How to Choose a Trading Signal:

A Forex Trader’s Guide

Trading signals can be a valuable tool for Forex traders, providing insights and recommendations on potential trading opportunities.

However, with countless providers offering a variety of services, selecting the right one can be overwhelming. This article will guide you through the essential factors to consider when choosing a trading signal.

Understanding Trading Signals

Before diving into the selection process, it’s crucial to grasp what trading signals are. Essentially, they are recommendations, generated by either human experts or automated systems, indicating potential entry and exit points for a trade. They often include information such as the currency pair, direction (buy or sell), stop-loss and take-profit levels, and the underlying rationale.

Understand Trading Signals

What are they? Recommendations to buy or sell an asset at a specific price.

How are they generated? By humans, algorithms, or a combination of both.

- Types: Forex, stocks, cryptocurrencies, and more.

- Delivery methods: Email, SMS, app notifications.

Key Factors to Consider

1.Provider Reputation and Track Record:

Research the provider’s history, reputation, and customer reviews.

Analyze their performance track record, including win rates, average profit per trade, and drawdown.

Be wary of providers with unrealistic claims or promises of guaranteed profits.

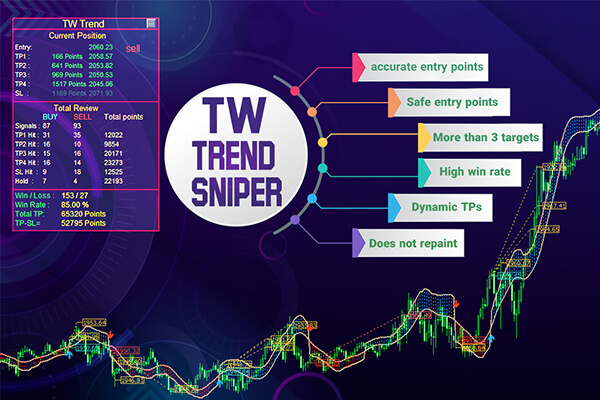

2.Signal Accuracy and Consistency:

Evaluate the signal provider’s historical performance data.

Look for consistency in signal quality over different market conditions.

Consider the signal-to-noise ratio; a high number of false signals can be detrimental.

3.Trading Style Compatibility:

Ensure the signal provider’s trading style aligns with your own.

Consider factors like timeframes, risk tolerance, and preferred trading strategies.

A mismatch between your style and the signal provider’s approach can lead to suboptimal results.

4.Transparency and Communication:

A reputable provider will be transparent about their methodology and trading strategies.

Look for clear communication channels and timely updates.

Avoid providers who are secretive or reluctant to share information.

5.Cost and Value:

Compare the cost of the signal service with the potential benefits.

Consider the value proposition and whether the service justifies the price.

Be cautious of excessively cheap or expensive options.

6.Trial Period:

Many signal providers offer free trials or demo accounts.

Take advantage of these opportunities to assess the service firsthand.

Test the signals with a small, virtual account before committing real capital.

7.Customer Support:

Reliable customer support is essential for addressing queries and resolving issues.

Evaluate the provider’s responsiveness and helpfulness.

Additional Tips

- Diversify Your Signals: Relying solely on one signal provider is risky. Consider using multiple sources to increase your chances of success.

- Backtesting: If possible, backtest the signal provider’s historical data to assess performance under different market conditions.

- Risk Management: Always implement robust risk management strategies, even when using trading signals.

- Education and Learning: Trading signals should complement your trading knowledge, not replace it. Continue to educate yourself about the forex market.

- Continuous evaluation: Monitor the signal’s performance and adjust your strategy accordingly.

Common Mistakes to Avoid

- Chasing high returns: Unrealistic promises often lead to losses.

- Ignoring fees: Hidden costs can erode profits.

- Overreliance on signals: Develop your own trading knowledge.

- Lack of risk management: Proper risk control is essential.

Where to Find Trading Signals?

- Brokerage platforms: Many offer built-in signal services.

- Independent signal providers: Numerous online platforms specialize in trading signals.

- Social trading networks: Connect with experienced traders and copy their trades.

By carefully considering these factors and conducting thorough research, you can increase your chances of finding a trading signal provider that aligns with your goals and helps you achieve better results. Remember, no signal service guarantees profits, and successful trading ultimately depends on your ability to manage risk and adapt to changing market conditions.

Disclaimer: Trading involves significant risk and the potential for loss. This article is for informational purposes only and should not be considered financial advice.

Happy trading

may the pips be ever in your favor!