This tutorial applies to 'The Dow Jones Killer MT5' EA whose product page is accessible by clicking on the image below:

The Dow Jones Killer is a state-of-the-art Expert Advisor (EA) designed for precise and efficient trading of the Dow Jones Index. It combines advanced trend and volume indicators across multiple timeframes to identify high-probability trade opportunities in real-time. The EA's responsive strategy uses hidden tight Stop Loss (SL) and Take Profit (TP) settings to prevent broker manipulation, allowing for quick, effective trades that minimize market risk exposure. Optimized for fast-moving markets, it adapts to various conditions while maintaining a high win rate. For best performance, use it with an ECN broker offering low latency, tight spreads, and fast order execution to ensure minimal slippage.

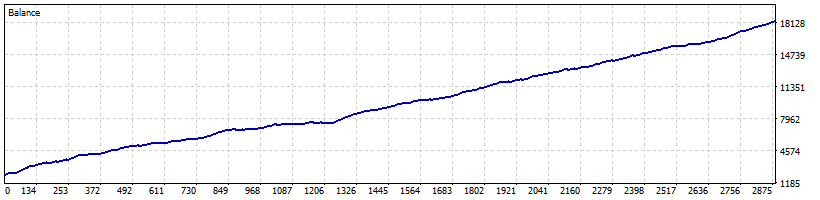

Below is the backtest of this EA for Dow Jones (default settings) from 01/01/2020:

Detailed features are described on the product page. Below is the list of EA settings with explanations.

-====Timing settings====-

Use Timer: define trading days and hours

Orders will only be opened on trading days. However, orders can be closed/modified even outside of the established time if at least one of the following parameters is enabled:

- 'Max % lost/day' ;

- 'Max % win/day' ;

- 'Close orders before weekend'.

- 'Max % lost/day' ;

- 'Max % win/day' ;

- 'Close orders before weekend'.

Monday: alerts & trading on Mondays

Tuesday: alerts & trading on Tuesdays

Wednesday: alerts & trading on Wednesdays

Thursday: alerts & trading on Thursdays

Friday: alerts & trading on Fridays

Saturday (crypto): alerts & trading on Saturday (generally for crypto trading)

Sunday (crypto): alerts & trading on Sunday (generally for crypto trading)

Start time: start of the session

End time: end of the session

Close orders before weekend: close all EA orders on Friday

Closing time before weekend: if ‘Close orders before weekend’ is ‘true’

-====Trading settings====-

Allow trading: if false, only alerts are operational. It is also possible to take into account buy orders or sell orders only.

Magic number: must be unique if other EA are running

Trading alerts: terminal and/or smartphone notifs

'Max open orders', 'Max % lost/day' and 'Max % win/day' are calculated from the magic number. For example, if you have 3 EAs with the same magic number, the total number of orders opened will be the sum of the orders opened in those 3 EAs.

Max open orders: max number of orders opened simultaneously (if 0, no max)

Max lost/day (in % of equity): if max value is reached, the EA open orders are closed and no other order is opened until the next day (if 0, no max)

The calculation is based on equity and not balance. In order to speed up the backtests, the calculation is done every hour during backtests, instead of every minute for a real trading session.

Max win/day (in % of equity): if max value is reached, the EA open orders are closed and no other order is opened until the next day (if 0, no max)

Same remark than for 'Max lost/day (in % of equity)'.

Max drawdown (in % of equity): if max value is reached, the EA open orders are closed and the EA is closed (if 0, no max)

Same remark than for 'Max lost/day (in % of equity)', but the calculation is done every 5 minutes (for backtests and real trading sessions).

Use money management: if ‘true’, lot size in % balance

Fixed lots size: lot size per order (if ‘Use money management’ is ‘false')

Lot size in %: % balance per order (if ‘Use money management’ is ‘true’)

Max spread: max allowed spread to open an order (if 0, no max spread)

Warning: if the value of the spread is too low, no order will be opened! To avoid any problem, it is recommended to set the value '0' for the backtests.

Max slippage: max allowed slippage to open an order

Same remark as 'Max spread'.

Warning:

- Do not use this EA with any symbol other than the Dow Jones.

- Trading involves significant risk, and past performance is not indicative of future results. Only invest money you can afford to lose.