Piyush Lalsingh Ratnu / Profilo

- Informazioni

|

no

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

The US Dollar (USD) appreciated significantly in the European trading session on Tuesday after rating agency Moody’s downgraded China’s credit outlook from stable to negative due to rising debt.

More US Dollar Strength comes from European Central Bank (ECB) member Isabel Schnabel, who said she is surprised by the substantial decline in inflation and no more interest-rate hikes are further needed.

XAUUSD price factors: Pressure building to Nonfarm Payrolls

• Rating agency Moody’s has issued a negative outlook for China, a downgrade from the previous “stable” label.

• European Central Bank (ECB) board member Isabel Schnabel said that she is surprised by the shere speed of decline in inflation in the Eurozone, and no further hikes should be needed. Schnabel is considered to be a hawk, which makes these comments even more important and signals a change in the stance and outlook of the ECB.

• At 18.45, the S&P Global Purchasing Managers Indices are expected:

1. The Services PMI is expected to stay stable from its preliminary reading at 50.8.

2. The Composite flash reading for November stood at 50.7.

• Chunky batch of data at 19:00 GMT:

1. The Institute for Supply Management (ISM) will release its November numbers:

2. Headline Services PMI for November expected to increase from 51.8 to 52.

3. Services Employment Index for October was at 50.2. No forecast.

4. Services New Orders Index for October was at 55.5. No forecast pencilled in.

5. Services Prices Paid for October was at 58.6. No forecast.

6. JOLTS Job Openings for October is expected to decline a little from 9.553 million to 9.3 million.

• Equities are bleeding severely this Tuesday with nearly all Asian equity indices down over 1%, with China’s leading indices down more than 2%. European equities are trading in the red, and US futures trade directionless.

• The CME Group’s FedWatch Tool shows that markets are pricing in a 97.5% chance that the Federal Reserve will keep interest rates unchanged at its meeting next week.

• The benchmark 10-year US Treasury Note steadies at 4.23%. Yields in Europe, on the other hand, are falling.

🟢 Crucial zones:

C: $2009/1985/1966

R: $2048/2069/2096

More US Dollar Strength comes from European Central Bank (ECB) member Isabel Schnabel, who said she is surprised by the substantial decline in inflation and no more interest-rate hikes are further needed.

XAUUSD price factors: Pressure building to Nonfarm Payrolls

• Rating agency Moody’s has issued a negative outlook for China, a downgrade from the previous “stable” label.

• European Central Bank (ECB) board member Isabel Schnabel said that she is surprised by the shere speed of decline in inflation in the Eurozone, and no further hikes should be needed. Schnabel is considered to be a hawk, which makes these comments even more important and signals a change in the stance and outlook of the ECB.

• At 18.45, the S&P Global Purchasing Managers Indices are expected:

1. The Services PMI is expected to stay stable from its preliminary reading at 50.8.

2. The Composite flash reading for November stood at 50.7.

• Chunky batch of data at 19:00 GMT:

1. The Institute for Supply Management (ISM) will release its November numbers:

2. Headline Services PMI for November expected to increase from 51.8 to 52.

3. Services Employment Index for October was at 50.2. No forecast.

4. Services New Orders Index for October was at 55.5. No forecast pencilled in.

5. Services Prices Paid for October was at 58.6. No forecast.

6. JOLTS Job Openings for October is expected to decline a little from 9.553 million to 9.3 million.

• Equities are bleeding severely this Tuesday with nearly all Asian equity indices down over 1%, with China’s leading indices down more than 2%. European equities are trading in the red, and US futures trade directionless.

• The CME Group’s FedWatch Tool shows that markets are pricing in a 97.5% chance that the Federal Reserve will keep interest rates unchanged at its meeting next week.

• The benchmark 10-year US Treasury Note steadies at 4.23%. Yields in Europe, on the other hand, are falling.

🟢 Crucial zones:

C: $2009/1985/1966

R: $2048/2069/2096

Piyush Lalsingh Ratnu

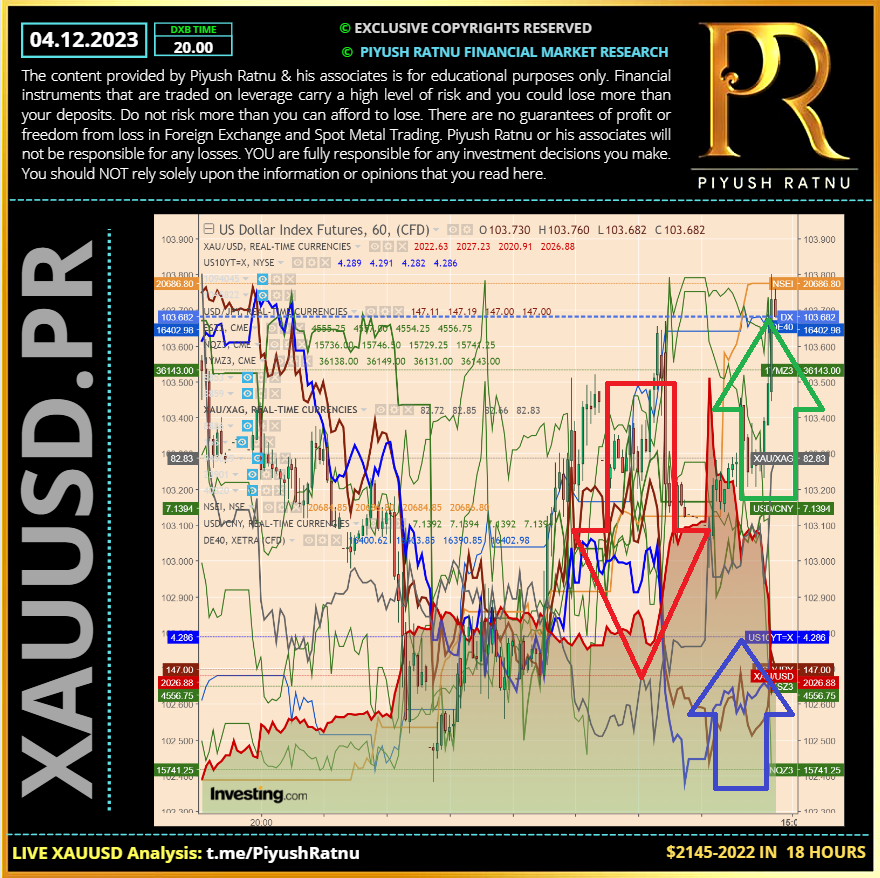

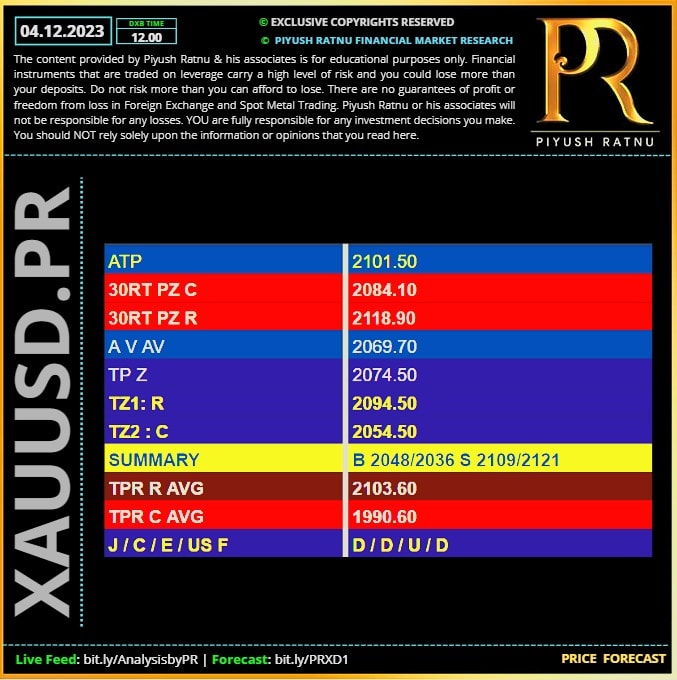

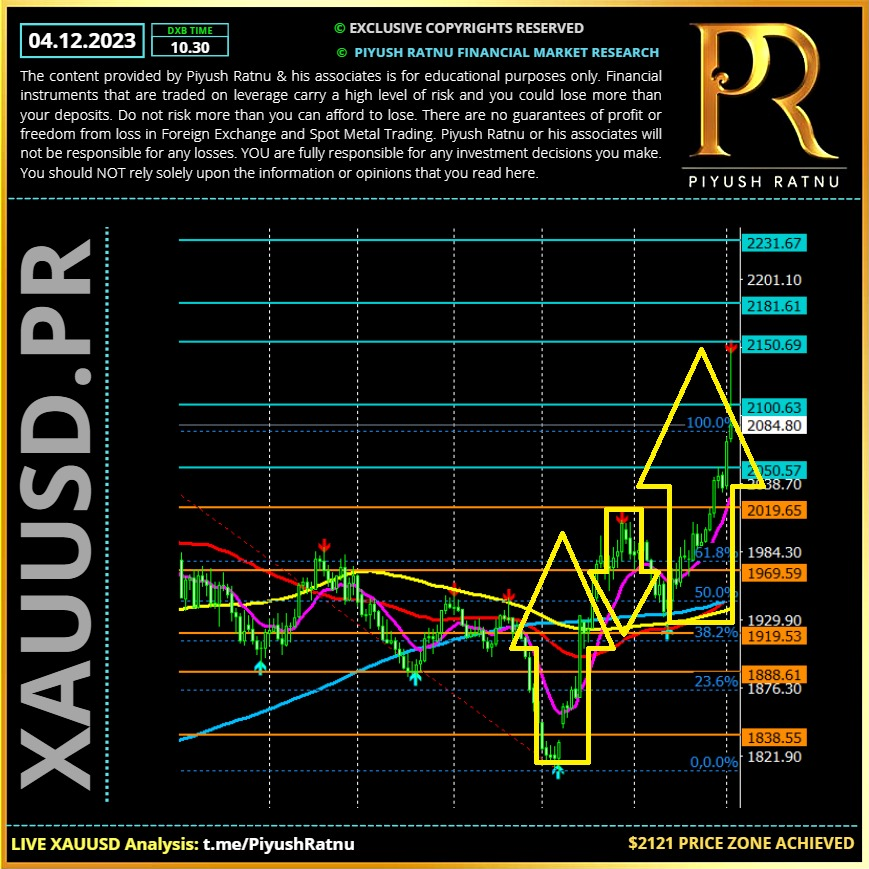

04.12.2023 | XAUUSD: Daily Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

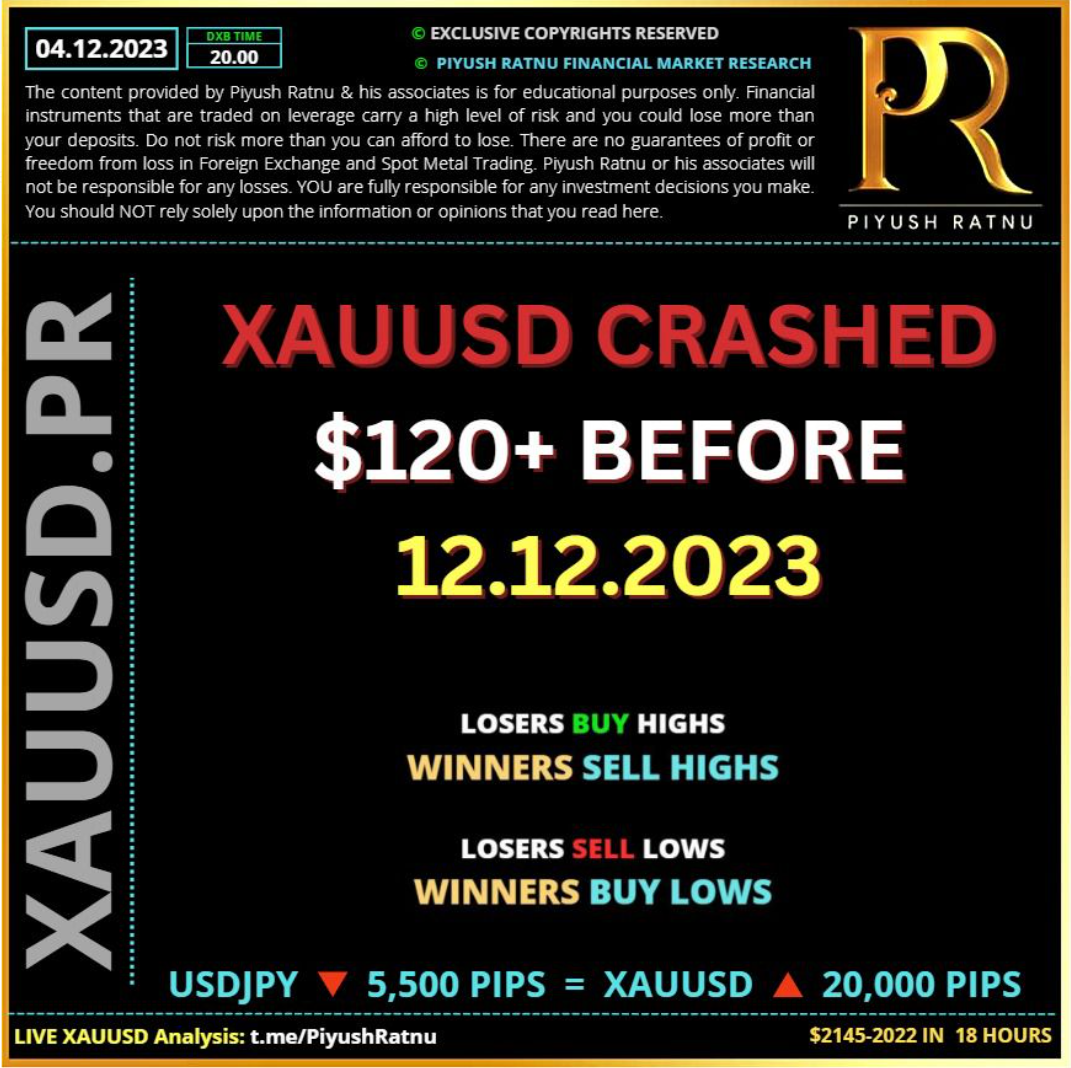

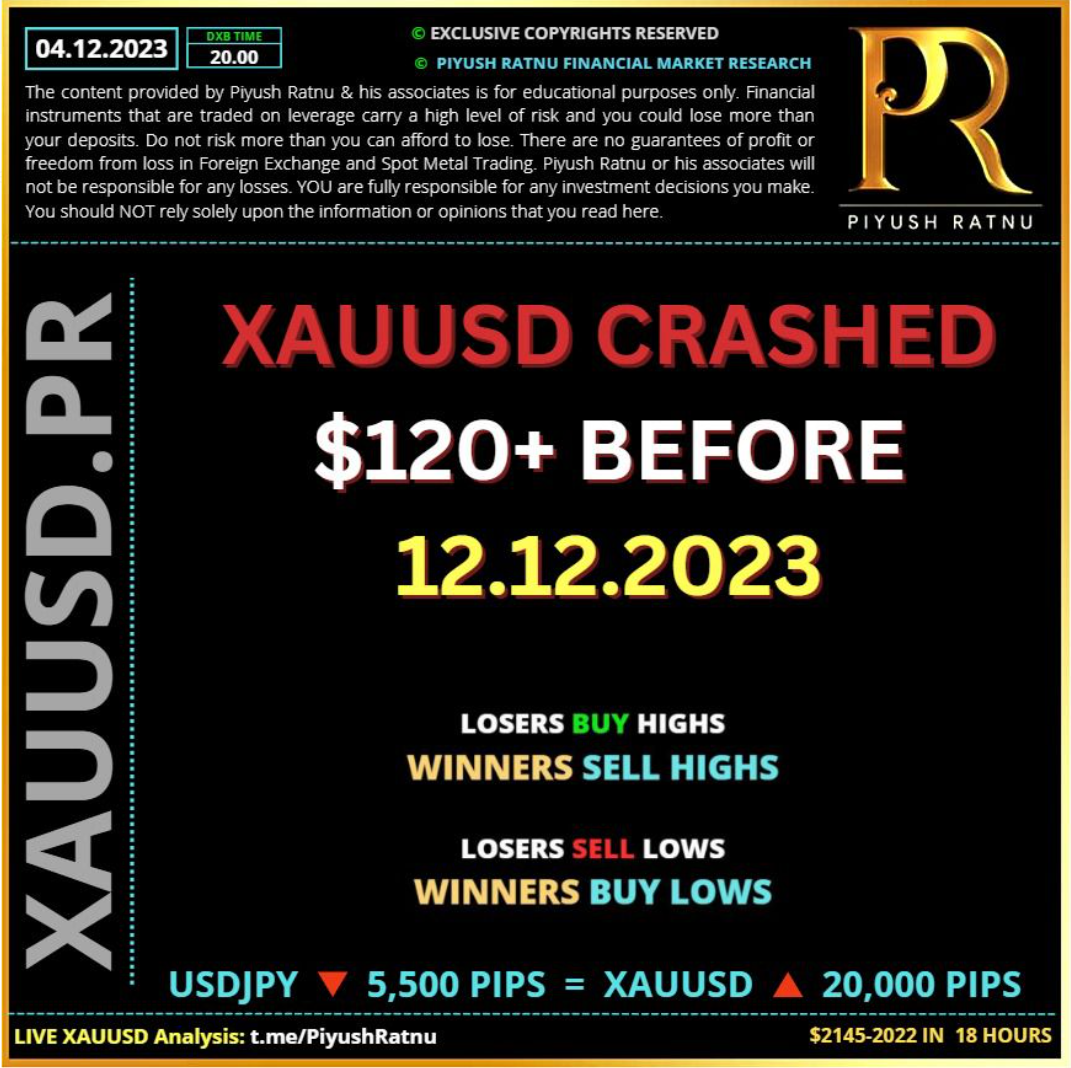

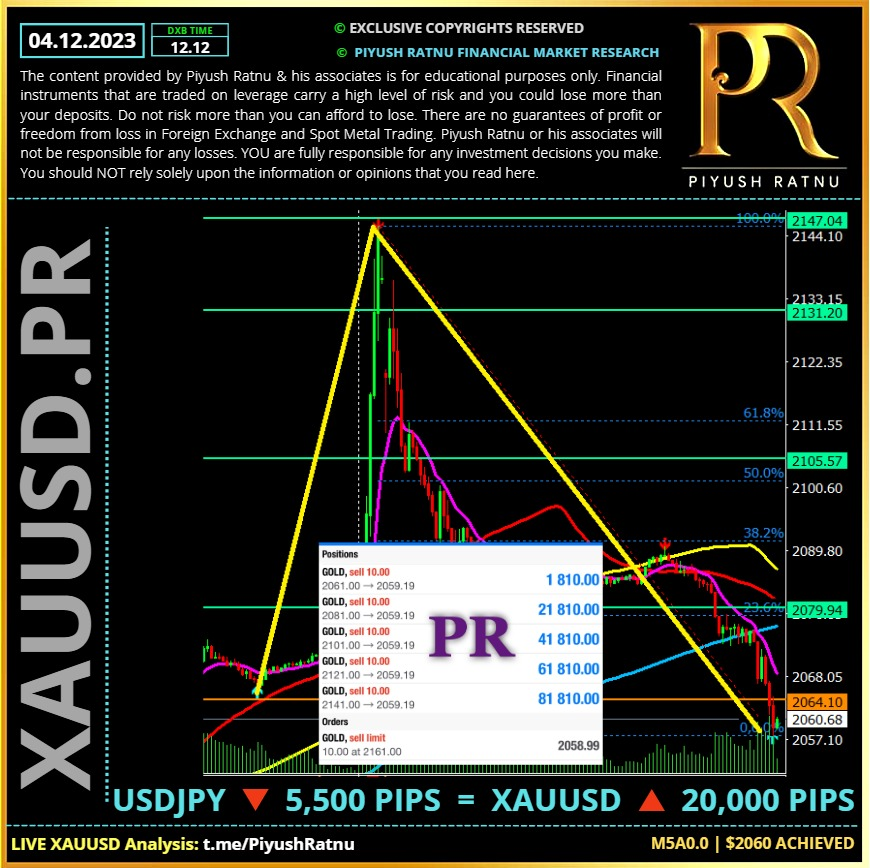

28/11/2023: I had projected $50 crash before 12.12.2023, however we witnessed (-)$120+ crash before 12.12.2023

Piyush Lalsingh Ratnu

28/11/2023: I had projected $50 crash before 12.12.2023, however we witnesses (-)$120+ crash before 12.12.2023.

Piyush Lalsingh Ratnu

♾USDJPY Update:

Despite the 3.5% strengthening of the yen against the US dollar from the levels of the November lows, hedge funds have increased their short positions in the Japanese currency to the highest level since April 2022. They are betting on maintaining a wide US-Japanese yield spread. According to speculators, it would be strange if all central banks, including the Fed, eased monetary policy in 2024, but the BoJ tightened it.

Insurance companies also do not believe in market pricing and have reduced currency hedging of transactions with foreign securities to 47.8%. This is the lowest level since the beginning of accounting in 2011. For comparison, six months ago, the ratio was 52.7%. Its decline results from a lack of concern about the strengthening of the yen, which reduces profits from foreign investments.

Thus, hedge funds and insurance companies trust the Bank of Japan more than the market. Kazuo Ueda has spoken many times about the regulator's commitment to an ultra-ease monetary policy and ignored the fact that inflation in the country has been exceeding the target of 2% for 19 months. They say deflation is structural, and a sustainable wage increase is required to ensure victory over it.

The market has a different opinion. Derivatives suggest the BoJ should end its policy of sub-zero interest rates in June and raise borrowing costs even higher by the end of 2024. The consensus forecast of Bloomberg experts indicates that the first increase in the BoJ rate from its current level of -0.1% will occur in April. At the same time, the derivatives market expects the Fed to ease monetary policy as early as March, followed by a reduction in the federal funds rate by 125 basis points to 4.25% by the end of next year.

🟢 Probable IMPACT: USD - JPY + = XAUUSD +

Despite the 3.5% strengthening of the yen against the US dollar from the levels of the November lows, hedge funds have increased their short positions in the Japanese currency to the highest level since April 2022. They are betting on maintaining a wide US-Japanese yield spread. According to speculators, it would be strange if all central banks, including the Fed, eased monetary policy in 2024, but the BoJ tightened it.

Insurance companies also do not believe in market pricing and have reduced currency hedging of transactions with foreign securities to 47.8%. This is the lowest level since the beginning of accounting in 2011. For comparison, six months ago, the ratio was 52.7%. Its decline results from a lack of concern about the strengthening of the yen, which reduces profits from foreign investments.

Thus, hedge funds and insurance companies trust the Bank of Japan more than the market. Kazuo Ueda has spoken many times about the regulator's commitment to an ultra-ease monetary policy and ignored the fact that inflation in the country has been exceeding the target of 2% for 19 months. They say deflation is structural, and a sustainable wage increase is required to ensure victory over it.

The market has a different opinion. Derivatives suggest the BoJ should end its policy of sub-zero interest rates in June and raise borrowing costs even higher by the end of 2024. The consensus forecast of Bloomberg experts indicates that the first increase in the BoJ rate from its current level of -0.1% will occur in April. At the same time, the derivatives market expects the Fed to ease monetary policy as early as March, followed by a reduction in the federal funds rate by 125 basis points to 4.25% by the end of next year.

🟢 Probable IMPACT: USD - JPY + = XAUUSD +

Piyush Lalsingh Ratnu

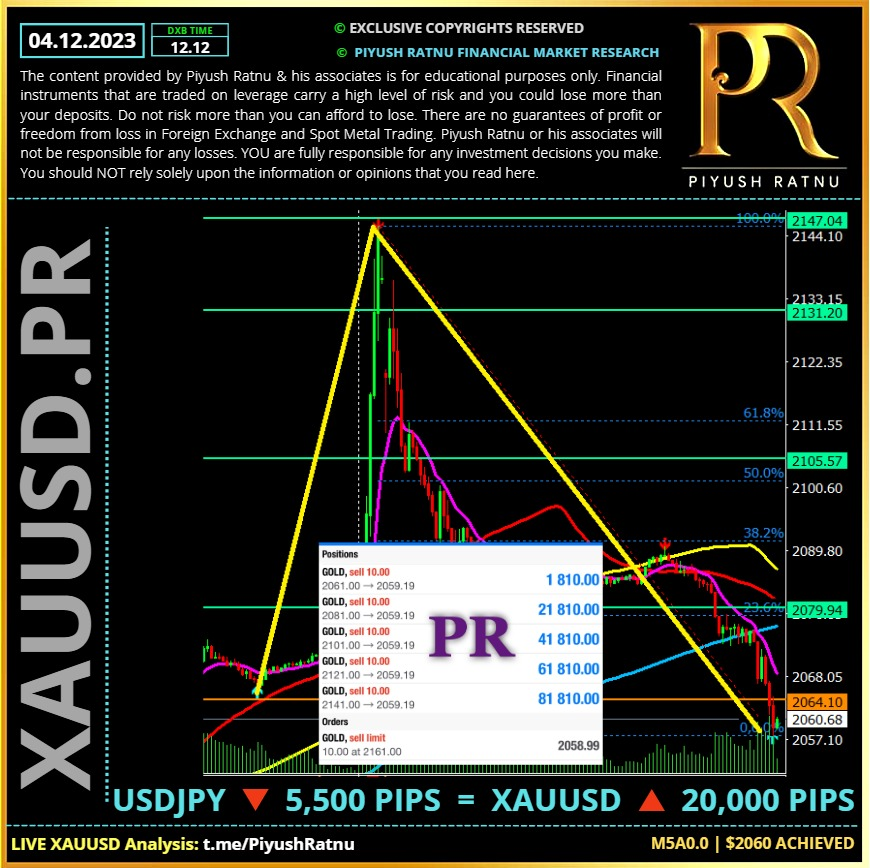

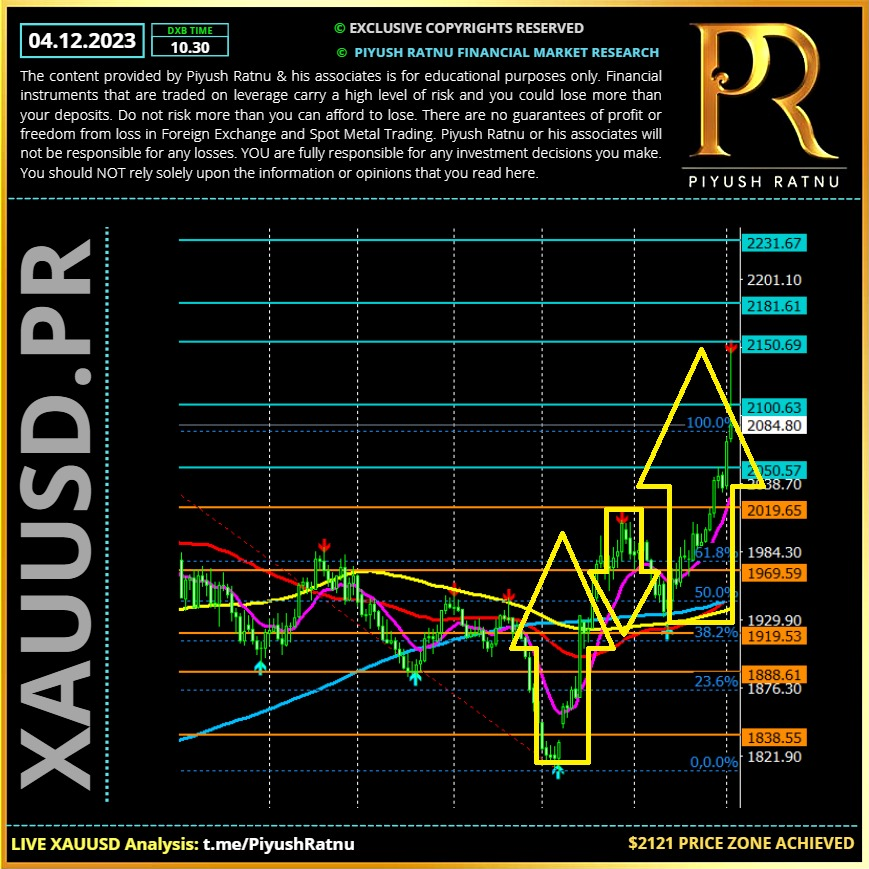

04.12.2023: XAUUSD breached $2121 zone, as projected in advance, read more:

https://www.piyushratnu.com/why-gold-price-xauusd-2023-2121-2145-in-2023/

https://www.piyushratnu.com/why-gold-price-xauusd-2023-2121-2145-in-2023/

Piyush Lalsingh Ratnu

⏰XAUUSD: This week:

A high ($2145) before NFP: will RT result in $2145 again?

A high ($2145) before NFP: a technical correction on the way?

🆘Crucial Zones this week:

R: $2145/2169

C: $2009/1985

A high ($2145) before NFP: will RT result in $2145 again?

A high ($2145) before NFP: a technical correction on the way?

🆘Crucial Zones this week:

R: $2145/2169

C: $2009/1985

Piyush Lalsingh Ratnu

Selling at V, above V proved a perfect trade scenario ONCE AGAIN. 2069-2096-2121-2145-2121-2096-2069 (z) achieved | As projected in advance on Friday, SHORTS above 2069: proved an ideal plan!

Piyush Lalsingh Ratnu

🟢 USDJPY - XAUUSD co-relation at it's best:

USDJPY @M30S5

XAUUSD @M30S5

🟢 USDJPY - XAUUSD co-relation at it's best:

USDJPY @M15VS1

XAUUSD @M15AS1

USDJPY @M30S5

XAUUSD @M30S5

🟢 USDJPY - XAUUSD co-relation at it's best:

USDJPY @M15VS1

XAUUSD @M15AS1

Piyush Lalsingh Ratnu

Three Major reasons for the + rally:

1. Israel war resumes

2. US fends of Red Sea attack

3. Fed statement

The precious metal jumped as much as 3.1% to $2,135.39 an ounce and Bitcoin climbed more than 2.5%. Asian shares were mixed, with a gain in Australian, Korean and Hong Kong stocks, while Japanese and mainland Chinese equities fell. US equity futures were steady.

Media is focusing on Ged related statements, however as per me: the real reason is:

As alerted at $1926 price zone, China had bought Gold, and as projected by me on the same day: $200 + rally was expected.

$1926 + 200: $2026

In addition, in last three trading days I had alerted + price movement of $30/45 in each set after USDJPY crashed more than $1/ set. Net movement of +$90 was awaited by me and hence I had projected selling above $2069 till $2121 zone and above with a price gap of $6 in each set. At CMP $2085, we are in Net profit in this set of trades.

Target zone achieved.

Same pattern was observed last year, when XAUUSD price was at $1616, after China bought Gold, XAUUSD crossed $200+ in 36 days, on 04 Dec 2022: XAUUSD traced price track of $1616-1818 zone.

1. Israel war resumes

2. US fends of Red Sea attack

3. Fed statement

The precious metal jumped as much as 3.1% to $2,135.39 an ounce and Bitcoin climbed more than 2.5%. Asian shares were mixed, with a gain in Australian, Korean and Hong Kong stocks, while Japanese and mainland Chinese equities fell. US equity futures were steady.

Media is focusing on Ged related statements, however as per me: the real reason is:

As alerted at $1926 price zone, China had bought Gold, and as projected by me on the same day: $200 + rally was expected.

$1926 + 200: $2026

In addition, in last three trading days I had alerted + price movement of $30/45 in each set after USDJPY crashed more than $1/ set. Net movement of +$90 was awaited by me and hence I had projected selling above $2069 till $2121 zone and above with a price gap of $6 in each set. At CMP $2085, we are in Net profit in this set of trades.

Target zone achieved.

Same pattern was observed last year, when XAUUSD price was at $1616, after China bought Gold, XAUUSD crossed $200+ in 36 days, on 04 Dec 2022: XAUUSD traced price track of $1616-1818 zone.

Piyush Lalsingh Ratnu

🆘 ALERT:

Crash in USDJPY observed: (-) 1500+ pips

(148.300 - 146.800 CMP)

Possible Impact on XAUUSD might + $35-45 from $2030

= $2075 on radar

Todays HIGH $2069

Crash in USDJPY observed: (-) 1500+ pips

(148.300 - 146.800 CMP)

Possible Impact on XAUUSD might + $35-45 from $2030

= $2075 on radar

Todays HIGH $2069

Piyush Lalsingh Ratnu

🆘 USDJPY crashed 0.70% CMP $147.100

RT might put DOWN pressure on GOLD price.

Selling HIGHS ideal strategy.

I will not take trades now, since it is a FRIDAY.

RT might put DOWN pressure on GOLD price.

Selling HIGHS ideal strategy.

I will not take trades now, since it is a FRIDAY.

Piyush Lalsingh Ratnu

🆘 ALERT:

Crash in USDJPY observed: (-) 1000+ pips

(148.300 - 147.300 CMP)

Possible Impact on XAUUSD might + $20/25

I will SELL HIGHS with $6 PG Exit NAP.

Crash in USDJPY observed: (-) 1000+ pips

(148.300 - 147.300 CMP)

Possible Impact on XAUUSD might + $20/25

I will SELL HIGHS with $6 PG Exit NAP.

Piyush Lalsingh Ratnu

🆘 Gold Prices are trading sideways on Friday, with bulls capped below the $2,048 resistance area with the $2,032 level containing downside attempts so far.

Gold price is back in the green early Friday, snapping a corrective decline from six-month highs of $2,052 seen Thursday. The renewed weakness in the United States Dollar (USD) and the US Treasury bond yields is boding well for Gold price, as the focus shifts toward the US ISM Manufacturing PMI data and US Federal Reserve (Fed) Chair Jerome Powell’s dual appearances later in the day.

The US Dollar has come under fresh selling pressure in Asian trading on Friday, helped by a modest downtick in the US Treasury bond yields, as traders cheer increased expectations of a Fed interest rate cut as early as March 2024. Gold price is, therefore, firming up to take on the $2,050 level once again.

Gold traders will closely scrutinize his words to judge whether the speculation surrounding the Fed rate cuts has some ground. Powell is likely to maintain his rhetoric stance that further tightening remains on the cards if the progress on inflation stalls.

In the meantime, Gold price will continue to draw support from a surprise expansion in the Chinese Caixin Manufacturing PMI data for November. China is the world’s top Gold consumer.

On Thursday, and today noon Gold price extended its corrective downside, as markets resorted to profit-taking on their long positions after the recent upsurge and amid the monthly closing. The end-of-the-month flows offered a temporary reprieve to the US Dollar.

🆘 XAUUSD: Crucial Zones:

R: $2069/2075

C: $2023/2019

Gold price is back in the green early Friday, snapping a corrective decline from six-month highs of $2,052 seen Thursday. The renewed weakness in the United States Dollar (USD) and the US Treasury bond yields is boding well for Gold price, as the focus shifts toward the US ISM Manufacturing PMI data and US Federal Reserve (Fed) Chair Jerome Powell’s dual appearances later in the day.

The US Dollar has come under fresh selling pressure in Asian trading on Friday, helped by a modest downtick in the US Treasury bond yields, as traders cheer increased expectations of a Fed interest rate cut as early as March 2024. Gold price is, therefore, firming up to take on the $2,050 level once again.

Gold traders will closely scrutinize his words to judge whether the speculation surrounding the Fed rate cuts has some ground. Powell is likely to maintain his rhetoric stance that further tightening remains on the cards if the progress on inflation stalls.

In the meantime, Gold price will continue to draw support from a surprise expansion in the Chinese Caixin Manufacturing PMI data for November. China is the world’s top Gold consumer.

On Thursday, and today noon Gold price extended its corrective downside, as markets resorted to profit-taking on their long positions after the recent upsurge and amid the monthly closing. The end-of-the-month flows offered a temporary reprieve to the US Dollar.

🆘 XAUUSD: Crucial Zones:

R: $2069/2075

C: $2023/2019

Piyush Lalsingh Ratnu

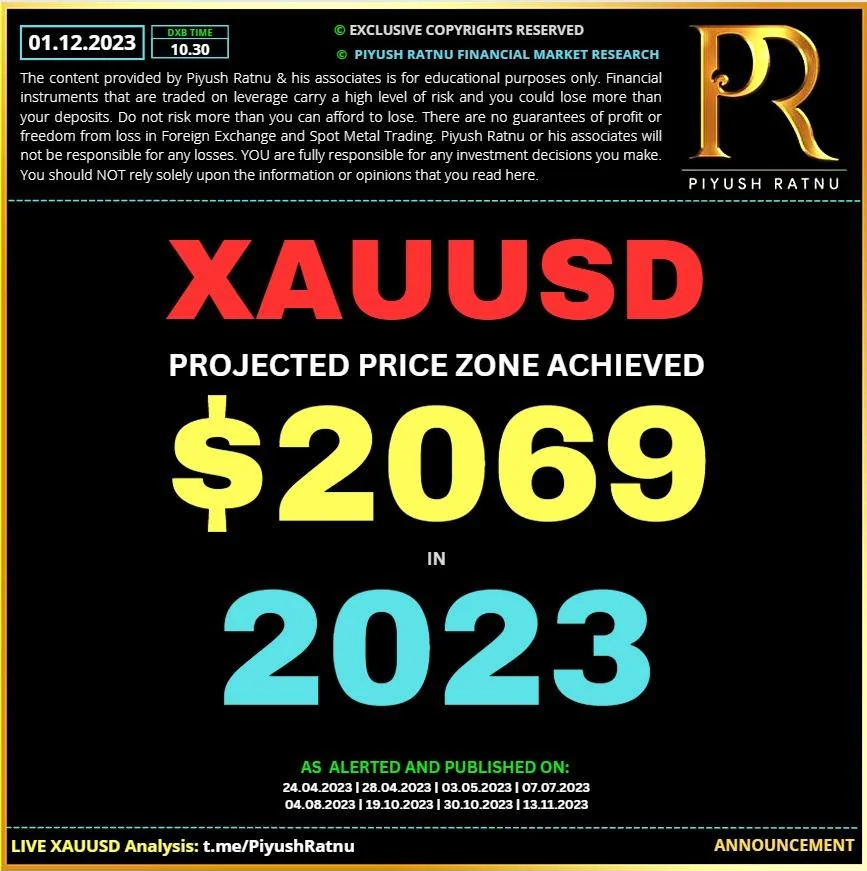

XAUUSD: $2023 in 2023, $2048 Selling Zone: Price target Achieved | Most Accurate Spot Gold XAUUSD Forex Analysis & Daily Price Projection by Piyush Ratnu

🔘 Watch Analysis Review at: https://youtu.be/gkohGyGu6oM

✔️AS ALERTED AND PUBLISHED ON:

24.04.2023 | 28.04.2023 | 03.05.2023 | 30.05.2023 | 07.07.2023 | 04.08.2023 | 19.10.2023 | 30.10.2023 | 13.11.2023

Current Market Situation:

Gold price hovers lower around $2,040 per troy ounce during the Asian session on Thursday. The yellow metal has retreated from the six-month high it reached at $2,052 on Wednesday. The pullback in Gold's price suggests a shift in market sentiment or profit-taking after the recent rally.

Gold encountered challenges as the US Dollar (USD) saw a modest rebound. The US Dollar Index (DXY) struggles to sustain its gains, hovering around 102.80 at the moment. The US Dollar (USD) successfully halted its four-day losing streak in the previous session, thanks to stronger-than-expected US Gross Domestic Product Annualized data released by the US Bureau of Economic Analysis. The US GDP Annualized increased by 5.2% during the third quarter, surpassing the previous reading of 4.9% and exceeding the market consensus of 5.0%.

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram: https://www.instagram.com/piyushratnu...

Facebook: https://www.facebook.com/PiyushRatnuO...

You Tube: https://www.youtube.com/piyushratnu

Reddit: https://www.reddit.com/r/prgoldanalysis

Twitter: https://twitter.com/piyushratnu

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

🔘 Watch Analysis Review at: https://youtu.be/gkohGyGu6oM

✔️AS ALERTED AND PUBLISHED ON:

24.04.2023 | 28.04.2023 | 03.05.2023 | 30.05.2023 | 07.07.2023 | 04.08.2023 | 19.10.2023 | 30.10.2023 | 13.11.2023

Current Market Situation:

Gold price hovers lower around $2,040 per troy ounce during the Asian session on Thursday. The yellow metal has retreated from the six-month high it reached at $2,052 on Wednesday. The pullback in Gold's price suggests a shift in market sentiment or profit-taking after the recent rally.

Gold encountered challenges as the US Dollar (USD) saw a modest rebound. The US Dollar Index (DXY) struggles to sustain its gains, hovering around 102.80 at the moment. The US Dollar (USD) successfully halted its four-day losing streak in the previous session, thanks to stronger-than-expected US Gross Domestic Product Annualized data released by the US Bureau of Economic Analysis. The US GDP Annualized increased by 5.2% during the third quarter, surpassing the previous reading of 4.9% and exceeding the market consensus of 5.0%.

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram: https://www.instagram.com/piyushratnu...

Facebook: https://www.facebook.com/PiyushRatnuO...

You Tube: https://www.youtube.com/piyushratnu

Reddit: https://www.reddit.com/r/prgoldanalysis

Twitter: https://twitter.com/piyushratnu

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Piyush Lalsingh Ratnu

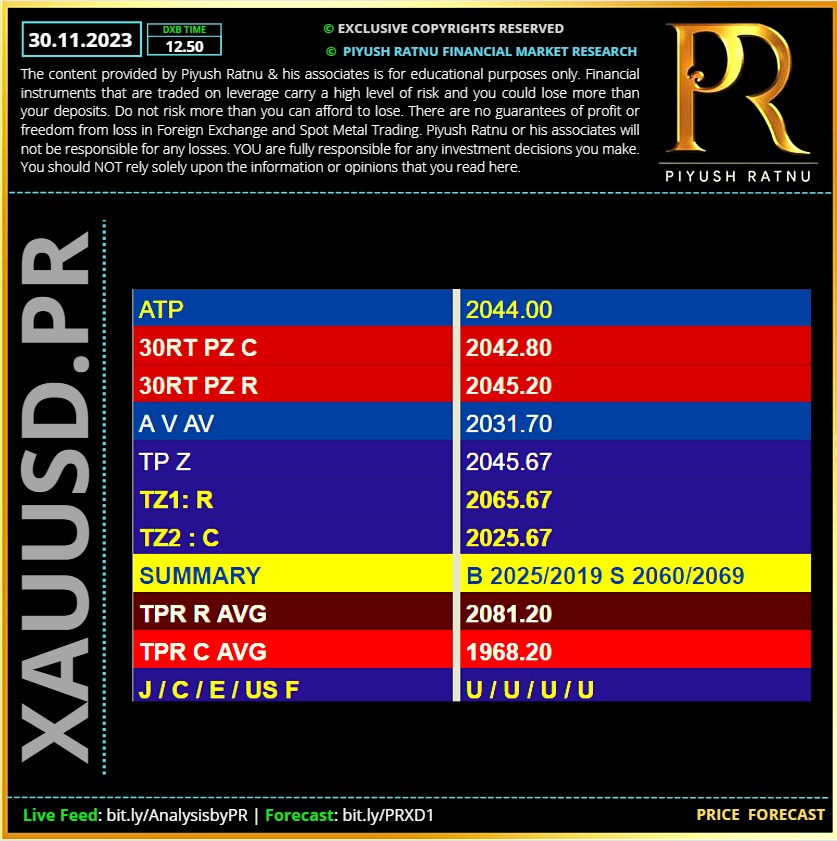

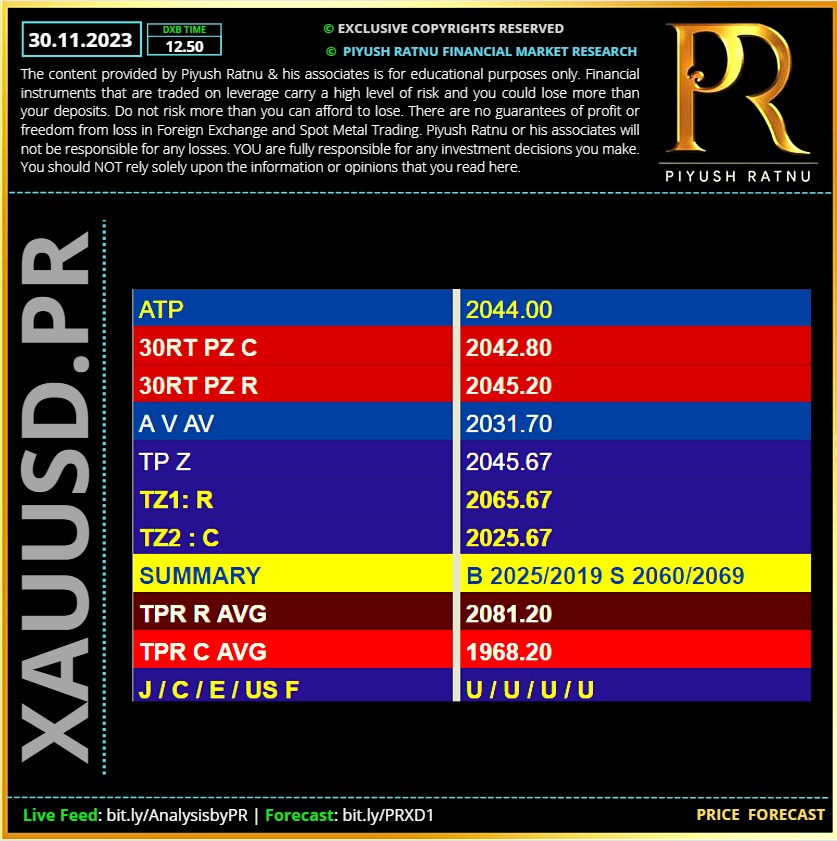

30.11.2023 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

The Federal Reserve's preferred inflation measure rose at slower rate on an annual basis in October compared to the prior month, in the latest sign that the central bank's long-standing campaign of interest rate hikes may be working to corral price growth.

Last month's personal consumption expenditures (PCE) price index increased by 3.0% annually, decelerating from 3.4% in September. On a monthly basis, the measure was 0.0%, down from an uptick of 0.4% in the prior month. Economists expected readings of 3.0% year-on-year and 0.1% month-on-month.

The data could help determine how Fed officials will calibrate interest rates in the coming months. The central bank is widely tipped to leave rates at a range of 5.25% to 5.50% at its meeting next month, although some policymakers have hinted that a pivot away from this unprecedentedly tight stance may be coming soon.

Earlier this week, Fed Governor Christopher Waller, a typically hawkish voice, suggested that "we could start lowering the policy rate" if inflation continues to slow for "several more months." The comments bolstered expectations that the Fed may slash rates as soon as May next year.

Last month's personal consumption expenditures (PCE) price index increased by 3.0% annually, decelerating from 3.4% in September. On a monthly basis, the measure was 0.0%, down from an uptick of 0.4% in the prior month. Economists expected readings of 3.0% year-on-year and 0.1% month-on-month.

The data could help determine how Fed officials will calibrate interest rates in the coming months. The central bank is widely tipped to leave rates at a range of 5.25% to 5.50% at its meeting next month, although some policymakers have hinted that a pivot away from this unprecedentedly tight stance may be coming soon.

Earlier this week, Fed Governor Christopher Waller, a typically hawkish voice, suggested that "we could start lowering the policy rate" if inflation continues to slow for "several more months." The comments bolstered expectations that the Fed may slash rates as soon as May next year.

Piyush Lalsingh Ratnu

XAU/USD: ADDITIONAL IMPORTANT LEVELS

Today last price 2043.22

Today Daily Change -1.45

Today Daily Change % -0.07

Today daily open 2044.67

🔘TRENDS

Daily SMA20 1983.09

Daily SMA50 1941.14

Daily SMA100 1936.29

Daily SMA200 1943.63

🔘LEVELS

Previous Daily High 2052.03

Previous Daily Low 2035.41

Previous Weekly High 2007.63

Previous Weekly Low 1965.51

Previous Monthly High 2009.49

Previous Monthly Low 1810.51

Daily Fibonacci 38.2% 2045.68

Daily Fibonacci 61.8% 2041.76

Daily Pivot Point S1 2036.04

Daily Pivot Point S2 2027.42

Daily Pivot Point S3 2019.42

Daily Pivot Point R1 2052.66

Daily Pivot Point R2 2060.66

Daily Pivot Point R3 2069.28

Today last price 2043.22

Today Daily Change -1.45

Today Daily Change % -0.07

Today daily open 2044.67

🔘TRENDS

Daily SMA20 1983.09

Daily SMA50 1941.14

Daily SMA100 1936.29

Daily SMA200 1943.63

🔘LEVELS

Previous Daily High 2052.03

Previous Daily Low 2035.41

Previous Weekly High 2007.63

Previous Weekly Low 1965.51

Previous Monthly High 2009.49

Previous Monthly Low 1810.51

Daily Fibonacci 38.2% 2045.68

Daily Fibonacci 61.8% 2041.76

Daily Pivot Point S1 2036.04

Daily Pivot Point S2 2027.42

Daily Pivot Point S3 2019.42

Daily Pivot Point R1 2052.66

Daily Pivot Point R2 2060.66

Daily Pivot Point R3 2069.28

: