How I Passed "Prop Firm Challenge" Using "Supply Demand EA ProBot"

Hello traders,

On this post i demonstrate you the settings that i used on "Supply Demand EA ProBot" to pass the Prop Firm Challenge

and a few words about my Trading Strategy. Also i recorded a video where you can see some of live trades and all of my closed positions on the trading history.

There are so many ways that you can use the "Supply Demand EA ProBot" . It is offering countless possibilities.

I would like to love to get your trading ideas about the Strategy you prefer to use using the Supply Demand Principles.

MT4 Version: https://www.mql5.com/en/market/product/116645

MT5 Version: https://www.mql5.com/en/market/product/117023

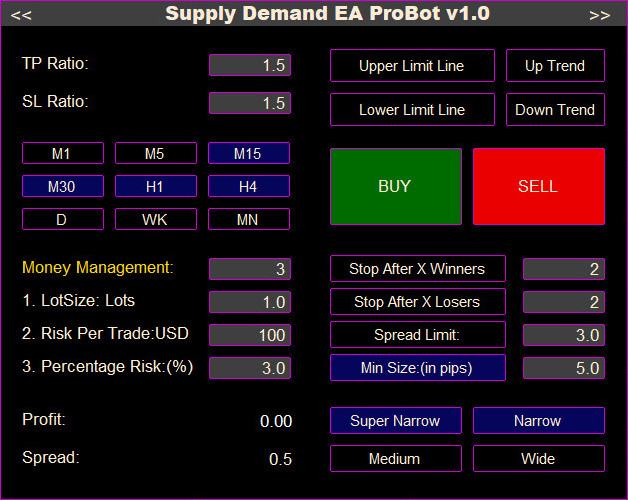

Panel Inputs:

TP Ratio: 1.5

SL Ratio:1.5

Timeframes : I chose to place trades from M15 to H4 timeframes

Avoid to trade 1min and 5min timeframes.

Money Management: 3

Percentage Risk %: 3.0

I used 3.0% percentage risk but if you want a more conservative approach you can use 2.0% or 1.0%

Trading Direction: I had enabled both BUY and SELL direction.

After a trade was placed automatically i also was checking it and if it was a trade that i thought that is not

high quality i was exiting in a small profit or in a small loss.

Min size(in pips): 4-5 pips for low spread forex pairs

or

Min size(in pips): 50-70 pips for Gold pair

Type of Zones: I had enbled trades only on Narrow and SuperNarrow Zones

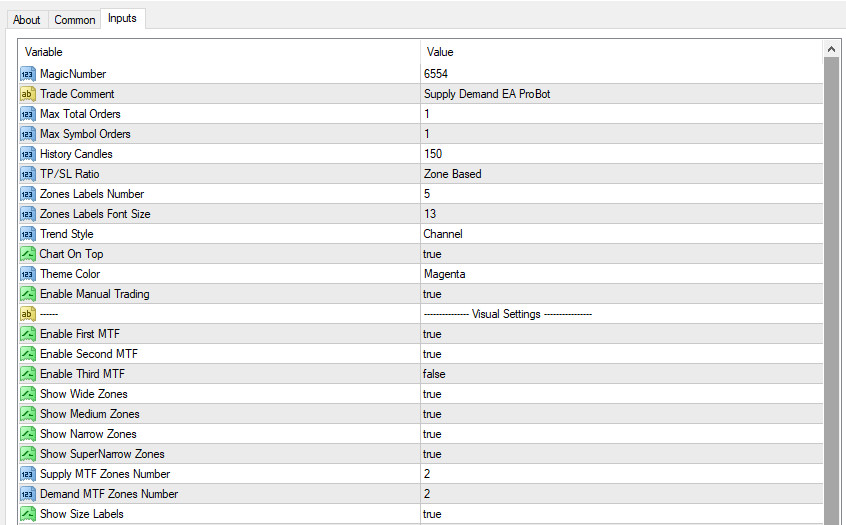

Input Parameters Settings:

TP/SL Ratio: Zone Based

Max Open Orders : 1

Max Symbol Orders: 1

Enable Manual Trading: true

I had enabled Manual trading and some of my trades were placed manually on high quality zones that i spotted by scanning

the markets.

A few words about my Strategy:

I had enabled Push Notification Alerts and when a new trade was opened i was getting a notification on my phone.

After i got the notification i was checking my platform to check the trade that was placed.

If it was a quality trade setup i was moving the TP even higher than 1.5 , if it was a trade that i thought it was not a good setup then

i was moving my TP into a small profit or into a small loss in order to avoid the full Loss.

My goal was to maximize my Profits and minimize the Loses. Loses are always part of the game so we can't avoid them

but we can minimize them, we need to close the trade early if we see that price action does not go in our favor.

Also i was checking my overall risk not to be more than $3k including Closed Trades and the Floating P/L at any given time.

That is easy to do because on the "Panel Extension" you can see real-time the current Closed Trades P/L+ Floating P/L.

If you have more than $3k loss within a day , it would be better to stop trading for the day and continue the next day.

On the video below you are able to watch some of my trading setups, the pairs that i had attached on the platform,

and all my position history untill i managed to exceed the $10k goal.