Technical Analysis Indicator MACD part one

Most technical analysis indicators are lagging. Let show you how to use MACD properly and its Leading indicator values.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video January 2014

Sergey Golubev, 2014.01.19 07:43

01: NON FARM PAYROLL (Part 1) - ECONOMIC REPORTS FOR ALL MARKETSThis is the 1st video in a series on economic reports created for all markets, or for those who simply have an interest in economics. In this and the next lesson, we cover the Employment Situation Report, also known as Non Farm Payroll.

============

Non-farm Payrolls (metatrader5.com)Non-farm Payrolls is the assessment of the total number of employees recorded in payrolls.

This is a very strong indicator that shows the change in employment in the country. The growth of this indicator characterizes the increase in employment and leads to the growth of the dollar. It is considered an indicator tending to move the market. There is a rule of thumb that an increase in its value by 200,000 per month equates to an increase in GDP by 3.0%.

- Release Frequency: monthly.

- Release Schedule: 08:30 EST, the first Friday of the month.

- Source: Bureau of Labor Statistics, U.S. Department of Labor.

============

FF forum economic calendar :

- Source : Bureau of Labor Statistics

- Measures : Change in the number of employed people during the previous month, excluding the farming industry

- Usual Effect : Actual > Forecast = Good for currency

- Frequency : Released monthly, usually on the first Friday after the month ends

- Why Traders Care : Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity

- Also Called : Non-Farm Payrolls, NFP, Employment Change

============

mql5 forum thread : Non-Farm Employment Strategy

============

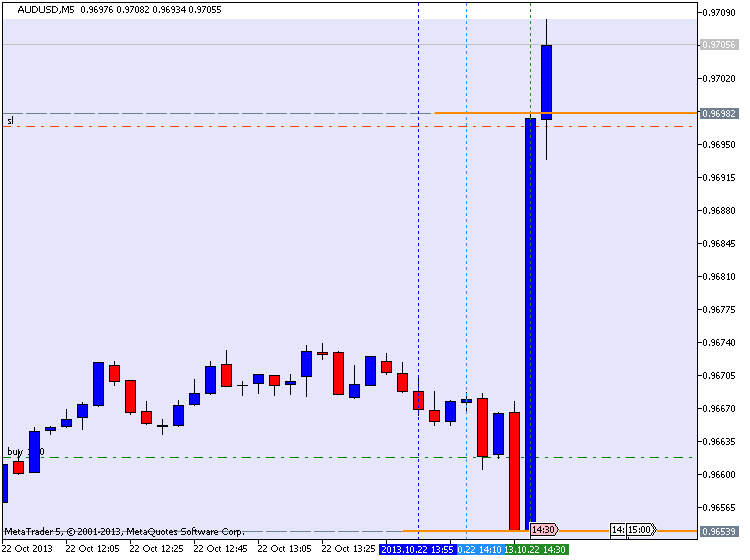

AUDUSD M5 with 45 pips in profit (by equity) for NFP :

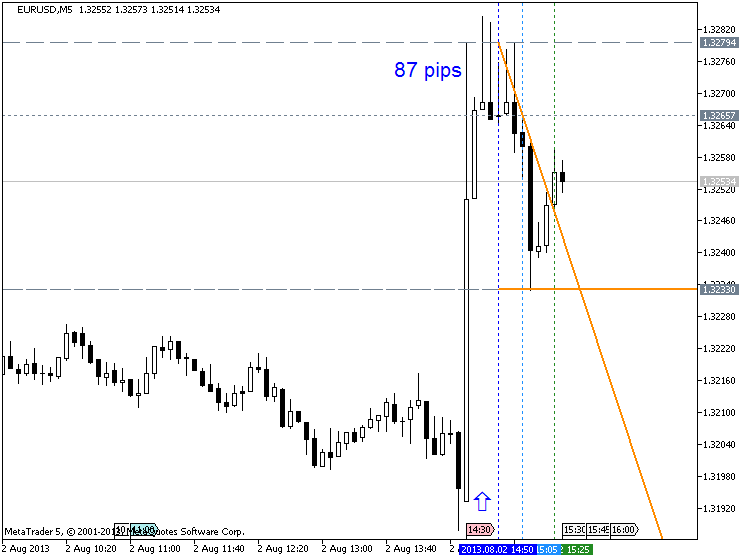

EURUSD M5 : 87 pips price movement by NFP news event :

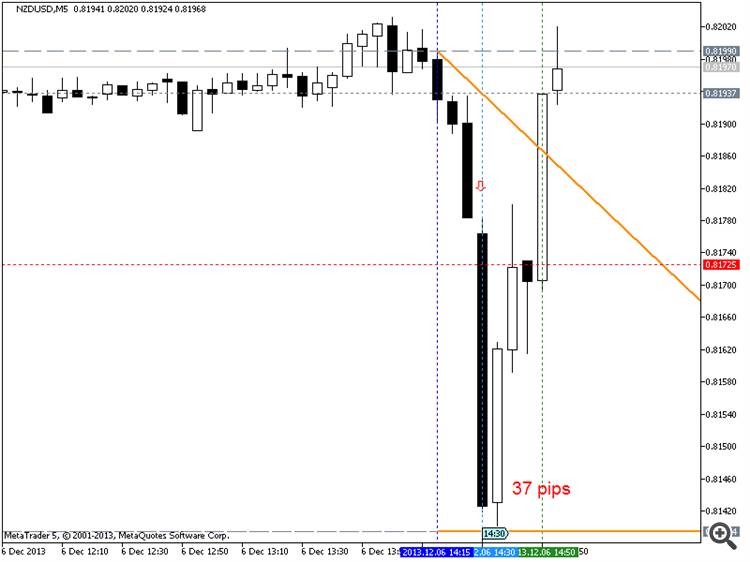

NZDUSD M5 : 37 pips price movement by USD - Non-Farm Employment Change :

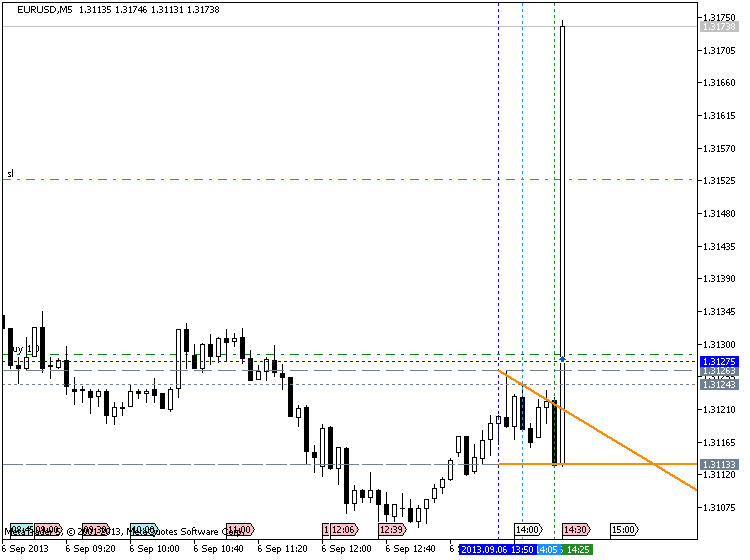

Trading EURUSD during NFP :

==================

Ichimoku Non Traditional Trading

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.09 14:10

Intra-Day Fundamentals - EUR/USD and FOMC Member Rosengren Speaks

2016-09-09 11:45 GMT | [USD - FOMC Member Rosengren Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Member Rosengren Speaks] = Speech about economic forecasts at the South Shore Chamber breakfast, in Boston.

==========

Exploring the Economy's Progress and Outlook

==========

EUR/USD M5: 10 pips price movement by FOMC Member Rosengren Speaks news event

Neural Networks Explained in Plain English with Ron Leplae

The goal of the webinar is to demystify neural networks, explain neural networks in plain English, and share easy to understand code examples how NN can be used.

- Artificial Intelligence: History and Background

- Neural Networks: The Basics

- Case Example

- Problems with Neural Networks

- Solutions to common problems with Neural Networks

What is financial market liquidity?

What is financial market liquidity? Are liquid markets always good? And what should citizens be concerned about?

Professional Money Managers and their Influence

Professor Shiller argues that institutional investors are fundamentally important to our economy and our society.

Following his thoughts about societal changes in a modern and capitalist world, he turns his attention to the fiduciary duties of investment managers. He emphasizes the "prudent person rule," and critically reflects on the limitations that these rules impose on investment managers.

Elaborating on different forms of institutional money management, he covers mutual funds, contrasting the legislative environments in the U.S. and Europe, and trusts. In the treatment of the next form, pension funds, he starts out with the history of pension funds in the late 19th and the first half of the 20th century, and subsequently presents the legislative framework for pension funds before he outlines the differences of defined benefit and defined contribution plans.

Professor Shiller finishes the list of forms of institutional money management with endowments, focusing on investment mistakes in endowment management, as well as family offices and family foundations.

00:00 - Chapter 1. Assets and Liabilities of U.S. Households and Nonprofit Organizations

11:30 - Chapter 2. Human Capital and Modern Societal Changes

17:04 - Chapter 3. The Fiduciary Duty of Investment Managers

28:23 - Chapter 4. Financial Advisors, Financial Planners, and Mortgage Brokers

33:53 - Chapter 5. Comparison of Mutual Funds between the U.S. and Europe

37:58 - Chapter 6. Trusts - Providing the Opportunity to Care for Your Children

43:14 - Chapter 7. Pension Funds and Defined Contribution Plans

58:23 - Chapter 8. History of Endowment Investing

01:02:34 - Chapter 9. Family Offices and Family Foundations

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.