The paradigm of working with signals for advisors Neon Trade MT4 and NeonTrade MT5 is described in this post, along with a listing of currently available signals.

Introduction

Brokers recommended for using the full range of signals

Characteristics of grouping settings by folders with signals

- dev - the smaller this number, the smoother the profit curve. (0 - perfectly smooth line)

- pos - the minimum acceptable number of positions in the setting

- q - the quality of the setting (typically equivalent to the profit factor, minus all costs, such as spreads and swaps)

Listing of available signals (folders with settings grouped by different criteria)

Signals of regular currency pairs with clustering by time and days:

Regular signals with long position holding:

- Signal1 - dev = 0.2 ; pos = 150+ ; q = 0.15 +

- Signal2 - dev = 0.15 ; pos = 50+ ; q = 0.15 +

- Signal3 - dev = 0.2 ; pos = 150+ ; q = 0.25 + ; H1 only

- Signal4 - dev = 0.15 ; pos = 100+ ; q = 0.15 +

- Signal5 - dev = 0.2 ; pos = 150+ ; q = 0.25 +

- Signal6 - dev = 0.15 ; pos = 50+ ; q = 0.25 +

- Signal7 - dev = 0.15 ; pos = 100+ ; q = 0.25 +

- Signal8 - dev = 0.2 ; pos = 150+ ; q = 0.35 +

- Signal9 - dev = 0.15 ; pos = 50+ ; q = 0.35 +

- Signal10 - dev = 0.15 ; pos = 100+ ; q = 0.35 +

- Signal11 - dev = 0.1 ; pos = 100+ ; q = 0.15 +

- Signal12 - dev = 0.1 ; pos = 150+ ; q = 0.25 +

- Signal13 - dev = 0.1 ; pos = 220+ ; q = 0.25 +

Short-term position signals (we aim to close the position as early as possible, but also look for a good exit point):

- Signal1scalp - dev = 0.2 ; pos = 150+ ; q = 0.15 +

- Signal2scalp - dev = 0.15 ; pos = 50+ ; q = 0.15 +

- Signal4scalp - dev = 0.15 ; pos = 100+ ; q = 0.15 +

- Signal5scalp - dev = 0.2 ; pos = 150+ ; q = 0.25 +

- Signal6scalp - dev = 0.15 ; pos = 50+ ; q = 0.25 +

- Signal7scalp - dev = 0.15 ; pos = 100+ ; q = 0.25 +

- Signal8scalp - dev = 0.2 ; pos = 150+ ; q = 0.35 +

- Signal9scalp - dev = 0.15 ; pos = 50+ ; q = 0.35 +

- Signal10scalp - dev = 0.15 ; pos = 100+ ; q = 0.35 +

- Signal11scalp - dev = 0.1 ; pos = 100+ ; q = 0.15 +

- Signal12scalp - dev = 0.1 ; pos = 150+ ; q = 0.25 +

- Signal13scalp - dev = 0.1 ; pos = 220+ ; q = 0.25 +

Short position-holding signals, additionally specifying a window for the position to exist (the position is closed when exiting the temporary window if the temporary window is selected correctly):

- Signal1CIOOT - dev = 0.2 ; pos = 150+ ; q = 0.15 + ;

- Signal2CIOOT - dev = 0.15 ; pos = 50+ ; q = 0.15 + ;

- Signal3CIOOT - dev = 0.15 ; pos = 100+ ; q = 0.15 + ;

crypto signals with clustering by time and days:

Regular signals with long position holding:- Crypto1 - dev = 0.2 ; pos = 70+ ; q = 0.35+ ;

- Crypto2 - dev = 0.15 ; pos = 30+ ; q = 0.25+;

- Crypto4 - dev = 0.15 ; pos = 40+ ; q = 0.15+;

- Crypto5 - dev = 0.1 ; pos = 40+ ; q = 0.15+;

Short-term position signals (we aim to close the position as early as possible, but also look for a good exit point):

- Crypto1scalp - dev = 0.2 ; pos = 70+ ; q = 0.15+ ;

- Crypto2scalp - dev = 0.15 ; pos = 30+ ; q = 0.15+;

- Crypto4scalp - dev = 0.15 ; pos = 40+ ; q = 0.15+;

- Crypto5scalp - dev = 0.1 ; pos = 40+ ; q = 0.15+;

Signals for American stocks with clustering by time and days:

Regular signals with long position holding:- STOCKS1 - dev = 0.2 ; pos = 150+ ; q = 0.15 +

- STOCKS2 - dev = 0.15 ; pos = 50+ ; q = 0.15 +

- STOCKS4 - dev = 0.15 ; pos = 100+ ; q = 0.15 +

- STOCKS5 - dev = 0.2 ; pos = 150+ ; q = 0.25 +

- STOCKS6 - dev = 0.15 ; pos = 50+ ; q = 0.25 +

- STOCKS7 - dev = 0.15 ; pos = 100+ ; q = 0.25 +

- STOCKS8 - dev = 0.2 ; pos = 150+ ; q = 0.35 +

- STOCKS9 - dev = 0.15 ; pos = 50+ ; q = 0.35 +

- STOCKS10 - dev = 0.15 ; pos = 100+ ; q = 0.35 +

- STOCKS11 - dev = 0.1 ; pos = 100+ ; q = 0.15 +

- STOCKS12 - dev = 0.1 ; pos = 30+ ; q = 0.25 +

- STOCKS13 - dev = 0.1 ; pos = 50+ ; q = 0.25 +

Short-term position signals (we aim to close the position as early as possible, but also look for a good exit point):

- STOCKS1scalp - dev = 0.2 ; pos = 150+ ; q = 0.15 +

- STOCKS2scalp - dev = 0.15 ; pos = 50+ ; q = 0.15 +

- STOCKS4scalp - dev = 0.15 ; pos = 100+ ; q = 0.15 +

- STOCKS5scalp - dev = 0.2 ; pos = 150+ ; q = 0.25 +

- STOCKS6scalp - dev = 0.15 ; pos = 50+ ; q = 0.25 +

- STOCKS7scalp - dev = 0.15 ; pos = 100+ ; q = 0.25 +

- STOCKS8scalp - dev = 0.2 ; pos = 150+ ; q = 0.35 +

- STOCKS9scalp - dev = 0.15 ; pos = 50+ ; q = 0.35 +

- STOCKS10scalp - dev = 0.15 ; pos = 100+ ; q = 0.35 +

- STOCKS11scalp - dev = 0.1 ; pos = 100+ ; q = 0.15 +

- STOCKS12scalp - dev = 0.1 ; pos = 30+ ; q = 0.25 +

- STOCKS13scalp - dev = 0.1 ; pos = 50+ ; q = 0.25 +

- STOCKS1CIOOT - dev = 0.2 ; pos = 150+ ; q = 0.15 + ;

- STOCKS2CIOOT - dev = 0.15 ; pos = 50+ ; q = 0.15 + ;

- STOCKS3CIOOT - dev = 0.15 ; pos = 100+ ; q = 0.15 + ;

Manual Assemblies (we select them individually, specifically for you, manually, using settings from our automatic channels):

- ManualAssembly1 - assembly for regular currency pairs

- CryptoAssembly1 - assembly for cryptocurrencies

- StocksAssembly1 - assembly for American stocks

It is worth noting that not all signals may contain settings for various reasons, for example, it may not be possible to generate at least one setting that meets the signal requirements. However, after some time, these settings may appear, so we leave these signals in the list and wait for them to be filled in with settings. This may occur due to the time spent or improvements in machine learning algorithms in the future.

Monitoring signals and different modes of their operation

I had to add a wrapper to the link because mql5 does not allow direct links to "myfxbook.com". You just need to pass the captcha and you will get a link to my profile. If you encounter any issues, use a VPN.

First of all, it is worth noting that signals themselves do not guarantee profit, but they provide the user with a wide choice and maximize the chances of successful trading. Additional modes of operation can expand the variability of signal data, which will also provide more diversification and variety. Monitoring is primarily a user's aid, making it easier for you to decide on connecting to a particular signal or choosing an additional signal operating mode. The following options are implied by the signal operating modes:

- Linearization

- Martingale

- Plus Swaps

- Effects

The list of monitors includes both pure signals and their mixes with different modes of operation and effects. This gives us variety in assembling our own signal configuration. It is allowed to use multiple signals within one account at the same time, see guide.

How to test a signal in the strategy tester?

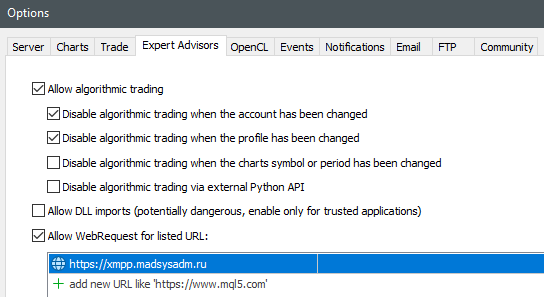

This can only be done by buying or renting an advisor, or by receiving a folder with settings from another user. Here I will show you how to do it assuming that the advisor has been purchased or rented by you. First of all, make sure to grant permission to access my API in the terminal settings if you have not already done so:

Now, let's create any chart in the terminal working window, or use an existing one. Attach an expert advisor to it, but make sure to turn off the "automatic trading" option in your terminal to avoid any trading operations that may occur when the expert advisor starts. It looks like this:

![]()

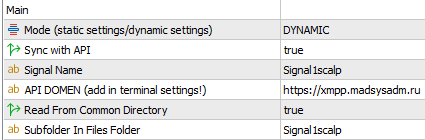

After that, we attach the advisor to your chart. Let's say we want to test "Signal1scalp" in the strategy tester. For this, we will need to set the following settings:

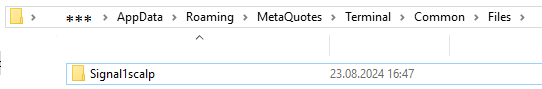

If everything is done correctly, you will see a user interface. It will display how many settings have been downloaded from the server. If the interface is empty, it means that the requested signal does not have any settings inside, or you made a mistake with the settings. If the indication appears, you can also see the downloaded folder with your signal at the following path "%APPDATA%\MetaQuotes\Terminal\Common\Files". This is how it will all look:

After that, we can remove the advisor from the chart. We no longer need it. We only did this operation to download the signal folder. This needs to be done before testing in the strategy tester, because the strategy tester disables any interactions with the API. By taking this action, we prepare the folder with files in advance. Now we can start testing the signal if it has been downloaded. To do this, in the tester we set the same settings as in the picture above, except for the following: "Sync with API = false". In other words, during testing, we disable synchronization with the API, as it does not work in the tester, as I mentioned earlier. Then we either set up a clean signal or add the effects you need. We repeat the operation with all the signals that interest you and make a decision on using one signal or another.

Afterword

Test and analyze as many signals and additional modes as possible, combine them to achieve the smoothest equity curve and recovery factor. Use our account monitoring for additional verification and filtering of test results, or rely solely on the monitoring. Prioritize monitoring to choose certain signals and additional modes.