- Breakout traders should first find support & resistance

- Entries can be set as close as 1 pip above these values

- Support and resistance can also be used for managing a position

Today we will continue the Definitive Guide to Scalping as we focus on scalping breakouts.

GBPCAD Early Morning Breakout

Trading a Breakout

The first key to scalping breakouts is to identify key levels of support

and resistance. This can be done through a variety of methods mentioned

in the 4th installment of the Definitive Guide to Forex Scalping. Once

found, setting up a breakout trade is a straight forward process. In the

event of a level of resistance breaking, traders will look to buy. An

example of this is depicted above using todays GBPCAD price action.

Conversely, traders will look to sell when a key level of support falls.

The big question is always where to enter into the market in the event

of a breakout. Theoretically a breakout occurs if a level of support or

resistance is breached by even 1 pip! This allows aggressive scalpers to

get into the market as soon as possible. Some traders may flock to this

methodology as it lets traders maximize their profits when a trade

moves in their favor. However, getting into the market first also will

expose you to be the first trader stopped out in the event of a false

breakout. Traders that need further confirmation can wait for a 30

minute candle close and then make a decision whether to enter the

market.

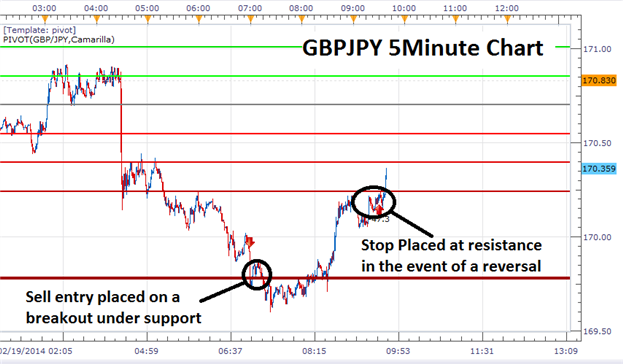

GBPJPY False Breakout with Stop

Risk and Breakouts

The first question I inevitably get regarding breakout trading, is how

to prevent false breakouts. While I understand that no one intends to

take a loss, it will happen at some point regardless of the strategy

that you use. With that being said, there is NO way to prevent false

breakouts. All we can do is to manage our risk when price moves back

against a breakout.

Above is an example of a false breakout this morning on the GBPJPY.

Notice how price broke cleanly through support, and then abruptly

changed directions. Even though at one time the trade might have been

profitable, when the market moves back above the designated breakout

area, traders should have a plan for exiting the market. When selling a

breakout of support, stops can be placed above this value which becomes

new resistance.

GBPCAD with Risk:Reward levels

Risk VS Reward

Overall, trading breakouts is an exciting way to approach scalping. It

should be noted since breakouts occur during times of market volatility

it is imperative to maximize your profits when the market breaks in your

favor! This can be done byusing a positive risk reward ratio. This

means traders should look to make more in profit, relative to what is

being risked through the placement of a stop order.

Highlighted above is a 1-2 Risk:Reward ratio with traders looking to

make 2x the amount of profit on a breakout relative to the amount

risked. This ratio can be improved by either reducing the amount risked

or increasing the amount of pips in profit targeted on a position.