, Gold price at the losing end

Gold price is coming up for some air after the relentless three-day decline, fuelled by a broadly firmer US Dollar amid an increased flight to safety and economic resilience showcased by the recent US economic statistics.

The Greenback built onto its upsurge on Wednesday after the benchmark 10-year US Treasury bond yields climbed to fresh 10-month highs just above 4.30% on the hawkish US Federal Reserve Minutes of the July meeting. The Fed Minutes revealed that "most" policymakers continued to pledge to tame inflation while seeing ‘upside risks’ to inflation, possibly suggesting more rate hikes to come from the Federal Reserve.

Additionally, lingering Chinese economic concerns combined with the revival of the hawkish Fed expectations sent risk tumbling, infusing safe-haven flows into the US Dollar. Upbeat US housing data also added to the positive mood around the US Dollar, exacerbating the pain in the non-interest-bearing Gold price. Single-family homebuilding in the United States rose 6.7% while Building Permits ticked up 0.1% to an annualized pace of 1.44 million units.

Later in the day, the US weekly Jobless Claims and Philadelphia Fed Manufacturing Survey will be eyed to confirm a resilient US economy, which could trigger a fresh leg higher in the US Dollar. The Greenback is likely to remain in a win-win situation even if risk sentiment takes a further knock.

Crucial Zones projected since 04.08.2023:

C: $1926/1907/1888/1866/1836/1818

R: $ 1947/1966/1985 (RT observed)/2009/2048

Read detailed analysis dated 04.08.2023 at:

https://bit.ly/PRTrackRecordXAUUSD

Gold price is coming up for some air after the relentless three-day decline, fuelled by a broadly firmer US Dollar amid an increased flight to safety and economic resilience showcased by the recent US economic statistics.

The Greenback built onto its upsurge on Wednesday after the benchmark 10-year US Treasury bond yields climbed to fresh 10-month highs just above 4.30% on the hawkish US Federal Reserve Minutes of the July meeting. The Fed Minutes revealed that "most" policymakers continued to pledge to tame inflation while seeing ‘upside risks’ to inflation, possibly suggesting more rate hikes to come from the Federal Reserve.

Additionally, lingering Chinese economic concerns combined with the revival of the hawkish Fed expectations sent risk tumbling, infusing safe-haven flows into the US Dollar. Upbeat US housing data also added to the positive mood around the US Dollar, exacerbating the pain in the non-interest-bearing Gold price. Single-family homebuilding in the United States rose 6.7% while Building Permits ticked up 0.1% to an annualized pace of 1.44 million units.

Later in the day, the US weekly Jobless Claims and Philadelphia Fed Manufacturing Survey will be eyed to confirm a resilient US economy, which could trigger a fresh leg higher in the US Dollar. The Greenback is likely to remain in a win-win situation even if risk sentiment takes a further knock.

Crucial Zones projected since 04.08.2023:

C: $1926/1907/1888/1866/1836/1818

R: $ 1947/1966/1985 (RT observed)/2009/2048

Read detailed analysis dated 04.08.2023 at:

https://bit.ly/PRTrackRecordXAUUSD

Piyush Lalsingh Ratnu

XAUUSD Projected BZ:

C 1888 | 1866 | 1847

XAUUSD Projected SZ:

R 1907 | 1926 | 1947

C 1888 | 1866 | 1847

XAUUSD Projected SZ:

R 1907 | 1926 | 1947

Piyush Lalsingh Ratnu

KEY POINTS

• Gold price is seen consolidating its recent decline to the lowest level since early June.

• Bets for one more rate hike by Federal Reserve continue to cap the non-yielding metal.

• China's economic woes and geopolitical tensions limit further losses for the XAU/USD.

• Traders now look forward to the US Retail Sales report for some meaningful impetus.

• last week's dismal Chinese trade data, which indicated that imports and exports fell much faster than expected in July as weaker demand threatens recovery prospects in the world's second-largest economy. Moreover, the Consumer Price Index (CPI) registered its first decline since February 2021 and the Producer Price Index (PPI) fell for a 10th consecutive month in July, suggesting that China's post-pandemic recovery has slowed after a brisk start in the first quarter. Even a surprise rate cut by the People's Bank of China (PBoC) does little to ease market concerns, allowing the Gold price to defend the $1,900 round figure, at least for the time being.

• The upside, however, remains capped in the wake of growing acceptance that the Federal Reserve (Fed) will keep interest rates higher for longer. It is worth recalling that the markets are still pricing in the possibility of one more 25 basis points (bps) lift-off by the end of this year, which remains supportive of elevated US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond shot to a nine-month high on Monday. This, in turn, assists the US Dollar (USD) to stand tall just below its highest level in more than two-month set the previous day and should continue to keep a lid on any meaningful recovery for the non-yielding Gold price.

• Traders might also refrain from placing aggressive bets and prefer to wait for the release of the monthly Retail Sales figures from the United States (US), due later during the early North American session. Tuesday's US economic docket also features the Empire State Manufacturing Index, which, along with the US bond yields will influence the USD price dynamics and provide some impetus to the Gold price. Apart from this, the broader risk sentiment might contribute to producing short-term trading opportunities around the safe-haven XAU/USD.

• Gold price is seen consolidating its recent decline to the lowest level since early June.

• Bets for one more rate hike by Federal Reserve continue to cap the non-yielding metal.

• China's economic woes and geopolitical tensions limit further losses for the XAU/USD.

• Traders now look forward to the US Retail Sales report for some meaningful impetus.

• last week's dismal Chinese trade data, which indicated that imports and exports fell much faster than expected in July as weaker demand threatens recovery prospects in the world's second-largest economy. Moreover, the Consumer Price Index (CPI) registered its first decline since February 2021 and the Producer Price Index (PPI) fell for a 10th consecutive month in July, suggesting that China's post-pandemic recovery has slowed after a brisk start in the first quarter. Even a surprise rate cut by the People's Bank of China (PBoC) does little to ease market concerns, allowing the Gold price to defend the $1,900 round figure, at least for the time being.

• The upside, however, remains capped in the wake of growing acceptance that the Federal Reserve (Fed) will keep interest rates higher for longer. It is worth recalling that the markets are still pricing in the possibility of one more 25 basis points (bps) lift-off by the end of this year, which remains supportive of elevated US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond shot to a nine-month high on Monday. This, in turn, assists the US Dollar (USD) to stand tall just below its highest level in more than two-month set the previous day and should continue to keep a lid on any meaningful recovery for the non-yielding Gold price.

• Traders might also refrain from placing aggressive bets and prefer to wait for the release of the monthly Retail Sales figures from the United States (US), due later during the early North American session. Tuesday's US economic docket also features the Empire State Manufacturing Index, which, along with the US bond yields will influence the USD price dynamics and provide some impetus to the Gold price. Apart from this, the broader risk sentiment might contribute to producing short-term trading opportunities around the safe-haven XAU/USD.

Piyush Lalsingh Ratnu

Crucial Zones:

🟢R: $1919/1926/1932 (1926 zone)

🟢C: $1892/1882 (1888 zone)

Technical Aspect:

USDJPY 145.500 (attempted 145.800)

XAUUSD $1902 CMP

US 10YT+

USDJPY+

US F YM: ideal BUY, PG 50

US F: NQ, SPX: Buy after H1A completion below S5

XAUXAG 84.85

USD S 64

JPY S 51

AUD S 17

DXY below 103.00 range.

🟢R: $1919/1926/1932 (1926 zone)

🟢C: $1892/1882 (1888 zone)

Technical Aspect:

USDJPY 145.500 (attempted 145.800)

XAUUSD $1902 CMP

US 10YT+

USDJPY+

US F YM: ideal BUY, PG 50

US F: NQ, SPX: Buy after H1A completion below S5

XAUXAG 84.85

USD S 64

JPY S 51

AUD S 17

DXY below 103.00 range.

Piyush Lalsingh Ratnu

USDJPY: crashed 700 pips

Impact on XAUUSD: 1400 pips

USDJPY: M30A618

XAUUSD: M30V618 CMP 1911.11

USDJPY: M30AS1 achieved

XAUUSD: M30VS1 achieved

XAUUSD @H1V382 R1 above PPZ

Impact on XAUUSD: 1400 pips

USDJPY: M30A618

XAUUSD: M30V618 CMP 1911.11

USDJPY: M30AS1 achieved

XAUUSD: M30VS1 achieved

XAUUSD @H1V382 R1 above PPZ

Piyush Lalsingh Ratnu

🆘3 min to go for US PPI

USDJPY @ 27June 2023 price zone: $145.000 zone

XAUUSD might hit 27 June 2023 price zone: $1900, if USD strengthens, reversal: XAUUSD might hit $1926/1936/1947 price stops.

Crucial price zones:

C: $1919/1907/1890

R: $1926/1947

USDJPY @ 27June 2023 price zone: $145.000 zone

XAUUSD might hit 27 June 2023 price zone: $1900, if USD strengthens, reversal: XAUUSD might hit $1926/1936/1947 price stops.

Crucial price zones:

C: $1919/1907/1890

R: $1926/1947

Piyush Lalsingh Ratnu

Buying at $1912: gave us neat results: CMP $1916

Net pips traced: 400+ | EXIT BUY Positions.

Net pips traced: 400+ | EXIT BUY Positions.

Piyush Lalsingh Ratnu

Buying at 1916 and below till 1914 gave us good results CMP 1922. XAUUSD approaching $1926 zone: and a breach of H1S5 might result in $1926+3/6/9 RT trades to be implemented.

Key highlights:

Gold price rebounds as US Dollar bulls catch a breath ahead of US inflation data.

Investors stay cautious amid US-Sino concerns and China’s growth worries.

Gold price sees downside risks due to a bearish technical setup on the daily chart.

Gold price is replicating the moves seen in the first half of Wednesday on the United States (US) Consumer Price Index (CPI) day. The United States Dollar (USD) buyers take a breather, awaiting the critical US inflation data for a fresh directional impetus. Gold price is making another recovery attempt from four-week troughs of $1,914 early Thursday. Markets trade with caution, reflective of the mixed tone in the Asian indices even though the US S&P 500 futures post small gains. Investors resort to adjusting their US Dollar positions ahead of the all-important CPI inflation data from the United States, which will have a significant influence on the US Federal Reserve (Fed) policy path.

🟠 An upside surprise to the headline and core CPI data could revive expectations for Fed rate hikes, triggering a fresh upswing in the US Dollar alongside the US Treasury bond yields. Hot US inflation data is likely to exacerbate the pain in the Gold price, opening floors for a test of the levels below the $1,907/1,900 mark.

Risk-aversion intensified, as US tech stocks tumbled after US President Joe Biden signed the highly anticipated bill that allows the US Treasury Department to prohibit or restrict certain US investments in Chinese technology companies, involved in semiconductors and microelectronics, quantum information technologies, and certain Artificial Intelligence (AI) systems.

USD Core CPI is scheduled to be published at 16.30 hours today with Initial Jobless Claims.

Crucial Stops:

C: $1907/1890

R: $1932(M30V100.0)/1947(H1V100.0)

A hot US inflation report will revive the selling interest around the Gold price, smashing it through the key support near the $1,910 region to challenge the critical 200-Daily Moving Average (DMA) at $1,900.

A sustained break below the latter will put the June 29 low of $1,888 to the test.

Only the downbeat US CPI data could rescue Gold buyers from monthly lows, with the recovery likely to face an initial hurdle at the $1,930 round figure, above which the downward-sloping 50-DMA at $1,947 zone could be challenged.

Key highlights:

Gold price rebounds as US Dollar bulls catch a breath ahead of US inflation data.

Investors stay cautious amid US-Sino concerns and China’s growth worries.

Gold price sees downside risks due to a bearish technical setup on the daily chart.

Gold price is replicating the moves seen in the first half of Wednesday on the United States (US) Consumer Price Index (CPI) day. The United States Dollar (USD) buyers take a breather, awaiting the critical US inflation data for a fresh directional impetus. Gold price is making another recovery attempt from four-week troughs of $1,914 early Thursday. Markets trade with caution, reflective of the mixed tone in the Asian indices even though the US S&P 500 futures post small gains. Investors resort to adjusting their US Dollar positions ahead of the all-important CPI inflation data from the United States, which will have a significant influence on the US Federal Reserve (Fed) policy path.

🟠 An upside surprise to the headline and core CPI data could revive expectations for Fed rate hikes, triggering a fresh upswing in the US Dollar alongside the US Treasury bond yields. Hot US inflation data is likely to exacerbate the pain in the Gold price, opening floors for a test of the levels below the $1,907/1,900 mark.

Risk-aversion intensified, as US tech stocks tumbled after US President Joe Biden signed the highly anticipated bill that allows the US Treasury Department to prohibit or restrict certain US investments in Chinese technology companies, involved in semiconductors and microelectronics, quantum information technologies, and certain Artificial Intelligence (AI) systems.

USD Core CPI is scheduled to be published at 16.30 hours today with Initial Jobless Claims.

Crucial Stops:

C: $1907/1890

R: $1932(M30V100.0)/1947(H1V100.0)

A hot US inflation report will revive the selling interest around the Gold price, smashing it through the key support near the $1,910 region to challenge the critical 200-Daily Moving Average (DMA) at $1,900.

A sustained break below the latter will put the June 29 low of $1,888 to the test.

Only the downbeat US CPI data could rescue Gold buyers from monthly lows, with the recovery likely to face an initial hurdle at the $1,930 round figure, above which the downward-sloping 50-DMA at $1,947 zone could be challenged.

Piyush Lalsingh Ratnu

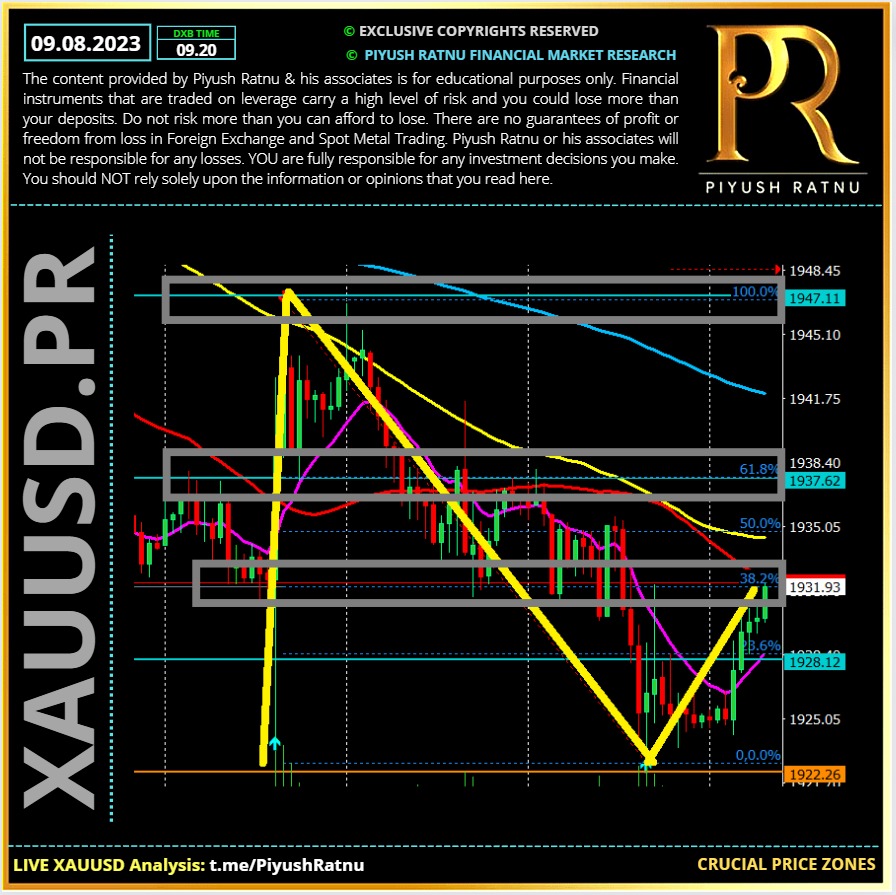

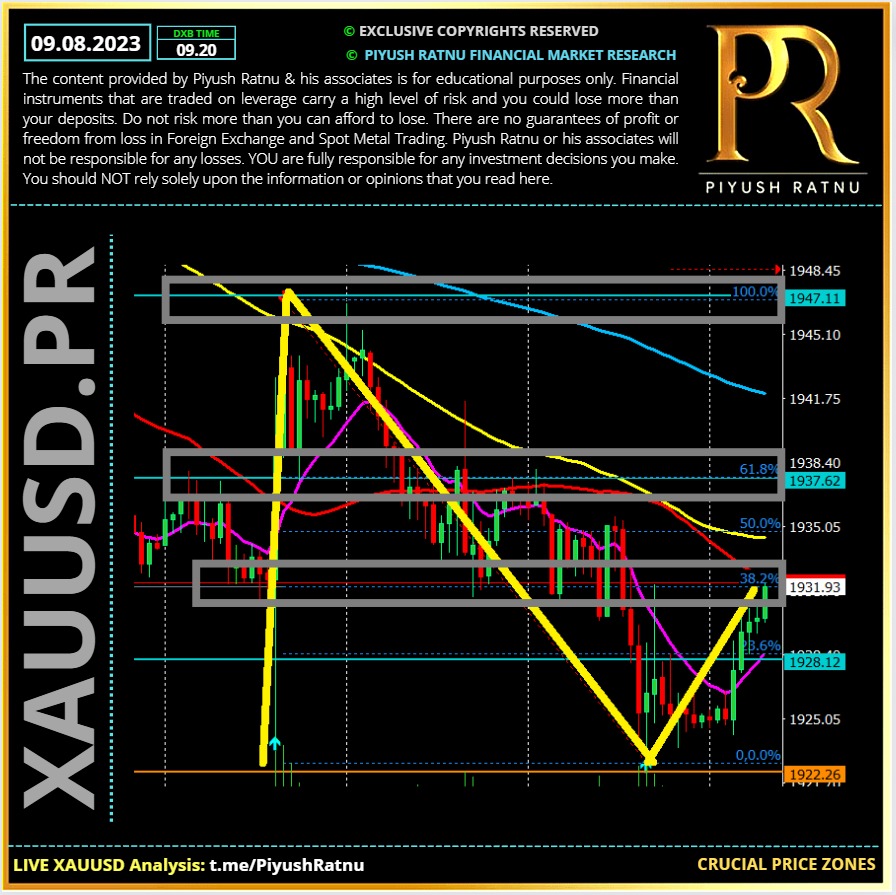

09.08.2023 | Crucial Price Zones | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

#forex #XAUUSD #SpotGold #PiyushRatnu #education #analysis #forextraining #forexcourse

#forex #XAUUSD #SpotGold #PiyushRatnu #education #analysis #forextraining #forexcourse

Piyush Lalsingh Ratnu

XAUUSD Projected BZ:

C 1919 | 1907 | 1888

XAUUSD Projected SZ:

R 1926 | 1947 | 1966

C 1919 | 1907 | 1888

XAUUSD Projected SZ:

R 1926 | 1947 | 1966

Piyush Lalsingh Ratnu

XAUUSD approaching H1VS5 19323 H4S5 1945

🆘Crucial Price zones:

C: 1926/1907 D1A0.0

R: 1947/1966 H4V618 z

Important data/events:

USD 10Y Note auction 21.00

Redbook 16.55

Due to lack of major economic data, USD might catch one side trend resulting in reversal trend in GOLD, it will be wise to maintain price gaps and focus on entries near SR D1 zones while tracing AV formations.

Earlier, yesterday:

XAU/USD edged sharply lower early in the American session, posting a fresh four-week low of $1,922.74 a troy ounce, as demand for the US Dollar picked up following comments from Federal Reserve (Fed) officials and ahead of the release of the United States (US) July Consumer Price Index (CPI).

Philadelphia Federal Reserve Bank President Patrick Harker said they are moving back to a more normal circumstance, and while he considers a soft landing is quite possible, he also added that supply chain issues are starting to heal. Furthermore, he said the Fed could be “patient” and hold rates steady, although he clarified the September decision would depend on upcoming data.

$1937-$1922 RT $1931 CMP:

Gold declined despite global stocks edging lower, reflecting mounting concerns about the economic future and as earnings reports missed. On a positive note, Treasury yields gave up some of their recent gains, enough to prevent the USD from appreciating further.

🆘Crucial Price zones:

C: 1926/1907 D1A0.0

R: 1947/1966 H4V618 z

Important data/events:

USD 10Y Note auction 21.00

Redbook 16.55

Due to lack of major economic data, USD might catch one side trend resulting in reversal trend in GOLD, it will be wise to maintain price gaps and focus on entries near SR D1 zones while tracing AV formations.

Earlier, yesterday:

XAU/USD edged sharply lower early in the American session, posting a fresh four-week low of $1,922.74 a troy ounce, as demand for the US Dollar picked up following comments from Federal Reserve (Fed) officials and ahead of the release of the United States (US) July Consumer Price Index (CPI).

Philadelphia Federal Reserve Bank President Patrick Harker said they are moving back to a more normal circumstance, and while he considers a soft landing is quite possible, he also added that supply chain issues are starting to heal. Furthermore, he said the Fed could be “patient” and hold rates steady, although he clarified the September decision would depend on upcoming data.

$1937-$1922 RT $1931 CMP:

Gold declined despite global stocks edging lower, reflecting mounting concerns about the economic future and as earnings reports missed. On a positive note, Treasury yields gave up some of their recent gains, enough to prevent the USD from appreciating further.

Piyush Lalsingh Ratnu

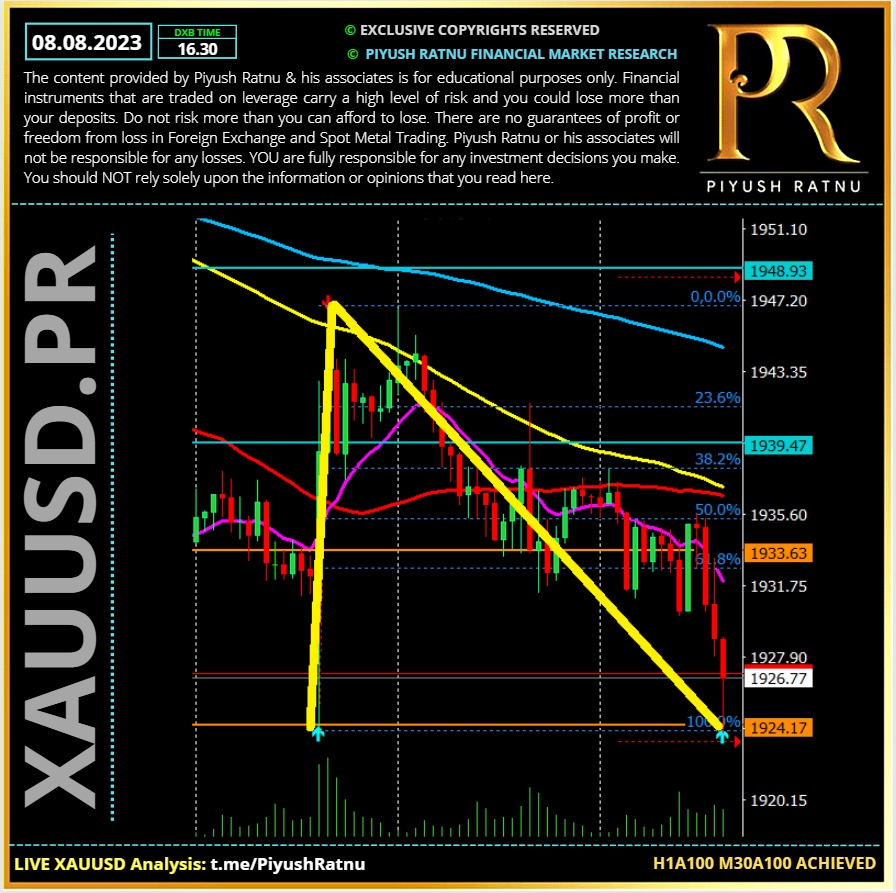

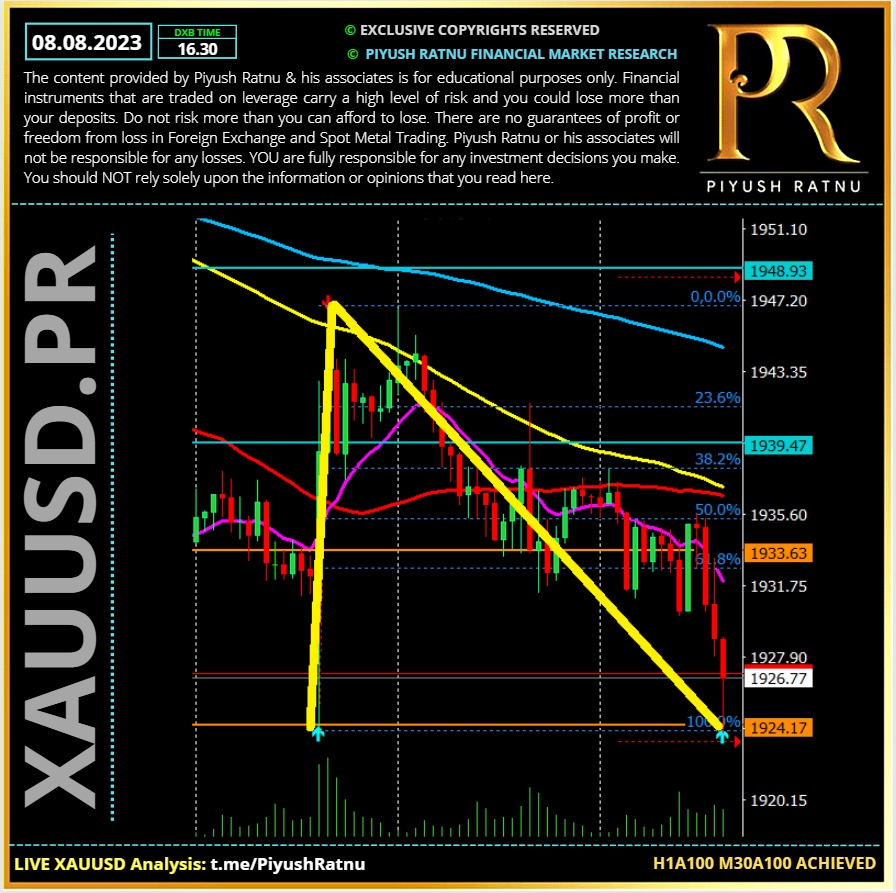

08.08.2023 | H1A100 M30A100 Achieved | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

#forex #XAUUSD #gold #PiyushRatnu #education #analysis

#forex #XAUUSD #gold #PiyushRatnu #education #analysis

: