Piyush Lalsingh Ratnu / Profilo

- Informazioni

|

no

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Piyush Lalsingh Ratnu

🟢 USDJPY - XAUUSD co-relation at it's best:

USDJPY @M30S5

XAUUSD @M30S5

🟢 USDJPY - XAUUSD co-relation at it's best:

USDJPY @M15VS1

XAUUSD @M15AS1

USDJPY @M30S5

XAUUSD @M30S5

🟢 USDJPY - XAUUSD co-relation at it's best:

USDJPY @M15VS1

XAUUSD @M15AS1

Piyush Lalsingh Ratnu

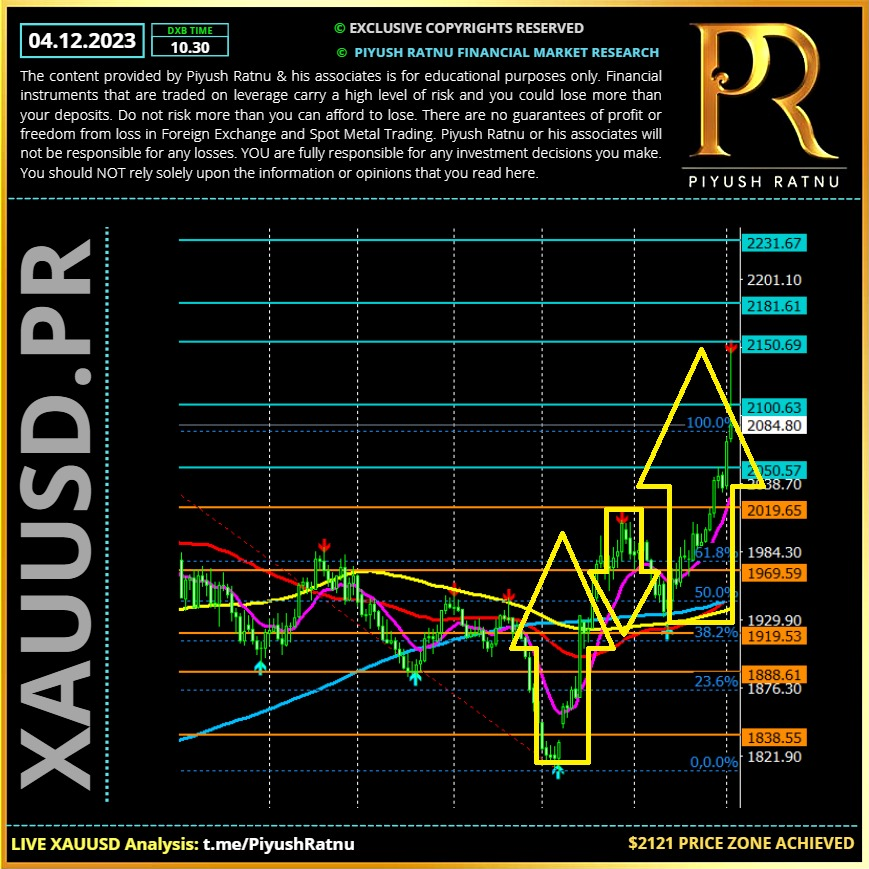

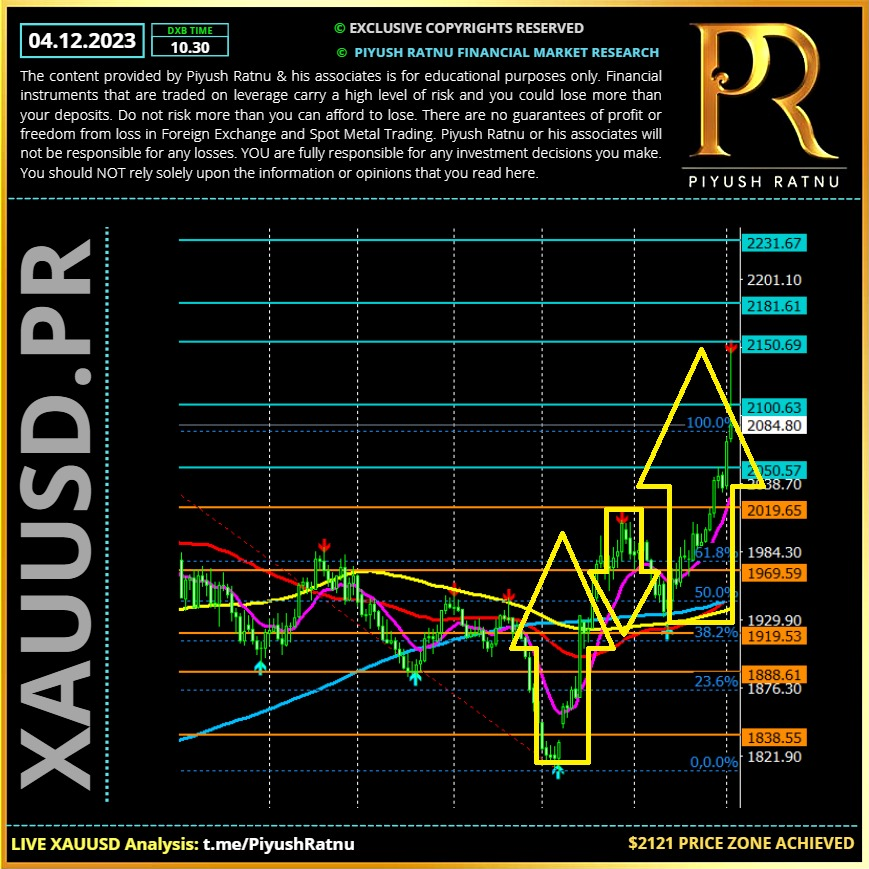

Three Major reasons for the + rally:

1. Israel war resumes

2. US fends of Red Sea attack

3. Fed statement

The precious metal jumped as much as 3.1% to $2,135.39 an ounce and Bitcoin climbed more than 2.5%. Asian shares were mixed, with a gain in Australian, Korean and Hong Kong stocks, while Japanese and mainland Chinese equities fell. US equity futures were steady.

Media is focusing on Ged related statements, however as per me: the real reason is:

As alerted at $1926 price zone, China had bought Gold, and as projected by me on the same day: $200 + rally was expected.

$1926 + 200: $2026

In addition, in last three trading days I had alerted + price movement of $30/45 in each set after USDJPY crashed more than $1/ set. Net movement of +$90 was awaited by me and hence I had projected selling above $2069 till $2121 zone and above with a price gap of $6 in each set. At CMP $2085, we are in Net profit in this set of trades.

Target zone achieved.

Same pattern was observed last year, when XAUUSD price was at $1616, after China bought Gold, XAUUSD crossed $200+ in 36 days, on 04 Dec 2022: XAUUSD traced price track of $1616-1818 zone.

1. Israel war resumes

2. US fends of Red Sea attack

3. Fed statement

The precious metal jumped as much as 3.1% to $2,135.39 an ounce and Bitcoin climbed more than 2.5%. Asian shares were mixed, with a gain in Australian, Korean and Hong Kong stocks, while Japanese and mainland Chinese equities fell. US equity futures were steady.

Media is focusing on Ged related statements, however as per me: the real reason is:

As alerted at $1926 price zone, China had bought Gold, and as projected by me on the same day: $200 + rally was expected.

$1926 + 200: $2026

In addition, in last three trading days I had alerted + price movement of $30/45 in each set after USDJPY crashed more than $1/ set. Net movement of +$90 was awaited by me and hence I had projected selling above $2069 till $2121 zone and above with a price gap of $6 in each set. At CMP $2085, we are in Net profit in this set of trades.

Target zone achieved.

Same pattern was observed last year, when XAUUSD price was at $1616, after China bought Gold, XAUUSD crossed $200+ in 36 days, on 04 Dec 2022: XAUUSD traced price track of $1616-1818 zone.

Piyush Lalsingh Ratnu

🆘 ALERT:

Crash in USDJPY observed: (-) 1500+ pips

(148.300 - 146.800 CMP)

Possible Impact on XAUUSD might + $35-45 from $2030

= $2075 on radar

Todays HIGH $2069

Crash in USDJPY observed: (-) 1500+ pips

(148.300 - 146.800 CMP)

Possible Impact on XAUUSD might + $35-45 from $2030

= $2075 on radar

Todays HIGH $2069

Piyush Lalsingh Ratnu

🆘 USDJPY crashed 0.70% CMP $147.100

RT might put DOWN pressure on GOLD price.

Selling HIGHS ideal strategy.

I will not take trades now, since it is a FRIDAY.

RT might put DOWN pressure on GOLD price.

Selling HIGHS ideal strategy.

I will not take trades now, since it is a FRIDAY.

Piyush Lalsingh Ratnu

🆘 ALERT:

Crash in USDJPY observed: (-) 1000+ pips

(148.300 - 147.300 CMP)

Possible Impact on XAUUSD might + $20/25

I will SELL HIGHS with $6 PG Exit NAP.

Crash in USDJPY observed: (-) 1000+ pips

(148.300 - 147.300 CMP)

Possible Impact on XAUUSD might + $20/25

I will SELL HIGHS with $6 PG Exit NAP.

Piyush Lalsingh Ratnu

🆘 Gold Prices are trading sideways on Friday, with bulls capped below the $2,048 resistance area with the $2,032 level containing downside attempts so far.

Gold price is back in the green early Friday, snapping a corrective decline from six-month highs of $2,052 seen Thursday. The renewed weakness in the United States Dollar (USD) and the US Treasury bond yields is boding well for Gold price, as the focus shifts toward the US ISM Manufacturing PMI data and US Federal Reserve (Fed) Chair Jerome Powell’s dual appearances later in the day.

The US Dollar has come under fresh selling pressure in Asian trading on Friday, helped by a modest downtick in the US Treasury bond yields, as traders cheer increased expectations of a Fed interest rate cut as early as March 2024. Gold price is, therefore, firming up to take on the $2,050 level once again.

Gold traders will closely scrutinize his words to judge whether the speculation surrounding the Fed rate cuts has some ground. Powell is likely to maintain his rhetoric stance that further tightening remains on the cards if the progress on inflation stalls.

In the meantime, Gold price will continue to draw support from a surprise expansion in the Chinese Caixin Manufacturing PMI data for November. China is the world’s top Gold consumer.

On Thursday, and today noon Gold price extended its corrective downside, as markets resorted to profit-taking on their long positions after the recent upsurge and amid the monthly closing. The end-of-the-month flows offered a temporary reprieve to the US Dollar.

🆘 XAUUSD: Crucial Zones:

R: $2069/2075

C: $2023/2019

Gold price is back in the green early Friday, snapping a corrective decline from six-month highs of $2,052 seen Thursday. The renewed weakness in the United States Dollar (USD) and the US Treasury bond yields is boding well for Gold price, as the focus shifts toward the US ISM Manufacturing PMI data and US Federal Reserve (Fed) Chair Jerome Powell’s dual appearances later in the day.

The US Dollar has come under fresh selling pressure in Asian trading on Friday, helped by a modest downtick in the US Treasury bond yields, as traders cheer increased expectations of a Fed interest rate cut as early as March 2024. Gold price is, therefore, firming up to take on the $2,050 level once again.

Gold traders will closely scrutinize his words to judge whether the speculation surrounding the Fed rate cuts has some ground. Powell is likely to maintain his rhetoric stance that further tightening remains on the cards if the progress on inflation stalls.

In the meantime, Gold price will continue to draw support from a surprise expansion in the Chinese Caixin Manufacturing PMI data for November. China is the world’s top Gold consumer.

On Thursday, and today noon Gold price extended its corrective downside, as markets resorted to profit-taking on their long positions after the recent upsurge and amid the monthly closing. The end-of-the-month flows offered a temporary reprieve to the US Dollar.

🆘 XAUUSD: Crucial Zones:

R: $2069/2075

C: $2023/2019

Piyush Lalsingh Ratnu

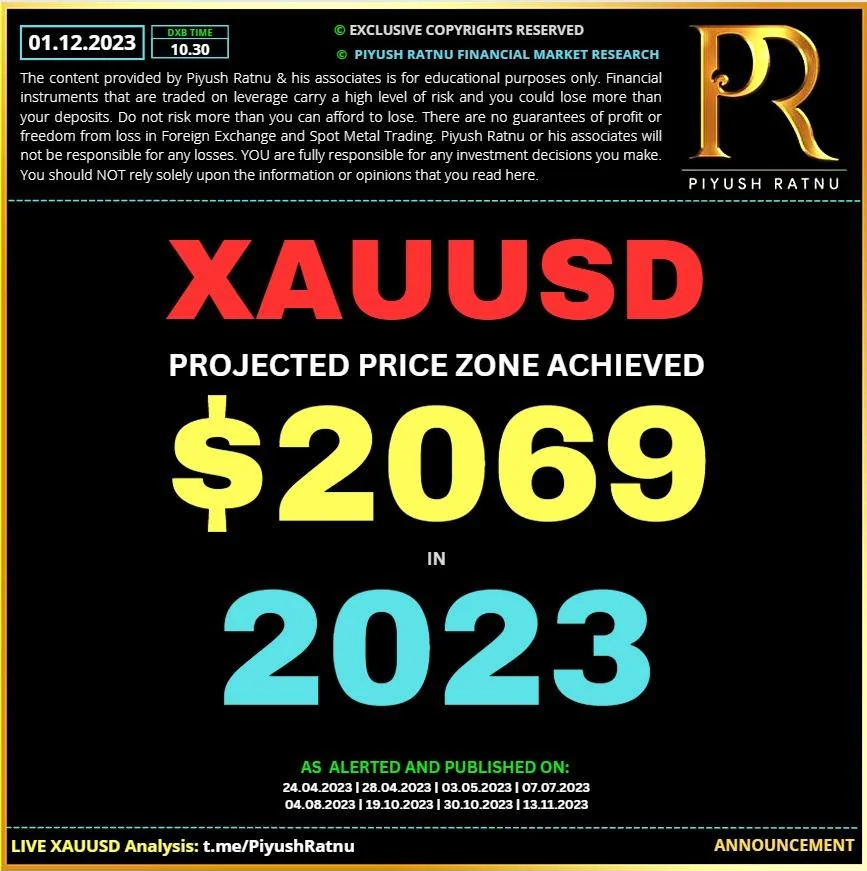

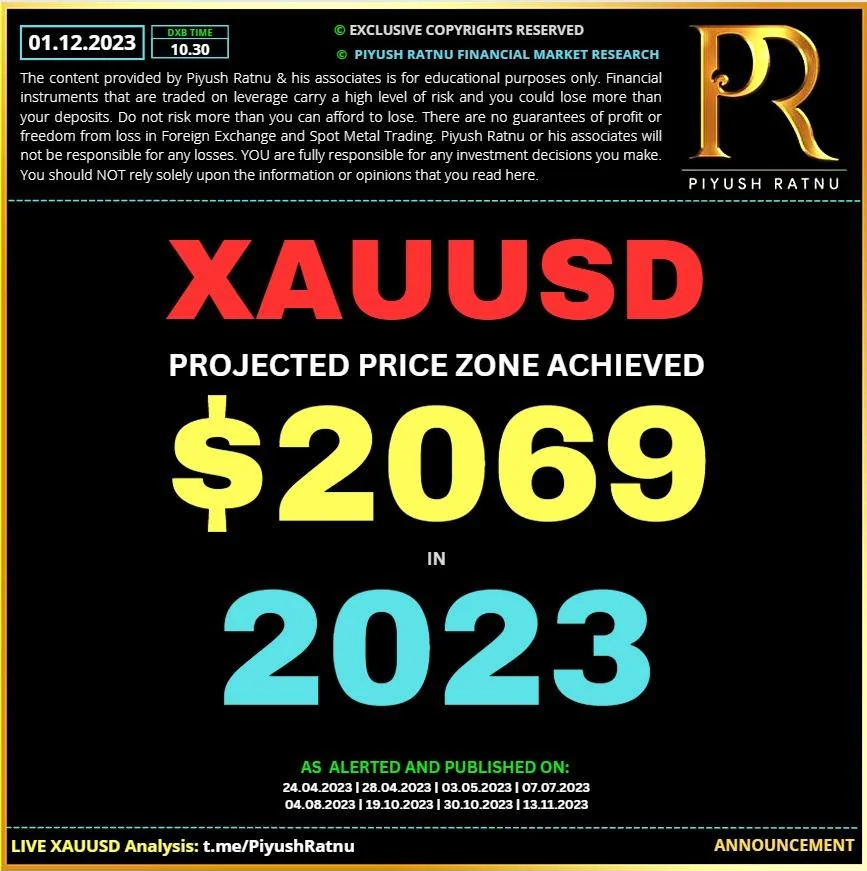

XAUUSD: $2023 in 2023, $2048 Selling Zone: Price target Achieved | Most Accurate Spot Gold XAUUSD Forex Analysis & Daily Price Projection by Piyush Ratnu

🔘 Watch Analysis Review at: https://youtu.be/gkohGyGu6oM

✔️AS ALERTED AND PUBLISHED ON:

24.04.2023 | 28.04.2023 | 03.05.2023 | 30.05.2023 | 07.07.2023 | 04.08.2023 | 19.10.2023 | 30.10.2023 | 13.11.2023

Current Market Situation:

Gold price hovers lower around $2,040 per troy ounce during the Asian session on Thursday. The yellow metal has retreated from the six-month high it reached at $2,052 on Wednesday. The pullback in Gold's price suggests a shift in market sentiment or profit-taking after the recent rally.

Gold encountered challenges as the US Dollar (USD) saw a modest rebound. The US Dollar Index (DXY) struggles to sustain its gains, hovering around 102.80 at the moment. The US Dollar (USD) successfully halted its four-day losing streak in the previous session, thanks to stronger-than-expected US Gross Domestic Product Annualized data released by the US Bureau of Economic Analysis. The US GDP Annualized increased by 5.2% during the third quarter, surpassing the previous reading of 4.9% and exceeding the market consensus of 5.0%.

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram: https://www.instagram.com/piyushratnu...

Facebook: https://www.facebook.com/PiyushRatnuO...

You Tube: https://www.youtube.com/piyushratnu

Reddit: https://www.reddit.com/r/prgoldanalysis

Twitter: https://twitter.com/piyushratnu

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

🔘 Watch Analysis Review at: https://youtu.be/gkohGyGu6oM

✔️AS ALERTED AND PUBLISHED ON:

24.04.2023 | 28.04.2023 | 03.05.2023 | 30.05.2023 | 07.07.2023 | 04.08.2023 | 19.10.2023 | 30.10.2023 | 13.11.2023

Current Market Situation:

Gold price hovers lower around $2,040 per troy ounce during the Asian session on Thursday. The yellow metal has retreated from the six-month high it reached at $2,052 on Wednesday. The pullback in Gold's price suggests a shift in market sentiment or profit-taking after the recent rally.

Gold encountered challenges as the US Dollar (USD) saw a modest rebound. The US Dollar Index (DXY) struggles to sustain its gains, hovering around 102.80 at the moment. The US Dollar (USD) successfully halted its four-day losing streak in the previous session, thanks to stronger-than-expected US Gross Domestic Product Annualized data released by the US Bureau of Economic Analysis. The US GDP Annualized increased by 5.2% during the third quarter, surpassing the previous reading of 4.9% and exceeding the market consensus of 5.0%.

Professional Forex Trading Courses by Piyush Ratnu

Duration: 1 Week | 1 month | 6 months | 12 months

Read complete glossary at:

https://bit.ly/PRForexGlossary

Instagram: https://www.instagram.com/piyushratnu...

Facebook: https://www.facebook.com/PiyushRatnuO...

You Tube: https://www.youtube.com/piyushratnu

Reddit: https://www.reddit.com/r/prgoldanalysis

Twitter: https://twitter.com/piyushratnu

Analysis Track Record:

https://bit.ly/GoldAnalysisbyPiyushRatnu

Piyush Lalsingh Ratnu

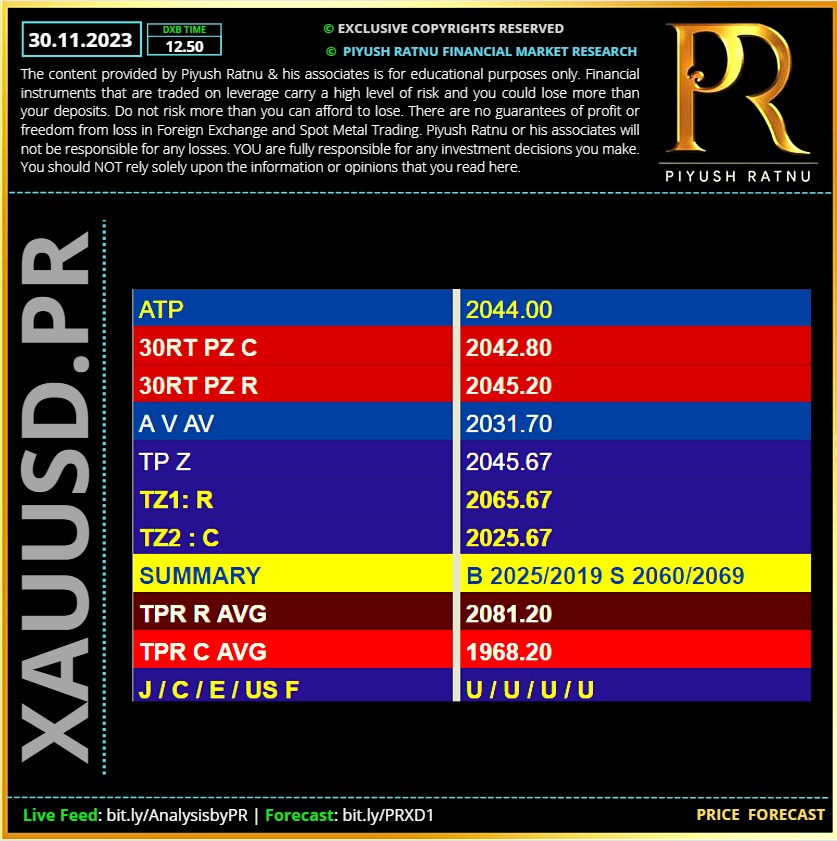

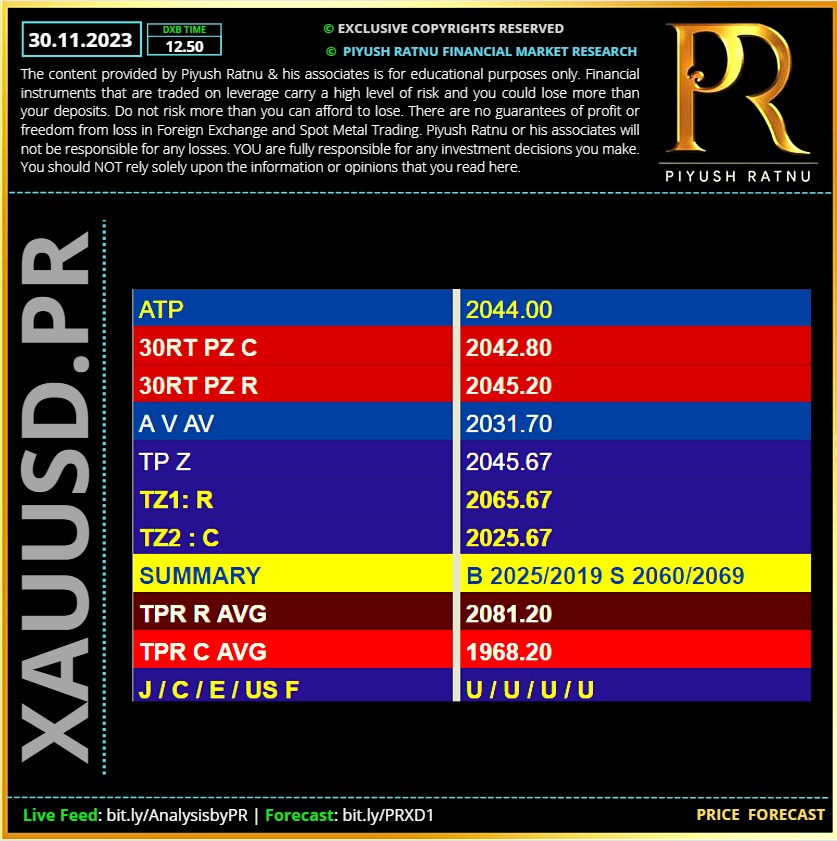

30.11.2023 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

The Federal Reserve's preferred inflation measure rose at slower rate on an annual basis in October compared to the prior month, in the latest sign that the central bank's long-standing campaign of interest rate hikes may be working to corral price growth.

Last month's personal consumption expenditures (PCE) price index increased by 3.0% annually, decelerating from 3.4% in September. On a monthly basis, the measure was 0.0%, down from an uptick of 0.4% in the prior month. Economists expected readings of 3.0% year-on-year and 0.1% month-on-month.

The data could help determine how Fed officials will calibrate interest rates in the coming months. The central bank is widely tipped to leave rates at a range of 5.25% to 5.50% at its meeting next month, although some policymakers have hinted that a pivot away from this unprecedentedly tight stance may be coming soon.

Earlier this week, Fed Governor Christopher Waller, a typically hawkish voice, suggested that "we could start lowering the policy rate" if inflation continues to slow for "several more months." The comments bolstered expectations that the Fed may slash rates as soon as May next year.

Last month's personal consumption expenditures (PCE) price index increased by 3.0% annually, decelerating from 3.4% in September. On a monthly basis, the measure was 0.0%, down from an uptick of 0.4% in the prior month. Economists expected readings of 3.0% year-on-year and 0.1% month-on-month.

The data could help determine how Fed officials will calibrate interest rates in the coming months. The central bank is widely tipped to leave rates at a range of 5.25% to 5.50% at its meeting next month, although some policymakers have hinted that a pivot away from this unprecedentedly tight stance may be coming soon.

Earlier this week, Fed Governor Christopher Waller, a typically hawkish voice, suggested that "we could start lowering the policy rate" if inflation continues to slow for "several more months." The comments bolstered expectations that the Fed may slash rates as soon as May next year.

Piyush Lalsingh Ratnu

XAU/USD: ADDITIONAL IMPORTANT LEVELS

Today last price 2043.22

Today Daily Change -1.45

Today Daily Change % -0.07

Today daily open 2044.67

🔘TRENDS

Daily SMA20 1983.09

Daily SMA50 1941.14

Daily SMA100 1936.29

Daily SMA200 1943.63

🔘LEVELS

Previous Daily High 2052.03

Previous Daily Low 2035.41

Previous Weekly High 2007.63

Previous Weekly Low 1965.51

Previous Monthly High 2009.49

Previous Monthly Low 1810.51

Daily Fibonacci 38.2% 2045.68

Daily Fibonacci 61.8% 2041.76

Daily Pivot Point S1 2036.04

Daily Pivot Point S2 2027.42

Daily Pivot Point S3 2019.42

Daily Pivot Point R1 2052.66

Daily Pivot Point R2 2060.66

Daily Pivot Point R3 2069.28

Today last price 2043.22

Today Daily Change -1.45

Today Daily Change % -0.07

Today daily open 2044.67

🔘TRENDS

Daily SMA20 1983.09

Daily SMA50 1941.14

Daily SMA100 1936.29

Daily SMA200 1943.63

🔘LEVELS

Previous Daily High 2052.03

Previous Daily Low 2035.41

Previous Weekly High 2007.63

Previous Weekly Low 1965.51

Previous Monthly High 2009.49

Previous Monthly Low 1810.51

Daily Fibonacci 38.2% 2045.68

Daily Fibonacci 61.8% 2041.76

Daily Pivot Point S1 2036.04

Daily Pivot Point S2 2027.42

Daily Pivot Point S3 2019.42

Daily Pivot Point R1 2052.66

Daily Pivot Point R2 2060.66

Daily Pivot Point R3 2069.28

Piyush Lalsingh Ratnu

SHORTING XAUUSD @2040 and above gave us good results.

🟢 CMP $2036

We will HOLD short trades.

🟢 CMP $2036

We will HOLD short trades.

Piyush Lalsingh Ratnu

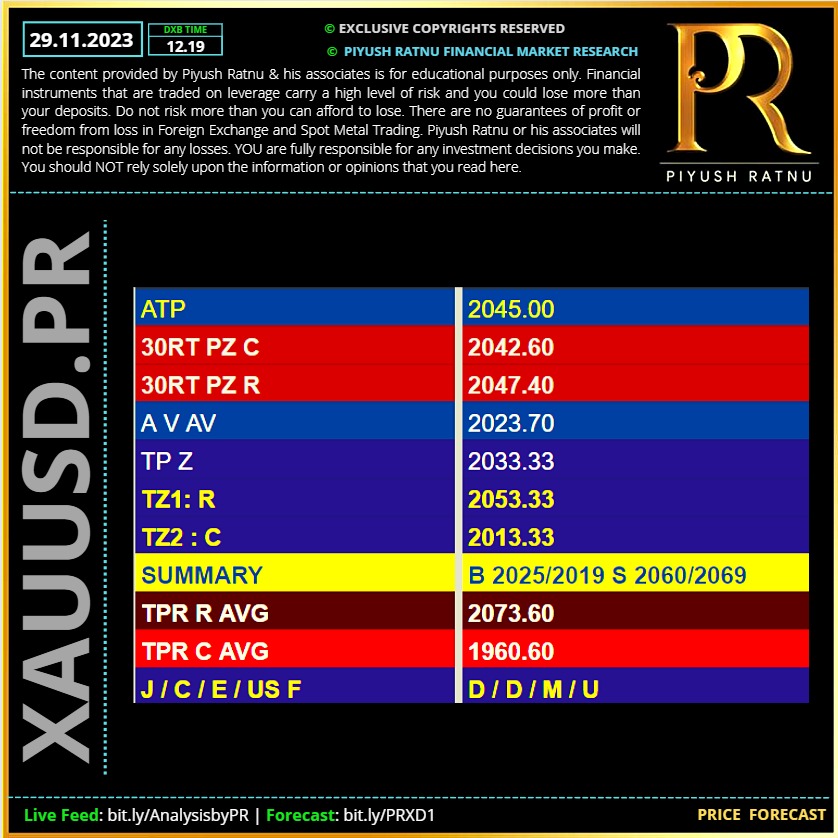

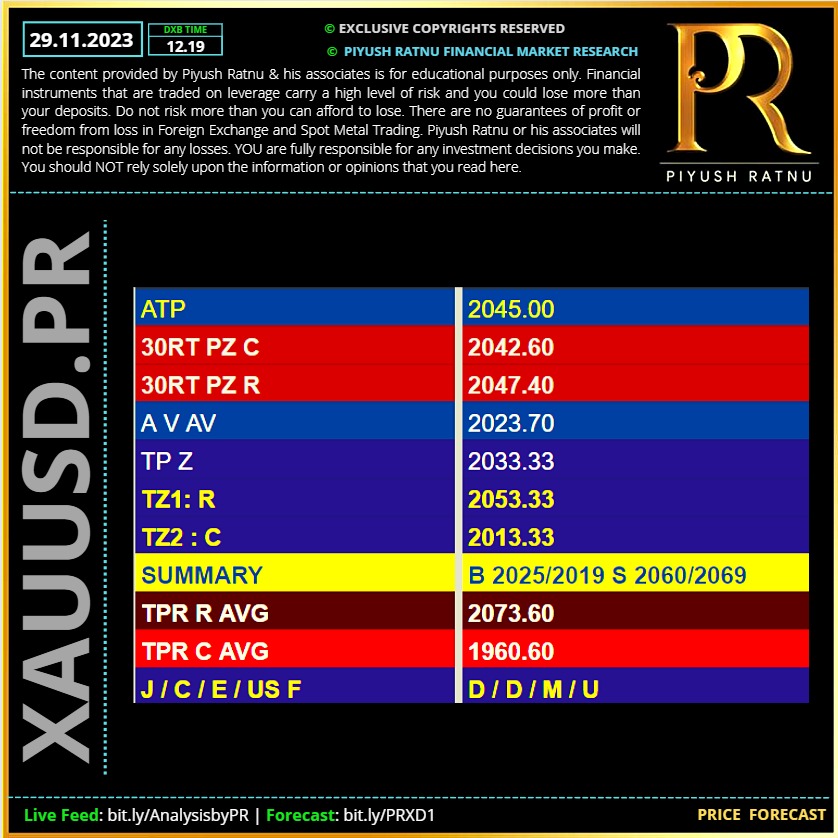

29.11.2023 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

Co-relation ALERT:

A crash of 700 pips observed in USDJPY

As per co-relation: XAUUSD might + $14-16

CMP $2046

A crash of 700 pips observed in USDJPY

As per co-relation: XAUUSD might + $14-16

CMP $2046

Piyush Lalsingh Ratnu

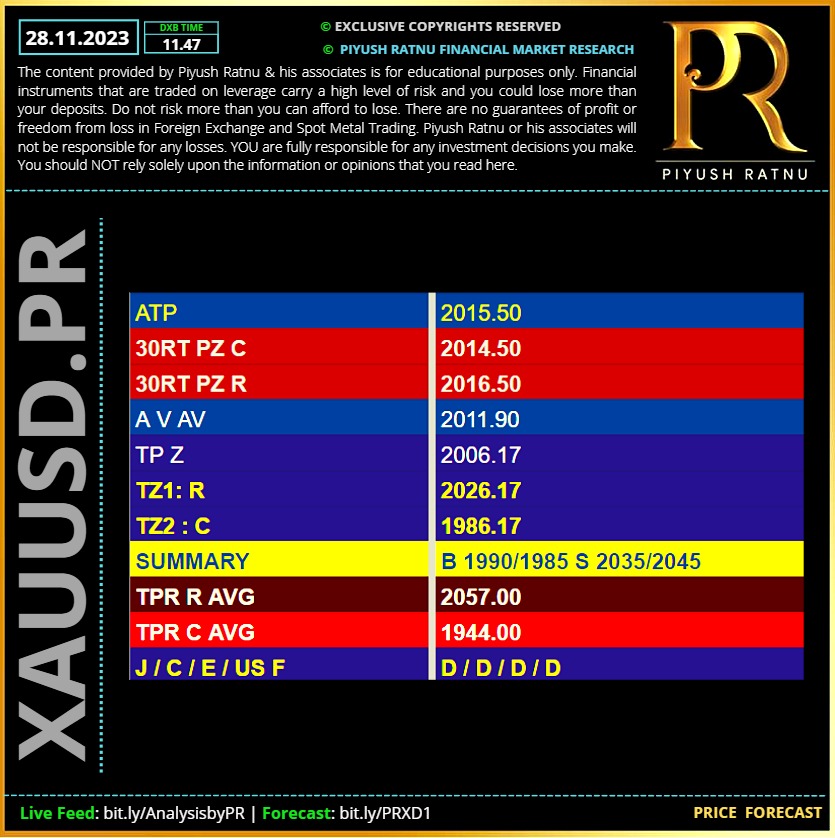

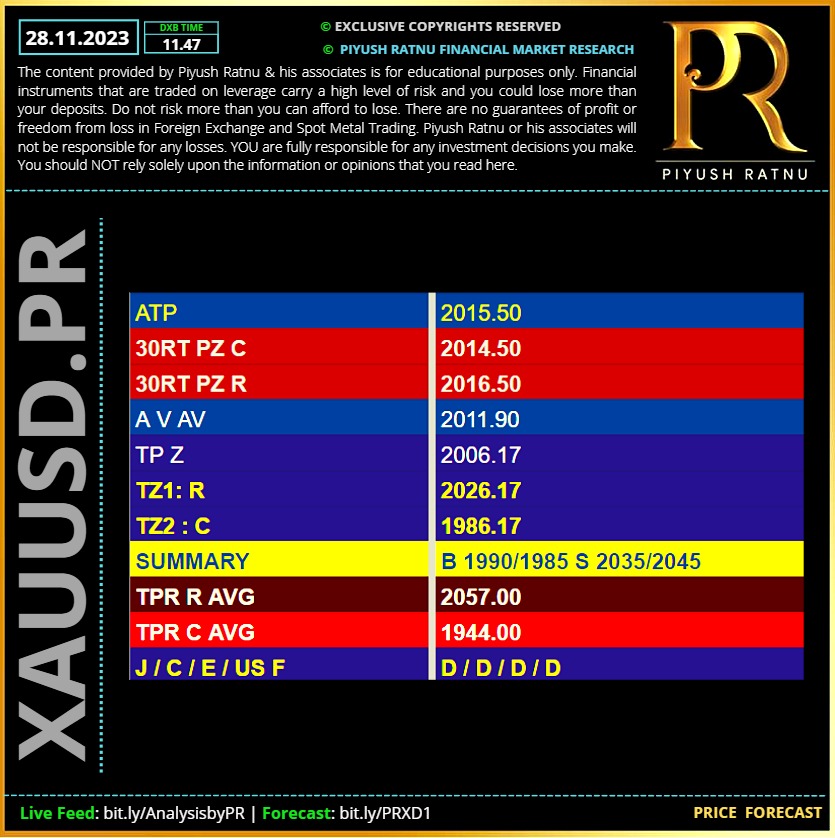

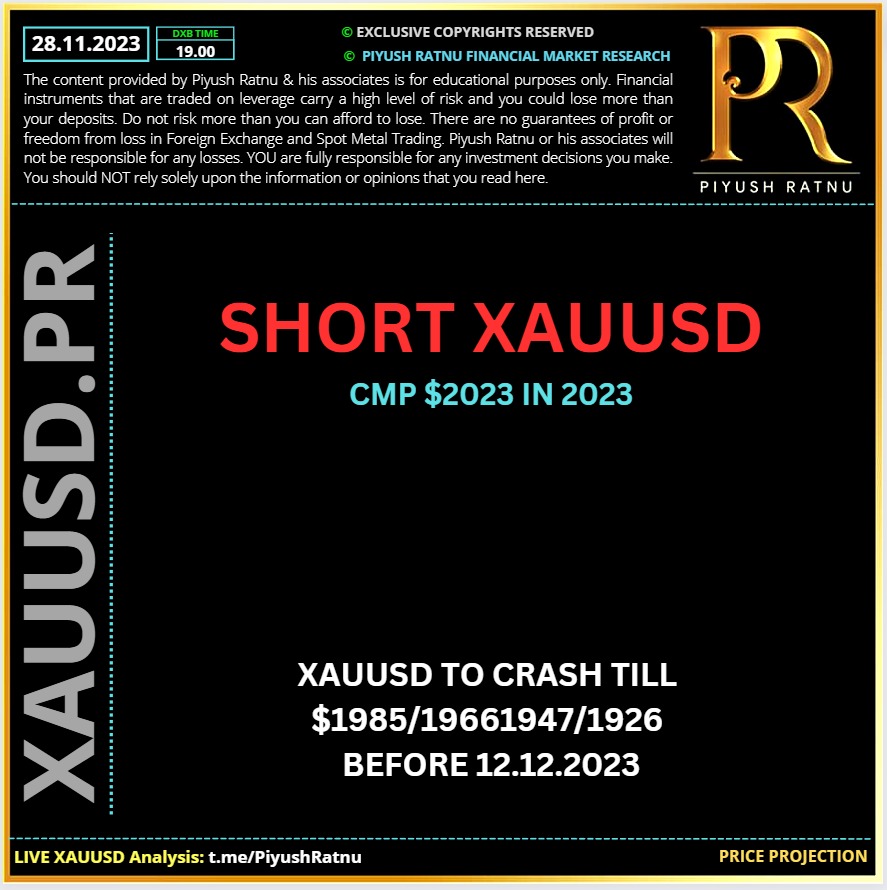

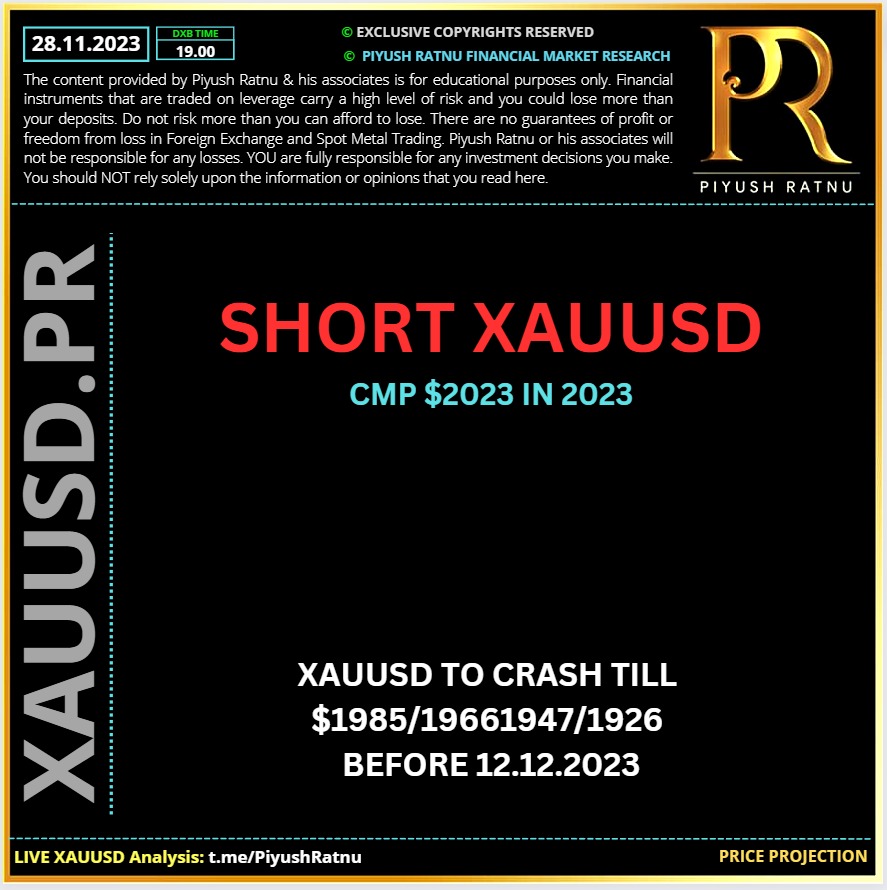

28.11.2023 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

28.11.2023 | XAUUSD: Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘ALERT:

USDJPY crashed 1200 pips today CMP 147.630

Crash observed from 148.880

Possible IMPACT as per Co-relation:

$30+ movement in XAUUSD

$2010 + 30= 2040

🆘🟢CMP $2036

USDJPY crashed 1200 pips today CMP 147.630

Crash observed from 148.880

Possible IMPACT as per Co-relation:

$30+ movement in XAUUSD

$2010 + 30= 2040

🆘🟢CMP $2036

Piyush Lalsingh Ratnu

28.11.2023 | XAUUSD: Analysis Accuracy Review | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 Co-relations Alert:

USDJPY CMP $148.300 (23.10.2023 range)

XAUUSD was at $1926 on 23.10.2023

USDJPY CMP $148.300 (23.10.2023 range)

XAUUSD was at $1926 on 23.10.2023

Piyush Lalsingh Ratnu

In 2020, the gold's record rally was fueled by pandemic-related fears and the Fed's cheap liquidity. COVID-19 gave rise to much uncertainty, favorable to safe-haven assets, while the Fed's aspiration to save the US economy using huge monetary stimuli weakened the greenback and reduced treasury yields. I have a sense of déjà vu at the end of 2023: the central bank is expected to loosen policy while geopolitics pushes investors to safe havens. Will gold update its historical peak, then?

Even if the evolution of many assets, starting with oil and shekel and ending with gold, indicates a de-escalation of the military conflict in the Middle East, the worst is yet to come. The truce will not last forever, while the advance of the Israeli army in Gaza will hardly be as fast as it has been so far.

In any case, geopolitics will remain the focus of investors’ attention. In 2024, we’ll have to deal with politics, too: nearly half the world's population will elect presidents. The developments in Mexico, Russia, the US, and elsewhere can shake up financial markets.

However, the Fed's loosening its policy seems to remain the main factor in the XAUUSD's rally. The odds of a Fed funds rate cut in 2024 increased drastically upon the publication of US inflation data for October. The derivatives predict a 100-point cut to 4.5%, with the first monetary expansion act scheduled for May.

Unsurprisingly, the yield on 10-year treasuries failed to consolidate above 5%, and the US dollar lost more than 3% of its value against major currencies and is about to close November with the worst monthly performance in two years. Gold usually thrives against such a background.

So, bullish sentiment dominates the market. ING forecasts an average price of $2,100 an ounce in Q4 2024. Goldman Sachs's estimate is $2,050 throughout the year on average, provided that the Fed drops the funds rate no earlier than October-December. Falling real bond yields and a weakening US dollar will support the precious metal.

If we add to this the increased activity of the People's Bank of China, which increased its gold reserves by 181 tonnes to 2,192 tonnes from January to September, as well as the high demand for gold in China, the prospects for the XAUUSD seem bullish ⚠️.

🟢 Hence, XAUUSD is forecast to reach new peaks as the demand is growing amid the geopolitical and political situation, central banks are showing support and the Fed's expected to introduce monetary stimuli. Let’s discuss it and make a trading plan.

Even if the evolution of many assets, starting with oil and shekel and ending with gold, indicates a de-escalation of the military conflict in the Middle East, the worst is yet to come. The truce will not last forever, while the advance of the Israeli army in Gaza will hardly be as fast as it has been so far.

In any case, geopolitics will remain the focus of investors’ attention. In 2024, we’ll have to deal with politics, too: nearly half the world's population will elect presidents. The developments in Mexico, Russia, the US, and elsewhere can shake up financial markets.

However, the Fed's loosening its policy seems to remain the main factor in the XAUUSD's rally. The odds of a Fed funds rate cut in 2024 increased drastically upon the publication of US inflation data for October. The derivatives predict a 100-point cut to 4.5%, with the first monetary expansion act scheduled for May.

Unsurprisingly, the yield on 10-year treasuries failed to consolidate above 5%, and the US dollar lost more than 3% of its value against major currencies and is about to close November with the worst monthly performance in two years. Gold usually thrives against such a background.

So, bullish sentiment dominates the market. ING forecasts an average price of $2,100 an ounce in Q4 2024. Goldman Sachs's estimate is $2,050 throughout the year on average, provided that the Fed drops the funds rate no earlier than October-December. Falling real bond yields and a weakening US dollar will support the precious metal.

If we add to this the increased activity of the People's Bank of China, which increased its gold reserves by 181 tonnes to 2,192 tonnes from January to September, as well as the high demand for gold in China, the prospects for the XAUUSD seem bullish ⚠️.

🟢 Hence, XAUUSD is forecast to reach new peaks as the demand is growing amid the geopolitical and political situation, central banks are showing support and the Fed's expected to introduce monetary stimuli. Let’s discuss it and make a trading plan.

: