Masayuki Sakamoto / Profil

- Informations

|

10+ années

expérience

|

0

produits

|

0

versions de démo

|

|

0

offres d’emploi

|

0

signaux

|

0

les abonnés

|

Hello, We are ForexTopTeam.

As I travel around the world

I earn about over 1 million dollar every year with forex trading.

I spend as much as I want in the place I like, and spend my days comfortably.

Even so, …

You won’t believe me.

So

Since 2015, our trade history has been published on my blog.

Below is the trading history.

https://topforexea.net/ftt-forex-trading-history/

If you are curious, please look at the history of the blog.

I’m not bragging about it, but it’s been producing realistic results like this.

And when I started writing this blog,

Many people have come to say, “Tell me about FX!”

About 3 years ago, I have started tell my FX trading method to a limited number of people,

But market is a “living thing” that is changing day by day,

You need to make a decision with getting real-time information that can be used right now,

If you didn’t, it’s difficult to win big continuously.

So, I will tell you everything in real time,

I decided to start an unprecedented service.

https://t.me/FXTopTeamSignalBot

Free for Everyone!

VIP Signal is Free now!

https://t.me/+fR3W_LwUrFlmYWI1

2022 Total +1,629,902 USD

2021 Total +1,024,116 USD

Monster Profit EA is Free now!

https://topforexea.net/products/

+1758% Profit From 2018 To 2022.

$10,000 ⇒ $185,839

VIP Signal

we provide trading signals in the VIP contact channel. This channel shows what kind of trade is used by active Million Dollar Trader. We give you Real-time Entry and Exit information, and this directly linked to your trading result.

https://topforexea.net/services-2/

“Monster Profit EA” is free now!

https://youtu.be/0n2wy710514

As I travel around the world

I earn about over 1 million dollar every year with forex trading.

I spend as much as I want in the place I like, and spend my days comfortably.

Even so, …

You won’t believe me.

So

Since 2015, our trade history has been published on my blog.

Below is the trading history.

https://topforexea.net/ftt-forex-trading-history/

If you are curious, please look at the history of the blog.

I’m not bragging about it, but it’s been producing realistic results like this.

And when I started writing this blog,

Many people have come to say, “Tell me about FX!”

About 3 years ago, I have started tell my FX trading method to a limited number of people,

But market is a “living thing” that is changing day by day,

You need to make a decision with getting real-time information that can be used right now,

If you didn’t, it’s difficult to win big continuously.

So, I will tell you everything in real time,

I decided to start an unprecedented service.

https://t.me/FXTopTeamSignalBot

Free for Everyone!

VIP Signal is Free now!

https://t.me/+fR3W_LwUrFlmYWI1

2022 Total +1,629,902 USD

2021 Total +1,024,116 USD

Monster Profit EA is Free now!

https://topforexea.net/products/

+1758% Profit From 2018 To 2022.

$10,000 ⇒ $185,839

VIP Signal

we provide trading signals in the VIP contact channel. This channel shows what kind of trade is used by active Million Dollar Trader. We give you Real-time Entry and Exit information, and this directly linked to your trading result.

https://topforexea.net/services-2/

“Monster Profit EA” is free now!

https://youtu.be/0n2wy710514

Masayuki Sakamoto

Publication publiéeCurrency Analysis and Technical Outlook (1-Hour Chart) – September 13, 2024

Currency Analysis and Technical Outlook (1-Hour Chart) – September 13, 2024 USD/JPY: Strong Sell The USD/JPY pair is declining around 141.00, indicating a bearish trend...

Masayuki Sakamoto

Publication publiée13th in September 2024, Today's Options:

Today's Options: EUR/USD: 1.0950: €721 million 1.0975: €1.4 billion 1.1000: €878 million 1.1030: €1 billion 1.1120: €982 million 1.1125: €826 million USD/JPY: 142.00: $1.3 billion 143...

Masayuki Sakamoto

Publication publiéeThis Week’s Indicators and Focus on Next Week's Fed Meeting: 25bp or 50bp?

This Week’s Indicators and Focus on Next Week's Fed Meeting: 25bp or 50bp? This week, the USD has shown volatility, while the JPY has been trending stronger...

Masayuki Sakamoto

Publication publiéeBought Crude Oil at 69.79

Position Update: Bought Crude Oil at 69.79 Stop Loss at 67.79...

Masayuki Sakamoto

Publication publiéeBought BTC/USD at 57,743.52 (This is Only half of our entries and 5mins late)

Bought BTC/USD at 57,743.52 Stop Loss at 56,488.00 This post is Half of all our entry and 5 mins late...

Masayuki Sakamoto

Publication publiée12th in September 2024,Today's Options

Today's Options EUR/USD (Euro/Dollar): Amount in Euros 1.0905: 1 billion EUR 1.0945: 2.1 billion EUR 1.0950: 1 billion EUR 1.0990: 891 million EUR...

Masayuki Sakamoto

Today, Focus Shifts to ECB Meeting and U.S. Economic Indicators Amidst Stabilizing Risk Sentiment

12 septembre 2024, 12:47

Today, Focus Shifts to ECB Meeting and U.S...

Masayuki Sakamoto

Publication publiéebuy USDJPY at 142.35.(This is Only half of our entries and 5mins late)

buy USDJPY at 142.35. Stop at 141.67. This post is Half of all our entry and 5 mins late...

Masayuki Sakamoto

Publication publiéeU.S. Presidential Debate Passed, Now Focus Shifts to U.S. CPI

U.S. Presidential Debate Passed, Now Focus Shifts to U.S. CPI In the Tokyo market, the yen is strengthening...

Masayuki Sakamoto

Publication publiéeEntered a buy position on BTC/USD at 56646.07.(This is Only half of our entries and 5mins late)

Entered a buy position on BTC/USD at 56646.07. Stop is set at 54342.00. This post is Half of all our entry and 5 mins late...

Masayuki Sakamoto

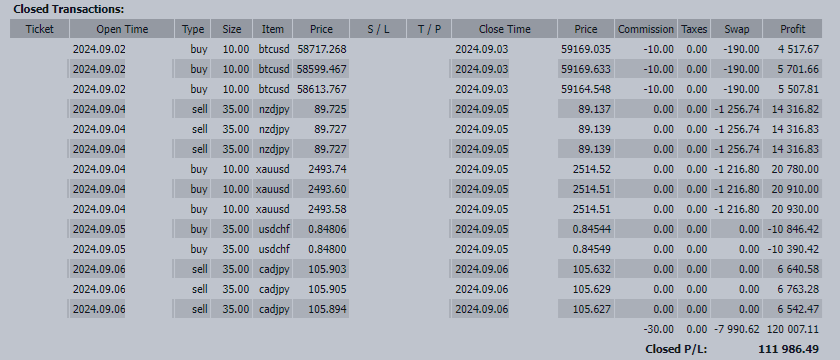

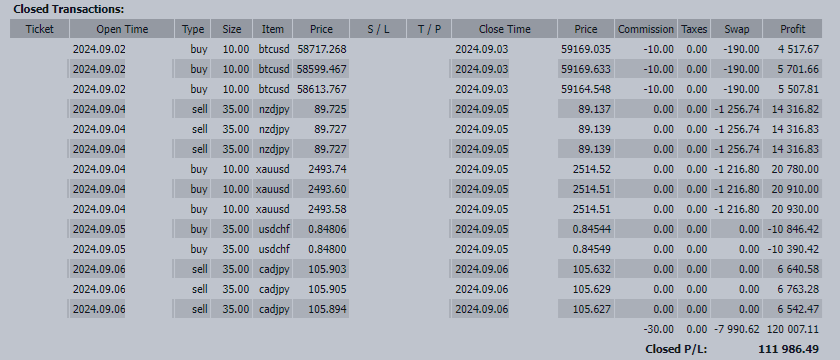

+111,986 USD: Will the U.S. CPI Trigger a Big Move? Strategy Ahead of the September FOMC

8 septembre 2024, 11:19

+111,986 USD: Will the U.S. CPI Trigger a Big Move? Strategy Ahead of the September FOMC The trading for the week of September 2nd to 6th resulted in +111,986 USD...

Masayuki Sakamoto

Publication publiéeEntered a short position on CAD/JPY at 105.91.(This is Only half of our entries and 5mins late)

Entered a short position on CAD/JPY at 105.91. Stop is set at 106.72. The Canadian employment data came in below expectations, triggering significant selling...

Masayuki Sakamoto

USD/JPY: Triangle Pattern Developing, Downward Correction Underway Current Trend The USD/JPY pair is undergoing a corrective decline at 142.37...

Masayuki Sakamoto

Publication publiéeU.S. Employment Report Release: Market on High Alert Amid Weak Related Indicators

U.S. Employment Report Release: Market on High Alert Amid Weak Related Indicators Today’s focus is on the U.S. August employment report, which is the most anticipated release...

Masayuki Sakamoto

Publication publiéeOpened a USD/CHF buy position at 0.8478 with a stop at 0.8431.(This is Only half of our entries and 5mins late)

Opened a USD/CHF buy position at 0.8478 with a stop at 0.8431. This post is Half of all our entry and 5 mins late...

Masayuki Sakamoto

Publication publiéeUSD/JPY – Strong Selling (1-Hour Chart Analysis, September 5, 2024)

USD/JPY – Strong Selling (1-Hour Chart Analysis, September 5, 2024) EUR/USD – Strong Buy The EUR/USD pair is showing unclear trading near 1.1075, following a significant rise the previous day...

Masayuki Sakamoto

Publication publiée5th in September 2024, Today's Options

Today's Options EUR/USD (Euro Amount) 1.0940: €1.3 billion 1.0955: €1.0 billion 1.0975: €1.2 billion 1.0985: €1.3 billion 1.1000: €937 million 1.1005: €1.4 billion 1.1020: €911 million 1.1060: €1...

Masayuki Sakamoto

Publication publiéeU.S. Economic Indicators Weaken This Week: Focus on ADP Employment Data and ISM Non-Manufacturing Index

U.S. Economic Indicators Weaken This Week: Focus on ADP Employment Data and ISM Non-Manufacturing Index The main event this week is the U.S. employment report on Friday...

Masayuki Sakamoto

Publication publiéeEntered a short position on NZD/JPY at 89.73. (This is Only half of our entries and 5mins late)

Entered a short position on NZD/JPY at 89.73. Stop is set at 90.69. Risk-off sentiment is spreading, and I expect Oceania currencies to be sold in response...

: