Leverage, Margin, Balance, Equity, Free Margin, Margin Level, Margin Call Level and Stop Out Level

Introduction

The aim of this page is to explain important terms to trades on Forex market. This will help to define the size of a position or configure properly an Expert Advisor like Wolfgrid or my other products: https://www.mql5.com/en/users/dorian75/seller#products

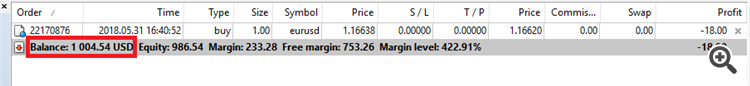

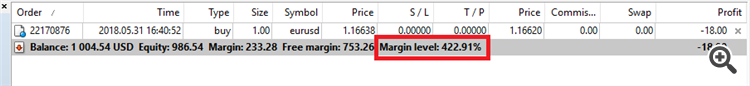

We will use the example below to undestand those key terms:

Balance

Balance shows the amount of deposited money in your trading account. The profit/loss of your orders will be added or deducted to/from your trading account balance when you close your orders.

In our example the balance is 1004.54 USD

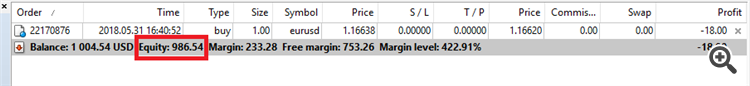

Equity

Balance and Equity show the same values as long as there is not any open order. When you have open orders in your trading account, the Balance will not change and it will stay fixed but the Equity will be floated according to the profit/loss of your current orders. The formula is:

Equity = Balance + Profit&Loss

Our example: Equity= 1004.54 - 18 = 986.54 USD

Leverage

Leverage is a feature offered by Forex brokers which helps traders to trade the larger amounts of currency pairs through having a smaller account balance.

In our example, the account leverage is 500:1, you can buy 500USD by paying 1USD. Therefore, to buy 100,000USD (one lot), you should pay only 200USD (100 000/500).

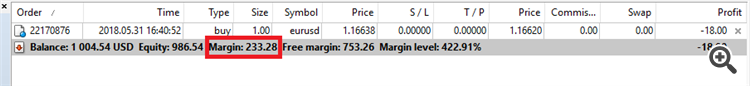

Margin

Margin is the amount of the money that is used to open a position or trade and it is calculated based on the leverage. In other words it is the amount of the money that gets involved in a position as collateral. This money is locked until the position is closed. The formula is:

Margin = (Price symbol x Volume) / Leverage

Our example: Margin= (1.16620 x 100 000) / 500 = 233.28 USD

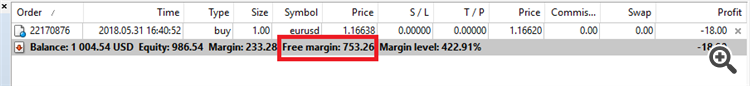

Free Margin

Free Margin= Equity - Margin

Our example: Free Margin= 986.54 -233.28 = 753.26 USD

Margin Level

Margin level is the ratio of the equity to the margin. Margin level is very important since brokers use it to determine whether the traders can take any new positions when they already have some positions.Different brokers have different limits for the margin level, but this limit is usually 100% with most of the brokers. This limit is called Margin Call Level. The formula is:

Margin Level %= (Equity / Margin) x 100

Our example: Margin Level= (986.54/233.28)x100 = 422.91%

Margin Call Level

100% margin call level means if your account margin level reaches 100%, you can still close your open positions, but you cannot take any new positions. Indeed, 100% margin call level happens when your account equity, equals the required margin.

Stop Out Level

For example, when the stop out level is set to 5% by a broker, the system starts closing your losing positions automatically if your margin level reaches 5%. It starts closing from the biggest losing position first. Usually, closing one losing position will take the margin level higher than 5%, because it will release the required margin of that position, and so, the total used margin will go lower and therefore the margin level will go higher.

The reason why this limit is setup is that the broker cannot allow you to lose more than the money you have deposited in your account.