Today, Focus Shifts to ECB Meeting and U.S. Economic Indicators Amidst Stabilizing Risk Sentiment

Today, Focus Shifts to ECB Meeting and U.S. Economic Indicators Amidst Stabilizing Risk Sentiment

In the Tokyo market, the Nikkei index has finally emerged from a seven-day losing streak, showing a more stable movement. The U.S. CPI results revealed that the headline year-on-year rate fell from 2.9% to 2.5%, while the core year-on-year rate remained high at 3.2%, and the core month-on-month rate increased by 0.3%. Initially, there was a rise in U.S. bond yields, a stronger dollar, and a drop in stocks. However, the Nasdaq led a rebound in the U.S. stock market, closing significantly higher. This has led to a shift from a strong dollar to a weaker yen.

September U.S. Rate Cut: With the U.S. employment statistics and CPI now out, a 25 basis point rate cut at the September FOMC has become the market consensus. The direction for a U.S. rate cut is almost set, with limited further fluctuations expected.

Key Events to Watch: In the upcoming European and NY markets, reports such as the U.S. Producer Price Index (PPI), initial jobless claims, and Canadian building permits will be released. However, these are expected to only confirm the 25 basis point rate cut, with no significant movements anticipated. Additionally, the ECB meeting is set to occur, with a 25 basis point rate cut being the consensus. The impact of President Lagarde’s remarks at the press conference will be a key point of interest.

ECB Meeting Points: In this ECB meeting, the deposit facility rate is expected to become the central policy rate. A reduction from 3.75% to 3.50% is anticipated. The market’s reaction could have a significant impact on the euro, depending on the content of President Lagarde’s remarks.

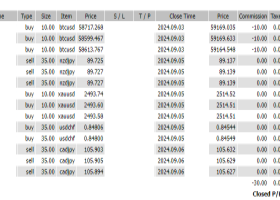

Strategy: Today, I will focus on the ECB meeting and U.S. PPI, aiming to time my entries according to the movements of the EUR and USD.