One of the great things about the forex market for individual traders

and one of the reasons we are starting with the forex market as our

first market specific course is the availability of real time demo

accounts. Unlike the equities and futures markets where one must pay the

exchanges to get access to real time data, most forex brokers not only

provide free real time quotes and charts but they also give you access

to the same platform that their live traders trade on and the ability to

trade there with virtual cash. This is a nice perk especially for

beginner traders, as it allows them to get to know the market and the

logistics of placing trades in a real time environment but without

risking any real money.

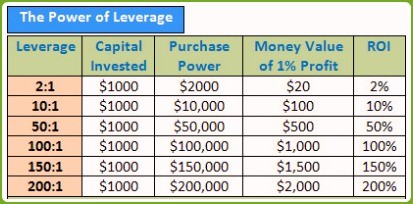

Leverage in forex = Purchase Power/Capital Invested = $100,000/$1,000 = 100

This leverage ratio of 1:100 is translated as following:

For every $1 I deposit in my forex broker's account, my broker in return deposits $100 in my margin account. So, if I deposit $1000 then my broker deposits $100,000 in my trading account. So with just $1000 of my own money, I can control $100,000 for my trading purposes. By doing so I created a leverage in forex.

Remember, a 25% loss requires a 33% return to get back to break even. If

a 25% loss in a fast moving market is difficult enough to overcome,

imagine how challenging it would be to overcome a 25% loss in a slow

moving market. Therefore, de-emphasize each trade and think of the next

trade simply as the first of ten trades rather than the next homerun.

You can reduce the emphasis by implementing less than 10x effective

leverage. Effective leverage is simply taking the total notional trade

size and dividing it by your account size. The result will indicate how

many times you have your equity levered. According to our research, we

recommend implementing less than ten times effective leverage.

Incorporating smaller trade sizes and less leverage will alleviate the

stress of having to produce a profitable trade. As a result, you’ll be

more likely to let the trade develop and let the trade evolve in the way

the patterns indicate.