You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Вы лучше скажите, как связаны эти монетки между собой? А вот пары - связаны.

That's what I mean. That is why I singled out the author's 50/50 premise, which is only confusing. The pairs themselves may seem random on their own, but in relation to each other they are correlated.

Essentially, the idea boils down to this average correlation coefficient across pairs over a large enough sample (time) is almost a constant, right Andrew?

===

Several years ago I read somewhere, I think in Foex Magazin - I don't remember, an article by Easy Money about carry trade. At that time I wasn't interested in forwards at all, and carry trade is a thankless business now, but it was just about deviations of hedged currencies in terms of additional incomes besides differences on swaps. And there was also something about volume corrections to maintain the balance.

SZZ: I remember the topicstarter wrote somewhere that he sees valpars as a ball of snakes :), I started to draw snakes with my calculations:

But my snakes, as it turned out today, if two snakes, no matter what, even GBPCHF, too disperse, then there will be a trend change, if too close together, then there will be a trend change, if all at once "bent" - then just a correction, and a short-term trend change is somehow later than on my charts, ie I still have a time machine :D

HH: In the picture, the thin line is the axis around which the snake should be twisted, all the axes are offset, i.e. there is no common

Now the blue snake = EUR has returned to its axis, around which it was supposed to go

The blue one = yen, and the blueback = euro going around its axis quite well, only another candlestick in the news spoils the whole picture :)

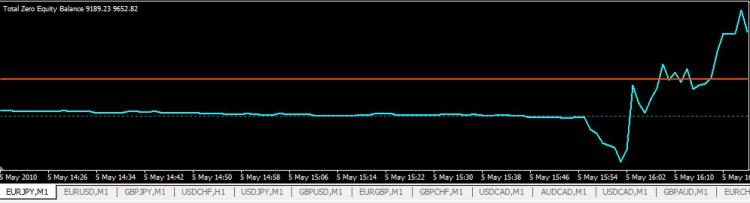

example of breaking the Ring by loc (+) and doubling (-)

The average pairwise correlation coefficient on a sufficiently large sample (time) is almost a constant, right Andrei?

apparently, yes, but rather the opposite on small time intervals

I re-read the first post in the thread, why did you marked some pairs in buy, others in sell?

I had to buy and sell as many times as i bought - for the balancing

Have you ever thought about the principle of the T101 portfolio?

You'll laugh - I have no idea how this terminator works

... count the rates, against the base, the base can be chosen whatever you want, not necessarily the quid.

i find it hard to imagine a non-fixed, floating reference point the proc in my brain can't handle, i guess.

But my snakes, as it turned out today, if two snakes, no matter what, even GBPCHF, get too far apart, then there will be a trend change, if they get too close, then there will be a trend change, if all at once "bent" - then just a correction, and the short-term trend change is somehow later than in my charts, i.e. I still have a time machine :D

HH: In the picture, the thin line is the axis around which the snake should be twisted, all the axes are offset, i.e. there is no common

and here is an example of a clearly premature ring-break (debugging the examiner)

Let's see how it ends...

Well, as long as no one's in the thread, I'll do the housework myself :)

>> I'll do it myself! )))

This is what my tangle looks like, Igor.

I am confused by the principle of portfolio formation = trade everything I see in the terminal :)

Can't you put your portfolio into some "human system"? Try, for example, taking GBPJPY anchor (from T101), rely on it and form your portfolio in the form:

USDGBP = 1/(GBPJPY/USDJPY)

EURGBP = 1/(GBPJPY/EURJPY)

i.e. you must use GBPJPY in every calculation and you will end up with a new base currency.

I looked at the last screen, there is definitely an analogy with mine, the yen part is clearly visible.

I'm confused by the principle of portfolio formation = trade everything I see in the terminal :)

Try to take the anchor (from T101) GBPJPY, build upon it and form your portfolio:

USDGBP =1/(GBPJPY/USDJPY)

EURGBP = 1/(GBPJPY/EURJPY)

i.e. any recalculation should necessarily use GBPJPY, as a result you will get a new base currency, and you may use such a portfolio for your ring, at least it makes sense

well, not everything in the terminal, so... 7 major ones... )))

where can i read about t101?

as for the recalculation via "anchor", the question still remains open to me: how can you jump from one ice floe to another in a rough river while wearing rollers?

CCFp counts every currency through the rest as it is...

:D

can you be more specific? what does it show and what is it based on?