Piyush Lalsingh Ratnu / Perfil

Piyush Lalsingh Ratnu

- Trader & Analyst en Piyush Ratnu Gold Market Research

- Emiratos Árabes Unidos

- 156

- Información

|

no

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Piyush Ratnu is an independent forex market analyst & trader with core expertise in XAUUSD/Spot Gold.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

With more than 15 years of experience as a Financial Market Analyst, Piyush Ratnu held the responsibility of developing and refining a series of algorithms & analytic tools to simplify the trading processes. His tools and algorithms were defined and rated as “unlike tools seen in the market before, extensively designed and most importantly, functional and logical” by some of the top financial companies and analysts at New York, London and Dubai.

Piyush Ratnu holds an experience of 290,000 trades, 1,790,000 pips calculated with a remarkable trading execution rate of 2 trades per second in an ideal scenario with profit booking in less than 8 seconds tracing 60+ pips/trade, as per audited and verified track record of last 10 years.

Core strength:

Economics, Economic Data Analysis, Spot Gold (XAUUSD), USD Majors, SR MTF Range Trading, Chart Patterns,

Volume Trading, Day Trading & Position Trading

Trading style

Fundamental based Intra-day trading.

Analysis based on proprietary algorithm + 90+ parameters.

Core focus: US Futures and XAUUSD | Spot Gold

Motto

Plan your trade, and then trade your plan!

Detailed research: https://www.reddit.com/r/prgoldanalysis

Track Record since 2021: https://bit.ly/PRxauusdAnalysis

MyFxBook:

X.com: https://x.com/piyushratnu

Insta: https://www.instagram.com/piyushratnuofficial

Connect for more details:

Telegram: https://www.T.me/PiyushRatnuOfficial

Risk Disclaimer:

Trading in foreign exchange (“Forex”) on margins entails high risk and is not suitable for all investors. Past performance is not an indication of future results. In this case, as well, the high degree of leverage can act both against you and for you. Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals.

The information made available by Piyush Ratnu is for your general information only and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation and is not intended to be relied upon by users in making, or refraining from making, any investment decisions.

Piyush Ratnu does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position(s) of Piyush Ratnu.

Amigos

15

Solicitudes

Enviadas

Piyush Lalsingh Ratnu

Why Yen carry-trades are in focus| Explained

The popular Yen-carry trade is in focus following the currency's sharp appreciation after the Bank of Japan raised interest rates for the first time in 17 years. Here's what it means.

What is carry-trade?

A carry-trade is an immensely popular trading strategy, where an investor borrows money from a country with low interest rates, through a weaker currency(Japan in this case), and reinvests the money in another country’s assets, which gives a higher rate of return. Carry trade has been one of the biggest sources of flows in the global currency market.

Why is Japan's Yen important for Carry Trade

With low volatility, yen-funded carry trades were the most popular as investors bet Japanese interest rates would remain at rock bottom. The Bank of Japan, however, raised its rates for a second time in 17 years in its July 31 meeting, and has hinted at more, reported Bloomberg. Traders are now looking at the Chinese yuan, betting on the currency’s weakening amid concerns about the country’s economy.

The popular Yen-carry trade is in focus following the currency's sharp appreciation after the Bank of Japan raised interest rates for the first time in 17 years. Here's what it means.

What is carry-trade?

A carry-trade is an immensely popular trading strategy, where an investor borrows money from a country with low interest rates, through a weaker currency(Japan in this case), and reinvests the money in another country’s assets, which gives a higher rate of return. Carry trade has been one of the biggest sources of flows in the global currency market.

Why is Japan's Yen important for Carry Trade

With low volatility, yen-funded carry trades were the most popular as investors bet Japanese interest rates would remain at rock bottom. The Bank of Japan, however, raised its rates for a second time in 17 years in its July 31 meeting, and has hinted at more, reported Bloomberg. Traders are now looking at the Chinese yuan, betting on the currency’s weakening amid concerns about the country’s economy.

Piyush Lalsingh Ratnu

#XAUUSD CMP $2404

H4AS5

H1AS2 achieved

Approaching D1AS5

Currently at PRSRSDBS S2

S3: $2385

S4: $2369

S5: $2342

#Gold #forex #PiyushRatnu #PRxauusd

H4AS5

H1AS2 achieved

Approaching D1AS5

Currently at PRSRSDBS S2

S3: $2385

S4: $2369

S5: $2342

#Gold #forex #PiyushRatnu #PRxauusd

Piyush Lalsingh Ratnu

Key Economic Data today:

17:45 USD S&P Global Composite PMI (Jul) 55.0 54.8

17:45 USD S&P Global Services PMI (Jul) 56.0 55.3

18:00 USD ISM Non-Manufacturing Employment (Jul) 46.1

18:00 USD ISM Non-Manufacturing PMI (Jul) 51.4 48.8

18:00 USD ISM Non-Manufacturing Prices (Jul) 56.3

17:45 USD S&P Global Composite PMI (Jul) 55.0 54.8

17:45 USD S&P Global Services PMI (Jul) 56.0 55.3

18:00 USD ISM Non-Manufacturing Employment (Jul) 46.1

18:00 USD ISM Non-Manufacturing PMI (Jul) 51.4 48.8

18:00 USD ISM Non-Manufacturing Prices (Jul) 56.3

Piyush Lalsingh Ratnu

BlackMonday #Yen #Japan #Gold #Dollar #Forex

Check Price projections by Piyush Ratnu Market Research:

https://bit.ly/BlackMondayScenariosbyPR

Check Price projections by Piyush Ratnu Market Research:

https://bit.ly/BlackMondayScenariosbyPR

Piyush Lalsingh Ratnu

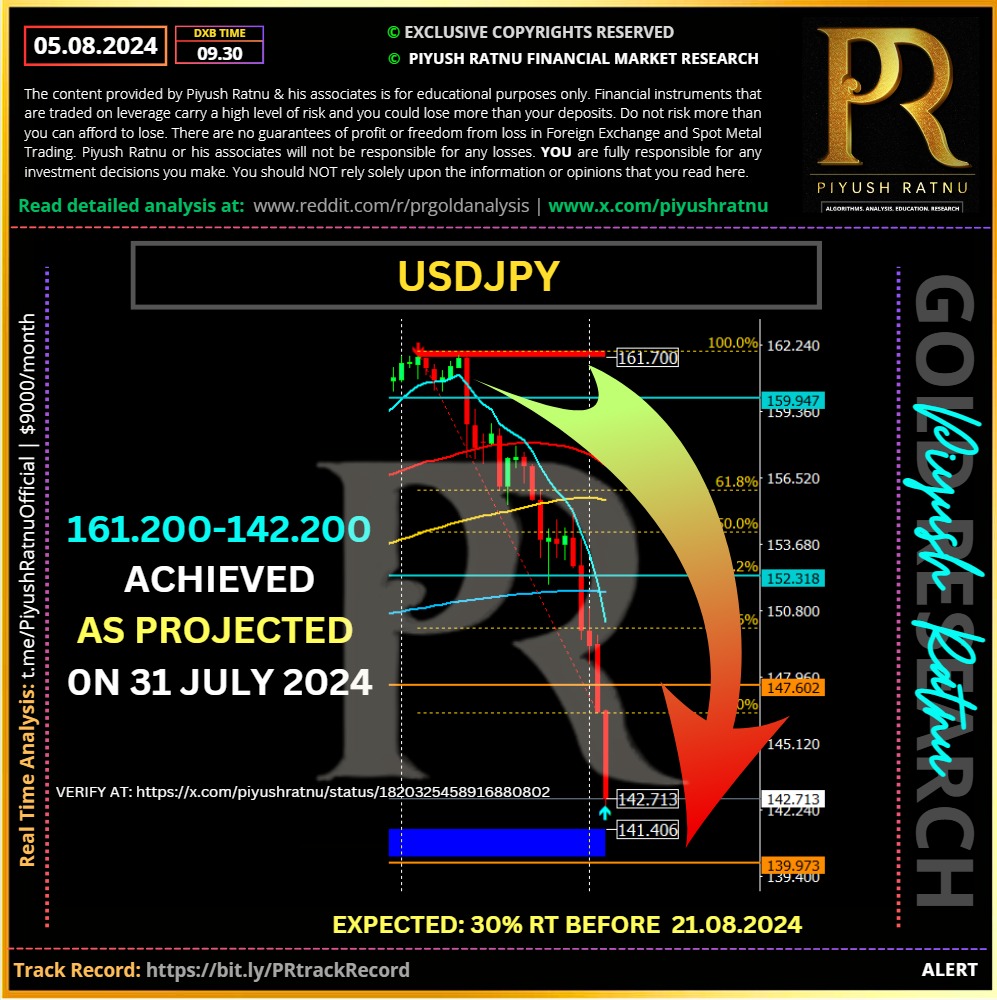

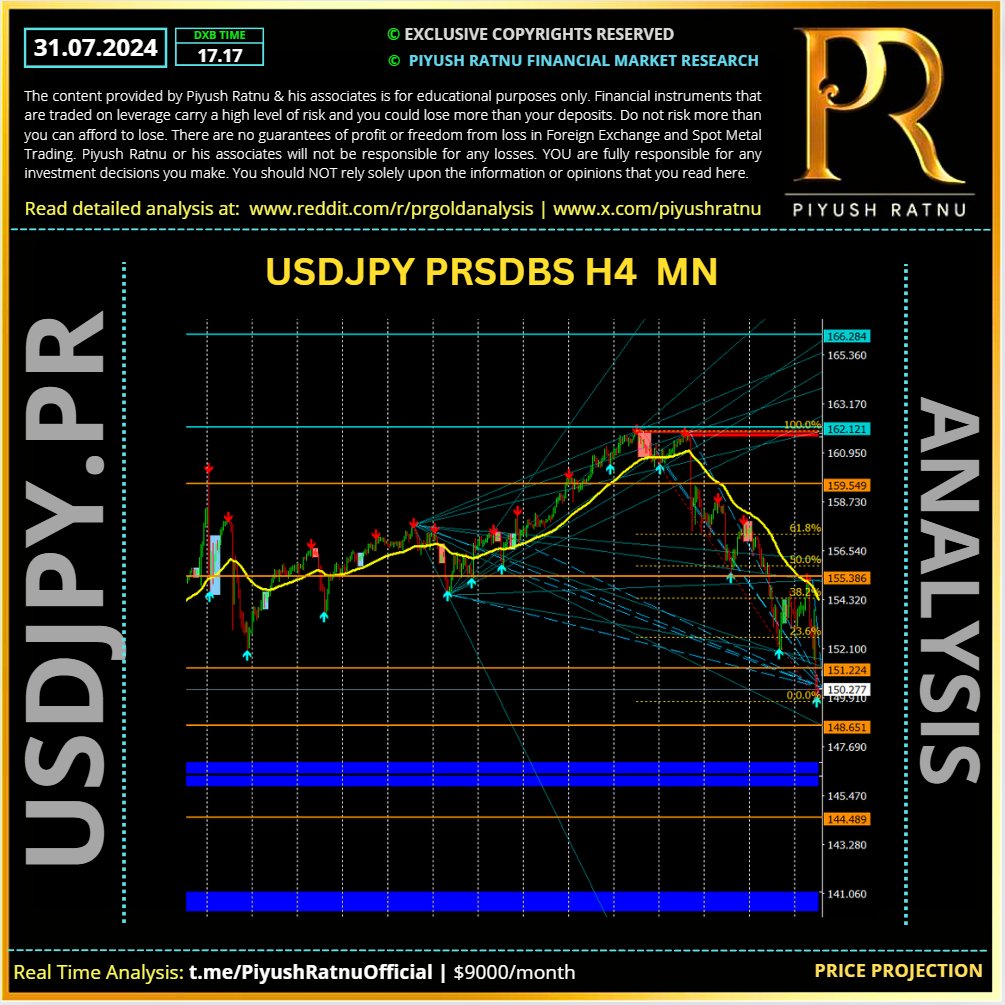

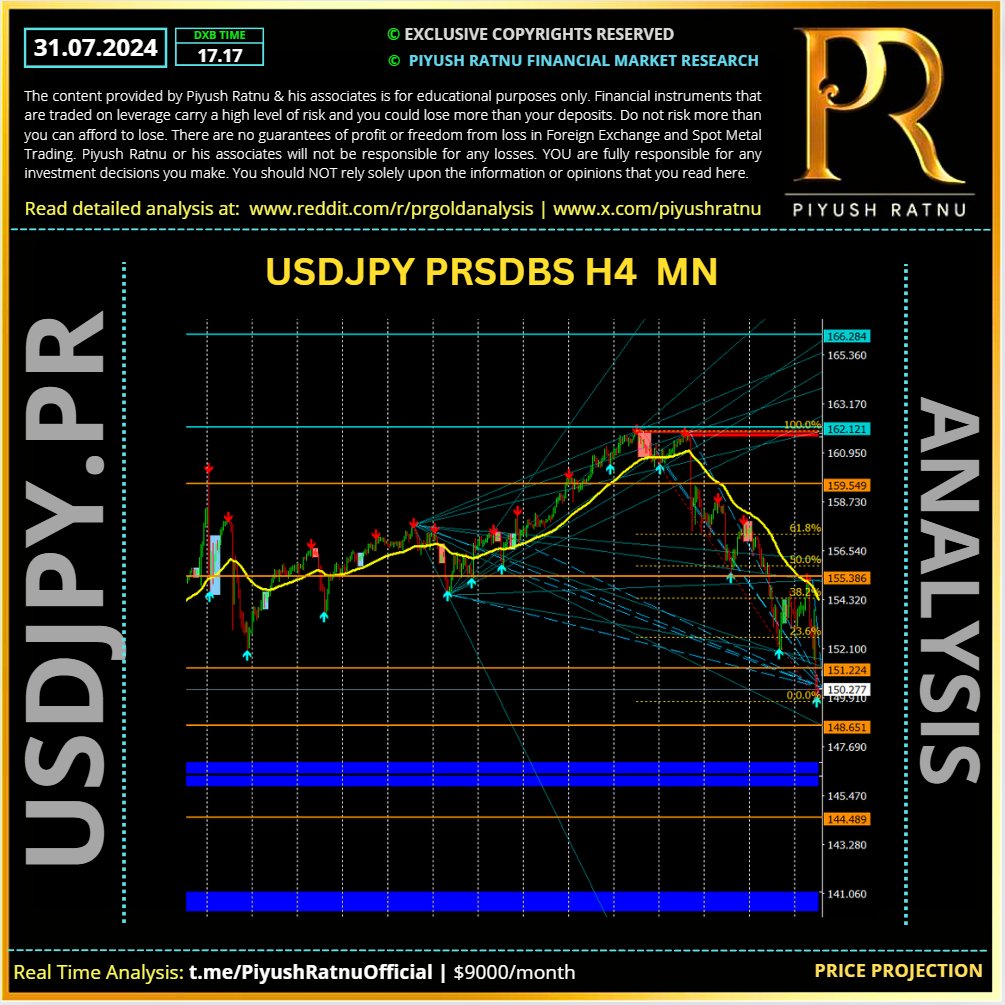

#USDJPY #Yen #Forex #Trading #PiyushRatnu

$142.170 target achieved

Buying zone As projected on 31.07.2024

Power of YEN! We alerted in advance!

https://www.cnbc.com/2024/08/02/carry-trade-how-japans-yen-could-be-ripping-through-us-stocks.html

https://www.reuters.com/markets/currencies/yen-rises-7-month-highs-us-slowdown-fears-carry-over-2024-08-05/

Verify at: https://x.com/piyushratnu/status/1818639008752075226

$142.170 target achieved

Buying zone As projected on 31.07.2024

Power of YEN! We alerted in advance!

https://www.cnbc.com/2024/08/02/carry-trade-how-japans-yen-could-be-ripping-through-us-stocks.html

https://www.reuters.com/markets/currencies/yen-rises-7-month-highs-us-slowdown-fears-carry-over-2024-08-05/

Verify at: https://x.com/piyushratnu/status/1818639008752075226

Piyush Lalsingh Ratnu

NFP Impact:

Data: Negative

indicates: IRC chances higher

USD - XAUUSD +

USDJPY crashed: 149.080-147.080

Net crash 2000P

Possible impact on XAUUSD: $55-65++ observed till now $20

Target zones of USDJPY: $147849-146.967 was projected by me on 31 July 2024.Achieved successfully on 02 Aug. 2024.

Target Zones: $2469+ / $2472 R2 PRSRSDBS D1 format,

$2478 PRSRSDBS MN format projected by me today morning 08.35 hours: achieved successfully at 16.45 hours after NFP data.

CMP $2475 Avoid Short orders.

#NFP #Gold #XAUUSD #PiyushRatnu #Trading #forex

Data: Negative

indicates: IRC chances higher

USD - XAUUSD +

USDJPY crashed: 149.080-147.080

Net crash 2000P

Possible impact on XAUUSD: $55-65++ observed till now $20

Target zones of USDJPY: $147849-146.967 was projected by me on 31 July 2024.Achieved successfully on 02 Aug. 2024.

Target Zones: $2469+ / $2472 R2 PRSRSDBS D1 format,

$2478 PRSRSDBS MN format projected by me today morning 08.35 hours: achieved successfully at 16.45 hours after NFP data.

CMP $2475 Avoid Short orders.

#NFP #Gold #XAUUSD #PiyushRatnu #Trading #forex

Piyush Lalsingh Ratnu

#Iran #Israel #XAUUSD #NFP #PiyushRatnu Iranian commanders are considering a combination of drones and missiles on military targets around Tel Aviv and Haifa while avoiding civilian targets, the New York Times reported. Iran is also considered a coordinated attack with its proxies in Yemen, Syria and Iraq, it said.

This might result in $50+ price rise in XAUUSD in a single day, hence avoid big SHORT positions.

This might result in $50+ price rise in XAUUSD in a single day, hence avoid big SHORT positions.

Piyush Lalsingh Ratnu

US F 1 2 3 : BUY at CMP

PG 75 P | Exit in NAP

Set: 1 1 2 2 3 3 5 5

#Trading #Analysis #PiyushRatnu

PG 75 P | Exit in NAP

Set: 1 1 2 2 3 3 5 5

#Trading #Analysis #PiyushRatnu

Piyush Lalsingh Ratnu

Investors will also focus on the Average Hourly Earnings data, a key measure of wage growth that fuels consumer spending and eventually drives price pressures. Annually, the wage growth measure is estimated to have decelerated to 3.7% from the prior reading of 3.9%, with the monthly figure growing steadily by 0.3%. Softer-than-expected wage growth data will diminish fears of persistent inflation, which will strengthen Fed rate-cut prospects. On the contrary, stubborn numbers would weaken them.

Meanwhile, deepening risks of an all-out war between Iran and Israel have improved the Gold’s safe-haven appeal. Iran vows to retaliate against the killing of Hamas leader Ismail Haniyeh by an Israeli air strike in Tehran.

Meanwhile, deepening risks of an all-out war between Iran and Israel have improved the Gold’s safe-haven appeal. Iran vows to retaliate against the killing of Hamas leader Ismail Haniyeh by an Israeli air strike in Tehran.

Piyush Lalsingh Ratnu

Central bank and over-the-counter buying pushed Gold demand to record levels in Q2

Gold demand was up 4 percent to 1,258 tons in the second quarter, the highest level on record since the World Gold Council started compiling data in 2000.

Demand for gold was strong in the second quarter despite record gold prices. The LBMA gold price averaged a record of $2,338 per ounce in Q2. That was 18 percent higher year-on-year and 13 percent quarter-on-quarter.

Central bank and over-the-counter (OTC) buying offset a sharp drop in gold jewelry demand.

Based on the most recent World Gold Council survey, central banks' appetite for gold won't be sated any time soon.

Gold bar and coin demand was down about 5 percent year-on-year. A big drop in gold coin sales (38 percent) drove the overall softening of physical investment demand. Bar demand was up 12 percent. This likely reflects the fact that bars are the preferred gold product in Asia, where demand remains robust.

"OTC markets are characterized by market participants trading directly with each other. The two counterparties to trade bilaterally agree on a price and have obligations to settle the transaction (exchange of cash for gold) with each other. This form of principal-to-principal gold trading is typically less regulated than trading on an exchange and is how most of the market has functioned historically."

Gold used in technology was up a healthy 11 percent to 81 tons in the second quarter. The electronics sector drove growth, increasing by 14 percent year-on-year.

Gold demand was up 4 percent to 1,258 tons in the second quarter, the highest level on record since the World Gold Council started compiling data in 2000.

Demand for gold was strong in the second quarter despite record gold prices. The LBMA gold price averaged a record of $2,338 per ounce in Q2. That was 18 percent higher year-on-year and 13 percent quarter-on-quarter.

Central bank and over-the-counter (OTC) buying offset a sharp drop in gold jewelry demand.

Based on the most recent World Gold Council survey, central banks' appetite for gold won't be sated any time soon.

Gold bar and coin demand was down about 5 percent year-on-year. A big drop in gold coin sales (38 percent) drove the overall softening of physical investment demand. Bar demand was up 12 percent. This likely reflects the fact that bars are the preferred gold product in Asia, where demand remains robust.

"OTC markets are characterized by market participants trading directly with each other. The two counterparties to trade bilaterally agree on a price and have obligations to settle the transaction (exchange of cash for gold) with each other. This form of principal-to-principal gold trading is typically less regulated than trading on an exchange and is how most of the market has functioned historically."

Gold used in technology was up a healthy 11 percent to 81 tons in the second quarter. The electronics sector drove growth, increasing by 14 percent year-on-year.

Piyush Lalsingh Ratnu

Co-relations

US10YT stable (-)

DXY RT +60% H1

XAUXAG 84.27

USDJPY + 148.600-150.400

1800 P possible impact on XAUUSD

= $30+20= $50

$2456-50= $2407/2385 range.

H1AS5 $2424 zone

H1AS1 $2407 zone

H1AS2 $2400 zone

H4AS1 $2407 zone

H4AS5 $2407 zone

$2407 looks like ideal BUY ZONE

Crash stops:

$2385

$2369

$2332

$2300

$2288

I will prefer to BUY LOWS.

US10YT stable (-)

DXY RT +60% H1

XAUXAG 84.27

USDJPY + 148.600-150.400

1800 P possible impact on XAUUSD

= $30+20= $50

$2456-50= $2407/2385 range.

H1AS5 $2424 zone

H1AS1 $2407 zone

H1AS2 $2400 zone

H4AS1 $2407 zone

H4AS5 $2407 zone

$2407 looks like ideal BUY ZONE

Crash stops:

$2385

$2369

$2332

$2300

$2288

I will prefer to BUY LOWS.

Piyush Lalsingh Ratnu

Key Economic Data Ahead:

16:30 USD Continuing Jobless Claims 1,860K 1,851K

16:30 USD Initial Jobless Claims 236K 235K

16:30 USD Nonfarm Productivity (QoQ) (Q2) 1.7% 0.2%

16:30 USD Unit Labor Costs (QoQ) (Q2) 1.8% 4.0%

17:15 GBP BoE Gov Bailey Speaks

17:45 USD S&P Global US Manufacturing PMI (Jul) 49.5 51.6

18:00 USD Construction Spending (MoM) (Jun) 0.2% -0.1%

18:00 USD ISM Manufacturing Employment (Jul) 49.0 49.3

18:00 USD ISM Manufacturing PMI (Jul) 48.8 48.5

18:00 USD ISM Manufacturing Prices (Jul) 51.9 52.1

16:30 USD Continuing Jobless Claims 1,860K 1,851K

16:30 USD Initial Jobless Claims 236K 235K

16:30 USD Nonfarm Productivity (QoQ) (Q2) 1.7% 0.2%

16:30 USD Unit Labor Costs (QoQ) (Q2) 1.8% 4.0%

17:15 GBP BoE Gov Bailey Speaks

17:45 USD S&P Global US Manufacturing PMI (Jul) 49.5 51.6

18:00 USD Construction Spending (MoM) (Jun) 0.2% -0.1%

18:00 USD ISM Manufacturing Employment (Jul) 49.0 49.3

18:00 USD ISM Manufacturing PMI (Jul) 48.8 48.5

18:00 USD ISM Manufacturing Prices (Jul) 51.9 52.1

Piyush Lalsingh Ratnu

FOMC Statement

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have moderated, and the unemployment rate has moved up but remains low. Inflation has eased over the past year but remains somewhat elevated. In recent months, there has been some further progress toward the Committee's 2 percent inflation objective.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals continue to move into better balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have moderated, and the unemployment rate has moved up but remains low. Inflation has eased over the past year but remains somewhat elevated. In recent months, there has been some further progress toward the Committee's 2 percent inflation objective.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals continue to move into better balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Piyush Lalsingh Ratnu

Daily digest market movers: XAUUSD: $2370/2360 or $2407/2417 today?

• Gold is regaining some of the ground lost on Monday, favoured by a somewhat brighter market mood as concerns of a full-blown war in the Middle East have eased.

• Israeli authorities assured that they want to retaliate Hizbullah, for the rocket attack that killed 12 people on the weekend, but that they want to avoid a regional war in the Middle East. This has calmed market fears.

• Later today, the Conference Board is expected to show that the Consumer Sentiment Index deteriorated marginally in July, to a reading of 99.5 from the 100.4 posted in the previous month.

• In the same line, US JOLTS Job Openings are seen to have declined to 8.03 million in June from the 8.14 million openings reported in May.

• The Fed is releasing its monetary policy decision on Wednesday, and the recent inflation readings have boosted market expectations that the bank might signal the exit of the restrictive cycle.

• US 10-year yields are marginally above four-month highs, while the 2-year yield, the most closely related to interest rate expectations, remains depressed at their lowest levels since February.

• The CME Group’s Fed Watch tool is pricing a 95% chance that the Fed will keep rates on hold on Wednesday and a 100% chance that rate cuts will start in September.

• Gold is regaining some of the ground lost on Monday, favoured by a somewhat brighter market mood as concerns of a full-blown war in the Middle East have eased.

• Israeli authorities assured that they want to retaliate Hizbullah, for the rocket attack that killed 12 people on the weekend, but that they want to avoid a regional war in the Middle East. This has calmed market fears.

• Later today, the Conference Board is expected to show that the Consumer Sentiment Index deteriorated marginally in July, to a reading of 99.5 from the 100.4 posted in the previous month.

• In the same line, US JOLTS Job Openings are seen to have declined to 8.03 million in June from the 8.14 million openings reported in May.

• The Fed is releasing its monetary policy decision on Wednesday, and the recent inflation readings have boosted market expectations that the bank might signal the exit of the restrictive cycle.

• US 10-year yields are marginally above four-month highs, while the 2-year yield, the most closely related to interest rate expectations, remains depressed at their lowest levels since February.

• The CME Group’s Fed Watch tool is pricing a 95% chance that the Fed will keep rates on hold on Wednesday and a 100% chance that rate cuts will start in September.

Piyush Lalsingh Ratnu

#XAUUSD #Gold #Trading #Forex #PiyushRatnu

Read previous article in which I had projected $2369 as potential buying zone:

https://www.reddit.com/r/prgoldanalysis/comments/1e9cjfh/xauusd_23422323_or_24852509_in_next_10_days/

XAUUSD today's low: $2366,

reversal achieved: $2366-2377 at 13.30 hours.

Read previous article in which I had projected $2369 as potential buying zone:

https://www.reddit.com/r/prgoldanalysis/comments/1e9cjfh/xauusd_23422323_or_24852509_in_next_10_days/

XAUUSD today's low: $2366,

reversal achieved: $2366-2377 at 13.30 hours.

Piyush Lalsingh Ratnu

🟢 Gold found fresh buying interest after its aggressive pullback from a record high of 2,483 paused at 2,383. The precious metal is currently looking to gain more, subject to key economic data scheduled to be published in next three days in sequence.

🟢 India slashed its import tax on gold and silver, a move that could further boost demand for both precious metals in the world’s second-biggest gold market and support higher prices globally.

The move will cut taxes on gold and silver imports by more than half, lowering duties from 15 percent to 6 percent. India will also lower the import tax on platinum to 6.4 percent.

Government officials hope that lowering the import duty will put a damper on rampant gold smuggling.

India Finance Minister Nirmala Sitharaman said the goal was to “enhance domestic value addition in gold and precious metal jewelry in the country.”

World Gold Council Indian operations CEO Sachin Jain told Reuters the tax cut is “a massive step in the right direction. It will reduce the incentives for smuggling of gold. It will create a level playing field for honest industry stakeholders.

Co-relations:

US 10 YT +

DXY +

XAUXAG 82.40

USD S 39

AUD S 35

JPY S 80

USDJPY net crash 155.900-154.500= 1400P

Possible impact on XAUUSD: (+) $40+

Important Economic Data today:

16:30 USD Building Permits 1.446M 1.399M

16:30 USD Goods Trade Balance (Jun) -98.80B -99.37B

16:30 USD Retail Inventories Ex Auto (Jun)

17:45 USD S&P Global US Manufacturing PMI (Jul) 51.7 51.6

17:45 USD S&P Global Composite PMI (Jul) 54.8

17:45 USD S&P Global Services PMI (Jul) 54.7 55.3

18:00 USD New Home Sales (MoM) (Jun) -11.3%

18:00 USD New Home Sales (Jun) 639K 619K

18:30 USD Crude Oil Inventories -2.600M -4.870M

18:30 USD Cushing Crude Oil Inventories -0.875M

20:00 USD Atlanta Fed GDPNow (Q2) 2.7% 2.7%

21:00 USD 5-Year Note Auction 4.331%

🟢Crucial Price Zones today:

🔻BZ $2400/2385

🔺SZ $2430/2440

#XAUUSD #PiyushRatnu #Gold #Forex #Trading

🟢 India slashed its import tax on gold and silver, a move that could further boost demand for both precious metals in the world’s second-biggest gold market and support higher prices globally.

The move will cut taxes on gold and silver imports by more than half, lowering duties from 15 percent to 6 percent. India will also lower the import tax on platinum to 6.4 percent.

Government officials hope that lowering the import duty will put a damper on rampant gold smuggling.

India Finance Minister Nirmala Sitharaman said the goal was to “enhance domestic value addition in gold and precious metal jewelry in the country.”

World Gold Council Indian operations CEO Sachin Jain told Reuters the tax cut is “a massive step in the right direction. It will reduce the incentives for smuggling of gold. It will create a level playing field for honest industry stakeholders.

Co-relations:

US 10 YT +

DXY +

XAUXAG 82.40

USD S 39

AUD S 35

JPY S 80

USDJPY net crash 155.900-154.500= 1400P

Possible impact on XAUUSD: (+) $40+

Important Economic Data today:

16:30 USD Building Permits 1.446M 1.399M

16:30 USD Goods Trade Balance (Jun) -98.80B -99.37B

16:30 USD Retail Inventories Ex Auto (Jun)

17:45 USD S&P Global US Manufacturing PMI (Jul) 51.7 51.6

17:45 USD S&P Global Composite PMI (Jul) 54.8

17:45 USD S&P Global Services PMI (Jul) 54.7 55.3

18:00 USD New Home Sales (MoM) (Jun) -11.3%

18:00 USD New Home Sales (Jun) 639K 619K

18:30 USD Crude Oil Inventories -2.600M -4.870M

18:30 USD Cushing Crude Oil Inventories -0.875M

20:00 USD Atlanta Fed GDPNow (Q2) 2.7% 2.7%

21:00 USD 5-Year Note Auction 4.331%

🟢Crucial Price Zones today:

🔻BZ $2400/2385

🔺SZ $2430/2440

#XAUUSD #PiyushRatnu #Gold #Forex #Trading

Piyush Lalsingh Ratnu

🟢 Political Uncertainty to drive GOLD Price for next few months

The recent developments in the US and China have significant implications for the gold market. Investors reacted little to President Joe Biden's decision to end his re-election campaign, as the US equity market is expected to benefit from Trump's proposed policies.

This shift in political dynamics could lead to a more inflationary environment under a potential second Trump presidency, pushing US Treasury bond yields higher. Higher yields often attract investors away from non-yielding assets like gold, contributing to downward pressure on gold prices. Additionally, the People's Bank of China's (PBoC) unexpected rate cuts have bolstered global risk sentiment, diminishing the appeal of safe-haven assets.

Despite the strong market drop last week and the emergence of a weekly bearish hammer, the overall market remains bullish. This bullish outlook is also validated by the ratio of senior gold miners to the US stock market, which shows a bottom and looks poised to rally.

This ratio indicates that the bottom in the gold market in 2024 is similar to the bottom in 2015 when the gold market rallied higher, along with the ratio.

Therefore, any price correction in gold prices indicates a buying opportunity for investors.

In conclusion, recent political and economic developments in the US and China have introduced some bearish factors for the gold market. These include a potentially more inflationary environment under a second Trump presidency and increased global risk sentiment due to China's rate cuts. The anticipated Federal Reserve rate cut and supportive technical indicators suggest potential support for gold prices. As investors navigate through upcoming US economic data and global economic health indicators, the interplay between these factors will continue to shape gold's trajectory, presenting both challenges and opportunities for investors.

🔺 The correction in gold is considered a strong buying opportunity for traders and investors.

📌 Crucial Price Zones Ahead

as per PRSR D1 and W1 average

🔻SZ $2442/2469/2485/2509/2525

🔺BZ $2385/2369/2342/2323/2303

The recent developments in the US and China have significant implications for the gold market. Investors reacted little to President Joe Biden's decision to end his re-election campaign, as the US equity market is expected to benefit from Trump's proposed policies.

This shift in political dynamics could lead to a more inflationary environment under a potential second Trump presidency, pushing US Treasury bond yields higher. Higher yields often attract investors away from non-yielding assets like gold, contributing to downward pressure on gold prices. Additionally, the People's Bank of China's (PBoC) unexpected rate cuts have bolstered global risk sentiment, diminishing the appeal of safe-haven assets.

Despite the strong market drop last week and the emergence of a weekly bearish hammer, the overall market remains bullish. This bullish outlook is also validated by the ratio of senior gold miners to the US stock market, which shows a bottom and looks poised to rally.

This ratio indicates that the bottom in the gold market in 2024 is similar to the bottom in 2015 when the gold market rallied higher, along with the ratio.

Therefore, any price correction in gold prices indicates a buying opportunity for investors.

In conclusion, recent political and economic developments in the US and China have introduced some bearish factors for the gold market. These include a potentially more inflationary environment under a second Trump presidency and increased global risk sentiment due to China's rate cuts. The anticipated Federal Reserve rate cut and supportive technical indicators suggest potential support for gold prices. As investors navigate through upcoming US economic data and global economic health indicators, the interplay between these factors will continue to shape gold's trajectory, presenting both challenges and opportunities for investors.

🔺 The correction in gold is considered a strong buying opportunity for traders and investors.

📌 Crucial Price Zones Ahead

as per PRSR D1 and W1 average

🔻SZ $2442/2469/2485/2509/2525

🔺BZ $2385/2369/2342/2323/2303

Piyush Lalsingh Ratnu

#Gaemi #XAUUSD #Forex #Trading #Taiwan

⚡️⚡️⚡️⚡️⚡️⚡️

https://www.bloomberg.com/news/articles/2024-07-23/typhoon-gaemi-shuts-taiwan-s-financial-markets-and-offices

Thinner volumes might impact Dollar volatility, resulting in sudden rally in XAUUSD/Spot Gold price.

⚡️⚡️⚡️⚡️⚡️⚡️

https://www.bloomberg.com/news/articles/2024-07-23/typhoon-gaemi-shuts-taiwan-s-financial-markets-and-offices

Thinner volumes might impact Dollar volatility, resulting in sudden rally in XAUUSD/Spot Gold price.

Piyush Lalsingh Ratnu

TRUMP effect: The TRIUMPH factor for DOLLAR!

“Recall, our gauge of discretionary trader positioning in Gold remains bloated relative to rates market expectations, with signs that the Trump trade has contributed to some froth above and beyond what is consistent with expectations of Fed cuts alone.

“Positioning risks are now asymmetrically skewed to the downside in the Yellow Metal, with Commodity Trading Advisors (CTAs) effectively sitting on a 'max long' position that remains vulnerable to a break south of $2380/oz, whereas even a modest reversal of the Trump trade could catalyze additional selling activity.”

“With Asia on a buyer's strike, as highlighted by the plummeting SGE premium alongside notable long liquidations on Shanghai Futures Exchange (SHFE), a liquidity vacuum could ensue with fewer buyers to offset potential liquidations from a potential reversal of the Trump trade compounded by CTA selling activity in a downtape. The window for downside is open in the Yellow Metal.”

#TDS

“Recall, our gauge of discretionary trader positioning in Gold remains bloated relative to rates market expectations, with signs that the Trump trade has contributed to some froth above and beyond what is consistent with expectations of Fed cuts alone.

“Positioning risks are now asymmetrically skewed to the downside in the Yellow Metal, with Commodity Trading Advisors (CTAs) effectively sitting on a 'max long' position that remains vulnerable to a break south of $2380/oz, whereas even a modest reversal of the Trump trade could catalyze additional selling activity.”

“With Asia on a buyer's strike, as highlighted by the plummeting SGE premium alongside notable long liquidations on Shanghai Futures Exchange (SHFE), a liquidity vacuum could ensue with fewer buyers to offset potential liquidations from a potential reversal of the Trump trade compounded by CTA selling activity in a downtape. The window for downside is open in the Yellow Metal.”

#TDS

: