You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

[attach=config]181679[/attach]

bullish ab=cd

Excuse me, but I wanted to know if anyone can help me to determine the targets of these patterns: 121 Black Swan 5-0 Leonardo Navarro 3 drivers thanks

This is what I do. Draw fibo and look for 23.6, 38.2, 50, 61.8 CD retracements for targets. I usually use 38.6 and 61.8 and also B of a pattern but it depends on confluence I find. Look at the 121 in the pic below. I see some confluence on 23.6, and 50 so my targets were 23.6 and 50. 38.2 could be a target too. Some traders with XD retracement for targets. Hope this gives you an idea to conceptualize some rule for targets.

This is what I do. Draw fibo and look for 23.6, 38.2, 50, 61.8 CD retracements for targets. I usually use 38.6 and 61.8 and also B of a pattern but it depends on confluence I find. Look at the 121 in the pic below. I see some confluence on 23.6, and 50 so my targets were 23.6 and 50. 38.2 could be a target too. Some traders with XD retracement for targets. Hope this gives you an idea to conceptualize some rule for targets.

Ok thank you very much aid, I thought that the targets were set at a fixed based on points.

Ok thank you very much aid, I thought that the targets were set at a fixed based on points.

You're very welcome. What do you mean by "fixed based on points?

EURUSD M30 - Potential bearish bat/N200.

You're very welcome. What do you mean by "fixed based on points?

In the sense that I did not think that the target was decided according to fibonacci retracement, but based on the points of the various patterns Xabcd

In the sense that I did not think that the target was decided according to fibonacci retracement, but based on the points of the various patterns Xabcd

If we trade harmonic patterns drawn by fibonacci rations, why don't we consider setting targets by using fibonacci ratios? That's what I thought and started using fibo ratios for targets. That's just what I do.

GBPUSD daily. Potential short reentry. Today's UK data pushed the pair up. Another UK data will be released tomorrow, which may push the pair higher up to fibonacci clusters I created or just retest recent high and leave DT. Divergence will be formed as well.

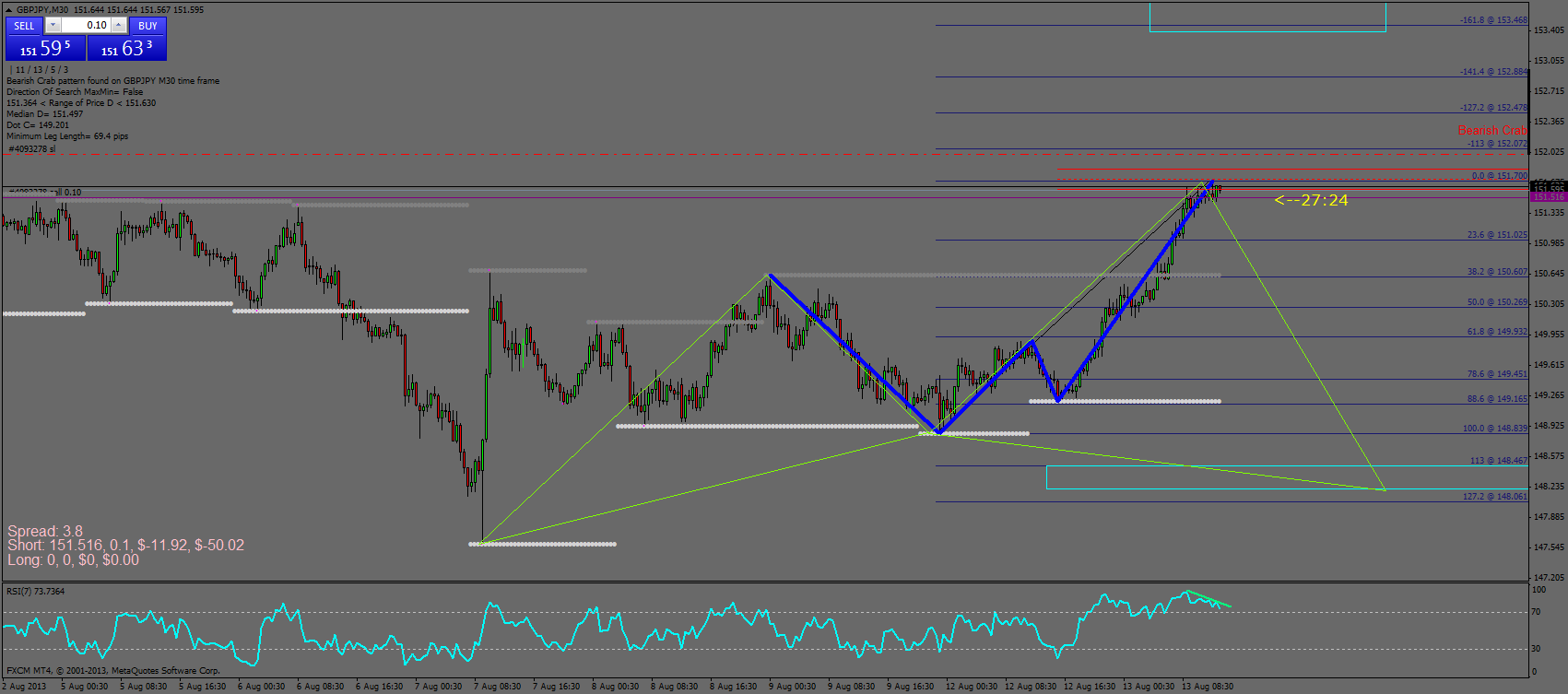

got another idea for the GBPJPY beside the navarro that have about 29 hours to complete otherwise it'll invalidate that

I went aggressive C on cypher- actually it appear to be safety C - we have RSI divergence on LTF and also bearish crab so.. up to you

I am planning to break even at 100 pips(it's around 38.2)

and keep rolling down with the trend 200 more pips and then begin my way up again.

Edited: I have been stoploss hunted, re-entered, if i'll get stopped out again, I am out of this ideathis morning gbpjpy went north closed above 141.4 so I just closed... seems to be the right call

NZDUSD 60m bearish cypher

anyone got that?