Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video December 2014

newdigital, 2014.12.17 08:56

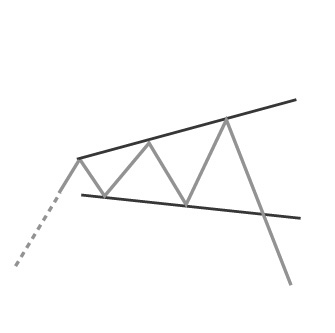

Introduction to the Megaphone Pattern (Broadening Top)

- The megaphone pattern, also known as the broadening top pattern, involves price making higher highs AND higher lows.

- As such, it is indicative of greater volatility and instability in the market.

- Specifically, traders should look for five points: a high (point A), a low (point B), a high that is higher than point A (this is point C), a low that is lower than point B (this is point D), and a high that is higher than point C (this is point E).

- Typically, the pattern emerges at the end of an uptrend and is a sign that the market is headed down.

A Megaphone Top is a relatively rare formation and is also known as a Broadening Top. Its shape is opposite to that of a Symmetrical Triangle. The pattern develops after a strong advance in a stock price and can last several weeks or even a few months.

A Megaphone Top is formed because the stock makes a series of higher highs and lower lows. The Megaphone Top usually consists of three ascending peaks and two descending troughs. The signal that the pattern is complete occurs when prices fall below the lower low.

Volume in the Megaphone Top usually peaks along with prices. It is usual to see trading volumes increase or remain high during the formation of this pattern. The eventual breakout and reversal can be difficult to identify at the time of its occurrence because volume does not appear unusual.

The target price provides an important indication about the potential price move that this pattern indicates. Consider whether the target price for this pattern is sufficient to provide adequate returns after your costs (such as commissions) have been taken into account. A good rule of thumb is that the target price must indicate a potential return of greater than 5% before a pattern should be considered useful, however you must consider the current price and the volume of shares you intend to trade.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video December 2014

newdigital, 2014.12.22 10:16

Oil Crash of 2014: Why It's Happening and How to Trade

1. Oil crash coincided with the introduction of economic sanctions against Russia

2. 80% of shale oil production in the US economically unviable at $60 per barrel

3. The impact of the crash in oil is impacting high yield credit markets and the financial markets of major oil exporting countries, like Russia and Nigeria

4. Is this part of a political war to weaken Iran and Russia and their allies?

5. In terms of trading strategies one could speculate that this is a cold war that will lead to hot war, that oil will rebound after bottoming (my personal favorite), or that deflation is happening and that the US dollar and US Treasury bonds will continue to benefit.

Trading Video: Short Term Euro and Yen Setups the Order for Next Week

- Tepid liquidity this past week curbed trade opportunities and another lull is expected on New Year's Day

- Medium and long-term trade setups are unlikely to progress this week, but short-term options can do well

- There are plenty of short-term breakouts setting up for EURUSD, EURJPY, AUDUSD and others

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.02 10:13

Trading Video: A Big Picture Technical Look at FX and Capital Markets for 2015 (based on dailyfx article)

- Looking at a decade or more of price can offer an eye-opening view of technical opportunity

- The Dollar, EURUSD, USDJPY, S&P 500 and Oil are just a few markets that benefit a 'big picture' review

- Combine the technical with fundamental and market conditions to set up your 2015 positions

Whether you are a short-term scalper or a more patient swing trader, taking a step back to look at the 'bigger picture' can help your trading. We have these past weeks looked at the bigger picture for fundamentals and general market conditions. So, to start off the New Year, we will look at the alluring big-picture technical patterns that have taken shape across the FX and capital markets. Incredible runs like that from USDollar, tentative massive breakouts from EURUSD and EURGBP, and the specter of reversal from the likes of USDJPY and EURJPY offer incredible potential for 2015. Combine the fundamental and market conditions views for the New Year with today's Trading Video technical overview to find your favorite setups.

Jim Rogers 2015 Forecast Buy Gold , Bull Market will come

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.03 11:07

Gold forecast for the week of January 5, 2015, Technical Analysis (based on fxempire article)

Gold markets did very little during the course of the week, essentially bouncing around just below the $1200 handle. Because of this, it appears of the market is ready to go sideways in the near term, although there is still a bit more of a negative bias at the moment. If we managed to get above the $1250 level, at that point time we would be comfortable with longer-term buying opportunities. Ultimately though, we feel that this market really doesn’t have a lot of momentum one way or the other, so therefore we are on the sidelines as far as long-term trades are concerned.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.03 11:11

USD/JPY forecast for the week of January 5, 2015, Technical Analysis (based on fxempire article)

The USD/JPY pair initially fell during the course of the week but found enough support below the 120 level to turn things back around and form a nice-looking hammer. The hammer of course is a positive sign, and as a result we feel that this market will continue the uptrend that we have seen for some time now. On top of that, the US Dollar Index of course went higher as well, so it does suggest that overall the US dollar will continue to be the favored currency in the Forex markets. With that, we are buyers of dips in this particular currency pair.

Ultimately, we believe that the US dollar will continue to be bought in favor of the Japanese yen, as the Bank of Japan continues to work against the value of its own currency by stepping into the bond markets and purchasing Japanese Government Bonds, essentially quantitative easing such as the Federal Reserve has done.

Look at the shape of the candle, it suggests that the markets review the 120 level as a bit of a “line in the sand”, but we believe that there is even more support down at the 115 handle than they are, so really at this point time this is a market that looks like it should continue to have buyers step into it again and again.

Keep in mind that the Federal Reserve has stepped away from the bond markets, essentially ending the quantitative easing game. With that, the US dollar will continue to strengthen overall, and with the Bank of Japan doing the exact opposite it makes quite a bit of sense that this market would continue to go higher given enough time and as a result every time it dips I will that the buyers will step in as it makes sense to think of the US dollar as being “on sale” against the Japanese yen every time we fall. In fact, at this point in time we have no scenario in which we are willing to sell this market.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.03 11:14

USD/CAD forecast for the week of January 5, 2015, Technical Analysis (based on fxempire article)

The USD/CAD pair fell initially during the week, but then shot higher in order to break out. We closed towards the top of the range, and it now appears that we are heading to the 1.18 handle in very short order. Pullbacks at this point time offer buying opportunities just as they always have, as the US dollar is without a doubt the favored currency around the world. We believe that there is essentially a “floor” in this market at the 1.12 level. We have no interest in selling at the moment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.03 11:17

NZD/USD forecast for the week of January 5, 2015, Technical Analysis (based on fxempire article)

The NZD/USD pair initially tried to rally during the course of the week, but you can see that the area above the 0.78 level offered way too much in the way of resistance. With that, it appears of the market is ready to go lower, so we are sellers overall. However, we would have to break down below the 0.76 handle in order to find enough downward pressure in order to drop to the 0.75 handle, and then of course the 0.70 handle as the Royal Bank of New Zealand continues to jawbone the value of the Kiwi dollar down.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.01.03 11:20

GBP/USD forecast for the week of January 5, 2015, Technical Analysis (based on fxempire article)The GBP/USD pair broke down below the 1.55 level at the end of the week, essentially “opening the floodgates” to the 1.50 handle. With that, we have plenty of reasons to sell this market and absolutely no interest in buying it. At this point in time, the 1.55 level now looks as if it’s resistance, mainly because it was previously support. The market looks as if it’s ready to continue to grind lower because of that, so we are simply waiting for resistant candle in order to push the value of the British pound down.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.