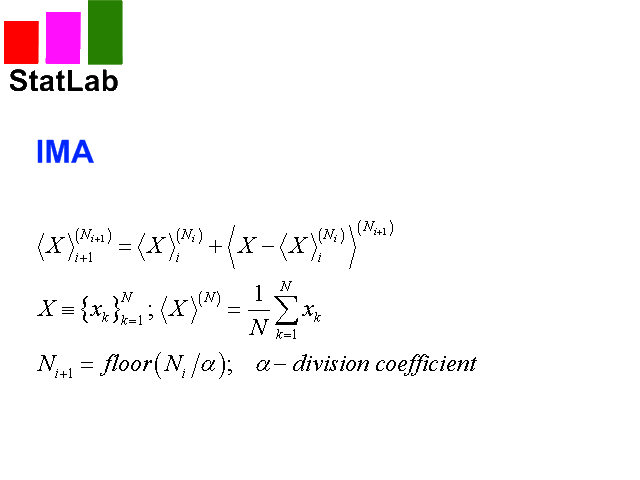

Iterative Moving Average – IMA. IMA is obtained by correcting the usual MA. The correction consists in addition to MA averaged difference between the time series (X) and its MA, i.e. IMA(X)=MA(X) + MA (Х-MA(X)). Correction is done in several iterations (and, exactly, 2 iterations in this indicator) and with a change in the averaging period. Indicator Settings.

Screenshots.

Download or buy the Iterative Moving Average may by on the link.

As a result, the time-series points begin to cluster around (on all sides) of the getting IMA and with a smaller delay than around the usual MA. Therefore, IMA is a more effective tool for manual and automatic trading than all types of conventional MA (SMA, EMA, SSMA, LMA). Formulas for IMA are given in the last screenshot.

Indicator Settings.

- Price type. Values: Close price, Open price, High price, Low price, Median price ((high + low)/2 - default), Typical price ((high + low + close)/3), Weighted price ((high + low + 2*close)/4).

- The averaging method. Values: Simple, Exponential (default), Smoothed, Linear weighted.

- The main averaging period. Integer. Default is 14.

- Coefficient of division of the averaging period. - The coefficient determines the period of the next iteration. Values: any positive real number, which is not zero. Default is 1.62 (Golden Ratio).

- Dimensions of markers - Marker sizes to display forecast points. Values: any positive integer from 0 to 5 (1 default).

Screenshots.