First, a review of last week’s forecast:

- if we talk about EUR/USD behaviour last week, we refused to provide any sensible forecast, as both experts and indicators were at a complete loss, pointing to different directions. And exactly this “forecast” turned out to be true - at first the pair made a “walk” downwards, then a little bit upwards, then downwards again, where it finished the week, not having decided what to do;

- as for the future of GBP/USD, most experts supported by graphical analysis predicted a sideways trend, which is what happened: like EUR/USD, at first the pair went slowly down to 1.5155, then went up to the area where it had been a month before, and then went down again to the area of the first support set by experts - 1.5185;

- as for the USD/JPY forecast, here graphical analysis turned out to be right. According to its forecast, the pair was first supposed to go up to the area 123.00÷123.75, fail to break through resistance and roll down, returning by the end of the week to the level of 122.50. In reality the pair failed twice to break through resistance in the zone of 123.60, after which it bounced down and finished at the level 122.80;

- The USD/CHF decided to go ahead of forecasts last week. It was expected to continue to oscillate in the range of 0.9900-1.0100 at first, then fix in the zone 1.0120÷1.0130, only from where it would start to assail 1.0210. In fact that was what happened, but much faster: it is already on Tuesday that the pair broke not only through resistance of 1.0100, but 1.0130 as well, and by Wednesday it reached the set height 1.0210 after which it calmed down and changed to a sideways trend.

***

Forecast for the upcoming week.

Summing up the opinions of several dozen analysts from world leading banks and broker companies as well as forecasts based on various methods of technical and graphical analysis, the following can be said:

- With regards to the behaviour of EUR/USD, all the indicators point to the south, however, the graphical analysis on H1 and H4 says that, having re-bounced from the support of 1.0628, the pair will first go up to the resistance of 1.0700, and only after that it will continue to fall. However, about half of the experts believe that the initial rebound can be 100 points stronger - to the level of 1.0800, and the bottom of the week for this pair will be in the zone of 1.0500 ÷ 1.0520;

- For GBP/USD graphical analysis both on H1 and H4 insists on the rebound of the pair up to the level of 1.5250, after which, having oscillated in the corridor 1.5170 ÷ 1.5250, it should fall to the 1.5085 support. Next support - 1.5025. Reaching the bottom, the pair is likely to return to the area of 1.5300, 65% of analysts agree with that;

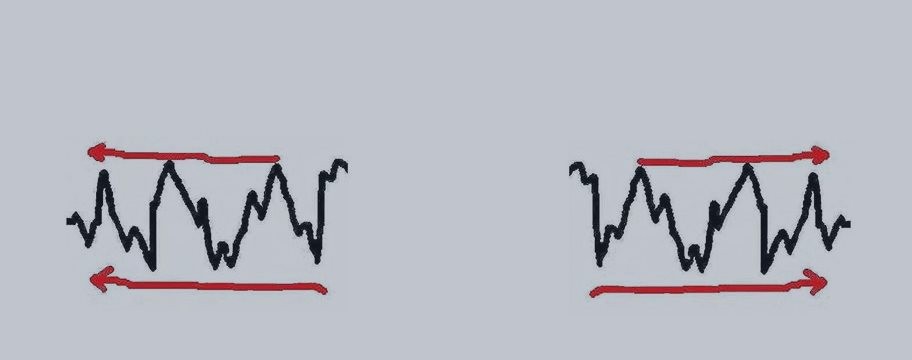

- If we talk about the USD/JPY, here indicators on H4 point strictly to south, and on D1 - strictly to north. About the same opinion is shared by the experts. An attempt to sum up their opinions shows quite a wide sideways channel with the range of 121.85 ÷ 123.20 and the Pivot Point in the area of 122.80. It should be noted that graphical analysis on H1 and H4 indicates that at the beginning of the week the pair will go down, and only then it will start to grow;

- A similar forecast can be given for USD/CHF - first a small pull back down - to support 1.0135 - and then a leap to a new height, with the purpose at 1.0250. At the same time, according to experts, the pair will remain in the corridor 1.0200 ÷ 1.0220 most of the time, and only one (!) analyst suggests that the pair may fall to the level of 0.9800.

Roman Butko, NordFX & Sergey Ershov