How to Make Profit from Forex Trading Using Expert Advisors (EAs)

Forex trading with Expert Advisors (EAs) can be an effective way to automate your trading strategies and potentially increase your profits. Here are some key strategies and considerations for making the most out of trading with EAs.

-

1. Understanding Expert Advisors

It is important to understand how an Expert Advisor is work

Expert Advisors (EAs) are automated trading systems designed to execute trades in the forex market based on predefined algorithms and strategies. Here’s a closer look at how they work and their significance in trading:

- Automation of Trading Decisions:

- EAs automate the trading process by analyzing market data, identifying trading opportunities, and executing trades without the need for human intervention. This automation helps eliminate emotional decision-making, allowing for a more disciplined trading approach

- Algorithm-Based Strategies:

- EAs operate based on specific algorithms that utilize technical indicators, price action, and other market data to generate trading signals. These signals dictate when to enter or exit trades, making EAs a valuable tool for traders looking to implement systematic strategies.

- Advantages of Using EAs:

- One of the primary benefits of EAs is their ability to operate 24/7, taking advantage of trading opportunities around the clock. They can also backtest strategies using historical data to optimize performance before live trading.

In this case .

Market Reversal EA

https://www.mql5.com/en/market/product/122265?source=Site+Market+Product+Page

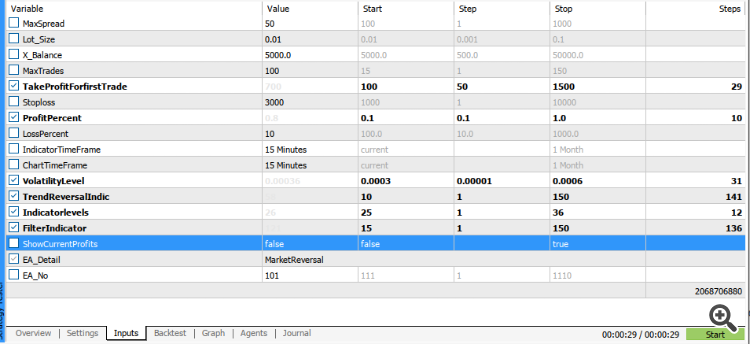

1. MaxSpread is the max value of spread for trade. If Spread is going grater than max level then EA will stop trading.

2. Lot size on balance you selected in x_balance

if you select 0.01 lotsize on 200 x_balance if balance going on 400 lotsize will be 0.02 automatic

3. MaxTrades

This option allow you to control number of max sell and buy trades. if you select max 50 trades its mean 50 sell and 50 buy trades

4.TakeProfit for fist trade.

In this case, there is no buy position exist and first open buy position place take profit and no stoploss same method for sell position.

5.Stoploss

In this case, if already buy position exist and then open new buy position it will place with stop loss with no takeprofit same method for sell position.

6. ProfitPerecent.

If profit of all buy or sell trade greater than percent value of total balance the close all sell or buy trades.

7. Loss Percent.

If Loss of all buy or sell trade lower than percent value of total balance the close all sell or buy trades.

8. IndicatorsTimeFrame

9. ChartTimeFrame

This option allow you to control trades. only one trade allow in one candle if M1 select one trade open in 1 minute if H4 select one trade open in 4 hours

10. VolatilityInCandles .

11. Volatility Level.

These two options are Measuring Volatility. If Volatility of current symbol is grater then selected level and EA generate buy or sell signal it will open order.

12.Trend Reversal Indicator.

13. Indicator levels.

These two option related to indicator. If indicator value is greater then high level its meaning value of Symbol in which you trade is over buy and over sold if lower then down level.

14. Filter Indicator

This indicator is help to find best price for sell or buy trade signal.

15.Show current Profit.

This option show the profit of current buy and sell position and number of sell and buy positions

16. EA detail.

This is for show your EA in Trade Comments

17. EA no

This is Magic Number of your EA

- 2. Optimize Your EA Settings

Basic Trading Principles and EA Functionality

In trading, a fundamental principle is that "when product prices are high, it is time to sell", and "when prices are low, it is time to buy". This principle is crucial for making informed trading decisions and is effectively utilized by Expert Advisors (EAs).

1. Trading Strategy:

The EA operates on the premise that when the price is in an "overbought" condition, it is likely to decline, signaling a good opportunity to sell. Conversely, when the price is "oversold", it indicates a potential rise, suggesting it is a good time to buy. This strategy aligns with the basic trading rule of buying low and selling high.

2. Optimization for Best Performance:

Optimization is a critical process in configuring an EA. It involves adjusting the parameters of the EA to find the optimal settings that enhance its performance. By optimizing the EA, traders can ensure that buying and selling actions are executed at the best possible prices, maximizing potential profits.

3. Importance of Continuous Adjustment:

While EAs automate trading, they still require "continuous monitoring and adjustment" to adapt to changing market conditions. Regularly reviewing the EA's performance and making necessary tweaks can help maintain its effectiveness over time.

By adhering to these principles and utilizing optimization techniques, traders can enhance their trading strategies and improve the overall performance of their EAs.

what we do when settings sets in millions?

In this case we use Fast genetic based algorithm in MT5.

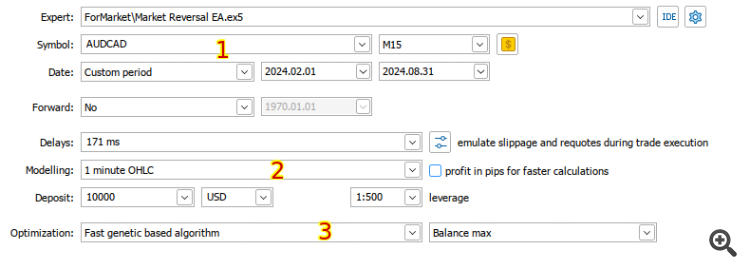

1- First chose your EA ,Symbol,Time frame,Last Six month date and no forward.

2-Select ping Delays,Modelling , uncheck Profit in pip, Deposit and leverage.

3-Chose Optimization Fast genetic and Balance max

Then set your settings that you imagine the best setting in these settings.

After Optimizing is completed.

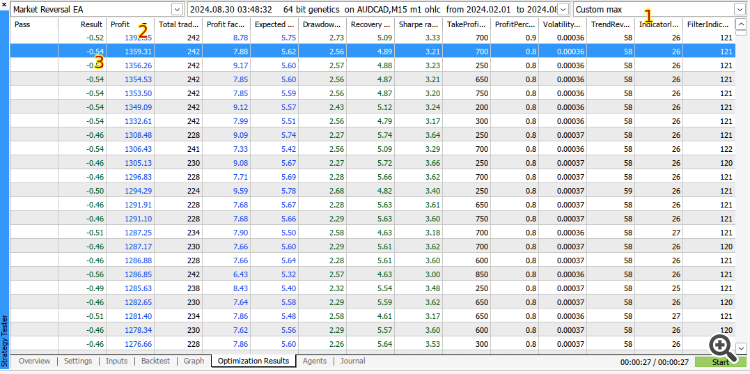

Select Settings

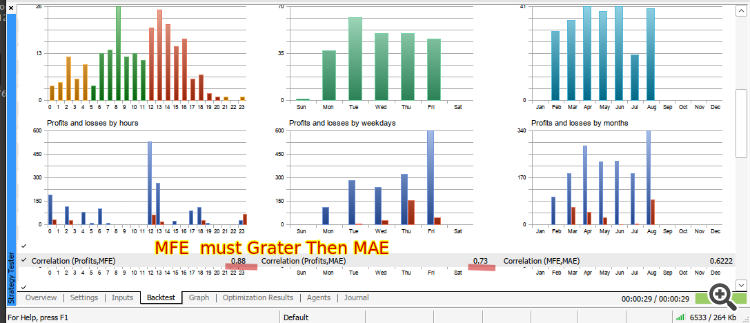

1-Chose Custom max

2-Click on profit

3-Chose Min Balance Drawdown Relative less then -1 and Equity Drawdown less then 3.

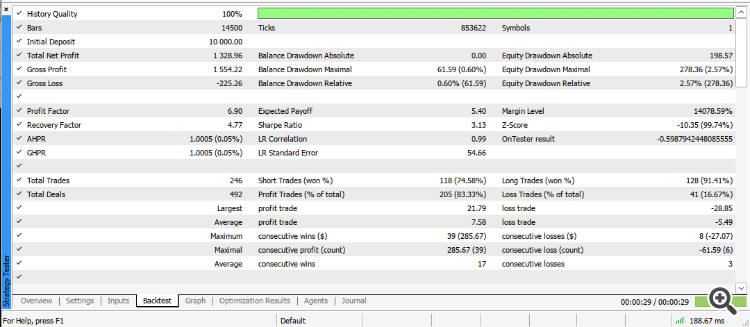

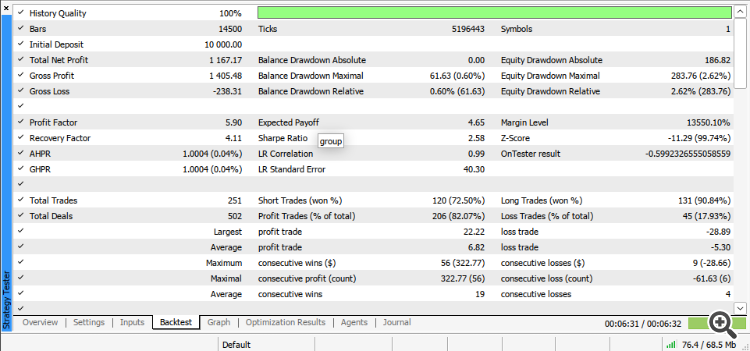

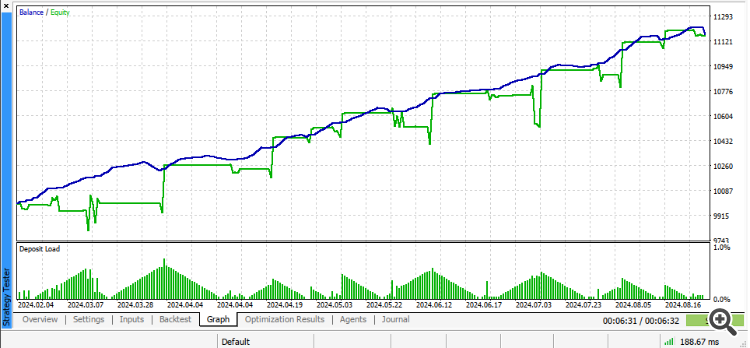

This is 1 minute OHLC result

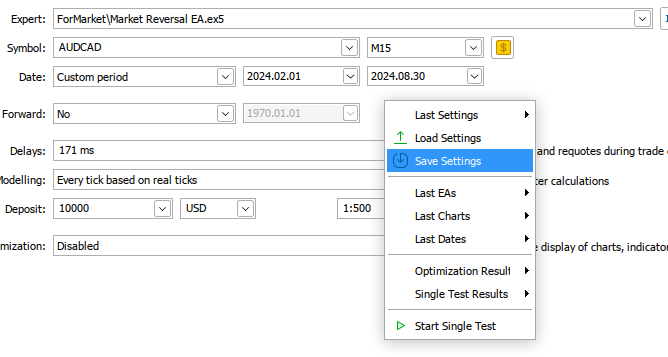

This is Every tick based on real ticks Result.

Note that there is not Equal result but 1 minute OHLC option save much time and computing power and its results is works in real market but some EAs must be optimize in Every tick based on real ticks.

To more refined setting you can repeat this process again but this time parameter more close to Profit able setting.

Note. Never over fit your EA setting on History date this is not profit able.

- 3.Continuous Monitoring and Adjustment of EAs

Even though Expert Advisors (EAs) automate trading, continuous monitoring is essential for maintaining their effectiveness. Here are some key points to consider:

1. Market Dynamics:

Market conditions can change rapidly, and strategies that were profitable in the past may not yield the same results in the future. Regularly reviewing the performance of your EA is crucial to adapt to these changes.

2. Performance Review:

It's important to conduct regular performance reviews of your EA. This includes analyzing its trading results and making necessary adjustments to settings or strategies based on current market conditions.

3. Avoiding Neglect:

Many traders make the mistake of setting up an EA and then neglecting to monitor its performance. This can lead to significant losses if the EA is not performing as expected.

4. Updates and Improvements:

Regularly check for updates or improvements to your EA, especially if it was purchased from a third-party provider. Developers often release updates to enhance performance or adapt to new market conditions.

5. Walk-Forward Testing:

Implementing walk-forward testing can help ensure that your EA remains robust and adaptable to changing market dynamics. This process involves periodically re-optimizing the EA based on the latest market data.

By maintaining a proactive approach to monitoring and adjusting your EA, you can enhance its performance and better navigate the complexities of the trading environment.

In this case EA set is profitable for a week and next week you must repeat this process and set new settings.

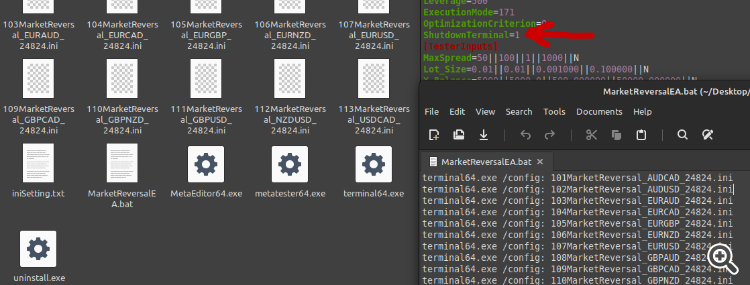

- 4. For multi symbol Auto back testing

For Start this process for multiple symbol you need to use text.bat format file with some settings

1. Enable your file extension option in window or Linux of you not know search of internet.

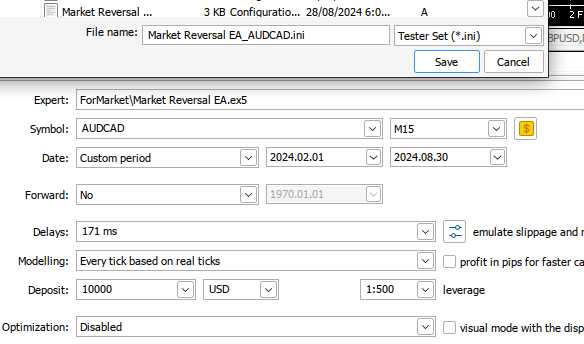

2. Create .ini file and Save file where you want.

3. .bat file format for Linux like this without double quotation marks and write ShutdownTerminal=1 command last of all settings upper Testerinputs of .ini file.

terminal64.exe /config: 101MarketReversal_AUDCAD

.bat file format for windows like this with double quotation marks and write ShutdownTerminal=1 command last of all settings upper Testerinputs of .ini file..

"terminal64.exe" /config: "101MarketReversal_AUDCAD"

If .bat file in different folder type full path of terminal and full path of .ini file.

path_to_platform\terminal64.exe /config:c:\path_to_file\myconfiguration.ini

This is easy way to start .bat file all .ini files and bat file in terminal folder.

To run .bat file in Linux right click on .bat file and Open with wine and Run .bat file in windows double click on file.

Note. First your terminal Exit. Then you run .bat file it will run all your .ini files one by one and save your test results in terminal.

For more guideline visit this link.

https://www.metatrader5.com/en/terminal/help/start_advanced/start

| Test History | Symbol name | Deposit | Net Profit | Balance DD | Equity DD | Profit factor | MAE | MFE |

|---|---|---|---|---|---|---|---|---|

| 2024.02.01 2024.09.01 | AUDCAD | 10000 | 1328 | 61.59(0.6%) | 278(2.57%) | 6.67 | 0.69 | 0.88 |

| 2024.02.01 2024.09.01 | AUDUSD | 10000 | 2148 | 66.43(0.56%) | 330(2.94%) | 8.51 | 0.65 | 0.80 |

| 2024.02.01 2024.09.01 | EURCAD | 10000 | 1562 | 153.68(1.31%) | 287(2.62%) | 8.61 | 0.68 | 0.83 |

| 2024.02.01 2024.09.01 | EURGBP | 10000 | 607 | 60.43(0.57%) | 159(1.56%) | 6.78 | 0.76 | 0.86 |

| 2024.02.01 2024.09.01 | EURNZD | 10000 | 915 | 51.54(0.48%) | 102(0.95%) | 4.84 | 0.59 | 0.69 |

| 2024.02.01 2024.09.01 | EURUSD | 10000 | 1242 | 84(0.74%) | 268(2.48%) | 7.24 | 0.68 | 0.85 |

| 2024.02.01 2024.09.01 | GBPNZD | 10000 | 558 | 38.43(0.33%) | 121(1.17%) | 7.98 | 0.32 | 0.86 |

| 2024.02.01 2024.09.01 | GBPUSD | 10000 | 1010 | 63(0.59%) | 190(1.79%) | 6.57 | 0.64 | 0.83 |

| 2024.02.01 2024.09.01 | NZDUSD | 10000 | 1671 | 120.42(1.02%) | 241(2.12%) | 5.84 | 0.76 | 0.89 |

| 2024.02.01 2024.09.01 | USDCAD | 10000 | 1237 | 82(0.74%) | 288(2.68%) | 5.21 | 0.72 | 0.88 |

| 2024.02.01 2024.09.01 | USDCHF | 10000 | 1501 | 78(0.72%) | 294(2.68%) | 4.66 | 0.73 | 0.80 |

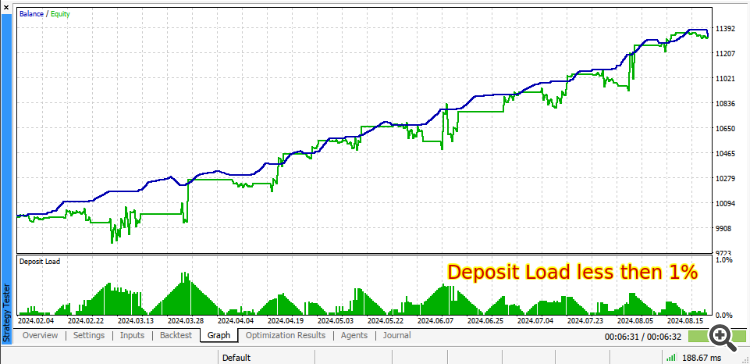

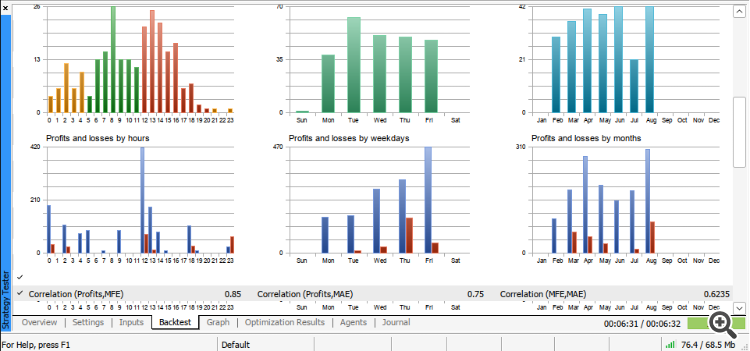

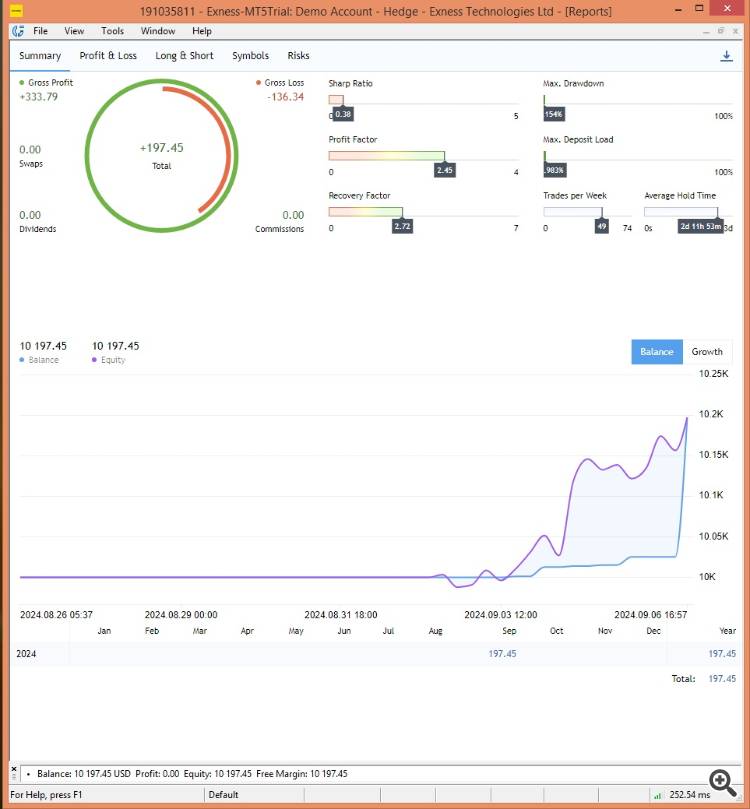

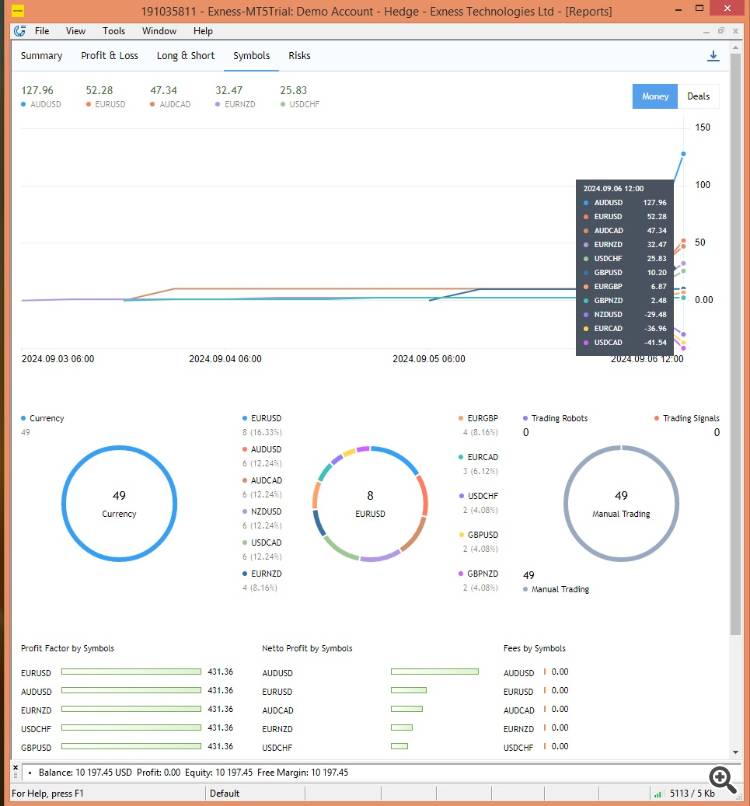

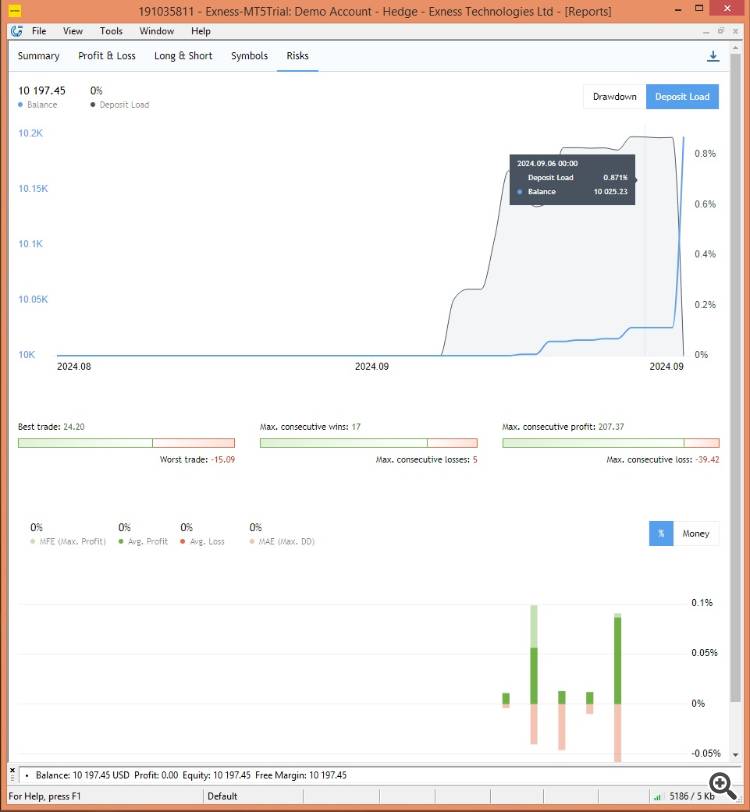

- 5. Real market Results

After a week of live trading the results is as expected.

Now after a week total profit return is 2% .

All details of results are in the images uploaded please examine these images .

Trades details in Excel file that is also attached please download.

- 6. Education and Community Engagement

Stay informed about the latest trends in Forex trading and engage with trading communities. Learning from other traders' experiences and insights can provide valuable knowledge that can enhance your trading strategies and the effectiveness of your EA.

By leveraging the capabilities of Expert Advisors and following these strategies, you can increase your chances of making a profit in Forex trading while minimizing risks.

Summary of Expert Advisor (EA) Trading Principles

When utilizing Expert Advisors (EAs) in trading, it's crucial to adopt strategies that enhance profitability while minimizing risks. Here are some key principles to consider:

1. Avoid Overfitting with Historical Data:

Overfitting your EA with extensive historical data can lead to poor performance in future trading. It's essential to ensure that the EA is not overly tailored to past market conditions, as this may not translate to future profitability.

2. Diversification Across Symbols:

Attaching your EA to multiple currency pairs can be beneficial. If some pairs incur losses, others may yield profits, thereby increasing your overall chances of profitability. This diversification strategy helps mitigate risks associated with individual trades.

3. Manage Account Balance Wisely:

It's vital not to overload your trades relative to your account balance. Excessive trading can deplete your account quickly, leading to significant losses. Maintaining a balanced approach to trading volume is essential for long-term success.

4. Use Appropriate Historical Data for Predictions:

Utilizing a small amount of historical data is suitable for making short-term predictions. However, for more reliable forecasts, a broader dataset may be necessary to capture various market conditions.

5. Optimization of EA Settings:

The effectiveness of future predictions heavily relies on the optimization of your EA settings. Properly tuning these settings based on optimization results can significantly enhance the EA's performance.By adhering to these principles, traders can improve their chances of achieving consistent profits while managing the inherent risks of trading with EAs.