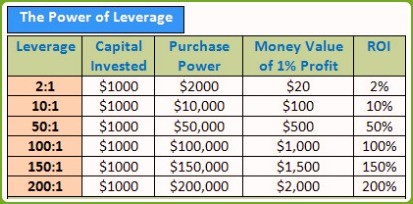

Leverage in forex is expressed as ratios - for example as the following: 1:1, 1:50, 1:100, 1:200, 1:400.

Leverage in forex = Purchase Power/Capital Invested = $100,000/$1,000 = 100

This leverage ratio of 1:100 is translated as following:

For every $1 I deposit in my forex broker's account, my broker in return deposits $100 in my margin account. So, if I deposit $1000 then my broker deposits $100,000 in my trading account. So with just $1000 of my own money, I can control $100,000 for my trading purposes. By doing so I created a leverage in forex.

Leverage has been in use from the early dawn of our civilization primarily to cope up with daily necessities. In the medieval era leverage was employed probably just to lift heavy stones to build houses. But in the modern era leverage has been used extensively in finance and commerce. When I am buying

one million dollar house with only 10% down payment, I am essentially using leverage. Leverage adds glamor to forex trading. It is what makes so many traders gravitate to forex trading as compared

to equities and other securities market. :)

Hence, leverage in forex is the secret behind huge wind fall profits in forex trading. Be that as it may, leverage can magnify losses in losing trades. This is also why leverage is considered double edged sword. If I make winning trades using leverage then my profits are huge. Likewise if I make losing trades my losses are also huge.