EURUSD Forecast: The Pair May Continue Declining Towards 1.1000

Current EURUSD price: 1.1046

Recession fears in the Eurozone have put pressure on the euro.

U.S. inflation and ECB monetary policy will be the focus this week.

EURUSD remains under selling pressure, with critical support at 1.1020.

The EURUSD pair dropped to 1.1035 during European trading hours as the euro was hit by weak local data, fueling concerns over the Eurozone's economic performance. Meanwhile, the U.S. dollar remained steady due to caution ahead of key events scheduled for this week.

The Eurozone released the September Sentix Investor Confidence Index, which fell for the third consecutive month to -15.4. The accompanying report indicated that the region's economy is on the brink of recession, largely due to poor performance in Germany. On Monday, the U.S. macroeconomic calendar will be light, with only wholesale inventory data for July and consumer credit changes for the same month being published.

However, on Wednesday, the U.S. will release the August Consumer Price Index (CPI), which is expected to have risen by 2.6% year-on-year. This figure would still be above the Federal Reserve's target of around 2%, but it would be an improvement from the 2.9% recorded in July. Additionally, on Thursday, the European Central Bank (ECB) will announce its monetary policy decision. It is widely expected that the ECB will cut rates by 25 basis points, following a previous rate cut. Today's EU data support the notion of easing monetary policy, given the risks that high rates pose to economic progress.

Short-Term Technical Outlook for EURUSD

The pair opened with a bearish gap and continued to decline. The moderately bullish 20-period Simple Moving Average (SMA) is providing resistance at 1.1090, while the 100 SMA is slowly rising above the 200 SMA in the 1.0850 price zone. However, technical indicators are heading firmly south, with the momentum indicator already below the 100 level, signaling continued selling pressure.

In the near term, based on the 4-hour chart, the risk is tilted to the downside. The pair extended its fall below the 20- and 100-day SMAs, with the shorter one gradually gaining bearish momentum. Technical indicators have stabilized as the pair bounced from the mentioned intraday low but remain in negative territory with no signs of exhaustion of the bearish trend. Support is at 1.1020, and breaking this level could trigger another sharp move to the downside.

Support Levels:

- 1.1020

- 1.0975

- 1.0930

Resistance Levels:

- 1.1090

- 1.1115

- 1.1150

Thanks for preparing the review to Valeria Bednarik

USE TRADING ROBOT FOR SCALPING ON EURUSD

✨ Advisor for Real Trading - Ice Cube Scalper! ✨

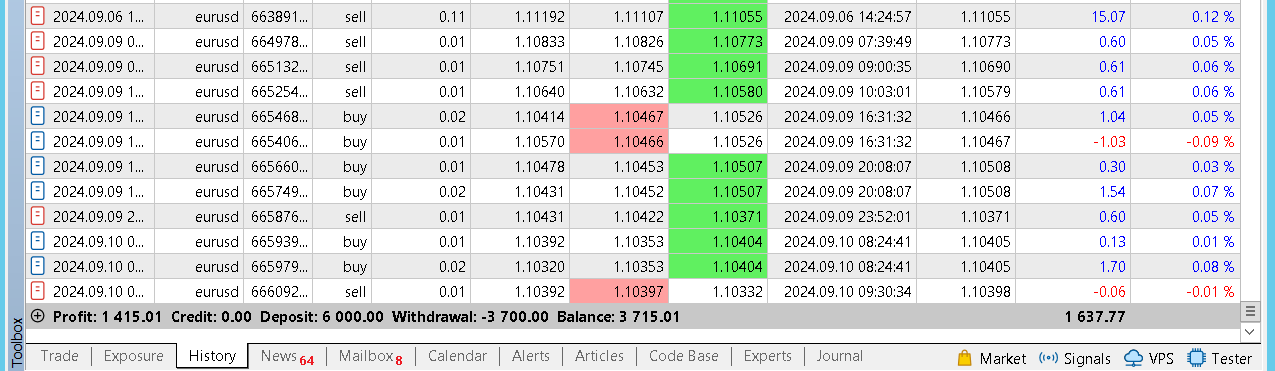

📈 Profitability: 421% in 84 weeks 💰

💼 Proven strategy - time-tested and stable!

🔍 Versions for MT4 and MT5 available.

МТ4 version – https://www.mql5.com/en/market/product/77108

МТ5 version - https://www.mql5.com/en/market/product/77697