EURUSD - Trends, Forecasts and Implications (Part 3) - page 788

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I see that the last two bars on the daily were formed not because of selling but because of shorting of buying, the question is whether this will be followed by selling or trampling with accumulation of buying.

22-Apr-2011 14:44

Although fears of a sovereign debt default in the US have been trying to tilt the balance, the eurozone remains the most dangerous flashpoint.Standard & Poor's took a warning shot at America this week by lowering its outlook on the country's sovereign debt, citing fears that political wrangling could prevent the States from implementing the fiscal reforms needed to regain control of its structural deficit.

Although the timing of the decision was unexpected, the fact that the outlook was lowered was not a cold water shower for most market observers. As Morningstar's Eric Jacobson pointed out, the rating agency said nothing new. The deficit problem has already hit a nerve, and the fact that Washington is virtually in a no-win situation didn't startle anyone either. S&P was absolutely right to say that finding a solution to the country's fiscal problem will be very difficult; the Washington authorities will have to make difficult choices between health care spending, tax rates and social security that are unlikely to prove politically popular.

However, my sleepless nights are not to blame for fears of a downgrade of the US sovereign rating. Yes, the political climate is very tense and unfavourable at the moment, but the debt problems are solvable.

The negotiations that averted a temporary government shutdown and the fact that politicians on both sides are expressing their intention and willingness to resolve the problems offer hope that an agreement can eventually be reached. Of course, this is unlikely to solve the problem completely, but at least it will be enough to maintain the current AAA rating.

Right now, whatever Congress tries to do to reduce the deficit will have a profound effect on investor sentiment. The government's attempts should add to the markets' confidence, but price increases, taxes and pension and healthcare deductions will put pressure on almost all investments. The deficit, and potential ways to deal with it, should be high on the government's list of priorities, but the likelihood of a US default is not something that should be of concern.

However, the fact that I am not concerned about the issue of a US default does not mean that I am indifferent to the topic at all. In fact, I believe Europe's debt problems could seriously worsen. Take Greece, for example.

Over the last few months it has virtually disappeared from the disturbing and sensationalist headlines that used to clutter the media. And the critical size of the debt burden has neither eased nor disappeared. The country has adopted draconian austerity measures and now Athens is back on the scene, already accompanied by that dreaded word "default".

The Greek economy may have to take a spectacular leap forward, raise even more funds for its bailout than it did last year, or suffer rabid inflation in order to avoid a debt restructuring. And I fear that any of the above scenarios could eventually materialise.

However, as far as large scale growth is concerned, the probability here is not very high. Greece is not very competitive compared to other European countries and there is little hope that this will change for the better in the near future, to put it bluntly. The EU has acted decisively by establishing a stabilisation fund, which once helped Greece avoid default. However, increasing the size of the rescue package will be virtually impossible. European parliaments are increasingly sceptical about bailout programmes. It is hard to imagine another bailout package for Greece without the participation of bondholders.

An option with inflation is also unlikely because Greece has no control over its currency. The ECB has already begun to tighten its monetary policy in order to combat inflation in the Eurozone. Jean-Claude Trichet does not want to accept a runaway increase in prices just to rescue Greek bond holders.

This leaves the option of a default on sovereign debt. Bond holders would have to face a reduction in their face value in order for Greece to finally put its crisis behind them. Yes, the picture will not look pretty. The restructuring will be loud, messy, and will exacerbate the situation around other troubled states in the region, such as Ireland and Portugal. Greece is a small country and a default would not be catastrophic. However, such a scenario would have a negative effect on global markets. Therefore investors should not lose sight of the situation in Europe.

http://news.morningstar.com/

Happy Holidays, everyone!!!

- Christ is risen! Leonid Ilyich...

- Thank you... I've already been informed.

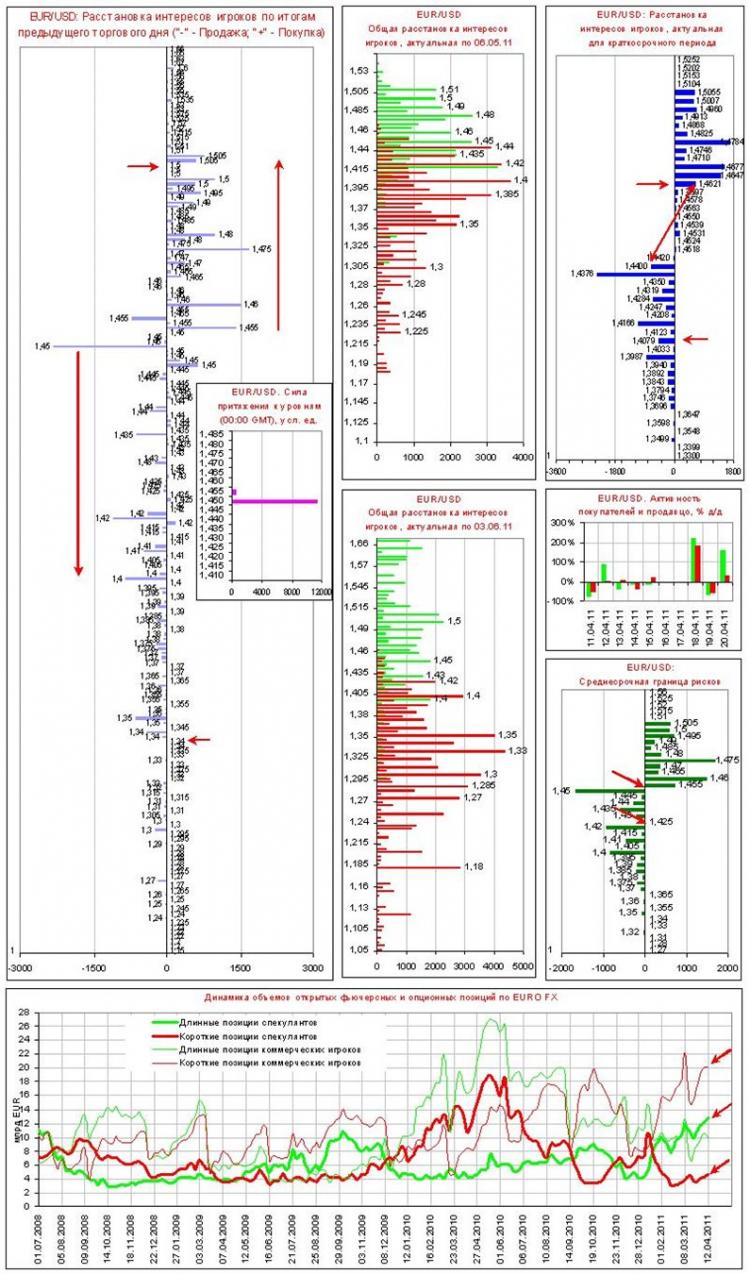

Everyone is voting that we are going to go up. The spread of interest shows that above 1.46-1.4650. There is no mutual interest in trading.That is why we are still near 1.46 and go south - by 1.3 the mutual interest in trading ends there as well.

Everyone is voting that we will go up. From the spread of interest, we can see that above 1.46-1.4650. There is no mutual interest in trading.

That is why it is about 1.46 and we should go south - the bilateral interest in trading ends there too, at 1.3.

a very beautiful, informative picture... and even in Russian.

Can you tell me from which site (or better the software) this data is from?

Thank you! Happy Easter, everyone!

When does the bidding start?

a very beautiful, informative picture... and even in Russian.

can you tell me from which website (or preferably software) this data is from?

from here

Yes, googled that site too.

Do you happen to know where the raw data is taken to calculate these charts?

(in the discussion someone replied that from Chicago CME...)